Attached files

| file | filename |

|---|---|

| 8-K - NORANDA ALUMINUM HOLDING CORPORATION 8-K - Noranda Aluminum Holding CORP | a6093730.htm |

| EX-99.1 - EXHIBIT 99.1 - Noranda Aluminum Holding CORP | a6093730_ex991.htm |

Exhibit 99.2

Noranda Aluminum Holding Corporation Third Quarter Earnings Call Friday, November 6, 2009 10:00 AM Eastern

Title: Cautionary Statement The following presentation and discussion may contain “forward-looking statements” which involve risks and uncertainties. You can identify forward-looking statements because they contain words such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “estimates,” or “anticipates” or similar expressions that relate to Noranda’s strategy, plans or intentions. All statements Noranda makes relating to its estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates and financial results or to the Company’s expectations regarding future industry trends are forward-looking statements. Participants are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made and which reflect management's current estimates, projections, expectations or beliefs and which are subject to risks and uncertainties that may cause actual results to differ materially. Noranda undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law. Noranda's actual results or performance may differ materially from those suggested, expressed or implied by forward-looking statements due to a wide range of factors including, without limitation, the general business environment, fluctuating commodity prices and the Company’s ability to return its New Madrid smelter to full capacity. For a discussion of additional risks and uncertainties that may affect the future results of Noranda, please see the Company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. This presentation makes reference to certain non-GAAP financial measures, as defined under SEC rules. Where required, we have provided a reconciliation of these measures for those directly comparable GAAP measures in our press release. 2

Title: Noranda Participants Kip Smith, CEO Kyle Lorentzen, COO Bob Mahoney, CFO 3

Noranda Title: Overview Q3-09 results were positive. We generated $122 million of operating cash flow We reported Adjusted EBITDA of $28.6 million. We made progress on our key objectives Return our smelter to full capability Grow our top-line Drive productivity to reduce costs and optimize working capital Manage our financial structure Aluminum’s long-term fundamentals remain intact. We are focused on the fundamentals of our business 4

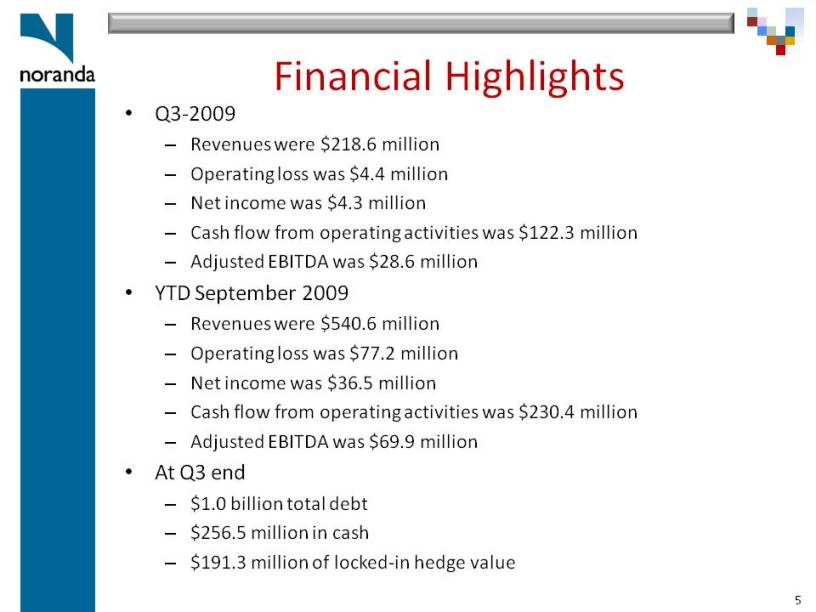

Noranda Title: Financial Highlights Q3-2009 Revenues were $218.6 million Operating loss was $4.4 million Net income was $4.3 million Cash flow from operating activities was $122.3 million Adjusted EBITDA was $28.6 million YTD September 2009 Revenues were $540.6 million Operating loss was $77.2 million Net income was $36.5 million Cash flow from operating activities was $230.4 million Adjusted EBITDA was $69.9 million At Q3 end $1.0 billion total debt $256.5 million in cash $191.3 million of locked-in hedge value 5

