Attached files

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date of

report (Date of earliest event reported): November 5, 2009 (October 30,

2009)

GC

China Turbine Corp.

(Exact

name of registrant as specified in Charter)

|

NEVADA

|

333-141641

|

98-0536305

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(Commission

File No.)

|

(IRS

Employee Identification

No.)

|

No.

86, Nanhu Avenue, East Lake Development Zone,

Wuhan,

Hubei Province 430223

People’s Republic of

China

(Address

of Principal Executive Offices)

+8627-8798-5051

(Issuer

Telephone number)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Forward

Looking Statements

This

Current Report on Form 8-K (“Form 8-K”) and other

reports filed by the Registrant from time to time with the Securities and

Exchange Commission (collectively the “Filings”) contain or

may contain forward looking statements and information that are based upon

beliefs of, and information currently available to, the Registrant’s management

as well as estimates and assumptions made by the Registrant’s management. When

used in the filings the words “anticipate”, “believe”, “estimate”, “expect”,

“future”, “intend”, “plan” or the negative of these terms and similar

expressions as they relate to the Registrant or the Registrant’s management

identify forward looking statements. Such statements reflect the current view of

the Registrant with respect to future events and are subject to risks,

uncertainties, assumptions and other factors (including the risks contained in

the section of this report entitled “Risk Factors”) relating to the Registrant’s

industry, the Registrant’s operations and results of operations and any

businesses that may be acquired by the Registrant. Should one or more of these

risks or uncertainties materialize, or should the underlying assumptions prove

incorrect, actual results may differ significantly from those anticipated,

believed, estimated, expected, intended or planned.

Although

the Registrant believes that the expectations reflected in the forward looking

statements are reasonable, the Registrant cannot guarantee future results,

levels of activity, performance or achievements. Except as required by

applicable law, including the securities laws of the United States, the

Registrant does not intend to update any of the forward-looking statements to

conform these statements to actual results. The following discussion should be

read in conjunction with the Registrant’s pro forma financial statements and the

related notes filed with this Form 8-K.

In

this Form 8-K, references to “we,” “our,” “us,” “GC China Turbine” the “Company”

or the “Registrant” refer to GC China Turbine Corp., a Nevada

corporation.

|

Item 1.01

|

Entry

into a Material Definitive

Agreement

|

On October

30, 2009 (the “Closing

Date”), GC China Turbine Corp. (formerly known as “Nordic Turbines,

Inc.”), a Nevada corporation (“GC China Turbine” or

“Company”),

closed a voluntary share exchange transaction with a wind turbines manufacturer

based in China pursuant to a Share Exchange Agreement (the “Exchange Agreement”)

by and among the Company, Luckcharm Holdings Limited (“Luckcharm”), a

company incorporated in Hong Kong Special Administrative Region, Golden Wind

Holdings Limited (“BVI”), a company

incorporated in the British Virgin Islands and owner of 100% of the issued and

outstanding equity interest of Luckcharm, and Wuhan Guoce Nordic New Energy Co.,

Ltd. (“GC

Nordic”), a company organized in the People’s Republic of China (the

“PRC” or “China”) and

wholly-owned subsidiary of Luckcharm. Throughout this Form 8-K, GC

China Turbine, Luckcharm and GC Nordic are sometimes collectively referred to as

“GC China Turbine Group.”

Prior to

the voluntary share exchange under the Exchange Agreement (“Exchange

Transaction”), we were a public reporting “shell company,” as defined in

Rule 12b-2 of the Securities Exchange Act of 1934, as amended. As a

result of the Exchange Transaction, the BVI became our controlling shareholder,

Luckcharm became our wholly-owned subsidiary, and the Company acquired the

business and operations of GC China Turbine Group.

The

following is a brief description of the terms and contingent conditions of the

Exchange Agreement and the transactions contemplated thereunder that are

material to the Company. A copy of the Exchange Agreement is filed herewith as

Exhibit 2.1.

Issuance of Common

Stock. At the closing of the Exchange Transaction on the Closing Date,

the Company issued 32,383,808 shares of its common stock to the BVI in

exchange for 100% of the issued and outstanding capital stock of Luckcharm and

US$ 10,000,000 in previously issued convertible promissory notes were converted

into 12,500,000 shares of the Company’s common stock. Immediately prior to the

Exchange Transaction, the Company had 7,686,207 shares of common stock issued

and outstanding. Immediately after the Exchange Transaction and notes

conversion (and taking into account 40,500,000 shares of common stock

surrendered by former Company officers and directors for cancellation on

September 11, 2009 and 1,298,793 additional shares of common stock surrendered

for cancellation on October 1, 2009), the Company had 58,970,015 shares of

common stock issued and outstanding.

Change in Management.

As a condition to closing the Exchange Agreement and as more fully described in

Item 5.02 below, Mr. John J. Lennon has resigned as the Company’s

Chief Executive Officer, Chief Financial Officer, President, Secretary,

Treasurer and director on the Closing Date, and Mr. Marcus Laun remains as a

director. Effective as of September 4, 2009, Mr. Hou Tie Xin, Ms. Qi

Na and Mr. Xu Jia Rong were appointed to the Company’s board of

directors. Mr. Hou was appointed as Chairman of the board of

directors. Effective on the Closing of the Exchange Transaction, Qi Na was

appointed as Chief Executive Officer; Zhao Ying was appointed as Chief Financial

Officer; Tomas Lyrner was appointed as Chief Technology Officer; and Chris

Walker Wadsworth was appointed to the Company’s board of directors.

2

Additional

Financing. The consummation of the Exchange Transaction was

also contingent on: (a) US$ 8,000,000 being subscribed for, and funded into

escrow, by certain accredited and institutional investors (“Investors”) for the

purchase of 6,400,000 shares of the Company’s Common Stock (the “Equity Financing”);

and (b) the closing of a debt financing transaction with Clarus Capital Ltd. for

the aggregate amount of US$ 1,000,000, which shall be convertible into

Company’s Common Stock at US$ 2.00 per share and have a 2 year repayment (the

“Debt

Financing”). Both the

Equity Financing and the Debt Financing are described more fully in Item 2.01

below. The Equity Financing shall close concurrently with the closing

of the Exchange Transaction and the Debt Financing shall close upon the

effective date of delivery of 20 wind turbine systems by GC Nordic to its

customers (the “Effective Delivery

Date”), under the terms and conditions approved by the Company’s board of

directors.

|

Item 2.01

|

Completion

of Acquisition or Disposition of

Assets

|

The

Exchange Transaction

On

October 30, 2009, GC China Turbine acquired Luckcharm and its business

operations as a result of the Exchange Transaction. Reference is made to

Item 1.01, which is incorporated herein, which summarizes the terms of the

Exchange Transaction.

From and

after the Closing Date, our primary operations consist of the business and

operations of GC China Turbine Group, which are conducted in the PRC. Therefore,

we disclose information about the business, financial condition, and management

of GC China Turbine Group in this Form 8-K.

