Attached files

| file | filename |

|---|---|

| 8-K - PACIFIC GAS & ELECTRIC Co | eeiform8k.htm |

Business

Update

Edison

Electric Institute

Financial Conference

November 2-3, 2009

Hollywood, Florida

Financial Conference

November 2-3, 2009

Hollywood, Florida

PG&E

Corporation

Exhibit

99

2

Cautionary

Language Regarding

Forward Looking Statements

Forward Looking Statements

This

presentation contains forward-looking statements regarding management’s guidance

for PG&E Corporation’s 2009,

2010, and 2011 earnings from operations

per common share, the assumptions on which the guidance is based, and proposed capital expenditures. These statements and assumptions are necessarily

subject to various risks and uncertainties, the realization or resolution of which may be outside management’s control. Actual results may differ

materially. Factors that could cause actual results to differ materially include:

per common share, the assumptions on which the guidance is based, and proposed capital expenditures. These statements and assumptions are necessarily

subject to various risks and uncertainties, the realization or resolution of which may be outside management’s control. Actual results may differ

materially. Factors that could cause actual results to differ materially include:

• the

Utility’s ability to manage capital expenditures and its operating and

maintenance expenses within authorized levels;

• the

outcome of pending and future regulatory proceedings and whether the Utility is

able to timely recover its costs through rates;

• the

adequacy and price of electricity and natural gas supplies, and the ability of

the Utility to manage and respond to the volatility of the electricity and

natural gas markets, including

the ability of the Utility and its counterparties to post or return collateral;

the ability of the Utility and its counterparties to post or return collateral;

• explosions,

fires, accidents, mechanical breakdowns, the disruption of information

technology and computer systems, and similar events that may occur while

operating and

maintaining an electric and natural gas system in a large service territory with varying geographic conditions, that can cause unplanned outages, reduce generating output, damage

the Utility’s assets or operations, subject the Utility to third party claims for property damage or personal injury, or result in the imposition of civil, criminal or regulatory fines or

penalties on the Utility;

maintaining an electric and natural gas system in a large service territory with varying geographic conditions, that can cause unplanned outages, reduce generating output, damage

the Utility’s assets or operations, subject the Utility to third party claims for property damage or personal injury, or result in the imposition of civil, criminal or regulatory fines or

penalties on the Utility;

• the

impact of storms, earthquakes, floods, drought, wildfires, disease and similar

natural disasters, or acts of terrorism, that affect customer demand, or that

damage or disrupt the

facilities, operations, or information technology and computer systems, owned by the Utility, its customers, or third parties on which the Utility relies;

facilities, operations, or information technology and computer systems, owned by the Utility, its customers, or third parties on which the Utility relies;

• the

potential impacts of climate change on the Utility’s electricity and natural gas

businesses;

• changes

in customer demand for electricity and natural gas resulting from unanticipated

population growth or decline, general economic and financial market conditions,

changes in

technology, including the development of alternative energy sources, or other reasons;

technology, including the development of alternative energy sources, or other reasons;

• operating

performance of the Utility’s two nuclear generating units at the Diablo Canyon

Power Plant (“Diablo Canyon”), the availability of nuclear fuel, the occurrence

of unplanned

outages at Diablo Canyon, or the temporary or permanent cessation of operations at Diablo Canyon;

outages at Diablo Canyon, or the temporary or permanent cessation of operations at Diablo Canyon;

• whether

the Utility can maintain the cost savings that it has recognized from operating

efficiencies that it has achieved and identify and successfully implement

additional sustainable

cost-saving measures;

cost-saving measures;

• whether

the Utility incurs substantial expense to improve the safety and reliability of

its electric and natural gas systems;

• whether

the Utility achieves the CPUC’s energy efficiency targets and recognizes any

incentives that the Utility may earn in a timely manner;

• the

impact of changes in federal or state laws, or their interpretation, on energy

policy and the regulation of utilities and their holding companies;

• the

impact of changing wholesale electric or gas market rules, including the impact

of future changes ordered by the Federal Energy Regulatory Commission that will

be incorporated

into the new day-ahead, hour-ahead, and real-time wholesale electricity markets established by the California Independent System Operator to restructure the California wholesale

electricity market;

into the new day-ahead, hour-ahead, and real-time wholesale electricity markets established by the California Independent System Operator to restructure the California wholesale

electricity market;

• how

the CPUC administers the conditions imposed on PG&E Corporation when it

became the Utility’s holding company;

• the

extent to which PG&E Corporation or the Utility incurs costs and liabilities

in connection with litigation that are not recoverable through rates, from

insurance, or from other third

parties;

parties;

• the

ability of PG&E Corporation, the Utility, and counterparties to access

capital markets and other sources of credit in a timely manner on acceptable

terms;

• the

impact of environmental laws and regulations and the costs of compliance and

remediation;

• the

effect of municipalization, direct access, community choice aggregation, or

other forms of bypass;

• the

outcome of federal or state tax audits and the impact of changes in federal or

state tax laws, policies, or regulations; and

• other

factors and risks discussed in PG&E Corporation’s and the Utility’s 2008

Annual Report on Form 10-K and other reports filed with the Securities and

Exchange Commission.

