Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DEL MONTE FOODS CO | d8k.htm |

Exhibit 10.1

| Certain portions of this lease agreement, for which confidential treatment has been requested, have been omitted and filed separately with the Securities and Exchange Commission. Sections of the lease agreement where portions have been omitted have been identified in the text. |

OFFICE LEASE AGREEMENT

Between

Landlord: PPF OFF ONE MARITIME PLAZA, LP,

a Delaware limited partnership

and

Tenant: DEL MONTE CORPORATION,

a Delaware corporation

ONE MARITIME PLAZA

SAN FRANCISCO, CALIFORNIA

TABLE OF CONTENTS

LEASE AGREEMENT

| Page | ||||

| 1. |

PREMISES AND COMMON AREAS; EXPANSION OPTION; RIGHTS OF FIRST OFFER | 1 | ||

| 2. |

TERM | 2 | ||

| 3. |

QUIET ENJOYMENT | 4 | ||

| 4. |

RENT PAYMENT | 4 | ||

| 5. |

OPERATING EXPENSES, TAXES AND INSURANCE EXPENSES | 5 | ||

| 6. |

LATE CHARGE | 13 | ||

| 7. |

PARTIAL PAYMENT | 13 | ||

| 8. |

SECURITY DEPOSIT [INTENTIONALLY OMITTED] | 13 | ||

| 9. |

USE OF PREMISES | 13 | ||

| 10. |

COMPLIANCE WITH LAWS | 16 | ||

| 11. |

RULES AND REGULATIONS | 17 | ||

| 12. |

SERVICES | 18 | ||

| 13. |

TELEPHONE AND DATA EQUIPMENT | 21 | ||

| 14. |

SIGNS | 22 | ||

| 15. |

FORCE MAJEURE | 24 | ||

| 16. |

REPAIRS AND MAINTENANCE BY LANDLORD | 24 | ||

| 17. |

REPAIRS BY TENANT | 24 | ||

| 18. |

ALTERATIONS AND IMPROVEMENTS/LIENS | 25 | ||

| 19. |

DESTRUCTION OR DAMAGE | 27 | ||

| 20. |

EMINENT DOMAIN | 28 | ||

| 21. |

DAMAGE OR THEFT OF PERSONAL PROPERTY | 28 | ||

| 22. |

INSURANCE; WAIVERS | 29 | ||

| 23. |

INDEMNITIES | 31 | ||

| 24. |

EXCULPATION AND WAIVER | 32 | ||

| 25. |

ESTOPPEL | 33 | ||

| 26. |

NOTICES | 33 | ||

| 27. |

DEFAULT | 34 | ||

| 28. |

REMEDIES | 35 | ||

| 29. |

LANDLORD’S DEFAULT | 36 | ||

| 30. |

SURRENDER OF PREMISES | 37 | ||

| 31. |

REMOVAL OF FIXTURES | 38 | ||

| 32. |

HOLDING OVER | 38 | ||

| 33. |

ATTORNEYS’ FEES | 38 | ||

| 34. |

MORTGAGEE’S RIGHTS | 38 | ||

| 35. |

ENTERING PREMISES | 40 | ||

| 36. |

RELOCATION | 41 | ||

| 37. |

ASSIGNMENT AND SUBLETTING | 41 | ||

| 38. |

SALE | 45 | ||

| 39. |

LIMITATION OF LIABILITY | 45 | ||

| 40. |

BROKER DISCLOSURE | 46 |

i

| 41. |

JOINT AND SEVERAL | 46 | ||

| 42. |

CONSTRUCTION OF THIS AGREEMENT | 46 | ||

| 43. |

NO ESTATE IN LAND | 46 | ||

| 44. |

PARAGRAPH TITLES; SEVERABILITY | 46 | ||

| 45. |

CUMULATIVE RIGHTS | 46 | ||

| 46. |

ENTIRE AGREEMENT | 46 | ||

| 47. |

SUBMISSION OF AGREEMENT | 46 | ||

| 48. |

AUTHORITY | 47 | ||

| 49. |

ELEVATOR | 47 | ||

| 50. |

ASBESTOS NOTIFICATION | 47 | ||

| 51. |

OFAC CERTIFICATION | 47 | ||

| 52. |

COUNTERPARTS; TELECOPIED OR ELECTRONIC SIGNATURES | 47 | ||

| 53. |

OPTIONS | 48 | ||

| 54. |

DETERMINATION AND DEFINITION OF FAIR MARKET RATE AND MARKET CONCESSIONS | 56 | ||

| 55. |

CONSENSUAL GENERAL JUDICIAL REFERENCE AGREEMENT | 57 | ||

| 56. |

CONFIDENTIALITY | 59 | ||

| 57. |

BUSINESS CONTINUITY PLANNING | 59 | ||

| LIST OF EXHIBITS | ||||

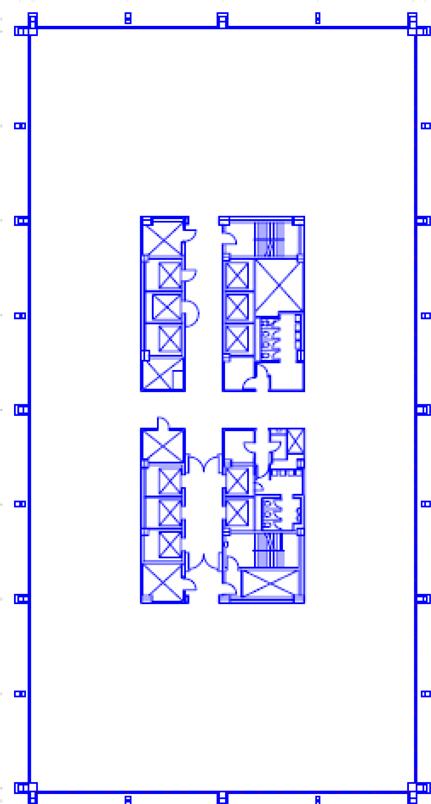

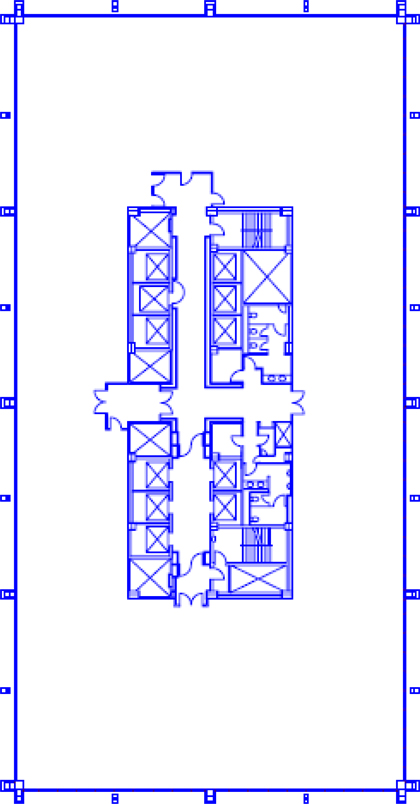

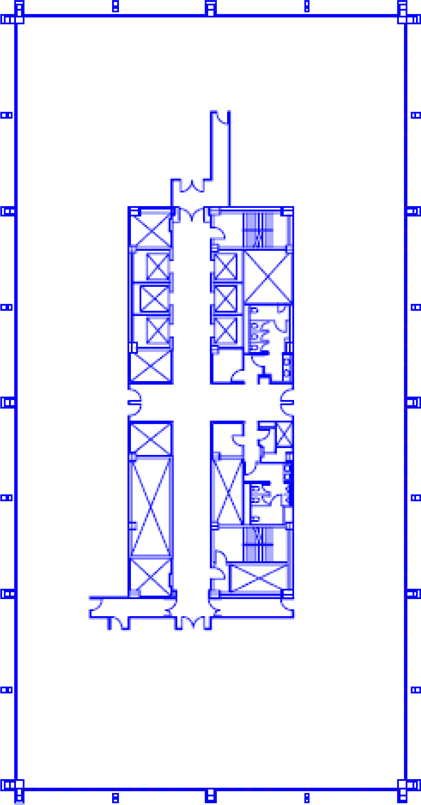

| A-1 |

Second Floor Space | |||

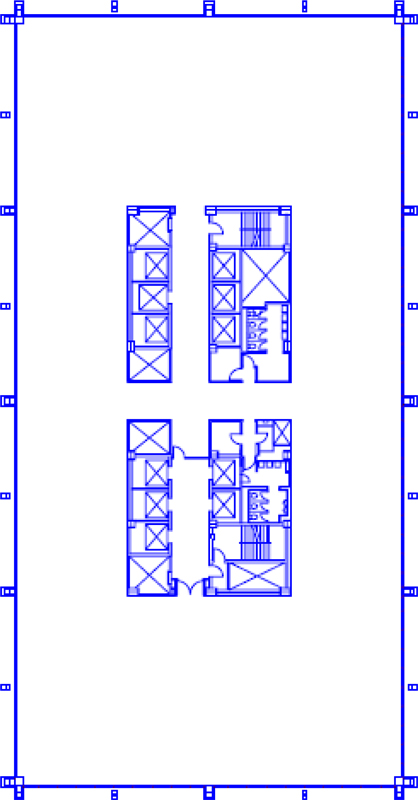

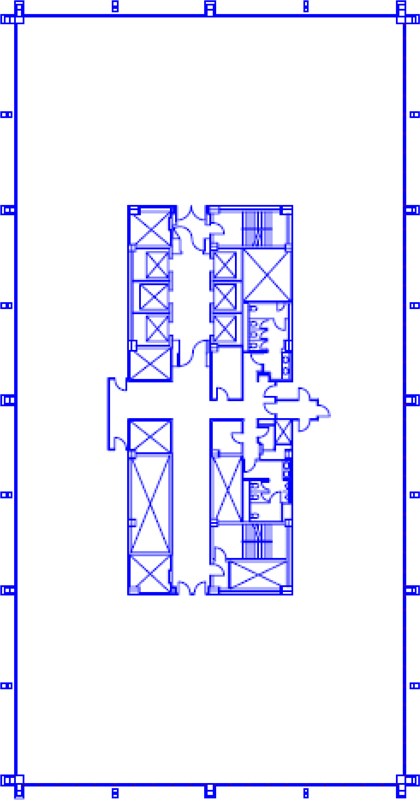

| A-2 |

Third Floor Space | |||

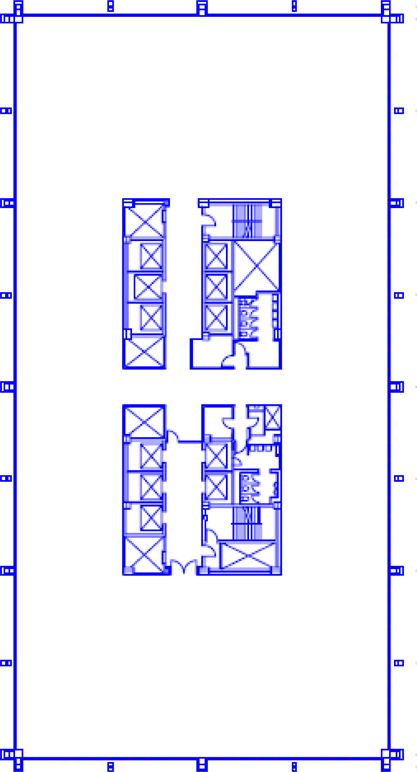

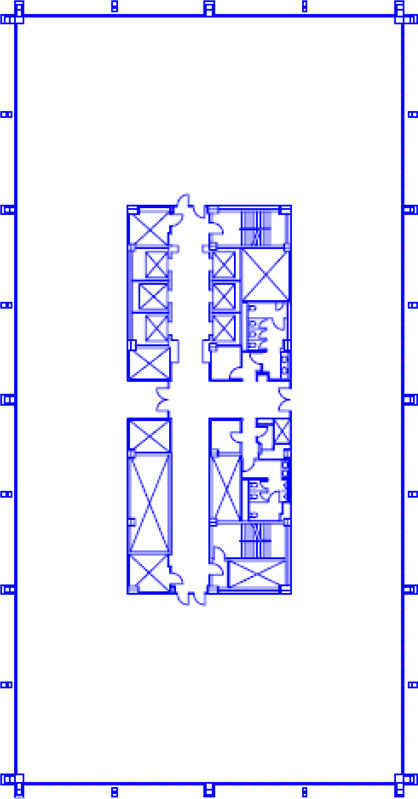

| A-3 |

Fourth Floor Space | |||

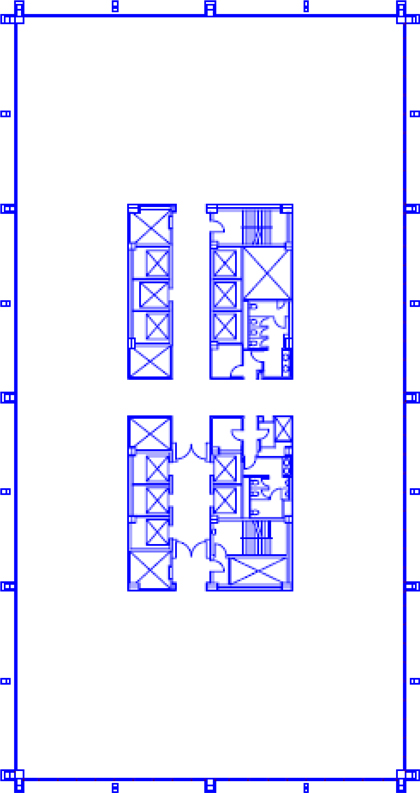

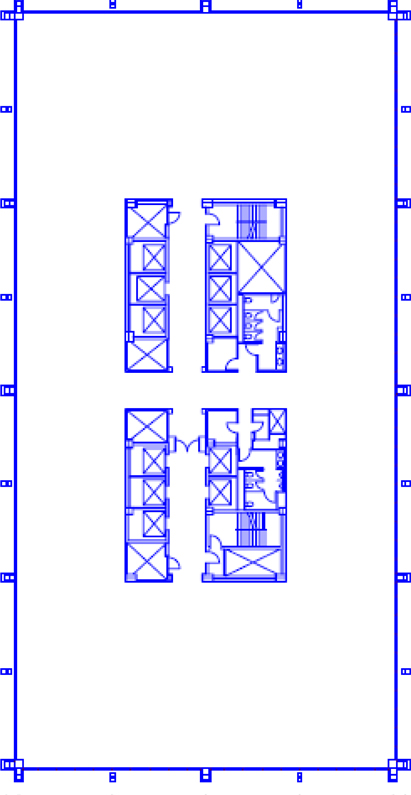

| A-4 |

Sixth Floor Space | |||

