Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - CAPITAL BANK CORP | exhibit23_1.htm |

As filed with the Securities and Exchange Commission on October 22, 2009

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CAPITAL BANK CORPORATION

(Exact name of registrant as specified in its charter)

North Carolina

(State or other jurisdiction of incorporation or organization)

6022

(Primary Standard Industrial Classification Code Number)

56-2101930

(IRS Employer Identification Number)

333 Fayetteville Street, Suite 700

Raleigh, North Carolina 27601

(919) 645-6400

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

B. Grant Yarber, President and Chief Executive Officer

Capital Bank Corporation

333 Fayetteville Street, Suite 700

Raleigh, North Carolina 27601

(919) 645-6400

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

|

Copies to: | |||

|

Margaret N. Rosenfeld, Esq.

Smith, Anderson, Blount, Dorsett,

Mitchell & Jernigan, L.L.P.

P. O. Box 2611

Raleigh, North Carolina 27602-2611

(919) 821-1220 |

Betty O. Temple, Esq.

Womble Carlyle Sandridge & Rice, PLLC

271 17th Street, NW, Suite 2400

Atlanta, Georgia 30363-1017

(404) 870-4824 |

||

As soon as practicable after the effective date of this Registration Statement.

(Approximate date of commencement of proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨ |

Accelerated filer þ |

||

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company þ |

|

CALCULATION OF REGISTRATION FEE

| ||

|

Title of each class of securities to be registered |

Proposed maximum aggregate offering price |

Amount of registration fee |

|

Common Stock, no par value per share

|

$55,000,000 (1) |

$3,069 (2) |

|

(1) |

Estimated solely for the purpose of determining the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended.

|

|

(2) |

Calculated pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities

Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

|

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities

in any state where the offer or sale is not permitted. |

SUBJECT TO COMPLETION, DATED OCTOBER 22, 2009

PROSPECTUS

l Shares

COMMON STOCK

We are offering l shares of our common stock, no par value per share. Our common stock is traded on the NASDAQ Global Select Market under the symbol “CBKN.” On October 16, 2009, the last reported sale price of our common stock on the NASDAQ Global Select Market was $5.00

per share.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 9 to read about factors you should consider before buying our common stock.

|

Per Share |

Total |

||||||

|

Public offering price |

$ |

l |

$ |

l |

|||

|

Underwriting discounts and commissions |

l |

l |

|||||

|

Proceeds to us, before expenses |

l |

l |

|||||

The underwriters also may purchase up to an additional l shares of our common stock within 30 days of the date of this prospectus to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

These shares of common stock are not savings accounts, deposits, or other obligations of our bank subsidiary or any of our non-bank subsidiaries and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

The underwriters are offering the shares of our common stock as described in “Underwriting.” Delivery of the shares will be made on or about l, 2009.

|

Sandler O’Neill + Partners, L.P. |

Howe Barnes Hoefer & Arnett |

The date of this prospectus is l, 2009.

|

ii |

||

|

ii |

||

|

1 |

||

|

6 |

||

|

9 |

||

|

23 |

||

|

23 |

||

|

24 |

||

|

24 |

||

|

25 |

||

|

33 |

||

|

36 |

||

|

36 |

||

|

37 |

||

|

37 |

You should rely only on the information contained or incorporated by reference in this prospectus. We have not, and the underwriters have not, authorized any person to provide you with different or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters

are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and the documents incorporated by reference is accurate only as of their respective dates. Our business, financial condition, results of operations and prospects may have changed since such dates.

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus to “Capital Bank Corporation,” “we,” “us,” “our,” or similar references, mean Capital Bank Corporation and its subsidiaries on a consolidated basis. References to “Capital Bank”

or the “Bank” mean our wholly-owned banking subsidiary.

Information set forth in this prospectus and the information it incorporates by reference may contain various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act,

which statements represent our judgment concerning the future and are subject to business, economic and other risks and uncertainties, both known and unknown, that could cause our actual operating results and financial position to differ materially from the forward-looking statements. Such forward-looking statements can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,” “estimate,” “believe,”

or “continue,” or the negative thereof or other variations thereof or comparable terminology.

We caution that any such forward-looking statements are further qualified by important factors that could cause our actual operating results to differ materially from those in the forward-looking statements, including without limitation, the management of our growth, the risks associated with possible or completed acquisitions, the risks

associated with the Bank’s loan portfolio, competition within the industry, dependence on key personnel, government regulation and the other risk factors described under the heading “Risk Factors” in this prospectus and in the documents incorporated herein by reference. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions

only as of the date such forward-looking statements are made.

You should read carefully this prospectus, together with the information incorporated herein by reference as described under the heading “Where You Can Find More Information,” completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify all of our forward-looking

statements by these cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

|

|

|

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus and may not contain all the information that you need to consider in making your investment decision. You should carefully read this entire prospectus, as well as the information to which we refer you and the

information incorporated by reference herein, before deciding whether to invest in our common stock.

|

|

About Capital Bank Corporation |

|

Capital Bank Corporation is a financial holding company incorporated under the laws of North Carolina on August 10, 1998. Our primary wholly-owned subsidiary is Capital Bank, a state-chartered banking corporation that was incorporated under the laws of the State of North Carolina on May 30, 1997 and commenced operations on June 20, 1997.

Capital Bank is a community bank engaged in the general commercial banking business, primarily in growth markets in central and western North Carolina. As of June 30, 2009, the Bank had assets of approximately $1.7 billion, with gross loans and deposits outstanding of approximately $1.3 billion and $1.4 billion, respectively. Our principal executive office

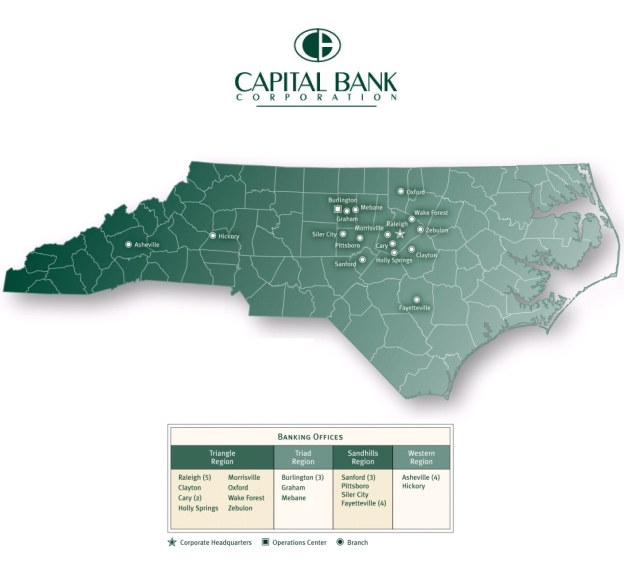

is located at 333 Fayetteville Street, Suite 700, Raleigh, North Carolina 27601, and our telephone number is (919) 645-6400. We operate 32 branch offices in North Carolina: five in Raleigh, four in Asheville, three in Burlington, two in Cary, four in Fayetteville, three in Sanford, and one each in Clayton, Graham, Hickory, Holly Springs, Mebane, Morrisville, Oxford, Pittsboro, Siler City, Wake Forest and Zebulon.

