Attached files

| file | filename |

|---|---|

| 8-K - UIL FORM 8-K DATED OCTOBER 30, 2009 - UIL HOLDINGS CORP | uil_form8kdated1023009.htm |

| EX-99 - UIL EXHIBIT 99 - EARNINGS RELEASE - UIL HOLDINGS CORP | uil_exh99.htm |

1

EEI

Nov. 2009

44th

Annual EEI Financial Conference

November

2009

-

transforming

investment into future value

Exhibit

99.1

2

EEI

Nov. 2009

Certain

statements contained herein, regarding matters that are not historical facts,

are forward-looking

statements (as defined in the Private Securities Litigation Reform Act of 1995). These include statements

regarding management’s intentions, plans, beliefs, expectations or forecasts for the future. Such forward-

looking statements are based on the Corporation’s expectations and involve risks and uncertainties;

consequently, actual results may differ materially from those expressed or implied in the statements.

Such risks and uncertainties include, but are not limited to, general economic conditions, legislative and

regulatory changes, changes in demand for electricity and other products and services, unanticipated

weather conditions, changes in accounting principles, policies or guidelines, and other economic,

competitive, governmental, and technological factors affecting the operations, timing, markets, products,

services and prices of the Corporation’s subsidiaries. The foregoing and other factors are discussed and

should be reviewed in the Corporation’s most recent Annual Report on Form 10-K and other subsequent

periodic filings with the Securities and Exchange Commission. Forward-looking statements included

herein speak only as of the date hereof and the Corporation undertakes no obligation to revise or update

such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of

unanticipated events or circumstances.

statements (as defined in the Private Securities Litigation Reform Act of 1995). These include statements

regarding management’s intentions, plans, beliefs, expectations or forecasts for the future. Such forward-

looking statements are based on the Corporation’s expectations and involve risks and uncertainties;

consequently, actual results may differ materially from those expressed or implied in the statements.

Such risks and uncertainties include, but are not limited to, general economic conditions, legislative and

regulatory changes, changes in demand for electricity and other products and services, unanticipated

weather conditions, changes in accounting principles, policies or guidelines, and other economic,

competitive, governmental, and technological factors affecting the operations, timing, markets, products,

services and prices of the Corporation’s subsidiaries. The foregoing and other factors are discussed and

should be reviewed in the Corporation’s most recent Annual Report on Form 10-K and other subsequent

periodic filings with the Securities and Exchange Commission. Forward-looking statements included

herein speak only as of the date hereof and the Corporation undertakes no obligation to revise or update

such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of

unanticipated events or circumstances.

Important

Note to Investors

James

Torgerson

President

and Chief Executive Officer

Anthony

Vallillo

President

and Chief Operating Officer, UI

Richard

Nicholas

Executive

Vice President and Chief Financial Officer

3

EEI

Nov. 2009

UIL

Corporate Structure

UIL

Holdings Corporation

GenConn

Energy LLC

50%

Ø Market cap

of ~ $786 million*

Ø 1,058

employees

Retail

Distribution

Transmission

The

United Illuminating

Company (UI)

Company (UI)

Ø Joint

venture between UI and NRG

Ø Peaking

generation new build

Ø Regulated

transmission

& distribution utility

& distribution utility

Ø ~ 324,000

customers

Ø Full

revenue decoupling

mechanism

mechanism

Ø Weighted

allowed

return on equity of

8.84% in 2009

return on equity of

8.84% in 2009

Ø Recently

completed Middletown-

to-Norwalk transmission line

to-Norwalk transmission line

Ø Composite

return on equity

approximately 12.5% in 2009

approximately 12.5% in 2009

Service

Territory in CT

Ø 335 square

miles

Ø Population

of ~736,000

*

As of 10/28/09

4

EEI

Nov. 2009

Progressive

pure-play

electric utility

electric utility

Transmission

focus

(FERC

Regulated)

Regulation

Ø Virtually

100% regulated

Ø Long

history of National 1st quartile reliability

performance

Ø 20 year

leader in Conservation & Load Management programs

Ø Smart Grid

- ahead of the curve

Ø Estimated

38% of 2009 total rate base

Ø 2009

composite return on equity of approximately 12.5% and capital structure of 50%

equity

Ø Identified

future investment opportunities

Ø Recent

distribution rate case includes favorable items such as revenue decoupling

mechanism,

pension

tracker and cost of debt tracking mechanism

Ø Expected

enhanced stability and predictability of earnings

Ø 2009

blended transmission & distribution allowed return on equity of

approximately 10.2%

UIL:

progressive pure-play electric utility with significant growth opportunities and

an attractive dividend yield

Conservative

financial

strategy

strategy

Ø Commitment

to investment grade credit profile

Ø Disciplined

capital investment program

Ø Consistent

history of dividend payments

High

probability

growth

growth

Ø $1.7

billion of projected regulated capital and equity investment for

2009-2018

Ø Base plan

provides significant growth 90+%

probability of occurrence

Ø GenConn:

cost-of-service electric generation development underway

Ø Proven

ability to execute on capital projects, e.g. Middletown-to-Norwalk transmission

line

Investment

Highlights

5

EEI

Nov. 2009

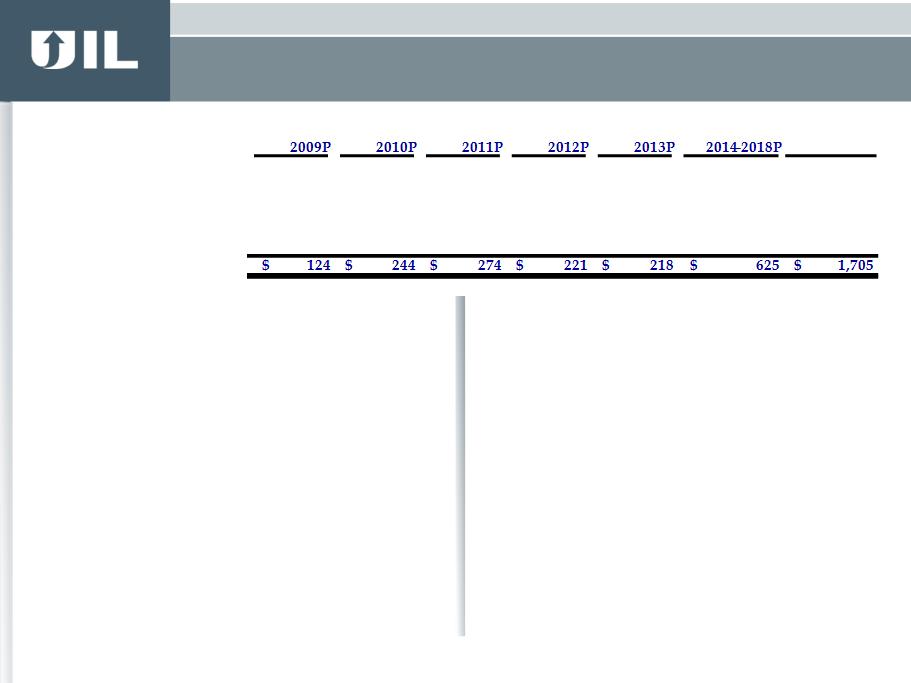

Total

2009-2018P

Distribution

95

$

141

$

147

$

141

$

122

$

534

$

1,178

$

Transmission

29

$

47

$

63

$

80

$

96

$

91

$

405

$

GenConn*

-

$

57

$

65

$

-

$

-

$

-

$

122

$

Total

Base Capital Exp.**

*

Equity investment - Devon plant in-service 6/1/10, Middletown plant in-service

6/1/11.

**

Amounts may not add due to rounding.

($ in

millions)

Base

10-yr CapEx Forecast

Ø High

probability of occurrence (90+%)

» Identified

projects with clear need and

regulatory support

regulatory support

Ø Reflects

decline in future peak load

forecasts

forecasts

» Pushing out

some capacity projects and dollars

beyond prior 10-yr plan

beyond prior 10-yr plan

Growth

Opportunities Beyond Base Forecast

Ø Transmission

investment within the

region

region

» Renewable

Portfolio Standards driving new

transmission

transmission

» Policy

support from New England Governors’

Energy Blueprint

Energy Blueprint

Ø Generation

Opportunities

» Potential

opportunity for ownership of base-

load generation

load generation

Base 10-yr

Capital Expenditure Program

6

EEI

Nov. 2009

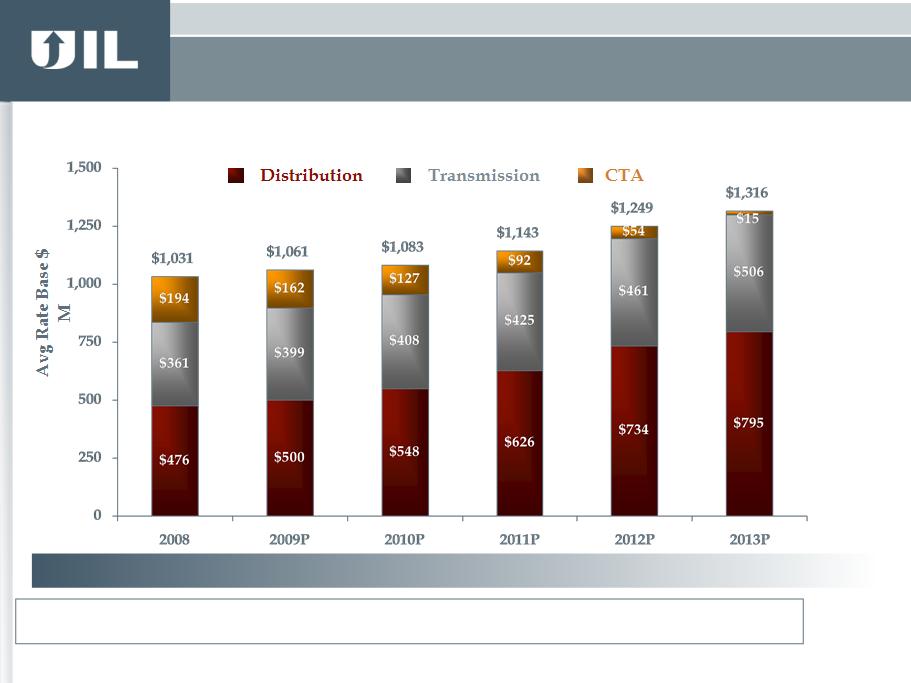

46%

35%

19%

47%

38%

15%

Rate

base growth even with a declining CTA balance

51%

38%

11%

55%

37%

8%

59%

37%

4%

60%

39%

Avg.

GenConn Rate Base Equivalent (UI’s share)

CAGR

5%

1%

$56m

$174m

$232m

$224m

Avg.

GenConn Equity Investment (UI’s share)

$28m

$116m

$112m

$87m

Forecasted

Average Rate Base 2008-2013

(Excluding GenConn Equity Investments)

(Excluding GenConn Equity Investments)

7

EEI

Nov. 2009

|

|

Opportunity

/ Enabler

|

Notes

/ Summary

|

Distribution

|

Transmission

|

In-State

Generation |

|

A

|

Renewable

Portfolio

Standards |

Six

of seven New England states

have adopted standards. CT has limited means to comply. Possible collaboration among New England Transmission Owners. |

|

ü

|

ü

|

|

B

|

New

England

Governors’ Blueprint |

Published

September ’09.

