Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF CHAPMAN PETROLEUM ENGINEERING, LTD. - Freedom Holding Corp. | ex231ka033109.htm |

| EX-32.1 - SECTION 1350 CERTIFICATIONS - Freedom Holding Corp. | ex321ka033109.htm |

| EX-31.1 - RULE 13A-14(A)/15D-14(A) CERTIFICATIONS - Freedom Holding Corp. | ex311ka033109.htm |

| EX-31.2 - RULE 13A-14(A)/15D-14(A) CERTIFICATIONS - Freedom Holding Corp. | ex312ka033109.htm |

| EX-23.2 - CONSENT OF HANSEN, BARNETT & MAXWELL, P.C. - Freedom Holding Corp. | ex232ka033109.htm |

| EX-32.2 - SECTION 1350 CERTIFICATIONS - Freedom Holding Corp. | ex322ka033109.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K/A

(Amendment No. 1)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE |

For the fiscal year ended March 31, 2009

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to _________

Commission File Number 001-33034

BMB MUNAI, INC.

(Exact name of registrant as specified in its charter)

|

Nevada |

|

30-0233726 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

202 Dostyk Ave, 4th Floor |

|

|

|

Almaty, Kazakhstan |

|

050051 |

|

(Address of principal executive offices) |

|

(Zip Code) |

+7 (727) 237-51-25

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act:

|

Title of Each Class |

|

Name of Exchange on Which Registered |

|

|

|

|

|

Common - $0.001 |

|

American Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

|

o Yes x No |

|

|

o Yes x No |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|

x Yes o No |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filed, an accelerated filer, or non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

Large accelerated Filer o |

Accelerated filer x |

|

|

Non-accelerated Filer o |

Smaller reporting company o |

|

|

(Do not check if smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.)

|

|

o Yes x No |

As of September 30, 2008 the aggregate market value of the common voting stock held by non-affiliates of the issuer based upon the closing stock price of $4.15 per share was approximately $152,710,000.

As of May 28, 2009, the registrant had 47,378,420 shares of common stock, par value $0.001, issued and outstanding.

Documents Incorporated by Reference

Portions of the Registrant’s proxy statement for its 2009 Annual Meeting of Shareholders filed with the Securities and Exchange Commission pursuant to Regulation 14A on July 1, 2009, as revised on July 30, 2009 are incorporated by reference into Part III of this report.

2

Table of Contents

|

|

PART I |

|

|

|

|

Page |

| EXPLANATORY NOTE |

3 |

|

|

|

|

|

|

Item 1. |

Business |

7 |

|

|

|

|

|

Item 1A. |

Risk Factors |

12 |

|

|

|

|

|

Item 1B. |

Unresolved Staff Comments |

23 |

|

|

|

|

|

Item 2. |

Properties |

24 |

|

|

|

|

|

Item 3. |

Legal Proceedings |

33 |

|

|

|

|

|

Item 4. |

Submission of Matters to a Vote of Security Holder |

34 |

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

35 |

|

|

|

|

|

Item 6. |

Selected Financial Data |

36 |

|

|

|

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

37 |

|

|

|

|

|

Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk |

53 |

|

|

|

|

|

Item 8. |

Financial Statements and Supplementary Data |

55 |

|

|

|

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

55 |

|

|

|

|

|

Item 9A. |

Controls and Procedures |

55 |

|

|

|

|

|

Item 9B. |

Other Information |

58 |

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

Item 10. |

Directors, Executive Officers and Corporate Governance |

58 |

|

|

|

|

|

Item 11. |

Executive Compensation |

58 |

|

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

58 |

|

|

|

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

58 |

|

|

|

|

|

Item 14. |

Principal Accounting Fees and Services |

59 |

|

|

|

|

|

Item 15. |

Exhibits, Financial Statement Schedules |

59 |

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

SIGNATURES |

63 |

3

Explanatory Note to Amendment No. 1 to Annual Report on Form 10-K

BMB Munai, Inc. (the “Company”) is filing this Amendment No. 1 on Form 10-K/A (the “First Amendment”) to amend its Annual Report on Form 10-K for the fiscal year ended March 31, 2009, which was filed with the Securities and Exchange Commission (“SEC”) on June 15, 2009 (the “Original Annual Report”). This First Amendment is being filed in response to certain comments raised by the staff of the SEC in connection with prior year reports. During the fourth quarter of the fiscal year ended March 31, 2008, the Company discovered certain errors in its accounting for deferred income taxes during the fiscal years ended March 31, 2006, 2007 and during the interim periods of fiscal 2008. Believing these adjustments to be changes in accounting estimates rather than accounting errors, the Company reported the accounting adjustments in its annual report on Form 10-K for the year ended March 31, 2008, as fourth quarter adjustments. During that fourth quarter, the Company also implemented new policies to enhance its controls to require its reporting manager to become more familiar with Kazakhstan taxation issues and to require the reporting manager to specifically give consideration to taxation issues in connection with the preparation of the Company’s annual and interim financial statements.

Subsequent to filing the Form 10-K for the year ended March 31, 2008, the Company determined the adjustments reported for the accounting for deferred income taxes was a correction of an error rather than a change in estimate, as disclosed in the Current Report on Form 8-K filed on July 8, 2009 and subsequent amendments thereto.

The changes presented in this First Amendment, as detailed below, are made to present corrected prior period financial information and disclosure of accounting for deferred income taxes for the year ended March 31, 2008, as well as the interim periods for that fiscal year. As noted above, the Company had enhanced its controls and procedures for the accounting for deferred income taxes as of March 31, 2008. Therefore, all adjustments presented in this amendment relate to periods prior to March 31, 2008. Periods subsequent to March 31, 2008 are not effected as controls and procedures for deferred income taxes were operating effectively.

Item 6 Selected Financial Data of the Original Annual Report is hereby amended to provide corrected Net income/(loss), Basic income/(loss) per common share figures for the fiscal years ended March 31, 2008, 2007 and 2006 and corrected Diluted income/(loss) per common share, Oil and gas properties, full cost method, net, Total assets, Total long term liabilities and Total Shareholders’ equity figures for the years ended March 31, 2007 and 2006.

Item 7 Management’s Discussion and Analysis of Financial Condition and Results of Operations is also hereby amended to correct the net income and basic and diluted income per share disclosure for the years ended March 31, 2008 and 2007.

4

Item 8 “Financial Statements and Supplementary Data” is hereby amended to reflect the changes discussed in the preceding paragraphs and to provide the correct Income Tax Benefit figures at March 31, 2008 and 2007 and corrected Stockholders’ Equity figures at March 31, 2007 and 2006. Note 2 has been revised to add a Restatement of Financial Statements section. Note 13 Income Taxes is hereby amended to provide corrected disclosure regarding our income tax accounting. Note 20 - Earnings Per Share Information has been amended to reflect the changes discussed above. Note 24 - Quarterly Financial Data (unaudited) is hereby amended to provide corrected Net income and Basic net income per share figures for the fiscal year ended March 31, 2008 and to provide corrected Net(loss)/ income, Basic net (loss)/income per share and Diluted net (loss)/income per share figures for the fiscal year ended March 31, 2007.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, this First Amendment also includes currently dated certifications from the Company’s Chief Executive Officer and Chief Financial Officer as required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002. The certification exhibits and signatures have been revised accordingly. A new consent of Hansen, Barnett & Maxwell, P.C. has also been included to the incorporation by reference of this First Amendment into the Registration Statement of the Company on Form S-3, as amended, currently on file with the Securities and Exchange Commission.

This First Amendment speaks only to the original filing date of the Original Annual Report, and except for those Items discussed in this explanatory note, is unchanged from the Original Annual Report. This First Amendment does not reflect events after the filing of the Original Annual Report or modify or update those disclosures affected by subsequent events. Therefore, you should read this First Amendment together with the other reports of the Company that update and supersede the information contained in this First Amendment.

