Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PDC ENERGY, INC. | pdc8k_20091105.htm |

| EX-99.1 - EX-99.1 - PDC ENERGY, INC. | pdcrelease2009_1105.htm |

NASDAQ:PETD

Petroleum

Development Corporation

2009

Third Quarter Teleconference

November 5,

2009

Richard

W. McCullough, Chairman & CEO

Gysle

R. Shellum, Chief Financial Officer

Barton

R. Brookman, SVP Exploration &

Production

Production

See

Slide 2 regarding Forward Looking Statements

2

The

following information contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act

of 1995. These forward-looking statements are based on Management’s current expectations and beliefs, as well as a number

of assumptions concerning future events.

of 1995. These forward-looking statements are based on Management’s current expectations and beliefs, as well as a number

of assumptions concerning future events.

These

statements are based on certain assumptions and analyses made by Management in

light of its experience and its

perception of historical trends, current conditions and expected future developments as well as other factors it believes are

appropriate in the circumstances. However, whether actual results and developments will conform with Management’s

expectations and predictions is subject to a number of risks and uncertainties, general economic, market or business

conditions; the opportunities (or lack thereof) that may be presented to and pursued by Petroleum Development Corporation;

actions by competitors; changes in laws or regulations; and other factors, many of which are beyond the control of Petroleum

Development Corporation.

perception of historical trends, current conditions and expected future developments as well as other factors it believes are

appropriate in the circumstances. However, whether actual results and developments will conform with Management’s

expectations and predictions is subject to a number of risks and uncertainties, general economic, market or business

conditions; the opportunities (or lack thereof) that may be presented to and pursued by Petroleum Development Corporation;

actions by competitors; changes in laws or regulations; and other factors, many of which are beyond the control of Petroleum

Development Corporation.

You are

cautioned not to put undue reliance on such forward-looking statements because

actual results may vary materially

from those expressed or implied, as more fully discussed in our safe harbor statements found in our SEC filings, including,

without limitation, the discussion under the heading “Risk Factors” in the Company’s 2008 annual report on Form 10-K and in

subsequent Form 10-Qs. All forward-looking statements are based on information available to Management on this date

and Petroleum Development Corporation assumes no obligation to, and expressly disclaims any obligation to, update

or revise any forward looking statements, whether as a result of new information, future events or otherwise.

from those expressed or implied, as more fully discussed in our safe harbor statements found in our SEC filings, including,

without limitation, the discussion under the heading “Risk Factors” in the Company’s 2008 annual report on Form 10-K and in

subsequent Form 10-Qs. All forward-looking statements are based on information available to Management on this date

and Petroleum Development Corporation assumes no obligation to, and expressly disclaims any obligation to, update

or revise any forward looking statements, whether as a result of new information, future events or otherwise.

The SEC

permits oil and gas companies to disclose in their filings with the SEC only

proved reserves, which are reserve

estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from

known reservoirs under existing economic and operating conditions. The Company uses in this presentation the terms

“probable” and “possible” reserves, which SEC guidelines prohibit in filings of U.S. registrants. Probable reserves are unproved

reserves that are more likely than not to be recoverable. Possible reserves are unproved reserves that are less likely to be

recoverable than probable reserves. Estimates of probable and possible reserves which may potentially be recoverable through

additional drilling or recovery techniques are by nature more uncertain than estimates of proved reserves and accordingly are

subject to substantially greater risk of not actually being realized by the Company. In addition, the Company’s reserves and

production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of

production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected

by significant commodity price declines or drilling cost increases.

estimates that geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from

known reservoirs under existing economic and operating conditions. The Company uses in this presentation the terms

“probable” and “possible” reserves, which SEC guidelines prohibit in filings of U.S. registrants. Probable reserves are unproved

reserves that are more likely than not to be recoverable. Possible reserves are unproved reserves that are less likely to be

recoverable than probable reserves. Estimates of probable and possible reserves which may potentially be recoverable through

additional drilling or recovery techniques are by nature more uncertain than estimates of proved reserves and accordingly are

subject to substantially greater risk of not actually being realized by the Company. In addition, the Company’s reserves and

production forecasts and expectations for future periods are dependent upon many assumptions, including estimates of

production decline rates from existing wells and the undertaking and outcome of future drilling activity, which may be affected

by significant commodity price declines or drilling cost increases.