| A-5 |

Seventh Floor Space | |||

| A-6 |

Twenty-Fourth Floor Space | |||

| A-7 |

Twenty-Fifth Floor Space | |||

| A-8 |

Ninth Floor Expansion Space | |||

| A-9 |

Nineteenth Floor Expansion Space | |||

| B |

Work Agreement | |||

| B-1 |

The Landlord Work | |||

| C |

Commencement Letter | |||

| D |

Rules and Regulations | |||

| E |

Janitorial Specifications | |||

| F |

Ground Floor Sign | |||

| G |

Competitors | |||

| H |

Asbestos Notification | |||

ii

BASIC LEASE PROVISIONS

The following sets forth some of the Basic Provisions of the Lease. In the event of any conflict between the terms of these Basic Lease Provisions and the referenced Sections of the Lease, the referenced Sections of the Lease shall control.

| 1. | Building: The building located at One Maritime Plaza, San Francisco, California. The Building contains approximately 526,464 rentable square feet. |

| 2. | Property: The Building and the parcel(s) of land on which it is located and, at Landlord’s discretion, the facilities and other improvements, if any, serving the Building and the parcel(s) of land on which they are located |

| 3. | Premises: An aggregate of 152,917 rentable square feet consisting of the entire Second (2nd), Third (3rd), Fourth (4th), Sixth (6th), Seventh (7th), Twenty-Fourth (24th) and Twenty-Fifth (25th) Floors, as follows: |

| Floor |

Rentable Area |

Exhibit |

Referred to As: | |||

| Second (2nd) |

21,841 | A-1 | Second Floor Space | |||

| Third (3rd) |

21,841 | A-2 | Third Floor Space | |||

| Fourth (4th) |

21,841 | A-3 | Fourth Floor Space | |||

| Sixth (6th) |

21,851 | A-4 | Sixth Floor Space | |||

| Seventh (7th) |

21,841 | A-5 | Seventh Floor Space | |||

| Twenty-Fourth (24th) |

21,851 | A-6 | Twenty-Fourth Floor Space | |||

| Twenty-Fifth (25th) |

21,851 | A-7 | Twenty-Fifth Floor Space |

| 4. | Term: Ten (10) years |

| Target Commencement Date (Section 2): April 1, 2011 |

| Target Expiration Date (Section 2): March 31, 2021 |

| Anticipated Delivery Dates: |

| Space |

Anticipated Delivery Date | |

| Twenty-Fifth Floor Space |

March 1, 2010 | |

| Twenty-Fourth Floor Space |

March 1, 2010 | |

| Seventh Floor Space |

August 1, 2010 | |

| Sixth Floor Space |

August 1, 2010 | |

| Fourth Floor Space |

November 1, 2010 | |

| Third Floor Space |

November 1, 2010 | |

| Second Floor Space |

November 1, 2010 |

i

| 5. | Base Rent: |

| (a) | Twenty-Fifth Floor Space (21,851 rentable square feet). |

| Years Following Commencement Date |

Annual Rate Per Rentable Square Foot |

Monthly Installment | ||

| Year 1 |

[**]* | [**]* | ||

| Year 2 |

[**]* | [**]* | ||

| Year 3 |

[**]* | [**]* | ||

| Year 4 |

[**]* | [**]* | ||

| Year 5 |

[**]* | [**]* | ||

| Year 6 |

[**]* | [**]* | ||

| Year 7 |

[**]* | [**]* | ||

| Year 8 |

[**]* | [**]* | ||

| Year 9 |

[**]* | [**]* | ||

| Year 10 |

[**]* | [**]* | ||

| (b) | Twenty-Fourth Floor Space (21,851 rentable square feet). |

| Years Following Commencement Date |

Annual Rate Per Rentable Square Foot |

Monthly Installment | ||

| Year 1 |

[**]* | [**]* | ||

| Year 2 |

[**]* | [**]* | ||

| Year 3 |

[**]* | [**]* | ||

| Year 4 |

[**]* | [**]* | ||

| Year 5 |

[**]* | [**]* | ||

| Year 6 |

[**]* | [**]* | ||

| Year 7 |

[**]* | [**]* | ||

| Year 8 |

[**]* | [**]* | ||

| Year 9 |

[**]* | [**]* | ||

| Year 10 |

[**]* | [**]* | ||

| * | CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

ii

| (c) | Sixth Floor Space and Seventh Floor Space (43,692 rentable square feet). |