5

Forward Looking Information

This annual report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended that are based on management’s beliefs and assumptions and on information currently available to our management. For this purpose any statement contained in this annual report that is not a statement of historical fact may be deemed to be forward-looking, including, but not limited to, statements about our results of operations, cash flows, capital resources and liquidity, drilling plans and future exploration, production and well operations, reserves, licensing, commodity price environment, actions, intentions, plans, strategies and objectives. Without limiting the foregoing, words such as “expect,” “project,” “estimate,” “believe,” “anticipate,” “intend,” “budget,” “plan,” “forecast,” “predict,” “may,” “should,” “could,” “will” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties and actual results may differ materially depending on a variety of factors, many of which are not within our control. These factors include, but are not limited to, market factors, market prices (including regional basis differentials) of natural gas and oil, results for future drilling and marketing activity, future production and costs, economic conditions, competition, legislative requirements and changes and the effect of such on our business, sufficiency of future working capital, borrowings, capital resources and liquidity and other factors detailed herein and in our other Securities and Exchange Commission filings. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated.

Forward-looking statements are predictions and not guarantees of future performance or events. The forward-looking statements are based on current industry, financial and economic information, which we have assessed but which by their nature are dynamic and subject to rapid and possibly abrupt changes. Our actual results could differ materially from those stated or implied by such forward-looking statements due to risks and uncertainties associated with our business. We hereby qualify all our forward-looking statements by these cautionary statements.

These forward-looking statements speak only as of their dates and should not be unduly relied upon. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Throughout this annual report, unless otherwise indicated by the context, references herein to the “Company”, “BMB”, “we”, our” or “us” means BMB Munai, Inc, a Nevada corporation, and its corporate subsidiaries and predecessors. Throughout this annual report all references to dollar amounts ($) refers to U.S. dollars unless otherwise indicated.

The following discussion should be read in conjunction with our financial statements and the related notes contained elsewhere in this report and in out our other filings with the Securities and Exchange Commission.

6

PART I

|

Item 1. |

Business |

Overview

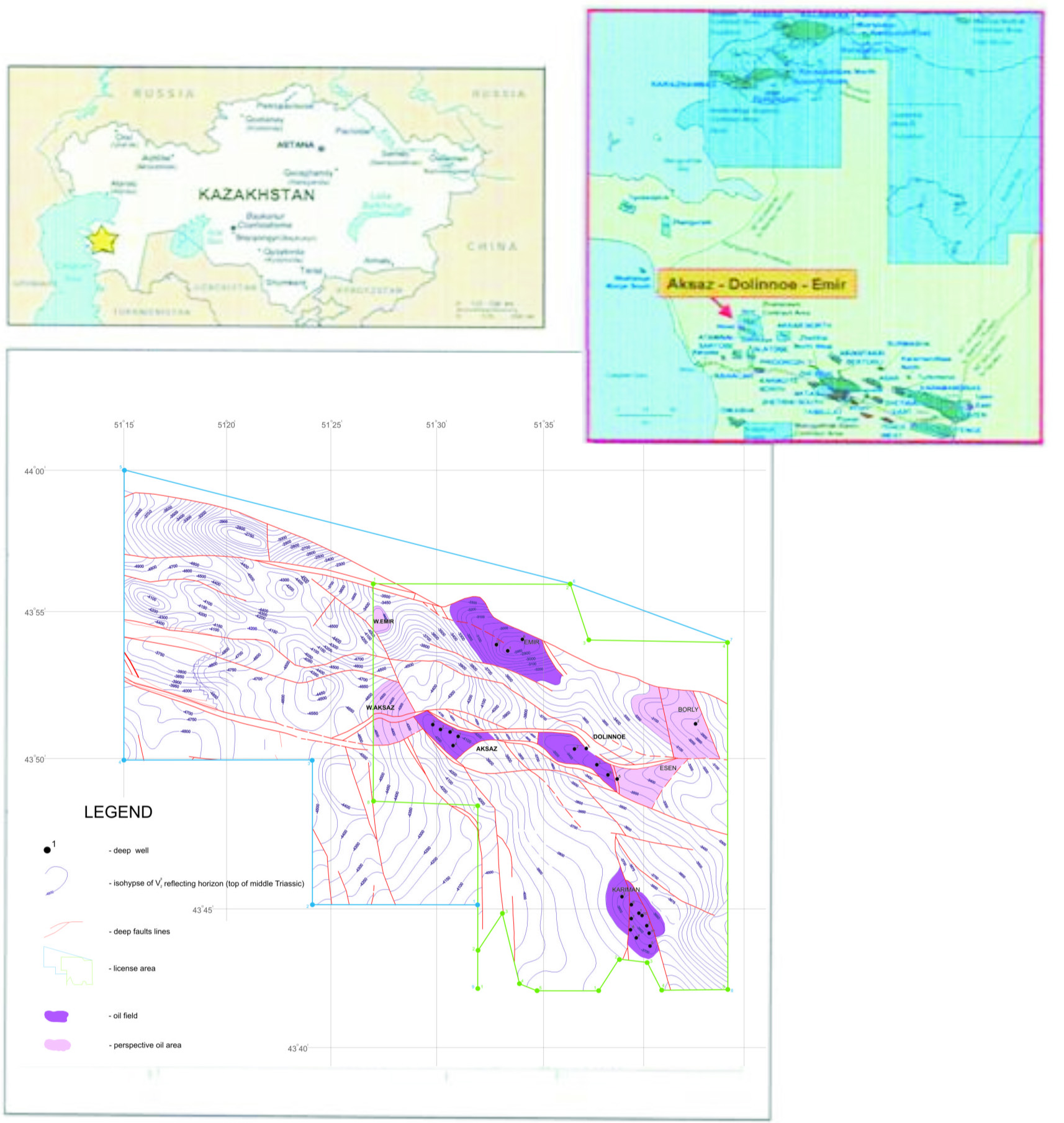

BMB Munai, Inc., our company, is organized under the laws of the State of Nevada. Our business activities focus on oil and natural gas company exploration and production in the Republic of Kazakhstan (sometimes also referred to herein as the “ROK” or “Kazakhstan”). We hold an exploration contract that allows us to conduct exploration drilling and oil production in the Mangistau Province in the southwestern region of Kazakhstan. Since the date of execution of the original exploration contract, we have successfully negotiated several amendments to the contract that have extended the term of the contract to January 2013 and extended the territory of the contract area to approximately 850 square kilometers.

Our original contract area comprised the ADE Block. As a result of our drilling and exploration activities this block now contains our Aksaz, Dolinnoe and Emir oil and gas fields. We then were granted an area extension which we designated as the Southeast Block, which now includes our Kariman oil and gas field and our unexplored Borly and Yessen structures. During our 2009 fiscal year we successfully negotiated a second area extension, which we have designated the Northwest Block. All of our exploration territory is contiguous. The ADE Block, the Southeast Block and the Northwest Block are collectively referred to herein as “our properties.”

Industry and Economic Factors

Our business is subject to many factors beyond our control. Foremost is the fluctuation of oil and gas prices. Historically, oil and gas markets have been cyclical and volatile. During fiscal year 2009 we experienced wide fluctuation in the world price for oil. We expect prices to continue to be difficult to predict.

While our revenues are a function of both production and prices, wide swings in commodity prices will likely continue to have a significant impact on our results of operations. We have not elected to engage in hedging transactions because we do not have the necessary infrastructure or the required flexibility in our rights to conduct export transactions.

Our operations entail significant complexities due to the depth and geological makeup of the structures we are entering. Advanced technologies requiring highly trained personnel are utilized in both exploration and development. Even when the technology is properly used, we still may not know conclusively whether hydrocarbons will be present nor the rate at which they may be produced when wells are completed. Despite our best efforts to limit our risks, exploration drilling is a high-risk activity that may not yield commercial production or reserves.

