Attached files

| file | filename |

|---|---|

| 8-K - COURTESY COPY OF CURRENT REPORT ON FORM 8-K - PEPCO HOLDINGS LLC | oct30-phi8k.pdf |

| EX-99 - COURTESY COPY OF EEI PRESENTATION - PEPCO HOLDINGS LLC | ex-99.pdf |

| 8-K - CURRENT REPORT ON FORM 8-K - PEPCO HOLDINGS LLC | oct30-phi8k.htm |

MANAGING

TODAY’S

CHALLENGES

Positioning

for Tomorrow’s Growth

44th EEI Financial

Conference • Hollywood,

Florida • November

1 - 4, 2009

Some of

the statements contained in today’s presentations are forward-looking statements

within the meaning of Section 21E of

the Securities Exchange Act of 1934 and are subject to the safe harbor created by the Private Securities Litigation Reform Act of

1995. These statements include all financial projections and any declarations regarding management’s intents, beliefs or current

expectations. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms or other comparable

terminology. Any forward-looking statements are not guarantees of future performance, and actual results could differ materially

from those indicated by the forward-looking statements. Forward-looking statements involve estimates, assumptions, known and

unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-

looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no

obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or

otherwise. A number of factors could cause actual results or outcomes to differ materially from those indicated by the forward-

looking statements contained in this presentation. These factors include, but are not limited to, prevailing governmental policies

and regulatory actions affecting the energy industry, including with respect to allowed rates of return, industry and rate structure,

acquisition and disposal of assets and facilities, operation and construction of plant facilities, recovery of purchased power

expenses, and present or prospective wholesale and retail competition; changes in and compliance with environmental and safety

laws and policies; weather conditions; population growth rates and demographic patterns; competition for retail and wholesale

customers; general economic conditions, including potential negative impacts resulting from an economic downturn; growth in

demand, sales and capacity to fulfill demand; changes in tax rates or policies or in rates of inflation; rules and changes in

accounting standards or practices; changes in project costs; unanticipated changes in operating expenses and capital

expenditures; the ability to obtain funding in the capital markets on favorable terms; restrictions imposed by Federal and/or state

regulatory commissions, PJM and other regional transmission organizations (NY ISO, ISO New England), the North American

Electric Reliability Council and other applicable electric reliability organizations; legal and administrative proceedings (whether civil

or criminal) and settlements that affect our business and profitability; pace of entry into new markets; volatility in market demand

and prices for energy, capacity and fuel; interest rate fluctuations and credit market concerns; and effects of geopolitical events,

including the threat of domestic terrorism. Readers are referred to the most recent reports filed with the Securities and Exchange

Commission.

the Securities Exchange Act of 1934 and are subject to the safe harbor created by the Private Securities Litigation Reform Act of

1995. These statements include all financial projections and any declarations regarding management’s intents, beliefs or current

expectations. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,”

“plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of such terms or other comparable

terminology. Any forward-looking statements are not guarantees of future performance, and actual results could differ materially

from those indicated by the forward-looking statements. Forward-looking statements involve estimates, assumptions, known and

unknown risks, uncertainties and other factors that may cause actual results, levels of activity, performance or achievements to be

materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-

looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no

obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or

otherwise. A number of factors could cause actual results or outcomes to differ materially from those indicated by the forward-

looking statements contained in this presentation. These factors include, but are not limited to, prevailing governmental policies

and regulatory actions affecting the energy industry, including with respect to allowed rates of return, industry and rate structure,

acquisition and disposal of assets and facilities, operation and construction of plant facilities, recovery of purchased power

expenses, and present or prospective wholesale and retail competition; changes in and compliance with environmental and safety

laws and policies; weather conditions; population growth rates and demographic patterns; competition for retail and wholesale

customers; general economic conditions, including potential negative impacts resulting from an economic downturn; growth in

demand, sales and capacity to fulfill demand; changes in tax rates or policies or in rates of inflation; rules and changes in

accounting standards or practices; changes in project costs; unanticipated changes in operating expenses and capital

expenditures; the ability to obtain funding in the capital markets on favorable terms; restrictions imposed by Federal and/or state

regulatory commissions, PJM and other regional transmission organizations (NY ISO, ISO New England), the North American

Electric Reliability Council and other applicable electric reliability organizations; legal and administrative proceedings (whether civil

or criminal) and settlements that affect our business and profitability; pace of entry into new markets; volatility in market demand

and prices for energy, capacity and fuel; interest rate fluctuations and credit market concerns; and effects of geopolitical events,

including the threat of domestic terrorism. Readers are referred to the most recent reports filed with the Securities and Exchange

Commission.

Safe

Harbor Statement

1

2009

- Progress on Many Fronts

We

are confident in our plan and are optimistic about longer term

growth

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

|

Long-Term

Strategic Objective

|

Status

|

|

Drive earnings

growth

|

· Four rate

cases filed requesting a total revenue increase of

$146 million · Significant

T&D investments planned (65% growth in rate base

2008 - 2013) |

|

Maintain

dividend and grow longer-term

|

· Commitment to

the dividend

|

|

Reduce overall

business risk and strengthen

investment grade ratings |

· Collateral

management through credit intermediation agreement

· Strategic

analysis of Retail Energy Supply

|

|

Invest in core

T&D business

|

· Two

significant projects - MAPP and Blueprint underway

· 2009 capital

spending tracking to plan

|

|

Implement

Blueprint initiatives

|

· Vendors

selected

· AMI deployment

in DE to begin by year-end 2009

· Legislation

adopted in DC approving AMI deployment

· DOE award of

$168 million for Smart Grid projects

|

|

Achieve

supportive regulatory outcomes

|

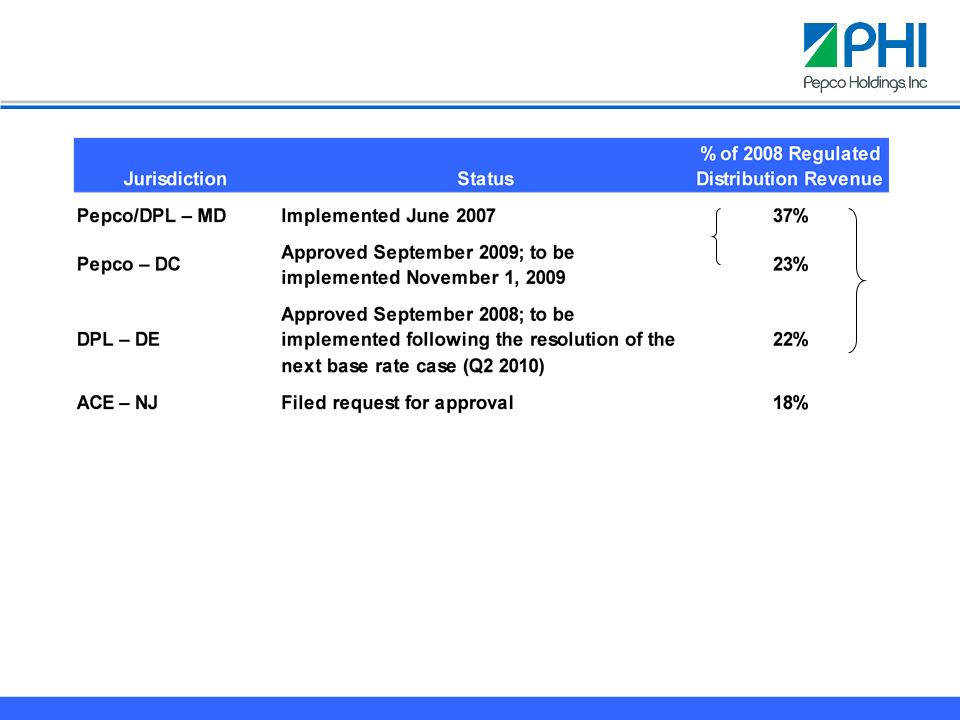

· Decoupling

adopted in DC; 60% of regulated distribution revenue

decoupled · Pursuit of

surcharges to minimize regulatory lag

|

|

Prudently

manage complementary

competitive energy businesses |

· Cumberland

plant online - June 1, 2009; Delta plant on schedule

· Expanding

energy services business

|

2

Transmission

& Distribution

Competitive

Energy / Other

2009

- 2013

Forecast

Business

Mix*

70

- 75%

25

- 30%

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

• Growing

regulated

infrastructure

infrastructure

• Leading

edge of

industry transformation

industry transformation

• Complementary

competitive energy

businesses

competitive energy

businesses

• Disciplined

growth

strategy

strategy

…

together offer an

Attractive

total return

Investing

in PHI

*

Percentages based on projected operating income.