The Bank offers a full range of banking services, including the following: checking accounts; savings accounts; NOW accounts; money market accounts; certificates of deposit; individual retirement accounts; loans for real estate, construction, businesses, agriculture, personal use, home improvement, automobiles, equity lines of credit, mortgage loans,

credit loans, consumer loans, credit cards; safe deposit boxes; bank money orders; internet banking; electronic funds transfer services including wire transfers and remote deposit capture; traveler’s checks; and free notary services to all Bank customers. In addition, the Bank provides automated teller machine access to its customers for cash withdrawals through nationwide ATM networks. Through a partnership between the Bank’s financial services division and Capital Investment Companies, an unaffiliated

Raleigh, North Carolina-based broker-dealer, the Bank also makes available a complete line of uninsured investment products and services.

As a financial holding company, we are subject to the supervision of the Board of Governors of the Federal Reserve System, or the Federal Reserve. We are required to file with the Federal Reserve reports and other information regarding our business operations and the business operations of our subsidiaries. As a North Carolina chartered bank,

the Bank is subject to primary supervision, periodic examination and regulation by the North Carolina Commissioner of Banks, or the NC Commissioner, and by the Federal Deposit Insurance Corporation, or the FDIC, as its primary federal regulator.

|

|

Our Strengths and Strategy |

|

Our vision is to be North Carolina’s most respected and profitable community bank through our commitment to providing hometown, personal service for our loyal customers, enhancing shareholder value by way of consistent earnings and giving back to the communities we serve. With our highly trained associates, sound fiscal management and the execution

of our strategic growth plan, we believe that we possess the ideal combination of big bank technology and small town service philosophy, resulting in a unique community banking approach that is the cornerstone of our business. We seek to achieve these goals by focusing on the following key strengths and objectives:

Operate in Desirable Geographic Markets. We believe that our current branch network, which we have grown both organically and by strategic acquisitions, has positioned us well in both higher-growth markets and markets with attractive core deposits. We believe that this combination

has historically allowed us to grow the bank both prudently and profitably and will continue to present attractive opportunities to strengthen our franchise. We operate in the following four geographic regions in North Carolina:

|

|

Capital Bank |

Total Market Area (2) |

|||||||||||||||||||||||||||||||||||

|

June 2009 |

Annualized 3-Year

Growth Rate |

June 2009 Deposit Data (3) |

Median Household

Income (4) |

|||||||||||||||||||||||||||||||||

|

Market Area (1) |

Deposits

($MM) |

Loans

($MM) |

Deposits |

Loans |

Deposits

in

Market

Area

($MM) |

CBKN

Market

Share |

Total

Market

Growth

Versus

June 2008 |

2009

Population |

2009

– 2014

Projected

Population

Growth |

2009

(Actual) |

2009

– 2014

Projected

Growth |

|||||||||||||||||||||||||

|

Triangle |

$ |

602 |

$ |

664 |

27 |

% |

28 |

% |

$ |

19,072 |

3.2 |

% |

10.9 |

% |

1,168,270 |

17.4 |

% |

$ |

68,870 |

3.4 |

% |

|||||||||||||||

|

Sandhills |

261 |

184 |

21 |

11 |

5,174 |

5.0 |

3.9 |

607,927 |

4.7 |

47,711 |

4.8 |

|||||||||||||||||||||||||

|

Triad |

389 |

193 |

–4 |

–11 |

2,544 |

15.3 |

7.9 |

147,797 |

6.6 |

50,579 |

4.8 |

|||||||||||||||||||||||||

|

Western |

129 |

252 |

11 |

14 |

9,253 |

1.4 |

1.3 |

576,365 |

6.1 |

47,740 |

6.0 |

|||||||||||||||||||||||||

|

Total |

$ |

1,381 |

$ |

1,293 |

12 |

% |

11 |

% |

$ |

36,043 |

3.8 |

% |

7.1 |

% |

2,500,359 |

11.1 |

% |

59,117 |

3.5 |

% |

||||||||||||||||

|

North Carolina |

8.1 |

% |

$ |

51,418 |

4.3 |

% |

||||||||||||||||||||||||||||||

|

USA |

4.6 |

% |

$ |

54,719 |

4.1 |

% |

||||||||||||||||||||||||||||||

|

(1) |

The Triangle market area (13 branches) comprises the Raleigh-Cary metropolitan statistical area, or MSA, and Granville County; the Sandhills market area (9 branches) comprises the Fayetteville MSA, and the counties of Chatham, Robeson and Lee; the Triad market area (5 branches) comprises the Burlington MSA; and the Western market area (5 branches)

comprises the Asheville MSA and Catawba County. | |||||||||||||||||||||||||||||||||||

|

(2) |

Per SNL Financial. | |||||||||||||||||||||||||||||||||||

|

(3) |

FDIC deposit data as of June 30, 2009. | |||||||||||||||||||||||||||||||||||

|

(4) |

Weighted average based on FDIC deposit data as of June 30, 2009. | |||||||||||||||||||||||||||||||||||

|

Our Triangle market consists of the Raleigh-Cary MSA and Granville County, which we consider the core areas for business growth in the Triangle area of North Carolina. The Triangle, which includes Raleigh, North Carolina’s capital, as well as Chapel Hill, Durham and Research Triangle Park, is an extremely well-diversified market with a mixture of

businesses, universities, large medical institutions and state/local government offices that provides a significantly stable economy. North Carolina State University, Duke University and The University of North Carolina at Chapel Hill are all located in the Triangle, and more than 80% of the workforce in Research Triangle Park is employed by multinational corporations such as IBM, GlaxoSmithKline, Cisco and Nortel. The area recently received, among others, the following #1 national rankings: top city for small

business (Biz Journals, February 2009), fastest growing metropolitan area in the country (U.S. Census, March 2009), best place for business and careers (Forbes.com, March 2009), city with best economic potential (fDi Magazine, April 2009), top city where Americans are relocating (Forbes.com, April 2009) and best place to live in the United States (msnbc.com, June 2008). We believe that the Triangle will continue to present our best overall opportunity for market share expansion.

The Sandhills market, which includes our operations in Fayetteville, Pittsboro, Sanford and Siler City, has in recent years experienced significant growth due to the 2005 Base Realignment and Closure process, or BRAC. Fayetteville is home to Fort Bragg, the largest global Army installation with 10% of the Army’s active forces. BRAC is estimated

to increase the population of the region around Fort Bragg by 40,000 between 2006 and 2013, lead to approximately $1.6 billion in military-related construction, and generate $1.0 billion in economic development in the surrounding counties as the headquarters for both the U.S. Army Forces Command and U.S. Army Reserve Command relocate to Fort Bragg. These two commands manage an estimated $30 billion of the United States’ annual defense budget, which is expected to result in the relocation of military contractors

to the markets stretching from the Triangle to Fayetteville, an area now being referred to as North Carolina’s All-American Defense Corridor. In 2008, Fayetteville’s gross domestic product, or GDP, grew by 5.3%, compared to national GDP growth of 0.8% and North Carolina’s GDP growth of 0.1% during the same period, according to data compiled by the U.S. Commerce Department through the Bureau of Economic Analysis.

We also have branches in the Triad market, which includes Burlington, Graham and Mebane, and the Western market, which includes Asheville and Hickory. While these markets are not currently experiencing loan growth, we believe they provide opportunities for affordable and stable core deposit growth and diversification of our deposit base.

| ||||||||||||||||||||||||||||||||||||

|

Maintain an Experienced Executive Management Team Complemented by a Highly Qualified Board of Directors. In the current turbulent economic environment, we believe the board of directors and management team of a community bank will have an important impact on its future performance.