Effective

as of September 4, 2009, Hou Tie Xin, Qi Na and Xu Jia Rong were appointed to

the Company’s board of directors. Mr. Hou was appointed as Chairman

of the board of directors. Effective as of the Closing Date, Mr. John

J. Lennon resigned as Chief Executive Officer, President, Chief Financial

Officer, Treasurer, Secretary and director, and Qi Na was appointed as Chief

Executive Officer, Zhao Ying was appointed as Chief Financial Officer, Tomas

Lyrner was appointed as Chief Technology Officer, and Chris Walker Wadsworth was

appointed as a member of the board of directors. The following

persons consist of the Company’s new executive officers and

directors:

|

Name

|

Position

|

|

|

Hou

Tie Xin

|

Chairman

of the Board

|

|

|

Qi

Na

|

Chief

Executive Officer, Director

|

|

|

Zhao

Ying

|

Chief

Financial Officer

|

|

|

Tomas

Lyrner

|

Chief

Technology Officer

|

|

|

Xu

Jia Rong

|

Director

|

|

|

Chris

Walker Wadsworth

|

Director

|

The

Company previously filed and mailed the Information Statement required

under Rule 14(f)-1 to its shareholders on August 25, 2009, and the 10-day

period as required under Rule 14(f)-1 expired on September 4,

2009. Additional information regarding the above-mentioned directors

and/or executive officers is set forth below under the section titled

“Management”.

The

Financing Transactions

Equity

Financing

Between October 5, 2009 and October 30,

2009, the Company entered into Securities Purchase Agreements with the

Investors, pursuant to which the Investors agreed to purchase up to

6,400,000 shares of common stock of the Company, at a purchase price of US$

1.25 per share for an aggregate offering price of US

$8,000,000. Additionally, the Company issued warrants to each Investor

in an amount equal to 10% of the number of shares that such Investor

purchased, with each warrant having an exercise price of US$ 1.00 per share and

being exercisable at any time within 3 years from the date of

issuance (the “Warrants”).

3

In

connection with the Securities Purchase Agreements, BVI entered into a make good

escrow agreement whereby BVI pledged 640,000 shares of common stock of the

Company to the Investors in order to secure the Company’s make good obligations.

In the make good escrow agreement, the Company established a minimum after tax

net income threshold of $12,500,000 for the fiscal year ending December 31,

2010. If the minimum after tax net income threshold for the fiscal year 2010 is

not achieved, then the Investors will be entitled to receive additional shares

of the Company’s common stock held by BVI based upon a pre-defined formula

agreed to between the Investors and BVI. BVI deposited a total of 640,000 shares

of common stock of the Company, into escrow with the escrow agent under the make

good escrow agreement.

Additionally, if the minimum after tax

net income threshold for the fiscal year 2010 is not achieved, then the

Investors will be entitled to have the exercise price of the Warrants adjusted

lower based upon a pre-defined formula agreed to between the Investors and the

Company.

The

private placement was conducted by the Company and certain placement

agents. In certain cases where investors were introduced to the Company,

the Company paid a 7% cash fee for the aggregate amount of $630,000 to the

respective placement agent and issued a warrant to purchase an amount equal to

5% of the shares sold through such placement agent. The

7% cash fee is based on the gross proceeds received by the Company

from the investors introduced by the respective placement agent. An

aggregate of 560,000 warrants have been reserved for such issuances and each

such warrant has an exercise price of US$ 1.00 per share and can be

exercised at any time within 3 years from the date of

issuance.

Debt Financing

On October 30, 2009, the Company

entered into a Note Purchase Agreement with Clarus Capital Ltd. ("Clarus") whereby

Clarus agreed to loan US $1,000,000 to the Company upon the Effective Delivery

Date. The loan will be in the form of a convertible promissory note

which shall bear interest at a rate of 1% per month (the "Note"), and have a

maturity date of 2 years from the date of issuance of the

Note. Additionally, the principal and accrued interest underlying the

Note (the "Debt") may be

converted by Clarus at US$ 2.00 per share into shares of common stock of the

Company at any time prior to the maturity date. Six months from the Effective

Delivery Date, the Company may at its option, convert the Debt at US$ 2.00 per

share into shares of its common stock anytime thereafter.

DESCRIPTION

OF BUSINESS

Except as

otherwise indicated by the context, references to “we”, “us” or “our”

hereinafter in this Form 8-K are to the consolidated business of GC China

Turbine Group, except that references to “our common stock”, “our shares of

common stock” or “our capital stock” or similar terms shall refer to the common

stock of the Registrant.

Overview

We are a

leading manufacturer of state-of-the-art 2-bladed wind turbines located in Wuhan

City of Hubei Province, China. The Company sought to license and

develop a groundbreaking technology in the wind energy space that would have a

high likelihood of meeting rigorous requirements for low-cost and high

reliability. We identified a 2-bladed wind turbine technology that was developed

through a 10 year research project costing over US$ 75 million. While the

2-blade technology is less commonly used in the market, the development project

that created our technology has been operating for 10 years with 97%

availability (for generation). Further, the 2-blade technology has

the benefits of lower manufacturing cost, lower installation cost and lower

operational costs. Therefore, the product is uniquely positioned to fulfill the

Company’s mission. Our launch product is a 1.0 megawatt (“MW”) utility scale

turbine with designs for a 2.3MW and 3.0MW utility scale turbine in

development. The Company’s initial efforts have been rewarded with

contracts of approximately US$ 128 million, including 3 contracts executed on

August 30, 2007, September 1, 2008 and July 17, 2009, to be carried out in the

next 1 to 2 years.

We are

producing the 1.0MW 2-blade wind turbines with a focus on our chosen Chinese

markets. The Company plans to penetrate the broader reaches of the Chinese

market with the launch of our larger 2.3 and 3.0 MW 2-blade wind

turbines. The 3.0 MW wind turbine is targeted for offshore

applications. We have already successfully won three wind farm

contracts and begun delivering turbines to fulfill some of these

contracts. We are developing a track record and brand-awareness

through the execution of our first three contracts.

The

Company was founded in 2006 by certain members of GC Nordic’s management team

and certain shareholders who formed Guoce Science and Technology Stock Co., Ltd.

(“Guoce Science and

Technology”), a leading technology provider to the Chinese utilities

industry. Guoce Science and Technology has a long history as a preferred

provider to the utilities industry in China. It is a producer of hydraulic

systems and electronic control systems that enjoy dominant market share of

approximately 40% in the PRC hydro-electric generation industry. GC

Nordic was founded as part of a strategy of expanding Guoce Science and

Technology’s product offerings in a business that closely parallels its current

business. Guoce Science and Technology is a company with great reputation in the

industry with businesses covering the whole power industrial chain with

productions ranging from power generation to power transmission to every sector

of power utilization. The management team of Guoce Science and

Technology also forms the core management team of our Company.

4

Company

Organization and Recent Events

Luckcharm

was originally incorporated in Hong Hong on June 15, 2009 by Fernside

Limited. On June 29, 2009, Fernside Limited transferred all of the

equity interest of Luckcharm to BVI. On August 1, 2009, Luckcharm

entered into an agreement to acquire 100% of the equity of GC Nordic from the

original nine individual shareholders (the “Founders”). On

August 5, 2009, GC Nordic received approval of this acquisition from the Bureau

of Commerce of the Wuhan City, Hubei Province, PRC. Prior to the Exchange

Transaction, on September 30, 2009, the Founders obtained 100% voting interests

in BVI in the same proportion as their ownership interest in GC Nordic, through

certain Call Option and Voting Trust Agreements with Xu Hong Bing, the sole

shareholder of BVI.

GC Nordic

was organized in the PRC on August 21, 2006 as a limited liability company upon

the issuing of a license by the Administration for Industry and Commerce of the

Wuhan City, Hubei Province, PRC with an operating period of 10 years to August

20, 2016. On August 5, 2009, all of the outstanding equity interests of GC

Nordic were acquired by Luckcharm, and GC Nordic became a wholly foreign owned

enterprise under PRC law. GC Nordic holds the government licenses and approvals

necessary to operate the wind turbines business in

China.