PHI

Investments

3

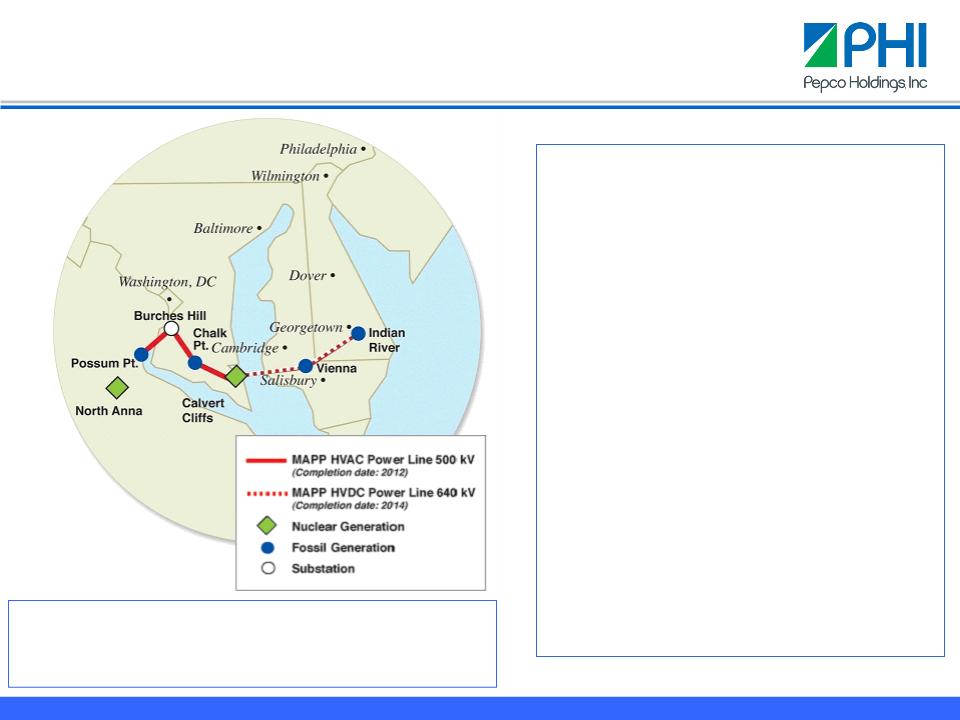

Recent

Events

· Environmental

permitting for Burches

Hill to Chalk Point segment expected

to be complete by early Q1 - 2010

Hill to Chalk Point segment expected

to be complete by early Q1 - 2010

· Cost estimates for

various routes

through Dorchester County to be

finalized Q4 - 2009

through Dorchester County to be

finalized Q4 - 2009

· PSC hearings on need

and

determination for CPCN for MAPP

tentatively scheduled for March 2010;

existing CPCN to be used for Burches

Hill to Chalk Point segment

determination for CPCN for MAPP

tentatively scheduled for March 2010;

existing CPCN to be used for Burches

Hill to Chalk Point segment

· Project is in due

diligence phase of

DOE loan guarantee program

DOE loan guarantee program

• Cost

of project - $1.2 billion

• Construction

activities to begin Q4 2009

• In-service

date - 2014

• Total

length - 150 miles (~ 30 miles on new right-of-way)

Mid-Atlantic

Power Pathway (MAPP)

4

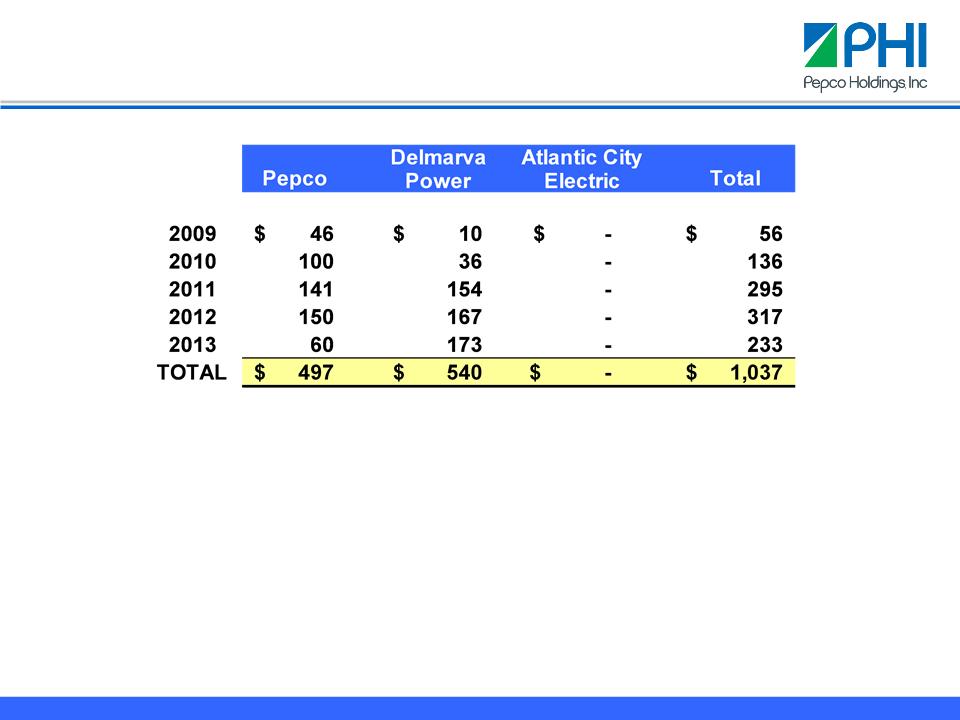

(Dollars

in Millions)

• Current total

estimated cost of project (2008 - 2015) is $1.2 billion

• Application filed

with the Department of Energy (DOE) seeking loans or loan

guarantees ($684 million)

guarantees ($684 million)

– Calvert Cliffs to

Indian River segment; construction expected to begin 2011

– Application passed

the first two levels of DOE review

– Currently in due

diligence phase; decision expected before construction begins

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

MAPP -

Construction Cost and Timing Estimates

5

· Key

vendors selected

· Delaware

deployment

– Completed field

acceptance testing of the AMI

equipment and systems in Q3 - 2009

equipment and systems in Q3 - 2009

– Meter deployment to

begin Q4 - 2009

– Dynamic Pricing

Working Group started work

· District

of Columbia approval of AMI

– Legislation adopted

in June approving AMI

deployment, subject to PSC agreeing to the

sufficiency of federal grants

deployment, subject to PSC agreeing to the

sufficiency of federal grants

– Legislation provides

for cost recovery, and a return

on costs, by the creation of a regulatory asset

on costs, by the creation of a regulatory asset

· Full

deployment expected by 2014, contingent

upon regulatory approvals

upon regulatory approvals

Combines

Smart Grid technology with energy

efficiency programs to help customers control

their energy use and cost, while providing

distribution rate base growth for the Company

efficiency programs to help customers control

their energy use and cost, while providing

distribution rate base growth for the Company

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Blueprint

for the Future

6

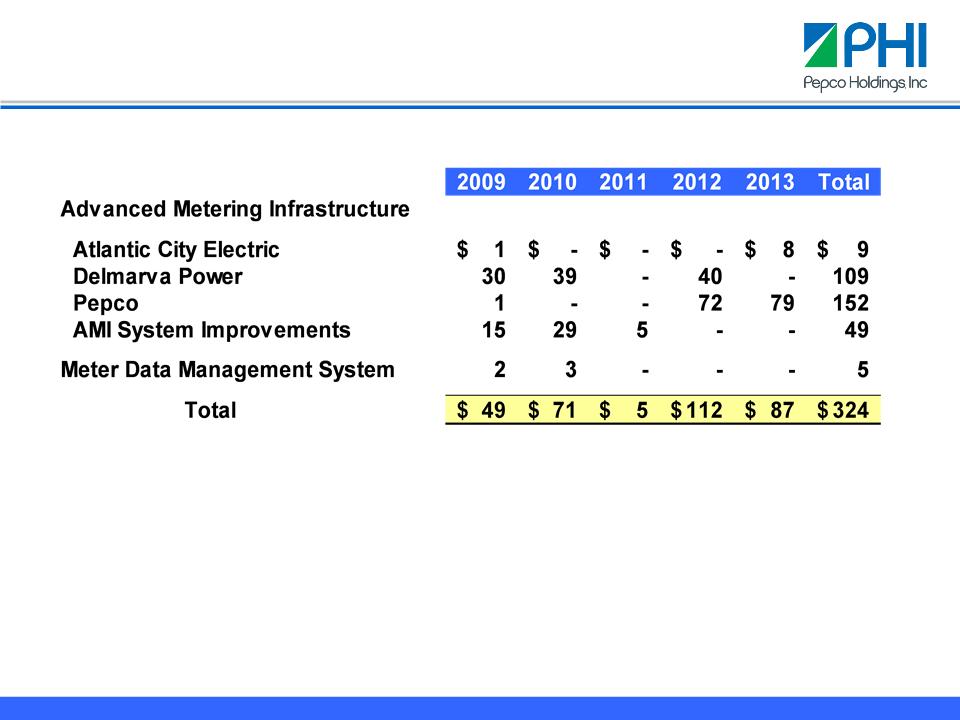

Blueprint for the Future -

Construction Cost and Timing Estimates

(Dollars

in Millions)

• Current

total estimated cost of project (2008 - 2014) is $422 million

• Department

of Energy awarded $168 million in federal stimulus funds for

Smart Grid projects in the District of Columbia, Maryland and New Jersey

Smart Grid projects in the District of Columbia, Maryland and New Jersey

• Grants

will be finalized through negotiations with DOE

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Note: Construction

cost and timing estimates do not reflect the impact of federal stimulus

funds.

7

Advantages

of decoupling:

• Fosters

energy conservation as it aligns the interests of customers and

utilities

• Eliminates

revenue fluctuations due to weather and changes in customer usage

patterns

• Provides

for more predictable utility distribution revenues

• Provides

for more reliable fixed-cost recovery

82%

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

60%

Decoupling

Status

8

|

|

Authorized

Return

on Equity

|

2008

Actual

|

Latest

Available

|

|

Delmarva

Power

|

|

|

|

|

Delaware-Electric

|

10.00%

|

9.3%

|

10.1% (2)

|

|

Delaware-Gas

|

10.25%

|

9.4%

|

9.6% (3)

|

|

Maryland

|

10.00%

|

9.8%

|

9.8% (4)

|

|

Pepco

|

|

|

|

|

Maryland

|

10.00%

|

11.2%

|

9.4% (3)

|

|

District

of Columbia

|

9.50%

(5)

|

7.8%

|

7.8% (4)

|

|

|

|

|

|

|

Atlantic

City Electric

|

|

|

|

|

New

Jersey

|

9.75%

|

9.3%

|

8.3% (2)

|

(1) Unadjusted

ROE represents the Return on Equity prior to any adjustments for regulatory

commission

treatment in a base rate case or any other adjustments to actual financials.

treatment in a base rate case or any other adjustments to actual financials.

(2) March

2009

(3) June

2009

(4) December

2008

(5) Reflects

50 basis point reduction for Bill Stabilization Adjustment.