Over the past six years, we have assembled an executive management team with significant experience in sales, credit administration, acquisition integration, special assets management, operations and financial management. Our senior management team is lead by:

| ||

|

• |

B. Grant Yarber: Mr. Yarber joined us in June 2003. He has served as our President and Chief Executive Officer since May 2004. Prior to his promotion to Chief Executive Officer, he served as our President and Chief Operating Officer. Prior

to joining us, Mr. Yarber served as Chief Credit Officer and Chief Lending Officer for MountainBank in Hendersonville, NC from 2002 to 2003. With more than 20 years of banking experience, Mr. Yarber has proven his skills as an effective leader throughout his many positions in lending and credit administration. Mr. Yarber began his career as a credit analyst at North Carolina National Bank (now Bank of America Corporation) in 1989, moving through various positions that included significant leadership roles as

Senior Credit Officer for Business Lending for the Southeastern United States. Prior to his credit role, he served as Regional Executive in Missouri and Illinois for Business Banking, Professional and Executive Banking and Agricultural Lending. | |

|

• |

Michael R. Moore: Mr. Moore joined us in 2007 and serves as our Executive Vice President and Chief Financial Officer. In this position, Mr. Moore is responsible for our financial activities, including asset and liability management, margin management, investment portfolio management, analyst

relations and strategic planning. Mr. Moore has over 29 years of banking experience and most recently served as Senior Vice President of Funds Management for Sky Financial Group Incorporated, where he was responsible for balance sheet management, including the investment portfolio, borrowed funds, margin management of all loan and deposit products and liquidity management. While at Sky Financial Group Incorporated, Mr. Moore was the team leader for due diligence and integration of nine bank mergers over seven

years, increasing company assets by approximately $10 billion. | |

|

• |

David C. Morgan: Mr. Morgan serves as our Executive Vice President and Chief Banking Officer. Mr. Morgan joined us in 2003 serving as our Triangle Regional President. Mr. Morgan has over 25 years of business lending expertise in executive level positions with Central Carolina Bank (now

part of SunTrust Banks, Inc.) where he served Granville, Wake, Durham and Franklin Counties. In his function as Chief Banking Officer, Mr. Morgan is responsible for the commercial and retail banking functions statewide. | |

|

• |

Mark J. Redmond: Mr. Redmond serves as our Executive Vice President and Chief Credit Officer. Mr. Redmond joined us in 2005, previously having served as Senior Credit Officer at BB&T for three years, where he was responsible for credit administration for the western half of Kentucky,

and with BB&T’s Capital Markets Group for two years. Mr. Redmond has over 15 years of banking experience, concentrating in the commercial lending and credit areas. In his function as Chief Credit Officer, Mr. Redmond is responsible for credit quality, loan review, special assets and the credit department. | |

|

We also are committed to growing the next generation of management through our management development program, which is designed to mentor and train qualified successors for each of our critical management roles. We anticipate that given the current operating conditions, the general state of the economy, as well as the ongoing consolidation in the industry,

we will have opportunities to recruit additional, highly-qualified personnel.

In addition to our seasoned management, our Board of Directors consists of highly qualified and respected members of the communities that we serve. Our directors are successful businessmen, many of whom own their own businesses in their local communities. In addition, several of our directors were founders of the Bank and have remained with us as directors

and significant shareholders since our inception. As of October 16, 2009, our executive officers and directors held approximately 13.6% of our outstanding common stock.

Recently, our Board of Directors, with the assistance of an outside consultant, conducted an assessment to determine ways in which it may be able to improve upon or optimize its performance. As a result of this assessment, the Board of Directors determined that its performance may be optimized by, among other actions, reducing its size from 17 to ten

directors. Nine of the remaining ten directors meet the definition of “independent director” as that term is defined in the NASDAQ Listing Rules, and the Chairman of the Board remains unchanged. We believe that this reduced Board of Directors will enable us to respond more quickly and efficiently to our needs and the needs of the Bank.

| ||

|

Continue a Proactive Approach to Asset Quality. We believe our strong credit culture has been the cornerstone of our success and, today, we employ a proactive credit review system to ensure strong results going forward.

We believe that the first pillar of our approach to protect our asset quality is our disciplined, prudent and diligent credit underwriting and loan approval processes, which involve close oversight by our Chief Credit Officer, loan committee and loan review department. It is the Bank’s philosophy to meet all legitimate business and consumer credit

needs within a defined market segment where standards of safety, regulatory requirements, profitability and liquidity can be satisfied. Our underwriting standards achieve loan structures consistent with our risk-taking philosophy articulated in our loan policies and credit culture. The loan approval process establishes consistent procedures for the processing of loan requests and procedures for co-approvals, documenting loan decisions and maintaining credit files. We also focus on underwriting loans that enhance

a balanced, diversified portfolio. For example, we analyze our commercial real estate loan portfolio concentrations by market region on a quarterly basis in order to prevent overexposure to any one type of commercial real estate loan. We believe that loan portfolio diversification helps to mitigate our potential credit risk. Additionally, we incorporate third party real estate analysis in this report to monitor market conditions. Going forward, we intend to decrease our reliance on commercial real estate lending

by expanding our business lending programs to focus on the small to mid-sized operating companies that are located in our markets.

The second pillar of our approach is an active system that identifies problem loans and manages the quality of our credit portfolio. This system includes our problem loan detection program, which is designed to prioritize potential problem loans at an early stage to enable timely solutions by our senior banking team. Under this program, we review loans

that are projected to be 30 or more days past due at month-end on a weekly rather than monthly basis, which allows us to recognize potential asset deterioration more quickly and coordinate an appropriate course of action. Additionally, we have an internal loan review department which is the quality control checkpoint for managing our credit process. It is the objective of the loan review department to audit a minimum of 25% of our loan commitments annually, concentrating on adversely risk rated credits, a small

sample of each consumer loan officer’s loan portfolio and all unsecured commercial loans greater than $500,000. All findings are shared with senior management and the Audit Committee of our Board of Directors.

The third pillar of our approach is to aggressively work with customers for which we have identified problem loans to attempt to resolve issues before defaults result. An example of this problem loan resolution approach is our residential buyer’s special financing program, in which we have identified potential problem residential and development

loans and worked closely with sellers, builders, real estate agents and marketing personnel to find qualified buyers.

As a result of these measures to protect our asset quality, our Past Due/Total Loans ratio was 1.17% and our Nonperforming Loans/Total Loans ratio was 1.43% as of June 30, 2009.

Capitalize on Opportunities Resulting from Market Disruption. We believe that our community banking approach of personalized, customer service delivered through the resources of a larger institution positions us to capitalize on attractive opportunities that are emerging from

the market disruption caused by current economic conditions. In our markets, we believe that both our smaller community banking competitors and the larger regional and national financial services companies are distracted by internal issues, including financial performance, asset quality and capital adequacy. As a result, we believe that our competitors are unable to offer the same level of products and services that their customers have been accustomed to and, consequently, we have been able to attract new customers

and recruit new associates to Capital Bank. For example, from June 30, 2008 to June 30, 2009, we increased customer deposits by 21% to $1.3 billion, or 95% of total deposits. Further, we believe that our relative stability in the current operating environment will contribute to the expansion of our business lending platform.

|

|

In addition to the organic expansion opportunities described above, we believe that we are well positioned to take advantage of FDIC-assisted transactions, which typically are acquisitions in which a failed bank is acquired by a successful bidder and the FDIC guarantees certain credit losses and operating expenses associated with defaults

pursuant to a loss share agreement with the acquirer. We may also consider strategic acquisitions similar to our merger with Burlington, North Carolina-based 1st State Bancorp, Inc. in 2006 and our acquisition of four bank branches in the Fayetteville area from Omni National Bank in December 2008. We believe that we have the management depth and experience, as well as other franchise resources, to efficiently and effectively analyze and execute upon potential opportunities in selected markets in North Carolina,

South Carolina and Virginia.

