Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MERCURY SYSTEMS INC | d8k.htm |

© 2009 Mercury Computer Systems, Inc. www.mc.com Tenth Annual Investor’s Conference November 10, 2009 Exhibit 99.1 |

© 2009 Mercury Computer Systems, Inc. www.mc.com Forward-Looking Safe Harbor Statement This presentation contains certain forward-looking statements, as that term is defined

in the Private Securities Litigation Reform Act of 1995, including those

relating to anticipated fiscal 2010 business performance and beyond. You can identify these statements by our use of the words "may," "will," "should," "plans,"

"expects," "anticipates," "continue," "estimate," "project," "intend," and similar expressions. These forward-looking statements involve risks and uncertainties that could cause actual

results to differ materially from those projected or anticipated. Such risks and

uncertainties include, but are not limited to, general economic and business conditions, including unforeseen weakness in the Company's markets, effects of continued geopolitical unrest and regional

conflicts, competition, changes in technology and methods of marketing, delays

in completing engineering and manufacturing programs, changes in customer order patterns, changes in product mix, continued success in technological advances and delivering technological

innovations, continued funding of defense programs, the timing of such funding,

changes in the U.S. Government's interpretation of federal procurement rules and regulations, market acceptance of the Company's products, shortages in components, production delays due

to performance quality issues with outsourced components, the inability to fully

realize the expected benefits from acquisitions or delays in realizing such benefits, challenges in integrating acquired businesses and achieving anticipated synergies, and difficulties in retaining key customers. These risks and uncertainties also include such additional risk factors as are discussed in the Company's

recent filings with the U.S. Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2009. The Company cautions readers not to place undue reliance upon any such forward-looking statements, which speak only as of

the date made. The Company undertakes no obligation to update any

forward-looking statement to reflect events or circumstances after the date on which such statement is made. Use of Non-GAAP (Generally Accepted Accounting Principles) Financial Measures In addition to reporting financial results in accordance with generally accepted accounting

principles, or GAAP, the Company provides non-GAAP financial measures

adjusted to exclude certain specified charges, which the Company believes are useful to help investors better understand its past financial performance and prospects for the future. However, the

presentation of non-GAAP financial measures is not meant to be considered in

isolation or as a substitute for financial information provided in accordance with GAAP. Management believes these non-GAAP financial measures assist in providing a more complete

understanding of the Company's underlying operational results and trends, and

management uses these measures, along with their corresponding GAAP financial measures, to manage the Company's business, to evaluate its performance compared to prior periods and the

marketplace, and to establish operational goals. A reconciliation of GAAP to

non-GAAP financial measures discussed in this presentation is contained in the Company’s First Quarter of Fiscal Year 2010 earnings release, which can be found on our website at www.mc.com/mediacenter/pressreleaseslist.aspx. 1 |

© 2009 Mercury Computer Systems, Inc. www.mc.com • Corporate Overview – Mark Aslett, CEO, Mercury Computer Systems – Mercury Situational Business Analysis – Plans for ACS Defense – the Need for a Converged Sensor Network – Mercury Federal – Evolving our COTS business Model • Keynote: John J. Young • Coffee Break (15 min) • Advanced Computing Solutions • Mercury Federal Systems (MFS) • Financial Review • Closing Remarks / Q&A Agenda 2 |

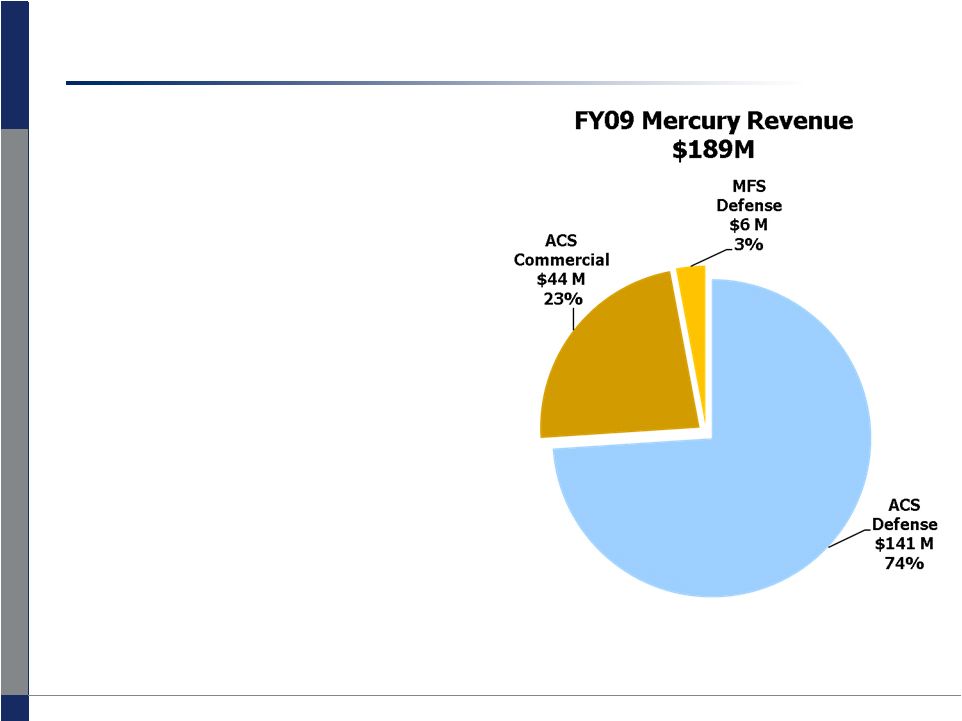

© 2009 Mercury Computer Systems, Inc. www.mc.com Mercury is a platform-independent, best-of-breed ISR systems and services company • Founded in 1981 • HQ in Massachusetts; R&D in MA, VA, AL • 517 employees • Leading provider of commercial high-performance signal, image and sensor processing • Focused on growing defense ISR market • FY2009 revenues of $189M • NASDAQ: MRCY 3 Note: $189M Total Revenue includes $2M interco eliminations |

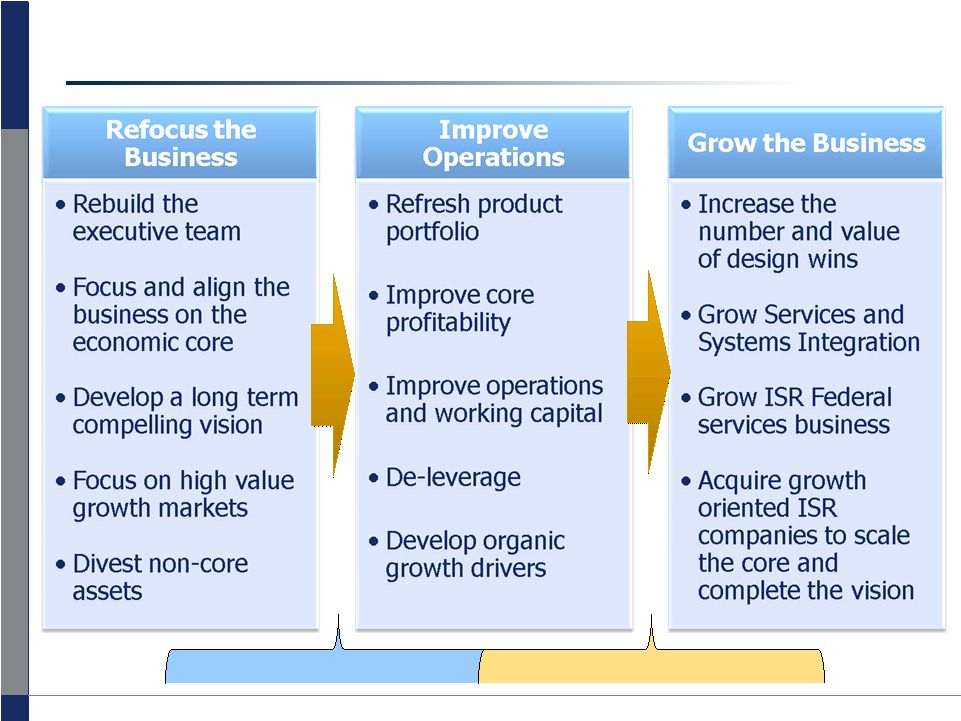

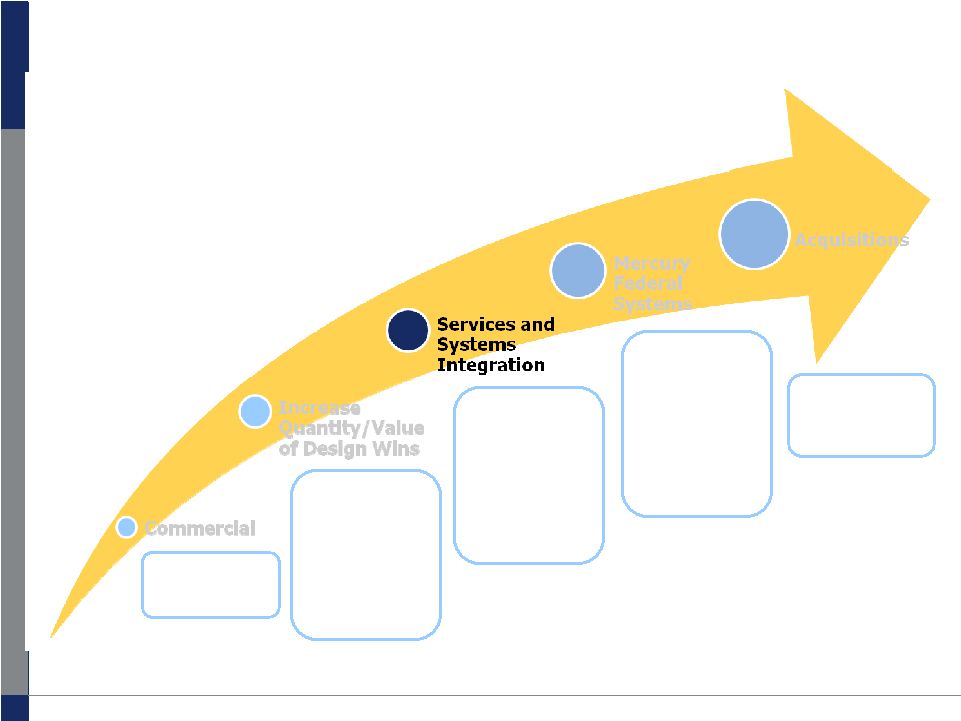

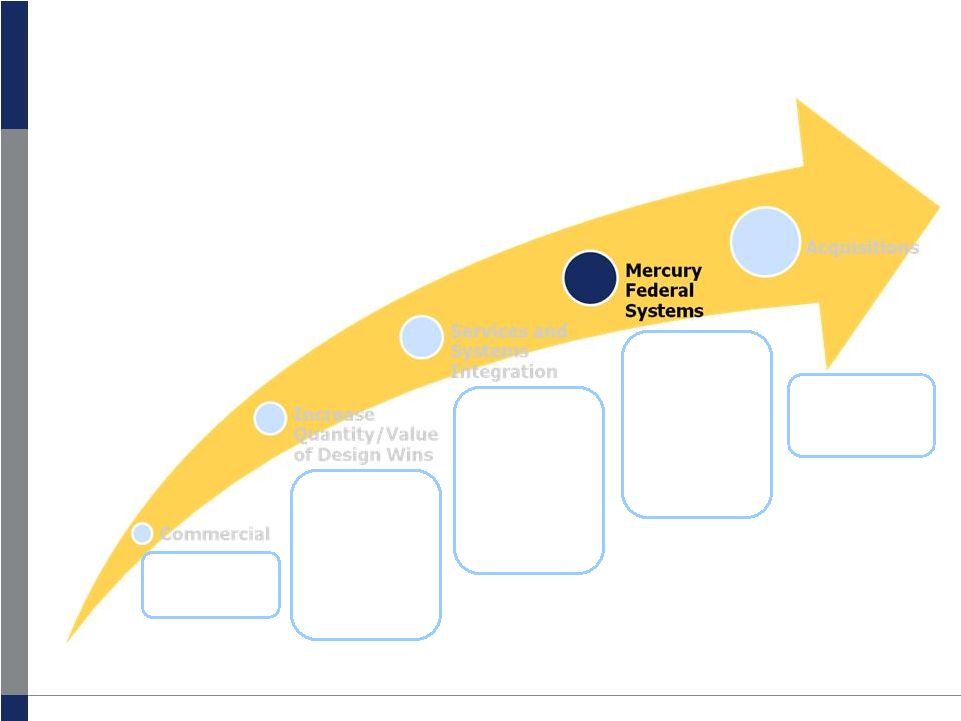

© 2009 Mercury Computer Systems, Inc. www.mc.com 4 Phases of Mercury's transformation 3 Overlapping Phases – Parallel Execution |

