Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TRAVELZOO | form8k.htm |

| EX-99.1 - PRESS RELEASE - TRAVELZOO | ex99-1.htm |

Exhibit 99.2

Please read this management presentation together

with the Company’s press release issued earlier today

announcing the Company’s third quarter 2009 financial

results and in conjunction with

the Company’s recent

Annual Report and Quarterly Results as filed with the

Securities and Exchange Commission (SEC).

IMPORTANT NOTICE

Certain statements contained in this presentation that are not historical facts may be

forward looking statements within the meaning of Section 27A of the Securities Act of

1933, as amended, and Section

21E of the Securities and Exchange Act of 1934, as

amended. These forward looking statements may include, but are not limited to,

statements about our plans, objectives, expectations, prospects and intentions, markets in

which we participate

and other statements contained in this presentation that are not

historical facts. When used in this presentation, the words "expect," "predict," "project,"

"anticipate," "believe," "estimate," "intend," "plan," "seek" and similar expressions

are

generally intended to identify forward looking statements. Because these forward looking

statements involve risks and uncertainties, there are important factors that could cause

actual results to differ materially from those expressed

or implied by these forward looking

statements, including changes in our plans, objectives, expectations, prospects and

intentions and other factors discussed in our filings with the SEC. We cannot guarantee

any future levels of activity, performance

or achievements. Travelzoo Inc. undertakes no

obligation to update forward-looking statements to reflect events or circumstances

occurring after the date of this presentation.