Recent Developments

FDIC Insurance Assessments. The Bank is subject to regular insurance assessments imposed by the FDIC, which is actively seeking to replenish its deposit insurance fund. The FDIC increased risk-based assessment rates uniformly by 7 basis points, on an annual basis,

beginning in the first quarter of 2009. On May 22, 2009, the FDIC adopted a final rule imposing a 5 basis point special assessment on each insured depository institution’s qualifying assets less Tier 1 capital as of June 30, 2009. The FDIC collected this special assessment on September 30, 2009.

On September 29, 2009, the FDIC announced its intention to require insured institutions to prepay their estimated quarterly risk-based assessments for the fourth quarter of 2009 and for the following three years. Such prepaid assessments would be collected on December 30, 2009 at a rate based on the insured institution’s modified third

quarter 2009 assessment rate. At the present time, we are unable to determine the precise amount of any prepaid assessment that may be levied against us, but as a result of the proposed accounting treatment, we do not believe the proposed assessment will have a material impact on our operating results for the fourth quarter of 2009.

Bank Stress Test. In May 2009, the Federal Reserve announced the results of the Supervisory Capital Assessment Program, or the SCAP, commonly referred to as the “stress test,” of the near-term capital needs of the 19 largest U.S. bank holding companies.

Although we were not subject to the Federal Reserve’s review under the SCAP, we conducted our own internal cumulative loss analysis or “stress test” of Capital Bank’s capital position at June 30, 2009, using many of the same methodologies of the SCAP, but applying underlying economic assumptions relating to potential losses that we believed to be more appropriately tailored to reflect the composition of Capital Bank’s loan portfolio. In addition to our internal analysis, we recently

retained a third party consultant to perform an independent review of our portfolio and to provide us with a cumulative loss analysis of our loan portfolio based on the methodology of the stress tests that were administered under the SCAP. Both our internal and the third party analysis used a “baseline” scenario as provided in the SCAP methodology, and our internal analysis also used a “more adverse” scenario as provided in the SCAP methodology. A “baseline” scenario assumes

a path for the economy that follows a consensus forecast for certain economic variables and a “more adverse” scenario assumes a more significant downturn.

Based on the results of our stress test and the cumulative loss analysis performed by the third party consultant, and the assumptions and cumulative estimates utilized in each analysis, we believe that following the completion of this offering, we will be “well capitalized” from a regulatory capital perspective and have sufficient

capital to withstand the economic challenges facing our company if the North Carolina and national economies weaken further or become weaker in the future than is currently expected.

Expiration of Interest Rate Swap Agreement. In October 2006, we entered into a $100 million (notional) three-year interest rate swap agreement to help mitigate our exposure to interest rate volatility in the prime-based portion of the commercial loan portfolio. The

swap, which expired on October 9, 2009, increased loan interest income by $1.1 million and $675 thousand for the quarters ended September 30, 2009 and 2008, respectively, representing a benefit to net interest margin of 27 and 19 basis points, respectively, during the quarters.

Special Meeting of Shareholders. We intend to call a special meeting of our shareholders, to be held December 4, 2009, for the purpose of approving an amendment to our Articles of Incorporation, as amended, or the Articles of Incorporation, to increase the number

of authorized shares of common stock to 50,000,000 shares.

|

|

The Offering

| |||

|

Issuer |

Capital Bank Corporation, a North Carolina corporation.

| ||

|

Common stock offered |

l shares of common stock.

| ||

|

Over-allotment option |

We have granted the underwriters an option to purchase up to an additional l shares of common stock within 30 days of the date of this prospectus in order to cover over-allotments, if any.

| ||

|

Common stock outstanding after this offering |

l shares of common stock. (1)

| ||

|

Use of Proceeds |

We intend to use the net proceeds of this offering for general corporate purposes, including to strengthen the capital of the Bank and to support our strategic growth opportunities in the future. See “Use of Proceeds.”

| ||

|

Market and trading symbol for the common stock |

Our common stock is listed and traded on the NASDAQ Global Select Market under the symbol “CBKN.” | ||

|

(1) |

The number of shares of common stock outstanding immediately after the closing of this offering is based on l shares of common stock outstanding as of l, 2009. This number excludes the shares of common stock issuable pursuant to the

exercise of the underwriters’ over-allotment option, l shares of common stock that are subject to outstanding but unexercised options to purchase shares of common stock or to granted but unvested restricted stock, l shares of common stock that are reserved for issuance under our equity compensation plans but not subject to any outstanding equity grants and 749,619 shares of common stock

issuable upon the exercise of the warrant held by the U.S. Department of the Treasury, or the Treasury. Under the terms of the warrant issued to the Treasury, if we complete a “qualified equity offering” of at least $41.3 million prior to December 31, 2009, the number of shares of common stock underlying the warrant will be reduced by one-half, or approximately 374,809 shares. This offering constitutes a “qualified equity offering.”

| ||

|

Risk Factors | |||

|

Investing in our common stock involves risks. You should carefully consider the information under “Risk Factors” beginning on page 9 and the other information included in this prospectus before deciding whether to invest in our common stock.

| |||

|

You should read the summary selected consolidated financial information presented below in conjunction with the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the notes to those financial statements appearing in our Annual Report on Form 10-K for the fiscal year

ended December 31, 2008 and our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2009, which are incorporated by reference in this prospectus.

The following tables set forth selected consolidated financial data for us as of and for each of the years in the five-year period ended December 31, 2008 and as of and for the six-month periods ended June 30, 2009 and 2008.

The balance sheet data for the years ended December 31, 2008 and 2007 and the operational data as of December 31, 2008, 2007 and 2006 have been derived from our audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2008, which is incorporated by reference in this prospectus. The balance sheet data

for the years ended December 31, 2006, 2005 and 2004 and the operational data as of December 31, 2005 and 2004 have been derived from our audited financial statements that are not included in this prospectus. The comparability of financial data from 2005 and 2006 has been significantly impacted by the acquisition of 1st State Bancorp, Inc. in January 2006, and the comparability of financial data from 2007 and 2008 has been significantly impacted by the goodwill impairment charge taken in 2008.

| |||

|

The selected financial data as of and for the six months ended June 30, 2009 and 2008 have been derived from our unaudited interim financial statements included in our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2009, which are incorporated by reference in this prospectus. In the opinion of management, these unaudited interim financial

statements include all adjustments necessary for a fair presentation of our financial condition and results of operations as of the dates and for the periods indicated. Historical results are not necessarily indicative of future results and the results for the six months ended June 30, 2009, are not necessarily indicative of our expected results for the full year ending December 31, 2009.