This

material also contains certain non-GAAP financial measures as defined under the

Securities and Exchange Commission

rules.

rules.

Disclaimer

See

Slide 2 regarding Forward Looking Statements

3

Rick

McCullough

Chairman & Chief

Executive Officer

See

Slide 2 regarding Forward Looking Statements

4

STRATEGIC

ASSESSMENT:

DEVELOPING STRATEGIES

DEVELOPING STRATEGIES

Scale

and Cost Control

• Control / reduce

CAPEX/OPEX through strategic negotiations

• Gain scale / mediate

cost sensitivity in basins which are highly

sensitive to commodity pricing (particularly Wattenberg)

sensitive to commodity pricing (particularly Wattenberg)

Alternative Capital

Sources

• Pursue joint

ventures in emerging Shale plays

• Position the Company

financially to capitalize on strategic

alternatives which could drive shareholder value creation

alternatives which could drive shareholder value creation

Financial

Focus

• Implement long-term

hedging strategy to mitigate risk and solidify

value preservation

value preservation

Diversify and

Increase Projects

• Continue to

monitor/assess acquisition and divestiture

opportunities, and enhance A&D capabilities

opportunities, and enhance A&D capabilities

See

Slide 2 regarding Forward Looking Statements

2009

Corporate Update

5

• Completed

Appalachian Joint Venture with Lime Rock Partners

• PDC Mountaineer, LLC

is the new JV company

• Mr. Dewey Gerdom

appointed Chief Executive Officer of the JV

• PDC received $45

million as return of capital at closing

• Lime Rock to

contribute total obligation of $113.5 million by early-to-mid 2011

• Equity Offering

Completed in August 2009

• 4.3 million shares

issued, for net proceeds of $48.5 million

• Equity provides

greater financial flexibility to pursue strategic objectives, and

provides a cushion against a downside commodity price scenario

provides a cushion against a downside commodity price scenario

• 83% of offering was

placed with 36 new institutional investors

• Extended Hedged

Position through 2013

• 70% - 80% of PDP

production hedged through 2013

• NYMEX swaps at $6.68

in 2011; swaps and collars in 2012 - 2013 with swaps

at $6.99 in 2012; $7.11 in 2013, and collars $6.00 - $8.50 range

at $6.99 in 2012; $7.11 in 2013, and collars $6.00 - $8.50 range

• Swapped oil at $81 -

$85 in 2010 - 2011, and added collars of $73-$104 range

through 2013

through 2013

See

Slide 2 regarding Forward Looking Statements

PDC

/ Lime Rock Joint Venture Overview

6

|

Summary:

|

PDC and Lime

Rock Partners (LRP) announced the formation of PDC

Mountaineer, LLC, to develop PDC’s Appalachian Marcellus Shale and Shallow Devonian assets |

|

Consideration:

|

PDC Appalachia

assets valued at approximately $158.5 million

|

|

Terms:

|

LRP funded $45

million as return of capital at closing. PDC

has an option to

take a second cash contribution of $11.5 million by year-end 2010 |

|

PDC

LRP

|

Contributes

$158.5 MM, withdraws $45 MM for net equity of $113.5 MM

Contributes

$45 MM, future

capital commitment of $68.5 MM equalizes equity

at $113.5 MM |

|

Operations:

|

Mr. Dewey

Gerdom has been appointed Chief Executive Officer of the JV. PDC

has designated approximately ninety of its employees to directly support the JV, which will be headquartered in Bridgeport, West Virginia |

|

AMI:

|

PDC and LRP to

form a limited Area of Mutual Interest to jointly develop

Marcellus acreage (existing and future) |

|

Governance:

|

JV Board will

have equal representation from PDC and

LRP

|

See

Slide 2 regarding Forward Looking Statements

• Marcellus shale is a

leading shale gas play with strong economics and production

growth profile

growth profile

• Accelerates

development of existing PDC acreage

• Provides capital to

capture new leasehold in Marcellus fairway

• Lime Rock Partners

brings substantial oil and gas expertise and history of successful

energy investments

energy investments

• PDC initial $45

million return of capital provides cash to pay down debt to offset

reduction in borrowing base at PDC

reduction in borrowing base at PDC

• Bank approval with

reduced borrowing base to $305 million without Appalachia assets;

