Attached files

| file | filename |

|---|---|

| EX-99.1 - PDF OF CONFERENCE SLIDES - NORTHERN TRUST CORP | dex9911.pdf |

| 8-K - FORM 8-K - NORTHERN TRUST CORP | d8k.htm |

Service Expertise Integrity NORTHERN TRUST CORPORATION Frederick H. Waddell President & Chief Executive Officer EXHIBIT 99.1 BancAnalysts Association of Boston 28 th Annual Fall Conference “Is That a Light at the End of the Tunnel?” November 6, 2009 © 2009 Northern Trust Corporation |

Integrity Expertise Service 2 Forward Looking Statement This presentation may include forward-looking statements such as statements that

relate to Northern Trust’s financial goals, dividend policy, expansion

and business development plans, anticipated expense levels and projected

profit improvements, business prospects and positioning with respect to

market, demographic and pricing trends, strategic initiatives,

re-engineering and outsourcing activities, new business results and

outlook, changes in securities market prices, credit quality including

reserve levels, planned capital expenditures and technology spending, anticipated tax benefits and expenses, and the effects of any extraordinary events

and various other matters (including developments with respect to

litigation, other contingent liabilities and obligations, and regulation

involving Northern Trust and changes in accounting policies, standards and interpretations) on Northern Trust’s

business and results. These statements speak of Northern Trust’s plans,

goals, targets, strategies, beliefs, and expectations, and refer to

estimates or use similar terms. Actual results could differ materially from

those indicated by these statements because the realization of those results

is subject to many risks and uncertainties. Our 2008 annual report and

periodic reports to the SEC contain information about specific factors that

could cause actual results to differ, and you are urged to read them.

Northern Trust disclaims any continuing accuracy of the information provided

in this presentation after today. |

Service Expertise Integrity © 2009 Northern Trust Corporation “Is That a Light at the End of the Tunnel?” |

4 Integrity Expertise Service 1889 2009 We See Daylight – Our Long-Term View Fuels Optimism 120-year heritage of service, expertise and integrity Leadership positions in client-focused business segments Attractive market and geographic growth opportunities Comprehensive product capabilities Distinctive balance sheet and capital strength Invested, experienced and stable management team Proven record of managing the business for long-term growth and profitability

Long-Term Success Due to Enduring Strategies: |

Integrity Expertise Service 5 Agenda: “Is That a Light at the End of the Tunnel?”

Expert Perspectives U.S. Economy Global Recovery Interest Rates Global Equity Markets Fixed Income Markets Regulatory Framework |

6 Integrity Expertise Service THE HOUSING MARKET THE HOUSING MARKET “I think the worst is over for housing. Supply and demand are coming into relationship with each other. Given the level of mortgage rates, given how much house prices have fallen, housing is very affordable today.” Paul Kasriel, Northern Trust’s Chief Economist, on the U.S. Economy CONSUMER CONFIDENCE CONSUMER CONFIDENCE “Consumer confidence is definitely recovering. Unfortunately, consumer confidence is not a very good forecaster of consumer spending.” UNEMPLOYMENT UNEMPLOYMENT “The unemployment rate is probably going to rise through the first half of 2010. And that is going to have a negative impact on consumer spending for the next several quarters. But [here] again, the worst is over [as] the largest rates of contraction occurred in the second half of 2008.” THE LABOR MARKET THE LABOR MARKET “We are seeing signs of the labor market stabilizing. Every week, people file for new unemployment insurance claims. And those claims are starting to trend lower.” CREDIT MARKETS CREDIT MARKETS “There is an overall significant thawing in credit markets. The short-end of credit markets has returned to pre-crisis conditions. More progress is desirable in the risky sector.” Source: Northern Trust Podcast, Coming Out of the Downturn: Is the Worst Over?,