| |||||||||||||||||||||||

|

As of and for the

Six Months Ended June 30, |

As of and for the Years Ended December 31, |

||||||||||||||||||||||

|

2009 |

2008 |

2008 |

2007 |

2006 |

2005 |

2004 |

|||||||||||||||||

|

(Dollars in thousands) |

|||||||||||||||||||||||

|

Selected Balance Sheet Data |

|||||||||||||||||||||||

|

Cash and investment securities |

$ |

340,918 |

$ |

289,120 |

$ |

332,593 |

$ |

299,288 |

$ |

293,379 |

$ |

238,690 |

$ |

183,591 |

|||||||||

|

Loans |

1,293,340 |

1,178,157 |

1,254,368 |

1,095,107 |

1,008,052 |

668,982 |

654,867 |

||||||||||||||||

|

Allowance for loan losses |

18,602 |

13,910 |

14,795 |

13,571 |

13,347 |

9,592 |

10,721 |

||||||||||||||||

|

Intangible assets |

3,282 |

62,831 |

3,857 |

63,345 |

64,543 |

12,853 |

13,065 |

||||||||||||||||

|

Total assets |

1,695,342 |

1,592,034 |

1,654,232 |

1,517,603 |

1,422,384 |

960,906 |

882,294 |

||||||||||||||||

|

Deposits |

1,380,842 |

1,182,615 |

1,315,314 |

1,098,698 |

1,055,209 |

698,480 |

654,976 |

||||||||||||||||

|

Borrowings |

127,589 |

201,297 |

147,010 |

208,642 |

160,162 |

107,687 |

119,075 |

||||||||||||||||

|

Subordinated debentures |

30,930 |

30,930 |

30,930 |

30,930 |

30,930 |

30,930 |

20,620 |

||||||||||||||||

|

Shareholders’ equity |

143,306 |

165,731 |

148,514 |

164,300 |

161,681 |

83,492 |

77,738 |

||||||||||||||||

|

Tangible common equity |

98,745 |

102,900 |

103,378 |

100,955 |

97,138 |

70,639 |

64,673 |

||||||||||||||||

|

Summary of Operations |

|||||||||||||||||||||||

|

Interest income |

$ |

40,420 |

$ |

44,001 |

$ |

85,020 |

$ |

94,537 |

$ |

86,952 |

$ |

50,750 |

$ |

42,391 |

|||||||||

|

Interest expense |

18,075 |

22,164 |

42,424 |

50,423 |

40,770 |

21,476 |

16,257 |

||||||||||||||||

|

Net interest income |

22,345 |

21,837 |

42,596 |

44,114 |

46,182 |

29,274 |

26,134 |

||||||||||||||||

|

Provision (credit) for loan losses |

7,678 |

1,415 |

3,876 |

3,606 |

531 |

(396 |

) |

1,038 |

|||||||||||||||

|

Net interest income after provision for loan losses |

14,667 |

20,422 |

38,720 |

40,508 |

45,651 |

29,670 |

25,096 |

||||||||||||||||

|

Noninterest income |

5,830 |

5,242 |

11,051 |

9,511 |

9,636 |

6,731 |

6,905 |

||||||||||||||||

|

Noninterest expense |

24,029 |

19,614 |

106,662 |

39,037 |

36,678 |

26,439 |

23,824 |

||||||||||||||||

|

Net (loss) income before tax (benefit) expense |

(3,532 |

) |

6,050 |

(56,891 |

) |

10,982 |

18,609 |

9,963 |

8,177 |

||||||||||||||

|

Income tax (benefit) expense |

(418 |

) |

1,668 |

(1,207 |

) |

3,124 |

6,271 |

3,264 |

2,866 |

||||||||||||||

|

Net (loss) income |

(3,114 |

) |

4,382 |

(55,684 |

) |

7,858 |

12,338 |

6,699 |

5,311 |

||||||||||||||

|

Dividend and accretion on preferred stock |

1,174 |

0 |

124 |

0 |

0 |

0 |

0 |

||||||||||||||||

|

Net income available to common shareholders |

(4,288 |

) |

4,382 |

(55,808 |

) |

7,858 |

12,338 |

6,699 |

5,311 |

||||||||||||||

|

As of and for the

Six Months Ended June 30, |

As of and for the Years Ended December 31, |

||||||||||||||||||||||

|

2009 |

2008 |

2008 |

2007 |

2006 |

2005 |

2004 |

|||||||||||||||||

|

Per Share Data |

|||||||||||||||||||||||

|

Net (loss) income – basic |

$ |

(0.38 |

) |

$ |

0.39 |

$ |

(4.94 |

) |

$ |

0.69 |

$ |

1.06 |

$ |

0.99 |

$ |

0.79 |

|||||||

|

Net (loss) income – diluted |

(0.38 |

) |

0.39 |

(4.94 |

) |

0.68 |

1.06 |

0.97 |

0.77 |

||||||||||||||

|

Book value |

9.03 |

14.76 |

9.54 |

14.71 |

14.19 |

12.18 |

11.76 |

||||||||||||||||

|

Tangible book value |

8.74 |

9.16 |

9.20 |

9.04 |

8.53 |

10.31 |

9.78 |

||||||||||||||||

|

Common stock dividends |

0.16 |

0.16 |

0.32 |

0.32 |

0.24 |

0.24 |

0.21 |

||||||||||||||||

|

Common shares outstanding |

11,300,369 |

11,229,085 |

11,238,085 |

11,169,777 |

11,393,990 |

6,852,156 |

6,612,787 |

||||||||||||||||

|

Diluted shares outstanding |

11,430,494 |

11,314,578 |

11,302,769 |

11,492,728 |

11,683,674 |

6,920,388 |

6,885,700 |

||||||||||||||||

|

Basic shares outstanding |

11,430,494 |

11,299,923 |

11,302,769 |

11,424,171 |

11,598,502 |

6,790,846 |

6,712,502 |

||||||||||||||||

|

| ||||||||||||||||||||||||

|

As of and for the

Six Months Ended June 30, |

As of and for the Years Ended December 31, |

|||||||||||||||||||||||

|

2009 |

2008 |

2008 |

2007 |

2006 |

2005 |

2004 |

||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Performance Ratios |

||||||||||||||||||||||||

|

Return on average shareholders’ equity 1 |

NM |

% |

5.18 |

% |

NM |

% |

4.78 |

% |

7.64 |

% |

8.32 |

% |

7.04 |

% | ||||||||||

|

Return on average assets 1 |

NM |

0.56 |

NM |

0.54 |

0.91 |

0.74 |

0.60 |

|||||||||||||||||

|

Net interest margin 2 |

2.95 |

3.20 |

3.08 |

3.53 |

3.94 |

3.59 |

3.28 |

|||||||||||||||||

|

Efficiency ratio |

85 |

72 |

77 |

73 |

66 |

73 |

72 |

|||||||||||||||||

|

Dividend payout ratio |

NM |

41 |

NM |

47 |

23 |

25 |

27 |

|||||||||||||||||

|

Capital Ratios |

||||||||||||||||||||||||

|

Tangible equity to tangible assets |

8.28 |

% |

6.73 |

% |

8.77 |

% |

6.94 |

% |

7.15 |

% |

7.45 |

% |

7.44 |

% | ||||||||||

|

Tangible common equity to tangible assets |

5.84 |

6.73 |

6.26 |

6.94 |

7.15 |

7.45 |

7.44 |

|||||||||||||||||

|

Leverage ratio |

9.94 |

8.91 |

10.58 |

9.10 |

9.42 |

10.64 |

9.61 |

|||||||||||||||||

|

Tier I risk-based capital |

11.52 |

9.85 |

12.17 |

10.19 |

10.76 |

11.73 |

11.08 |

|||||||||||||||||

|

Total risk-based capital |

12.77 |

10.88 |

13.24 |

11.28 |

11.92 |

13.71 |

12.33 |

|||||||||||||||||

|

|

||||||||||||||||||||||||

|

Asset Quality Ratios |

||||||||||||||||||||||||

|

Nonperforming loans / gross loans |

1.43 |

% |

0.44 |

% |

0.73 |

% |

0.55 |

% |

0.49 |

% |

1.21 |

% |

1.25 |

% | ||||||||||

|

Nonperforming assets / total assets |

1.40 |

0.37 |

0.63 |

0.50 |

0.42 |

0.92 |

0.98 |

|||||||||||||||||

|

Allowance / gross loans |

1.44 |

1.18 |

1.18 |

1.24 |

1.32 |

1.43 |

1.64 |

|||||||||||||||||

|

Allowance / nonperforming loans |

100 |

267 |

162 |

227 |

272 |

119 |

131 |

|||||||||||||||||

|

Net charge-offs / average loans 1 |

0.30 |

0.19 |

0.30 |

0.32 |

0.46 |

0.12 |

0.25 |

|||||||||||||||||

|

1 Return and charge-off ratios for the six months ended June 30, 2009 and 2008 are annualized. | ||||||||||||||||||||||||

|

2 Net interest margin ratios for the six months ended June 30, 2009 and 2008 are annualized. Net interest margin ratios for all periods are on a tax equivalent basis.

| ||||||||||||||||||||||||

An investment in our common stock involves certain risks. Before making an investment decision, you should read carefully and consider the risk factors below relating to this offering. You should also refer to other information contained in or incorporated by reference in this prospectus, including our financial statements

and the related notes incorporated by reference herein. Additional risks and uncertainties not presently known to us at this time or that we currently deem immaterial may also materially and adversely affect our business and operations.

Risks Related to Our Business

U.S. and international credit markets and economic conditions could adversely affect our liquidity, financial condition and profitability.