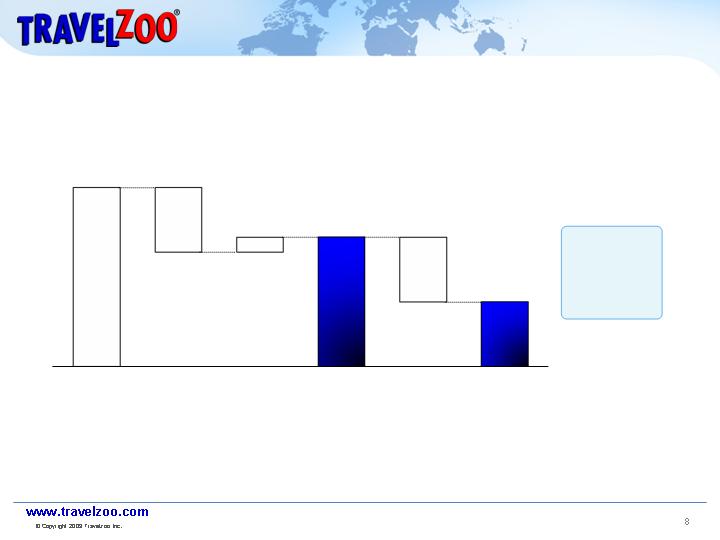

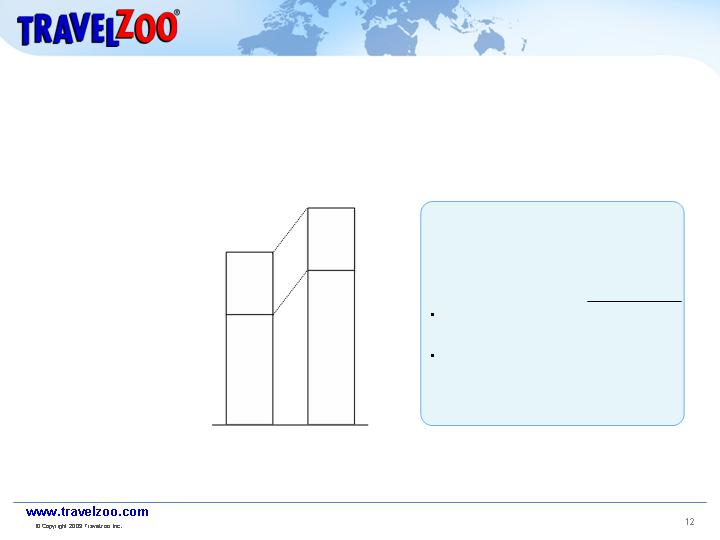

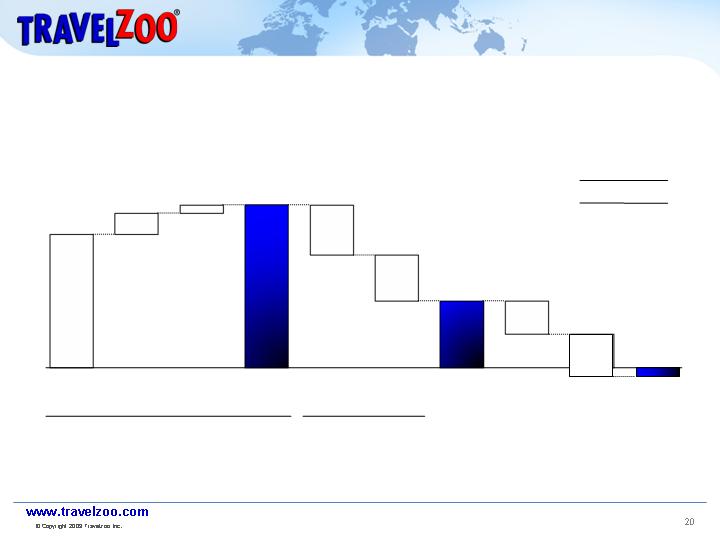

Revenues

(continuing operations)

$ millions

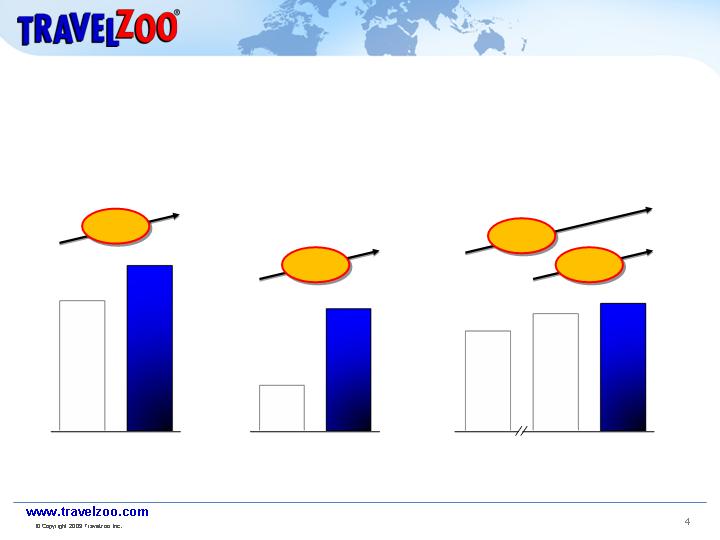

In a challenging economy, Travelzoo was able to close Q3 2009

with significant growth across our most important metrics.

Q3 2009 FINANCIAL PERFORMANCE

Q3

2008

Q3

2009

Q3

2008

Q2

2009

Q3

2009

Q3

2008

Q3

2009

EPS

(continuing operations)

$ per share

Subscribers

(continuing operations)