3

2009

Business Priorities

•

Improve reliability

•

Improve safety and human performance

•

Deliver on budget, on plan, and on purpose

•

Drive customer satisfaction

•

Champion effective regulatory and legislative policies

4

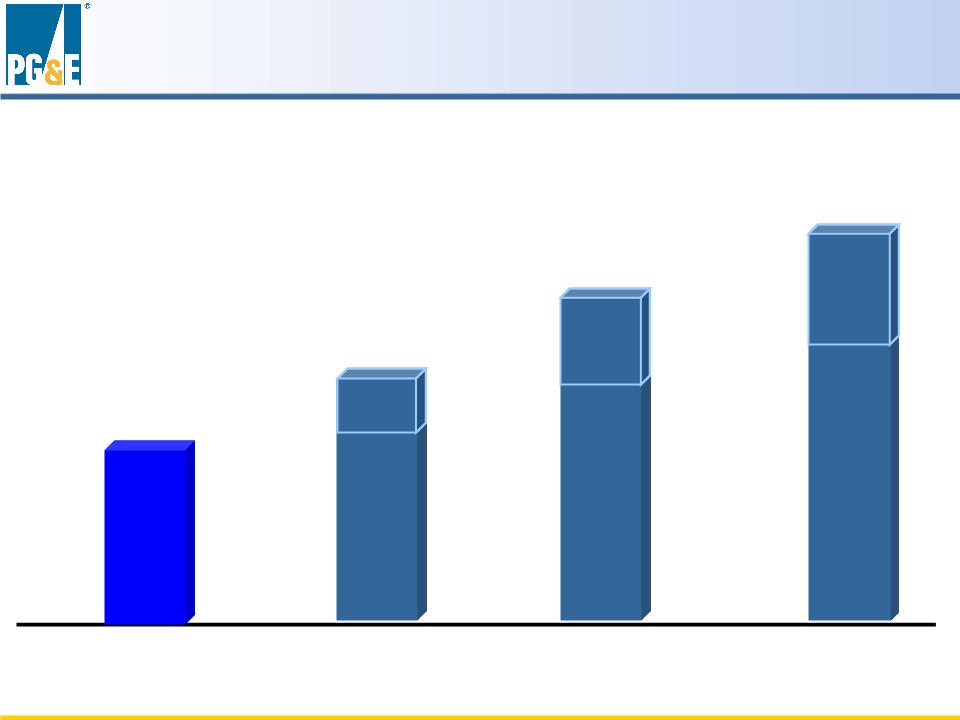

PCG

Investment Case

• PCG

is focused on better service to our customers,

which is the foundation of our growth:

which is the foundation of our growth:

•

Substantial Cap Ex Program

•

Manageable financing requirements

•

Decoupled revenues

•

Pass-through of procurement costs

•

11.45% weighted ROE on 52% equity

•

Low carbon footprint

2009

$3.25

$3.25

$3.15

$3.15

5

2011

EPS

Guidance

$3.85

$3.85

2008

Actual

Actual

$2.95

$2.95

$3.65

$3.65

Low

Low

High

High

Low

Low

High

High

2010

$3.50

$3.50

$3.35

$3.35

Earnings

per Share from Operations

Earnings

per Share from Operations

* Reg G

reconciliation to GAAP for 2008 EPS from Operations, and 2009-2011 EPS Guidance

is contained in the Appendix

and at www.pge-corp.com under the “Investors” page

High

High

Low

Low

6

Financial

Assumptions 2009-2011

GUIDANCE

REFLECTS:

• Capital

expenditures consistent with low and high case ranges

• CPUC

authorized ROE of at least 11.35% and Utility earns at least

12% on FERC projected rate base

12% on FERC projected rate base

• Ratemaking

capital structure maintained at 52% equity

• CEE

incentives, operational changes and efficiencies and tax cash

flow consistent with low and high case earnings ranges

flow consistent with low and high case earnings ranges

• Resolution

of FERC generator claims in 2009-2011 results in

financing needs

financing needs

7

Cost

of Capital

• Affirmative

decision to extend cost of capital mechanism

• Maintains

52% equity capital structure through 2012

• Maintains

11.35% ROE and adjustment mechanism

through 2012

through 2012

• No

ROE adjustment in 2010

8

GRC

Overview

• Continued

investments in safe and reliable service

• Contribute

to economy of our local communities

• Work

toward a greener, smarter energy future

2009

2009

2010

2010

2011

2011

2011

General Rate Case

July:

Filed Notice of Intent

Filed Notice of Intent

Summer

2010:

Hearings

Hearings

January

2011:

Rates go into effect

Rates go into effect

December:

File Application

File Application

Key

Regulatory Proceedings

9

Q1

2010

A.