© 2009 Mercury Computer Systems, Inc. www.mc.com Mercury operational and financial highlights 5 Operations • Refocused the business • Completed divestiture of all non-core assets • Improved working capital • Refreshing product portfolio • Developed a strong growing position in ISR market • Growing services and systems integration business Financial • Restored profitability • Double-digit bookings and backlog growth • Increased operating cash flows • Repaid $125m debenture • Robust target business model 17-18% Adj. EBITDA • $100M shelf registration effective We enable the military to gather more relevant information, evaluate it faster, share and act upon it sooner |

© 2009 Mercury Computer Systems, Inc. www.mc.com 5 key business growth drivers 6 • Product Portfolio Refresh • Application Expansion • Platform Penetration • Customer Expansion • Expand Total Addressable Market to $3.5B • Increased System Content • Platform Penetration • Application Expansion • Expand Total Addressable Market to $30B Defense Electronics Market • Focus on Persistent ISR • Growth in Federal Services • Filed $100M Universal Shelf • Complementary ISR Businesses • Semiconductor Market Rebound |

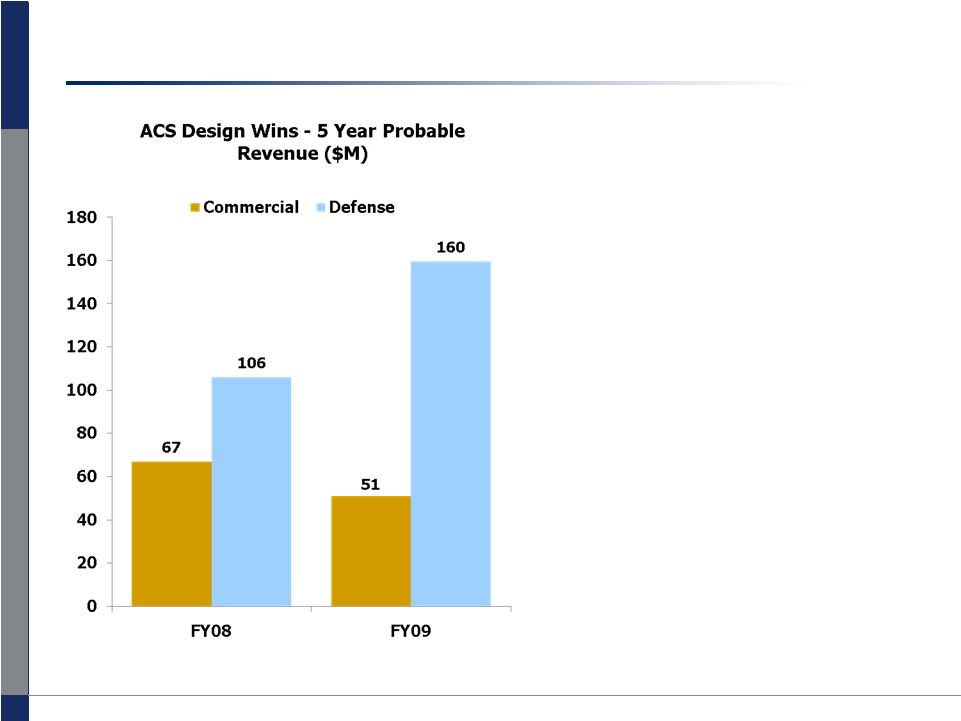

© 2009 Mercury Computer Systems, Inc. www.mc.com ACS 5-year design win value increased 22% overall in FY09 with 51% growth in defense 7 Defense Highlights • Aegis – Naval BMD, C4I • Missile Defense – Ground Radar • Argon – Naval SIGINT • Predator – Airborne Radar • JCREW – Ground SIGINT • Rivet Joint – Airborne SIGINT • Gorgon Stare – Airborne ISR • NASP – Airborne Sonar • Guardrail – Airborne SIGINT Commercial Highlights • KLA Tencor – Semiconductor • Hughes – Satellite Comms • Rapiscan – Baggage Scanning • L3 – Baggage Scanning • ASML – Semiconductor Note: Potential is 5 year probable value based on customer-supplied information at time design win

awarded. Actual program value may be higher or lower |

© 2009 Mercury Computer Systems, Inc. www.mc.com Success in semiconductor equipment – position controller for lithography Application Requirement: • Low-latency, deterministic processing for precision control in Stepper/Scanners Initial Deal: • $10M pre-production orders booked and partially shipped • Starting to receive production orders • Integrated platforms for production (immersion/EUV, new/upgrades) Advanced processing technology: • AdvancedTCA utilizing serial RapidIO 8 Note: Potential is 5 year probable value based on customer-supplied information at time design win

awarded. Actual program value may be higher or lower Total Opportunity Potential: ~$100M over 5 years |

©

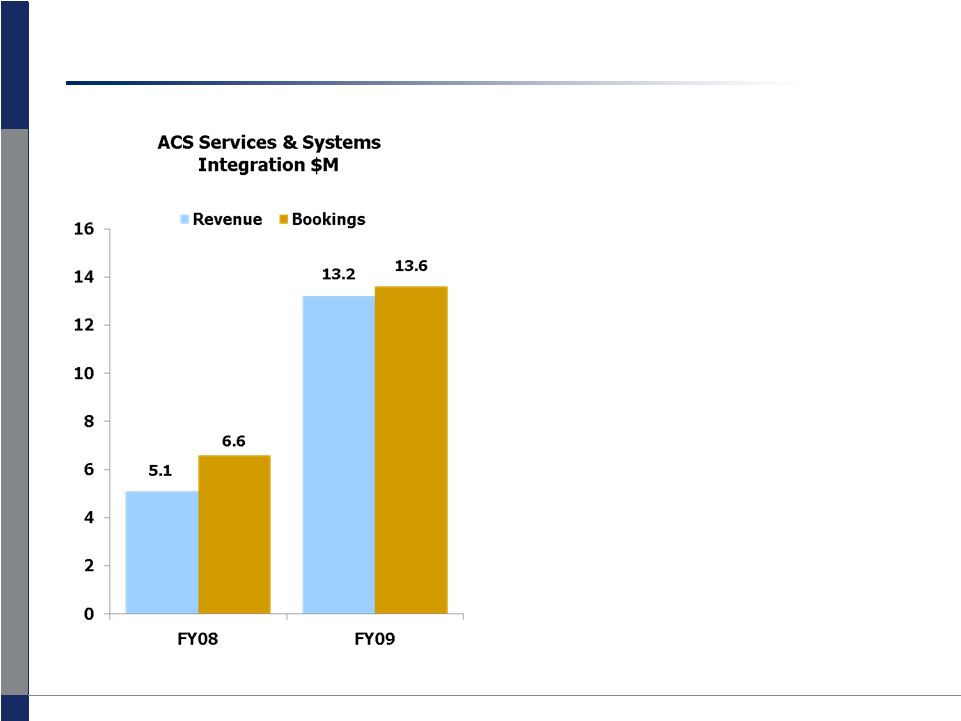

2009 Mercury Computer Systems, Inc. www.mc.com Services and Systems Integration drove significant revenue growth in its first full year of operation • Expand ACS total addressable market • From startup in FY08, FY09 bookings growth +106%, revenue growth +157% • FY09 proved the business model and potential • Enables substitute and 3 party technologies e.g. blade computing • Enables faster time to revenue on programs and increased deal sizes 9 rd |

©

2009 Mercury Computer Systems, Inc. www.mc.com Success in Services & System Integration – Radar Digital Processor Project Requirement: • Phased Array Radar for Ground Missile Defense (FMS) Initial Deal: • $12M engineering services and system integration • $6M production order (1 country) Advanced processing technology: • OpenVPX™ embedded computing 10 Note: Potential is 5 year probable value based on customer-supplied information at time design win

awarded. Actual program value may be higher or lower Future Opportunity Potential: $12M total production for next 2 countries; ~15-20 countries expected to follow |