On May

22, 2009, GC Nordic entered into a Letter of Intent ("LOI") with GC China

Turbine Corp. f.k.a. Nordic Turbines, Inc., a Nevada corporation (“Nordic Turbines”)

whereby Nordic Turbines would purchase all of the issued and outstanding shares

of GC Nordic from the shareholders, and the shareholders of GC Nordic would

receive a 54% ownership interest in the Company. Further on July 31,

2009, an Amended and Restated Binding Letter of Intent ("Revised LOI") was

entered between Luckcharm, GC Nordic, Nordic Turbines, New Margin Growth Fund

L.P. ("New

Margin"), Ceyuan Ventures II, L.P. ("CV") and Ceyuan

Ventures Advisors Fund II, LLC ("CV Advisors") whereby

Nordic Turbines would purchase all of the issued and outstanding shares of

Luckcharm from the shareholders, and the shareholders of Luckcharm would receive

a 54% ownership interest in the Company. The Revised LOI further provides that

(i) upon consummation of the Exchange Transaction, Nordic Turbines shall

directly or indirectly own all of the outstanding capital stock of GC Nordic;

(ii) the closing date for the Exchange Transaction shall be thirty days from the

date GC Nordic completes an audit of its financial statements as required under

U.S. securities laws; and (iii) the obligation of GC Nordic to consummate the

Exchange Transaction is conditioned upon an additional financing of at least US$

10 million into the combined entities at closing.

On May

22, 2009, GC Nordic entered into a promissory note in favor of us in the

principal amount of US$ 1 million. On July 31, 2009, Luckcharm

entered into an amended and restated promissory note in favor of us in the

principal amount of US$ 1 million. The promissory note is secured by

the assets of Luckcharm, accrues interest at 6% per annum calculated annually

from May 31, 2009, and is due 24 months from the closing of the Exchange

Transaction. Upon closing of the agreements as described above, the

promissory note, excluding any interest accrued, will be considered an

inter-company loan. If the proposed transactions are not completed by December

8, 2009, and the principal, together with interest, have not been fully repaid

by June 8, 2010, Nordic Turbines will have the right, at its option, to convert

the promissory note to a percentage equity interest in Luckcharm, equal to 4.44%

multiplied by that fraction of the principal not repaid by June 8,

2010.

On July

31, 2009, Luckcharm, GC Nordic, Nordic Turbines, New Margin, CV and CV Advisors

entered into an amended and restated financing agreement (the "Financing

Agreement"). The Financing Agreement provides that Nordic Turbines agreed

to lend Luckcharm (i) US$ 2.5 million before July 24, 2009 and (ii) US$ 7.5

million before July 31, 2009. In order to guarantee Luckcharm’s lending

obligations under the Financing Agreement, New Margin agreed to lend US$ 5

million to us and CV and CV Advisors each agreed to lend the aggregate of US$ 5

million to the Company prior to the dates indicated above. Upon the consummation

of the Exchange Transaction, the US$ 10 million aggregate loan amount made to us

by each of New Margin, CV and CV Advisors will be converted into shares of our

common stock at a conversion price equal to US$ 0.80 per share.

On July

31, 2009, Luckcharm entered into a promissory note in favor of us in the

principal amount of US$ 10 million in connection with Nordic Turbines’s loan

made to Luckcharm as described above. Under the terms of the promissory note, we

shall forgive the debt and cancel the promissory note so long as (i) the

Exchange Transaction is completed pursuant to its terms or (ii) if the Exchange

Transaction is not completed pursuant to its terms, the debt is converted

pursuant to the Financing Agreement. If the Exchange Transaction is not

completed and the debt is not converted pursuant to the Financing Agreement, the

debt shall be due and payable within 180 days from the date of the promissory

note.

5

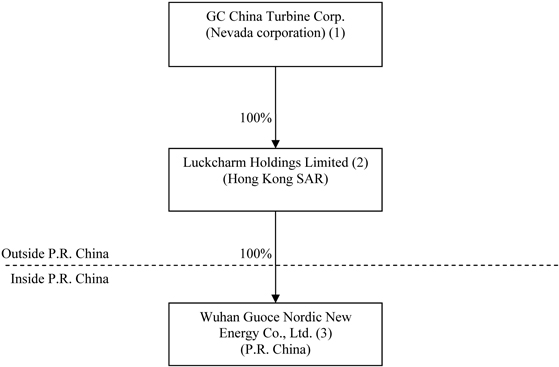

Our

Corporate Structure

The

following diagram illustrates our corporate structure from and after the

Exchange Transaction:

|

|

(1)

|

From

and after the Exchange Transaction, the management of GC China Turbine

includes: Hou Tie Xin as Chairman, Qi Na as Chief Executive Officer and

director, Zhao Ying as Chief Financial Officer, Tomas Lyrner as Chief

Technology Officer, and Xu Jia Rong, Marcus Laun and Chris Walker

Wadsworth as members of the board of directors. As of the date of this

Form 8-K, none of the management owns any shares of GC China Turbine

common stock. Mr. Hou, Ms. Qi, Ms. Zhao and Mr. Xu, however, are parties

to a Call Option Agreement dated September 30, 2009 pursuant to which they

have the right to acquire the shares of GC China Turbine common stock

issued to the BVI in connection with the Exchange Agreement, and to a

Voting Trust Agreement dated September 30, 2009 pursuant to which they are

voting trustees under a voting trust created to hold all such

shares.

|

|

|

(2)

|

The

management of Luckcharm is comprised of Xu Hong Bing as the sole

director.

|

|

|

(3)

|

The

management of GC Nordic includes: Hou Tie Xin as Chairman, Qi

Na as General Manager, Wu Wei as Deputy General Manager, Zhao Ying as

Chief Financial Officer, and Xu Jia Rong as Deputy General

Manager.

|

Our

Industry

Wind

Power

Wind

power is the conversion of wind energy into more useful forms of energy, such as

electricity, using wind turbines. Humans have been using wind power

for at least 5,500 years to propel sailboats and sailing ships, and architects

have used wind-driven natural ventilation in buildings since similarly ancient

times.

6

Compared

to the environmental effects of traditional energy sources, the environmental

effects of wind power are relatively minor. Wind power consumes no fuel, and

emits no air pollution, unlike fossil fuel power sources. The energy consumed to

manufacture and transport the materials used to build a wind power plant is

equal to the new energy produced by the plant within a few months of

operation.

The power

in the wind can be extracted by allowing it to blow past moving wings that exert

torque on a rotor. The amount of power transferred is directly proportional to

the density of the air, the area swept out by the rotor, and the cube of the

wind speed. The mass flow of air that travels through the swept area of a wind

turbine varies with the wind speed and air density. Because so much power is

generated by higher wind speed, much of the average power available to a

windmill comes in short bursts. As a general rule, wind generators

are practical where the average wind speed is 10 mph (16 km/h or 4.5 m/s) or

greater. An ideal location would have a near constant flow of non-turbulent wind

throughout the year and would not suffer too many sudden powerful bursts of

wind. An important turbine siting factor is access to local demand or

transmission capacity. The wind blows faster at higher altitudes because of the

reduced influence of drag on the surface (sea or land) and the reduced viscosity

of the air. The increase in velocity with altitude is most dramatic

near the surface and is affected by topography, surface roughness, and upwind

obstacles such as trees or buildings. As the wind turbine extracts

energy from the air flow, the air is slowed down, which causes it to spread out

and divert around the wind turbine to some extent. Betz' law states

that a wind turbine can extract at most 59% of the energy that would otherwise

flow through the turbine's cross section. The Betz limit applies

regardless of the design of the turbine. Intermittency and the

non-dispatchable nature of wind energy production can raise costs for

regulation, incremental operating reserve, and (at high penetration levels)

could require demand-side management or storage solutions.