October 8, 2009. RECESSION IS BEHIND US RECESSION IS BEHIND US “The third quarter GDP numbers indicate that a recovery has begun. The Federal Reserve has been aggressive and that has helped stabilize the financial markets. In addition, and for all its problems, the Treasury’s TARP program, I think, played a role in stabilizing the markets. Going forward, the fiscal stimulus should hasten the pace of recovery.” |

7 Integrity Expertise Service Views on the Global Recovery “We believe the third quarter marked the low point for Caterpillar sales and revenues in what has been the toughest recession since the 1930s.” “While we are still navigating through a very difficult environment in 2009, we see signs of improving economic conditions throughout most of the world.” “However, the world economy is still facing significant challenges. There is uncertainty about the timing and strength of recovery.” Jim Owens Chairman & CEO Caterpillar Inc. October 20, 2009 The steel market post crisis: “A slow and uncertain recovery [is expected] in the developed world.” “[However,] China is booming again and emerging markets are recovering rapidly.” “Driven by emerging markets, world steel demand [is expected] to return to a 3% to 5% growth trend post crisis.” Lakshmi Mittal Chairman & CEO ArcelorMittal September 16, 2009 Jim Owens’ comments are from Caterpillar’s 3Q09 Earnings Release. Lakshmi Mittal’s comments are from ArcelorMittal’s 2009 Investor Day. “The global economy swung strongly into growth mode in the third quarter, with worldwide manufacturing output growing greater than 10%.” “Worldwide GDP [is] estimated to have grown around 3.5% after growing just 1.5% in the second quarter.” “Emerging markets, particularly China, are leading the way, with growth estimated to be twice as fast as that experienced in the developed world.” Jim McDonald Chief Investment Strategist Northern Trust Corporation October 26, 2009 |

8 Integrity Expertise Service The Federal Funds Rate (0%-0.25%) was left unchanged at the FOMC’s late September meeting. The September FOMC policy statement reiterated Chairman Bernanke’s opinion that an economic recovery is underway, representing a significant departure from the August policy statement which noted that “economic activity is leveling out.” European Central Bank and the Bank of England actions in October left current stimulative policy measures unchanged. The Swedish and South African central banks left their interest rates unchanged in meetings held on October 22, 2009. Monetary Policy is Beginning to Normalize Interest Rates in developed economies remain at absolutely low levels, though emerging market related economies are beginning to show early signs of normalizing. In late August, the Bank of Israel raised its benchmark interest rate by 0.25% to 0.75% stating that its decision “strikes a balance between the need to moderate inflation and the need to continue to support the recent recovery in economic activity.” Evidence of the start of a global financial tightening cycle continued to emerge in early October as Australia became the first G-20 central bank to raise its benchmark short rate from 3% to 3.25%. On October 28, Norway raised its benchmark rate from 1.25% to 1.5%. Sources: Northern Trust Perspective, October 19, 2009 and September 18,

2009. Northern Trust Daily Global Commentary, September 23, 2009. We expect the Federal Reserve to remain accommodative for an extended period, as low inflationary pressures allow it to delay raising rates until the economic recovery is strong enough to sustain them. |