Our business, as with other extractive industries, depletes our reserves and therefore oil and gas produced must be replaced for our Company to remain viable. During the past fiscal year we have realized a net increase in our reserves over the end of fiscal year 2008.

7

Our Strategy

Since 2004 we have been actively drilling wells in each field on the ADE Block and since 2005 we have been drilling in the Southwest Block in the Kariman field. Our activities have been funded through private placements of equity and debt securities as well as income generated from sales of our exploration stage oil production.

Our drilling activities have consisted in drilling an array of exploratory wells to delineate reservoir structures and developmental wells intended to provide income to the Company. Our operational focus during the last fiscal year has been to continue our practice of increasing our oil reserves by developing resource category assets to reserve category assets and proved undeveloped reserves to proved developed reserves. Currently, we have 1,230 gross (1,230 net) proved developed producing acres, plus 180 gross (180 net) acres of proved undeveloped reserves. We also hold approximately 112,260 gross (112,260 net) unproved, undeveloped acres.

During the last fiscal year we completed a very active three-year drilling program on our territory. During this time we drilled 17 wells to an average depth of 3,800 meters. Beginning in September of 2008 we began to phase out our new well drilling activities and we have released four large drilling rigs since that date as current drilling projects were completed.

Our strategy for the current year is to establish a sound financial basis to support our development of a long-term and profitable oil and gas exploration and production business. We intend to do this by focusing our attention in the next fiscal year on the following objectives:

Reduce our current accounts payable. As a result of the collapse of world oil prices in 2008, depressed local oil prices, contractual commitments to drillers and the tax structure imposed on oil exporters by the ROK, we saw significant increase in our current accounts payable over our current assets. Responding to this financial stress has required us to seek special arrangements with creditors and to temporarily cease drilling new wells. We made significant progress in reducing our current accounts payable during the later part of the fiscal year.

Conduct field operations focused on maximizing production and field delineation. We will focus on increasing our oil production without substantial capital outlay during the next fiscal year. We are concentrating efforts on stabilizing production from our existing wells by using a smaller workover rig and by installing pumps on various wells to establish consistent production in each of our oil fields.

Our existing wells are sufficient in number to allow us to integrate our geological and geophysical reports, seismic data, drilling logs, testing and production logs to create a complete profile of the ADE Block and Kariman field. Similar to most oil production in Kazakhstan, our oil is produced mainly from carbonate rocks of limestone and dolomite. These formations can prove to be challenging when attempting to understand oil field structure, designate well locations and determination of the number of wells required to develop a field. A full understanding of these issues is critical, as they can have a substantial impact on a field’s commercial viability and the expect return on investment. We have engaged experts in the United States with experience working in Kazakhstan with these issues to assist our internal engineering staff.

8

Commence investigation of the Northwest Block. Our contract territory nearly doubled during the last fiscal year due to our successful negotiation of an amendment to our exploration contract to acquire rights to the Northwest Block. The Northwest Block did have limited Soviet-period exploration and drilling conducted on it. It is our intention to review the historical geological records of the area and to conduct new 3D seismic studies of this Block during the coming fiscal year. We anticipate that the seismic work will be complete during the current fiscal year and that interpretation of the data will be available in the second calendar quarter of 2010.

Oil and Natural Gas Reserves

The following table sets forth our estimated net proved oil and natural gas reserves and the standardized measure of discounted future net cash flows related to such reserves as of March 31, 2009. We engaged Chapman Petroleum Engineering, Ltd. (“Chapman”), to estimate our net proved reserves, projected future production and the standardized measure of discounted future net cash flows as of March 31, 2009. Chapman’s estimates are based upon a review of production histories and other geologic, economic, ownership and engineering data provided by us. Chapman has independently evaluated our reserves for the past several years. In estimating the reserve quantities that are economically recoverable, Chapman used oil and natural gas prices in effect as of March 31, 2009 without giving effect to hedging activities. In accordance with requirements of the Securities and Exchange Commission (the “SEC”) regulations, no price or cost escalation or reduction was considered by Chapman. The standardized measure of discounted future net cash flows is not intended to represent the current market value of our estimated oil and natural gas reserves. The oil and natural gas reserve data included in, or incorporated by reference in this document, are only estimates and may prove to be inaccurate.

|

|

Proved reserves to be recovered by January 9, 2013(1) |

|

Proved reserves to be recovered after January 9, 2013(1) |

|

|

||||

|

|

Developed(2) |

|

Undeveloped(3) |

|

Developed(2) |

|

Undeveloped(3) |

|

Total |

|

Oil and condensate (MBbls)(4) |

6,850 |

|

833 |

|

14,220 |

|

1,738 |

|

23,641 |

|

Natural gas (MMcf) |

- |

|

- |

|

- |

|

- |

|

- |

|

Total BOE (MBbls) |

6,850 |

|

833 |

|

14,220 |

|

1,738 |

|

23,641 |

|

|

|

|

|

|

|

|

|

|

|

|

Standardized Measure of discounted future net cash flows(5) (in thousands of U.S. Dollars) |

|

|

|

|

|

|

|

|

$253,352 |

|

(1) |

Under our exploration contract we have the right to sell the oil and natural gas we produce while we undertake exploration stage activities within our licensed territory. As discussed in more detail in “Risk Factors” and “Properties” we have the right to engage in exploration stage activities until January 9, 2013. To retain our rights to produce and sell oil and natural gas after that date, we must apply for and be granted commercial production rights by no later than January 2013 or obtain a further extension of our exploration contract. If we are not granted commercial production rights or another extension by that time, we would expect to lose our rights to the licensed territory and would expect to be unable to produce reserves after January 2013. |

9

|

(2) |

Proved developed reserves are proved reserves that are expected to be recovered from existing wells with existing equipment and operating methods. |

|

(3) |

Proved undeveloped reserves are proved reserves which are expected to be recovered from new wells on undrilled acreage or from existing wells where a relatively major expenditure is required for recompletion. |

|

(4) |

Includes natural gas liquids. |

|

(5) |

The standardized measure of discounted future net cash flows represents the present value of future net cash flow net of all taxes. |

The reserve data set forth herein represents estimates only. Reserve engineering is a subjective process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact manner. The accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. As a result, estimates made by different engineers often vary. In addition, results of drilling, testing and production subsequent to the date of an estimate may justify revision of such estimates, and such revisions may be material. Accordingly, reserve estimates are generally different from the quantities of oil and natural gas that are ultimately recovered. Furthermore, the estimated future net revenue from proved reserves and the present value thereof are based upon certain assumptions, including current prices, production levels and costs that may vary from what is actually incurred or realized.

No estimates of proved reserves comparable to those included herein have been included in reports to any federal agency other than the SEC.

In accordance with SEC regulations, the Chapman Report used oil and natural gas prices in effect at March 31, 2009. The prices used in calculating the standardized measure of discounted future net cash flows attributable to proved reserves do not necessarily reflect market prices for oil and natural gas production subsequent to March 31, 2009. There can be no assurance that all of the proved reserves will be produced and sold within the periods indicated, that the assumed prices will actually be realized for such production or that existing contracts will be honored or judicially enforced.

Marketing and Sales to Major Customers

There are a variety of factors which affect the market for oil and natural gas, including the extent of domestic production and imports of oil and natural gas, the availability, proximity and capacity of natural gas pipelines and other transportation facilities, demand for oil and natural gas, the marketing of competitive fuels and the effects of state and federal regulations on oil and natural gas productions and sales.