09-02-019

Solar

PV Application

Q1

2010

A.

08-05-023

Cornerstone

Improvement Program

Q4

2009

Filing

/ Decision Date

R.

09-01-019

Energy

Efficiency 2006-2008 Cycle

Docket

#

Case

Q2

2010

A.

09-04-001

Request

for New Generation Offers

Q3

2010

ER09-1521-000

Transmission Owner

Rate Case 12

Filing

in December 2009; expected

decision Q4 2010

decision Q4 2010

2011

General Rate Case

Filing

in Q3 2009; expected decision

Q4 2010

Q4 2010

A.09-09-013

Gas

Transmission & Storage Rate Case 2011

Q4

2009

R.

08-12-009

SmartGrid Order

Instituting Rulemaking (OIR)

10

Energy

Efficiency Incentive Revenues

• Received

35% of 2006-2007 incentive award in 2008

• Expecting

CPUC decision on proposed 2006-2008 interim

incentive award by December 2009

incentive award by December 2009

• Expecting

CPUC decision to resolve held back incentive

amounts by December 2010

amounts by December 2010

2006

- 2008 Cycle

2006

- 2008 Cycle

2009

and beyond

2009

and beyond

• Development

of new incentive mechanism is underway

• Objective

is to adopt a mechanism that is much easier to

understand and assess

understand and assess

• New

mechanism should result in more predictable,

annual earnings

annual earnings

11

PG&E

Ownership of Renewables

Proposed

Solar PV Program

•

Up to 250 MW of Utility-owned PV generation

•

Up to 250 MW of standard-offer PV PPAs

Next Steps

• 2MW

pilot program underway

• Operational

target date end of 2009

• Next

25 MW planned for 2010

12

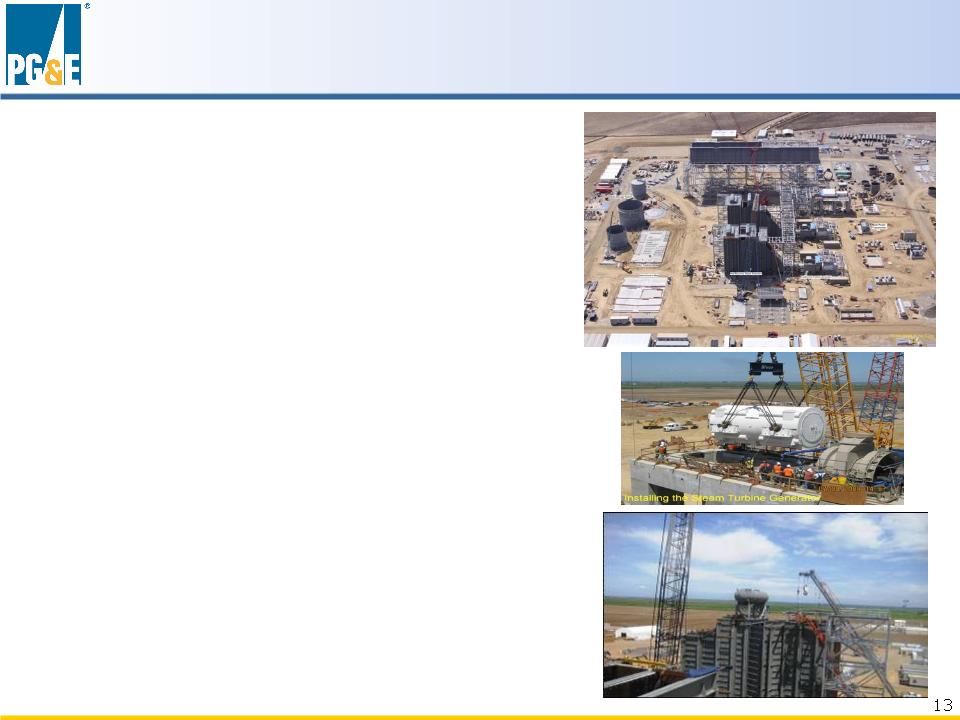

New

Conventional Generation Offers

•

800-1,200 MW of new resources to be on-line by 2015

•

All contracts filed with CPUC, waiting for approval

• Mariposa - 184

MW

• Marsh Landing - 719

MW

• Midway Sunset - 129

MW

• Contra Costa

Generating Station - 586 MW

(Purchase and Sale Agreement)