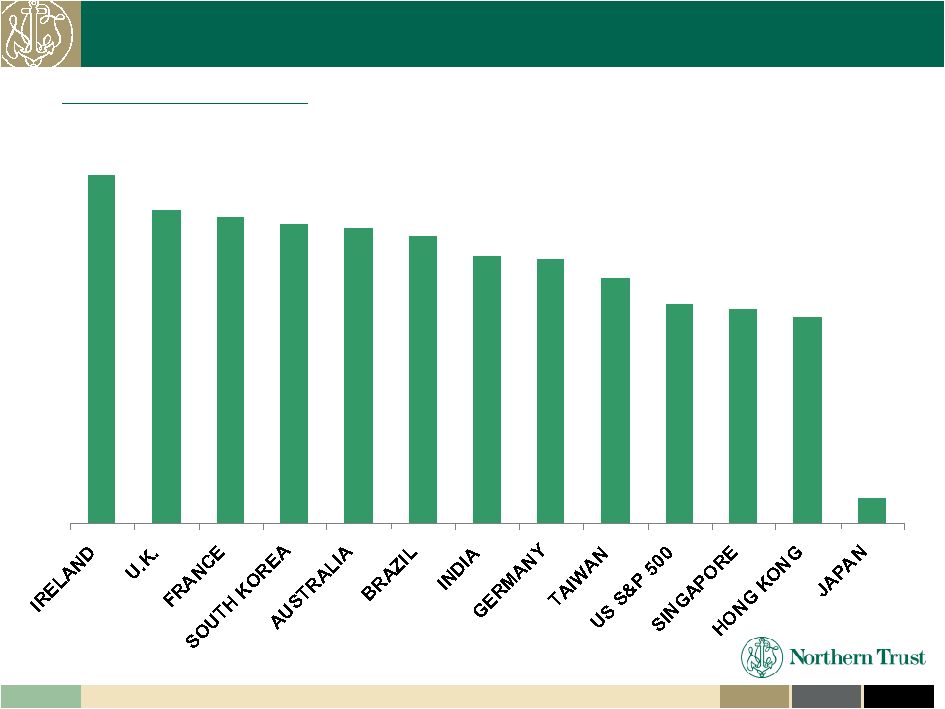

9 Integrity Expertise Service Developed and Emerging Equity Markets Have Improved 23.7% 21.3% 20.9% 20.4% 20.1% 18.0% 16.7% 15.0% 14.6% 14.0% 1.8% 18.2% 19.5% Global Equity Indices – Third Quarter 2009 Sources: Haver Analytics |

10 Integrity Expertise Service “While economic data was somewhat negative in October 2009, U.S. Treasury Bill and

Treasury rates have been range bound. Northern Trust Fixed Income Research expects these rates to move only marginally through the end of 2009. In the minutes of the FOMC’s September 23 meeting, committee members noted that credit ‘remained difficult to obtain and costly for many borrowers’ and was expected to improve ‘only gradually.’ There has been significant improvement with respect to market liquidity, although we

do expect volatility in prices and spreads to continue for the foreseeable

future. Northern Trust Fixed Income Research also expects interest rate and

credit market rallies to be interspersed with market

sell-offs.” Fixed Income Markets and Liquidity Normalizing Fixed Income Markets continue to improve in 2009, but have not fully recovered. Source: Colin Robertson, Director of Fixed Income, Northern Trust Fixed Income Market

Update Podcast, October 22, 2009. |

11 Integrity Expertise Service “We find ourselves increasingly focused on the impact of government action on

financial markets. This includes discussion around the unwind of policy initiatives, regulatory change and

geopolitical risks. Our conclusion is that the global economic

recovery is going to be heavily impacted by government actions. Government intervention got us through Phase I - the stabilization of credit markets with an early economic recovery supported by inventory rebuilding - of this recovery. Government intervention will heavily influence Phase II - the withdrawal of credit market support alongside an economic expansion supported by end-demand - of this recovery. The proportionate impact of the eventual policy moves will be influenced, to a

significant degree, by the financial strength of the region being discussed

and its exposure to the current drivers of global growth. Emerging

markets are better positioned than their developed

counterparts.” A Still Evolving Governmental and Regulatory Framework

The full impact of Governmental and Regulatory efforts on financial markets remains to be seen. Source: Jim McDonald, Northern Trust’s Chief Investment Strategist, Insights

from Northern Trust, October 13, 2009. |

Service Expertise Integrity © 2009 Northern Trust Corporation Implications for Northern Trust |