Significant transmission build- out needed (potential $7B to $9B range, could be higher or lower) |

|

ü

|

ü

|

|

C

|

Smart

Grid

|

Advanced

metering, enhanced

monitoring and customer applications |

ü

|

ü

|

|

|

D

|

Reliability,

Capacity,

Aging Infrastructure |

On-going

studies to assess

future needs |

ü

|

ü

|

|

|

E

|

Section

83

CT

Public Act 07-242

|

Allows

UI to purchase, operate

existing plants offered for sale within the state |

|

|

ü

|

Opportunities

not included in 2009-2018 Base Plan

Growth -

Opportunities / Enablers

8

EEI

Nov. 2009

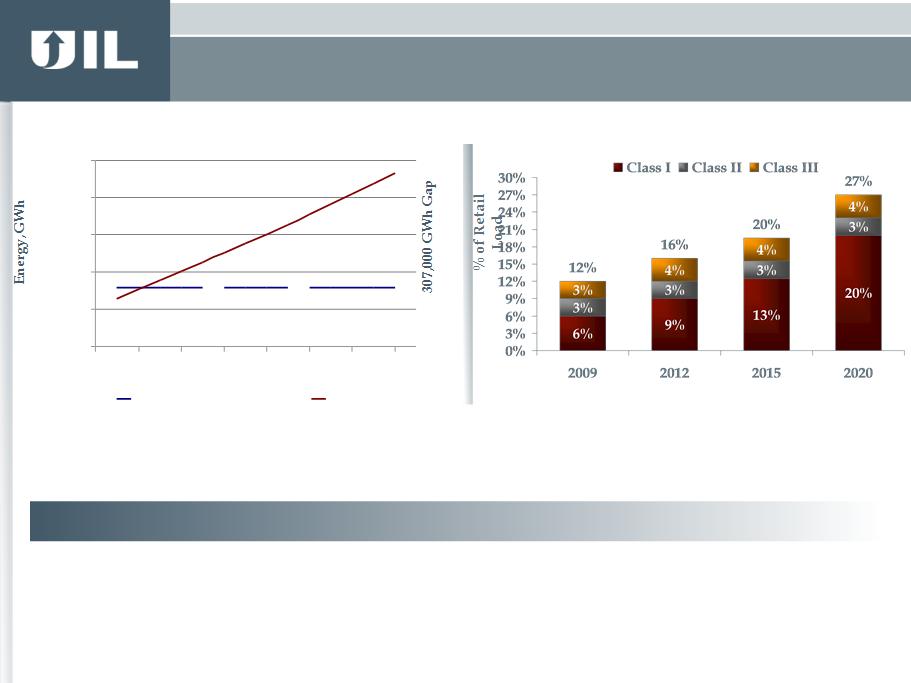

RPS

expected to create investment opportunities for UIL

Class

I

resources include energy derived from solar, wind, fuel cell, methane gas from

landfills, ocean thermal, wave, tidal, run-of-river hydropower and

sustainable

biomass. Data/tables from ISO-NE Update on New England Renewable Portfolio Standards (RPS) and Renewable Resources Outlook, May 15, 2009

biomass. Data/tables from ISO-NE Update on New England Renewable Portfolio Standards (RPS) and Renewable Resources Outlook, May 15, 2009

Class

II

resources include other biomass (NOx emission <0.2 lbs/MMBtu of heat input,

began operation before July 1, 1998), small run-of-river hydroelectric

(<5MW,

began operation before July 1, 2003) and municipal solid waste trash-to-energy facilities

began operation before July 1, 2003) and municipal solid waste trash-to-energy facilities

Class

III

include customer-sited combined heat and power (with operating efficiency

>50% of facilities installed after January 1, 2006), waste heat recovery

systems

(installed on or after April 1, 2007), electricity savings from conservation and load management programs (began on or after January 1, 2006)

(installed on or after April 1, 2007), electricity savings from conservation and load management programs (began on or after January 1, 2006)

Existing

Renewables vs. Region-wide RPS CT RPS

Requirements

Ø Requirement

is ~3 times current renewables level

Ø Gap will

likely be filled by renewables remote from load

-

10,000

20,000

30,000

40,000

50,000

2007

2009

2011

2013

2015

2017

2019

2021

Exist.

Renew. Energy

RPS

Reqmt

10.3%

12.7%

10.8%

30.1%

Growth -

Renewable Portfolio Standards (RPS)

9

EEI

Nov. 2009

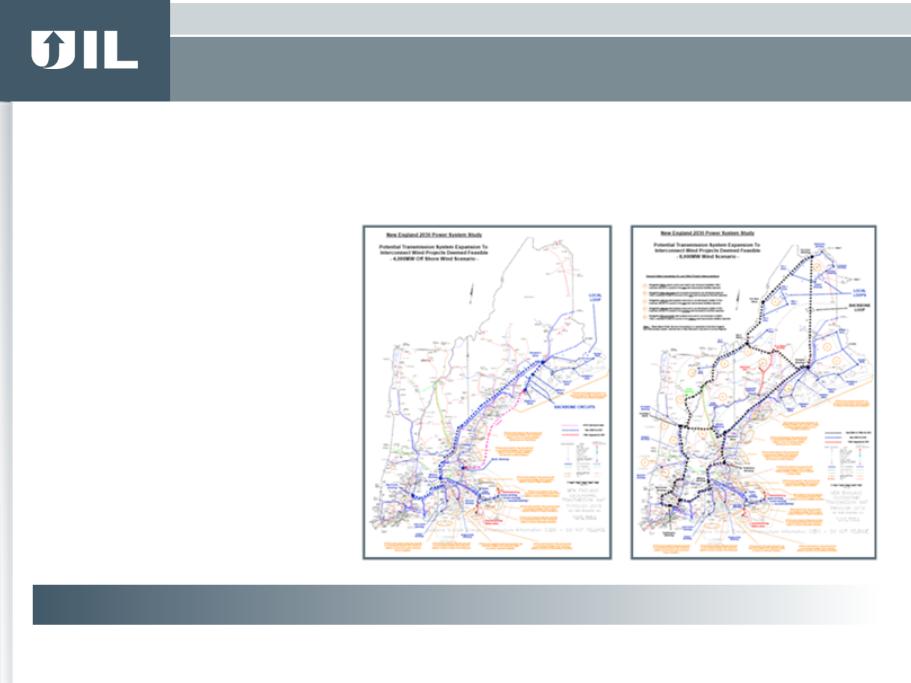

Study

expected to create investment opportunities for UIL

Data

from ISO-NE Preliminary Maps and Cost Estimates for Transmission Scenarios, July

17, 2009. View

distorted intentionally.