Millions

18.6

23.6

13.2

15.2

16.3

+27%

+167%

+7%

+24%

$0.03

$0.08

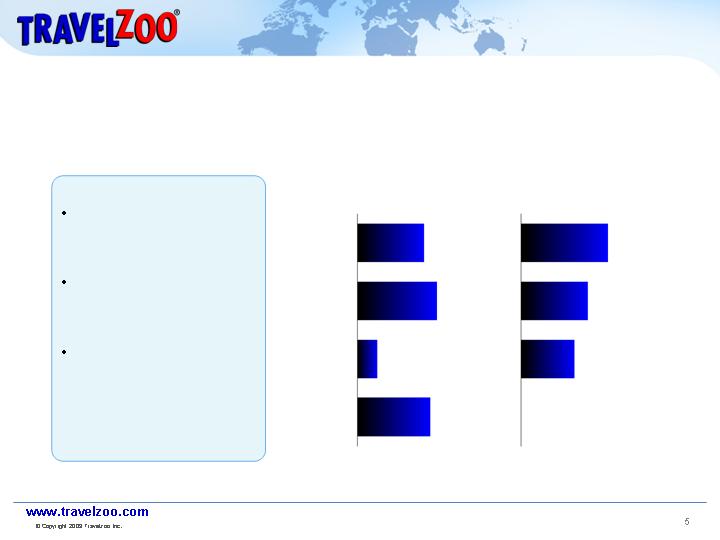

With the pending sale of our Asia Pacific assets, the business segment

is now being treated as discontinued operations.

2008

2009

Sale of Asia Pacific

assets expected to close

on October 31.

Asia Pacific business

segment treated as

discontinued operations

2008 EPS from

continuing operations:

$0.37, compared to

previously reported loss

of $(0.29) per share

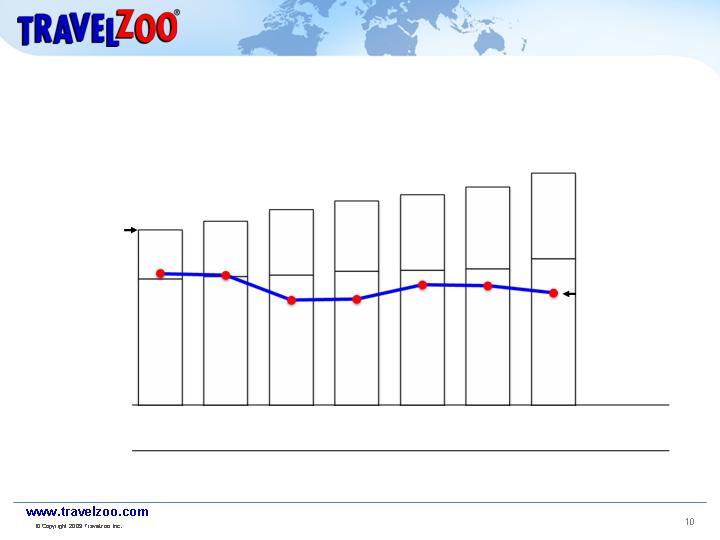

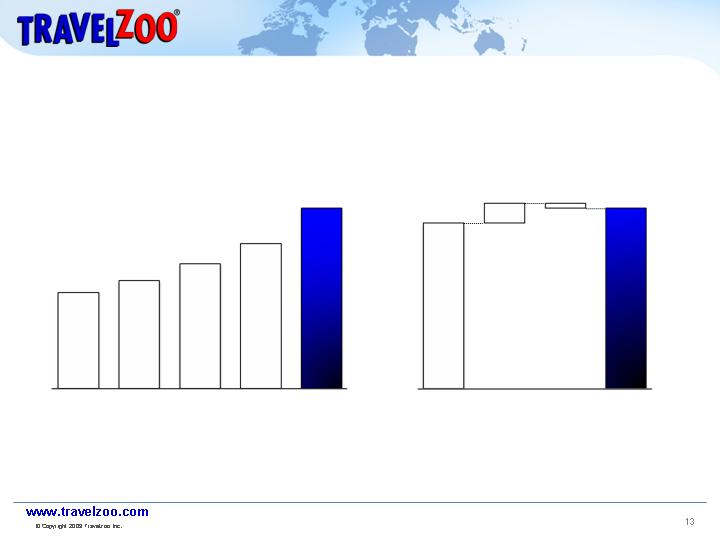

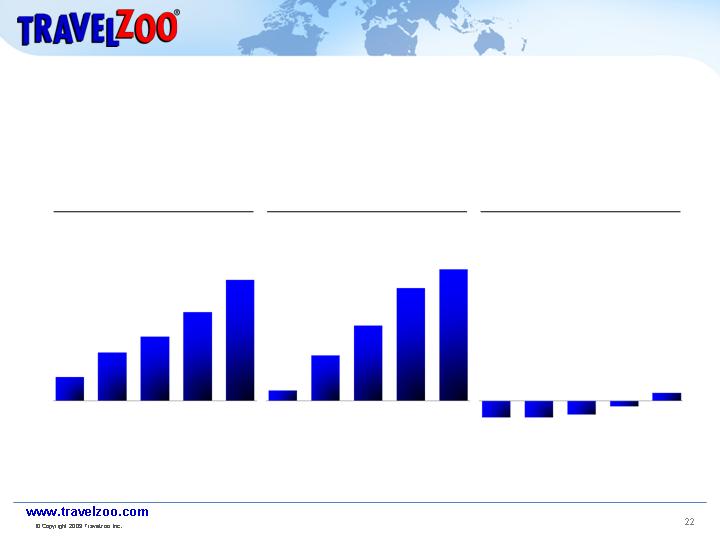

EPS FROM CONTINUING OPERATIONS

$ per share

Q1

Q2

Q3

Q4

0.10

0.13

0.03

0.11

0.13

0.10

0.08

N/A

Q1

2008

2009

2009

2008

2009

2008

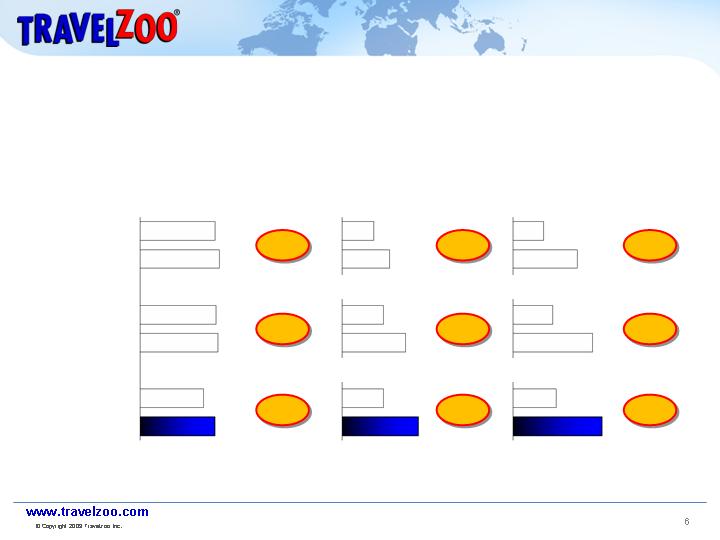

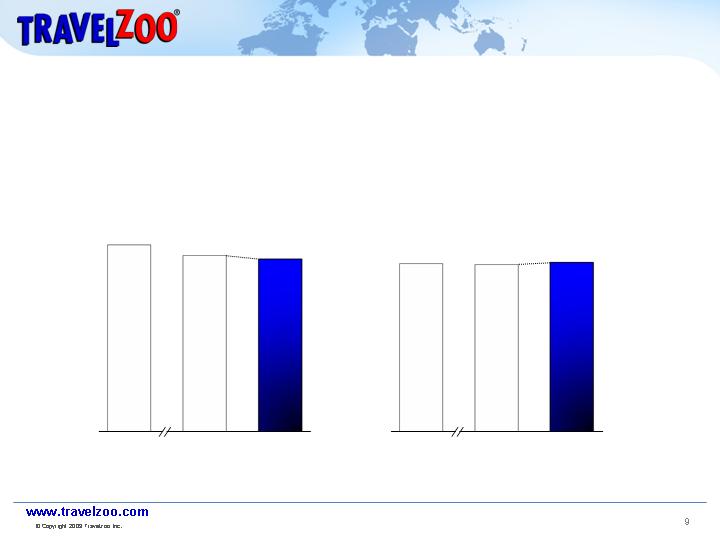

North America

$ millions

18.9

20.0

19.2

19.7

18.9

16.0

Europe

$ millions

Europe

(local currency)

£ millions

+6%

Year-over-year revenue growth accelerated in both North America and

Europe.