Global market and economic conditions continue to be disruptive and volatile and the disruption has particularly had a negative impact on the financial sector. The possible duration and severity of this adverse economic cycle is unknown. Although we remain well capitalized and have not suffered any liquidity issues as a result of these recent

events, the cost and availability of funds may be adversely affected by illiquid credit markets. Continued turbulence in U.S. and international markets and economies may also adversely affect our liquidity, financial condition and profitability.

Legislative and regulatory actions taken now or in the future to address the current liquidity and credit crisis in the financial industry may significantly affect our liquidity or financial condition.

The Emergency Economic and Stabilization Act of 2008, or EESA, which established the Troubled Asset Relief Program, or TARP, was enacted on October 3, 2008. As part of the TARP, the Treasury created the Capital Purchase Program, under which the Treasury will invest up to $250 billion in senior preferred stock of U.S. banks and savings associations

or their holding companies for the purpose of stabilizing and providing liquidity to the U.S. financial markets. On February 17, 2009, the American Recovery and Reinvestment Act of 2009, or ARRA, was enacted as a sweeping economic recovery package intended to stimulate the economy and provide for extensive infrastructure, energy, health and education needs. We participated in the Capital Purchase Program and sold $41.3 million in Fixed Rate Cumulative Perpetual Preferred Stock, Series A, or the Series A Preferred

Stock, and a warrant to purchase 749,619 shares of our common stock to the Treasury. Future participation in this or similar programs may subject us to additional restrictions and regulation. There can be no assurance as to the actual impact that EESA or its programs, including the Capital Purchase Program, and ARRA or its programs, will have on the national economy or financial markets. The failure of these significant legislative measures to help stabilize the financial markets and a continuation or worsening

of current financial market conditions could materially and adversely affect our financial condition, results of operations, liquidity or stock price.

Changes in local economic conditions could lead to higher loan charge-offs and reduce our net income and growth.

Our business is subject to periodic fluctuations based on local economic conditions in central and western North Carolina. These fluctuations are not predictable, cannot be controlled and may have a material adverse impact on our operations and financial condition even if other favorable events occur. Our operations are locally oriented and

community-based. Accordingly, we expect to continue to be dependent upon local business conditions as well as conditions in the local residential and commercial real estate markets we serve. For example, an increase in unemployment, a decrease in real estate values or increases in interest rates, as well as other factors, could weaken the economies of the communities we serve.

Weakness in our market areas could depress our earnings and consequently our financial condition because:

| • | customers may not want or need our products or services; | |

| • | borrowers may not be able to repay their loans; |

| • | the value of the collateral securing loans to borrowers may decline; and | |

| • | the quality of our loan portfolio may decline. |

Any of the latter three scenarios could require us to charge off a higher percentage of loans and/or increase provisions for credit losses, which would reduce our net income.

Because the majority of our borrowers are individuals and businesses located and doing business in Wake, Granville, Lee, Cumberland, Johnston, Chatham, Alamance, Buncombe, Catawba and Robeson Counties, North Carolina, our success will depend significantly upon the economic conditions in those and the surrounding counties. Unfavorable economic

conditions in those and the surrounding counties may result in, among other things, a deterioration in credit quality or a reduced demand for credit and may harm the financial stability of our customers. Due to our limited market areas, these negative conditions may have a more noticeable effect on us than would be experienced by a larger institution that is able to spread these risks of unfavorable local economic conditions across a large number of diversified economies.

We are exposed to risks in connection with the loans we make.

A significant source of risk for us arises from the possibility that losses will be sustained because borrowers, guarantors and related parties may fail to perform in accordance with the terms of their loans. We have underwriting and credit monitoring procedures and credit policies, including the establishment and review of the allowance

for loan losses, that we believe are appropriate to minimize this risk by assessing the likelihood of nonperformance, tracking loan performance and diversifying our loan portfolio. Such policies and procedures, however, may not prevent unexpected losses that could adversely affect our results of operations. Loan defaults result in a decrease in interest income and may require the establishment of or an increase in loan loss reserves. Furthermore, the decrease in interest income resulting from a loan default or

defaults may be for a prolonged period of time as we seek to recover, primarily through legal proceedings, the outstanding principal balance, accrued interest and default interest due on a defaulted loan plus the legal costs incurred in pursuing our legal remedies. No assurance can be given that recent market conditions will not result in our need to increase loan loss reserves or charge off a higher percentage of loans, thereby reducing net income.

A significant portion of our loan portfolio is secured by real estate, and events that negatively impact the real estate market could hurt our business.

A significant portion of our loan portfolio is secured by real estate. As of June 30, 2009, approximately 85% of our loans had real estate as a primary or secondary component of collateral. The real estate collateral in each case provides an alternate source of repayment in the event of default by the borrower and may deteriorate in value

during the time the credit is extended. A weakening of the real estate market in our primary market areas could result in an increase in the number of borrowers who default on their loans and a reduction in the value of the collateral securing their loans, which in turn could have an adverse effect on our profitability and asset quality. If we are required to liquidate the collateral securing a loan to satisfy the debt during a period of reduced real estate values, our earnings and shareholders’ equity

could be adversely affected. The declines in home prices in the markets we serve, along with the reduced availability of mortgage credit, also may result in increases in delinquencies and losses in our portfolio of loans related to residential real estate construction and development. Further declines in home prices coupled with a deepened economic recession and continued rises in unemployment levels could drive losses beyond that which is provided for in our allowance for loan losses. In that event, our earnings

could be adversely affected.