| Years Following Commencement Date |

Annual Rate Per Rentable Square Foot |

Monthly Installment | ||

| Year 1 |

[**]* | [**]* | ||

| Year 2 |

[**]* | [**]* | ||

| Year 3 |

[**]* | [**]* | ||

| Year 4 |

[**]* | [**]* | ||

| Year 5 |

[**]* | [**]* | ||

| Year 6 |

[**]* | [**]* | ||

| Year 7 |

[**]* | [**]* | ||

| Year 8 |

[**]* | [**]* | ||

| Year 9 |

[**]* | [**]* | ||

| Year 10 |

[**]* | [**]* | ||

| (d) | Second Floor Space, Third Floor Space and Fourth Floor Space (65,523 rentable square feet). |

| Years Following Commencement Date |

Annual Rate Per Rentable Square Foot |

Monthly Installment | ||

| Year 1 |

[**]* | [**]* | ||

| Year 2 |

[**]* | [**]* | ||

| Year 3 |

[**]* | [**]* | ||

| Year 4 |

[**]* | [**]* | ||

| Year 5 |

[**]* | [**]* | ||

| Year 6 |

[**]* | [**]* | ||

| Year 7 |

[**]* | [**]* | ||

| Year 8 |

[**]* | [**]* | ||

| Year 9 |

[**]* | [**]* | ||

| Year 10 |

[**]* | [**]* | ||

| * | CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

iii

| (e) | Cumulative |

| Years Following Commencement Date |

Monthly Installment | |

| Year 1 |

[**]* | |

| Year 2 |

[**]* | |

| Year 3 |

[**]* | |

| Year 4 |

[**]* | |

| Year 5 |

[**]* | |

| Year 6 |

[**]* | |

| Year 7 |

[**]* | |

| Year 8 |

[**]* | |

| Year 9 |

[**]* | |

| Year 10 |

[**]* | |

| 6. | Rent Payment Address: |

PPF OFF ONE MARITIME PLAZA, LP

One Maritime Plaza

P.O. Box 100761

Pasadena, CA 91189-0761

| 7. | Base Year: |

| Tax Base Year: |

2011 calendar year | |

| Operating Expense Base Year: |

2011 calendar year | |

| Insurance Expense Base Year: |

2011 calendar year |

| 8. | Tenant’s Share: 29.05% (i.e., 152,917/526,464). |

| 9. | Security Deposit: None |

| 10. | Landlord’s Broker: CB Richard Ellis, Inc. |

Tenant’s Broker: CAC Group, Inc.

| * | CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

iv

| 12. Notice Addresses: | ||

| Landlord | Tenant | |

| PPF OFF ONE MARITIME PLAZA, LP c/o Morgan Stanley US RE Investing Division 555 California Street, Suite 2200, Floor 21 San Francisco, California 94104 Attention: Keith Fink |

Prior to Commencement Date: Del Monte Corporation 50 California Street, 11th Floor San Francisco, California 94111 Attention: Director of Corporate Real Estate

After Commencement Date: Del Monte Corporation One Maritime Plaza San Francisco, California 94111 Attention: Director of Corporate Real Estate | |

V

OFFICE LEASE AGREEMENT

THIS OFFICE LEASE AGREEMENT (hereinafter called the “Lease”) is entered into as of October 27, 2009 (the “Effective Date”), by and between the Landlord and Tenant identified above.

1. Premises and Common Areas; Expansion Options; Rights of First Offer.

(a) Premises; Rentable Area. Landlord leases to Tenant and Tenant leases from Landlord the Premises located in the Building identified in the Basic Lease Provisions, situated on the Property, such Premises as further shown on the drawings attached hereto as Exhibits A-1 through A-7 and made a part hereof by reference. Landlord and Tenant agree that the rentable area of the Premises as described in Paragraph 2 of the Basic Lease Provisions has been confirmed and conclusively agreed upon by the parties. No easement for light, air or view is granted hereunder or included within or appurtenant to the Premises.

(b) Common Areas.

(i) Generally. Tenant shall have the nonexclusive right (in common with other tenants or occupants of the Building, Landlord and all others to whom Landlord has granted or may hereafter grant such rights) to use the Common Areas, subject to the Rules and Regulations. Landlord may at any time close temporarily any Common Areas to make repairs or changes therein or to effect construction, repairs, or changes within the Building, or to prevent the acquisition of public rights in such areas, and may do such other acts in and to the Common Areas as in its reasonable judgment may be desirable. Landlord may from time to time permit portions of the Common Areas to be used exclusively by specified tenants on terms comparable to those in section 1(b)(ii) below and only so long as such exclusive use does not materially impair the availability and utility of the Common Areas in accordance with Tenant’s reasonable expectations (other than on a temporary basis in the same manner that Tenant’s usage described in Section 1(b)(ii) below would impair the availability and utility of the Common Areas for other tenants of the Building) or increase Operating Expenses (defined in Section 5(b)). Landlord may also, from time to time, place or permit customer service and information booths, kiosks, stalls, push carts and other merchandising facilities in the Common Areas, but only so long as such use does not materially impair the availability and utility of the Common Areas in accordance with Tenant’s reasonable expectations or increase Operating Expenses. “Common Areas” shall mean any of the following or similar items: (a) to the extent included in the Building, the total square footage of areas of the Building devoted to nonexclusive uses such as ground floor lobbies, seating areas and elevator foyers; fire vestibules; mechanical areas; restrooms and corridors on all multi-tenant floors; elevator foyers and lobbies on multi-tenant floors; electrical and janitorial closets outside of leased premises; telephone and equipment rooms outside of leased premises; and other similar facilities maintained for the common benefit of Building tenants and invitees, but shall not mean Major Vertical Penetrations (defined below); and (b) all parking garage vestibules; loading docks; locker rooms, exercise and conference facilities available for use by Building tenants (if any); walkways, roadways and sidewalks; trash areas; mechanical areas; landscaped areas including courtyards, plazas and patios; and other similar facilities maintained for the common benefit of Building tenants and invitees. As used herein,

1

“Major Vertical Penetrations” shall mean the area or areas within Building stairs (excluding the landing at each floor), elevator shafts, and vertical ducts that service more than one floor of the Building. The area of Major Vertical Penetrations shall be bounded and defined by the dominant interior surface of the perimeter walls thereof (or the extended plane of such walls over areas that are not enclosed). Major Vertical Penetrations shall exclude, however, areas for the specific use of Tenant or installed at the request of Tenant, such as special stairs or elevators.

(ii) Outdoor Courtyard/Plaza. The Property includes a landscaped courtyard and associated plaza, which constitute exterior Common Areas. Subject to approval, to the extent necessary, of the City of San Francisco, and to prior scheduling with Landlord, Tenant may, from time to time, but no more often than three (3) times in any calendar year, use the courtyard and/or plaza for corporate functions such as picnics, barbeques, etc. However, Tenant acknowledges that pedestrian access to the Building is achieved primarily through the exterior plaza, and, as a consequence, at no time will any occupant of the Property (including Tenant) have exclusive use to all of the exterior plaza. All costs associated with such usage will be borne by Tenant and will not be included in Operating Expenses.

2. Term.

(a) Generally.

(i) Delivery Dates. Landlord will perform the work described as the “Landlord Work” in the Work Agreement attached hereto as Exhibit B (the “Work Agreement”) in each floor comprising the Premises, and will deliver each such floor to Tenant. The “Delivery Date” with respect to any floor comprising the Premises will mean the date upon which Landlord has Substantially Completed (as defined in the Work Agreement) the Landlord Work on such floor and delivered such floor to Tenant in order to allow Tenant to commence the construction of the Tenant Improvements (defined in the Work Agreement) therein. Notwithstanding the foregoing to the contrary, the parties acknowledge that the performance of certain portions of the Landlord Work, as Landlord and Tenant may agree in writing, may be more appropriately completed as and when Tenant’s construction of the Tenant Improvements are being carried out, and in such event, the completion of any such item on a floor comprising the Premises will not be a precondition for the Delivery Date with respect to such floor.

(ii) Commencement Date. Tenant shall have and hold the Premises for the term (“Term”) identified in the Basic Lease Provisions commencing on the date (the “Commencement Date”) which is the earlier of (i) the date that is one hundred fifty (150) days after the final Delivery Date on which Landlord has delivered all floors comprising the Premises to Tenant and (ii) the date Tenant first occupies all of the Premises for the conduct of its business. The parties estimate that the Delivery Date for each floor comprising the Premises will be the estimated Delivery Date(s) specified in the Basic Lease Provisions.

(iii) Expiration Date. This Lease shall terminate at midnight on the day immediately preceding the tenth (10th) anniversary of the Commencement Date (the “Expiration Date”), unless sooner terminated or extended as hereinafter provided. Promptly

2

following the initial Delivery Date, Landlord and Tenant shall enter into a letter agreement in the form attached hereto as Exhibit C (“Commencement Letter”).