QUARTERLY REVENUES BY SEGMENT

2.0

3.0

2.6

4.0

4.8

2.6

1.0

2.1

1.3

2.6

2.9

1.4

Q2

Q3

+3%

+18%

+45%

+57%

+82%

+100%

+100%

+110%

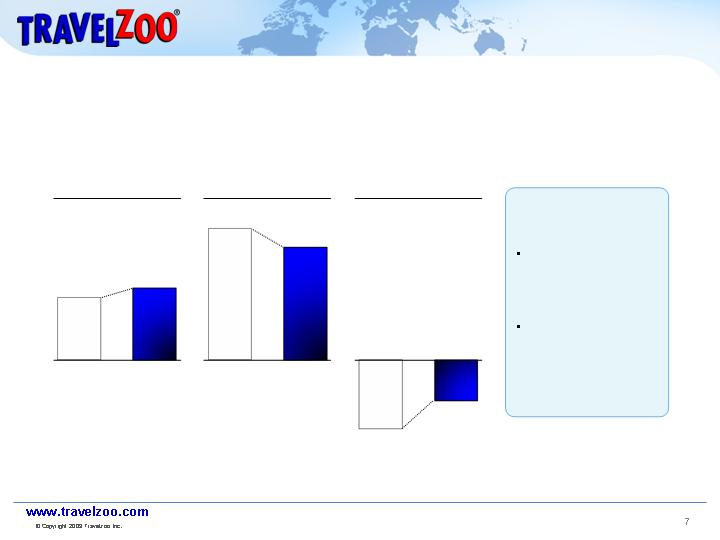

Operating income increased in spite of significantly higher spending on

subscriber acquisition and the launch of Fly.com.

Increased investment

levels in Q3 2009:

Subscriber acquisition

up by

$1.3 million

versus Q3 2008

Launch of Fly.com

added over

$1.6 million

in expenses, com-pared

to Q3 2008

Q3

2008

Q3

2009

2.0

2.3

Q3

2008

Q3

2009

4.2

3.6

Q3

2008

Q3

2009

(1.3)

Q3 OPERATING INCOME – 2009 VS. 2008

$ millions

Total*

North America

Europe

(2.2)

* From continuing operations

The effective tax rate continues to be high, as we treat losses from

Europe as not having a recognizable tax benefit.

Q3 2009 INCOME AND TAX EXPENSES*

$ millions

0.3

2.6

-1.3

1.3

-1.3

3.6

Operating

income

North

America

Operating

income

Europe

Non-

operating

income**

Income

from con-

tinuing

operations

before

income

taxes

Income

taxes

Income

from con-

tinuing

operations,

net of tax

Effective

tax income

rate 50%

* From continuing operations

** Interest income and foreign currency gain

Cash management during Q3 2009 improved slightly versus last year

and the previous quarter.

Q2

2009

Q3

2009

49

48

DSO

(Days Sales Outstanding)

# of days

Q3

2008

Q2

2009

15.8

15.5

Cash Balance

at End of Quarter*

$ millions

DSO AND CASH BALANCES

Q3

2008

52

Q3

2009

15.7

* Includes cash and cash equivalents

While headcount has increased, productivity has remained relatively

stable.