Wind

Turbines

A wind

turbine is a rotating machine which converts the kinetic energy in wind into

mechanical energy. If the mechanical energy is used directly by

machinery, such as a pump or grinding stones, the machine is usually called a

windmill. If the mechanical energy is then converted to electricity,

the machine is called a wind generator, wind turbine, wind power unit (WPU),

wind energy converter (WEC), or aerogenerator.

Wind

turbines require locations with constantly high wind speeds. Wind

turbines are designed to exploit the wind energy that exists at a

location. Small wind turbines for lighting of isolated rural

buildings were widespread in the first part of the 20th century. The

modern wind power industry began in 1979 with the serial production of wind

turbines by Danish manufacturers Kuriant, Vestas, Nordtank, and

Bonus. These early turbines were small by today's standards, with

capacities of 20–30 kilowatts each. Since then, they have increased

greatly in size, while wind turbine production has expanded to many

countries.

Wind

Industry

The wind

industry is the world's fastest growing energy sector and offers an

excellent opportunity to begin the transition to a global economy based on

sustainable energy. A report published by The Global Wind Energy Council (“GWEC”) and Greenpeace

in October 2008 references multiple studies that indicate that the long-term

potential supply using existing technology could be double the current worldwide

electricity demand. Prior GWEC reports indicate that there are no

technical, economic or resource barriers to supplying 12% of the world's

electricity needs with wind power alone by 2020, as compared to the challenging

projection of two thirds increase of electricity demand by 2020.

According

to the GWEC, by the end of 2007 (2008 figures not currently available), the

capacity of global wind energy installations had reached a generation capacity

level of over nearly 94,000 MW, an increase of nearly 20,000 MW over 2006

figures and representing a worldwide investment of over US$ 50 billion. Europe

accounts for 56,500 MW or 60% of the total installed capacity followed by the

U.S. with 17.9% or 16,800 MW. The fastest growing market is China

with 145% growth or 3,304 MW added in 2007 to over 5,900 MW by the end of

2007. Each of these markets is expected to continue to drive the

worldwide growth of wind turbine installations. The total value of

installed equipment worldwide in 2007 was approximately US$ 1.8 million per MW

for a turbine equipment market size of US$ 36 billion on a total investment of

US$ 50 billion.

Internationally,

demand for electricity has dramatically increased as our society has become more

technologically driven. Demand for “green” energy has also

dramatically increased due to consumers’ desire to become environmentally

conscious. Both trends are expected to

continue. Significant new capacity for the generation of electricity

will be required to meet anticipated demand.

7

Most of

the world’s primary energy sources are still based on the consumption of

non-renewable resources such as petroleum, coal, natural gas and

uranium. While still a small segment of the energy supply, renewable

sources such as wind power are growing rapidly in market share. Wind

power delivers multiple environmental benefits. It operates without

emitting any greenhouse gases and has one of the lowest greenhouse gas lifecycle

emissions of any power technology. Wind power does not result in any

harmful emissions, extraction of fuel, radioactive or hazardous wastes or use of

water to steam or cool. Wind projects are developed over large areas, but their

carbon footprint is light. Farmers, ranchers and most other land

owners can continue their usual activities after wind turbines are installed on

their property.

According

to the U.S. Department of Energy, Energy Information Administration’s

publication “Renewable Resources in the U.S. Electricity Supply,” wind power

generation was and is projected to increase eight-fold between 1990 and 2010, a

rate of 10.4% per year. Annual growth in the wind power industry for

the past 10 years has exceeded 28% per year according to the

GWEC. Although wind power produces under 1% of electricity worldwide

according to the GWEC’s Global Wind 2007 Report, it is a leading renewable

energy source and accounts for 19% of electricity production in Denmark

(according to the U.S. Department of Energy’s Energy Facts web page), 10% in

Spain and 7% in Germany (according to the GWEC’s Europe region web

page).

Chinese

Wind Industry

Wind-power

generation is a mature technology that is embraced in China due to its

relatively low cost (compared to other renewable energy sources such as solar

power) and abundance of wind resources. Satisfying rocketing

electricity demand and reducing air pollution are also main driving forces

behind the development of wind energy in China. Given the country’s

substantial coal resources and still relatively low cost of coal-fired

generation, cost reduction of wind power is an equally crucial

issue. This is being addressed through the development of large scale

projects and boosting local manufacturing of turbines. The Chinese

government believes that the localization of wind turbine manufacturing brings

benefits to the local economy and helps keep costs down. Moreover,

since most good wind sites are located in remote and poorer rural areas, wind

farm construction benefits the local economy through the annual income tax paid

to county government, local economic development, grid extension for rural

electrification as well as employment in wind farm construction and

maintenance.

Current

Chinese government guideline mandates that 30,000 MW of wind power be installed

by 2020. The Brussels-based GWEC reported that in 2008, China added more than

6,000 MW of wind-power generation capacity, bringing China’s total installed

wind-power generating capacity to over 12,000MW. Moreover, the Chinese

government has mandated that 70% of wind components be sourced domestically by

2010. The wind manufacturing industry in China is

booming. In the past, imported wind turbines dominated the market,

but this is changing rapidly as the growing market and clear policy direction

have encouraged domestic production. At the end of 2007, there were

40 Chinese manufacturers involved in wind energy, accounting for about 56% of

the equipment installed during the year, an increase of 21% over

2006. This percentage is expected to increase substantially in the

future. Total domestic manufacturing capacity is now about 8,000 MW,

and expected to reach about 12 GW by 2010.

Wind

energy resources are widely distributed in China, with rich resources broken

into the southeast coastal areas, the three northern regions (northeast, north,

and northwest) and inland regions including but not limited to Hunan, Hubei,

Jiangxi, Shanxi, Henan, Chongqing, and Yunnan.

Presently,

the thriving locations for the development of wind farms are the three northern

regions. However, inland regions where wind resources are abundantly

distributed are at an early development stage, and thus the market potential is

large. Further, some provinces in the inland regions have planned or

promulgated preferential policies for the development of wind power, and thus

the inland wind power industry may also become the new thriving points for

China‘s wind power development.

Abundant

wind energy resource areas along the southeast coast and its coastal areas

mainly include Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, Guangxi

and Hainan and other provinces and cities’ coastal zones of nearly 10km

wide with annual wind power density above 200 w/m² and wind power density line

parallels to the coastlines.

Abundant

wind energy resource areas distributed in north areas mainly include, three

north provinces, Hebei, Inner Mongolia, Gansu, Ningxia and Xinjiang and other

provinces and districts’ of nearly 200 km wide with wind power density above

200—300 w/m², some of which could up to 500 w/m² more, such as Alashankou, Daban

City, Huitengxile, Huitengliang of Xilinhaote, Chengde and

Weichang.

Abundant

wind energy resource areas distributed in inland areas mainly include, Hunan,

Hubei, Jiangxi, Shanxi, Henan, Chongqing, Yunnan and other areas, with a general

wind power density of 100—200 w/m². Wind energy resources are also

abundant in some areas due to the impacts by the lakes and topography.

Technological accepted development capacity for wind power in inland areas

exceeds 12,000,000 kilowatts.

8

China

Wind Power Potential

Today,

wind power in China is developing rapidly and receives particularly strong

government support. The new Renewable Energy Law and its detailed incentive

policies reflect the Chinese government’s intention to build up this industry.