In the exploration, development and production business, production is normally sold to relatively few customers. We are now exporting nearly all of our test production for sale in the world market. Currently, 81% of our production is being sold to one client, Titan Oil (former Euro-Asian Oil AG). Revenue from oil sold to Titan Oil made up 94% of our total revenue. The loss of Titan Oil may have a material adverse effect on our operations in the short-term. Based on current demand for crude oil and the fact that alternate purchasers are readily available, we believe the loss of Titan Oil would not materially adversely effect our operations long-term.

10

Our crude oil exports are transported via the Aktau sea port to world markets. Pursuant to our agreement with Titan Oil (formerly Euro-Asian Oil AG), delivery is FCA (Incoterms 2000) at the railway station in Mangishlak. The oil is shipped via railway cars provided by Titan Oil (formerly Euro-Asian Oil AG). The volume and sales price are determined on a monthly basis, with all payments being covered by an irrevocable standby letter of credit opened through a first-class international bank. Sales prices is based on the average quoted Brent crude oil price from Platt's Crude Oil Marketwire for the three days following the bill of lading date less a discount for transportation expenses, freight charges and other expenses. The quality of crude oil supplied must meet minimum quality specifications.

Competition

Competition in Kazakhstan and Central Asia includes other junior hydrocarbons exploration companies, mid-size producers and major exploration and production companies. We compete for additional exploration and production properties with these companies who in many cases have greater financial resources and larger technical staffs than we do.

We face significant competition for capital from other exploration and production companies and industry sectors. At times, other industry sectors may be more in favor with investors, limiting our ability to obtain necessary capital. However, we expect that our success and market exposure during the past several years has positioned us to seek financing to meet our business objectives.

We believe we have a competitive advantage in Kazakhstan in that our management team is comprised of Kazakh nationals who have developed trusted relationships with many of the departments and ministries within the government of Kazakhstan.

Government Regulation

Our operations are subject to various levels of government controls and regulations in both the United States and Kazakhstan. We focus on compliance with all legal requirements in the conduct of our operations and employ business practices that we consider to be prudent under the circumstances in which we operate. It is not possible for us to separately calculate the costs of compliance with environmental and other governmental regulations as such costs are an integral part of our operations.

In Kazakhstan, legislation affecting the oil and gas industry is under constant review for amendment or expansion. Pursuant to such legislation, various governmental departments and agencies have issued extensive rules and regulations which affect the oil and gas industry, some of which carry substantial penalties for failure to comply. These laws and regulations can have a significant impact that can adversely affect our profitability by increasing the cost of doing business and by imposition of new taxes, tax rates and tax schemes. Inasmuch as new legislation affecting the industry is commonplace and existing laws and regulations are frequently amended or reinterpreted, we are unable to predict the future cost or impact of complying with such laws and regulations.

11

Employees

We have approximately 360 full-time employees. None of our employees are covered by collective bargaining agreements. From time to time we utilize the services of independent consultants and contractors to perform various professional services. Field and on-site production operation services, such as pumping, maintenance, dispatching, inspection and testing are generally provided by independent contractors.

Executive Offices

Our principal executive and corporate offices are located in an office building located at 202 Dostyk Avenue, in Almaty, Kazakhstan. We lease this space and believe it is sufficient to meet our needs for the foreseeable future.

We also maintain an administrative office in Salt Lake City, Utah. The address is 324 South 400 West, Suite 225, Salt Lake City, Utah 84101, USA.

Reports to Security Holders

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other items with the Securities and Exchange Commission (“SEC”). We provide free access to all of these SEC filings, as soon as reasonably practicable after filing, on our Internet web site located at www.bmbmunai.com. In addition, the public may read and copy any documents we file with the SEC at the SEC's Public Reference Room at 100 F Street N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains its Internet site www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers like BMB Munai.

|

Item 1A. Risk Factors |

Our current liabilities exceed our current assets which, if not resolved, may result in the Company being unable to satisfy its obligations or make suitable arrangements with creditors as obligations become due.

At March 31, 2009, our current liabilities exceeded our current assets by $11,218,705. This has created liquidity problems for the Company. This increase in current liabilities over current assets arose from the steep decline in world oil prices, a drop in oil production and the export duty imposed by the government at a time when we were under contractual obligation to drill wells at four locations on our contract territory. In an effort to correct this situation we have ceased drilling new wells and we are working with creditors to establish payment schedules or otherwise reduce our current liabilities while continuing operations. We have no assurance that we will be successful in negotiating favorable terms with our creditors.

12

If we are unable to pay our debts or make suitable arrangement with creditors, this might be asserted to be an event of default under the Indenture governing our 5.0% convertible senior notes due 2012 (the “Notes”) and an event of default could result in the Notes becoming immediately due. We currently have insufficient funds to repay the Note principal. Given the current conditions in the credit and financial markets, we believe it would be difficult to obtain funding to retire the Notes if demand for payment were to be made prior to the scheduled maturity date.

The current financial crisis and economic conditions have and may continue to have a material adverse impact on our business and financial condition that we cannot predict.

The economic conditions in the United States and throughout the world have deteriorated during the past fiscal year. The global financial markets have experienced a period of unprecedented turmoil and upheaval characterized by extreme volatility and declines in prices of securities, diminished liquidity and credit availability, inability to access capital, the bankruptcy, failure, collapse or sale of financial institutions and an unprecedented level of intervention from the U.S. federal government and other governments. In particular, the cost of raising money in the debt and equity capital markets has increased substantially while the availability of funds from those markets generally has diminished significantly. Also, as a result of concerns about the stability of financial markets generally and the solvency of counterparties specifically, the cost of obtaining money from the credit markets generally has increased as many lenders and institutional investors have increased interest rates, enacted tighter lending standards, refused to refinance existing debt at maturity and, have reduced and in many cases, ceased to provide any new funding.

Although we cannot predict the impacts on us of the deteriorating economic conditions, they could materially adversely affect our business in the following ways:

|

|

• |

our ability to obtain credit and access the capital markets may continue to be restricted adversely affecting our financial position and our ability to continuing exploration and drilling activities on our territory; |

|

|

|

• |

the values we are able to realize in transactions we engage in to raise capital may be reduced, thus making these transactions more difficult to consummate and more dilutive to our shareholders; and |

|

|

|

• |

the demand for oil and natural gas may decline due to weak international economic conditions. |

Oil and gas prices are characteristically volatile, and if they remain low for a prolonged period, our revenues, profitability and cash flows will decline. A sustained period of low oil and natural gas prices would adversely affect our business operations, our asset values and our financial condition and ability to meet our financial commitments.

13

The global financial crises and economic downturn has resulted in significantly decline in oil and natural gas prices from their highs of 2008. The prices we receive for our oil and natural gas production heavily influence our revenue, profitability, access to capital and future rate of growth. The prices we receive for our production, and the levels of our production, depend on a variety of additional factors that are beyond our control, such as:

|

|

|

|

|

|

• |

the domestic and foreign supply of and demand for oil and natural gas; |

|

|

• |

the price and level of foreign imports of oil and natural gas; |

|

|

• |

the level of consumer product demand; |

|

|

• |

weather conditions; |

|

|

• |

overall domestic and global economic conditions; |

|

|

• |

political and economic conditions in oil and gas producing countries, including embargoes and continued hostilities in the Middle East and other sustained military campaigns, acts of terrorism or sabotage; |

|

|

• |

actions of the Organization of Petroleum Exporting Countries and other state-controlled oil companies relating to oil price and production controls; |

|

|

• |

the impact of the U.S. dollar exchange rates on oil and gas prices; |

|

|

• |

technological advances affecting energy consumption; |

|

|

• |

domestic and foreign governmental regulations and taxation; |

|

|

• |

the impact of energy conservation efforts; |

|

|

• |

the costs, proximity and capacity of gas pipelines and other transportation facilities; and |

|

|

• |

the price and availability of alternative fuels. |

Our revenue, profitability and cash flow depend upon the prices and demand for oil and gas, and a drop in prices can significantly affect our financial results and impede our growth. In particular, price declines or sustained low prices for oil and gas will:

|

|

• |

negatively impact the value of our reserves because declines in oil and natural gas prices would reduce the amount of oil and natural gas we can produce economically; |

|

|

|

• |

reduce the amount of cash flow available for capital expenditures; and |

|

|

|

• |

limit our ability to borrow money or raise additional capital. |

We may not have the funds, or the ability to raise the funds, necessary to repurchase the Notes when they become due.