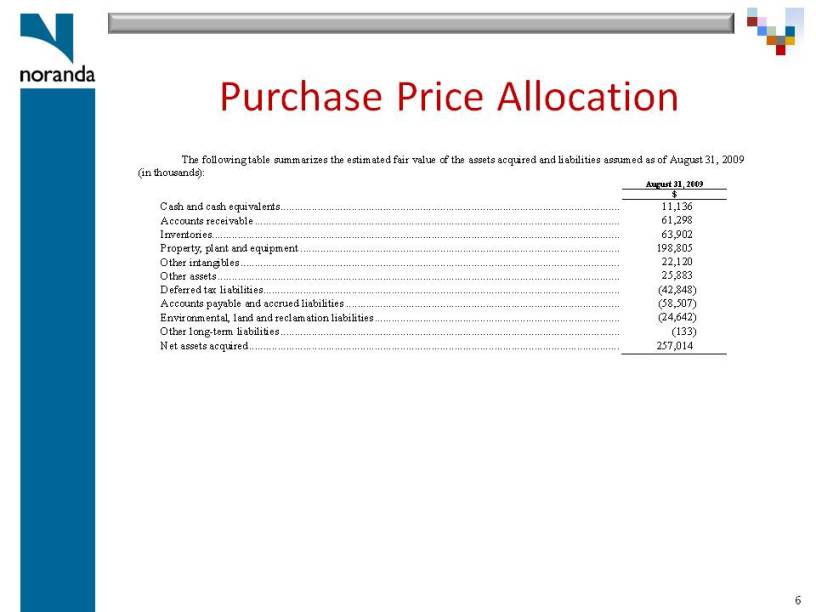

Noranda Title: Purchase Price Allocation The following table summarizes the estimated fair value of the assets acquired and liabilities assumed as of August 31, 2009 (in thousands): $ Cash and cash equivalents 11,136 Accounts receivable 61,298 Inventories 63,902 Property, plant and equipment 198,805 Other intangibles 22 120 Other assets 25,883 Deferred tax liabilities (42,848) Accounts payable and accrued liabilities (58,507) Environmental, land and reclamation liabilities (24,642) Other long-term liabilities (133) 257,014 Net assets acquired 6

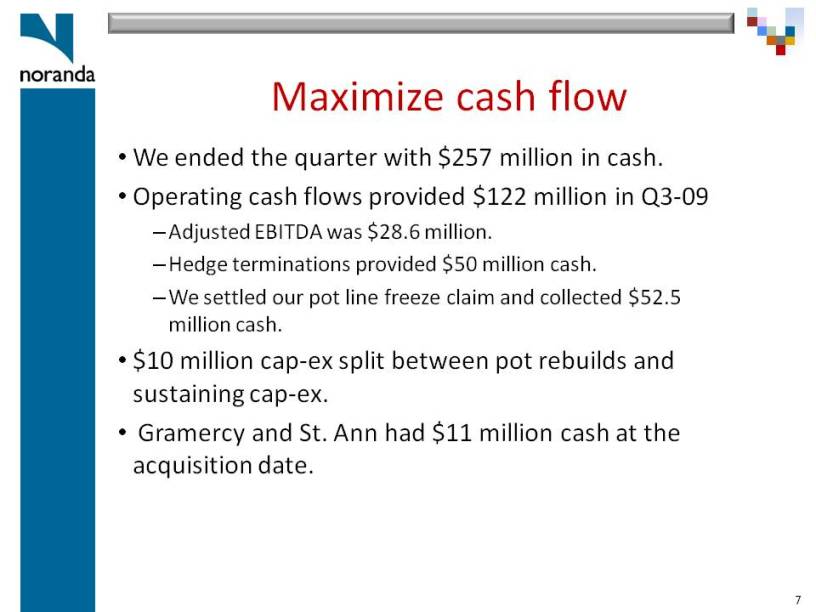

Noranda Title: Maximize cash flow We ended the quarter with $257 million in cash. Operating cash flows provided $122 million in Q3-09 Adjusted EBITDA was $28.6 million. Hedge terminations provided $50 million cash. We settled our pot line freeze claim and collected $52.5 million cash. $10 million cap-ex split between pot rebuilds and sustaining cap-ex. Gramercy and St. Ann had $11 million cash at the acquisition date. 7