Additionally, recent weakness in the secondary market for residential lending could have an adverse impact on our profitability. Significant ongoing disruptions in the secondary market for residential mortgage loans have limited the market for and liquidity of most mortgage loans other than conforming Fannie Mae and Freddie Mac loans. The

effects of ongoing mortgage market challenges, combined with the ongoing correction in residential real estate market prices and reduced levels of home sales, could result in further price reductions in single family home values, adversely affecting the value of collateral securing mortgage loans held, mortgage loan originations and gains on sale of mortgage loans. Continued declines in real estate values and home sales volumes, and financial stress on borrowers as a result of job losses or other factors, could

have further adverse effects on borrowers that result in higher delinquencies and greater charge-offs in future periods, which could adversely affect our financial condition or results of operations.

Our real estate and land acquisition and development loans are based upon estimates of costs and the value of the complete project.

We extend real estate land loans, construction loans, and acquisition and development loans to builders and developers, primarily for the construction/development of properties. We originate these loans on a presold and speculative basis and they include loans for both residential and commercial purposes. As of June 30, 2009, these loans

totaled $482.2 million, or 37% of our total loan portfolio. Approximately $113.2 million of this amount was for construction of residential 1-4 properties and $94.5 million was for construction of commercial properties. Additionally, approximately $209.1 million was for acquisition and development loans for both residential and commercial properties. Land loans, which are loans made with raw land as security, totaled $65.4 million, or 5% of our portfolio, at June 30, 2009.

In general, construction and land lending involves additional risks because of the inherent difficulty in estimating a property’s value both before and at completion of the project. Construction costs may exceed original estimates as a result of increased materials, labor or other costs. In addition, because of current uncertainties

in the residential and commercial real estate markets, property values have become more difficult to determine than they have been historically. Construction and land acquisition and development loans often involve the repayment dependent, in part, on the ability of the borrower to sell or lease the property. These loans also require ongoing monitoring. In addition, speculative construction loans to a residential builder are often associated with homes that are not presold, and thus pose a greater potential risk

than construction loans to individuals on their personal residences. At June 30, 2009, $91.9 million of our residential construction loans were for speculative construction loans. Slowing housing sales have been a contributing factor to an increase in non-performing loans as well as an increase in delinquencies. Residential construction loans and commercial construction loans represented 25% and 0%, respectively, of our non-performing assets at June 30, 2009.

Our non-owner occupied commercial real estate loans may be dependent on factors outside the control of our borrowers.

We originate non-owner occupied commercial real estate loans for individuals and businesses for various purposes, which are secured by commercial properties. These loans typically involve repayment dependent upon income generated, or expected to be generated, by the property securing the loan in amounts sufficient to cover operating expenses

and debt service. This may be adversely affected by changes in the economy or local market conditions. Non-owner occupied commercial real estate loans expose a lender to greater credit risk than loans secured by residential real estate because the collateral securing these loans typically cannot be liquidated as easily as residential real estate. If we foreclose on a non-owner occupied commercial real estate loan, our holding period for the collateral typically is longer than a 1-4 family residential property

because there are fewer potential purchasers of the collateral. Additionally, non-owner occupied commercial real estate loans generally have relatively large balances to single borrowers or related groups of borrowers. Accordingly, charge-offs on non-owner occupied commercial real estate loans may be larger on a per loan basis than those incurred with our residential or consumer loan portfolios.

As of June 30, 2009, our non-owner occupied commercial real estate loans totaled $302.9 million, or 23% of our total loan portfolio.

Repayment of our commercial business loans is dependent on the cash flows of the borrower, which may be unpredictable, and the collateral securing these loans may fluctuate in value.

We offer different types of commercial loans to a variety of small to medium-sized businesses. The types of commercial loans offered are owner-occupied term real estate loans, business lines of credit and term equipment financing. Commercial business lending involves risks that are different from those associated with non-owner occupied commercial

real estate lending. Our commercial business loans are primarily underwritten based on the cash flow of the borrower and secondarily on the underlying collateral, including real estate. The borrowers’ cash flow may be unpredictable, and collateral securing these loans may fluctuate in value. Some of our commercial business loans are collateralized by equipment, inventory, accounts receivable or other business assets, and the liquidation of collateral in the event of default is often an insufficient source

of repayment because accounts receivable may be uncollectible and inventories may be obsolete or of limited use.

As of June 30, 2009, our commercial business loans totaled $321.8 million, or 25% of our total loan portfolio. Of this number, $141.7 million was secured by owner-occupied real estate and $180.1 was secured by business assets.

A portion of our commercial real estate loan portfolio utilizes interest reserves which may not accurately portray the financial condition of the project and the borrower’s ability to repay the loan.

Some of our commercial real estate loans utilize interest reserves to fund the interest payments and are funded from loan proceeds. Our decision to establish a loan-funded interest reserve upon origination of a loan is based on the feasibility of the project, the creditworthiness of the borrower and guarantors and the protection provided

by the real estate and other collateral. When applied appropriately, an interest reserve can benefit both the lender and the borrower. For the lender, an interest reserve provides an effective means for addressing the cash flow characteristics of a properly underwritten acquisition, development and construction loan. Similarly, for the borrower, interest reserves provide the funds to service the debt until the property is developed, and cash flow is generated from the sale or lease of the developed property.

Although potentially beneficial to the lender and the borrower, our use of interest reserves carries certain risks. Of particular concern is the possibility that an interest reserve may not accurately reflect problems with a borrower’s willingness or ability to repay the debt consistent with the terms and conditions of the loan obligation.

For example, a project that is not completed in a timely manner or falters once completed may appear to perform if the interest reserve keeps the loan current.

In some cases, we may extend, renew or restructure the term of certain loans, providing additional interest reserves to keep the loan current. As a result, the financial condition of the project may not be apparent and developing problems may not be addressed in a timely manner. Consequently, we may end up with a matured loan where the interest

reserve has been fully advanced, and the borrower’s financial condition has deteriorated. In addition, the project may not be complete, its sale or lease-up may not be sufficient to ensure timely repayment of the debt or the value of the collateral may have declined, exposing us to increasing credit losses.

As of June 30, 2009, we had a total of 53 loans funded by an interest reserve with a total outstanding balance of $139.6 million, representing approximately 11% of our total outstanding loans. Total commitments of these loans equaled $175.2 million with total remaining interest reserves of $7.8 million, representing a weighted average term

of 16 months of remaining interest coverage. These 53 loans had an average loan-to-value ratio of 60% based on most recent appraisals.

Our allowance for loan losses may prove to be insufficient to absorb losses in our loan portfolio.