• $45 million

distribution to PDC at closing; no net change in PDC corporate

liquidity

• PDC does not expect

the borrowing base to be adjusted in November redetermination

• PDC Mountaineer, LLC

to operate assets via service agreements with PDC

Joint

Venture Rationale

7

See

Slide 2 regarding Forward Looking Statements

Quarterly

Realized Hedge Price

8

See

Slide 2 regarding Forward Looking Statements

Corporate

Summary

9

• Third quarter 2009

results in-line with previous guidance

– Adjusted Net Loss

about break-even at ($2.8 MM)

– Adjusted Cash Flow

from Operations of $37.3 MM

• Hedging activity

continues to provide cash flow certainty

• PDC Team maintains

focus on operational enhancements and is

prepared to capitalize on market recovery as it unfolds

prepared to capitalize on market recovery as it unfolds

• Another good quarter

of cash flow per share and production

performance

performance

• Liquidity at

approximately $200 million as of October 31, 2009

See

Slide 2 regarding Forward Looking Statements

10

Bart

Brookman

Senior

V.P. Exploration & Production

See

Slide 2 regarding Forward Looking Statements

11

Core

Operating Regions

Q3 2009 Production Summary

Q3 2009 Production Summary

See

Slide 2 regarding Forward Looking Statements

Rocky

Mountains

2008

Production: 1.6

Bcfe

1st Q 2009

Production 0.3

Bcfe

2nd Q 2009

Production 0.4

Bcfe

3rd Q 2009

Production 0.4

Bcfe

Michigan

Basin

2008

Production: 3.9

Bcfe

1st Q 2009

Production 1.0

Bcfe

2nd Q 2009

Production 1.0

Bcfe

3rd Q 2009

Production 1.0

Bcfe

Appalachian

Basin

2008

Production: 33.2

Bcfe

1st Q 2009

Production 9.9

Bcfe

2nd Q 2009

Production 9.8

Bcfe

3rd Q 2009

Production 9.5

Bcfe

Q3

2009 Production

10.9

Bcfe

• 7.5%

increase over 3rd

Quarter 2008

Quarter 2008

• 117

MMcfe average daily

production rate during Q3 2009

production rate during Q3 2009

Note:

Does not include impact of Marcellus Joint Venture.