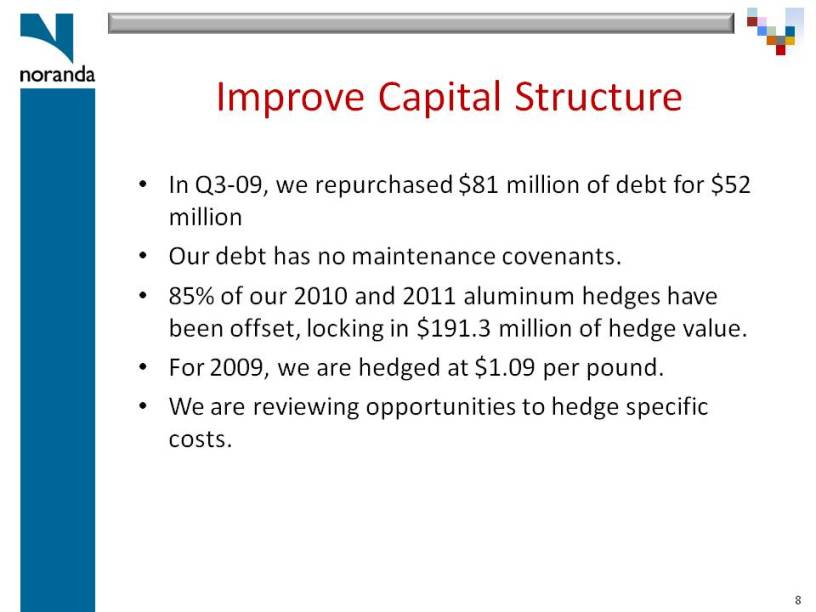

Noranda Title: Improve Capital Structure In Q3-09, we repurchased $81 million of debt for $52 million Our debt has no maintenance covenants. 85% of our 2010 and 2011 aluminum hedges have been offset, locking in $191.3 million of hedge value. For 2009, we are hedged at $1.09 per pound. We are reviewing opportunities to hedge specific costs. 8

Noranda Title: Expand Production and Sales The smelter recovery project has progressed smoothly. On average for Q3-09, over 60% of pots were operational. We produced 22% more aluminum in Q3-09 than Q2-09. Company-wide, we shipped 11% more aluminum to external customers in Q3-09 than in Q2-09. Our sales have outperformed the market in key downstream market segments. In October, we entered into a multi-year contract to sell approximately 25% of Gramercy’s capacity. We expect to return Gramercy and St. Ann operations to full capacity by year-end. 9

Noranda Title: Improve Productivity Aluminum cash cost was $0.76 per pound through Q3-09. Cash cost was adversely affected by $0.03 in Q3-09 from producing below capacity at New Madrid. YTD Q3-09 CORE has generated $35 million in cost savings. We continue to identify individual productivity projects at each facility. Our safety statistics continue to improve. 10

Noranda Title: Closing Q3-09 results were encouraging but challenges remain. We will continue to execute well around our key objectives. Return our smelter to full capability. Maximize top-line by providing best-in-class customer support. Drive productivity by reducing costs and optimizing working capital. Manage our financial structure. Results are validating our strategy, plans and execution $257 million cash on hand at September 30 $28.6 million of Adjusted EBITDA for the quarter Year-to-date productivity savings of $35 million $81 million face value of debt repurchased Above segment average downstream revenue performance 11