HEADCOUNT AND AVERAGE ANNUALIZED REVENUE PER EMPLOYEE*

Q1

2008

Q2

2008

Q3

2008

Q4

2008

Q1

2009

Q2

2009

Q3

2009

140

147

156

163

168

174

185

Europe

North America

39

44

52

56

60

65

68

101

103

104

107

108

109

117

Headcount

Average

annualized

revenues per

employee

(in $ thousands)

$598

$590

$477

$481

$547

$543

$510

* Continuing operations only

OPERATING EXPENSES – NORTH AMERICA DIVISION

$ millions and as percentage

of revenues

Q3

2008

Q3

2009

3.8

4.7

7.3

9.2

Sales &

Marketing

General &

Administrative

24%

46%

25%

49%

Operating expenses in North America increased, driven primarily by

increased spend on subscriber acquisition, SuperSearch, and Fly.com.

11.1

13.9

70%

74%

Major reasons for Y/Y increase

in operating expenses

Impact

Increased subscriber

acquisition

$0.6 million

Launch of Fly.com

$1.0 million

Increased marketing

for SuperSearch

$0.8 million

OPERATING EXPENSES – EUROPE DIVISION

$ millions and as percentage of revenues

Q3

2008

Q3

2009

1.7

1.7

3.1

4.3

Sales &

Marketing

General &

Administrative

66%

117%

35%

90%

In Europe, operating expenses as a percentage of revenues

declined in spite of increased spend on subscriber acquisition.

4.8

6.0

183%

125%

Major reasons for Y/Y increase

in operating expenses

Impact

Increased subscriber

acquisition

$0.8 million

Larger sales force

and production team

$0.4 million

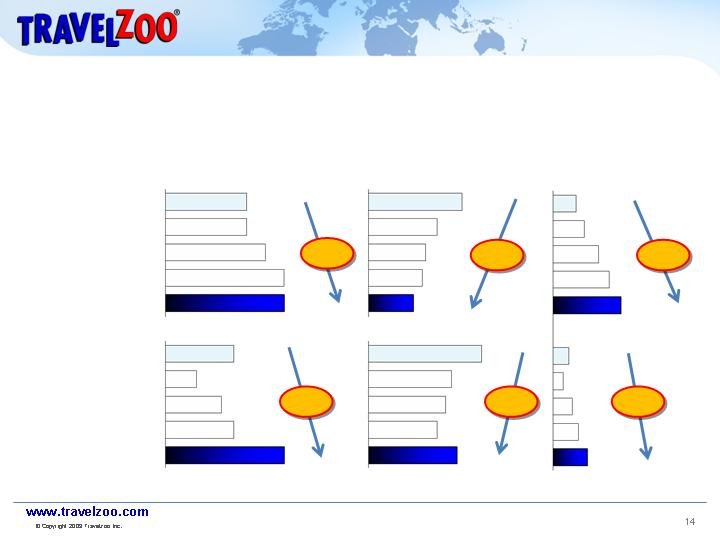

During Q3 2009 we further accelerated subscriber acquisition as we see

audience growth as investment into future revenues and profits.

Subscribers to Travelzoo publications

in North America & Europe

Millions

Quarter-over-quarter

comparison: Q3 09 vs. Q2 08

Millions

YE

2005

YE

2006

YE

2007

YE

2008

QE

Q3 2009

Total

sub-

scribers

at end of

Q2 2009

New

sub-

scribers

Sub-

scribers

removed

Total

sub-

scribers

at end of

Q3 2009

9.7

10.9

12.4

13.5

16.3

15.2

1.6

-0.5

16.3

Improved execution and lower media prices helped us drive down

acquisition costs for new subscribers significantly year-over-year.

Q3 2008

North

America

Europe

Q4 2008

Q1 2009

Q2 2009

Q3 2009

Q4 2008

Q1 2009

Q2 2009

Q3 2009

Q3 2008

1.3

Subscriber

acquisition expense

$ millions

1.3

1.6

1.9

1.9

1.1

0.5

0.9

1.9

1.1

3.73

Acquisition cost

per subscriber

$/subscriber

2.75

2.29

2.15

1.80

4.52

3.32

3.09

3.53

2.74

361

New subscribers

added

Thousands

488

720

885

1,076

254

160

297

542

408

+44%

-52%

+199%

+67%

-22%

+114%

Note: In Q3 2009 subscriber acquisition in Europe had an increased focus on Germany, where acquisition costs are higher.