ISO-NE

Study:

Ø Basis for

“Blueprint” is the

Renewable Development

Scenario Analysis

Renewable Development

Scenario Analysis

Ø Region

can

develop sufficient

wind resources to satisfy RPS

(and even export)

wind resources to satisfy RPS

(and even export)

Ø Various

scenarios studied, e.g.:

Ø 2,000 MW

on-shore and/or off-

shore

shore

Ø 4,000 MW

on-shore and/or off-

shore

shore

Ø 8,000 MW

on- and off-shore

Ø 12,000 MW

on- and off-shore

Ø Various

reinforcements of

interconnections

interconnections

Transmission

Needed:

Ø Significant

transmission build-out indicated

Ø Potential

$7B to $9B range, could be higher or lower

~4,000

MW by 2030 ~12,000

MW by 2030

Growth -

New England Governors’ Blueprint

10

EEI

Nov. 2009

GenConn

Energy - Devon Site Under Construction

11

EEI

Nov. 2009

UI

Equity Bridge Loan

Ø $121.5m in

total à $88.3m

drawn as of

9/30/09

9/30/09

» $57m due

6/1/10 with Devon in-service

» $64.5m due

6/1/11 with Middletown in-service

NRG

Equity Bridge Loan

Ø $121.5m in

total

GenConn

Project Financing

Ø $291m in

total à includes

$48m working

capital facility

capital facility

Base Plan -

GenConn Energy

Ø 50/50

debt/equity

Status

Ø Devon

Plant

» Turbines

enroute

Ø GenConn

2010 rate case to be filed no later

than December 3, 2009

than December 3, 2009

12

EEI

Nov. 2009

Empowering

the Customer: Current State

“My Account” Dashboard

“My Account” Dashboard

13

EEI

Nov. 2009

Advanced

Metering

Meters

& Meter Equipment

Meter Data

Management

2-way Mesh

Network

Standards

Arc Flash

Mitigation

Customer

Applications

Enhanced

Monitoring

Outage

Management System

SCADA

Network

Systems Communications

Home Area

Network Stimulus

PHEV

Charging Stations

Estimated

Spend $83 million (2009-2018)

UI’s Smart

Grid Base Plan

14

EEI

Nov. 2009

UI - Ahead

of the Curve

Smart

Grid Vision Established - Execution in Progress

Approximately

17% of UI’s Customers are on Time of Use rates

Fixed

one-way wireless network since 2002

Ø Remote

meter reading once a day

Ø Depending

on customer class, meter reading capability

» Hourly

» In 15

minute intervals

Upgraded

to a two-way mesh network in 2009

Ø Allows

2-way communication to and from meters

Ø Allows

communication meter to meter

5,000

Advanced Metering Infrastructure (AMI) meters already installed

Ø 80,000 AMI

meters to be installed by 2012

Ø Remote

disconnect/reconnect capabilities

Ø Network

outage notification and restoration verification

15

EEI

Nov. 2009

AMI

Network

AMI

Host

Software

Wireless

Thermostat

Wireless

Dimmer

Wireless

Dimmer

Wireless

Switch

Wireless

Switch

Wireless

Keypad

InHome

TM

Wireless

Contact Switch

Home

Heartbeat TM

Wireless

Contact Switch

Home

Heartbeat TM

Wireless

Water

Sensor

Sensor

Wireless

Remote

Wireless

Outlet

Dimmer

Home

Theater Controller

AC

Load

Control

Direct

Load

Control

Wireless

Display

Energy

Management

Services

HAN

Software

2-Way Mesh

Network - already

in place

First

prototype Advanced Meters being installed

Enabling

In-Home Displays & Load Control Appliances

Empowering

the Customer: Future State

Interactive Devices and “Smart” Appliances

Interactive Devices and “Smart” Appliances

16

EEI

Nov. 2009

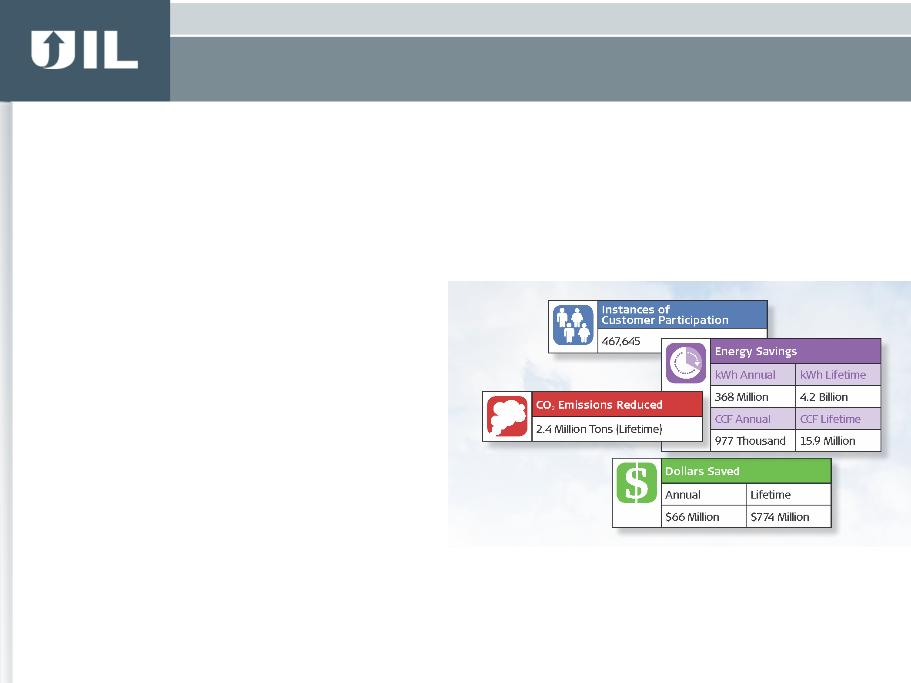

CT

Energy Efficiency Fund Activities in 2008

UI

approximately 20%

UI

has been a leader in energy efficiency programs for more than 2

decades

Leader in

Conservation and Demand Response Programs

Ø Nationally

and internationally

recognized for its programs

recognized for its programs

Ø Small

Business Energy Advantage

Program incorporates innovative

“on-bill financing”