Distribution

Summary (Unadjusted ROE)1

9

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

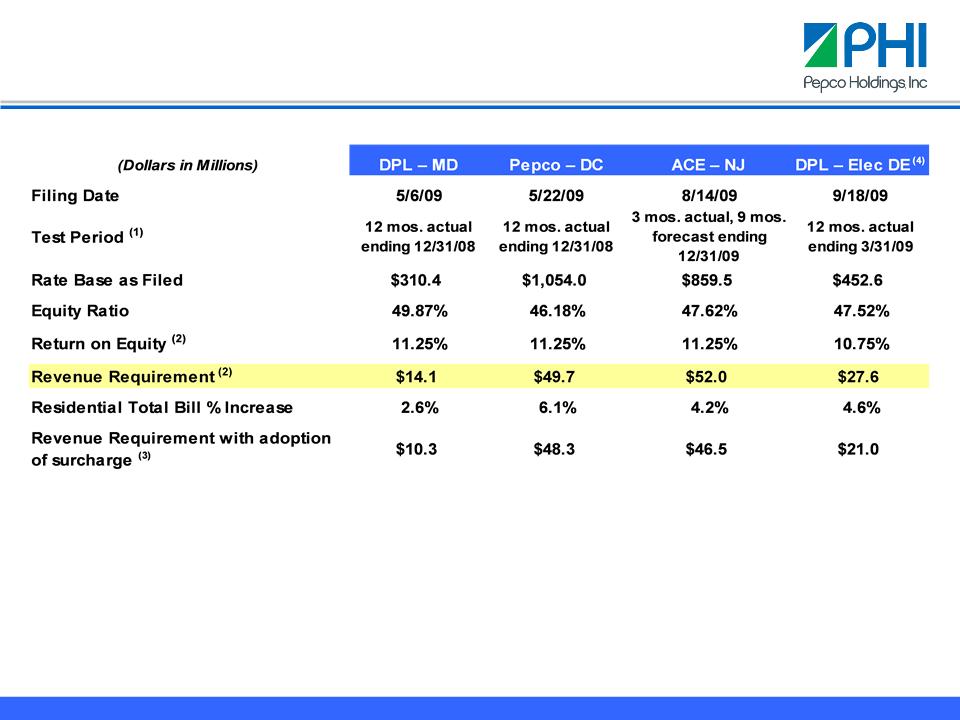

(1) Test

period adjusted for known and measurable changes in all cases; NJ test period to

be updated for actuals during the proceeding.

(2) Return

on equity and revenue requirement as filed by the company assuming

Bill Stabilization Adjustment approval. Return

on equity

recommendation has been updated in the DPL - MD case to 10.75%. The Pepco - DC and ACE - NJ cases may have updated return on

equity recommendations should current market conditions continue.

recommendation has been updated in the DPL - MD case to 10.75%. The Pepco - DC and ACE - NJ cases may have updated return on

equity recommendations should current market conditions continue.

(3) In the

filings, a three year rolling average treatment of pension, OPEB, and bad debt

expense was requested. The

average of these costs

would be recovered through a surcharge (updated annually) with the difference between the average and the actual costs incurred

deferred for future recovery.

would be recovered through a surcharge (updated annually) with the difference between the average and the actual costs incurred

deferred for future recovery.

(4) An

interim rate increase of $2.5 million will be put into effect on November 17,

2009, subject to refund.

Distribution Rate Cases - Summary

10

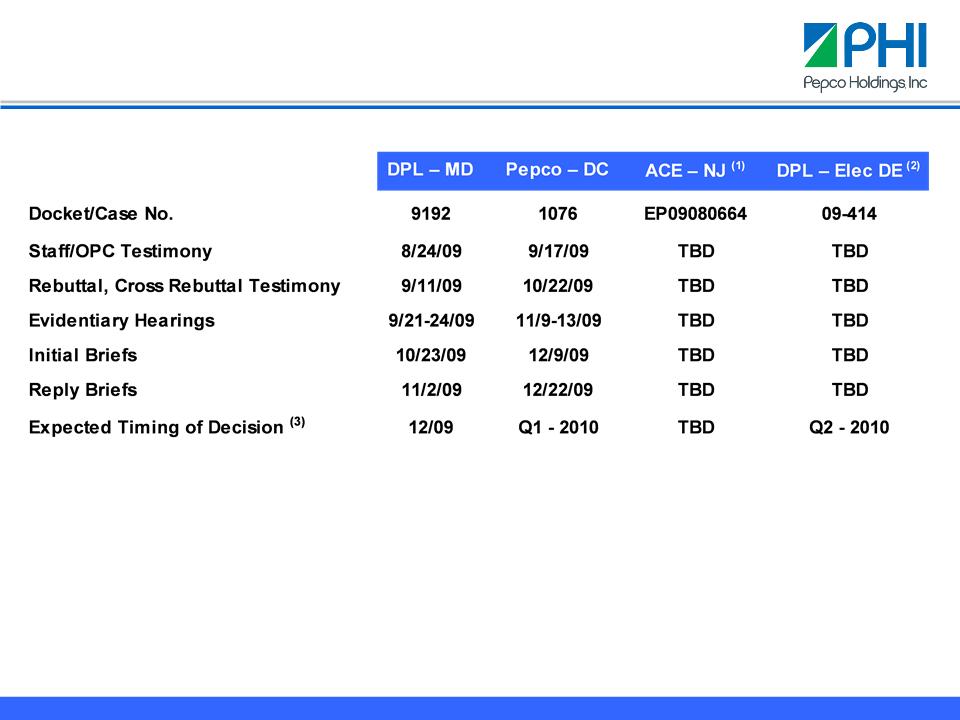

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

(1) Administrative

Law Judge to convene a prehearing conference by year end to set a procedural

schedule.

(2) Opening

order for the case was issued October 6, 2009, with the intervention period

ending on November 6,

2009. Procedural schedule is expected to be set following the end of the intervention period.

2009. Procedural schedule is expected to be set following the end of the intervention period.

(3) Maryland

and Delaware statutes require completion of cases within seven months or rates

can be put into effect

subject to refund; no statute in the District of Columbia, target to complete cases within nine months of filing;

New Jersey has a nine month statute in place with BPU option to grant extensions.

subject to refund; no statute in the District of Columbia, target to complete cases within nine months of filing;

New Jersey has a nine month statute in place with BPU option to grant extensions.

Distribution

Rate Cases - Timeline

11

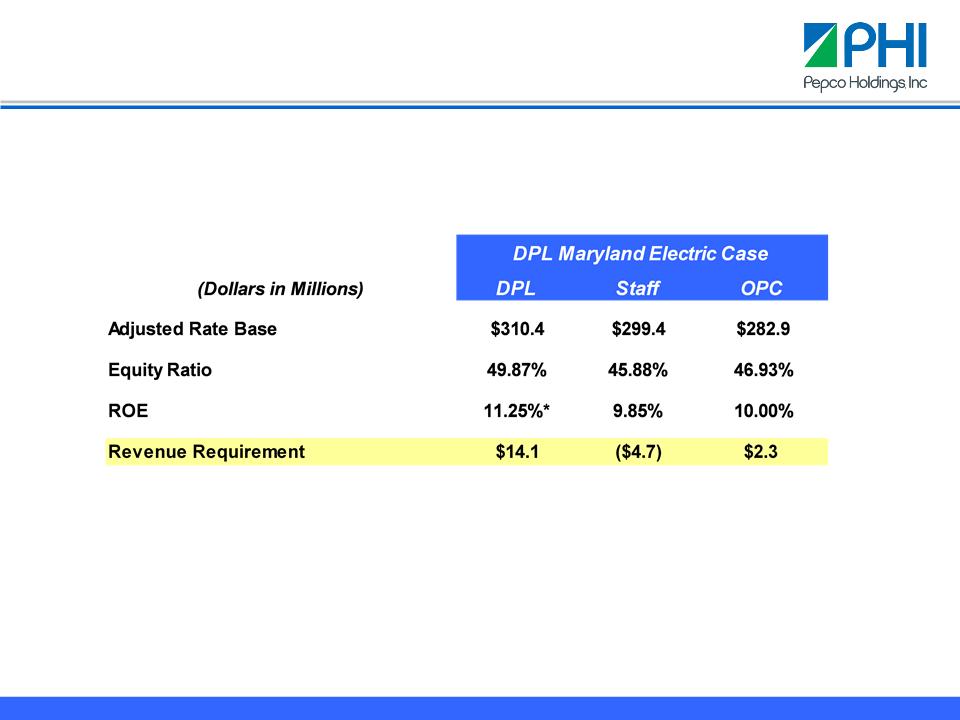

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

*

Return

on equity recommendation has been updated to 10.75%.