(b) Delivery Delay [**]*. As of the Effective Date, Tenant occupies space in the building commonly known as the Landmark Building (the “Landmark Premises”) pursuant to a lease (“Landmark Lease”) and space in the building commonly known as 50 California Street (the “50 Cal Premises”); pursuant to a sublease (which sublease, together with any direct lease of the 50 Cal Premises, is referred to as the “50 Cal Lease”; and together with the Landmark Lease, the “Tenant’s Existing Leases”). The 50 Cal Premises, together with the Landmark Premises, are referred to herein as “Tenant’s Existing Premises”. If the Delivery Date for the Second Floor Space, Third Floor Space and/or Fourth Floor Space is delayed beyond November 1, 2010 (“Delivery Delay”) or if a Landlord Delay (as defined in the Work Agreement) occurs and either such Delivery Delay or such Landlord Delay, or both causes Substantial Completion of any material portion of the Tenant Improvements in the Premises to be delayed beyond April 1, 2011, such Delivery Delay or Landlord Delay may result in Tenant having to hold over in all or a portion of Tenant’s Existing Premises beyond April 1, 2011. Tenant agrees to use diligent good faith efforts to negotiate with Tenant’s landlords under Tenant’s Existing Leases, and to schedule Tenant’s relocation of personnel into the Premises, in an effort to mitigate, to the extent reasonably possible consistent with an efficient relocation process, any requirements that Tenant will hold over in Tenant’s Existing Premises. If, notwithstanding such efforts, as a result of Delivery Delay or a Landlord Delay, Tenant must nonetheless hold over with respect to all or any portion of Tenant’s Existing Premises beyond April 1, 2011, [**]*. Tenant shall, at Landlord’s request from time to time, apprise Landlord of Tenant’s efforts to mitigate holdover obligations in Tenant’s Existing Premises and the status of any holdover obligation of Tenant in Tenant’s Existing Premises. For clarification, if Tenant determines in good faith that it would be inefficient for Tenant to relocate from Tenant’s Existing Premises into the Premises in phases, and decides to move only when the Tenant Improvements on all floors of the Premises are substantially complete, [**]*.

(c) Beneficial Occupancy. Tenant shall have the right to occupy all or any portion of the Sixth Floor Space, the Seventh Floor Space, the Twenty-Fourth Floor Space and/or the Twenty-Fifth Floor Space from and after February 1, 2011 through and to March 31, 2011 (any such occupancy being referred to herein as “Beneficial Occupancy” and the period of such Beneficial Occupancy is referred to as the “Beneficial Occupancy Period”). All the rights and obligations of the parties under this Lease (other than Tenant’s obligation to pay Base Rent, except as set forth below, but expressly including without limitation, Tenant’s obligation to carry and provide Landlord with evidence of insurance coverage pursuant to this Lease, Tenant’s indemnification obligations, etc.) shall apply during the Beneficial Occupancy Period of any such Beneficial Occupancy. Tenant will coordinate any Beneficial Occupancy with Landlord. Notwithstanding the foregoing to the contrary, if and to the extent that during any Beneficial Occupancy Period, Tenant relocates personnel to the portion(s) of the Premises in which Tenant has Beneficial Occupancy and, as a consequence, Tenant avoids the obligation to pay rent either under the Landmark Lease or under the 50 Cal Lease, then, on a per diem basis for each square foot for which Tenant avoids such rental liability at Tenant’s Existing Premises, Tenant will pay

| * | CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

3

Base Rent for any floor for which Tenant has Beneficial Occupancy during such Beneficial Occupancy Period at the rate initially payable hereunder for such floor. For example, if Tenant is relieved of thirty (30) days of rent obligation with respect to 20,000 rentable square feet in the Landmark Premises as a result of its ability to have Beneficial Occupancy of 20,000 rentable square feet in the Seventh Floor Space, Tenant shall pay Base Rent for such 20,000 rentable square feet at the rate set forth above for the Seventh Floor Space for the first year of the Term, for thirty (30) days of the Beneficial Occupancy Period; provided, however, that Tenant shall have a right to apply the Abated Rent described in Section 4(b) below towards such rental obligation.

3. Quiet Enjoyment. Tenant, upon payment in full of the required Rent and full performance of the terms, conditions, covenants and agreements contained in this Lease, shall peaceably and quietly have, hold and enjoy the Premises during the Term. The foregoing is in lieu of any implied covenant of quiet enjoyment. Landlord shall not be responsible for the acts or omissions of any other tenant or third party that may interfere with Tenant’s use and enjoyment of the Premises, except to the extent such interference would have been avoided by Landlord’s commercially reasonable efforts to enforce its rights against such other tenant or third party, provided that Landlord receives written notice of such interference from Tenant and a reasonable time in which to so enforce its rights (and provided further that this sentence will in no event be construed or interpreted to require that Landlord commence any litigation against any tenant or third party).

4. Rent Payments.

(a) Generally. Tenant shall pay to Landlord annual base rent (“Base Rent”) in the amounts set forth in the Basic Lease Provisions. The Base Rent shall be payable in equal monthly installments, due on the first day of each calendar month, in advance, in legal tender of the United States of America, without abatement, demand, deduction or offset whatsoever, except as may be expressly provided in this Lease. Base Rent shall be due and payable on or before the first day of each calendar month following the Commencement Date during the Term. Tenant shall pay, as additional Rent, all other sums due from Tenant under this Lease (the term “Rent”, as used herein, means all Base Rent and all other amounts payable hereunder by Tenant to Landlord, inclusive of Storage Rent (defined in Section 9(c) below). Unless otherwise specified herein, all items of Rent (other than Base Rent and amounts payable on a recurring monthly basis pursuant to Article 5 below) shall be due and payable by Tenant on or before the date that is thirty (30) days after billing by Landlord. Rent shall be made payable to the entity, and sent to the address, Landlord designates (initially set forth in the Basic Lease Provisions) and shall be made by good and sufficient check, wire transfer or by other means acceptable to Landlord.

(b) Abatement. So long as Tenant is not in Monetary Default (defined in Section 27(a) below) under this Lease, Tenant shall be entitled to an abatement of Base Rent payable hereunder for the [**]* full calendar months following the Commencement Date (without any reference to partial calendar months if the Commencement Date is other than the first (1st) day

| * | CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

4

of a calendar month) as well as the [**]* full calendar months following the Commencement Date (each, an “Abatement Period”). The total amount of Base Rent abated during the Abatement Periods is referred to herein as the “Abated Rent”. If Tenant is in Monetary Default hereunder at any time during the Term, and such Monetary Default occurs prior to the expiration of the Abatement Periods, there will be no further abatement of Rent pursuant to this Section 5(b) during the remainder of the Abatement Periods unless and until such Monetary Default is cured; upon any cure of such Monetary Default by Tenant, any remaining scheduled abatement of Rent pursuant to this Section 5(b) will take place as scheduled, and any abatement of Rent which ceased or did not occur as a result of the pendency of such Monetary Default will commence upon the date that is [**]* days following Tenant’s cure of such Monetary Default.

5. Operating Expenses, Taxes and Insurance Expenses.

(a) Generally. Tenant will reimburse Landlord throughout the Term, as additional Rent hereunder, for Tenant’s Share (defined below) of: (i) the annual Operating Expenses (as defined below) in excess of the Operating Expenses for the Operating Expense Base Year set forth in the Basic Lease Provisions (hereinafter called the “Base Year Expense Amount”); and (ii) the annual Taxes (as defined below) in excess of the Taxes for the Tax Base Year set forth in the Basic Lease Provisions (hereinafter called the “Base Year Tax Amount”); and (iii) the annual Insurance Expenses (as defined below) in excess of the Insurance Expenses for the Insurance Expense Base Year set forth in the Basic Lease Provisions (hereinafter called the “Base Year Insurance Amount”). The term “Tenant’s Share” as used in this Lease shall mean the percentage determined by dividing the rentable square footage of the Premises by the rentable square footage of the Building and multiplying the quotient by 100. Landlord and Tenant hereby agree that Tenant’s Share with respect to the Premises initially demised by this Lease is as set forth in the Basic Lease Provisions. Tenant’s Share of excess Operating Expenses, excess Taxes and Excess Insurance Expenses for any calendar year shall be appropriately prorated for any partial year occurring during the Term. The obligations of the parties pursuant to this Article 5 will survive the expiration or sooner termination of this Lease.

(b) “Operating Expenses” shall mean all of those expenses actually paid by Landlord in operating, servicing, managing, maintaining and repairing the Property, Building, and all related Common Areas. Operating Expenses shall include, without limitation, the following: (1) all costs related to the providing of water, heating, lighting, ventilation, sanitary sewer, air conditioning and other utilities, but excluding those utility charges actually paid separately by Tenant or any other tenants of the Building; (2) janitorial and maintenance expenses, including: (a) janitorial services and janitorial supplies and other materials used in the operation and maintenance of the Building; and (b) the cost of maintenance and service agreements on equipment, window cleaning, grounds maintenance, pest control, security, trash removal, and other similar services or agreements; (3) management fees actually incurred (or an imputed charge for management fees if Landlord provides its own management services) but not in excess of the greater of (i) one and seventy-five one hundredths percent (1.75%) of Building Revenue (defined below) and (ii) then then-prevailing rates payable to third party management companies by owners of comparable premier “class A” office buildings in the San Francisco

| * | CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

5

financial district (“Comparable Buildings”), but in any event not in excess of three percent (3%) of Building Revenue; as used herein “Building Revenue” shall mean the aggregate of (a) the annual base rentals for all Property tenants, (b) amounts of commercially reasonable rent abatement and (c) other income from the use or occupancy of the Building; (4) the market rental value (as reasonably determined by Landlord) of an on-site management office (or the prorated portion of any off-site management office whose occupants perform management services for the Property; (5) the costs, including interest at a market rate, amortized over the applicable useful life determined in accordance with generally accepted accounting principles, of (a) any capital improvement made to the Building by or on behalf of Landlord which is required under any governmental law or regulation (or any judicial interpretation thereof) or any insurance requirement that was not applicable to the Building as of the Effective Date, (b) any capital cost of acquisition and installation of any device or equipment which is acquired or installed for the primary purpose of improving the operating efficiency of any system within the Building or reducing Operating Expenses and which is properly capitalized, provided that the amortized amount of such capital cost included in Operating Expenses in any year pursuant to this clause (b) shall be limited to the amount which Landlord, based upon the reasonable recommendations and estimates of qualified, independent, non-biased third-party consultants or experts (“Experts”) as evidenced by a written analysis provided to Tenant, reasonably anticipates to be the savings in Operating Expenses which are likely to be realized in such year resulting from such improvement (provided that if Landlord or Tenant demonstrates to the other, based upon the reasonable determination of one or more Experts’ subsequent review, that the actual savings realized or resulting from any such improvement materially departs from the initially projected savings, then Landlord will make a line item adjustment to Operating Expenses in the next-issued Landlord’s Statement (defined below) to reflect the best estimate of the Expert(s) of the actual savings realized by such improvement), and (c) the cost of any capital improvement or capital equipment which is acquired to improve the safety of the Building or Property and is consistent with safety improvements installed in Comparable Buildings, and (d) capital improvements which are replacements or modifications of items located in the Common Areas required to keep the Common Areas in good order or condition; (6) all services, supplies, repairs, replacements or other expenses directly and reasonably associated with servicing, maintaining, managing and operating the Building, including, but not limited to the lobby, vehicular and pedestrian traffic areas and other Common Areas; (7) wages and salaries of Landlord’s employees (not above the level of Building or Property Manager or such other title representing the on-site management representative primarily responsible for management of the Building) engaged in the maintenance, operation, repair and services of the Building, including taxes, insurance and customary fringe benefits; (8) legal and accounting costs (but not including legal costs incurred in collecting delinquent rent from any occupants of the Property); (9) costs to maintain and repair the Building and Property; and (10) landscaping and security costs unless and to the extent that Landlord hires a third party to provide such services pursuant to a service contract and the cost of that service contract is already included in Operating Expenses as described above.

Operating Expenses shall specifically exclude: (i) costs of alterations of tenant spaces (including all tenant improvements to such spaces); (ii) costs of capital improvements except as provided in clause (5) of Section 5(b) above (and rent charges for leases of items which would be capital items if purchased and the cost of which, pursuant to the provisions of clause (5) of

6

Section 5(b) above, would not be included in Operating Expenses); (iii) depreciation, amortization, interest and principal payments on mortgages, and other debt costs, if any; (iv) real estate brokers’ leasing commissions or compensation and advertising and other marketing expenses; (v) payments to affiliates of the Landlord for goods and/or services to the extent the same are materially in excess of what would be paid to non-affiliated parties of similar experience, skill and expertise for such goods and/or services in an arm’s length transaction; (vi) costs of work and other services performed or provided for the singular benefit of another tenant or occupant or in excess of the work and services provided to Tenant hereunder without extra cost (other than for Common Areas of the Building); (vii) legal, space planning, construction, and other expenses incurred in procuring tenants for the Building or renewing or amending leases with existing tenants or occupants of the Building; (viii) costs of advertising and public relations and promotional costs and attorneys’ fees associated with the leasing of the Building; (ix) any expense to the extent that Landlord actually is reimbursed from insurance, condemnation awards, other tenants or any other source; (x) costs incurred in connection with the sale, financing, refinancing, mortgaging, or other change of ownership of the Building or in connection with defense of Landlord’s title to the Property; (xi) all expenses in connection with the installation, operation and maintenance of any observatory, broadcasting facilities, luncheon club, athletic or recreation club, cafeteria, dining facility or other facility not generally available to all office tenants of the Building, including Tenant; (xii) Taxes (and all amounts specifically excluded from the definition of “Taxes”); (xiii) Insurance Expenses; (xiv) any expenses relating to parking facilities; (xv) rental under any ground or underlying lease or leases; (xvi) sums (other than management fees as described in clause (3) of the foregoing definition of “Operating Expenses”) paid to subsidiaries or other affiliates of Landlord for services but only to the extent that the cost of such service materially exceeds the competitive costs for such services rendered by persons or entities of similar skill, competence and experience in the market; (xvii) costs incurred in connection with the removal, encapsulation or other treatment of Hazardous Material (defined in Section 9(b) below) existing in the Building and classified as a Hazardous Material as of the date of this Lease, except to the extent such removal, encapsulation or other treatment is related to the ordinary general repair and maintenance of the Building (for example, the removal and disposal of oil from Building machinery in the course of typical building maintenance and not as a response to any action of any tenant or occupant of the Building or other release of Hazardous Materials); (xviii) costs that Landlord incurs in restoring the Building after the occurrence of a fire or other casualty or after a partial condemnation thereof; (xix) interest, fines, penalties or damages for violation of Law or late payment by Landlord, including penalty interest; (xx) the cost of defending any lawsuit and of paying any judgment, settlement or arbitration award resulting from Landlord’s liability for failure to perform its obligations under any lease or other contract by which it may be bound; (xxi) costs of correcting any violation of applicable Laws existing as of the Effective Date hereof; (xxii) contributions to civic organizations or charities; (xxiii) the cost of acquisition of objects of fine art that Landlord installs in the Building; (xxiv) any increased costs resulting from the negligence or willful misconduct of Landlord or its employees, agents or contractors (provided that the issue of such negligence or willful misconduct has been fully adjudicated, beyond the exhaustion of any appeal rights); (xxv) costs incurred by Landlord to correct construction defects in the Base Building (defined in Section 10(a) (provided that the issue of the existence of a construction defect has been fully adjudicated, beyond the exhaustion of any appeal rights); (xxvi) general or administrative overhead not directly associated with operation and management of the Building

7

and (xxvii) any category or individual expense which, as of the Effective Date, is customarily excluded from operating expenses in leases of office space in Comparable Buildings (unless such item or category is so “excluded” because it is not applicable to such other buildings; as an example, Operating Expenses includes the cost to Landlord of maintenance of the exterior fountain in the plaza portion of the Property, but other Comparable Buildings may not feature fountains and, thus, may not have fountain maintenance costs as a component of operating expenses).

(c) “Taxes” shall mean all taxes and assessments of every kind and nature which Landlord shall become obligated to pay with respect to any calendar year of the Term or portion thereof because of or in any way connected with the ownership, leasing, or operation of the Building and the Property, as well as any assessment, tax, fee, levy or charge in addition to, or in substitution, partially or totally, of any assessment, tax, fee, levy or charge previously included within the definition of real property tax, it being acknowledged by Tenant and Landlord that Proposition 13 was adopted by the voters of the State of California in the June 1978 election (“Proposition 13”) and that assessments, taxes, fees, levies and charges may be imposed by governmental agencies for such services as fire protection, street, sidewalk and road maintenance, refuse removal and for other governmental services formerly provided without charge to property owners or occupants. Notwithstanding anything to the contrary contained herein but subject to Section 5(g) below, (i) Landlord shall include in Taxes each year hereunder (including, without limitation, the Tax Base Year) the amounts levied, assessed, accrued or imposed for such year, regardless of whether paid or payable in another year, and Landlord shall each year make any other appropriate changes to reflect adjustments to Taxes for prior years (including, without limitation, the Tax Base Year) due to error by the taxing authority, supplemental assessment or other reason, regardless of whether Landlord uses an accrual system of accounting for other purposes (and the amount of any tax refunds received by Landlord during the Term of this Lease (subject to the provisions of Section 5(g) below) shall be deducted from Taxes for the calendar year to which such refunds are attributable), and Tenant will receive a refund or credit against Taxes in excess of Base Year Tax Amount, if any, in the amount of any resulting retroactive reductions in Taxes previously payable (and actually paid) by Tenant [subject to the provisions of Section 5(g) below]); (ii) the amount of special taxes and special assessments to be included shall be limited to the amount of the installments (plus any interest, other than penalty interest, payable thereon) of such special tax or special assessment payable for the calendar year in respect of which Taxes are being determined; (iii) the amount of any tax or excise levied by the State or the City where the Building is located; any political subdivision of either, or any other taxing body, on rents or other income from the Property (or the value of the leases thereon) shall be included in Taxes in any year subsequent to the Base Year only if Base Year Tax Amount includes (or is retroactively adjusted to include) the amount which would have been payable on account of such tax or excise by Landlord during the Tax Base Year had such tax or excise been applicable to the Tax Base Year; (iv) if any portion of the Taxes in the Tax Base Year includes an assessment which is no longer payable in a subsequent calendar year, Taxes for the Tax Base Year shall be adjusted to eliminate the amount of the annual assessment originally included therein; and (v) Taxes shall also include Landlord’s reasonable costs and expenses (including reasonable attorneys’ fees) in contesting or attempting to reduce any Taxes. Taxes will not include income taxes, excess profits taxes, franchise taxes, capital stock taxes, personal property taxes (other than taxes on machinery or equipment used in the operation,

8

maintenance or management of the Property (for example, but not by way of limitation, window washing equipment) and inheritance or estate taxes.

(d) “Insurance Expenses” shall mean the amount paid or incurred by Landlord (i) in insuring all or any portion of the Project under policies of insurance and/or commercially reasonable self-insurance, which may include commercial general liability insurance, property insurance, earthquake insurance, worker’s compensation insurance, rent interruption insurance, contingent liability and builder’s risk insurance, and any commercially reasonable insurance as may from time to time be maintained by Landlord and (ii) for commercially reasonable deductible payments under any insured claims; provided, that to the extent that any deductible payment incurred by Landlord in any calendar year during the Term is in excess of [**]* (any such excess being referred to herein as the “Excess Deductible Payment”) then for the purposes of inclusion in Insurance Expenses, any such Excess Deductible Payment shall be amortized in accordance with clause (5) of Section 5(b) above.