International Expansion

Multiply the Travelzoo business in attractive international

markets; build global brand and global content

Expand scope of Travelzoo® business

Expand Travelzoo product offerings and content into

entertainment (e.g., Broadway shows, sports events)

Fly.com

Meta-search identified as opportunity with attractive

economics and great synergies with Travelzoo business

TRAVELZOO’S GROWTH STRATEGY

Our growth strategy is built on three pillars that include both

geographical and product expansion.

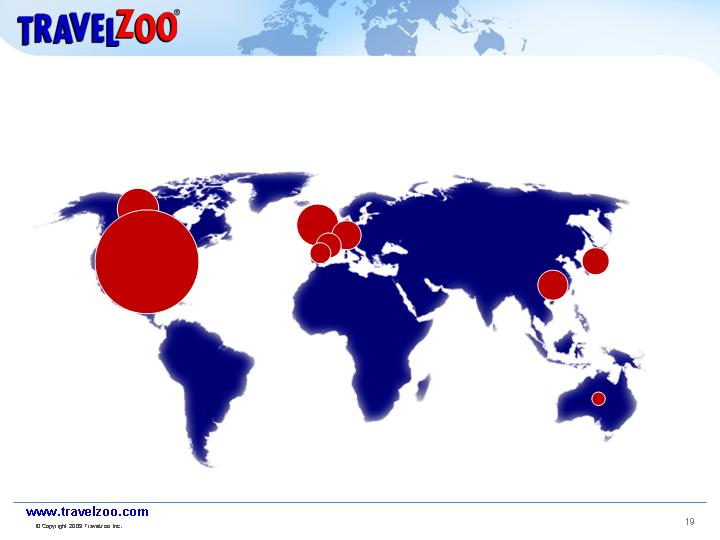

In 2005, Travelzoo’s subscriber base resided almost exclusively in the U.S.

We just started growing internationally.

TRAVELZOO SUBSCRIBERS BY COUNTRY AT END OF 2005

Millions

U.K.

0.3

Worldwide:

9.7 million subscribers

U.S.

9.4

Germany

0.4

From 2005 through 2008, we expanded primarily in Europe and launched

operations in Asia Pacific.

TRAVELZOO SUBSCRIBERS BY COUNTRY AT END OF 2008

Millions

Canada

0.9

U.K.

1.1

Spain

0.1

France

0.6

Greater

China*

0.7

Japan

0.3

Australia

0.1

U.S.

10.4

U.S.

10.4

* Includes Hong Kong, China, and Taiwan

Worldwide:

14.6 million subscribers

During 2009, we have begun re-igniting growth in North America, and

accelerated our expansion in Europe.

TRAVELZOO SUBSCRIBERS BY COUNTRY (AS OF Q3 2009)

Millions

Canada

1.1

U.K.

1.5

Germany

0.7

Spain

0.4

France

0.8

Greater

China*

0.9

Japan

0.6

Australia

0.3

U.S.

12.0

* Includes Hong Kong, Mainland China, and Taiwan

Worldwide:

18.2 million subscribers

The international expansion comes at a cost: Subscriber acquisition as

well as losses that have no immediate tax benefit, are dragging EPS down.

OPERATING INCOME AND NET INCOME ON PER-SHARE BASIS

$ per share

0.39

(0.12)

(0.11)

0.16

0.03

0.34

0.02

(0.08)

-0.02

(0.10)

Europe

Interest &

FX gains

Europe

Taxes

Loss from

discon-

tinued

operations

EPS

net loss

per share

Operating income

excluding subscriber acquisition

Subscriber acquisition

expenses

Q3 2009 EXAMPLE

North

America

North

America

Operating

income

before

taxes

As a result of our aggressive global expansion, EPS is impacted by

increased investments in subscriber acquisition.