©

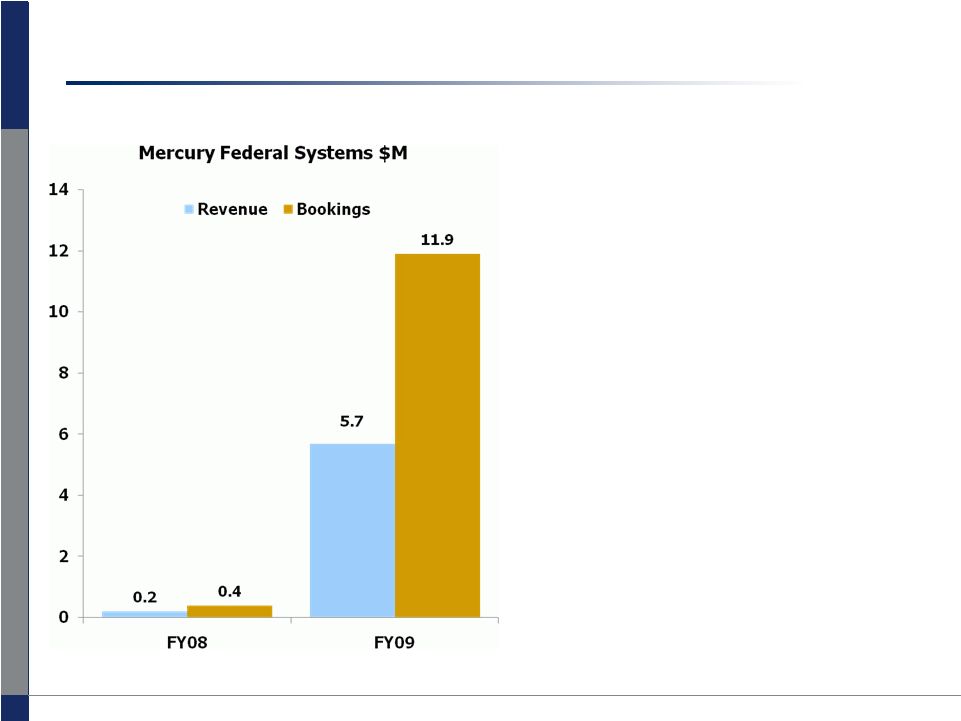

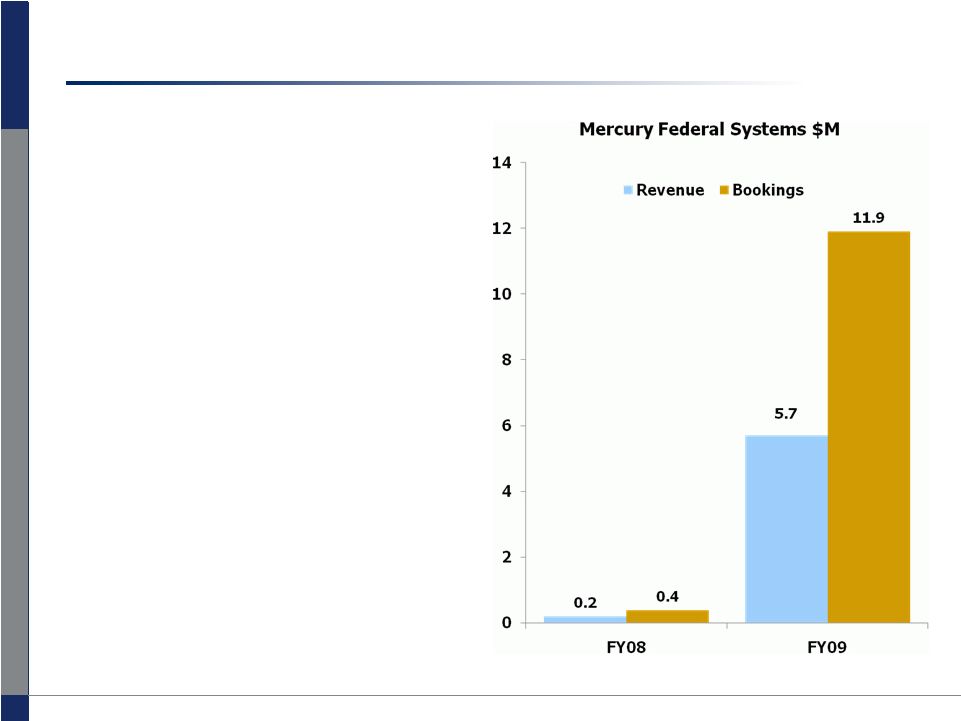

2009 Mercury Computer Systems, Inc. www.mc.com • Strong revenue ($5.7M) and bookings ($11.9M) in FY09 • Concurrently, generating new opportunities for ACS • 8 active engagements; 3 direct prime contracts • Recognized by the DoD as advanced processing architects for next-gen airborne ISR systems Mercury Federal Systems (MFS) delivered significant first year bookings and revenue 11 |

©

2009 Mercury Computer Systems, Inc. www.mc.com MFS success story – Wide Area Airborne Surveillance Project Requirement: • Concurrent near real-time situational awareness for MQ-9 Reaper UAV (Gorgon Stare) Initial Deal: • $7M bookings • 1/2 hardware / software • 1/2 engineering services Advanced processing technology: • Embedded GPUs w/IO 12 Note: Potential is 5 year probable value based on customer-supplied information at time design win

awarded. Actual program value may be higher or lower Total Opportunity Potential: ~ $20M |

©

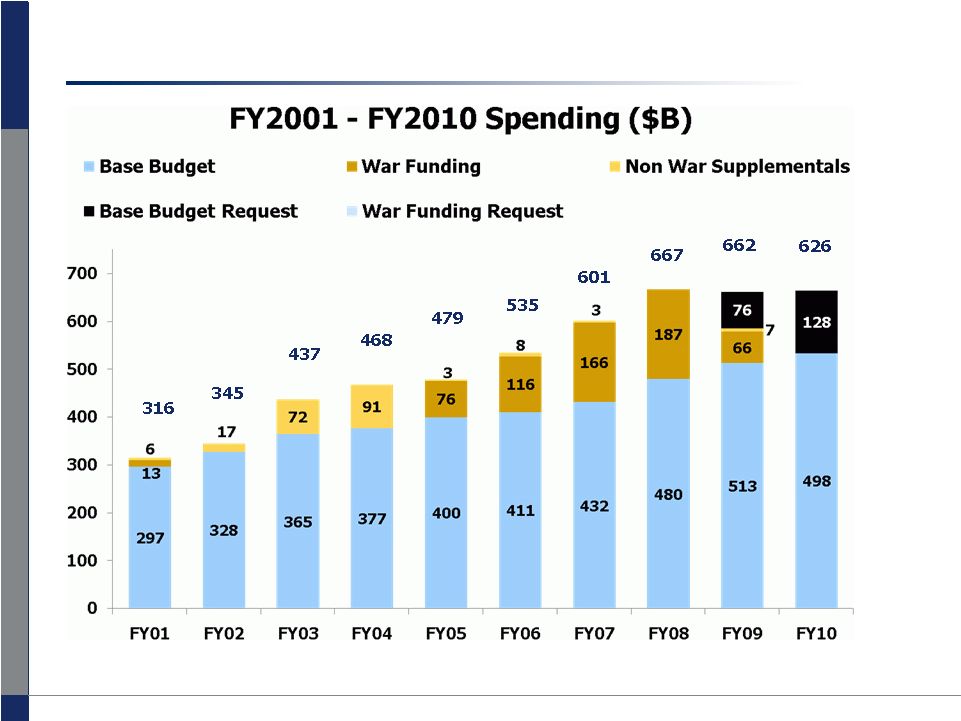

2009 Mercury Computer Systems, Inc. www.mc.com Defense department spending FY10 forecast 13 Source: Defense Appropriations Act FY200-2009, National Defense Budget Estimates FY200, OMB

Historical Tables FY2009 |

©

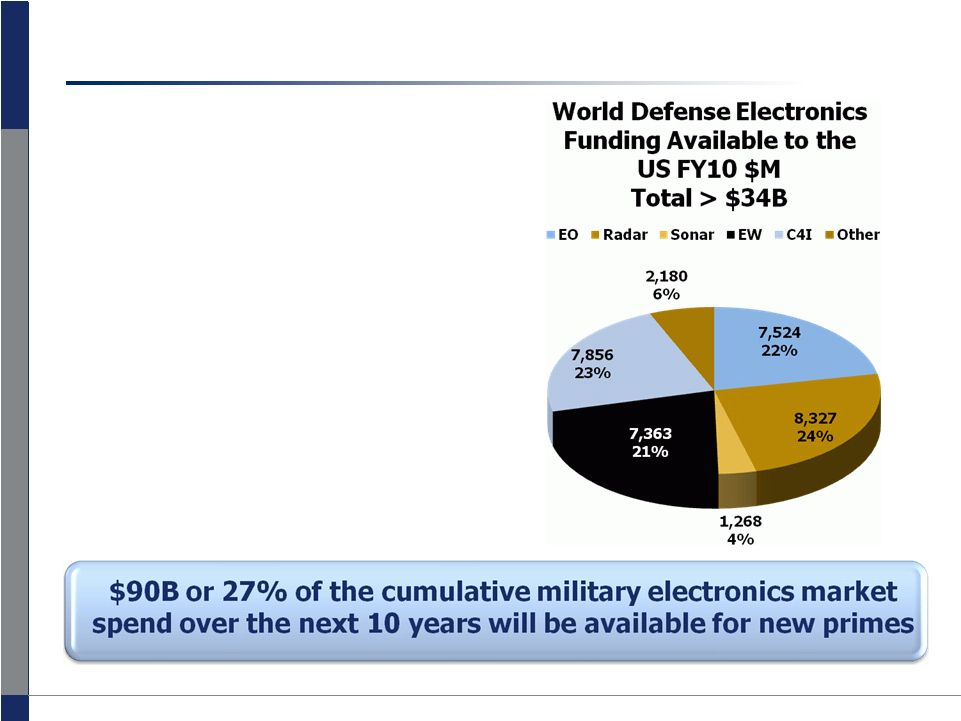

2009 Mercury Computer Systems, Inc. www.mc.com Military electronics is a market sweet spot 14 • Retrofit and upgrades remain strong for legacy programs • Increased need for EW; intelligence, surveillance, reconnaissance assets • Networked nodal platforms, time to information • Next-gen onboard processing, exploitation and dissemination architecture critical Sources : The Military Electronics Briefing, 2008 Ed. , The TEAL Group, Frost & Sullivan, U.S

C4ISR Market 2007 |

©

2009 Mercury Computer Systems, Inc. www.mc.com Key defense platforms and programs driving growth Representative Program List 15 Global Hawk Predator/Reaper Rivet Joint Gorgon Stare F-16 F-35 JSF BAMS MESA P8-MMA MP-RTIP Aegis RDP - Ground Missile Defense Radar THAAD JCREW Software Defined Jammer Guardrail SSEE(F) CADF Deepwater |

©

2009 Mercury Computer Systems, Inc. www.mc.com FY10 budget reprioritization benefiting Mercury • Increase ISR spend by $2B – Build a 43 CAP fleet of Predator class UAVs by end of FY10 – Increase manned turboprop ISR capabilities – Initiate ISR R&D for enhancements and experimental platforms • Sustain air superiority – Increase F35 JSF from 14 aircraft in FY09 to 30 in FY10 – Increase JSF funding from $6.8B to $10.4B – Purchase 513 F35s over next 5 years – Ultimately purchase 2,443 F35s • Increase theatre missile defense – Additional $41M for radar support of THAAD – Fund conversion of 6 more Aegis BMD ships • Increase spending on counter IED i.e. JCREW 16 |

© 2009 Mercury Computer Systems, Inc. www.mc.com Government/DoD frustration leads to defense procurement reform Today’s Model • Government frustrated with current model • Platform-centric approach • Proprietary closed system architectures • Significant cost overruns • Significant schedule slips Emerging Model • Best-of-breed model emerging • More commercial items • Open platform-independent architectures • QRC – rapid deployment, lower cost and risk • Likely to occur for signal processing and computing 17 Budget pressure and significant schedule slippage is leading to Defense procurement reforms that could benefit Mercury |

©

2009 Mercury Computer Systems, Inc. www.mc.com To the warfighter, time to information is critical to address the growing gap between: What’s analyzed? What’s collected? 100GB per mission 100TB per mission Force Protection Mission Critical Real-time Forensics Last 18 hours Recent minutes For decision makers who need timely, actionable, and relevant information What’s actionable? ? 18 |

© 2009 Mercury Computer Systems, Inc. www.mc.com 19 Airborne ISR R&D costs Signal Processing / Systems Integration Platform Sensor Datalink Ground Station 10% 40% 30% 5% 15% 45% 10% 15% 10% 10% 5% 5% Datalink Platform Sensor Ground Station Application Acceleration/ Systems Integration Warfighter Terminals Warfighter Terminals Broadcast Provision Broadcast Provision Source: DoD Budget Request FY93 and FY2008 1993 2008 Mercury’s Opportunity Mercury’s Opportunity Budget priorities being realigned to maintain technology edge |