Program incorporates innovative

“on-bill financing”

Ø 973 million

annual lifetime

kilowatt hour savings (5

-year average)

kilowatt hour savings (5

-year average)

Ø 528

thousand annual lifetime tons

of carbon dioxide emissions (5

-year average)

of carbon dioxide emissions (5

-year average)

Ø Annual

pre-tax income

approximately $1 million

approximately $1 million

17

EEI

Nov. 2009

UI

is a leading demand response provider throughout New England

Leader in

Conservation and Demand Response Programs

Ø All the

Home Depot, Walmart and

Kohl’s stores in New England

participate in UI’s Load Response

Program

Kohl’s stores in New England

participate in UI’s Load Response

Program

Ø 600

individual customer assets, 100

MW of load

MW of load

Ø Active in

ISO-NE Market

Committee and Forward Capacity

Working Group to help create

demand response programs that

customers value

Committee and Forward Capacity

Working Group to help create

demand response programs that

customers value

Ø Annual

pre-tax income

approximately $1-$2 million

approximately $1-$2 million

18

EEI

Nov. 2009

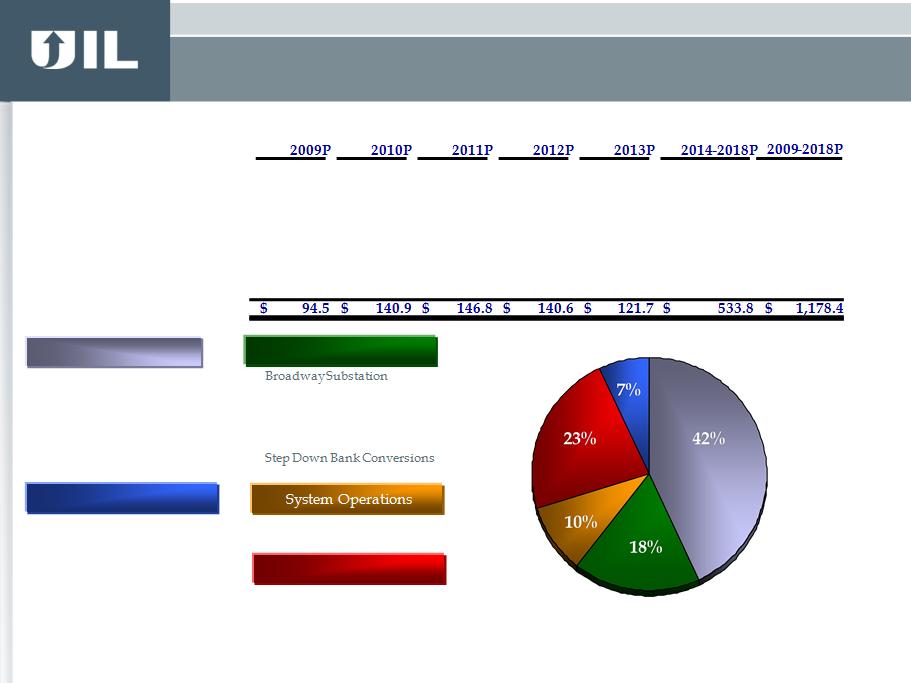

Total

Aging

Infrastructure

36.0

$

49.1

$

39.7

$

48.4

$

57.5

$

276.9

$

507.4

$

Capacity

19.8

$

20.0

$

18.3

$

27.5

$

26.5

$

95.7

$

207.8

$

System

Operations

12.6

$

16.1

$

12.5

$

10.1

$

9.1

$

53.8

$

114.2

$

Core

Support

16.2

$

38.9

$

57.2

$

40.4

$

19.3

$

94.0

$

266.1

$

Smart

Grid

(base)

10.0

$

16.8

$

19.2

$

14.2

$

9.4

$

13.4

$

83.0

$

Total

Base Distribution*

Aging

Infrastructure

Cable &

Pole Replacement

Distribution

Transformer

Replacement

Replacement

Splice

Chambers

Substation

Rebuilds

Substation

Removals

Capacity

Shelton

Substation

Bus

Additions

Feeder

Transfers

Core

Support

IT

related

Other

support

Customer

Projects

*

Amounts may not add due to rounding.

Smart

Grid

Advanced

Metering

Meter Data

Management

Outage

Management

SCADA

2-way Mesh

Network

($ in

millions)

Base Plan -

Distribution Investments

19

EEI

Nov. 2009

Advanced

Metering Initiatives

Remote

Connect/Disconnect

Meters

& Meter Equipment

Outage

Management System

Approximate

cost: $48 million (2009-2018)

Status:

On-going

*

Although

UI’s application was not granted by the DOE, UI will continue to invest in a

range of previously approved projects designed to

increase its power grid’s capabilities and in doing so offer measurable benefits to its customers.

increase its power grid’s capabilities and in doing so offer measurable benefits to its customers.