Delmarva

Power - Maryland Electric Case

12

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

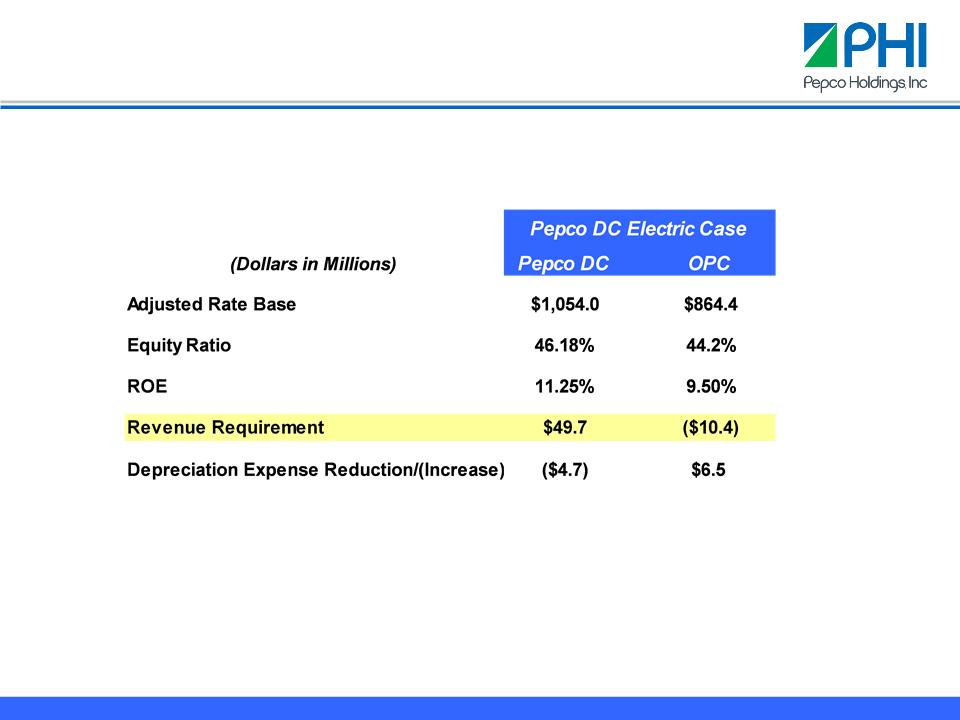

Pepco

- DC Electric Case

13

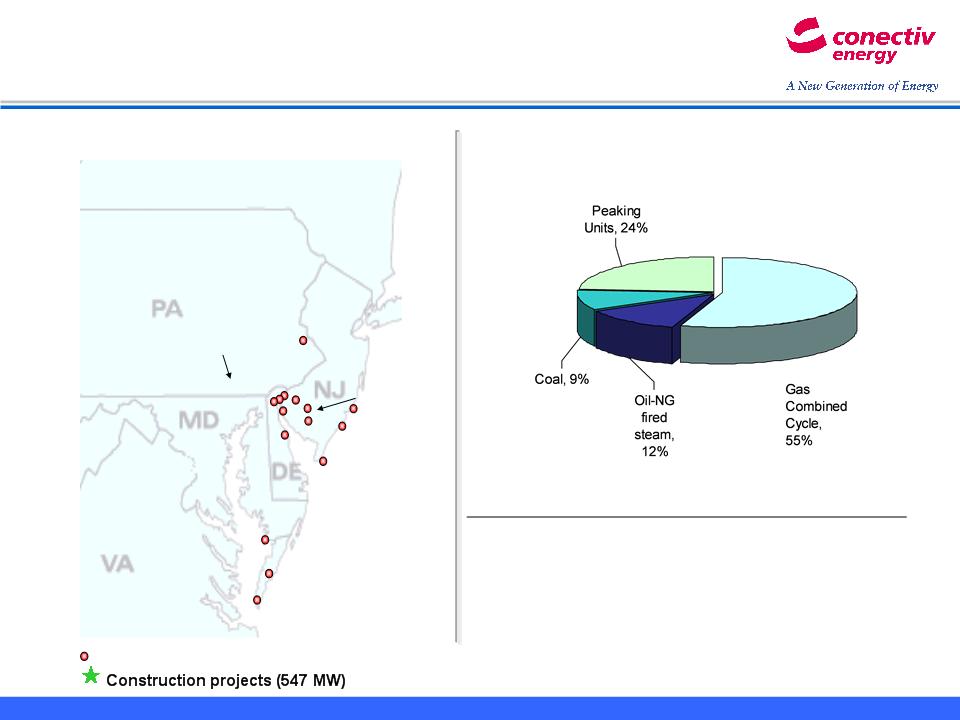

Vineland

Delta

«

«

2009

Capacity (4,350 MW)

(Owned

and contracted)

An

Eastern PJM, mid-merit focused generator

Financials

(as of 9/30/09)

Property, Plant

& Equipment $1,340 M

Construction Work in

Process $ 269 M

Employees 424

Note: Excludes

units under development

Existing

sites

Conectiv

Energy Generating Facilities

14

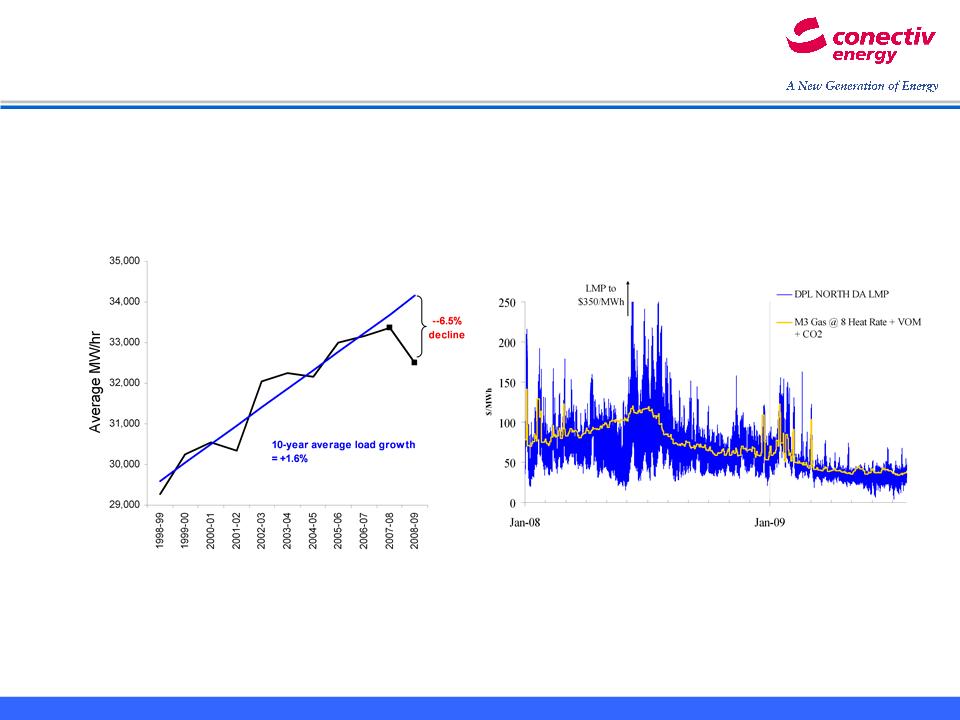

Economic

recession and mild weather have

lowered demand and dampened volatility

lowered demand and dampened volatility

PJM

MAAC Average Load

Gas

CC Hourly Spark Spread

(Jan

2008 - Jul 2009)

Jul-08

Jul-09

Year-to-date

MAAC load is at the same level experienced 6 years ago

15

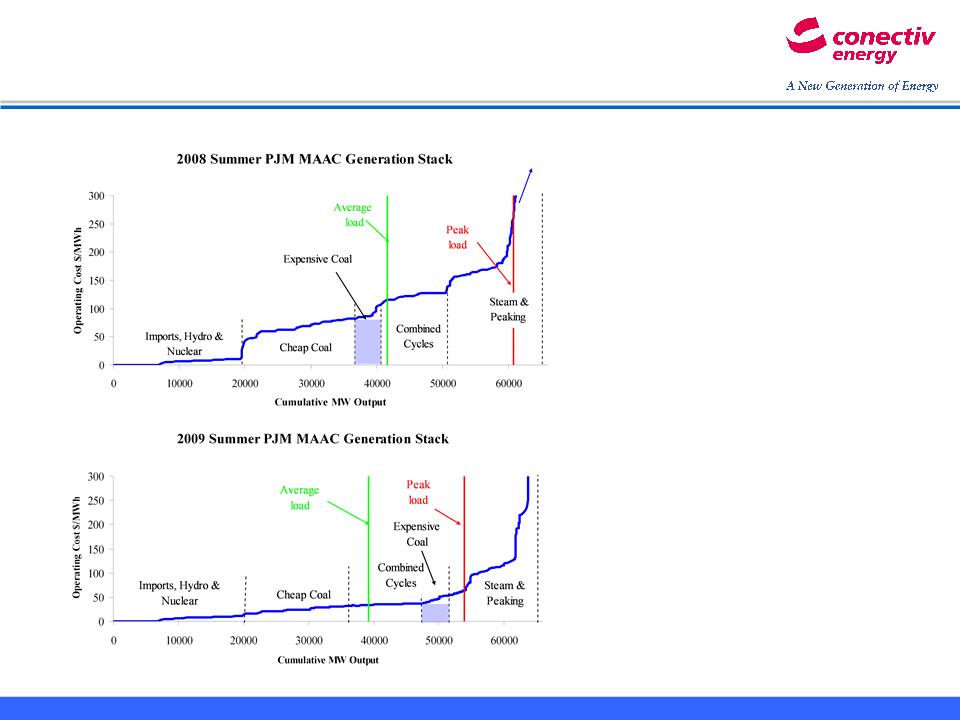

• All fuel prices have

significantly

decreased since last summer -

decreased since last summer -

with

natural gas falling the most -

resulting in much lower power prices

resulting in much lower power prices

• More efficient

combined cycle plants

have displaced “expensive coal”

plants - older sub-critical vintage or

those with high transportation or

environmental costs

have displaced “expensive coal”