©

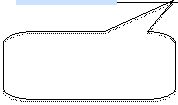

2009 Mercury Computer Systems, Inc. www.mc.com Mercury's new Converged Sensor Network™ (CSN™) vision for persistent ISR A revolutionary open architecture that combines 20 SAN Video Radar SIGINT Signal Processing Signal Processing Image Processing Information Dissemination Data Exploitation Become the government’s trusted partner for next-generation ISR platform signal processing and computing Multi-Sensor Signal Processing Information Management Technologies Transformational Access to Information in the Tactical Edge Global Information Grid |

©

2009 Mercury Computer Systems, Inc. www.mc.com Positioned for growth • Focused on growing ISR market segment • Creating a platform-independent, best-of-breed ISR systems and services company • Unique capabilities in commercial high-performance embedded signal, image and sensor processing • Building government amenable business model in line with expected Defense procurement reform • Delivering strong organic growth in defense with robust target business model • Will pursue complementary ISR acquisitions to scale 21 |

©

2009 Mercury Computer Systems, Inc. www.mc.com • Corporate Overview • Keynote – John J. Young, Former Undersecretary of Defense, ATL – Perspectives on Acquisition Challenges, Open Architectures, Budget Outlook, and Future Program Directions • Coffee Break (15 min) • Advanced Computing Solutions • Mercury Federal Systems (MFS) • Financial Review • Closing Remarks / Q&A Agenda 22 |

©

2009 Mercury Computer Systems, Inc. www.mc.com • Corporate Overview • Keynote: John J. Young • Advanced Computing Solutions – Didier Thibaud, SVP & GM, Advanced Computing Solutions – Commercial Market Growth – Increase Quantity/Value of Design Wins – Services and Systems Integration • Mercury Federal Systems (MFS) • Financial Review • Closing Remarks / Q&A Agenda 23 |

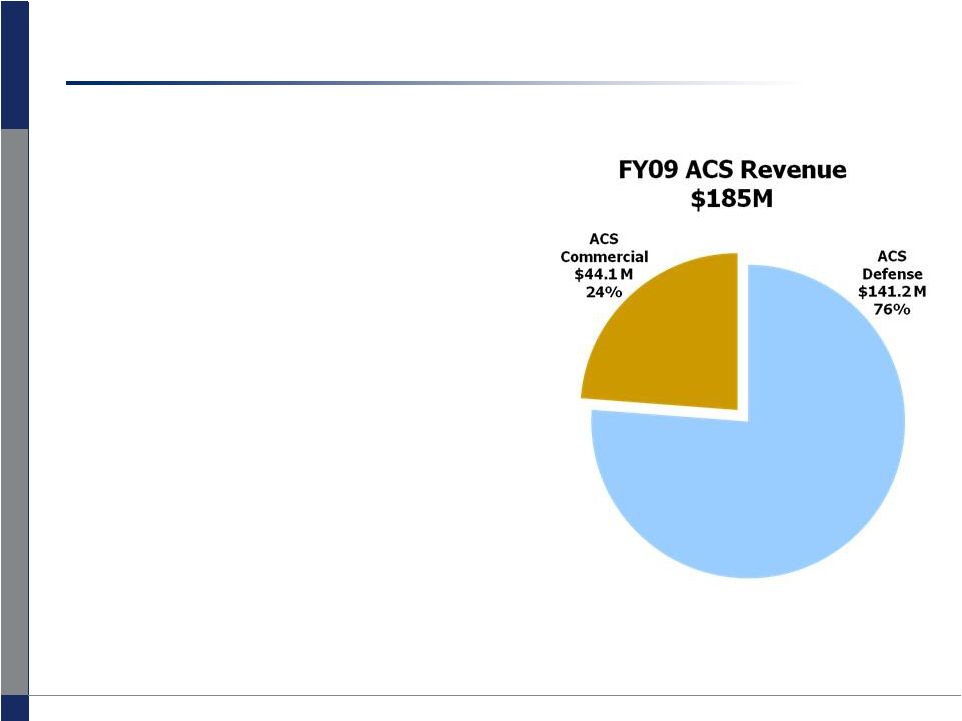

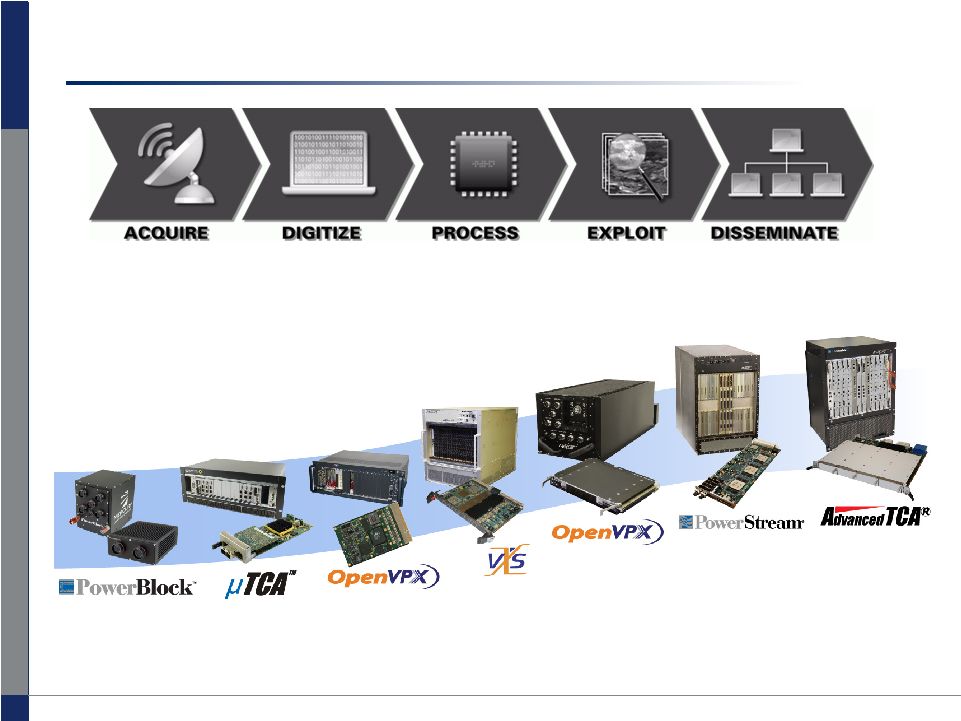

©

2009 Mercury Computer Systems, Inc. www.mc.com Advanced Computing Solutions (ACS) 24 • Focus on providing solutions for high-performance embedded computing • Leverage technologies and product between commercial and defense markets • Focus on C4ISR in defense • Optimized performance for SWAP • Quick Response Capabilities (QRC) through our service offerings |

©

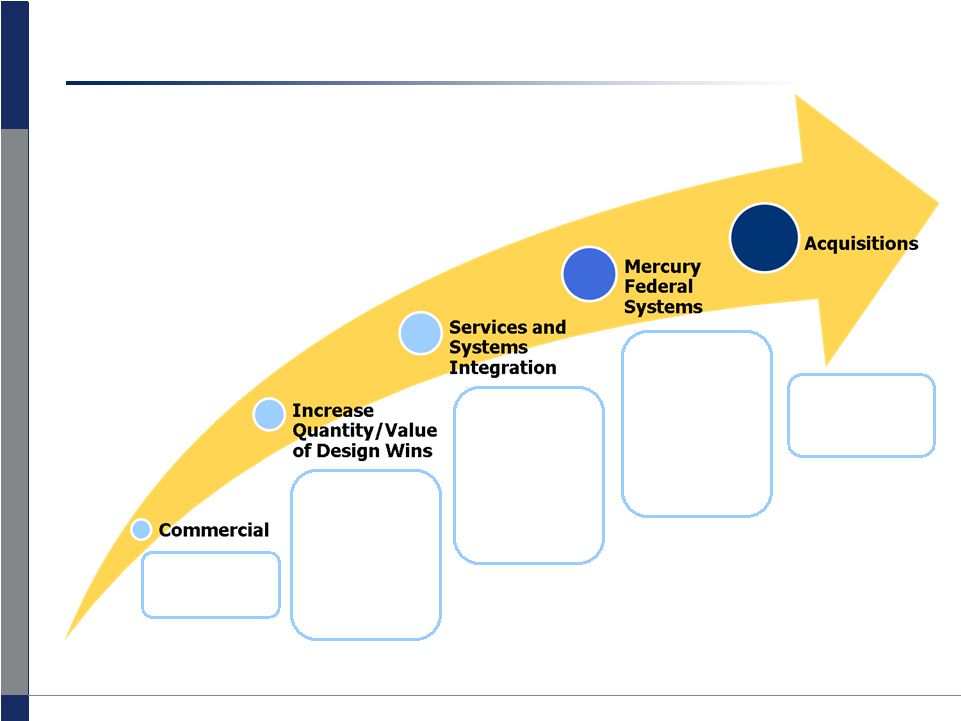

2009 Mercury Computer Systems, Inc. www.mc.com 5 key business growth drivers 25 Commercial Increase Quantity/Value of Design Wins Services and Systems Integration Mercury Federal Systems Acquisitions • Product Portfolio Refresh • Application Expansion • Platform Penetration • Customer Expansion • Expand Total Addressable Market to $3.5B • Increased System Content • Platform Penetration • Application Expansion • Expand Total Addressable Market to $30B Defense Electronics Market • Focus on Persistent ISR • Growth in Federal Services • Filed $100M Universal Shelf • Complementary ISR Businesses • Semiconductor Market Rebound |

©

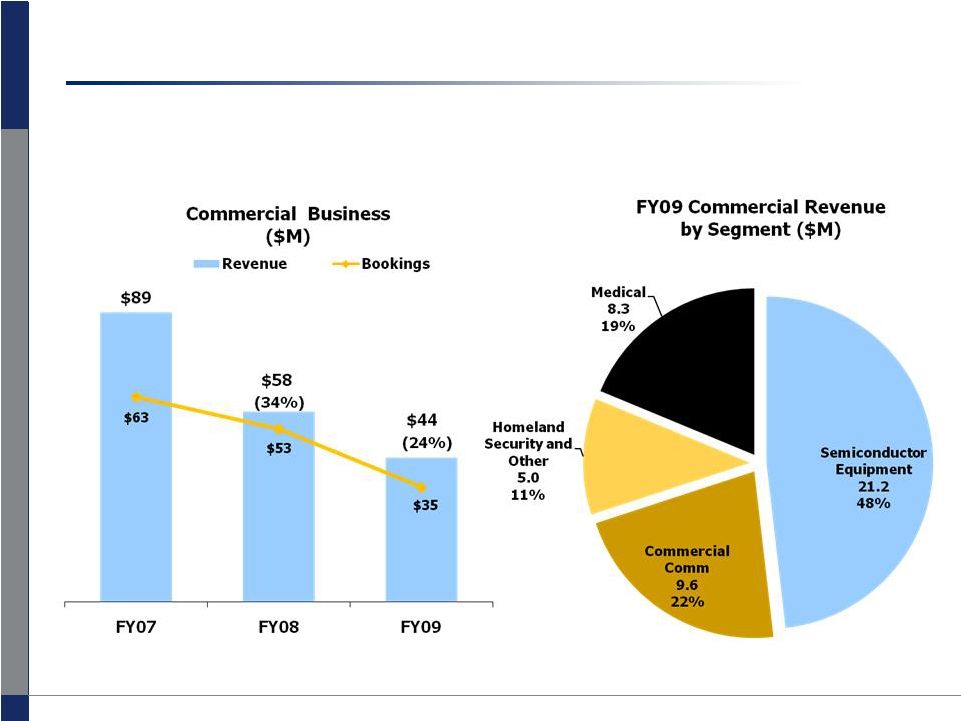

2009 Mercury Computer Systems, Inc. www.mc.com ACS commercial segment dynamics • Commercial revenues down 24% FY08 to FY09 • Positioning for a turnaround 26 |