Broadway

Substation

Base

Distribution (and Smart Grid*) Examples

Major

Distribution Programs

Substations

(capacity

& aging infrastructure)

Splice

Chamber Replacement

Cable

Replacement

Approximate

cost: $267 million (2009-2018)

Status:

On-going

20

EEI

Nov. 2009

Substation

Rebuilds

Line/Cable

Replacement

Customer

Projects

NERC/Cyber

Security/IT related

SCADA

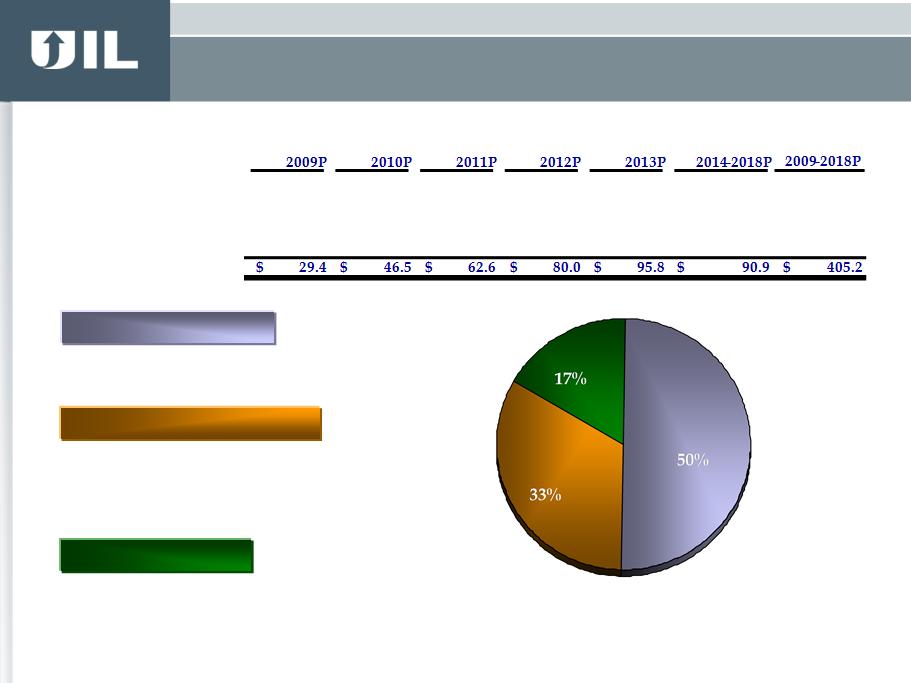

Total

Aging

Infrastructure

3.9

$

24.9

$

33.2

$

30.2

$

39.6

$

67.0

$

198.8

$

Capacity

14.1

$

14.5

$

9.5

$

8.4

$

19.7

$

4.2

$

70.4

$

Standards

Compliance/Other

11.4

$

7.1

$

19.8

$

41.5

$

36.6

$

19.7

$

136.0

$

Total

Base Transmission*

Capacity

Standards

Compliance/Other

*Amounts

may not add due to rounding.

($ in

millions)

New

Substations

Reliability

Projects

Aging

Infrastructure

Base Plan -

Transmission Investments

21

EEI

Nov. 2009

Shelton

Substation

Approximate

cost - $34 million

(60%

Transmission, 40% Distribution)

Estimated

in-service - June 2013

Status

Ø Preparing

filing for CT Siting Council

Base -

Transmission Project Examples

Grand

Avenue Switching Station

Approximate

cost - $62 million

(100%

Transmission)

Estimated

in-service - June 2012

Status

Ø CT Siting

Council approval

Ø Continued

preliminary design

22

EEI

Nov. 2009

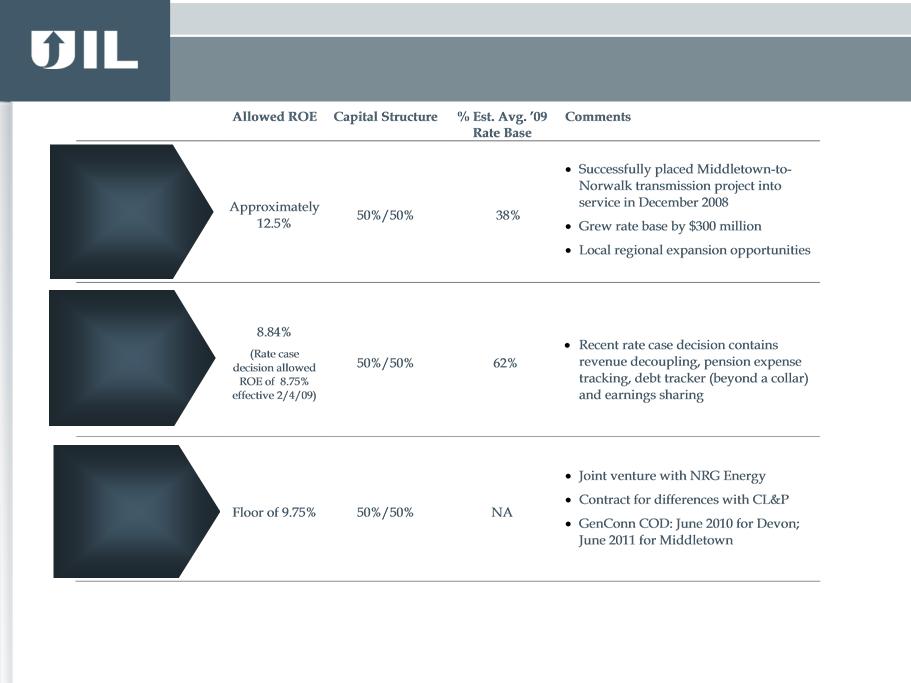

‘09

Transmission & Distribution Blended Allowed ROE Approx. 10.2%

Transmission

Distribution

&

CTA

Generation

23

EEI

Nov. 2009

Regulatory

Benefits

from 2008 Distribution Rate Case

Ø Rate years

2/4/09 through 2/3/11

» Full

revenue decoupling adjustment

» Cost of

debt tracking mechanism

» Pension

& postretirement expense is recoverable in rates or as a regulatory asset

for

future recovery

future recovery

Ø Portion of

uncollectible expense allocated to Generation Services Charge (GSC)