plants - older sub-critical vintage or

those with high transportation or

environmental costs

• Mild weather,

efficiency gains, and the

economy have reduced demand -

further reducing the marginal price to

serve the last MW of load

economy have reduced demand -

further reducing the marginal price to

serve the last MW of load

This

has adversely impacted

our 2009 fleet results

our 2009 fleet results

Low

prices and decreased demand have displaced

“expensive coal” generation and compressed margins

“expensive coal” generation and compressed margins

16

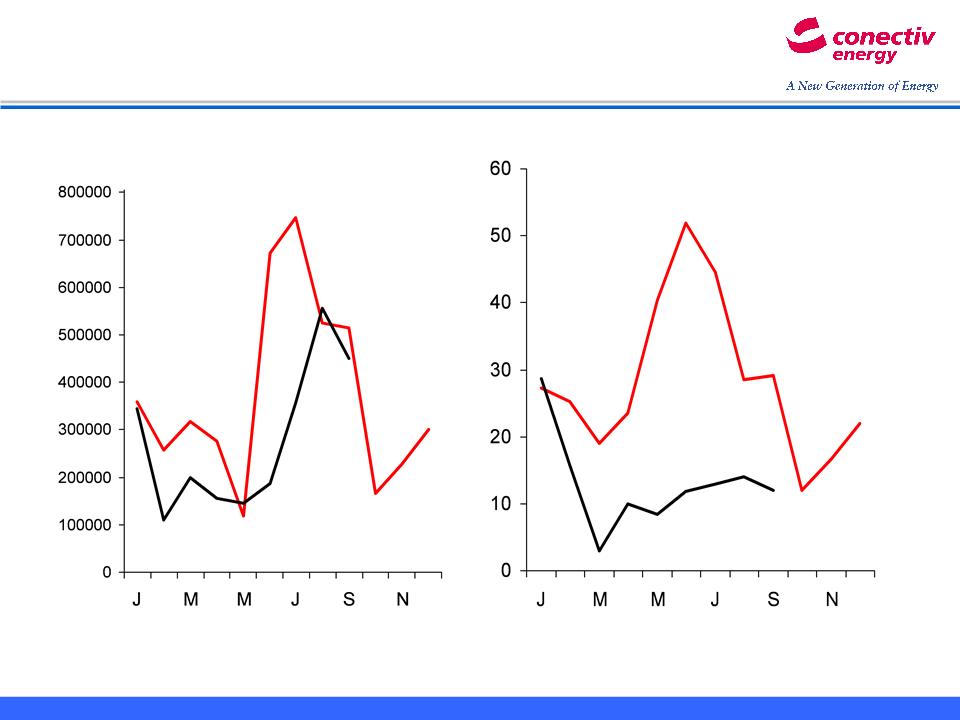

MWHR

$/MWHR

Fleet

Generation Volume

Average

Generation Unit Margin

Lower

fleet runs and narrower spreads have resulted in

generation margins that are significantly less than 2008

generation margins that are significantly less than 2008

YTD

Generation volumes are

23% less than 2008 results

23% less than 2008 results

YTD

Generation unit margins are

58% less than 2008 results

58% less than 2008 results

2008

2008

2009

2009

17

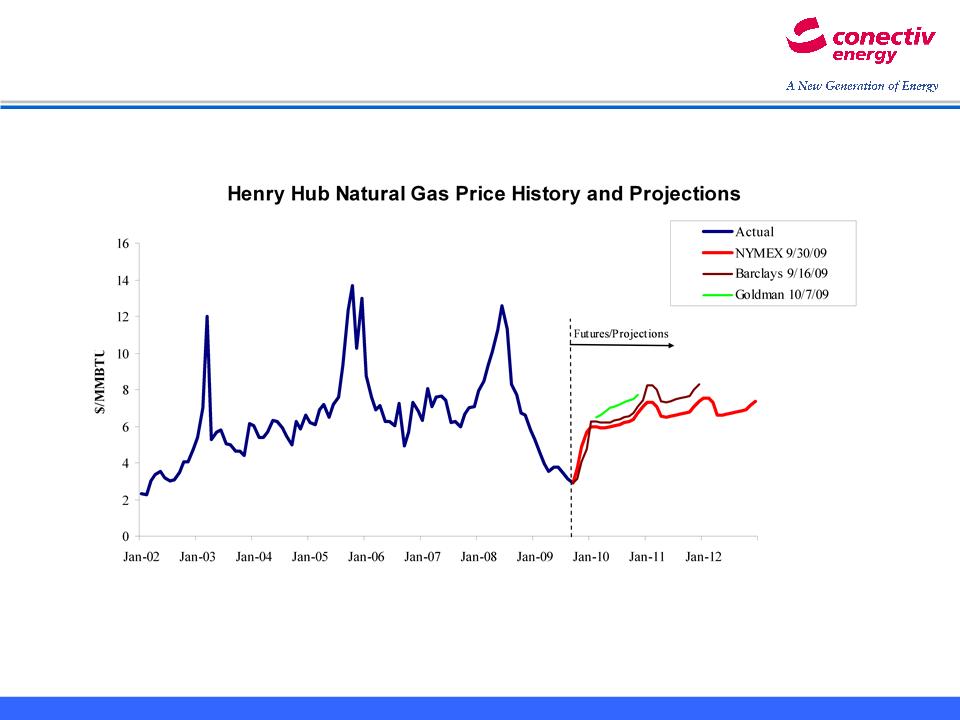

Natural

gas has experienced 2-3 year pricing cycles

On

the positive-side, markets expect

commodity price recovery in 2010-11

commodity price recovery in 2010-11

18

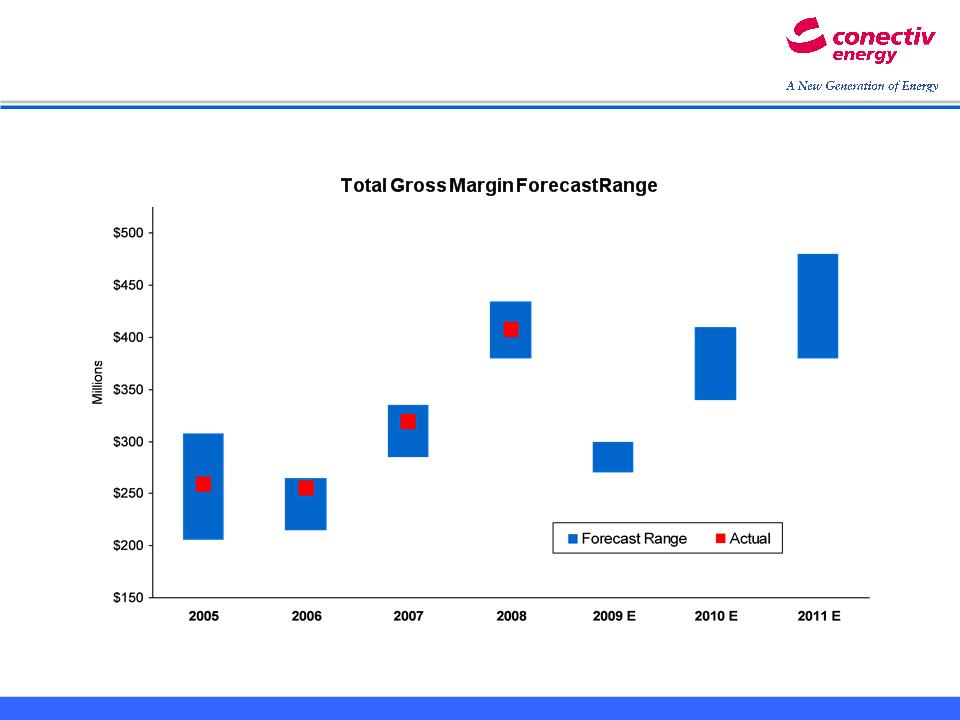

$215

$206

$308

$265

$285

$335

$380

$435

$270

$300

$340

$410

$380

$480

$259

$255

$319

$407

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Conectiv

Energy Gross Margin Forecast -

narrowed 2010 and 2011 ranges

narrowed 2010 and 2011 ranges

19

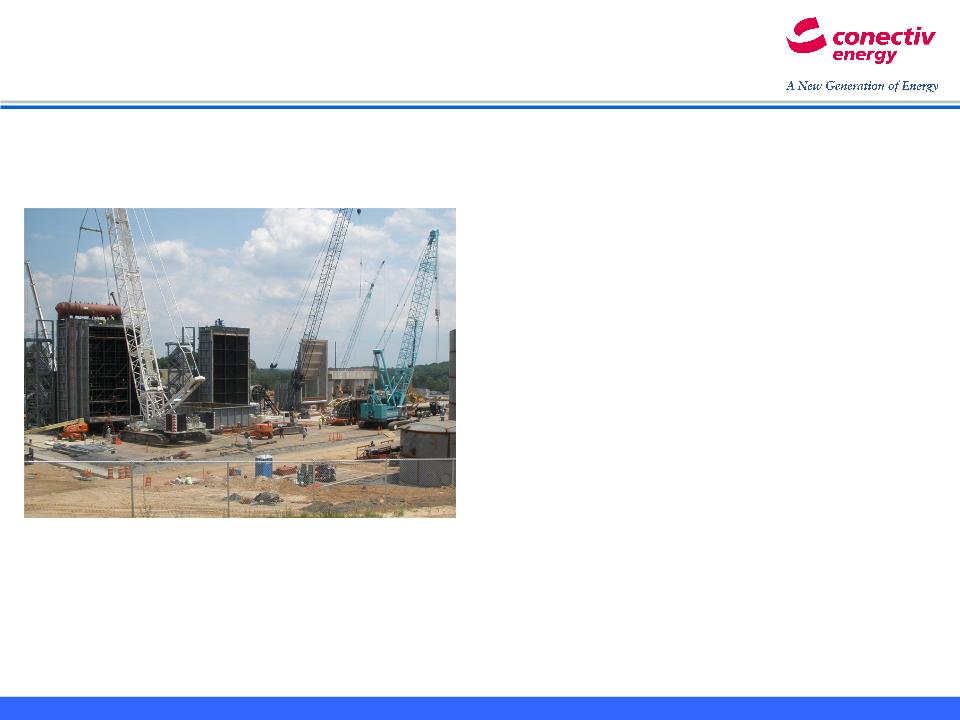

Delta

Project - on time; on budget for June 2011

Commercial Operation

Commercial Operation

• 545

MW dual fuel combined cycle plant

located in Peach Bottom Township, PA

located in Peach Bottom Township, PA

• Project

Cost: $470

million

• Project

Summary:

– Construction

~30% complete

– Similar

design with Siemens technology as

Hay Road and Bethlehem plants

Hay Road and Bethlehem plants

– 6-year

tolling agreement with Constellation

provides stable earnings

provides stable earnings

– Permits

and infrastructure allow for

expansion

expansion

20

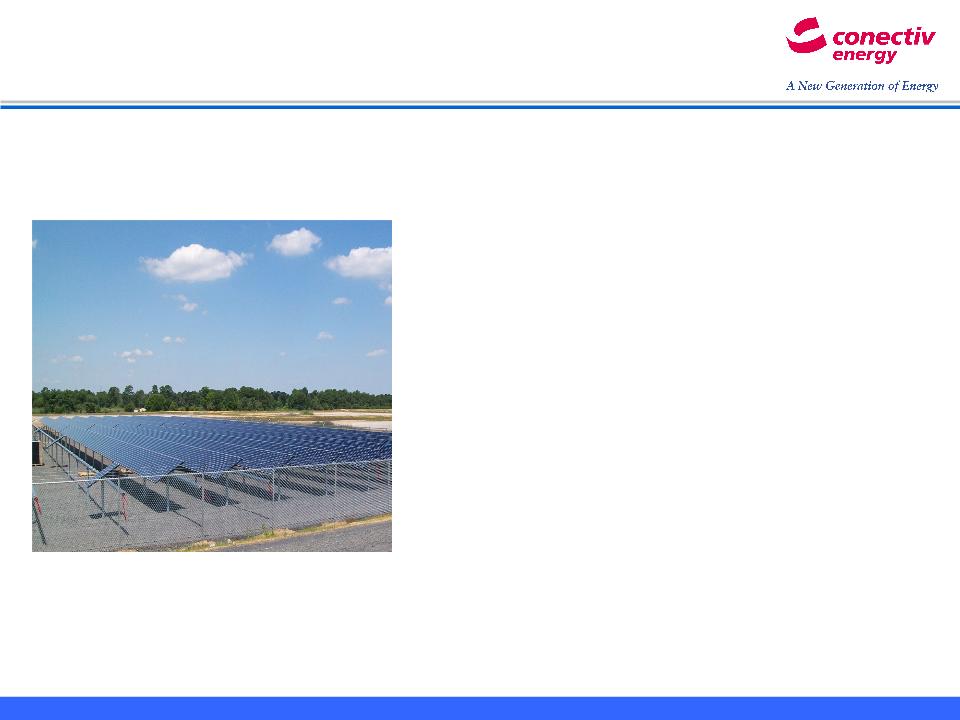

Vineland

Solar Project -

Largest solar facility in New Jersey

Largest solar facility in New Jersey

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

4

MW Solar PV project located in Vineland, NJ

Project

Cost: $20

million

Project

Summary

• Supports

initiative to increase renewable

energy portfolio

energy portfolio

• 25

Year PPA with City of Vineland

• Located

on 28-acre site

Project

Status

• Phase

I: 2.3

MW September

2009

• Phase

II:

1.7 MW December

2009

21

PES

has shifted its strategic focus from

Energy Supply to Energy Services

Energy Supply to Energy Services

PES

earnings contributed

19¢/share

in 2008

Energy

Services 8¢

Services 8¢

Energy

Supply 11¢

Supply 11¢

Overview

• PES provides retail

energy services to large commercial, industrial, and

government customers

government customers

• Energy

Services

– Energy Performance

Contracting (energy efficiency)

– Renewable Energy and

Combined Heat and Power

• Energy

Supply

– Retail Electric and

Natural Gas Supply

• PHI intends to

conclude a strategic analysis

of this business during the 4th quarter 2009

of this business during the 4th quarter 2009

– Power

Generation

• Slated for retirement in

2012

22

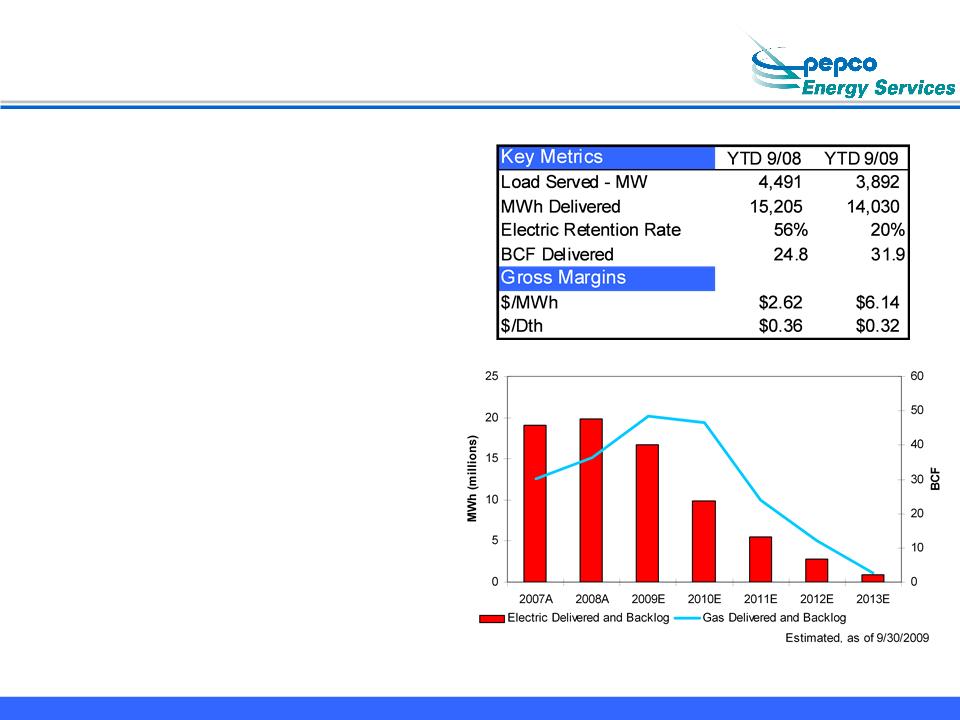

• PES continues to

include a cost of

capital component for all retail supply

proposals to reflect credit market

conditions

capital component for all retail supply

proposals to reflect credit market

conditions

• For all successful

proposals, PES

has been using collateral-free

hedges

has been using collateral-free

hedges

– However, PES’s

retention rate

has been less than 15%

has been less than 15%

• PES expectations of

gross margins

over the long term:

over the long term:

– Historically we have

achieved

approximately $3.00/MWh, although

margins have been in the

$6.00+/MWh range in 2009

approximately $3.00/MWh, although

margins have been in the

$6.00+/MWh range in 2009

– $0.30/Dth range for

natural

gas

gas

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Retail

electric and natural gas business

23

• PES is well

positioned to grow its energy efficiency business

– Energy Performance

Contracting does not require capital expenditures or

contingent capital; it fits well with PHI’s strategic direction

contingent capital; it fits well with PHI’s strategic direction

– PES has installed

over $750 million of energy efficiency projects since

1995

1995

– PES was ranked the

10th largest ESCO

in North America in a recent

2009 survey

2009 survey

• PES is growing its

development capability to pursue federal energy

efficiency contracts

efficiency contracts

– PES is among a

select group of companies qualified to bid on energy

efficiency projects at all federal facilities

efficiency projects at all federal facilities

– PES has grown its

sales and engineering staff by 40% since 12/31/08

Focused

on growing our energy

efficiency business

efficiency business

24

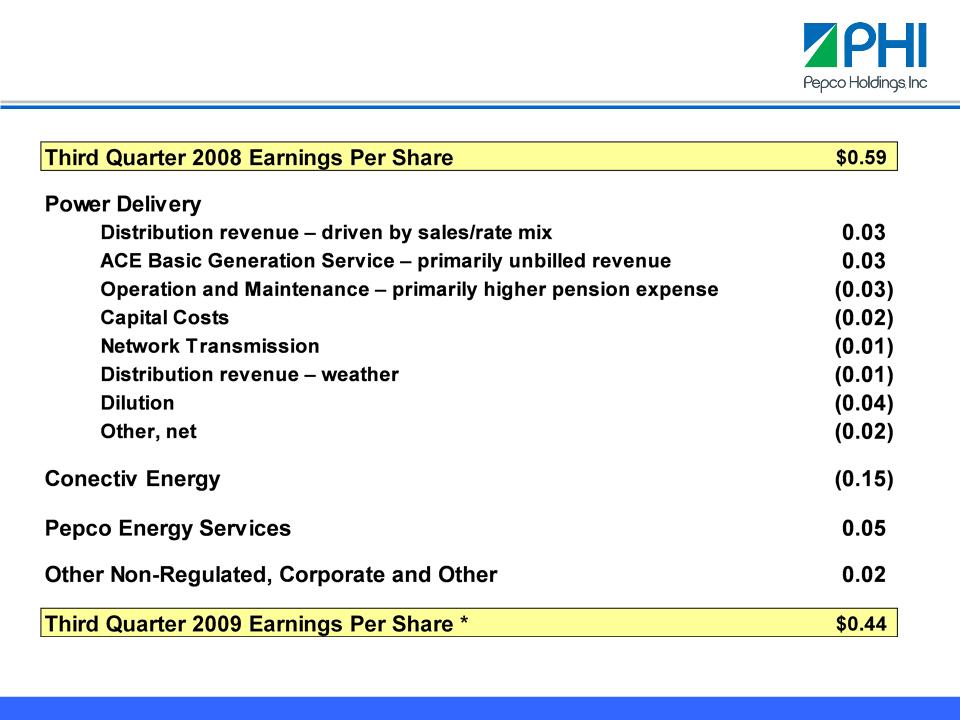

* Excludes

special items. See

appendix for reconciliation to GAAP.