EARNINGS FROM CONTINUING OPERATIONS,

INCLUDING AND EXCLUDING SUBSCRIBER ACQUISITION

Q3 2008

Q4 2008

Q1 2009

Q2 2009

Q3 2009

Operating income excluding

subscriber acquisition expense

$0.27

$0.27

$0.44

$0.38

$0.37

- Subscriber acquisition expense

$0.15

$0.12

$0.16

$0.18

$0.23

Operating income

$0.12

$0.15

$0.28

$0.20

$0.14

+ Currency gain and interest income

-

$0.03

($0.01)

-

$0.02

Income taxes

($0.09)

($0.07)

($0.14)

($0.10)

($0.08)

Income from continuing operations,

net of tax

$0.03

$0.11

$0.13

$0.10

$0.08

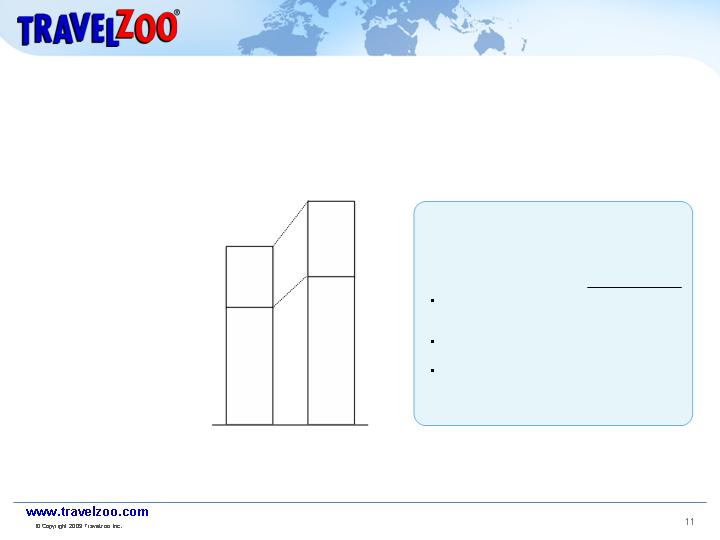

Over time, audience and revenue growth appear to drive profitability.

U.K. EXAMPLE: SUBSCRIBERS, REVENUES AND OPERATING

INCOME/LOSS

Millions, and £ millions

0.3

Subscribers at Year-End*

0.6

0.8

1.1

1.5*

0.4

1.7

2.8

4.2

4.9**

(0.6)

(0.6)

(0.5)

(0.2)

0.3**

Revenues

Operating income/loss

2005

2006

2007

2008

2009*

2005

2006

2007

2008

2009**

2005

2006

2007

2008

2009**

* Subscribers at end of Q3 2009

** Q1 through Q3 only

In our international markets revenues are growing faster than expenses,

bringing us closer to our goal of profitability in each country.

COMPARISON OF REVENUE GROWTH, EXPENSES AND

OPERATING MARGINS BY COUNTRY

Percent*

U.K.

Canada

Germany

France

Spain

Year launched

2005

2006

2006

2007

2008

Revenue growth*

Q3 2009 over Q3 2008

40%

86%

240%

228%

> 1000%

Growth in expenses*

Q3 2009 over Q3 2008

25%

(8%)

33%

13%

24%

Operating margin

Q3 2007

(10%)

(22%)

> (1,000%)

n/a

n/a

Q3 2008

(6%)

(25%)

(330%)

(371%)

n/a

Q3 2009

5%

38%

(69%)

(62%)

(256%)

* Growth rates calculated based on revenues and expenses in US-dollars

Close sale of Asia Pacific assets

(Keeping option to purchase back Asia Pacific

business in the future)

Continue to grow audience in Europe, while moving

operations closer to positive income/contribution

Monetize the increased audience in North America

Aggressively sell global audience; produce global

content

Continue expansion into entertainment

Grow Fly.com audience and revenues

MANAGEMENT FOCUS Q4 2009 AND 2010