See

Slide 2 regarding Forward Looking Statements

12

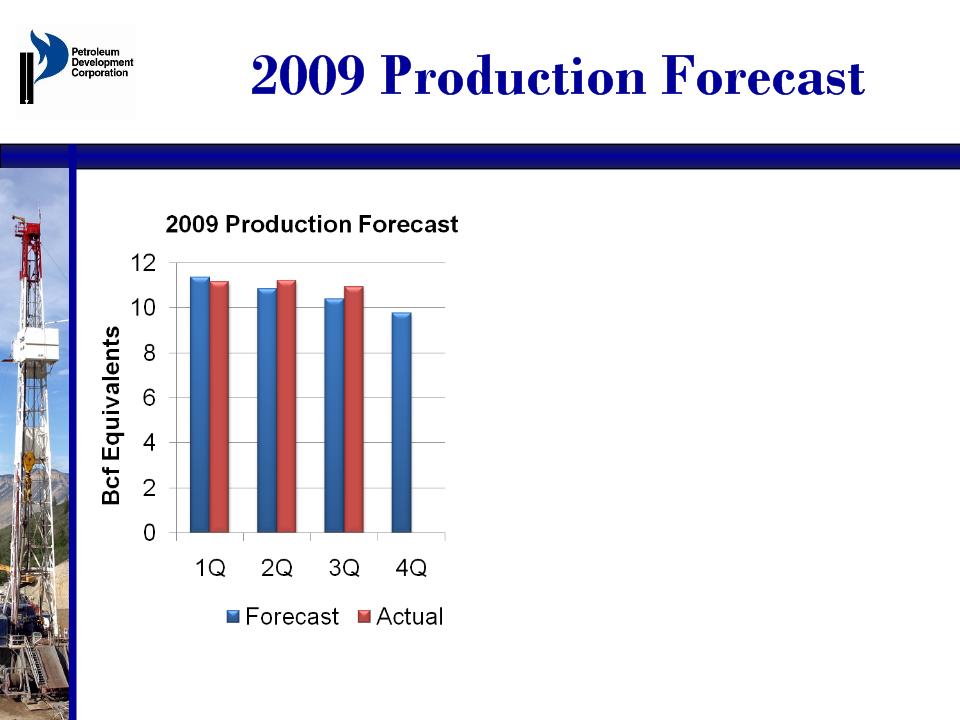

• Estimated 2009

production of

43.1 Bcfe

43.1 Bcfe

• Q4 production

forecast adjusted

for recent Marcellus JV

for recent Marcellus JV

• Actual production

slightly above

forecast

forecast

• Wattenberg

production and

completions continue to exceed

expectations

completions continue to exceed

expectations

• Strong production

optimization

efforts underway

efforts underway

See

Slide 2 regarding Forward Looking Statements

13

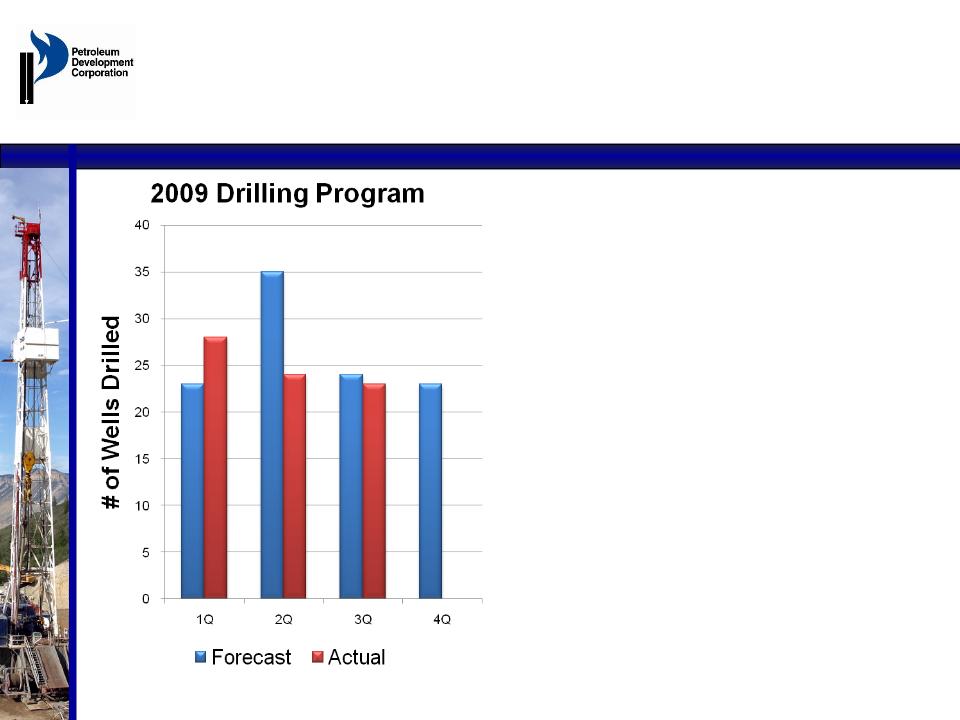

2009

Drilling Activity

• Plan 103 gross wells

in 2009

• 23 gross wells in

Q3

• 83% of 2009 wells

are planned

for the Wattenberg field

for the Wattenberg field

• Seven vertical

Marcellus wells

drilled to date

drilled to date

See

Slide 2 regarding Forward Looking Statements

14

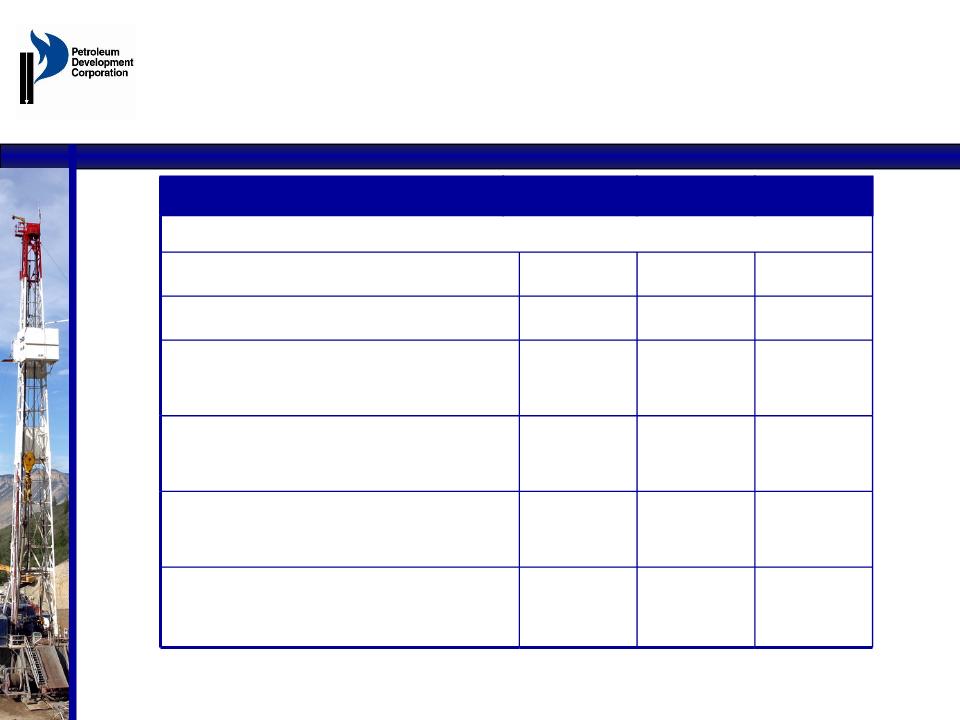

2009

CAPEX

($ in millions)

($ in millions)

|

|

Actual

Nine Months Ended September 30, 2009 |

Estimated

Three Months Ended December

31, 2009

|

Estimated

Total 2009 |

|

Net

Development Capital

|

$66

|

$13

|

$79

|

|

Exploration,

Land, G&G

|

10

|

3

|

13

|

|

Acquisitions

|

6

|

1

|

7

|

|

Miscellaneous

Capital

|

8

|

1

|

9

|

|

Total

Net Capital

|

$90

|

$18

|

$108

|

See

Slide 2 regarding Forward Looking Statements

Lease

Operating Expenses

15

|

Lifting

Cost Improvements

(per Mcfe) |

||||

|

|

Twelve

Months