©

2009 Mercury Computer Systems, Inc. www.mc.com Commercial growth factors • Semiconductor – market rebound – Early signs of market recovery – Design wins entering production – New potential opportunities • Communication – Entering new area: 4G test equipment – New satellite communication systems in deployment • Homeland Security – Design wins still in development – New opportunities 27 |

©

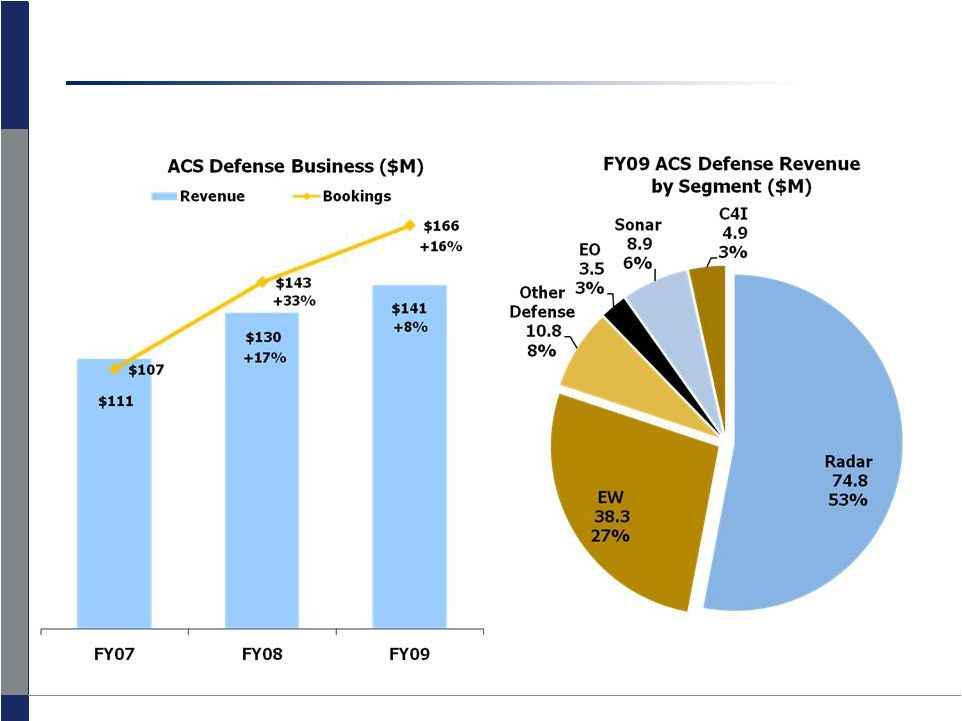

2009 Mercury Computer Systems, Inc. www.mc.com Strength in ACS defense markets • Radar (32% CAGR FY07-09) and EW (9% CAGR) driving growth 28 |

©

2009 Mercury Computer Systems, Inc. www.mc.com 5 key business growth drivers 29 Commercial Increase Quantity/Value of Design Wins Services and Systems Integration Mercury Federal Systems Acquisitions • Product Portfolio Refresh • Application Expansion • Platform Penetration • Customer Expansion • Expand Total Addressable Market to $3.5B • Increased System Content • Platform Penetration • Application Expansion • Expand Total Addressable Market to $30B Defense Electronics Market • Focus on Persistent ISR • Growth in Federal Services • Filed $100M Universal Shelf • Complementary ISR Businesses • Semiconductor Market Rebound |

©

2009 Mercury Computer Systems, Inc. www.mc.com The Warfighter’s challenge to Government? Time to Information Key market drivers 30 Open Systems Quick Response Capability/ Increase Outsourcing The Government’s challenge to Primes? Lower Costs Faster to Theater Enable Deliver |

©

2009 Mercury Computer Systems, Inc. www.mc.com Open architecture solutions to cover the ISR spectrum 31 Ensemble ES 1000 Ensemble ES 3000 Ensemble ES 5000 Ensemble ES 6000 Ensemble ES 7100 Ensemble ES 8000 Ensemble ES 2000 |

©

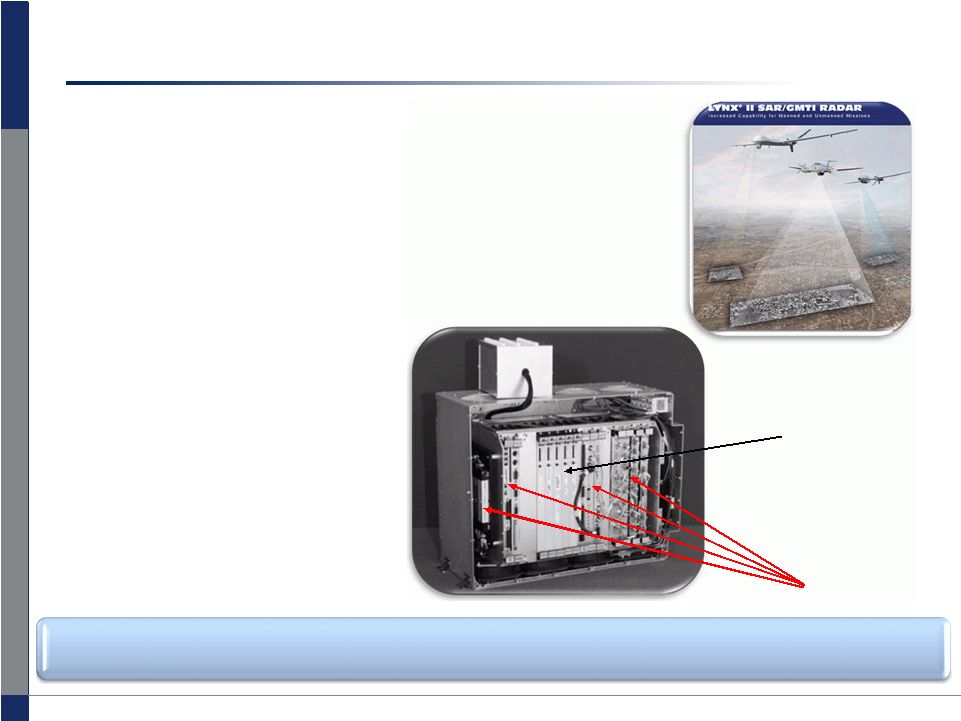

2009 Mercury Computer Systems, Inc. www.mc.com Growth: program penetration – SAR Predator • Provide DSP processing for SAR • Expand system footprint – RF and acquisition subsystem – Storage subsystem – Command and Control – Systems integration 32 Mercury Processing Boards Opportunities for new design wins, product growth and services Total Opportunity Potential: Double our $ content per UAV |

©

2009 Mercury Computer Systems, Inc. www.mc.com AEGIS BMD radar processing • Selected for BMD Radar – Most powerful deployed embedded computer for digital beam-forming – Extend to Radar Control System • Addressable market 60 ships out of 92 – Plan of Record for ship upgrade: 33 2011 2012 2013 2014 2015 Total 6 6 6 6-8 6-8 30-34 • Additional 8 ships to be built • Upside with FMS sales and additional ships in out years Total 5 year opportunity: $100M |

©

2009 Mercury Computer Systems, Inc. www.mc.com Growth: platform expansion - AEGIS • Expand to new sensor systems beyond BMD radar – Electronic Warfare – SIGINT – EO / IR – Combat System • Example EW subsystem – Starting deployment in 2011-2012 – Will be used on LCS 34 Surface Electronic Warfare System Additional Opportunity Potential: $100M |

©

2009 Mercury Computer Systems, Inc. www.mc.com Growth: expand to new customers • Historically targeted LM, Raytheon, NGC based on Radar and SIGINT focus • New design wins with BAE, ITT, SNC, Goodrich enabling expansion in EW, EO/IR and C4I • New product portfolio opening new markets like EO / IR 35 |

©

2009 Mercury Computer Systems, Inc. www.mc.com 5 key business growth drivers 36 • Product Portfolio Refresh • Application Expansion • Platform Penetration • Customer Expansion • Expand Total Addressable Market to $3.5B • Increased System Content • Platform Penetration • Application Expansion • Expand Total Addressable Market to $30B Defense Electronics Market • Focus on Persistent ISR • Growth in Federal Services • Filed $100M Universal Shelf • Complementary ISR Businesses • Semiconductor Market Rebound |

©

2009 Mercury Computer Systems, Inc. www.mc.com The changing environment opens growth opportunities through Systems Integration • Government demands increasing – Provide more warfighting capability more rapidly at lower cost – Quick reaction capability (QRC) – New requirements rapidly evolving – UAV and UGV driving small high-density systems • Proven solutions in deployment – New technology driving complex solutions – Risk reduction – “Best-of-breed” solution – Established track record 37 |

©

2009 Mercury Computer Systems, Inc. www.mc.com ACS summary – well positioned for growth • Commercial business ready for rebound • ISR requirements in ACS sweet spot • Full product refresh driving new design wins • Go-to-Market Strategy focusing on program, platform and customer expansion • Services and Systems Integration tapping $3.5B market • Bridge to MFS – Hybrid Business Model 38 |

©

2009 Mercury Computer Systems, Inc. www.mc.com • Corporate Overview • Keynote: John J. Young • Advanced Computing Solutions • Mercury Federal Systems (MFS) – J. Michael Johnson, RADM USN (Retired) and Interim President, MFS – Evolving our COTS business Model • Financial Review • Closing Remarks / Q&A Agenda 39 |

©

2009 Mercury Computer Systems, Inc. www.mc.com 5 key business growth drivers 40 • Product Portfolio Refresh • Application Expansion • Platform Penetration • Customer Expansion • Expand Total Addressable Market to $3.5B?? • Increased System Content • Platform Penetration • Application Expansion • Expand Total Addressable Market to $30B Defense Electronics Market • Focus on Persistent ISR • Growth in Federal Services • Filed $100M Universal Shelf • Complementary ISR Businesses • Semiconductor Market Rebound |

©

2009 Mercury Computer Systems, Inc. www.mc.com Mercury Federal Systems overview • Wholly owned subsidiary of MRCY • Incorporated 2007 in Delaware • Arlington, VA office open May 2008 • 13 employees • Focus on Persistent ISR government market • $12M bookings in FY09 • 8 programs • TS facility clearance • DCAA approved labor rates 41 |

©

2009 Mercury Computer Systems, Inc. www.mc.com MFS core strategic vision • Be the leading provider of consulting and software engineering services to: – Deploy leading-edge computing capabilities for C4ISR systems – Increase client agility and compatibility – Reduce technological and financial risk – Accelerate system performance • Leverage Mercury’s expertise to become the architect and steward of the DoD’s “smart processing” initiative • Succeed with Mercury’s breadth, depth, and trusted position in ISR sensors, platforms, and programs and its heritage in COTS 42 |