DPUC

Ø Initiated

informational meetings to discuss "Impact of Recent Economic and

Financial Crisis on Utility Financing & Investment“

Financial Crisis on Utility Financing & Investment“

Ø New docket

(DN 09-10-06) opened to investigate feasibility and desirability of

generic ROE proceeding

generic ROE proceeding

24

EEI

Nov. 2009

3Q

’09 earnings from continuing operations of $21.7 million, or $0.73 per

share,

compared to $21.5 million, or $0.86 per share, in 3Q ’08

compared to $21.5 million, or $0.86 per share, in 3Q ’08

YTD

’09 earnings from continuing operations of $47.6 million, or $1.74 per

share,

compared to $39.4 million, or $1.57 per share, during the same period in ’08

compared to $39.4 million, or $1.57 per share, during the same period in ’08

Ø Successfully

managing O&M costs

Ø Decoupling

adjustment provided Commission-determined revenue requirement

Ø Reasonable

opportunity to achieve distribution allowed return on equity (ROE)

Ø Underlying

transmission growth - higher rate base and equity capitalization

Ø On track to

earn transmission allowed weighted average ROE of approximately

12.5%

3Q &

YTD 2009 Financial Results - Summary

25

EEI

Nov. 2009

Quarter

Ended September 30,

Nine

Months Ended September 30,

2009

2008

Difference

2009

2008

Difference

UI

Distribution,

CTA and Other

15.4

$

16.2

$

(0.8)

$

30.3

$

24.4

$

5.9

$

Transmission

6.9

6.1

0.8

19.2

17.0

2.2

Total

UI Net Income

22.3

$

22.3

$

-

$

49.5

$

41.4

$

8.1

$

UIL

Corporate

(0.6)

(0.7)

0.1

(1.8)

(1.8)

-

Total

Continuing Operations

21.7

$

21.6

$

0.1

$

47.7

$

39.6

$

8.1

$

Discontinued

Operations - Xcelecom

-

(0.1)

0.1

(0.1)

(0.2)

0.1

Total

Net Income

21.7

$

21.5

$

0.2

$

47.6

$

39.4

$

8.2

$

Average

Shares Outstanding - Basic

29.9

25.1

4.8

27.4

25.1

2.3

EPS

0.73

$

0.86

$

(0.13)

$

1.74

$

1.57

$

0.17

$

The

dilutive effect of the May 2009 issuance of an additional 4,600,000 shares of

common stock in the third quarter and first nine months of 2009

was

$0.13 per share and $0.14 per share, respectively.

3Q &

YTD 2009 Financial Results

26

EEI

Nov. 2009

Ø Successfully

managing O&M expense

Ø Decoupling

adjustment provided DPUC-

determined revenue requirement

determined revenue requirement

Ø Regulatory

true up favorable due to the

absence in 2009 of adjustments recorded in

2008

absence in 2009 of adjustments recorded in

2008

Ø Favorable

uncollectible expense - portion

allocated to GSC ($0.2m in 3Q and $1.1m

YTD)

allocated to GSC ($0.2m in 3Q and $1.1m

YTD)

Ø Pension

& postretirement expense

unfavorable variance primarily due to

negative impact of the financial markets

on pension and postretirement assets.

Such cost increases are fully recoverable

unfavorable variance primarily due to

negative impact of the financial markets

on pension and postretirement assets.

Such cost increases are fully recoverable

Transmission

- growth in both the quarter and YTD

Ø Earning on

higher rate base

Quarter

Ended

Nine

Months Ended

September

30, 2009

September

30, 2009

Favorable/(Unfavorable)

($M)

vs.

2008

vs.

2008

Operating

Revenues

Decoupling

adjustment

1.5

$

3.9

$

Regulatory

true up items

1.4

4.1

Distribution

rates & pricing

(1.4)

1.5

Sales

volume

(2.4)

(5.3)

Other

0.1

0.1

Operation

and Maintenance (O&M) Expense

Customer

service - allocated

(0.5)

1.6

Uncollectibles

1.2

3.3

Outside

services and other expense

1.0

3.3

Pension

& postretirement

(1.5)

(5.4)

Other

Distribution,

CTA & Other Net Income variance

(0.8)