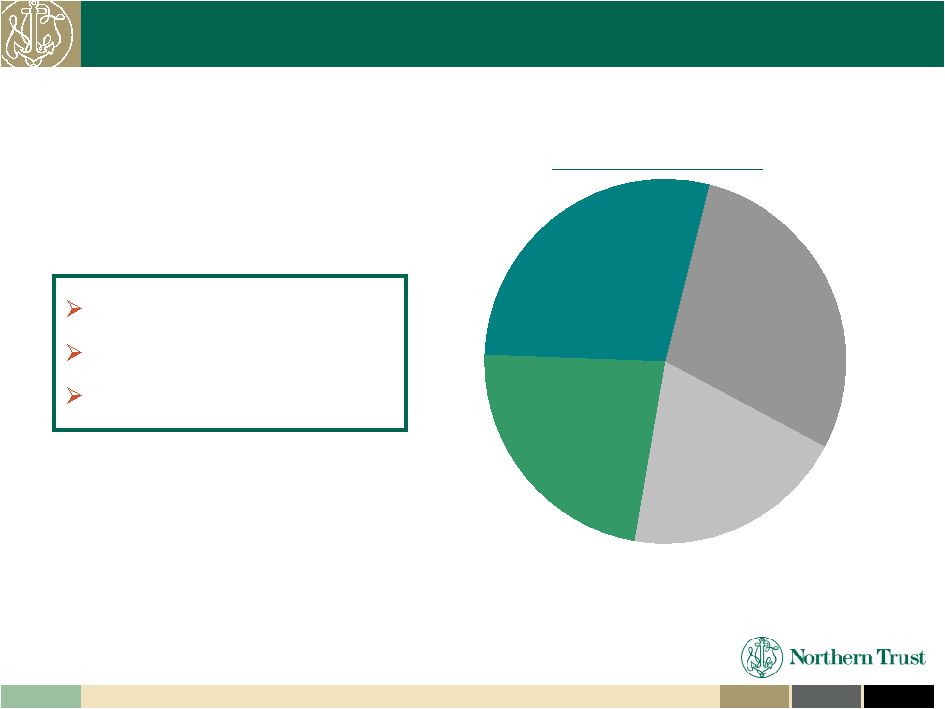

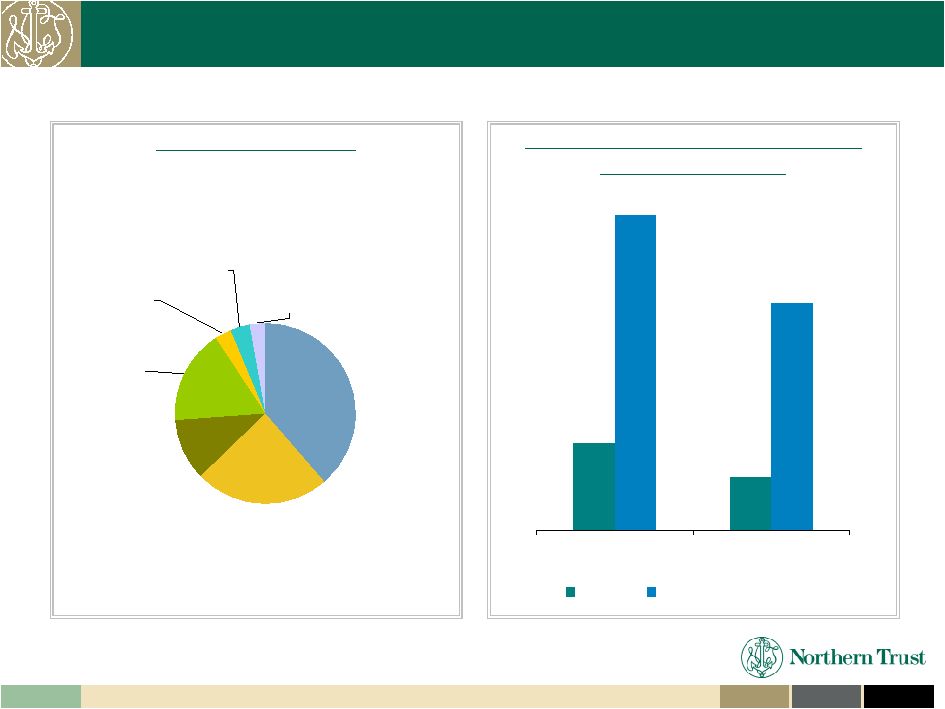

13 Integrity Expertise Service Equity and Fixed Income Market Implications PFS Trust Fees PFS Trust Fees 23% 23% Net Interest Income 29% C&IS Trust Fees C&IS Trust Fees 28% 28% Other Revenue 20% Note: Revenues exclude VISA items. Marks in one mark-to-market securities

lending collateral fund have also been excluded. Assets Under Custody

Global Custody Assets Assets Under Management Total Revenues Year-to-Date 9/30/09 Market Value of Client Assets Drives Key Revenue Components |