(Purchase and Sale Agreement)

• 659

MW generating capacity

• Capital

investment of $673 MM

• Approximately

70% complete

• 425

workers on site

• All

generating equipment on

foundations

foundations

• Online

in 2010

Colusa

Generating Station Update

14

Humboldt

Bay Generating Station

• 163

MW generating capacity

• Capital

investment of $239 MM

• Approximately

60% complete

• 130

workers on site

• Online

in 2010

SmartMeter

Program Update

• Largest

deployment of Advanced Metering

Infrastructure (AMI) nationwide

Infrastructure (AMI) nationwide

• Capital

investment of $1.8 B

• Installations

complete in 2012

• Enables

time-of-use pricing

• Enhanced

capabilities over time

• Installed

about 3.8MM SmartMeters to date

15

Appendix

Electric

And Gas Distribution

(1) Authorized revenues

= operating costs + (rate of return ´ rate

base)

Rate

base = net plant ± adjustments to approximate invested capital

|

Business

Scope

|

|

• Retail

electricity and natural gas distribution service (construction,

operations and maintenance) • Customer

services (call centers, meter reading, billing)

• 5.1 million

electric and 4.3 million gas customer accounts

|

|

Primary

Assets

|

|

• $11.9 billion

of rate base (2008 wtd. avg.)

|

|

Regulation

|

|

• California

state regulation (CPUC)

• Cost of

service ratemaking (1)

|

17

Midway

Los

Banos

Moss

Landing

Diablo

Canyon

Gates

Dixon

Malin

Round

Mt

Vaca

Electric

Transmission

|

Business

Scope

|

|

• Wholesale

electric transmission services (construction, maintenance)

• Operation by

CA Independent System Operator

|

|

Primary

Assets

|

|

• $2.8 billion

of rate base (2008 wtd. avg.)

|

|

Regulation

|

|

• Federal

regulation (FERC)

• Cost of

service ratemaking

• Revenues vary

with system load

|

18

Natural

Gas Transmission

|

Business

Scope

|

|

• Natural gas

transportation, storage, parking and lending

services • Customers:

PG&E natural gas distribution and electric

generation businesses, industrial customers, California electric generators |

|

Primary

Assets

|

|

• $1.5 billion

of rate base (2008 wtd. avg.)

|

|

Regulation

|

|

• California

state regulation (CPUC)

• Incentive

ratemaking framework (“Gas Accord”)

• Revenues vary

with throughput

|

19

Electric

Procurement & Owned Generation

|

Business

Scope

|

|

• Electricity

and ancillary services from owned and controlled

resources • Energy

procurement program

|

|

Primary

Assets

|

|

• $2.0 billion

of rate base (2008 wtd. avg.)

• Diablo Canyon

Nuclear Power Plant (2,240 MW)

• Gateway

Generating Station (530 MW)

• Largest

privately owned hydro system (3,896 MW)

• Funded nuclear

plant decommissioning trusts of $1.8 billion

|

|

Regulation

|

|

• Cost of

service ratemaking for utility-owned generation

• Pass through

of power procurement costs

|

20

Helms

Pumped Storage

Diablo

Canyon Power Plant

Conventional

Hydroelectric

facilities

facilities

PG&E

Generation in California

Gateway

21

Agricultural

Electric

Customers

(88,127

GWh delivered)

Gas

Customers

(833

Bcf delivered)

Industrial

68%

68%

Commercial

8%

8%

Residential

24%

24%

Industrial

18%

18%

Commercial

39%

39%

Residential

36%

36%

Agricultural

& Other

& Other

7%

2008

Customer Profiles (% by Sales)

22

|

Owned

Generation

|

Type

|

|

|

Diablo

Canyon

|

Nuclear

|

2,240

|

|

Hydroelectric

Facilities

|

Hydro

|

3,896

|

|

Humboldt

|

Fossil

|

135

|

|

Total

|

|

6,271

|

2008

Resource Mix

* Approximately

12% of total retail sales are supplied by eligible renewable resources coming

from utility-owned, QF, Irrigation Districts, and

other sources.

other sources.