Third

Quarter 2009

Financial Performance - Drivers

Financial Performance - Drivers

25

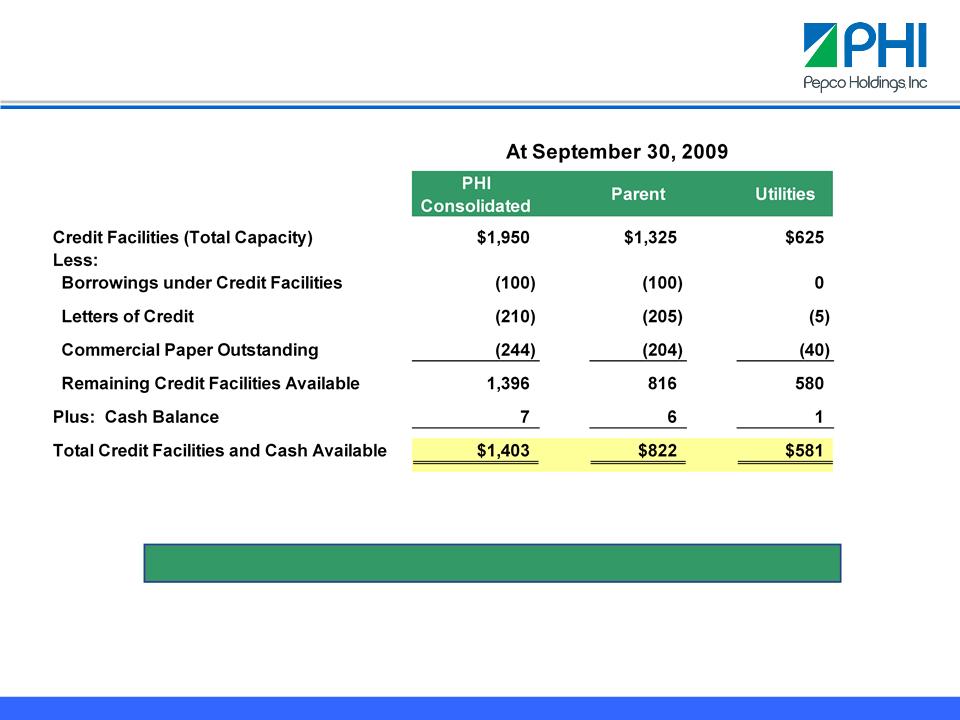

Liquidity

Position

PHI

maintains sufficient liquidity to execute the business plan

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Millions

of Dollars

26

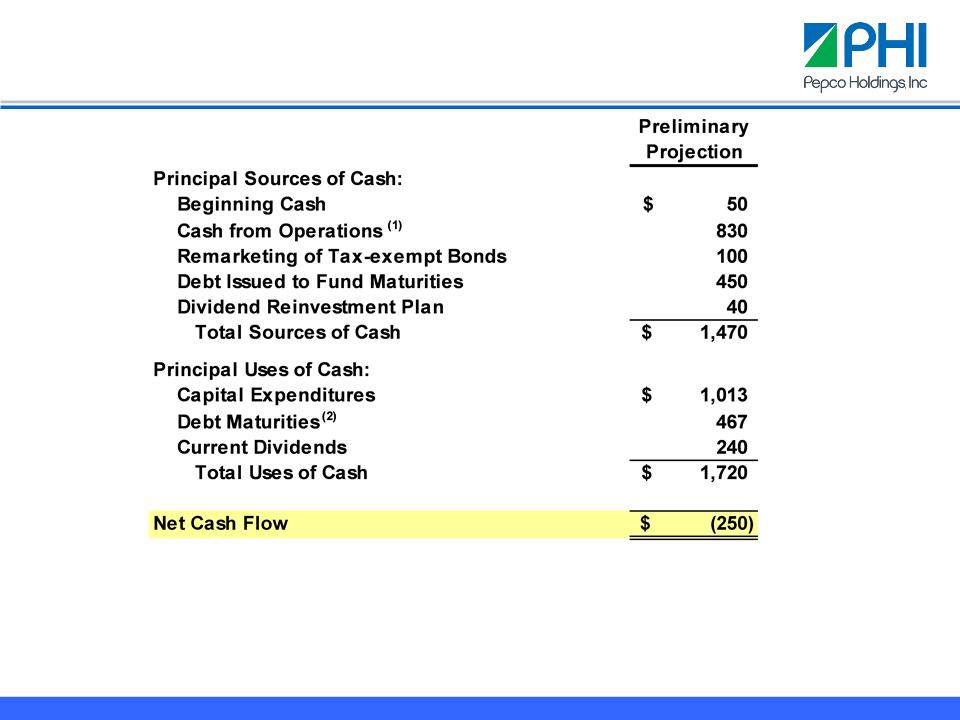

Millions

of Dollars

(1) Midpoint

of projected cash from operations range, includes tax refund from NOL carry back

and

assumes the return of cash collateral per the PES retail energy supply backlog schedule. Excludes

any impact from the recent DOE stimulus fund awards.

assumes the return of cash collateral per the PES retail energy supply backlog schedule. Excludes

any impact from the recent DOE stimulus fund awards.

(2) Reflects

Pepco Holdings and Utility debt maturities; excludes debt maturities related to

the Atlantic

City Electric securitization bonds.

City Electric securitization bonds.

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

2010

Principal Sources & Uses of Cash

27

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

2009

• Renewed $400 mm PHI

364-day credit facility in October; new maturity is

October

15, 2010

• Evaluating

pre-funding a portion of the $450 mm PHI debt due May/June 2010

2010

• Evaluation of

capital expenditures continues

– Delay of $400 mm

announced early 2009

– Evaluating

additional delay of 2010 capital expenditures

• Potential

sources

– Stimulus

funds

– Possible

acceleration of PES collateral return

– Small equity

issuance

– Utility debt

issuances

– Sale of selected

assets

– Capacity to fund

with short-term debt

2010

financing is manageable - more specifics to be provided in Q1 -

2010

Financing

and Funding

28

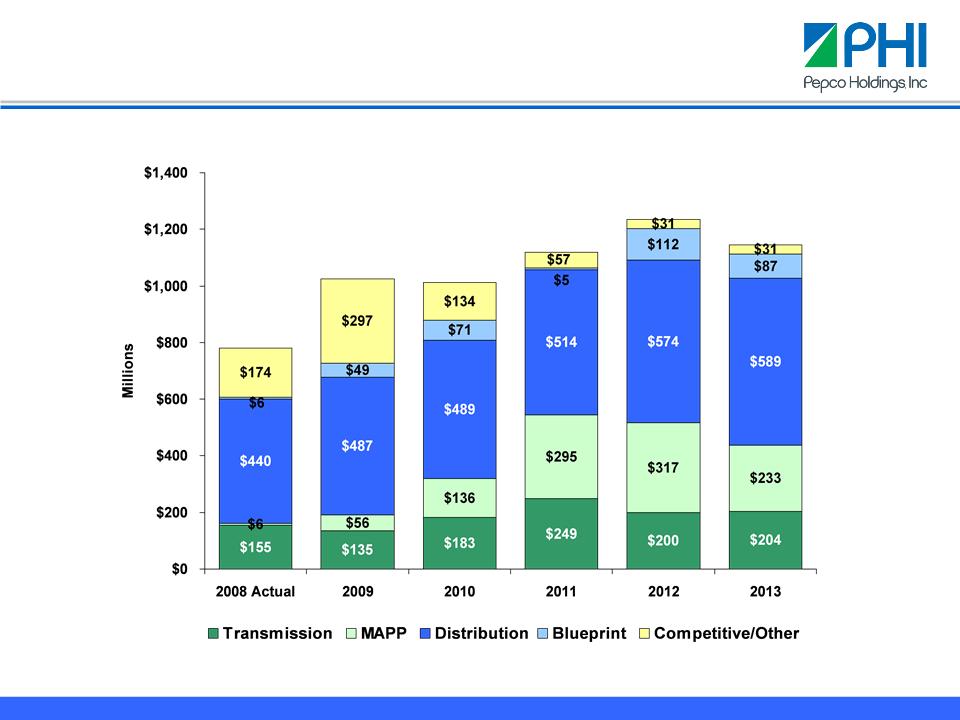

$1,024

$1,013

$1,120

$1,234

$1,144

Construction

Expenditures - Projection

$781

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

29

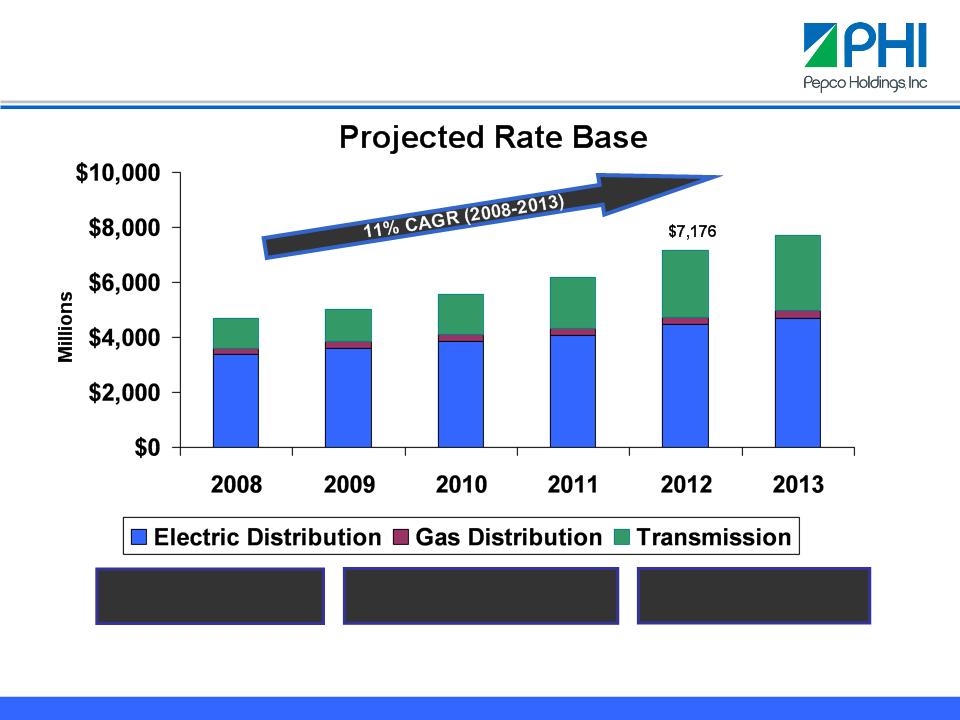

Power

Delivery - A Driver of Growth

Total

Rate Base

Growth - 65%

Growth - 65%

Electric

Distribution Rate

Base Growth - 39%

Base Growth - 39%

Transmission

Rate

Base Growth - 158%

Base Growth - 158%

*

Actual 2008 year end rate base, projected 2009 - 2013 year end rate

bases.

$4,678

$7,712

$5,033

$5,566

$6,192

$3,383

$3,614

$3,854

$4,068

$4,455

$4,708

$231

$233

$243

$250

$259

$263

$1,064

$1,186

$1,469

$1,874

$2,462

$2,741

*

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

30

Cross-Border

Energy Leases - Status

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

• Investment

– Carrying value of

cross-border leases is evaluated each quarter

– Equity investment of

$1.4 billion as of September 30, 2009

• Path

forward

– Concluding the

appeals process with IRS; expect appeals effort to end by year

-end 2009

-end 2009

– Two litigation paths

- pursue in Tax Court or pay the tax and sue for refund in

District Court or Federal Court of Claims; either process could take 18 - 24 mos.

District Court or Federal Court of Claims; either process could take 18 - 24 mos.