By 2020, China plans to have 30 gigawatts of wind power. European

companies dominate China’s wind power equipment market. Among U.S. companies,

only GE Wind Power is active in China. In 2005, GE Wind Power occupied 3% of the

in-grid wind turbine market in China.

According

to the China Academy of Meteorological Sciences, the country possesses a total

235 gigawatts of practical onshore wind power potential that can be utilized at

10 meters above the ground. Annual potential production from wind

power could reach 632.5 gigawatts if the annual, full-load operation reaches

2,000-2,500 hours. A detailed survey is needed, however, for economically

utilizable wind power resources. The potential for offshore wind

power is even greater, estimated at 750 gigawatts. Offshore wind

speed is higher and more stable than onshore wind, and offshore wind farm sites

are closer to the major electricity load centers in eastern

China. Areas rich in wind power resources are mainly concentrated in

two areas: northern China’s grasslands and Gobi desert, stretching from Inner

Mongolia, Gansu and Xinjiang provinces; and in the east coast from Shangdong and

Liaoning and the southeast coast in Fujian and Guangdong provinces.

In 1986,

China built its first wind farm in Rongcheng, Shandong Province. From 1996 to

1999, in-grid wind power developed very quickly, entering a localization stage.

By the end of 2004, there were 43 wind farms with 1291 wind turbines in China,

with 764 MW of installed capacity. Liaoning, Xinjiang, Inner Mongolia and

Guangdong experienced the fastest wind power development, representing 60% of

the installed power generating capacity of national wind power. Currently,

Xinjiang’s Dabancheng is the largest wind farm in China, with 100 MW of

installed power generating capacity. Most generators range from 500 kilowatts to

1 MW, accounting for 84% of China’s wind turbine generators.

Our

Products

Our

Company’s core product is the 2-bladed wind turbine which is designed with

technologies of soft concept, compact transmission chain, overall damping,

condition monitoring and other proprietary technologies that reduce vibration

and overheating, lower installation and transportation cost as well as improve

service life and utilization rate with the ultimate benefits of improving wind

turbine quality and lowering the costs of manufacturing, installation and

maintenance.

We use

“soft technology” which is a combination of a passive yaw system, teeter style

hub and the soft tower. By using the soft technology as a damping system for the

vibration and loads of the system, we can produce a transmission chain that does

not have to absorb those forces. Therefore, the transmission chain is

more compact, cheaper, proprietary, and more reliable than other

designs. The technology offers a new approach and significant

opportunities for large scale wind farms including remote onshore and offshore

installations. Additionally, constant feedback ensures we achieve the

highest efficiency.

The key

advantages of the 2-bladed wind turbine with influences on costs by proprietary

technologies are as follows:

|

Proprietary

Technologies

|

Design

Features

|

Influence

on Costs and

Benefits

|

|

Soft

technology

|

Passive

yaw system

|

·

Yaw is a term used to describe the mechanical system of aiming the

turbine blades into the wind.

·

GC China Turbine has a passive yaw system, eliminating the need for

mechanical yaw braking system.

·

The passive yaw reduces loads on the tower and foundation thereby

allowing for a lighter tower and smaller foundation as well as reducing

the manufacturing costs for a complete machine.

|

||

|

Teeter-style

hub

|

·

The teeter-style hub reduces the negative effects of imbalanced air

pressure on the blades not unlike the function of rubber engine mounts in

a motor vehicle. The rubber bushings greatly reduce twisting loads on the

transmission chain, tower and other components and increase the service

lives of these components. This technology is characterized by rubber

mountings of the blades to the main gearbox.

|

|||

|

Soft

tower

|

·

The soft tower is lighter than a stiff tower so as to directly save

raw material costs. This is achieved by designing a tower that is allowed

to flex during operation. This is partially possible because the turbine

and blades are significantly lighter than a 3-blade

system.

|

|||

|

Compact

transmission chain

|

Support

tube

|

·

Generator, gearbox and high-speed shaft are directly connected

which greatly improves the service lives of the key components in

transmission chain.

|

||

|

Integrated

gearbox

|

·

Because GC China Turbine’s design eliminates the main shaft and

main bearing of 3-bladed designs, the Company enjoys a lower cost profile

and eliminates a significant component sourcing bottleneck.

·

Integrated main shaft has a longer service life, improves the

availability rate and reduces maintenance costs.

|

|||

|

Overall

damping design

|

Teeter

and hub rubber elements, nacelle chassis rubber elements

|

·

Significantly reduces fatigue loads on all moving parts, extends

the service life and reduces operational costs.

|

||

|

Condition

monitoring

|

Conducts

maintenance according to actual conditions, instead of preventive and

post-fault maintenance

|

·

Extends service life of wind turbine and reduces maintenance

costs.

|

9

As shown

in the table above, GC China Turbine Group’s 2-blade 1.0MW wind turbine is

designed with proprietary technologies of soft concept, compact transmission

chain, overall damping, condition monitoring and other proprietary technologies

that reduce vibration and operating temperature as well as improve service life

and utilization rate. The resulting benefits are high wind turbine quality, low

manufacturing cost and cheaper installation and maintenance.

Our

Company’s advantage is a combination of simple design that makes it cost

effective and that advantage will be enhanced by the replacement of imported

components with high quality Chinese components, which in many cases, come from

well established state-owned enterprises and public companies, and part of which

come from our Company’s European component manufacturers. In order to

sustain the low-cost advantage, the Company has also been actively seeking and

identifying domestic suppliers of all key components that will make it possible

to complete the assembly of 100% Chinese-content wind turbines as of this year

with full distribution into the market by end of 2009. These efforts

will greatly reduce our manufacturing costs and will help to further enhance the

low-cost advantage of our product.

Our

Sales and Marketing

The

Company will continue to compete in the mainstream wind farm bids as well as

seek out more niche projects where the light weight and easy transportation and

installation of our 2-bladed wind turbine offers additional advantages over the

competition. These projects would include mountainous areas. The Company intends

to bid for offshore application wind turbine bids when the research and

development for 3.0MW wind turbines is completed.

We divide

the Chinese market into 3 segments:

|

|

1)

|

Northeast

and northwest wind farms

|

The wind

resource in this area is allocated between 5 large utility companies. It is

currently deploying product into the Daqing project within this

market.

|

2)

|

Inland

wind farms

|

Inland

wind farms have less wind resources and more mountainous terrain that will give

GC China Turbine additional advantages over the competition.

|

3)

|

Coastal

and offshore wind farms

|

This area

has good wind resource and involves technically more difficult

installations. Thus, the simpler installation of 2-blade turbines has

an advantage over the 3-blade turbine.

China is

actively pursuing a plan to increase the percentage of energy supplied by

renewable means. We have a healthy pipeline of wind farm projects on which to

bid. Some of these projects are considered local projects which gives

GC China Turbine Group an inside track. The Company intends to create production

facilities in many provinces so that it can enjoy the privileges of being a

local manufacturer across many markets. The Company can create numerous

manufacturing facilities efficiently as warehouse space is inexpensive and the

production of these turbines is not labor intensive. Labor costs for production

is approximately 1% of COGS.

10

GC Nordic

has established a good relationship with local and central government

departments through its relationship with Guoce Science and Technology to source

potential contracts. Given that all the potential wind farms projects have to be

pre-approved by the central National Development and Reform Commission (the

“NDRC”) or the

NDRC at the provincial level, our relationship with the government will provide

us with first hand information of the potential wind farm projects in our

targeted markets and allow us to compete for such projects.