23

30%

18%

15%

35%

2%

2008

EPS - Reg G Reconciliation

*

Earnings per share from operations is a non-GAAP measure. This

non-GAAP measure is used because it allows

investors to compare the core underlying financial performance from one period to another, exclusive of items that do not

reflect the normal course of operations.

investors to compare the core underlying financial performance from one period to another, exclusive of items that do not

reflect the normal course of operations.

**

Items impacting comparability reconcile earnings from operations with

consolidated Income Available for Common

Shareholders as reported in accordance with GAAP. For the three and twelve months ended December 31, 2008, PG&E

Corporation recognized $257 million of net income resulting from a settlement of tax audits for tax years 2001 through

2004. Of this amount, $154 million was related to PG&E Corporation’s former subsidiary, National Energy & Gas

Transmission, Inc., and was recorded as income from discontinued operations

Shareholders as reported in accordance with GAAP. For the three and twelve months ended December 31, 2008, PG&E

Corporation recognized $257 million of net income resulting from a settlement of tax audits for tax years 2001 through

2004. Of this amount, $154 million was related to PG&E Corporation’s former subsidiary, National Energy & Gas

Transmission, Inc., and was recorded as income from discontinued operations

|

EPS on an

Earnings from Operations Basis*

|

$2.95

|

|

Items

Impacting Comparability**

|

0.68

|

|

EPS on a GAAP

Basis

|

$3.63

|

2008

24

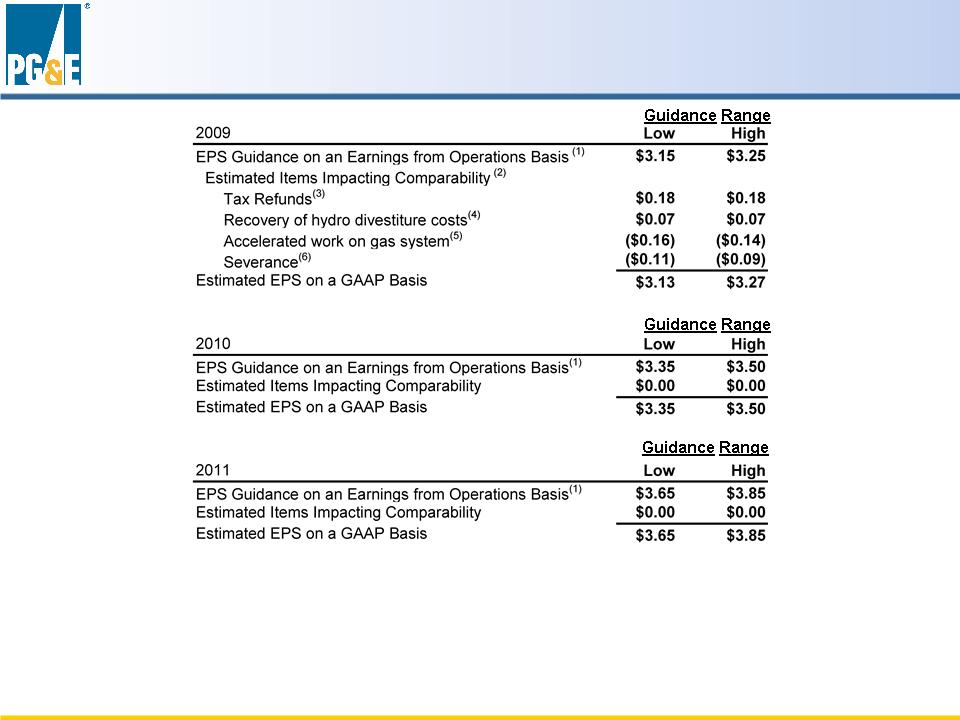

EPS

Guidance - Reg G Reconciliation

|

(1) Earnings per

share from operations is a non-GAAP measure. This

non-GAAP measure is used because it allows investors to compare the core

underlying

financial performance from one period to another, exclusive of items that do not reflect the normal course of operations. (2) Items impacting

comparability reconcile earnings from operations with Consolidated Income

Available for Common Shareholders in Accordance with GAAP.

(3) In June 2009,

the Joint Committee of Taxation approved deferred gain treatment for power

plant sales in 1998 and 1999. This amount recognizes the

interest

and state tax benefit related to the tax refund (4) On April 16,

2009, the CPUC authorized recovery of costs previously incurred in

connection with the Utility’s hydroelectric generation

facilities.

(5) Costs to

perform accelerated system-wide gas integrity surveys and associated

remedial work.

(6) Severance costs

related to the reduction of approximately 2% of the Utility’s

workforce.

|

Reg

G reconciliation also provided on the PG&E Corporation website:

www.pge-corp.com under the “Investors” page

25