(e) Allocations and Special Adjustments.

(i) If any item of Operating Expenses, Insurance Expenses or Taxes is properly allocable or attributable to the Property, as well as to another property, the amount of such item shall be allocated in an equitable manner.

(ii) If any Substantial Item (defined below) of Operating Expenses, Insurance Expenses or Taxes is not included in the Base Year Expense Amount, the Base Year Insurance Amount or the Base Year Tax Amount, but is included in Operating Expenses, Insurance Expenses or Taxes for a subsequent year due to a change in insurance requirements (other than a change which is mandated by a change in laws or a new law) or in Landlord policy, then the Base Year Expense Amount, the Base Year Insurance Amount or the Base Year Tax Amount, as the case may be, shall be adjusted to include the amount which would have been paid for such Substantial Item had such change in insurance requirements or Landlord policy been in effect during the Base Year.

(iii) Similarly, if any Substantial Item of Operating Expenses, Insurance Expenses or Taxes is included in the Base Year Expense Amount, the Base Year Insurance Amount or the Base Year Tax Amount but is subsequently removed from Operating Expenses, Insurance Expenses or Taxes due to a change in insurance requirements (other than a change which is mandated by a change in laws or a new law) or in Landlord policy (for example, if Landlord maintains earthquake insurance coverage during the Base Year, but subsequently declines to carry such coverage), then the Base Year Expense Amount, the Base Year Insurance Amount or the Base Year Tax Amount, as the case may be, shall be adjusted to remove from the Base Year, the amount which had been previously included for such Substantial Item.

(iv) As used herein, any item of Operating Expenses, Insurance Expenses or Taxes, which in the applicable year in which such item is either first included in Operating Expenses, Insurance Expenses or Taxes (in the case of clause (ii) above), or first removed from

| * | CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

9

Operating Expenses, Insurance Expenses or Taxes (in the case of clause (iii) above) is equal to or greater than [**]*, will be deemed a “Substantial Item”.

(f) Cost Pools. Landlord shall have the right, from time to time, to equitably allocate some or all of the Operating Expenses and/or Insurance Expenses among different portions or occupants of the Building (the “Cost Pools”), in Landlord’s reasonable discretion. Such Cost Pools may, for example, include, but shall not be limited to, the office space tenants of the Building, and the retail space tenants. The Operating Expenses and/or Insurance Expenses allocable to each such Cost Pool shall be allocated to such Cost Pool and charged to the tenants within such Cost Pool in an equitable manner.

(g) “Proposition 8” Appeals. Notwithstanding anything to the contrary herein, if Taxes for the Base Year or any subsequent year are decreased as a result of any proceeding filed by Landlord for a reduction in the Building and Property’s assessed value obtained in connection with California Revenue and Taxation Code Section 51 (a “Proposition 8 Reduction”), Landlord shall make the following adjustments in determining Taxes (i) any Proposition 8 Reduction applicable to the Tax Base Year (whether actually obtained in the Tax Base Year or obtained retroactively in any subsequent year) shall be disregarded for purposes of determining Base Year Tax Amount; and (ii) any Proposition 8 Reduction applicable to a subsequent year shall be recognized for purposes of determining Taxes for that year; however, if and to extent that as a result of any Proposition 8 Reduction applicable to a subsequent year Taxes are reduced below the Base Tax Year amount, Tenant will not be entitled to any credit or refund related to such reduction below the Base Tax Year Amount.

(h) Procedure. As soon as reasonably possible after the commencement of each calendar year, commencing with 2012, Landlord will provide Tenant with a statement of the estimated monthly installments of Tenant’s Share of increases in Operating Expenses and increases in Taxes and excess Insurance Expenses which will be due for the remainder of such calendar year in accordance with this Article 5. Landlord shall deliver to Tenant within one hundred twenty (120) days after the close of each calendar year (including the calendar year in which this Lease terminates), a statement (“Landlord’s Statement”) setting forth: (1) the amount of any increases in Operating Expenses for such calendar year in excess of the Operating Expenses for the Operating Expense Base Year, (2) the amount of any increases in the Taxes for such calendar year in excess of the Taxes for the Tax Base Year and (3) the amount of any increases in Insurance Expenses for such calendar year in excess of the Insurance Expenses for the Insurance Expense Base Year. Notwithstanding the one hundred twenty (120) day deadline for the delivery of a Landlord’s Statement described in the immediately preceding sentence, if and to the extent that Landlord, despite reasonable efforts has not, as of such deadline, (x) received final invoices or statements from any vendor, or service provider or utility necessary to allow Landlord to calculate one or more components of Operating Expenses attributable to such year and/or (y) received any notice necessary to calculate actual Taxes applicable to such year, Landlord will, for the purposes of delivering Landlord’s Statement, estimate such amounts in good faith but may recalculate such estimates once Landlord determines the actual amounts applicable in either event. Landlord will use diligent efforts to finalize each Landlord’s Statement as promptly as practicable.

| * | CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

10

(i) For each year following the applicable Base Year, Tenant shall pay to Landlord, together with its monthly payment of Base Rent, as additional Rent hereunder, the estimated monthly installment of Tenant’s Share of the increase in Operating Expenses and increases in Taxes and increases in Insurance Expenses payable by Tenant in accordance with this Article 5 for the calendar year in question. At the end of any calendar year, and upon Landlord’s completion of Landlord’s Statement for such year, if Tenant has paid to Landlord an amount in excess of Tenant’s Share of increases in Operating Expenses, or increases in Taxes or increases in Insurance Expenses for such calendar year, Landlord shall reimburse to Tenant any such excess amount (or shall apply any such excess amount to any amount then owing to Landlord hereunder, and if none, to the next due installment or installments of Base Rent or additional Rent due hereunder); if Tenant has paid to Landlord less than Tenant’s Share of increases in Operating Expenses, or increases in Taxes or increases in Insurance Expenses for such calendar year, Tenant shall pay to Landlord any such deficiency within thirty (30) days after the date of delivery of the applicable Landlord’s Statement.

(ii) For the calendar year in which this Lease terminates and is not extended or renewed, the provisions of this Section 5(g) shall apply, but Tenant’s Share of increases in Operating Expenses, or increases in Taxes or increases in Insurance Expenses for such calendar year shall be subject to a pro rata adjustment based upon the number of days in such calendar year prior to the expiration of the Term of this Lease. Tenant’s obligation to pay Tenant’s Share of increases in Operating Expenses, increases in Taxes and increases in Insurance Expenses (or any other amounts) accruing during, or relating to, the period prior to expiration or earlier termination of this Lease shall survive such expiration or termination. Tenant shall pay the amount due after the actual amounts are determined, in each case within thirty (30) days after Landlord sends a statement therefor. If the actual amount is less than the amount Tenant has paid as an estimate, Landlord shall refund the difference within thirty (30) days after such determination is made.

(iii) If the Building is less than ninety five percent (95%) occupied for all or a portion of any calendar year of the Term, inclusive of the Operating Expense Base Year, then those actual Operating Expenses for the calendar year in question which vary with occupancy levels in the Building (including for example, but not limited to, elevator maintenance costs, janitorial costs and management fees) shall be increased by Landlord, for the purpose of determining Tenant’s Share of excess Operating Expenses, to be the amount of Operating Expenses which Landlord reasonably determines would have been incurred during that calendar year if the Building had been at least ninety-five (95%) occupied throughout such calendar year.

(i) Tenant’s Audit Right. Landlord shall make available to Tenant, and Tenant shall have the right to conduct an audit of, Landlord’s books and records relating to Operating Expenses, Insurance Expenses and Taxes in accordance with the following terms and provisions, provided that Tenant delivers written notice of its intent to audit within ninety (90) days after receipt by Tenant of Landlord’s Statement and completes such audit within one hundred eighty (180) days after the date Landlord makes its relevant books and records available to Tenant:

(i) No Monetary Default on the part of Tenant then exists.

11

(ii) Tenant shall have the right to have an employee of Tenant or a Qualified Auditor (as defined below) inspect Landlord’s accounting records at Landlord’s office at reasonable times upon reasonable advance notice to Landlord.

(iii) Neither the employee of Tenant nor the Qualified Auditor shall be employed or engaged on a contingency basis, in whole or in part.

(iv) Prior to commencing the audit, Tenant and the auditor shall: (i) if the auditor is not an employee of Tenant, provide Landlord with evidence that the auditor is a certified public accountant from a licensed, regional accounting firm acceptable to Landlord in Landlord’s reasonable discretion with significant (i.e., at least the immediately preceding five (5) years’) experience in auditing operating expenses in first-class office buildings (a “Qualified Auditor”); and (ii) each sign a confidentiality letter, on reasonable terms, to be provided by Landlord.

(v) The audit shall be limited solely to confirming that the Operating Expenses and/or Insurance Expenses and/or Taxes reported in the Landlord’s Statement, and the calculations made by Landlord with respect thereto, are consistent with the terms of this Lease.

(vi) If Tenant’s auditor finds errors or overcharges in Landlord’s Statement that Tenant wishes to pursue, then within the time period set forth above Tenant shall advise Landlord thereof in writing with specific reference to claimed errors and overcharges and the relevant Lease provisions addressing such expenses. Landlord shall have a reasonable opportunity to meet with Tenant’s auditor (and any third auditor selected hereinbelow, if applicable) to explain its calculation of Operating Expenses, it being the understanding of Landlord and Tenant that Landlord intends to operate the Building as a first-class office building with services at or near the top of the market. If Landlord agrees with said findings, appropriate rebates or charges shall be made to Tenant. If Landlord does not agree, Landlord shall engage its own auditor to review the findings of Tenant’s auditor and Landlord’s books and records. The two (2) auditors and the parties shall then meet to resolve any difference between the audits.