Ended December 31,

2008

|

Three Months

Ended

September 30, 2009 |

Nine Months

Ended

September 30, 2009 |

Year-to-Date

% Variance 2008 vs. 2009 |

|

Direct Well

Expenses

|

$0.84

|

$0.55

|

$0.55

|

-35%

|

|

Indirect Well

Expenses

|

$0.23

|

$0.24

|

$0.24

|

4%

|

|

Lifting

Cost ($ per Mcfe)

|

$1.07

|

$0.79

|

$0.79

|

-26%

|

|

|

|

|

|

|

|

Production

Taxes

|

$0.48

|

$0.24

|

$0.22

|

-54%

|

|

Well

Operations Segment

|

$0.15

|

$0.17

|

$0.16

|

7%

|

|

Overhead and

Other

Production

Expenses

|

$0.32

|

$0.19

|

$0.21

|

-34%

|

|

Oil

& Gas Production and

Well

Operations Costs

|

$2.02

|

$1.39

|

$1.37

|

-32%

|

See

Slide 2 regarding Forward Looking Statements

Q3

2009 Operating Highlights

• Marcellus

Update

– 55,000 net

acres

– Seven vertical wells

drilled YTD

– Completed ten square

mile 3D seismic shoot in West Virginia

– Engineering near

completion on 1st

horizontal Marcellus well

• Scheduled Q1

2010

– Recent formation of

Marcellus JV

• Operating one

drilling rig in Wattenberg

• Continued focus on

capital and LOE reductions

• Production slightly

above expectations

16

See

Slide 2 regarding Forward Looking Statements

17

Gysle

Shellum

Chief

Financial Officer

See

Slide 2 regarding Forward Looking Statements

18

Q3

2009 Highlights

• Realized hedging

gains from production of $23.2 MM

for Q3 2009

for Q3 2009

• Key financial

metrics (comparison to

Second Quarter 2009):