The first

step of the selling process includes setting up initial communications with the

owner and obtaining wind conditions, terrain and other project specifications.

Once we have obtained the bidding information on a project, we can begin the

design process. This would include working with the farm developer to make sure

that the GC Nordic is included in the specifications as a possible turbine type.

At this stage it is crucial that the owner understands the characteristics and

advantages of our products before making a selection. The average sales process

for a wind farm takes 6 to 9 months.

The

Company is also planning to adopt a “Resources Exchange Model” to win bids for

potential wind farm projects. The Company sometimes signs wind farm projects

directly with the government and then invites the investors to buy, invest or

co-invest in the projects. As a condition for invitation, these wind farm

projects have to purchase and use of our 2-blade wind turbines.

As a

newcomer to the industry, due to the lack of actual turbines in use, some

cautious customers were taking a wait and see approach to making purchase

decisions from our Company. Now that our wind turbines have been

running steadily for over half a year in Daqing wind farm with positive

operating results, buyers will be more confident in our Company and

brand.

Currently,

there are 6 members of the sales team, handling the following responsibilities:

planning, project management, technical support and

administration. In the future, GC China Turbine Group will increase

the size of the planning, project management and technical support teams as

necessary to support these functions.

Our sales

goals and targeted milestones from 2009 to 2015 are as follows:

2009-2010

|

|

·

|

Using

the model project of Daqing wind farm, GC China Turbine Group will target

inland wind farms as the entry point to gain a foothold in the market,

with a goal of being one of the top three producers in that

market.

|

|

|

·

|

Further

exploring northeast/northwest wind farm opportunity starting in 2009, and

adopting resources exchange model to conduct the market development and

striving to compete against large manufacturers with our low-cost

advantage.

|

|

|

·

|

Launch

offshore markets and overseas

markets.

|

2011-2013

|

|

·

|

Set

up 2 to 3 production and research bases in coastal areas, achieving top 3

production status.

|

|

|

·

|

Develop

equipment for a number of projects in Eastern Europe, Africa and South

America markets, striving to become a top 5 exporter of Chinese

turbines.

|

2013-2015

|

|

·

|

Continue

to extend inland market share.

|

|

|

·

|

To

have top 3 market share in the coastal wind farm

market.

|

11

Our

Customers

The Company is currently executing

three contracts with the following entities: Daqing Longjiang Wind Power Co.,

Ltd (“Daqing

Longjiang”), Wuhan Kaidi Electric Engineering Co., Ltd (“Wuhan Kaidi”) and

Kelipu Wind Power Co., Ltd. (“Kelipu”).

|

|

1.

|

Daqing

Longjiang

|

Daqing

Longjiang has signed a wind turbine purchasing contract with GC Nordic for 50

units of 1.0MW wind turbines. These wind turbines will be installed in Daqing

City, Heilongjiang Province. Daqing Longjiang was established in 2007

and is a company within the Daqing Ruihao Energy Group specializing in the

research, development, construction and operation of wind power generation. The

company is mainly engaged in wind power project operations of new energy and

high efficient energy-saving technology and environmental protection technology

and currently possesses the exclusive development right of wind power in Dumeng

County.

|

|

2.

|

Wuhan

Kaidi

|

Wuhan

Kaidi has signed a purchase contract with GC Nordic for 50 units of 1.0MW wind

turbines. These wind turbines will be installed in Pinglu City, Shanxi Province.

Wuhan Kaidi is joint-stock high-tech enterprise registered at Wuhan East Lake

High-Tech Development Zone, and it is a subsidiary of Wuhan Kaidi Holding

Investment Co., Ltd. The company was established in 2004 with businesses in

coal-fired power generation, biomass power generation, wind power, hydropower

and other power construction including power plant consulting, design, equipment

procurement, construction, installation and commissioning and commercial

operation.

|

|

3.

|

Kelipu

|

Kelipu

executed a purchase contract with GC Nordic for 50 units of 1.0MW wind turbines

in July 2009. These wind turbines will be installed at Kelipu’s wind

farm located in Tu Quan County of Inner Mongolia. However, as of date

of this Form 8-K, Kelipu has applied for but has not yet received final approval

of its wind farm entry procedure from the local

government. Therefore, implementation of this contract with Kelipu

may be delayed until it has received the relevant approvals from the local

government.

Production

and Quality Control

The

Company is using production of the 1.0 MW turbines to grow market share by

exploiting its low-cost advantage. Concurrently the Company is investing in

research and development for its larger turbines. The Company is targeting

production of its large turbines for 2010.

The

Company implements quality control in respect of purchasing, production, and

provision and after sale services as follows:

|

|

(1)

|

Purchasing:

We choose reliable suppliers and require complete background information

and test data from such suppliers to make sure their supplies meet our

rigorous standards.

|

|

|

(2)

|

Production:

We run inspections throughout the whole manufacturing and production

process. We conduct follow-up inspections and use specialized instruments

to guarantee the specifications of moment of force and gap. We implement

several check points throughout the process from component manufacturing

to provision, such as a check point for the size and flatness of the

bottom portion of the turbine, a check point for the yaw gear gap of 0.7mm

to 0.9 mm, a check point for the moment of force of the binding bolt, and

a check point for parameters in operation. We keep detailed test data of

the check points and keep a detailed profile of such

information.

|

|

|

(3)

|

Provision

and after sale services: We strictly follow guidelines in adjustment of

lubrication, hydraulic cooling and hydro-electric control

system.

|

The

Company conformed to the quality management system standard ISO 9001:2000 for

the process of manufacturing and servicing wind turbines on September 10,

2008.

12

Our

Suppliers

The Chinese government’s support of the

wind turbine industry has created significant capacity for components. The

Company has signed contracts with all domestic component suppliers. For key

components, GC China Turbine Group has investigated several alternative

suppliers, 2 to 3 of which will be selected to sign supply contracts with us,

thereby ensuring the supply of components for future production needs.

After components are successfully trial produced by the suppliers,

components will then be tested by the original manufacturers, and each component

is also tested by GC China Turbine Group for performance before installation

into our wind turbines. Our principal Chinese suppliers include Yong

Jin Gear Co., Ltd., Chuan Run Stock Co., Ltd., Xiang Tan Generator Stock Co.,

Ltd. and Zhong Neng Wind Power Device Co., Ltd. Our other principal

suppliers include Brevini, Jahnel-Kestermann Getriebewerke GmbH, Mita—Teknik

A/S, Weier Antriebe Und Energietechnik GmbH, and CA-VerkenAB.

Logistics

and Inventory

Because

supply of wind turbines outpaces demand, the Company follows a make-to-order

policy. We make annual orders with our suppliers at the beginning of the year

based on the forecast of our sales. We start production of the wind turbines

upon execution of sales contracts with our customers and upon receipt of a

deposit on such contracts. We generally hold a 10% inventory in case of

unexpected demand.

Seasonality

Our

Company’s operating results are not affected by seasonality.

Competition

The wind power market is rapidly

evolving and is expected to become intensively competitive. Some of

our competitors have established a market position more prominent than ours and

if we fail to attract and retain customers and establish a successful

distribution network for our wind turbines, we may be unable to increase our

sales and market share. We compete with major international and PRC

companies including Dongfang Steam Turbine, Dalian Huarui, Gold Wind, CSIC,

Spanish Gamesa, and Indian Suzion. Some of these companies are older

and more established than us with established manufacturing

capabilities. Some of these companies are well-capitalized and

benefit from earlier development advantages. We also expect that our

future competition will include new entrants to the wind power market offering

new technological solutions.