(vii) If agreement cannot be reached within two (2) weeks thereafter, then the auditors shall together select a third auditor (who shall be a Qualified Auditor not affiliated with and who does not perform services for either party or their affiliates) to which they shall each promptly submit their findings in a final report, with copies submitted simultaneously to the first two (2) auditors, Tenant and Landlord. Within two (2) weeks after receipt of such findings, the third auditor shall determine which of the two reports best meets the terms of this Lease, which report shall become the “Final Finding”. The third auditor shall not have the option of selecting a compromise between the first two auditors’ findings, nor to make any other finding.

(viii) If the Final Finding determines that Landlord has overcharged Tenant, Landlord shall credit Tenant toward the payment of Base Rent or additional Rent next due and payable under this Lease the amount of such overcharge. If the Final Finding determines that Tenant was undercharged, then within thirty (30) days after the Final Finding, Tenant shall reimburse Landlord the amount of such undercharge.

12

(ix) If the Final Finding results in a determination that Landlord overstated Operating Expenses, Insurance Expenses and Taxes by more than five percent (5%) of Tenant’s Share of the Operating Expenses, Insurance Expenses and Taxes for the calendar year subject to the audit, Landlord shall pay its own audit costs and reimburse Tenant for its costs associated with said audits. If the Final Finding results in no credit to Tenant with respect to increases in Operating Expenses, Insurance Expenses and Taxes for the calendar year subject to the audit (or in a determination that Tenant underpaid increases in Operating Expense, Insurance Expenses and Taxes for such year), Tenant shall pay its own costs and shall reimburse Landlord for Landlord’s costs associated with said audits. In all other events, each party shall pay its own audit costs, including one half (1/2) of the cost of the third auditor.

(x) The results of any audit of Operating Expenses hereunder shall be treated by Tenant, all auditors, and their respective employees and agents as confidential, and shall not be discussed with nor disclosed to any third party, except for disclosures required by applicable law, court rule or order or in connection with any litigation or arbitration involving Landlord or Tenant.

6. Late Charge. Other remedies for non-payment of Rent notwithstanding, if any monthly installment of Base Rent or additional Rent is not received by Landlord on or before the date due, or if any payment due Landlord by Tenant which does not have a scheduled due date is not received by Landlord on or before the thirtieth (30th) day following the date Tenant was invoiced for such charge, a late charge of five percent (5%) of such past due amount shall be immediately due and payable as additional Rent; provided, however, that Tenant shall be entitled to notice and the passage of a five (5) day grace period prior to the imposition of such late charge on the first (1st) occasion in any calendar year in which Tenant fails to timely pay any amount due hereunder. Additionally, interest shall accrue on all delinquent amounts from the date past due until paid at a rate equal to the sum of three percent (3%) plus the “prime rate”, in effect from time to time, as quoted in the Wall Street Journal (the “Interest Rate”).

7. Partial Payment. No payment by Tenant or acceptance by Landlord of an amount less than the Rent herein stipulated shall be deemed a waiver of any other Rent due. No partial payment or endorsement on any check or any letter accompanying such payment of Rent shall be deemed an accord and satisfaction, but Landlord may accept such payment without prejudice to Landlord’s right to collect the balance of any Rent due under the terms of this Lease or any late charge or interest assessed against Tenant hereunder.

8. Security Deposit. [INTENTIONALLY OMITTED]

9. Use of Premises.

(a) Generally. Tenant shall use and occupy the Premises for general office purposes of a type customary for first-class office buildings and for other ancillary uses reasonably related to Tenant in its operations within the Premises (including, for example, a food preparation kitchen for product presentations) and consistent with the operation, maintenance and occupancy of the Building as a first-class office building (any non-office usage is subject to Landlord’s prior written consent, which shall not be unreasonably withheld) and for no other

13

purpose. The Premises shall not be used for any illegal purpose, nor in violation of any valid regulation of any governmental body, nor in any manner to create any nuisance or trespass, nor in any manner which will void the insurance or materially increase the rate of insurance on the Premises or the Building, nor in any manner inconsistent with the first-class nature of the Building.

(b) Hazardous Materials.

(i) Tenant shall not cause or permit the receipt, storage, use, location or handling on the Property (including the Building and Premises) of any product, material or merchandise which is explosive, highly inflammable, or a “Hazardous Material,” as that term is hereafter defined. “Hazardous Material” shall include all materials or substances which are listed in, regulated by or subject to any applicable federal, state or local laws, rules or regulations from time to time in effect, including, without limitation, hazardous waste (as defined in the Resource Conservation and Recovery Act); hazardous substances (as defined in the Comprehensive Emergency Response, Compensation and Liability Act, as amended by the Superfund Amendments and Reauthorization Act); gasoline or any other petroleum product or by-product or other hydrocarbon derivative; toxic substances (as defined by the Toxic Substances Control Act); insecticides, fungicides or rodenticide, (as defined in the Federal Insecticide, Fungicide, and Rodenticide Act); and asbestos, radon and substances determined to be hazardous under the Occupational Safety and Health Act or regulations promulgated thereunder. Notwithstanding the foregoing, Tenant shall not be in breach of this provision as a result of (A) the presence in the Premises of minor amounts of Hazardous Materials which are in compliance with all applicable laws, ordinances and regulations and are customarily present in a general office use (e.g., copying machine chemicals and kitchen cleansers), or (B) acts of third parties over whom Tenant has no reasonable control.

(ii) Without limiting in any way Tenant’s obligations under any other provision of this Lease, Tenant and its successors and assigns shall indemnify, protect, defend (with counsel approved by Landlord) and hold Landlord, its partners, officers, directors, shareholders, employees, agents, lenders, contractors and each of their respective successors and assigns (the “Indemnified Parties”) harmless from any and all claims, damages, liabilities, losses, costs and expenses of any nature whatsoever, known or unknown, contingent or otherwise (including, without limitation, attorneys’ fees, litigation, arbitration and administrative proceedings costs, expert and consultant fees and laboratory costs, as well as damages arising out of the diminution in the value of the Premises, the Property or any portion thereof, damages for the loss of the Premises or the Property or any portion thereof, damages arising from any adverse impact on the marketing of space in the Premises, and sums paid in settlement of claims), which arise during or after the Term in whole or in part as a result of the presence or suspected presence of any Hazardous Materials, in, on, under, from or about the Premises due to Tenant’s acts or omissions, except to the extent such claims, damages, liabilities, losses, costs and expenses arise out of or are caused by the negligence or willful misconduct of any of the Indemnified Parties. Landlord and its successors and assigns shall indemnify and hold Tenant and its successors and assigns harmless against all such claims or damages to the extent arising out of or caused by the negligence or willful misconduct of Landlord, its agents or employees. The indemnities contained herein shall survive the expiration or earlier termination of this Lease.

14

(c) Storage Space.

(i) Tenant shall have the Option to lease, on the terms of this Section 9(c), storage space on the Basement floor of the Building which storage space (the “Storage Space”) shall be identified in accordance with this Section 9(c), for a term (the “Storage Term”) that is coterminous with the Term, unless earlier terminated. If Tenant wishes to lease storage space, Tenant shall so inform Landlord in writing, and within thirty (30) days thereafter, Landlord shall inform Tenant in writing of the location and configuration of storage space, if any, which is then available for Tenant’s use (the “Storage Space Availability Notice”). Within thirty (30) days after receipt of the Storage Space Availability Notice, Tenant may by notice to Landlord (the “Storage Space Exercise Notice”) exercise its option to lease some or all of the storage space offered in the Storage Space Availability Notice, as specified by Tenant in the Storage Space Exercise Notice, in which case the specified Storage Space shall be leased on the terms of this Section 9(c) for a term commencing on the date specified in the Storage Space Exercise Notice. Tenant shall have the right to terminate its lease of the Storage Space (or discreet portions thereof) upon thirty (30) days’ notice to Landlord.

(ii) The Storage Space shall will be delivered in its “as-is” condition and be used by Tenant for the storage of equipment, inventory or other non-perishable items normally used in Tenant’s business, and for no other purpose whatsoever. Tenant agrees to keep the Storage Space in a neat and orderly fashion and to keep all stored items in cartons, file cabinets or other suitable containers. All items stored in the Storage Space shall be elevated at least 6 inches above the floor on wooden pallets, and shall be at least 18 inches below the bottom of all sprinklers located in the ceiling of the Storage Space, if any. Tenant shall not store anything in the Storage Space which is unsafe or which otherwise may create a hazardous condition, or which may increase Landlord’s insurance rates, or cause a cancellation or modification of Landlord’s insurance coverage. Without limitation, Tenant shall not store any flammable, combustible or explosive fluid, chemical or substance nor any perishable food or beverage products, except with Landlord’s prior written approval. Landlord reserves the right to adopt and enforce reasonable rules and regulations governing the use of the Storage Space from time to time. Upon expiration or earlier termination of Tenant’s rights to the Storage Space, Tenant shall completely vacate and surrender the Storage Space to Landlord in the condition in which it was delivered to Tenant, ordinary wear and tear excepted, broom-clean and empty of all personalty and other items placed therein by or on behalf of Tenant.

(iii) Tenant shall pay Rent for the Storage Space (“Storage Rent”) at a rental rate, throughout the Storage Term, of [**]* per rentable square foot per annum in equal monthly installments each payable in advance on or before the first day of each month. Any partial month shall be appropriately prorated. All Storage Rent shall be payable in the same manner that Base Rent is payable hereunder.