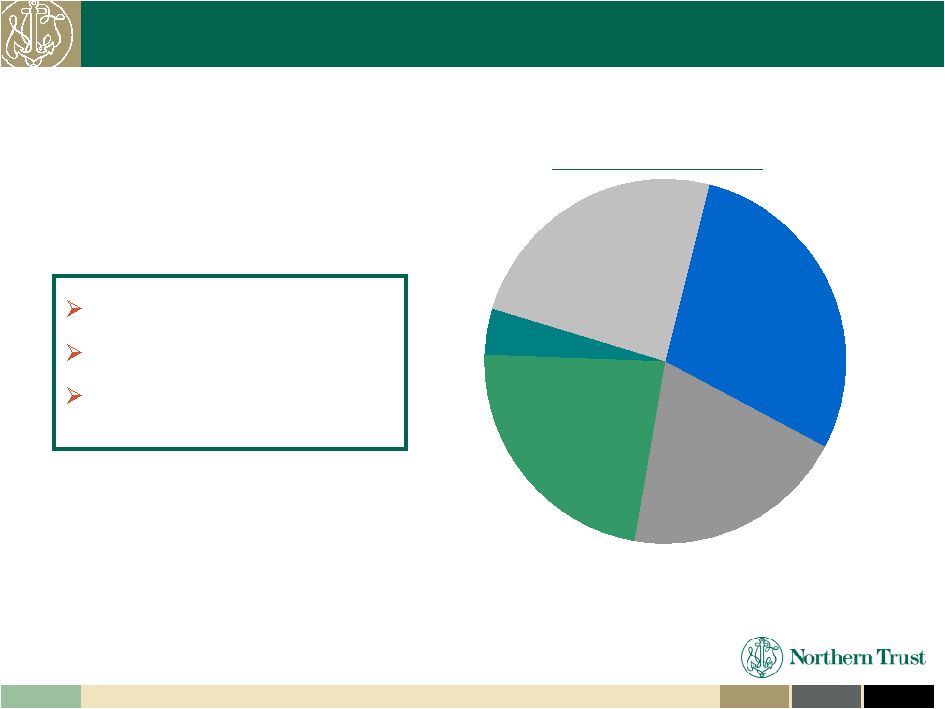

14 Integrity Expertise Service Interest Rate Environment Implications Net Net Interest Interest Income Income 29% 29% C&IS Trust Fees excl. SL 24% Other Revenue 20% Securities Securities Lending 4% Lending 4% Net Interest Income Securities Lending Trust Fees – Mutual Fund Fee Waivers Total Revenues Year-to-Date 9/30/09 Note: Revenues exclude VISA items. Marks in one mark-to-market securities

lending collateral fund have also been excluded. PFS Trust Fees PFS Trust Fees 23% 23% Level of Interest Rates Affects Key Revenue Components |