$

5.9

$

Distribution,

CTA & Other Net Income

Earnings

Details Compared to the Same Periods in 2008

Distribution,

CTA & Other - favorable Net Income YTD

27

EEI

Nov. 2009

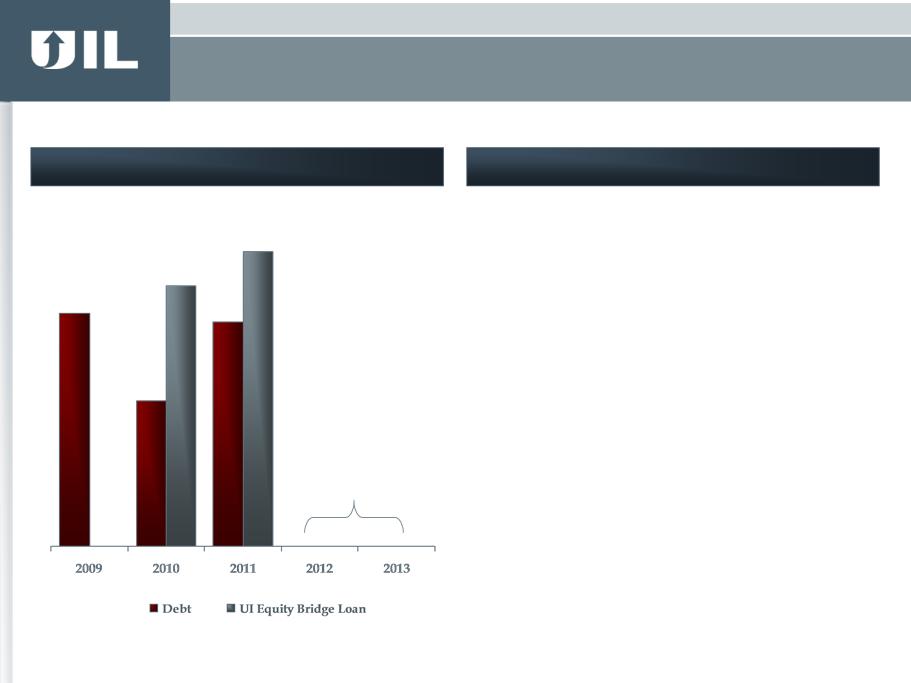

Liquidity

outlook

Ø UIL &

UI have a $175 million joint credit

facility due December 22, 2011 - $50 million

of limit available for UIL

facility due December 22, 2011 - $50 million

of limit available for UIL

» No

short-term borrowings outstanding under

this facility as of September 30, 2009

this facility as of September 30, 2009

Ø UIL also

has an uncommitted money market

loan facility

loan facility

» No

outstanding balance as of September 30,

2009

2009

Ø UI must pay

off $121.5 equity bridge loan to

fund its portion of the contribution to

GenConn on the commercial operation date

for each facility, Devon June 2010,

Middletown June 2011

fund its portion of the contribution to

GenConn on the commercial operation date

for each facility, Devon June 2010,

Middletown June 2011

» Borrowings

under this facility as of

September 30, 2009 were $88.3 million

September 30, 2009 were $88.3 million

Ø

No plans to

issue equity before the end of 2010

Debt

maturity schedule as of 9/30/09 ($M)

$49.2

$51.0

$31.8

$57.0

$64.5

NONE

Debt

Maturity and Liquidity

28

EEI

Nov. 2009

2009

expectations are not intended to be additive.

Guidance

Notes

Ø Raised low

end of the 2009 earnings guidance from $1.83 per share

Ø Includes

dilution from equity issuance

Ø Distribution,

CTA & Other positioned for reasonable opportunity to achieve weighted

average

allowed return on equity of 8.84%

allowed return on equity of 8.84%

Ø Transmission

expected to earn an overall allowed weighted average return on equity

of

approximately 12.5%

approximately 12.5%

Ø

2008

Nine

Months Ended

September

30, 2009

2009

EPS Guidance

The United

Illuminating Company

$2.03

$1.81

$1.97 -

$2.07

Distribution,

CTA & Other

1.09

1.11

1.05 -

1.15

Transmission

0.94

0.70

0.90 -

0.95

Corporate

(0.10)

(0.07)

(0.12) -

(0.07)

Total

Continuing Operations

$1.93

$1.74

$1.87

- $1.97

(0.01)

Total

UIL

$1.92

$1.74

YTD 3Q

Earnings & 2009 EPS Guidance as of October 30, 2009

29

EEI

Nov. 2009

2010

Earnings Drivers

Ø Earnings

from GenConn - Devon

» On schedule

to be in-service June 1, 2010

Ø Continual

management of O&M expenses

Ø Executing

on capital expenditure plan

» Rate base

growth

Ø Non-rate

base earnings opportunities

» Conservation

& load management

» ISO-NE

demand response

» Distributed

generation incentives

Ø Earning

distribution allowed ROE

30

EEI

Nov. 2009

Progressive

pure-play

electric utility

electric utility

Transmission

focus

(FERC

Regulated)

Regulation

Ø Virtually

100% regulated

Ø Long

history of National 1st quartile reliability

performance

Ø 20 year

leader in Conservation & Load Management programs

Ø Smart Grid

- ahead of the curve

Ø Estimated

38% of 2009 total rate base

Ø 2009

composite return on equity of approximately 12.5% and capital structure of 50%

equity

Ø Identified

future investment opportunities

Ø Recent

distribution rate case includes favorable items such as revenue decoupling

mechanism,

pension

tracker and cost of debt tracking mechanism

Ø Expected

enhanced stability and predictability of earnings

Ø 2009

blended transmission & distribution allowed return on equity of

approximately 10.2%

UIL:

progressive pure-play electric utility with significant growth opportunities and

an attractive dividend yield

Conservative

financial

strategy

strategy

Ø Commitment

to investment grade credit profile

Ø Disciplined

capital investment program

Ø Consistent

history of dividend payments

High

probability

growth

growth

Ø $1.7

billion of projected regulated capital and equity investment for

2009-2018

Ø Base plan

provides significant growth 90+%

probability of occurrence

Ø GenConn:

cost-of-service electric generation development underway

Ø Proven

ability to execute on capital projects, e.g. Middletown-to-Norwalk transmission

line

Investment

Highlights

31

EEI

Nov. 2009

Q&A

32

EEI

Nov. 2009

Full

revenue

decoupling

decoupling

Ø Annual

true-up

» If revenues

< approved, rates will be adjusted to collect additional

revenues

» If revenues

> approved, excess will be returned to customers

Ø Decoupling

established for two-year pilot period

Other

Ø 50/50

Debt-to-Equity Capitalization with 8.75% ROE

Ø Approved

90% of proposed distribution capital program expenditures

Ø Transferred

approximately $7 million of uncollectibles and other expense to

Generation Services Charge

Generation Services Charge

Pension

Ø Established

a regulatory asset for a portion of 2009 increased pension and

postretirement expense

postretirement expense

» Future

recovery of $10.2 million

Ø Pension

tracker

» 2010

expense true-up based on year-end valuation, which takes into account

changes, if any, in asset values and the discount rate

changes, if any, in asset values and the discount rate

Cost

of debt tracking

mechanism

mechanism

Ø Annual

true-up

» If embedded

debt cost after issuances, differs from allowed embedded cost of debt

of

6.42% for 2009, 6.76% for 2010

6.42% for 2009, 6.76% for 2010

4 True up if

min. 25 basis points and results in +/- $1.5 million interest expense or

greater. $1.5

million deadband à true up covers amounts beyond +/- $1.5 million.

million deadband à true up covers amounts beyond +/- $1.5 million.

Overview of

2008 Distribution Rate Decision