• Recent court

decision

– October 21, 2009

U.S. Court of Federal Claims issued a decision in favor of the

taxpayer regarding a lease-in lease-out cross-border lease transaction

taxpayer regarding a lease-in lease-out cross-border lease transaction

– Transaction subject

to the court ruling is similar to PHI’s cross-border energy

lease investments

lease investments

– Currently evaluating

the implications of this decision

31

Potential mitigation

to cash outflow would be the liquidation of the lease portfolio -

PHI could generate sufficient cash proceeds to cover the $695 million of taxes and

interest due within a 6 - 12 month period to satisfy the tax obligation

PHI could generate sufficient cash proceeds to cover the $695 million of taxes and

interest due within a 6 - 12 month period to satisfy the tax obligation

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

Cross-Border

Energy Leases - Alternatives

• Cash payment to the

IRS for a disallowance of tax

benefits would only be required if one of the following

occurs:

benefits would only be required if one of the following

occurs:

– Future settlement

with the IRS

– Litigation is

pursued in District Court or Federal Court of Claims, in which case

a payment would be made currently to the IRS for the 2001 and 2002 tax years

under audit (approximately $72 million plus interest); a suit for refund of the

payment is sought through the litigation process

a payment would be made currently to the IRS for the 2001 and 2002 tax years

under audit (approximately $72 million plus interest); a suit for refund of the

payment is sought through the litigation process

– Litigation is

pursued in Tax Court, and PHI receives an unfavorable decision; in

the worst case of a total disallowance of tax benefits, PHI would be obligated to

pay approximately $595 million of additional taxes and $100 million of interest

at the time a decision is rendered based on September 30, 2009 balances

the worst case of a total disallowance of tax benefits, PHI would be obligated to

pay approximately $595 million of additional taxes and $100 million of interest

at the time a decision is rendered based on September 30, 2009 balances

32

Earnings

Guidance

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

• PHI will begin

providing annual earnings per share

guidance

guidance

• The announcement of

guidance for 2010 is targeted

for the March Analyst Conference

for the March Analyst Conference

33

POM

Investment Case

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

• Long-term earnings

growth

• Commitment to

dividend

• Investment grade

credit quality

• Improved liquidity

position

• Focus on lowering

business risk

34

Appendix

35

Note: See Safe

Harbor Statement at the beginning of today’s presentation.

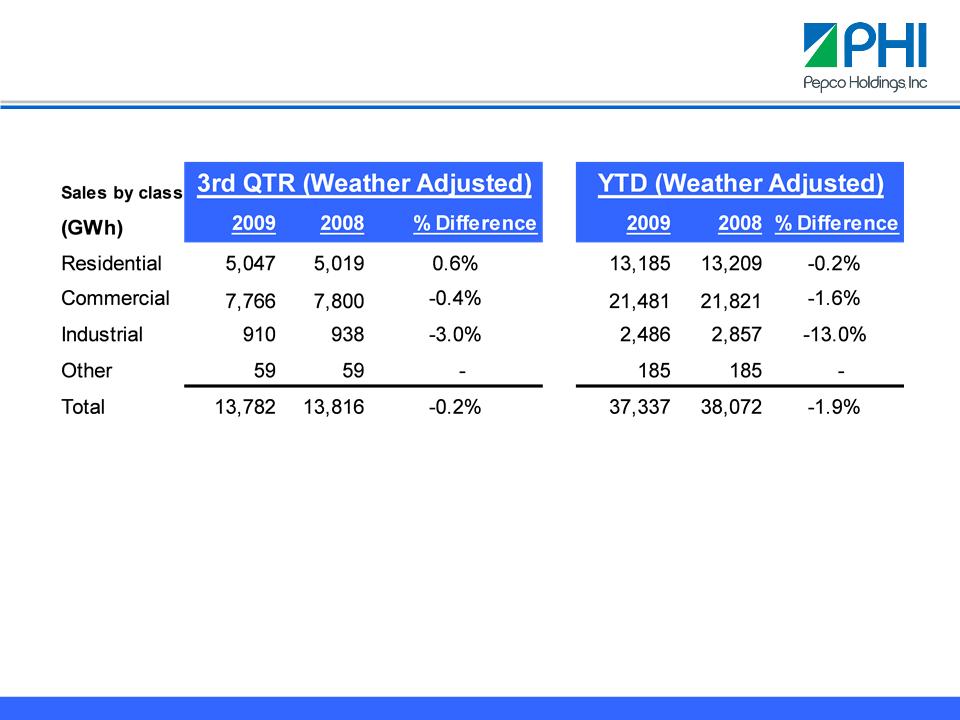

Regulated

T&D Electric Sales

· Although

industrial sales have decreased year-to-date versus last year, the earnings

impact is less

due to smaller margins earned in this class.

due to smaller margins earned in this class.

· 60%

of regulated distribution sales will be decoupled at 11/1/09. By

mid-year 2010, 80% are expected

to be decoupled.

to be decoupled.

· Estimated

2010 weather normalized billed sales are expected to be flat relative to

2009.

· Year-to-date

2009 customer growth is .5% compared to 2008; estimated 2010 customer growth

is

expected to be .6% relative to 2009.

expected to be .6% relative to 2009.

36

* Excludes

special items. See

slide 39 in appendix for reconciliation to GAAP.

Year-to-Date

2009

Financial Performance - Drivers

Financial Performance - Drivers

37

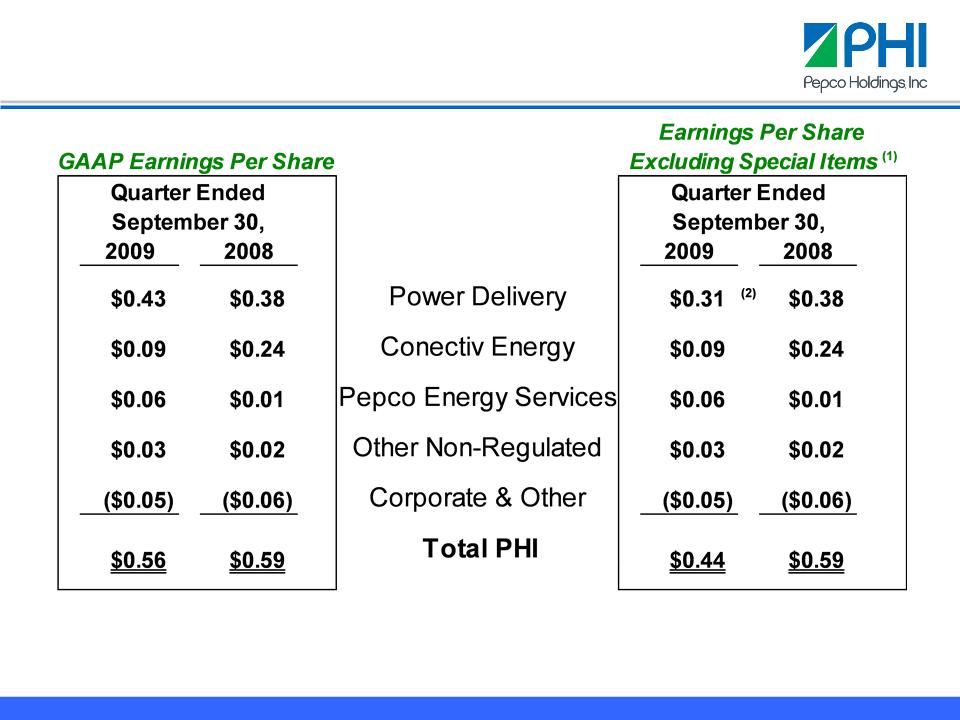

(1) Management

believes the special items are not representative of the Company’s ongoing

business operations.

(2) Excludes

gain from the Mirant bankruptcy settlement $0.07 and MD Income Tax Benefit

$0.05.

Third

Quarter 2009 Financial Performance

38

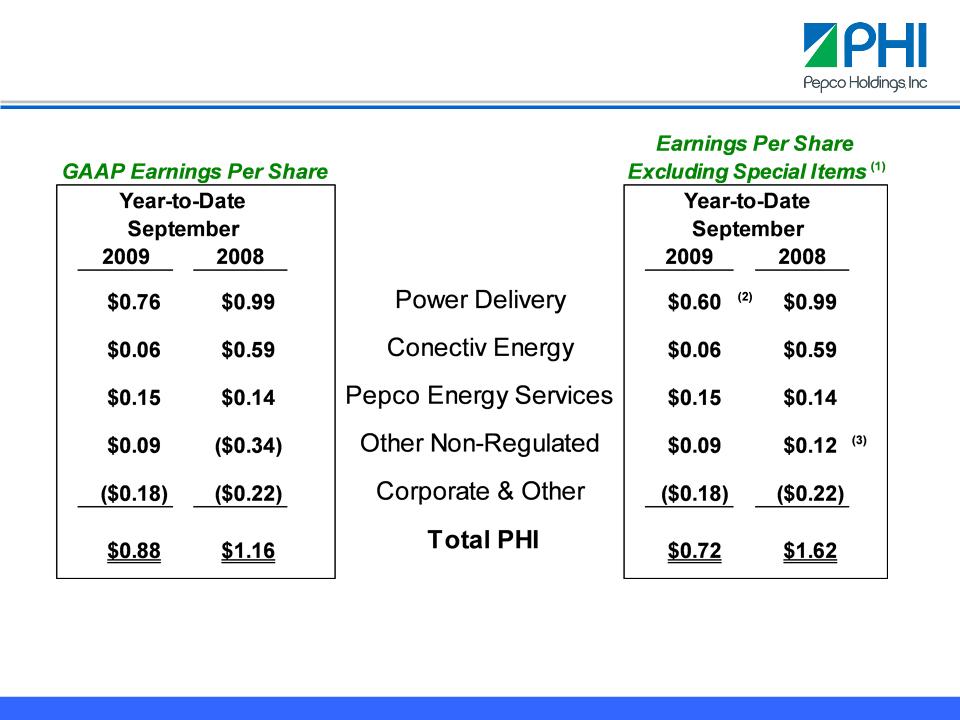

Year-to-Date

2009 Financial Performance

(1) Management

believes the special items are not representative of the Company’s ongoing

business operations.

(2) Excludes

gains from the Mirant bankruptcy settlement $0.11 and MD Income Tax Benefit

$0.05.

(3) Excludes

the adjustment to the equity value of the cross-border energy leases $0.43 and

the interest accrued on

the related income tax obligations of $0.03.

the related income tax obligations of $0.03.

39