The Notes mature in July 2012. However, the indenture agreement governing the Notes provides that following a change in control of the Company, or on July 13, 2010, holders of the Notes may require us to repurchase their Notes. We do not currently have funds to do so, nor do we expect to generate sufficient funds from operations by July 2010 to pay the repurchase price of any Notes if tendered.

Our failure to repurchase the Notes when required would result in an event of default with respect to the notes. Such an event of default could negatively affect the trading price of our common stock because the event of default could lead to the principal and accrued but unpaid interest on the outstanding notes becoming immediately due and payable.

14

Future price declines may result in a write-down of our asset carrying values.

Lower oil and natural gas prices may not only decrease our revenues, profitability and cash flows, but also reduce the amount of oil and gas that we can produce economically. This may result in downward adjustments to our estimated proved reserves. Substantial decreases in oil and gas prices could render our future planned exploration and development projects uneconomical. If this occurs, or if our estimates of development costs increase, production data factors change or drilling results deteriorate, accounting rules may require us to write down, as a non-cash charge to earnings, the carrying value of our properties for impairments. We are required to perform impairment tests on our assets periodically and whenever events or changes in circumstances warrant a review of our assets. To the extent such tests indicate a reduction of the estimated useful life or estimated future cash flows of our assets, the carrying value may not be recoverable and may, therefore, require a write-down of such carrying value. We may incur impairment charges in the future, which could have a material adverse effect on our results of operations in the period incurred and on our ability to borrow funds under our credit agreements.

Unless we replace our oil and natural gas reserves, our reserves and future production will decline, which would adversely affect our cash flows and income.

Unless we conduct successful development, exploration and exploitation activities, our proved reserves will decline as those reserves are produced. Producing oil and natural gas reservoirs generally are characterized by declining production rates that vary depending upon reservoir characteristics and other factors. Our future oil and natural gas reserves and production, and, therefore our cash flow and income, are highly dependent upon our success in efficiently developing and exploiting our current reserves and economically finding or acquiring additional recoverable reserves. If we are unable to develop, exploit, find or acquire additional reserves to replace our current and future production, our cash flow and income will decline as production declines, until our existing properties would be incapable of sustaining commercial production.

We may not be able to replace our reserves or generate cash flows if we are unable to raise capital.

In order to increase our asset base, we will need to make substantial capital expenditures for the exploration, development, production and acquisition of oil and gas reserves and the construction of additional facilities. These maintenance capital expenditures may include capital expenditures associated with drilling and completion of additional wells to offset the production decline from our producing properties or additions to our inventory of unproved properties or our proved reserves to the extent such additions maintain our asset base. These expenditures could increase as a result of:

|

|

• |

changes in our reserves; |

|

|

|

• |

changes in oil and gas prices; |

|

|

|

• |

changes in labor and drilling costs; |

15

|

|

• |

our ability to acquire, locate and produce reserves; |

|

|

|

• |

changes in license acquisition costs; and |

|

|

|

• |

government regulations relating to safety and the environment. |

Our cash flow from operations and access to capital is subject to a number of variables, including:

|

|

|

|

|

|

• |

our proved reserves; |

|

|

• |

the success or our drilling efforts; |

|

|

• |

the level of oil and gas we are able to produce from existing wells; |

|

|

• |

the prices at which our oil and gas is sold; and |

|

|

• |

our ability to acquire, locate and produce new reserves. |

Historically, we have financed these expenditures primarily with cash raised through the sale of our equity and debt securities and revenue generated by operations. If our revenues or borrowing base decreases, which is expected, as a result of lower oil and natural gas prices, operating difficulties or declines in reserves, we may have limited ability to expend the capital necessary to undertake or complete future drilling programs. Additional debt or equity financing or cash generated by operations may not be available to meet these requirements. Due to the current low prices for oil and gas and the restrictions in the capital markets due to the global financial crisis, we anticipate that we will not have any significant capital available during the upcoming fiscal year to make substantial capital expenditures.

Drilling for and producing oil and gas is a costly and high-risk activity with many uncertainties that could adversely affect our financial condition or results of operations.

Our drilling activities are subject to many risks, including the risk that we will not discover commercially productive reservoirs. The cost of drilling, completing and operating a well is often uncertain, and cost factors, as well as the market price of oil and natural gas, can adversely affect the economics of a well. Furthermore, our drilling and producing operations may be curtailed, delayed or canceled as a result of other factors, including:

|

|

|

|

|

|

• |

high costs, shortages or delivery delays of drilling rigs, equipment, labor or other services; |

|

|

• |

adverse weather conditions; |

|

|

• |

equipment failures or accidents; |

|

|

• |

pipe or cement failures or casing collapses; |

|

|

• |

compliance with environmental and other governmental requirements; |

|

|

• |

environmental hazards, such as gas leaks, oil spills, pipeline ruptures and discharges of toxic gases; |

|

|

• |

lost or damaged oilfield drilling and service tools; |

|

|

• |

loss of drilling fluid circulation; |

|

|

• |

unexpected operational events and drilling conditions; |

16

|

|

• |

unusual or unexpected or difficult geological formations; |

|

|

|

• |

natural disasters, such as fires; |

|

|

|

• |

blowouts, surface cratering and explosions; and |

|

|

|

• |

uncontrollable flows of oil, gas or well fluids. |

A productive well may become uneconomical in the event deleterious substances are encountered, which impair or prevent the production of oil or gas from the well. In addition, production from any well may be unmarketable if it is contaminated with water or other deleterious substances. We may drill wells that are unproductive or, although productive, do not produce oil or gas in economic quantities. Unsuccessful drilling activities could result in higher costs without any corresponding revenues. Furthermore, the successful completion of a well does not ensure a profitable return on the investment.

Reserve estimates depend on many assumptions that may turn out to be inaccurate. Any material inaccuracies in these reserve estimates or underlying assumptions will materially affect the size and present value of our reserves.

The process of estimating oil and natural gas reserves is complex. It requires interpretations of available technical data and many assumptions, including assumptions relating to economic factors. Any significant inaccuracies in these interpretations or assumptions could materially affect the estimated quantities and present value of reserves shown in this report.

In order to prepare estimates, we must project production rates and timing of development expenditures. We must also analyze available geological, geophysical, production and engineering data. The extent, quality and reliability of this data can vary. The process also requires economic assumptions about matters such as oil and natural gas prices, drilling and operating expenses, capital expenditures, taxes and availability of funds. Therefore, estimates of oil and natural gas reserves are inherently imprecise.

Actual future production, oil and natural gas prices, revenues, taxes, development expenditures, operating expenses and quantities of recoverable oil and natural gas reserves most likely will vary from our estimates. Any significant variance could materially affect the estimated quantities and present value of reserves shown in this report. In addition, we may adjust estimates of proved reserves to reflect production history, results of exploration and development, prevailing oil and natural gas prices and other factors, many of which are beyond our control.

You should not assume that the present value of future net revenues from our proved reserves referred to in this report is the current market value of our estimated oil and natural gas reserves. In accordance with SEC requirements, we generally base the estimated discounted future net cash flows from our proved reserves on prices and costs on the date of the estimate. Actual future prices and costs may differ materially from those used in the present value estimate. If future values decline or costs increase, it could have a negative impact on our ability to finance operations; individual properties could cease being commercially viable; affecting our decision to continue operations on producing properties or to attempt to develop properties. All of these factors would have a negative impact on earnings and net income, and most likely the trading price of our securities.