©

2009 Mercury Computer Systems, Inc. www.mc.com The Federal market is continuously evolving 43 DoD 1993 2010 2013e Budget ($B) 258 498 511 • Supplemental ($B) None +128 GWOT None planned • R&D ($B) 44 79 63 Procurement ($B) 56 105 113 C4ISR Budget ($B) 13 21 24 UAS Platforms (#) 25 2,100 3,300 Fed Svcs ($B) 95 250 310 Source: DoD Budget Request FY93 and FY2008 MFS focused on capturing growth in C4ISR systems integration and related engineering services |

©

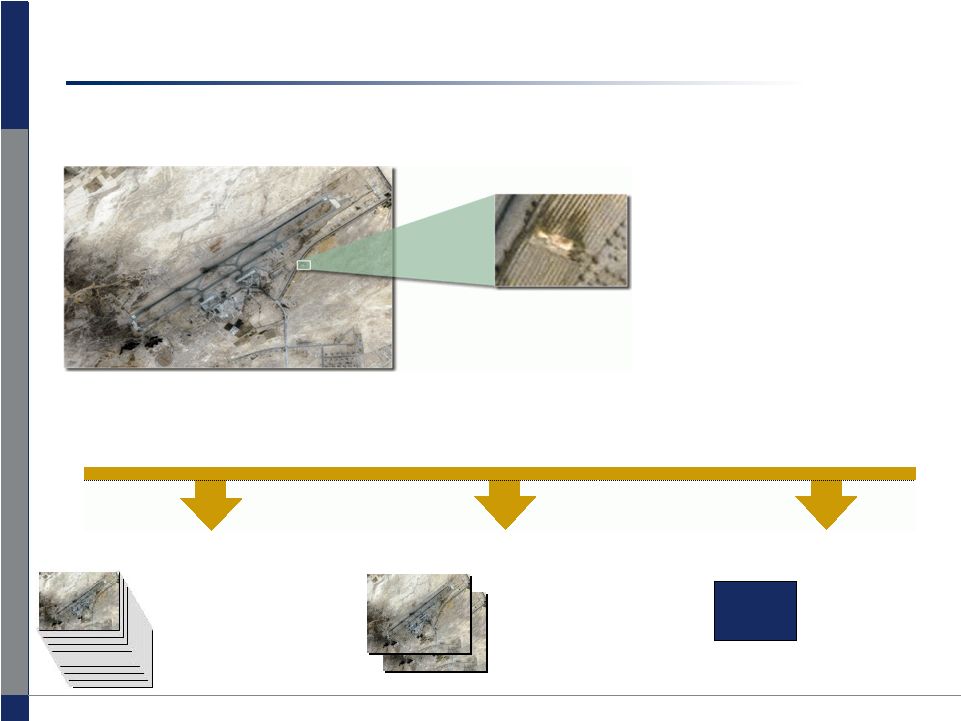

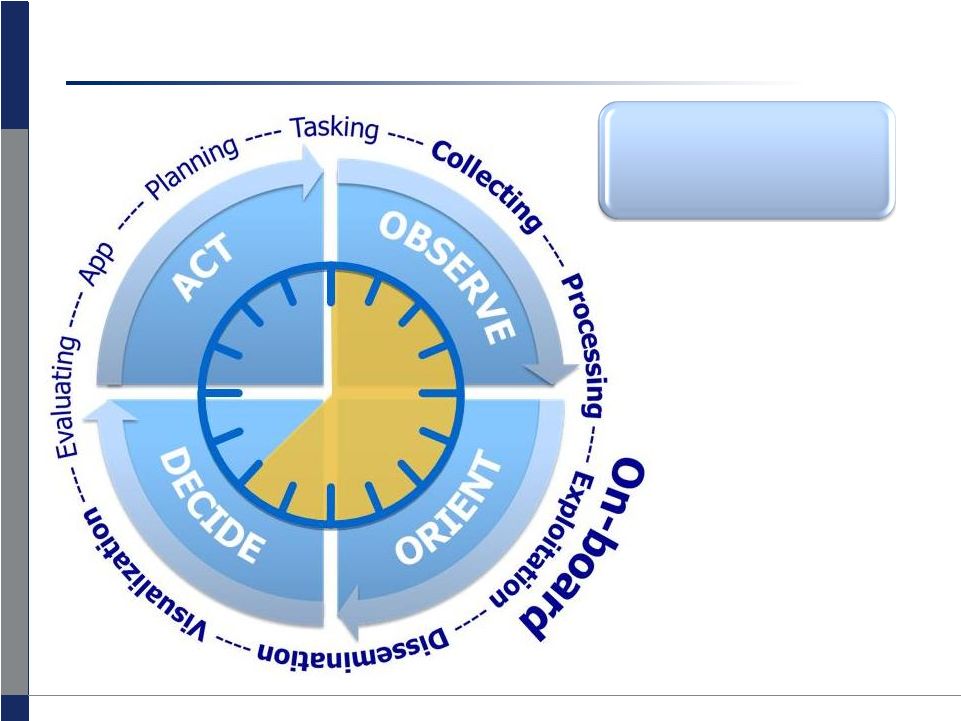

2009 Mercury Computer Systems, Inc. www.mc.com Collection cycles appropriate to track targets of interest in any theatre of operation Collection cycles appropriate to track targets of interest in any theatre of operation Era of “persistent conflict” defines ISR Needs 44 • Global coverage • On station 24/7 • Multi-function / multi-sensor • Networked, fused data • Tactical, smart dissemination • Robust, long endurance Persistent ISR strives to understand activity as it is taking place |

©

2009 Mercury Computer Systems, Inc. www.mc.com 45 • On-demand sensing • Machine-assisted processing, exploitation, and dissemination • Direct to the warfighter • In time to do something, < 1s Time-to-information is our differentiator Time-to-information is our differentiator Tactical Smart Processing is our strength 45 Leveraging our trusted position in ISR market |

©

2009 Mercury Computer Systems, Inc. www.mc.com Maximize our State-of-the-Shelf Expertise MCS/MFS approach – hybrid business model 46 46 |

©

2009 Mercury Computer Systems, Inc. www.mc.com Benefits of a hybrid business model to Mercury • Closer to the end customer – track the money flows, insight years ahead of the competition • Leverages current business model to a future state • Funded product development helps lower R&D expenses, accelerate growth and reduces risk • Larger deal sizes overall – fighting for a bigger piece of the platform and military electronics pie • MFS services-led strategy will balance hardware revenue – lower volatility once established • MFS faster time to revenue than pure hardware model 47 |

©

2009 Mercury Computer Systems, Inc. www.mc.com MFS program example: Gorgon Stare (WAAS) Validation of MCS & MFS leadership and agility • Won C4ISR Journal’s 2009 “Big 25” award in “Innovations” category • Partnered with other agile companies (Sierra Nevada Corp, ITT, Adam Works, General Atomics) • Rapid prototyping leading to first flight demos in 2010 48 |

©

2009 Mercury Computer Systems, Inc. www.mc.com MFS summary • Currently executing 8 Programs – 3 as Prime – Bookings grew from $.4M in 2008 to $11.9M in 2009 – Revenue grew from $.2M in 2008 to $5.7M in 2009 • Positioning MFS on critical path of several key government programs • Demonstrating success on current contracts • Assembling world-class team of ISR experts 49 49 |

©

2009 Mercury Computer Systems, Inc. www.mc.com Agenda 50 • Corporate Overview • Keynote: John J. Young • Advanced Computing Solutions • Mercury Federal Systems (MFS) • Financial Review – Bob Hult, CFO, Mercury Computer Systems – FY09 Financial Results – FY10 Guidance • Closing Remarks / Q&A |

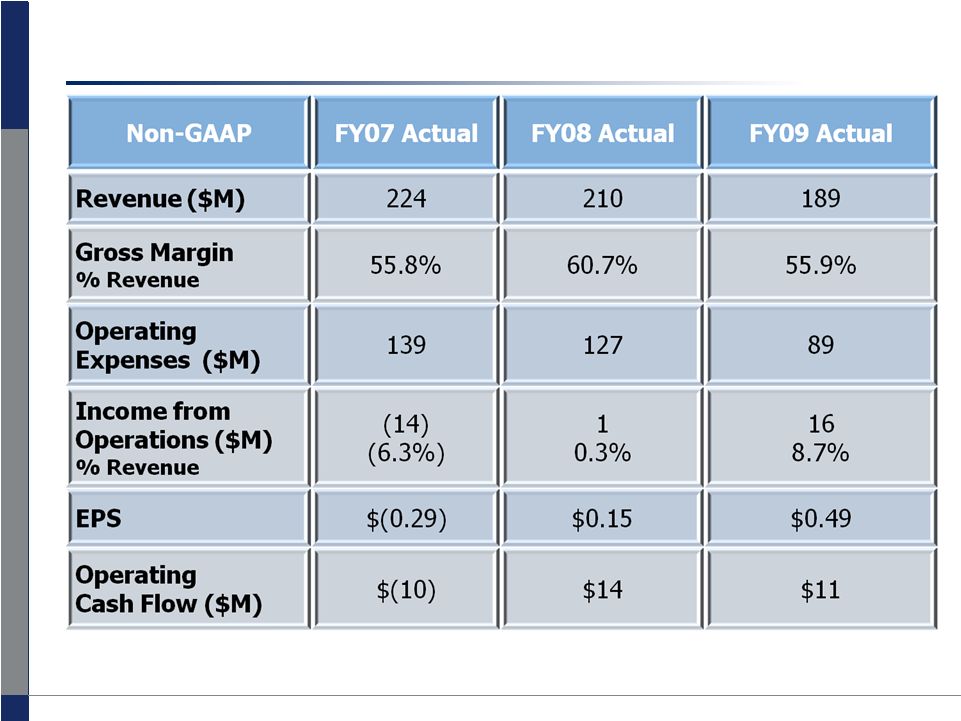

©

2009 Mercury Computer Systems, Inc. www.mc.com 51 FY07 – FY09: Restored profitability 51 Note: All historical income statement figures are as reported in the Company’s earnings press

release at the end of the applicable fiscal year and have not been restated for

operations that have been discontinued subsequent to that time. |

©

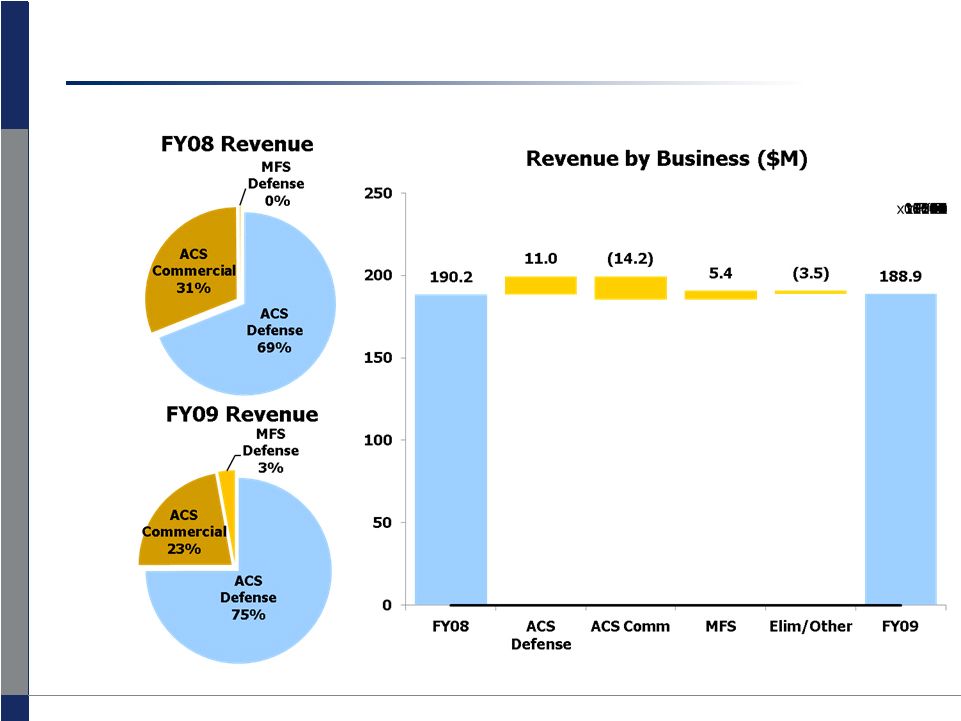

2009 Mercury Computer Systems, Inc. www.mc.com Major business dynamics • Focus on strengthening and growing the defense business 52 Note: Excludes $2M interco eliminations |