However,

we believe that the cost and performance of our technologies, products and

services will have advantages compared to competitive technologies, products and

services. Some of our competitors are large enterprises resulting in

inflexible operations. Some of our competitors receive less

government support. We also have the following advantages over our

competitors:

1. Our

Cost Advantage

We

believe our 2-bladed wind turbine and technological process provides for lower

manufacturing costs resulting from significantly more efficient material usage,

use of fewer parts and fewer manufacturing steps for our product as compared to

our competitors, which commonly use a 3-bladed wind turbine. The

installation costs of our product are also significantly lower as compared to

our competitors because our 2-bladed wind turbine has a simple structure,

lighter total weight and can be more easily installed at less cost than the cost

of installation of 3-bladed wind turbines used by our

competitors. Further, use of our 2-bladed wind turbine can also

significantly reduce overall maintenance costs for a wind farm because it is

equipped with condition monitoring system which monitors the operational

condition of the wind turbine, and signals for maintenance based on actual

turbine condition, increasing revenue and reducing maintenance

costs. These cost advantages greatly reduce the initial investment,

installation costs and maintenance costs of wind farm for owners using our

2-bladed wind turbine.

2. Our

Relationship with Guoce Science and Technology

Since GC

China Turbine Group was formed by certain founders of Guoce Science and

Technology which also formed our core management team, we have the advantage of

initial strategic guidance and the supply of necessary start-up resources. The

main businesses of Guoce Science and Technology’s include research and

development, production, sales, and system engineering services of power testing

instrument, computer-based monitoring system for hydropower station, hydropower

governor, hydropower station excitation, direct current system, substation

automation, power dispatching automation, network monitoring, cluster server,

and computer storage technology.

13

Guoce

Science and Technology has a strong reputation as a provider of technology

services in the energy industry. Its businesses cover the whole power

industrial chain with products ranging from power generation to power

transmission to every sector of power utilization. With the complete product

framework, it expects to hold the leading position in the industry for a long

time.

Our

relationship with Guoce Science and Technology has many benefits

including:

|

|

·

|

access

to engineering prowess

|

|

|

·

|

access

to established technology in the turbine control

arena

|

|

|

·

|

access

to the utilities industry in China as it has large market share for their

products

|

|

|

·

|

credibility

within the utilities industry because it has long-standing relationships

and operating history within the

industry

|

The entire wind power industry also

faces competition from other power generation sources, both conventional and

emerging technologies. Large utility companies dominate the energy

production industry. Coal continues to dominate as the primary

resource for electricity production. Other conventional resources,

including natural gas, oil and nuclear compete with wind energy in generating

electricity. Wind power has some advantages and disadvantages when

compared to other power generating technologies. Wind power is

plentiful and widely distributed. It is a renewable source of

energy. Since wind power does not generate greenhouse gases, it does

not contribute to global warming. Wind power produces no water or air

pollution that can contaminate the environment because no chemical processes are

involved in wind power generation. As a result, wind power reduces

toxic atmospheric gas emissions. However, wind turbines require

locations with constantly high wind speeds and since wind is unpredictable, wind

power is not predictably available.

Research

and Development

GC China

Turbine identified a 2-bladed wind turbine technology that was developed through

a 10 year research project costing over US$ 75 million. While the 2-bladed

technology is relatively less commonly used in the market, the development

project that created GC China Turbine’s technology has been operating for 10

years with 98% availability (for generation). Further, the 2-bladed technology

has the benefits of lower manufacturing cost, lower installation cost and lower

operational costs.

The

2-bladed wind turbine was developed by a firm called Deltawind AB (“Deltawind”). GC

China Turbine has a 10 year license with Deltawind, with opportunity for

renewal, which allows us to manufacture and distribute these turbines in the

Chinese markets. GC China Turbine has successfully retained the

services of some members of the Deltawind team and those executives are

assisting in the research and development efforts as well as the testing of the

new Chinese components. Deltawind was subsequently purchased by a

U.S. licensee of the technology named Nordic Windpower Ltd.

Our

launch product is a 1.0MW utility scale turbine with designs for a 2.3MW and

3.0MW utility scale turbine in development. The Company’s initial efforts have

been rewarded with contracts of approximately US$ 128 million. The

Company is using production of the 1.0 MW turbines to grow market share by

exploiting its low-cost advantage. For fiscal years 2007 and 2008, we

have spent US$ 0 and US$ 94,300, respectively, on research and development

expenses. The Company plans to continue investing more in research and

development for its larger turbines. The Company is targeting production of its

2.3MW and 3.0MW turbines for 2010.

Intellectual

Properties and Licenses

The

following table describes the intellectual property currently owned by GC

Nordic:

|

Type

|

Name

|

Category

Number and Description

|

Issued

By

|

Duration

|

Description

|

|

Trademark

|

GC-NORDIC

|

39

(transport; packaging and storage of goods; travel

arrangement)

|

State

Trademark Administration

|

September

28, 2009 to September 27, 2019

|

N/A

|

|

Trademark

|

Nordic

|

39

(transport; packaging and storage of goods; travel

arrangement)

|

State

Trademark Administration

|

June

21, 2009 to June 20, 2019

|

N/A

|

|

Trademark

|

诺德

|

7

(Machines and machine tools; motors and engines (except for land

vehicles); machine coupling and transmission components (except for land

vehicles); agricultural implements other than hand-operated; incubators

for eggs)

|

State

Trademark Administration

|

June

7, 2009 to June 6, 2019

|

N/A

|

14

GC China

Turbine Group takes all necessary precautions to protect our intellectual

property. Aside from registering our trademarks with the State

Trademark Administration to protect our intellectual property, our marketing

team also diligently conducts market research to ensure that our intellectual

property is not being violated. However, we cannot assure you that we will be

able to protect or enforce our intellectual property rights. In the

event of any infringement upon our intellectual property rights, we will pursue

all legal rights and remedies.

China

Economic Incentive Policies

To

support the development of wind power technology and growth of the in-grid wind

power market, the Chinese government has implemented a series of projects and

also stipulated a series of economic incentive policies:

Ride the Wind Program

To import

technology from foreign companies and to establish a high-quality Chinese wind

turbine generator sector, the former State Development and Planning Commission

(“SDPC”)

initiated the “Ride the Wind Program” in 1996. This initiative led to two joint

ventures, NORDEX (Germany) and MADE (Spain). These joint ventures

effectively introduced a 600 kilowatts wind turbine generator manufacturing

technology into China.

National

Debt Wind Power Program

To

encourage the development of domestic wind power equipment manufacturing, the

former State Economic & Trade Commission (“SETC”) implemented

the “National Debt Wind Power Program.” This program required the

purchase of qualified, locally-made wind power components for new generation

projects. China’s government provided bank loans with subsidized

interest to wind farm owners as compensation for the risk of using locally-made

wind turbine generators. These loans funded construction of

demonstration project wind farms with a total installed capacity of

8MW. This program has been completed.

Wind

Power Concession Project

The NDRC

initiated the “Wind Power Concession Project” in 2004 with a 20-year operational

period. This program aims to reduce the in-grid wind power tariff by

building large capacity wind farms and achieving economies of scale. Each of the

wind farms built under this program must reach a 100MW capacity. By 2006, NDRC

had approved 5 wind farms, in Jiangsu, Guangdong, Inner Mongolia, and Jilin

Province.