17

We will be unable to produce up to 68% of our proved reserves if we are not able to obtain a commercial production contract or extend our current exploration contract, which would likely require us to terminate our operations.

Under our exploration contract on our properties we have the right to produce oil and gas only until January 2013, yet 68% of our proved reserves are scheduled to be produced after January 2013. We have the exclusive right to negotiate a commercial production contract as per the terms of our exploration contract. The MEMR does not make public its determinations on the granting of commercial production rights. Based on discussions with the MEMR, we have learned that the primary factors used by the MEMR in determining whether to grant commercial production rights are whether the contract holder has fulfilled its minimum work program commitments, proof of commercial discovery and submission of an approved development plan by a third-party petroleum institute in Kazakhstan to exploit the established commercial reserves. Typically, if commercial production rights are not granted it is because the contract holder has failed to make a commercial discovery within their contract territory and had decided to abandon the contract territory or the contract holder has insufficient funds to complete its minimum work program requirement and was unable to complete the necessary work to substantiate the presence of commercially producible reserves to the MEMR. Our efforts are focused toward meeting our minimum work program requirements and making and substantiating commercial discoveries in as many of the identified structures as possible to support our application for commercial production rights. If we are not granted commercial production rights prior to the expiration of our exploration contract, we may lose our right to produce the reserves on our current properties. If we are unable to produce those reserves, we will be unable to realize revenues and earnings and to fund operations and we would most likely be unable to continue as a going concern.

Prospects that we decide to drill may not yield oil or natural gas in commercially viable quantities or quantities sufficient to meet our targeted rate of return.

The structures we have located on our territory are typically at a depth of 3,100 to 3,800 meters and some structures may be deeper in the Northwest Block. The rock is generally carbonates of limestone and dolomite, which can inhibit oil flow and well drainage and thereby results in higher risk drilling, reduced well drainage areas, lower production rates and higher than expected well decline rates. These factors in turn adversely effect the valuation of our reserve base. We attempt to address these challenges through careful selection of drilling sites and we are now in process of developing models of our oil fields that will guide our well locations, drilling activities and technology deployment.

A “prospect” is a property which, based on available seismic and geological data, we believe shows potential oil or natural gas. Our prospects are in various stages of evaluation and interpretation. There is no way to accurately predict in advance of incurring drilling and completion costs whether a prospect will be

18

economically viable. Even with seismic data and other technologies and the study of producing fields in the same area, we cannot know conclusively prior to drilling whether oil or natural gas will be present or, if present, will be present in commercial quantities. The analysis that we perform using data from other wells, more fully explored prospects and/or producing fields may not be useful in predicting the characteristics and potential reserves associated with our drilling prospects. When we drill unsuccessful wells, our drilling success rate declines and we may not achieve our targeted rate of return.

We may incur substantial losses and be subject to substantial liability claims as a result of our operations.

We are not insured against all risks. Losses and liabilities arising from uninsured and underinsured events could materially and adversely affect our business, financial condition or results of operations. Our oil and natural gas exploration and production activities are subject to all of the operating risks associated with drilling for and producing oil and natural gas, including the possibility of:

|

|

• |

environmental hazards, such as uncontrollable flows of oil, natural gas, brine, well fluids, toxic gas or other pollution into the environment, including groundwater contamination; |

|

|

• |

abnormally pressured formations; |

|

|

• |

mechanical difficulties, such as stuck oil field drilling and service tools and casing collapse; |

|

|

• |

fires and explosions; |

|

|

• |

personal injuries and death; and |

|

|

• |

natural disasters. |

Any of these risks could adversely affect our ability to conduct operations or result in substantial losses. In instances when we believe that the cost of available insurance is excessive relative to the risks presented we may elect not to obtain insurance. In addition, pollution and environmental risks generally are not fully insurable. If a significant accident or other event occurs that is not fully covered by insurance, it could adversely affect us.

We are subject to complex laws that can affect the cost, manner or feasibility of doing business.

Exploration, development, production and sale of oil and natural gas are subject to extensive governmental regulation. We may be required to make large expenditures to comply with these regulations. Matters subject to regulation include:

|

|

• |

discharge permits for drilling operations; |

|

|

• |

reports concerning operations; |

|

|

• |

the spacing of wells; |

|

|

• |

unitization and pooling of properties; and |

|

|

• |

taxation. |

19

Under these laws, we could be liable for personal injuries, property damage and other damages. Failure to comply with these laws may also result in the suspension or termination of our licenses or operations and could subject us to administrative, civil and criminal penalties. Moreover, these laws could change in ways that substantially increase our costs. Any such liabilities, penalties, suspensions, terminations or regulatory changes could materially adversely affect our financial condition and results of operations. We believe that there is political and legal risk doing business in Kazakhstan, as the country has existed for less than two decades and is still in process of developing stable and predictable laws required to underpin a free market economy and foster private enterprise.

We may incur substantial liabilities to comply with environmental laws and regulations.

Our oil and natural gas operations are subject to governmental laws and regulations relating to the release or disposal of materials into the environment or otherwise relating to environmental protection. These laws and regulations may require the acquisition of permits before drilling commences, restrict the types, quantities and concentration of substances that can be released into the environment in connection with drilling and production activities and impose substantial liabilities for pollution resulting from our operations. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, imposition of investigatory or remedial obligations or even injunctive relief. Changes in environmental laws and regulations occur frequently. Any changes that result in more stringent or costly waste handling, storage, transport, disposal or cleanup requirements could require us to make significant expenditures to maintain compliance, and may otherwise have a material adverse effect on our results of operations, competitive position or financial condition as well as on the industry in general. Under these environmental laws and regulations, we could be held strictly liable for the removal or remediation of previously released materials or property contamination regardless of whether we were responsible for the release or whether our operations were standard in the industry at the time they were performed.

Because of our lack of asset and geographic diversification, adverse developments in our operating area would adversely affect our results of operations.

Substantially all of our assets are currently located in southwestern Kazakhstan. As a result, our business is disproportionately exposed to adverse developments affecting this region. These potential adverse developments could result from, among other things, changes in governmental regulation, capacity constraints with respect to storage facilities, transportation systems and pipelines, curtailment of production, natural disasters or adverse weather conditions in or affecting these regions. Due to our lack of diversification in asset type and location, an adverse development in our business or the area in which we operate would have a significantly greater impact on our financial condition and results of operations than if we maintained more diverse assets and operating areas.

20

The unavailability or high price of transportation systems could adversely affect our ability to deliver our oil on terms that would allow us to operate profitably, or at all.

Because of the location of our properties, the crude oil we produce must be transported by truck or by rail. In the future it will likely also be transported by pipelines. These railways and pipelines are operated by state-owned entities or other third-parties, and there can be no assurance that these transportation systems will always be functioning and available, or that the transportation costs will not become cost prohibitive. In addition, any increase in the cost of transportation or reduction in its availability to us could have a material adverse effect on our results of operations. There is no assurance that we will be able to procure sufficient transportation capacity on economical terms, if at all.

We depend on one customer for sales of crude oil. A reduction by this customer in the volumes of oil it purchases could result in a substantial decline in our revenues and net income.

During the year ended March 31, 2009, we sold approximately 81% of our crude oil production to Titan Oil (formerly Euro-Asian Oil AG). Revenue from oil sold to Titan Oil made up 94% of our revenue during the year ended March 31, 2009. The loss of Titan Oil may have a material adverse effect on our operations in the short-term. Based on current demand for crude oil and the fact that alternate purchasers are readily available, we believe the loss of Titan Oil would not materially adversely effect our operations long-term.

If you purchase shares of our stock, your investment will be subject to the same risks inherent in international operations, including, but not limited to, adverse governmental actions, political risks, and expropriation of assets, loss of revenues and the risk of civil unrest or war.