©

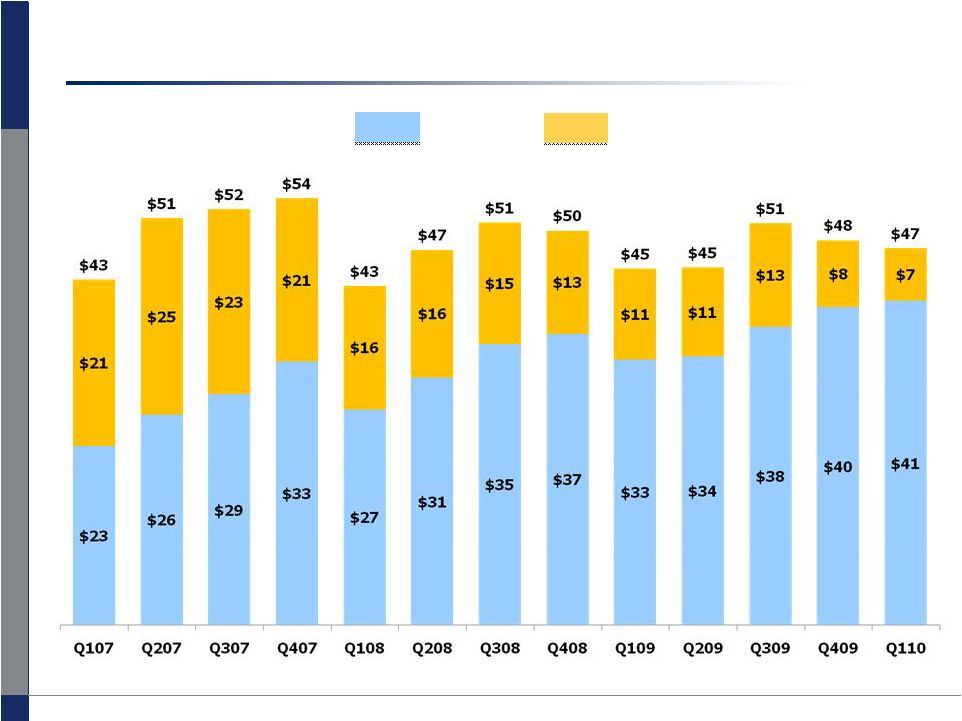

2009 Mercury Computer Systems, Inc. www.mc.com 53 Strong defense revenue 53 Note: All historical figures adjusted for the discontinued operations 14% Defense CAGR FY07 – FY09 Revenue ($M) Commercial Defense |

©

2009 Mercury Computer Systems, Inc. www.mc.com Strong growth in bookings and backlog FY07-FY09: • Total Company – 11% Bookings CAGR – 18% Backlog CAGR • Defense – 28% Bookings CAGR – 28% Backlog CAGR 54 54 Note: Historical figures adjusted for discontinued operations Bookings Total Company $M Ending Backlog 170 199 210 70 78 98 0 25 50 75 100 125 150 175 200 225 FY07 FY08 FY09 Defense $107 Defense $145 Defense $174 Defense $58 Defense $67 Defense $94 |

©

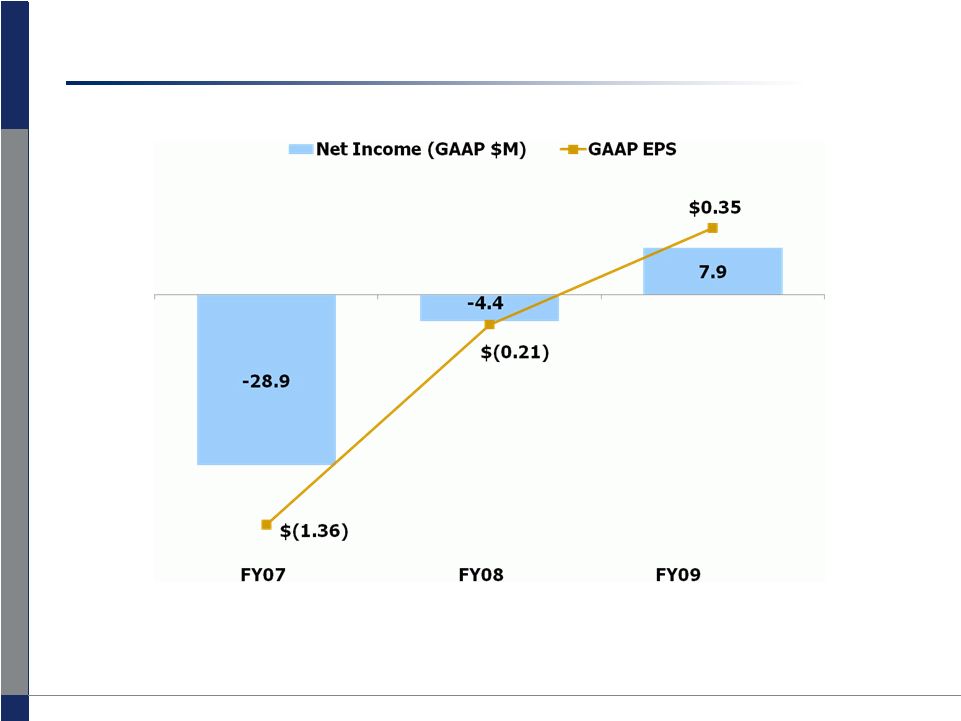

2009 Mercury Computer Systems, Inc. www.mc.com FY07-FY09 profitability improves 55 Note: GAAP Net Income and EPS results are from continuing operations |

©

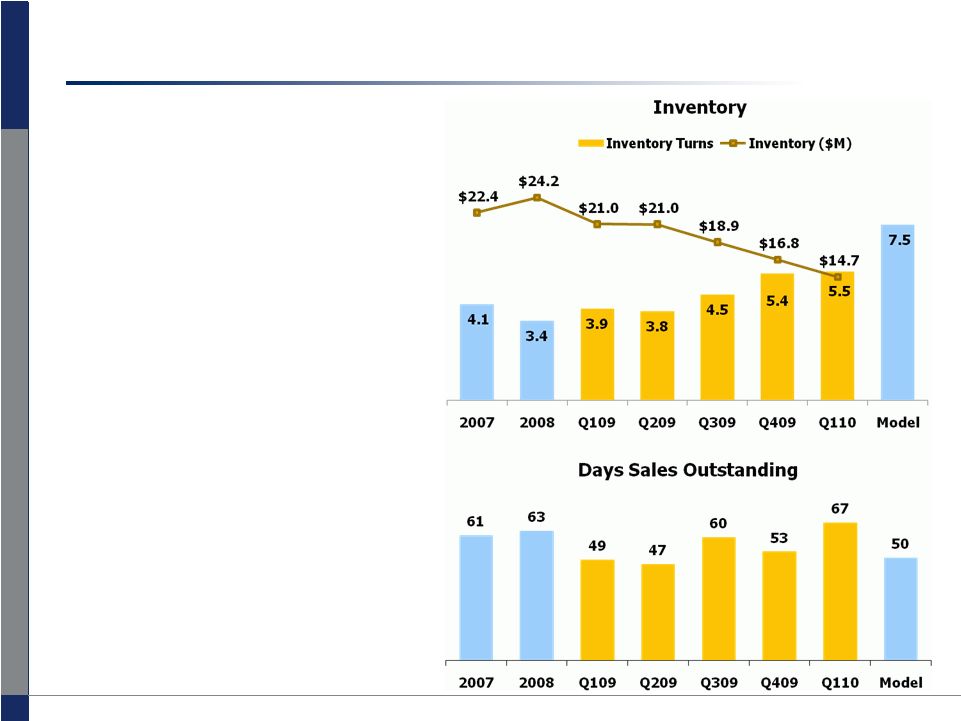

2009 Mercury Computer Systems, Inc. www.mc.com Improved working capital efficiencies • Supply chain transformation – Operational efficiencies – Manufacturing lead times – Cost of quality – Competitive advantage for Mercury and customers – Inventory reduced $13.9M since Q3 FY08 as reported • Customer satisfaction – Blue chip customers – End-of-quarter shipment skew 56 |

©

2009 Mercury Computer Systems, Inc. www.mc.com Much improved cash conversion cycle 57 |

©

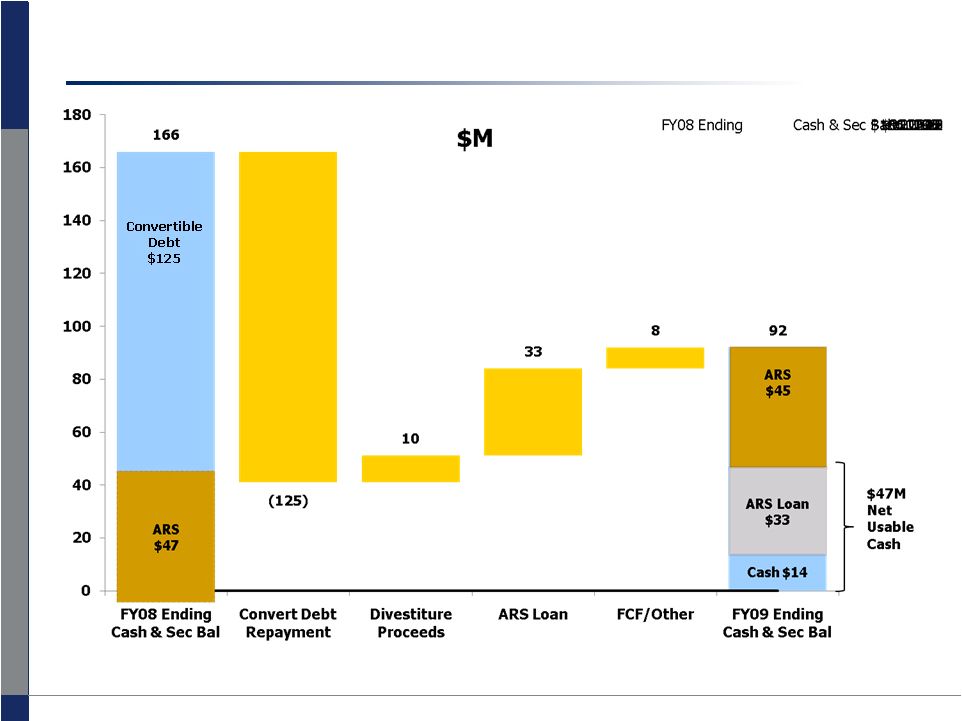

2009 Mercury Computer Systems, Inc. www.mc.com 58 Repaid debt and improved cash balance Note: ARS settlement at par ($50M) with UBS 6/30/10 |