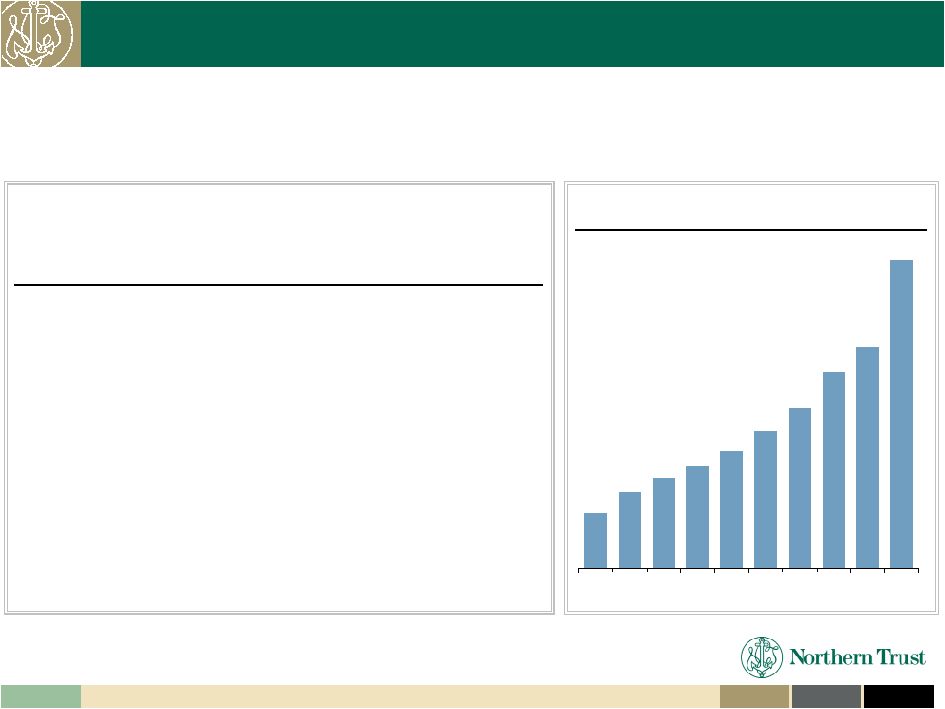

15 Integrity Expertise Service Economic Recovery Implications Relationship Based Lending Strategy All data is as of 9/30/09. NPAs = Non-Performing Assets. NCOs = Net Charge-offs Commercial Real Estate $3.1 11% Commercial $6.8 24% Personal $4.7 17% Leases $1.0 4% Other $0.8 3% Non-U.S. $0.8 3% Residential Real Estate $10.8 38% $28B Loan Portfolio ($ in Billions) 3.86% 2.78% 1.07% 0.65% EOP NPAs to Loans NCOs to Avg Loans NTRS Top 20 Peers' Average Loan Quality Notably Better Than Industry Averages |

16 Integrity Expertise Service $4.5 $6.2 $2.3 $3.6 $3.3 $3.1 $2.9 $3.9 $4.9 $2.7 2000 2001 2002 2003 2004 2005 2006 2007 2008 3Q09 COMMON EQUITY ($ Billions) CAGR: +12% Tier 1 Capital 9.2% 13.3% 6.0% Total Risk-Based 11.4% 15.7% 10.0% Leverage 6.6% 9.0% 5.0% Tier 1 Common Equity 8.7% 12.7% -- Tangible Common Equity 5.5% 7.5% -- “Well Capitalized” CAPITAL RATIOS 9/30/08 9/30/09 Guideline Regulatory Framework Implications Consistent capital strength is a Northern Trust hallmark |

Service Expertise Integrity © 2009 Northern Trust Corporation Concluding Thoughts |

Integrity Expertise Service 18 Growth Driven by Highly Focused, Client-centric Business Model Our Clients Operations & Technology Government Agencies Taft-Hartley Foundations / Endowments / Healthcare Individuals Privately Held Businesses Pension Funds Large Corporations Investment Management Firms Insurance Companies Families Family Foundations Family Offices Personal Financial Services Corporate & Institutional Services Northern Trust Global Investments Sovereign Wealth Funds 120 - year heritage of service, expertise and integrity |

Service Expertise Integrity NORTHERN TRUST CORPORATION Frederick H. Waddell President & Chief Executive Officer BancAnalysts Association of Boston 28 Annual Fall Conference “Is That a Light at the End of the Tunnel?” November 6, 2009 © 2009 Northern Trust Corporation th |