While we have significant experience working in Kazakhstan, and feel we have good relationships with government agencies at many levels, we remain subject to all the risks inherent in international operations, including adverse governmental actions, uncertain legal and political systems, and expropriation of assets, loss of revenues and the risk of civil unrest or war. Our primary oil and gas properties are located in Kazakhstan, which until 1990 was part of the Soviet Union. Kazakhstan retains many of the laws and customs of the former Soviet Union, but has and is continuing to develop its own legal, regulatory and financial systems. As the political and regulatory environment changes, we may face uncertainty about the interpretation of our agreements; in the event of dispute, we may have limited recourse within the legal and political system.

Prior to the expiration of our exploration rights, we plan to make application for commercial production rights to the extent we have established commercially producible reserves on our properties. We have the exclusive right to negotiate a commercial production contract for the ADE Block and Extended Territory, and the

21

government is required to conduct these negotiations under the “Law of Petroleum.” The terms of the commercial production contract will establish the royalty and other payments due to the government in connection with commercial production. At the time the commercial production contract is issued, we will be required to begin repaying the government its historical investment costs of exploration and development of the ADE Block and the Extended Territory. Our obligation associated with the ADE Block is approximately $6 million. Our obligation associated with the Extended Territory is approximately $5.3 million. If satisfactory terms for commercial production rights cannot be negotiated, it could have a material adverse effect on our financial position.

Our ability to obtain additional financing or use our operating cash flow to fund operations may be adversely affected by our level of indebtedness.

Our level of indebtedness could have negative consequences, which include, but are not limited to, the following:

|

|

• |

Our ability to obtain additional financing to fund capital expenditures, acquisitions, working capital, repay debts or for other purposes may be impaired; |

|

|

• |

Our ability to use operating cash flow in other areas of our business may be limited because we must dedicate a substantial portion of these funds to repay debt obligations; |

|

|

• |

We may be unable to compete with others who may not be as highly leveraged; and |

|

|

• |

Our debt may limit our flexibility to adjust to changing market conditions, changes in our industry and economic downturns. |

Risks Relating to Our Common Stock

Our stock price may be volatile.

The following factors could affect our stock price:

|

|

|

|

|

|

• |

our operating performance and future prospects; |

|

|

• |

quarterly variations in the rate of growth of our financial indicators, such as net income per share, net income and revenues; |

|

|

• |

actual or anticipated variations in our reserve estimates and quarterly operating results; |

|

|

• |

fluctuations in oil and natural gas prices; |

|

|

• |

speculation in the press or investment community; |

|

|

• |

sales of our common stock by large block stockholders; |

|

|

• |

short-selling of our common stock by investors; |

|

|

• |

the outcome of current litigation; |

|

|

• |

issuance of a significant number of shares to raise additional capital to fund our operations; |

|

|

• |

changes in applicable laws or regulations; |

|

|

• |

changes in market valuations of similar companies; |

|

|

• |

additions or departures of key management personnel; |

|

|

• |

actions by our creditors; and |

|

|

• |

international economic, legal and regulatory factors unrelated to our performance. |

22

It is unlikely that we will be able to pay dividends on our common stock.

We have never paid dividends on our common stock. We cannot predict with certainty that our operations will result in sufficient revenues to enable us to operate profitably and with sufficient positive cash flow so as to enable us to pay dividends to the holders of common stock.

The percentage ownership evidenced by the common stock is subject to dilution.

We are authorized to issue up to 500,000,000 shares of common stock and are not prohibited from issuing additional shares of such common stock. Moreover, to the extent that we issue any additional common stock, a holder of the common stock is not necessarily entitled to purchase any part of such issuance of stock. The holders of the common stock do not have statutory “preemptive rights” and therefore are not entitled to maintain a proportionate share of ownership by buying additional shares of any new issuance of common stock before others are given the opportunity to purchase the same. Accordingly, you must be willing to assume the risk that your percentage ownership, as a holder of the common stock, is subject to change as a result of the sale of any additional common stock, or other equity interests in the Company.

Our common stock is an unsecured equity interest.

Just like any equity interest, our common stock will not be secured by any of our assets. Therefore, in the event of our liquidation, the holders of our common stock will receive distributions only after all of our secured and unsecured creditors have been paid in full. There can be no assurance that we will have sufficient assets after paying its secured and unsecured creditors to make any distribution to the holders of our common stock.

Provisions in Nevada law could delay or prevent a change in control, even if that change would be beneficial to our stockholders.

Certain provisions of Nevada law may delay, discourage, prevent or render more difficult an attempt to obtain control of us, whether through a tender offer, business combination, proxy contest or otherwise. The provisions of Nevada law are designed to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors.

Item 1B. Unresolved Staff Comments

|

|

None. |

23

Item 2. Properties

Under the statutory scheme in the Republic of Kazakhstan prospective oil fields are developed in two stages. The first stage is an exploration and appraisal stage during which a private contractor is given a license to explore for oil and gas on a territory for a set term of years. During this stage the primary focus is on the search for a commercial discovery, i.e., a discovery of a sufficient quantity of oil and gas to make it commercially feasible to pursue execution of, or transition to, a commercial production contract with the government. Under the terms of an exploration contract the contract holder has the right to sell all oil and natural gas produced during the term of the exploration contract.

24

We currently own a 100% interest in a license to use subsurface mineral resources and a hydrocarbon exploration contract issued by the ROK in 1999 and 2000, respectively (collectively referred to herein as the (“license” or the “exploration contract”). When initially granted, the exploration and development stage of our exploration contract had a five year term, with provision for two extensions for a period of two years each. On June 24, 2008 the MEMR agreed to extend the exploration stage of our exploration contract until January 2013.

Initially, the exploration contract granted us the right to engage in exploration and development activities in an area of approximately 200 square kilometers referred to herein as the “ADE Block.” The ADE Block is comprised of three fields, the Aksaz, Dolinnoe and Emir fields. During our 2006 fiscal year our exploration contract was expanded to include an additional 260 square kilometers of land adjacent to the ADE Block, which we refer to herein as the “Southeast Block”, which includes the Kariman oil and gas field and the Borly and Yessen structures. In October 2008 the MEMR granted a further extension of the territory covered under our exploration contract to include an additional 390 square kilometer area, bring our total contract area to 850 square kilometers (approximately 210,114 acres). The additional territory is located to the north and west of our current exploration territory, extending the exploration territory toward the Caspian Sea and is referred to herein as the “Northwest Block.” The Southeast Block and the Northwest Block are governed by the terms of our exploration contract.

In order to be assured that adequate exploration activities are undertaken during exploration stage, the MEMR establishes an annual mandatory minimum work program to be accomplished in each year of the exploration contract. Under the minimum work program the contractor is required to invest a minimum dollar amount in exploration activities within the contract territory, which may include geophysical studies, construction of field infrastructure or drilling activities. During the exploration stage, the contractor is also required to drill sufficient wells in each field to establish the existence of commercially producible reserves in any field for which it seeks a commercial production license. Failure to complete the minimum work program requirements for any particular field during the term of the exploration contract could preclude the contractor from receiving a longer-term production contract for such field, regardless the success of the contractor in proving commercial reserves during the partial fulfillment of the minimum work program.

The contract we hold follows the above format. The contract sets the minimum dollar amount we must expend during each year of our work program. Through July 2009, our work program year ended on July 9 each year. As a result of certain changes to our exploration license, our work program year end has now changed to January 9 of each year through January 9, 2013. Therefore our work program year does not coincide with our fiscal year. As a result of these timing differences, the amounts reflected in the table below as “Actually Made” may differ from amounts disclosed elsewhere in our Management’s Discussion and Analysis or Consolidated Financial Statements, which present figures based on our fiscal year rather than our work program year.