– Average realized

prices (including realized gains/losses on

derivatives) per Mcfe were $6.02 in Q3 2009, a 3% increase

from $5.87 per Mcfe in Q2 2009

derivatives) per Mcfe were $6.02 in Q3 2009, a 3% increase

from $5.87 per Mcfe in Q2 2009

– Average Lifting

Costs per Mcfe increased 23% to $0.79 in

Q3 2009 from $0.64 in Q2 2009(1), however for nine

months ended 9/30/09 costs have decreased approximately

26%

Q3 2009 from $0.64 in Q2 2009(1), however for nine

months ended 9/30/09 costs have decreased approximately

26%

(1) The Q2 2009 average

lifting cost includes a benefit for the reimbursement of costs incurred in Q1

2009.

(2) See appendix for

reconciliation to GAAP.

See

Slide 2 regarding Forward Looking Statements

19

Summary

Financial Results

($ in millions, except for per share data)

($ in millions, except for per share data)

|

|

Three

Months Ended

September

30,

|

Nine

Months Ended

September

30,

|

||

|

|

2009

|

2008

|

2009

|

2008

|

|

O&G

Revenues

|

$44.0

|

$99.4

|

$125.3

|

$265.6

|

|

O&G

Production & Well Operating Costs

|

$15.2

|

$22.6

|

$45.6

|

$62.1

|

|

O&G

Operating Margins(1)

|

$28.8

|

$76.8

|

$79.7

|

$203.5

|

|

Net Income

(Loss)

|

($24.5)

|

$126.9

|

($63.3)

|

$72.3

|

|

Earnings

(Loss) per Diluted Share

|

($1.44)

|

$8.55

|

($4.07)

|

$4.86

|

|

Adjusted Net

Income (Loss)(2)

|

($2.8)

|

$20.8

|

($2.4)

|

$46.6

|

|

Adjusted Cash

Flow from Operations(2)

|

$37.3

|

$59.1

|

$114.7

|

$158.7

|

|

Adjusted Cash

Flow from Operations (per

share)

(2)

|

$2.20

|

$3.98

|

$7.39

|

$10.68

|

|

DD&A

|

$32.3

|

$28.6

|

$100.5

|

$71.9

|

|

G&A

|

$9.6

|

$8.1

|

$36.5

|

$27.2

|

(1) O&G operating

margins is defined as O&G sales less O&G production and well operations

costs.

(2) See appendix for

reconciliation to GAAP.

See

Slide 2 regarding Forward Looking Statements

Note:

The revolver due in 2012 has a borrowing base size of $305 million.

Relative

Balance Sheet Strength (1)

qPDC’s leverage and

coverage measures

compare favorably to its peer group

compare favorably to its peer group

qPDC’s leverage and

coverage measures

compare favorably to “BB” credits.

compare favorably to “BB” credits.

qPDC is a ‘B’ credit

due to its smaller size

and scale

and scale

qMaturity schedule

reflects:

q Mitigation of

liquidity risk

q Diversification of

funding sources

Debt/Book

Capitalization

Debt/Proved

Reserves

Maturity

Profile

Debt/LTM

EBITDA

20

Revolver

Senior

Notes

In

$millions

Source:

EnerCom, June 2009

PDC

Peer Group: BBG, BRY, COG, GDP, KWK, PLLL, PVA, ROSE, WLL

20

$0.41

$0.88

(1)

On 10/29/09 the borrowing base was reduced from $350 MM to $305 MM as a

result of the JV. Debt balance is pro-forma to include $45 MM loan repayment

due to JV distribution.

result of the JV. Debt balance is pro-forma to include $45 MM loan repayment

due to JV distribution.