(iv) Except as otherwise provided herein, all terms and provisions of the Lease shall be applicable to the Storage Space, except that Landlord need not supply air-cooling, heat,

| * | CONFIDENTIAL INFORMATION HAS BEEN OMITTED AND HAS BEEN FILED SEPARATELY WITH THE SECURITIES AND EXCHANGE COMMISSION. |

15

water, janitorial service, cleaning, passenger or freight elevator service, window washing or electricity to the Storage Space and Tenant shall not be entitled to any allowances, rent credits, or expansion rights with respect to the Storage Space unless such concessions or rights are specifically provided for herein with respect to the Storage Space. Landlord shall not be liable for any theft or damage to any items or materials stored in the Storage Space, it being understood that Tenant is using the Storage Space at its own risk, except to the extent any loss or liability results from the negligence or willful misconduct of Landlord or its employees, agents or contractors (and in any event subject to the provisions of Section 22(e) below). The Storage Space shall not be included in the determination of Tenant’s Share nor shall Tenant be required to pay Operating Expenses, Insurance Expenses or Property Taxes in connection with the Storage Space.

(v) At any time and from time to time, Landlord shall have the right to relocate the Storage Space to a new location which shall be no smaller than the square footage of the Storage Space and no less accessible or usable than the Storage Space. Landlord shall pay the direct, out-of-pocket, reasonable expenses of such relocation.

10. Compliance with Laws.

(a) Tenant’s Obligations. Tenant, at its sole cost and expense, shall promptly comply with all statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity whether in effect now or later, including the Americans with Disabilities Act (collectively, “Law(s)”), regarding the operation of Tenant’s business and the use, condition (following Landlord’s completion of Landlord’s Work), configuration and occupancy of the Premises. In addition, Tenant shall, at its sole cost and expense, promptly comply with any Laws that relate to the Base Building, but only to the extent such obligations are triggered by Tenant’s use of the Premises, other than for general office use, or by Alterations or improvements performed by or for the benefit of Tenant. “Base Building” shall mean the structural portions of the Building, the public restrooms (it being acknowledged that restrooms on any full floor comprising the Premises are not “public” restrooms) and the Building mechanical, electrical, life-safety and plumbing systems and equipment located in the internal core of the Building on the floor or floors on which the Premises are located. Tenant shall promptly provide Landlord with copies of any notices it receives regarding an alleged violation of Law with respect to the Premises or Tenant’s occupancy of the Building. Tenant, at Tenant’s expense, may contest by appropriate proceedings in good faith the legality or applicability of any Law affecting the Premises, provided that (i) the Property or any part thereof (including the Premises) shall not be subject to being condemned or vacated by reason of non-compliance or otherwise by reason of such contest, (ii) no unsafe or hazardous condition remains unremedied as a result of such contest, (iii) such non-compliance or contest is not prohibited under any Security Documents (defined in Article 34) and Tenant posts any security required under such Security Documents in connection with such contest (or the non-compliance that is the subject thereof), (iv) such non compliance or contest shall not prevent Landlord from obtaining any and all permits and licenses then required by applicable Laws in connection with the operation of the Building, and (v) the Certificate of Occupancy for the Building (or any portion) is neither subject to being suspended by reason such of non-compliance or contest (any such proceedings instituted by Tenant being referred to herein as a “Compliance Challenge”). If Landlord may be subject to any civil fines

16

or penalties or other criminal penalties or may be liable to any third party by reason of the Compliance Challenge, then Tenant shall furnish to Landlord, at Tenant’s option, either (x) a bond of a surety company that is issued by, and in form and substance, reasonably satisfactory to Landlord, or (y) such other security that is reasonably satisfactory to Landlord, and, in either case, in an amount equal to one hundred twenty percent (120%) of the sum of (A) the cost of such compliance, (B) the criminal or civil penalties or fines that may accrue by reason of such non-compliance (as reasonably estimated by Landlord), and (C) the amount of such liability to third parties (as reasonably estimated by Landlord). If Tenant initiates any Compliance Challenge, then Tenant shall keep Landlord advised regularly as to the status of such proceedings. Landlord shall have the right to use the aforesaid bond or other security to satisfy any such fines or penalties that are levied or assessed against Landlord as a result of the Compliance Challenge; Landlord’s obligation to so return such bond or other security shall survive the expiration or sooner termination of this Lease. Landlord shall return to Tenant the aforesaid bond or other security (or the unapplied portion thereof, as the case may be), promptly after Tenant completes the Compliance Challenge. If Tenant institutes a Compliance Challenge which concludes on or after the date of expiration or termination of this Lease, Tenant’s obligations hereunder with respect to the compliance in question will survive the expiration or sooner termination of this Lease to the extent that the result of any Compliance Challenge is that Tenant is required to perform any compliance work.

(b) Landlord’s Obligations. Landlord represents to Tenant that, as of the Effective Date, Landlord has not received written notice from any governmental authority of any currently existing condition in the Premises or Base Building which has been interpreted as a material violation of Laws for which Landlord’s compliance is currently required. Landlord shall comply with all Laws relating to the performance of Landlord’s Work, as well as all Laws relating to the Base Building (exclusive of any Base Building systems that were constructed by or for the benefit of Tenant) and the Common Areas, provided that such compliance with Laws is not the responsibility of Tenant under this Lease, and provided further that Landlord shall not be in breach of this Section 10(b) unless failure to comply therewith would (1) prohibit Tenant from obtaining or maintaining a temporary certificate of occupancy or its equivalent for the Premises, (2) would affect the health or safety of Tenant’s employees, contractors or invitees, (3) would otherwise materially, adversely affect Tenant’s use of the Premises, (4) would expose Tenant to any material cost or liability, or (5) be inconsistent with the operation of the Building as a first-class office building. Notwithstanding the foregoing, Landlord shall have the right to contest in good faith any alleged violation of Law, including, without limitation, the right to apply for and obtain a waiver or deferment of compliance, the right to assert any and all defenses allowed by Law and the right to appeal any decisions, judgments or rulings to the fullest extent permitted by Law.

11. Rules and Regulations. The current rules and regulations of the Building (the “Rules and Regulations”), a copy of which is attached hereto as Exhibit D, and all reasonable rules and regulations and modifications thereto which Landlord may hereafter from time to time adopt and promulgate after notice thereof to Tenant are hereby made a part of this Lease and shall be observed and performed by Tenant, its agents, employees and invitees. Landlord shall not enforce the Rules and Regulations against Tenant in a manner materially more strict than Landlord’s enforcement of the Rules and Regulations against other tenants of the Building. In

17

the event of any inconsistency between the terms of the Rules and Regulations and the terms of this Lease, the terms of this Lease shall govern.

12. Services.

(a) Generally. The normal business hours of the Building (“Building Service Hours”) shall be from 8:00 A. M. to 6:00 P.M. on Monday through Friday and 9:00 A.M. to 1:00 P.M. on Saturday, exclusive of Building holidays as reasonably designated by Landlord which shall be generally recognized holidays (“Building Holidays”). Except when and where Tenant’s right of access is specifically prevented as a result of (i) an emergency, (ii) a requirement by law, or (iii) a specific provision set forth in this Lease, Tenant shall have the right of ingress and egress to the Premises, the Building, and the parking areas twenty-four (24) hours per day, seven (7) days per week. Initially and until further notice by Landlord to Tenant, the Building Holidays shall be: New Year’s Day, Presidents Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day. Landlord shall furnish the following services during the Building Service Hours except as noted:

(i) Passenger elevator service at all times;

(ii) Heating, ventilation and air conditioning (“HVAC”) reasonably adequate to allow for the comfortable occupancy of the Premises, subject to governmental regulations (so long as the occupancy level of the Premises and the heat generated by electrical lighting and fixtures do not exceed the following thresholds:

(1) Occupant Load: One (1) person per 200 rentable square feet;

(2) Equipment & Lighting Load: 5.0 watts per rentable square foot.

(iii) Water at all times for all restrooms and lavatories;

(iv) Janitorial service Monday through Friday (exclusive of Building Holidays) in accordance with the janitorial specifications set forth on Exhibit E attached hereto, subject to such reasonable changes to janitorial specifications as Landlord may elect so long as, at all times, the janitorial service provided by Landlord is consistent with that provided in Comparable Buildings;

(v) Electric power, at all times, for lighting and outlets not in excess of five (5) watts per rentable square foot of the Premises at 100% connected load (but Tenant shall pay for any electrical service in excess of the Electrical Allowance described in Section 12(b)(iii)); and

(vi) Replacement of Building standard lamps and ballasts as needed from time to time.

18

(b) Extra Services. Except as expressly set forth herein, Tenant shall have no right to any services in excess of those provided herein; however:

(i) Tenant shall have the right to receive HVAC service during hours other than Building Service Hours by paying Landlord’s then-standard charge for additional HVAC service and providing such prior notice as is reasonably specified by Landlord. Landlord’s current standard charge for after hours HVAC service is as follows: $75.00 per hour for fans only, $105.00 per hour (plus engineering and labor costs, if any) for heating and $170.00 per hour (plus engineering and labor costs, if any) for cooling, with a minimum of four (4) hours in each case. The foregoing charges are subject to change from time to time to the extent necessary to meet changes in Landlord’s cost of providing such service. Any such increased charge shall be based upon the actual cost of electricity consumed by the Building’s HVAC equipment and Landlord’s reasonable, good faith estimate of the cost of increased maintenance and wear and tear on the Building’s HVAC equipment plus such after-hours usage, and labor costs, if any, related to the provision of such after-hours HVAC service.