25

|

Amount of Expenditure |

Mandated by Contract |

Actually Made |

|

Prior to July 2007 |

$40,200,000 |

$104,750,000 |

|

July 2007 to July 2008 |

$8,480,000 |

$115,040,000 |

|

July 2008 to July 2009 |

$1,845,000 |

$ 39,717,000* |

|

July 2009 to January 2010 |

$8,565,000 |

$ - |

|

January 2010 to January 2011 |

$21,520,000 |

$ - |

|

January 2011 to January 2012 |

$27,300,000 |

$ - |

|

January 2012 to January 2013 |

$14,880,000 |

$ - |

|

Total |

$122,790,000 |

$259,507,000 |

* Investment as of March 31, 2009.

As reflected in the above table, in connection with the extension of the term and territory of our exploration contract, we agreed to expend not less than $72.7 million dollars in additional work program activities through January 9, 2013.

Under the rules of the MEMR there is an option for expenditures above the minimum requirements in one period to be carried over to meet minimum obligations in future periods. As the above chart shows we have significantly exceeded the minimum expenditure requirement in each period of the contract and have more than doubled the total minimum capital expenditure requirement during the exploration stage.

In addition to mandatory minimum capital expenditures in each year, exploration contracts typically require the contract holder to drill a certain number of wells in each structure for which it plans to seek commercial production rights.

In Kazakhstan, typically, one exploratory well and two appraisal wells are sufficient to support a claim of commercially producible reserves in a particular field, although in some cases, commercial reserves have been demonstrated with fewer wells. The total number of wells the MEMR requires during exploration stage is generally determined by the number of fields or structures identified by the seismic studies done on a territory. 3D seismic studies completed on the ADE Block and the Southeast Block, have identified six potential fields or structures. We plan to perform 3D seismic studies on the Northwest Block to identify potential structures in that Block.

26

To date, we have drilled a total of 24 wells as set forth in more detail below:

|

Structures |

Aksaz |

Dolinnoe |

Emir |

Kariman |

Borly |

Yessen |

Northwest Block |

|

Exploratory Wells |

1 |

1 |

1 |

1 |

1 |

1 |

3(1) |

|

Appraisal Wells |

2 |

2 |

2 |

2 |

2 |

2 |

* |

|

|

|

|

|

|

|

|

|

|

Existing Wells |

5 |

6 |

3 |

10 |

0 |

0 |

0 |

|

Wells in Progress |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Remaining Wells to Drill by 2013 |

0 |

0 |

0 |

0 |

3 |

3 |

* |

(1) Addendum No. 6 to our exploratory contract requires the drilling of three exploratory wells. Depending upon the results of 3D seismic studies of the Northwest Block we may need to drill additional exploratory and appraisal wells in the Northwest Block.

|

|

* |

Unknown at this time. |

Pursuant to the terms of the extensions of our exploration contract, we will be required to drill not less than nine new wells by January 9, 2013. If we discover structures in the Northwest Block, we will need to drill additional wells to determine and establish the existence of commercially producible reserves within the various structures in our license territory.

The bottom half of the above chart shows current progress on drilling of exploratory and appraisal wells.

To date we have been conservative in our approach to exploration. It has been our practice to drill our first few wells serially. Our first well was the Dolinnoe-2 well drilled in 2004. This was followed by the Dolinnoe-3 well, and then the Aksaz-4 and Kariman-1 wells. While we have verified the presence of oil and gas in all our wells thus far, not all our wells produce oil at commercial levels. We have expended substantial time and money to study our wells.

The purpose of the exploration stage is to study the geology and geophysical characteristics of each field and individual well, with a view to qualifying for a longer-term production contract. Once drilling of a well is completed, our emphasis focuses on an extended period of testing a well’s production characteristics and capacities to determine the best method for producing oil from that well and to gain insight into the further development of the entire field. During exploration, oil production is subject to wide fluctuations caused by varying pressures commonly experienced in new wells and by significant periods of well closure to accommodate mandatory testing. Maximizing oil production only becomes the central focus during the post-exploration phase when exploiting the commercial discovery commences under a production contract.

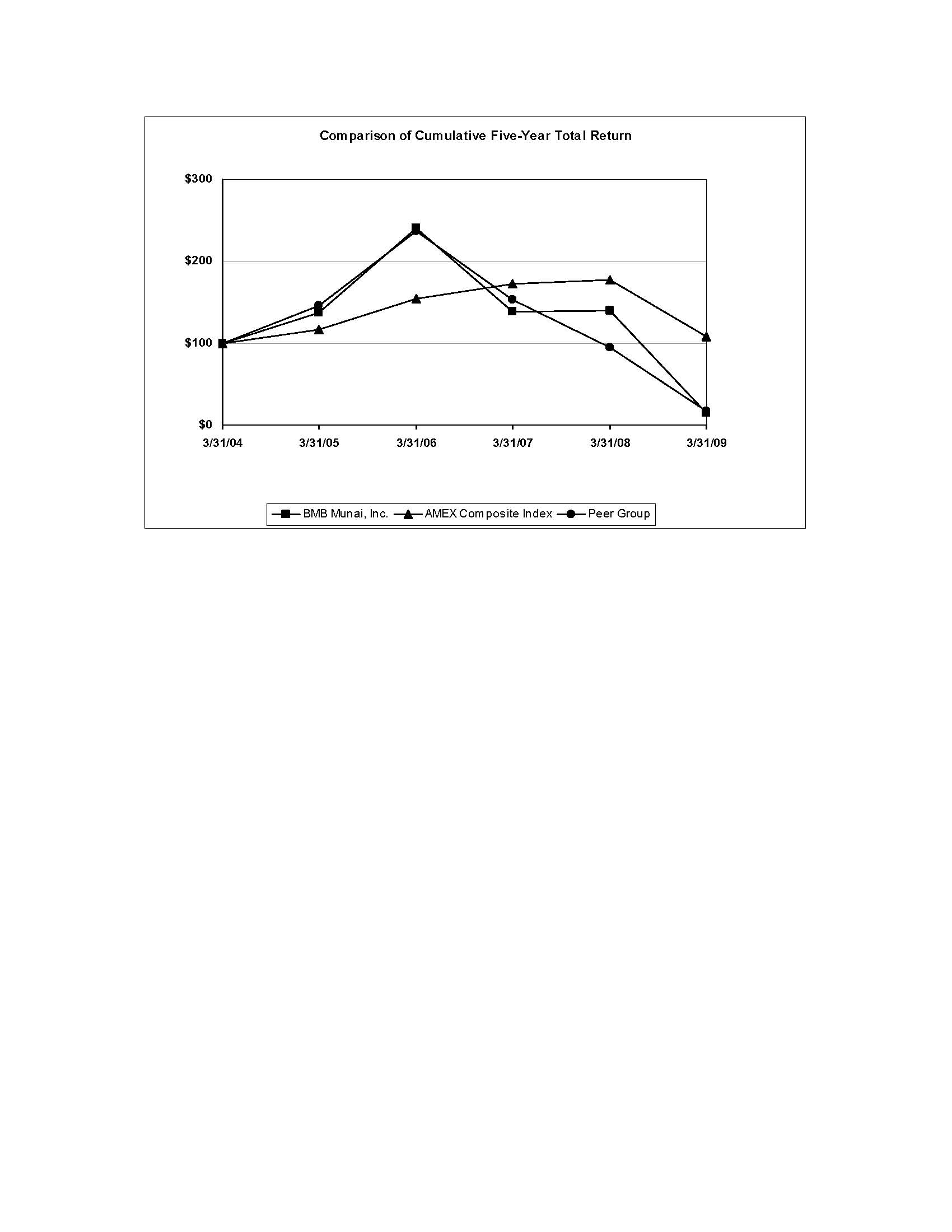

27