See

Slide 2 regarding Forward Looking Statements

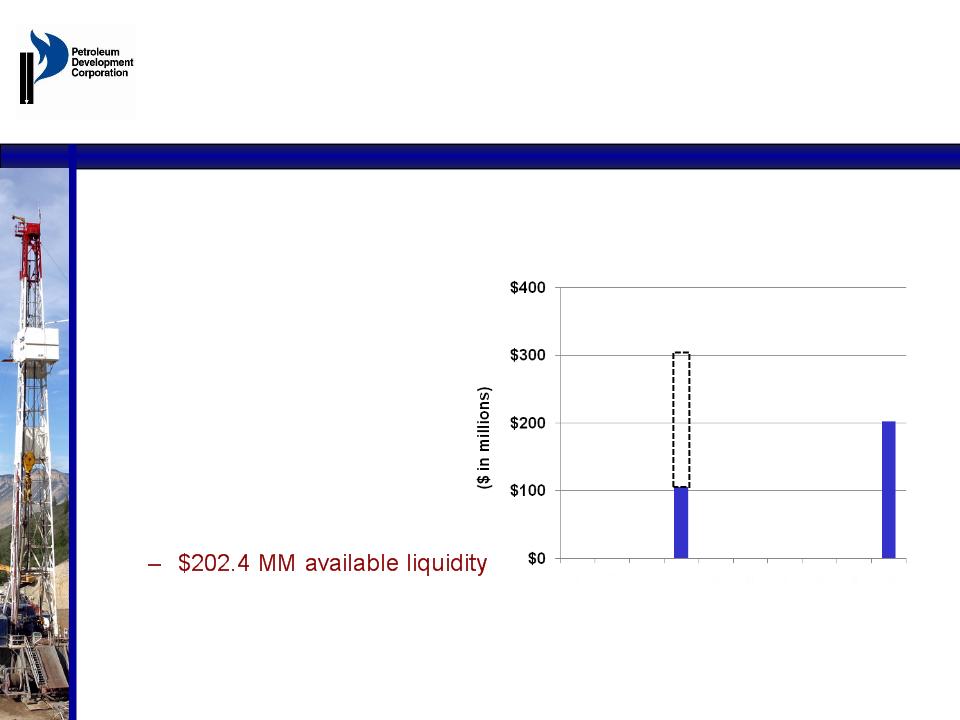

21

• $305 million

revolver matures

May 22, 2012 (1)

May 22, 2012 (1)

• Maturity schedule

reflects:

– Mitigation of

liquidity risk

– Diversification of

funding

sources

sources

• As of September 30,

2009:

– $151 MM drawn

balance

– $18.7 MM undrawn

LC

– $22.1 MM cash

balance

• November 2009

borrowing

base redetermination

base redetermination

Debt

Maturity Schedule

(as of September 30, 2009)

(as of September 30, 2009)

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

$106

$203

$305

(1)

On 10/29/09 the borrowing base was reduced from $350 MM to $305 MM as a

result of the JV. Debt balance is pro-forma to include $45 MM loan repayment

due to JV distribution.

result of the JV. Debt balance is pro-forma to include $45 MM loan repayment

due to JV distribution.