In

February 2005, China’s Renewable Energy Law was formulated and was put into

effect on January 1, 2006. The law stipulates that the power grid

company must sign a grid connection agreement with the wind power generating

company and purchase the full amount of the wind power generated by

it. The wind power tariff will be determined by the wind farm project

tendering. The winner’s quoted tariff will be the tariff of that wind

farm project.

Wind

power is a priority “National Clean Development Mechanism Project” of the

Chinese government. Wind farm developers can sell Certified Emission

Reduction Certificates (“CER’s”) to developed

countries under the terms of the Kyoto Protocol.

Governmental

Regulations

This

section sets forth a summary of the most significant regulations or requirements

that affect our business activities in China.

15

Compliance with Circular 75, Circular 106 and the 2006 M&A

Regulations

China’s

State Administration of Foreign Exchange (“SAFE”) issued a

public notice known as “Circular 75” in October 2005, requiring PRC residents to

register with the local SAFE branch before establishing or acquiring the control

of any company outside of China for the purpose of financing that offshore

company with assets or equity interest in a PRC company. PRC residents that are

shareholders of offshore special purpose companies established before November

1, 2005 were required to conduct the overseas investment registration with the

local SAFE branch before March 31, 2006, and once the special purpose vehicle

has a major capital change event (including overseas equity or convertible bonds

financing), the residents must conduct a registration relating to the change

within 30 days of occurrence of the event. On May 29, 2007, the SAFE issued an

additional notice known as “Circular 106,” clarifying some outstanding issues

and providing standard operating procedures for implementing the prior notice.

According to the new notice, SAFE sets up seven schedules that track

registration requirements for offshore fundraising and roundtrip

investments.

Likewise,

the “Provisions on Acquisition of Domestic Enterprises by Foreign Investors,”

issued jointly by the Ministry of Commerce (“MOFCOM”), State-owned

Assets Supervision and Administration Commission, State Taxation Bureau, State

Administration for Industry and Commerce, China Securities Regulatory Commission

and SAFE in September 2006, impose approval requirements from MOFCOM for

“round-trip” investment transactions, including acquisitions in which equity was

used as consideration.

Dividend

Distribution

The

principal laws, rules and regulations governing dividends paid by our PRC

operating subsidiary include the Company Law of the PRC (1993), as amended in

2006, Wholly Foreign Owned Enterprise Law (1986), as amended in 2000, and Wholly

Foreign Owned Enterprise Law Implementation Rules (1990), as amended in 2001.

Under these laws and regulations, our PRC subsidiary may pay dividends only out

of its accumulated profits, if any, determined in accordance with PRC accounting

standards and regulations. In addition, our PRC subsidiary is required to set

aside at least 10% of its after-tax profit based on PRC accounting standards

each year to its statutory surplus reserve fund until the accumulative amount of

such reserve reaches 50% of its respective registered capital. These reserves

are not distributable as cash dividends. The board of directors of a

wholly foreign-owned enterprise has the discretion to allocate a portion of its

after-tax profits to its staff welfare and bonus funds. After the

allocation of relevant welfare and funds, the equity owners can distribute the

rest of the after-tax profits provided that all the losses of the previous

fiscal year have been made up.

Taxation

The

applicable tax laws, regulations, notices and decisions (collectively referred

to as “Applicable Tax

Law”) related to foreign investment enterprises and their investors

include the follows:

|

|

·

|

Enterprise

Income Tax Law of the People’s Republic of China issued by the National

People’s Congress of China on January 1,

2008;

|

|

|

·

|

Implementing

Rules of the Enterprise Income Tax Law of the People’s Republic of China

promulgated by the State Council of China, which came into effect on

January 1, 2008;

|

|

|

·

|

Interim

Regulations of the People’s Republic of China Concerning Value-added Tax

promulgated by the State Council came into effect on January 1,

2009;

|

|

|

·

|

Implementation

Rules of The Interim Regulations of the People’s Republic of China

Concerning Value-added Tax promulgated by the Treasury Department of China

came into effect on January 1,

2009;

|

|

|

·

|

Business

Tax Interim Regulations of the People’s Republic of China promulgated by

the State Council came into effect on January 1,

2009;

|

|

|

·

|

Implementation

Rules of The Business Tax Interim Regulations of the People’s Republic of

China promulgated by the Treasury Department of China came into effect on

January 1, 2009.

|

Income

Tax on Foreign Investment Enterprises

GC Nordic

is subject to income tax at a rate of 25.0% of their taxable income starting

from January 1, 2008 according to the Enterprise Income Tax Law and its

Implementation Rules of People’s Republic of China.

16

Before

the implementation of the Enterprise Income Tax (“EIT”) law (as

discussed below), Foreign Invested Enterprises established in the People’s

Republic of China are generally subject to an EIT rate of 33.0%, which includes

a 30.0% state income tax and a 3.0% local income tax. On March 16, 2007,

the National People’s Congress of China passed the new Corporate Income Tax Law

(“CIT Law”),

and on November 28, 2007, the State Council of China passed the Implementation

Rules for the CIT Law (“Implementation

Rules”) which took effect on January 1, 2008. The CIT Law and

Implementation Rules impose a unified EIT of 25.0% on all domestic-invested

enterprises and foreign invested enterprises (“FIEs”), unless they

qualify under certain limited exceptions. Therefore, nearly all FIEs are subject

to the new tax rate alongside other domestic businesses rather than benefiting

from the old tax laws applicable to FIEs, and its associated preferential tax

treatments, beginning January 1, 2008.

Value-added

Tax

The new

Interim Regulations of the People’s Republic of China on Value-added Tax

promulgated by the State Council came into effect on January 1, 2009 and its

Implementation Rules promulgated by the Treasury Department of China came into

effect on January 1, 2009. Under these regulation and rules,

value-added tax is imposed on goods sold in or imported into the PRC and on

processing, repair and replacement services provided within the

PRC.

Value-added

tax payable in the PRC is charged on an aggregated basis at a rate of 13% or 17%

(depending on the type of goods involved) on the full price collected for the

goods sold or, in the case of taxable services provided, at a rate of 17% on the

charges for the taxable services provided but excluding, in respect to both

goods and services, any amount paid in respect of value-added tax included in

the price or charges, and less any deductible value-added tax already paid by

the taxpayer on purchases of goods and service in the same financial

year.

Business

Tax

The new

Interim Regulations on Business Tax of the People’s Republic of China

promulgated by the State Council came into effect on January 1, 2009, providing

that the business tax rate for a business that provides services, assigns

intangible assets or sells immovable property will range from 3% to 5% of the

charges of the services provided, intangible assets assigned or immovable

property sold, as the case may be except that the entertainment industry shall

pay a business tax at a rate ranging from 5% to 20% of the charges of the

services provided.

Tax

on Dividends from PRC Enterprise with Foreign Investment

According

to the Enterprise Income Tax Law, income resulting from rental properties,

royalties and profits in the PRC derived by a foreign enterprise which has no

establishment in the PRC or has establishment but the income has no relationship

with such establishment is subject to a 10% withholding tax, subject to

reduction as provided by any applicable double taxation treaty, unless the

relevant income is specifically exempted from tax under the Enterprise Income

Tax Law.

Wholly

foreign-owned enterprise

Wholly

foreign-owned enterprises are governed by the Law of the People’s Republic of

China Concerning Enterprises with Sole Foreign Investments, which was

promulgated on 12th April, 1986 and amended on 31 October 2000, and its

Implementation Regulations promulgated on 12th December, 1990 and amended on 12

April 2001 (together the “Foreign Enterprises

Law”).

|

(a)

|

Procedures

for establishment of a wholly foreign-owned

enterprise

|

The