©

2009 Mercury Computer Systems, Inc. www.mc.com Strong and unencumbered balance sheet 59 Q1'10 ($M) Cash and Marketable Securities 94 Total Current Assets 152 Total Assets 226 Debt 33 Total Liabilities 76 Shareholders' Equity 150 • Generated $2M free cash flow in Q1 • Zero cost ARS loan of $33M • $50M ARS balance repaid at par 6/30/10 • 22.5M shares outstanding |

©

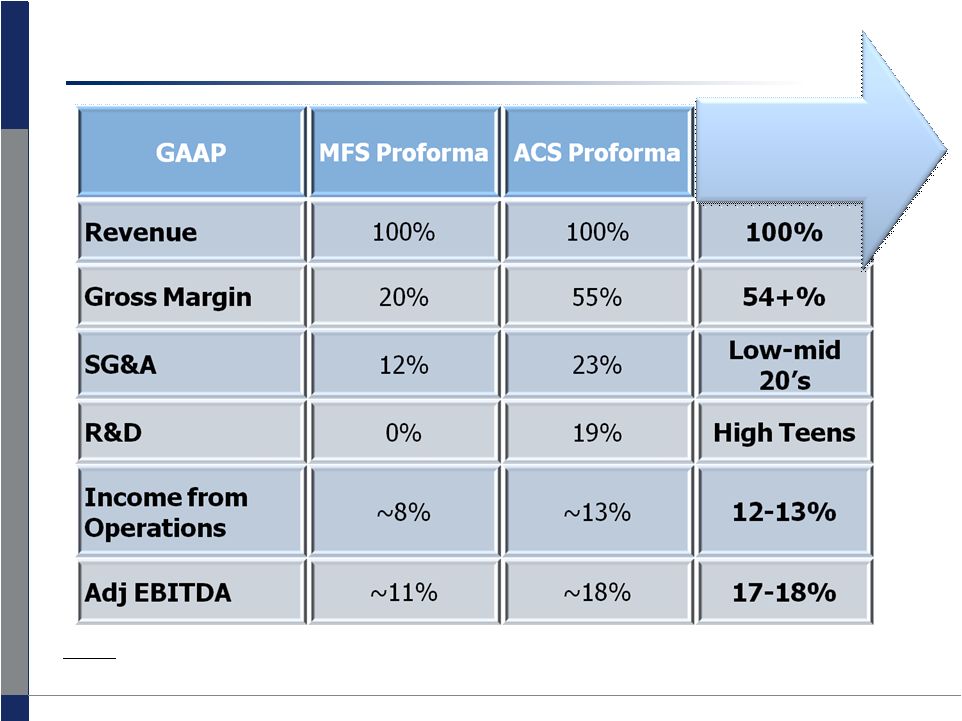

2009 Mercury Computer Systems, Inc. www.mc.com 60 Robust target business model Notes: Target Business Model assumes organic growth. ACS /MFS approx 90%/10% revenue split Adj EBITDA adjusts for Depreciation 2-3% of revenue and Stock Based Comp 2-3% of

revenue Target Business Model |

©

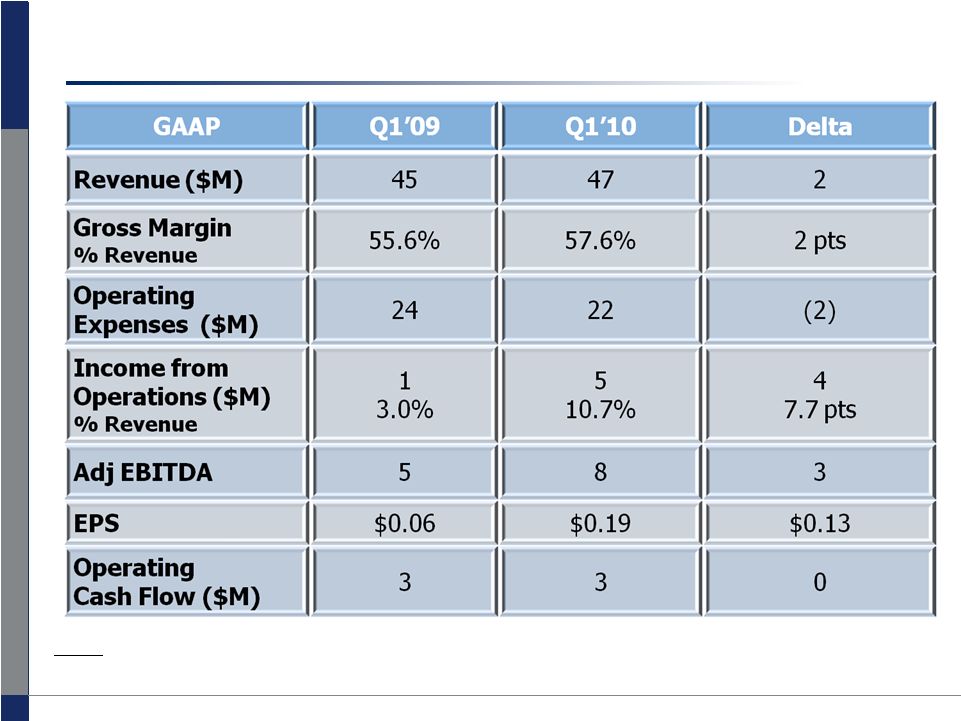

2009 Mercury Computer Systems, Inc. www.mc.com Q1'10 prior year comparison (GAAP) 61 Notes: 1)All historical income statement figures have been restated for operations that have been

discontinued subsequent to that time. 2) Adj EBITDA is earnings before impairment charges, interest, taxes, restructuring, stock compensation,

amortization and depreciation. |

©

2009 Mercury Computer Systems, Inc. www.mc.com Last 9 quarter’s revenues and EPS exceeded or met the top end of guidance 62 2008 Q1 Q2 Q3 Q4 Reported Guidance Reported Guidance Reported Guidance Reported Guidance Revenue ($M) 49.2 48.0 52.6 51.0 56.5 53.0-55.0 55.2 53.0-56.0 EPS ($) 0.09 (0.08) 0.04 (0.05) 0.04 (0.04)- 0.00 0.01 (0.05)- 0.01 2009 Q1 Q2 Q3 Q4 Revenue ($M) 49.1 47.0-49.0 50.7 47.0- 49.0 50.6 48.0-50.0 48.4 46.0- 48.0 EPS ($) 0.07 (0.07)- (0.03) 0.03 (0.05)- 0.00 0.20 0.05-0.09 0.13 0.05- 0.08 2010 Q1 Q2 Q3 Q4 Revenue ($M) 47.4 43.0-45.0 EPS ($) 0.19 0.03-0.08 Note: FY08 – FY09 Guidance Reporting are on a Non-GAAP basis; Q1 FY10 is on a GAAP basis

|

©

2009 Mercury Computer Systems, Inc. www.mc.com Q2’10 guidance 63 Quarter Ending December 31, 2009 Low High Revenues ($M) $40 $42 GAAP EPS ($0.08) ($0.04) Adj EBITDA $0.6 $1.9 Note - Adj EBITDA Adjustments: Net Income (1.8) (0.8) Stock compensation 1.3 1.3 Interest Expense 0.1 0.1 Interest Income (0.1) (0.1) Taxes (0.7) (0.4) Amortization 0.4 0.4 Depreciation 1.4 1.4 Adj EBITDA 0.6 1.9 |

©

2009 Mercury Computer Systems, Inc. www.mc.com Financial summary • Returned to profitability • 11% bookings and 18% backlog growth (CAGR) • Improved working capital efficiencies • Healthy cash flows from operations • Strong and unencumbered balance sheet • Robust target business model 17-18% Adj. EBITDA • $100M shelf registration effective 64 |

©

2009 Mercury Computer Systems, Inc. www.mc.com www.mc.com NASDAQ: MRCY Thank You 65 |

© 2009 Mercury Computer Systems, Inc. www.mc.com Appendix |

©

2009 Mercury Computer Systems, Inc. www.mc.com 67 GAAP to Non-GAAP Reconciliation Notes: 1)FY07 – FY08 GAAP net income (loss) figures are as reported in the Company’s earnings press release at the end of the applicable fiscal period 2)FY09 GAAP net income (loss) figures are restated for discontinued operations as reported

3)GAAP related items: stock comp, amortization, restructuring and adjustment to taxes

Year Ended Year Ended Year Ended June 30, 2007 (1) June 30, 2008 (1) June 30, 2009 (2) GAAP net income (loss) ($37.8) ($35.4) ($1.3) Adjustment to exclude stock-based compensation 10.6 10.4 4.6 Adjustment to exclude inventory write-down 0.0 0.8 0.0 Adjustment to exclude in-process research and development 3.1 0.0 0.0 Adjustment to exclude amortization of acquired intangible assets 7.2 7.3 2.4 Adjustment to exclude impairment of goodwill and long-lived assets 0.1 18.0 0.0 Adjustment to exclude restructuring 5.5 5.2 1.7 Adjustment to exclude gain on sale of long-lived assets 0.0 (3.2) 0.0 Adjustment for tax impact 5.2 0.2 (5.6) Non-GAAP net income (loss) ($6.2) $3.3 $1.8 Adjustment to exclude taxes and other income (expense) 7.9 2.8 0.2 Non-GAAP Income (loss) from operations ($14.1) $0.5 $1.6 GAAP net income (loss) ($37.8) ($35.4) ($1.3) Adjustment to exclude loss from disco ops, net of income taxes (8.9) (30.0) (20.3) Adjustment to exclude gain (loss) on sale of disco ops 0.0 (1.0) 11.1 GAAP net income (loss) from continuing operations ($28.9) ($4.4) $7.9 Adjustment to exclude GAAP related items (3) 3.1 Non-GAAP net income (loss) from continuing operations $11.0 Adjustment to exclude taxes and other income (expense) 5.4 Non-GAAP Income (loss) from continuing operations $16.4 Net income (loss) per share - Diluted - GAAP ($1.78) ($1.64) ($0.06) Net income (loss) per share - Diluted - Non-GAAP ($0.29) $0.15 $0.08 Net income (loss) per share - continuing operations - Diluted - GAAP ($1.36) ($0.21) $0.35 Net income (loss) per share - continuing operations - Diluted - Non-GAAP $0.49 Weighted average shares - Diluted - GAAP 21.2 21.6 22.4 Weighted average shares - Diluted - Non-GAAP 21.2 22.0 22.4 |

©

2009 Mercury Computer Systems, Inc. www.mc.com Adjusted EBITDA reconciliation 68 Note: All historical income statement figures have been restated for operations that have been

discontinued subsequent to that time. Quarter Ended Quarter Ended Sept 30, 2008 Sept 30, 2009 Income from Operations $1.3 $5.1 Other income / (expense) 0.0 0.3 Income Tax Expense 0.0 0.9 Net income from continuing operations $1.4 $4.4 Stock-based compensation expense 1.1 0.5 Interest Expense 0.8 0.1 Interest Income (1.0) (0.1) Income Tax Expense 0.0 0.9 Restructuring 0.2 0.3 Amortization of acquired intangible assets 1.0 0.4 Depreciation 1.5 1.3 Adj EBITDA $5.1 $7.8 |