See

Slide 2 regarding Forward Looking Statements

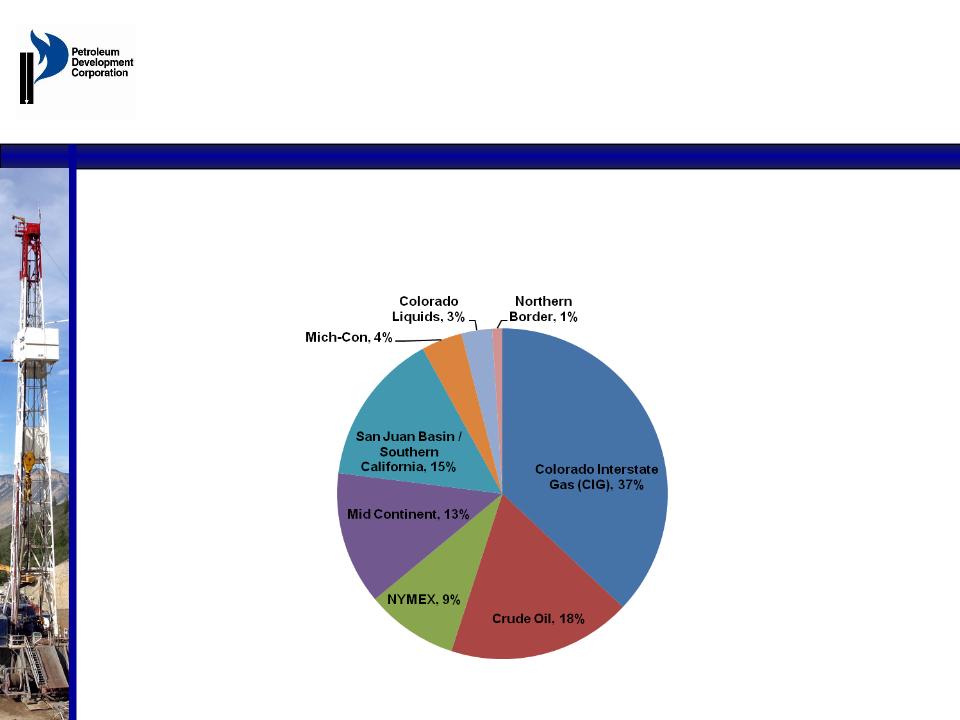

22

Energy

Market Exposure

See

Slide 2 regarding Forward Looking Statements

Percentage

of Mcfe Sold by Market

(for Three Months Ended September 30, 2009)

(for Three Months Ended September 30, 2009)

See

Slide 2 regarding Forward Looking Statements

Oil

and Gas Hedges

in Place as of October 27, 2009

in Place as of October 27, 2009

2009

2010

2011

Weighted Average

Hedge Price (Mcfe)(1)

With

Floors

$8.95

$7.84

$6.85

With

Ceilings

$10.79

$8.77

$7.74

% of

Forecasted Production(1)

81%

79%

78%

Weighted Avg Forward

Price(2)

$5.53

$6.63

$7.15

Weighted Avg Price

of Forecasted

Production(3)

Production(3)

$8.32

$7.59

$6.91

Weighted Avg Price

of Forecasted

Production

Production

Assuming 15%

increase in Production

$7.95

N/A

N/A

(1) Based

on 9/30/09 PDP

(2) Based

on forward curves as of 9/30/2009

(3) Blended

price for forecasted production at hedged and at forward prices

23

See

Slide 2 regarding Forward Looking Statements

Q1

Q2

Q3

Q4

24

Adjusted

Cash Flow

from Operations

from Operations

• Adjusted cash flow

from operations is defined as cash flow

from operations before working capital changes

from operations before working capital changes

Note:

See appendix for reconciliation to GAAP.

$200.1

Q2

Q3

$37.3

$39.8

2009

Guidance Range:

$131

MM - $145 MM

See

Slide 2 regarding Forward Looking Statements

25

A

P P E N D I X

2009

Financial Results

See

Slide 2 regarding Forward Looking Statements

26

Adjusted

Cash Flow Reconciliation

($ in millions)

($ in millions)

|

|

Three

Months Ended

September 30, |

Nine

Months Ended

September 30, |

||

|

|

2009

|

2008

|

2009

|

2008

|

|

Net Cash

provided by

Operating Activities |

$39.3

|

$36.1

|

$100.0

|

$103.8

|

|

Changes in

Assets & Liabilities

Related to Operations |

(2.0)

|

23.0

|

14.7

|

54.9

|

|

Adjusted Cash

Flow from

Operations |

$37.3

|

$59.1

|

$114.7

|

$158.7

|

See

Slide 2 regarding Forward Looking Statements

27

Adjusted

Net Income Reconciliation

($ in millions)

($ in millions)

|

|

Three

Months Ended

September 30, |

Nine

Months Ended

September

30,

|

||

|

|

2009

|

2008

|

2009

|

2008

|

|

Net income

loss

|

($24.5)

|

$126.9

|

($63.3)

|

$72.3

|

|

Unrealized

derivative loss (1)

|

35.0

|

(171.0)

|

95.7

|

(45.4)

|

|

Tax

effect

|

(13.3)

|

65.1

|

(37.4)

|

15.7

|

|

Other

|

-

|

(0.2)

|

2.6

|

4.0

|

|

Adjusted net

income (loss)

|

($2.8)

|

$20.8

|

($2.4)

|

$46.6

|

(1) Includes natural gas

marketing activities.

NASDAQ:PETD

Petroleum

Development Corporation

2009

Third Quarter Teleconference

November 5,

2009