Lending money is a substantial part of our business, and each loan carries a certain risk that it will not be repaid in accordance with its terms or that any underlying collateral will not be sufficient to assure repayment. This risk is affected by, among other things:

|

• |

cash flow of the borrower and/or the project being financed; | |

|

• |

the changes and uncertainties as to the future value of the collateral, in the case of a collateralized loan; | |

|

• |

the duration of the loan; | |

|

• |

the credit history of a particular borrower; and | |

|

• |

changes in economic and industry conditions. |

We maintain an allowance for loan losses, which is a reserve established through a provision for loan losses charged to expense, which we believe is appropriate to provide for probable losses in our loan portfolio. The amount of this allowance is determined by our management through periodic reviews and consideration of several factors, including,

but not limited to:

| • | our general reserve, based on our historical default and loss experience and certain macroeconomic factors based on management’s expectations of future events; and | |

| • | our specific reserve, based on our evaluation of non-performing loans and their underlying collateral. |

The determination of the appropriate level of the allowance for loan losses inherently involves a high degree of subjectivity and requires us to make significant estimates of current credit risks and future trends, all of which may undergo material changes. Continuing deterioration in economic conditions affecting borrowers, new information

regarding existing loans, identification of additional problem loans and other factors, both within and outside of our control, may require an increase in the allowance for loan losses. In addition, bank regulatory agencies periodically review our allowance for loan losses and may require an increase in the provision for probable loan losses or the recognition of further loan charge-offs, based on judgments different than those of management. In addition, if charge-offs in future periods exceed the allowance

for loan losses, we will need additional provisions to increase the allowance for loan losses. Any increases in the allowance for loan losses will result in a decrease in net income and, possibly, capital, and may have a material adverse effect on our financial condition and results of operations.

If our allowance for loan losses is not adequate, we may be required to make further increases in our provisions for loan losses and to charge off additional loans, which could adversely affect our results of operations.

For the quarter ended June 30, 2009, we recorded a provision for loan losses of $1.7 million compared to $850 thousand for the quarter ended June 30, 2008, an increase of $842 thousand. We also recorded net loan charge-offs of $1.6 million for the quarter ended June 30, 2009 compared to $503 thousand for the quarter ended June 30, 2008. For

the six months ended June 30, 2009, we recorded a provision for loan losses of $7.7 million compared to $1.4 million for the six months ended June 30, 2008, an increase of $6.3 million. We also recorded net loan charge-offs of $3.9 million for the six months ended June 30, 2009 compared to $1.1 million for the six months ended June 30, 2008. Generally, our non-performing loans and assets reflect operating difficulties of individual borrowers resulting from weakness in the local economy; however, more recently

the deterioration in the general economy has become a significant contributing factor to the increased levels of delinquencies and non-performing loans. Slower sales and excess inventory in the housing market has been the primary cause of the increase in delinquencies and foreclosures for residential construction loans, which represented 25% of our non-performing assets at June 30, 2009. In addition, slowing housing sales have been a contributing factor to the increase in non-performing loans as well as the increase

in delinquencies. At June 30, 2009, our total non-performing loans increased to $18.5 million, or 1.43% of total loans, compared to $5.2 million, or 0.54% of total loans, at June 30, 2008.

If current trends in the housing and real estate markets continue, we expect that we will continue to experience higher than normal delinquencies and credit losses. Moreover, until general economic conditions improve, we may continue to experience increased delinquencies and credit losses. As a result, we may be required to make additional

provisions for loan losses and to charge off additional loans in the future, which could materially adversely affect our financial condition and results of operations.

We are subject to environmental liability risk associated with lending activities.

A significant portion of our loan portfolio is secured by real property. During the ordinary course of business, we may foreclose on and take title to properties securing certain loans. In doing so, there is a risk that hazardous or toxic substances could be found on these properties. If hazardous or toxic substances are found, we may be

liable for remediation costs, as well as for personal injury and property damage. Environmental laws may require us to incur substantial expenses to address unknown liabilities and may materially reduce the affected property’s value or limit our ability to use or sell the affected property. In addition, future laws or more stringent interpretations or enforcement policies with respect to existing laws may increase our exposure to environmental liability. Although we have policies and procedures to perform

an environmental review before initiating any foreclosure action on nonresidential real property, these reviews may not be sufficient to detect all potential environmental hazards. The remediation costs and any other financial liabilities associated with an environmental hazard could have a material adverse effect on our financial condition and results of operations.

The results of our internal stress test and third party cumulative loss analysis may be incorrect and may not accurately predict the impact on us if the condition of the economy were to deteriorate more than assumed.

Recently, the Federal Reserve Board announced the results of the SCAP, commonly referred to as the “stress test,” of the near-term capital needs of the 19 largest U.S. bank holding companies. Although we were not subject to the Federal Reserve’s review under the SCAP, we conducted our own internal cumulative loss analysis

or “stress test” of Capital Bank’s capital position as of June 30, 2009, using many of the same methodologies of the SCAP, but applying underlying economic assumptions relating to potential losses that we believed to be more appropriately tailored to reflect the composition of Capital Bank’s loan portfolio. In addition to our internal analysis, we recently retained a third party consultant to perform an independent review of our portfolio and to provide us with a cumulative loss analysis

of our loan portfolio based on the methodology of the stress tests that were administered under the SCAP. Both our internal and the third party analysis used a “baseline” scenario as provided in the SCAP methodology, and our internal analysis also used a “more adverse” scenario as provided in the SCAP methodology. A “baseline” scenario assumes a path for the economy that follows a consensus forecast for certain economic variables, and a “more adverse” scenario assumes

a more significant downturn.

Based on the results of our stress test and the cumulative loss analysis performed by the third party consultant, we believe that, following completion of this offering, we will be “well capitalized” from a regulatory capital perspective and will have sufficient capital to withstand the economic challenges facing our company even

if the North Carolina and national economies weaken further or become weaker in the future than is currently expected. However, the results of our internal stress test and the cumulative loss analysis performed by the third party consultant may be inaccurate. In addition, while we believe that appropriate assumptions were applied in performing the stress test and cumulative loss analysis, these assumptions may prove to be incorrect. Moreover, the results of the stress test and cumulative loss analysis may not

accurately reflect the impact on us if economic conditions are materially different than our assumptions.

Changes in interest rates may have an adverse effect on our profitability.

Our earnings and financial condition are dependent to a large degree upon net interest income, which is the difference between interest earned from loans and investments and interest paid on deposits and borrowings. Approximately 68% of our loans were variable rate loans at June 30, 2009, which means that our interest income will generally

decrease in lower interest rate environments and rise in higher interest rate environments. Our net interest income will be adversely affected if market interest rates change such that the interest we earn on loans and investments decreases faster than the interest we pay on deposits and borrowings. We cannot predict with certainty or control changes in interest rates. Regional and local economic conditions and the policies of regulatory authorities, including monetary policies of the Board of Governors of the

Federal Reserve, affect interest income and interest expense. We have ongoing policies and procedures designed to manage the risks associated with changes in market interest rates. However, changes in interest rates still may have an adverse effect on our earnings and financial condition.

The fair value of our investments could decline.

Our investment securities portfolio as of June 30, 2009 has been designated as available-for-sale pursuant to Financial Accounting Standards Board Statement of Financial Accounting Standards No. 115, Accounting for Certain Investments in Debt and Equity Securities, or SFAS No. 115, relating to accounting for investments. SFAS No. 115 requires

that unrealized gains and losses in the estimated value of the available-for-sale portfolio be “marked to market” and reflected as a separate item in shareholders’ equity (net of tax) as accumulated other comprehensive income. At June 30, 2009, we maintained $263.8 million, or 98%, of our total securities as available-for-sale.

Shareholders’ equity will continue to reflect the unrealized gains and losses (net of tax) of these investments. The fair value of our investment portfolio may decline, causing a corresponding decline in shareholders’ equity.

Our securities portfolio contains whole loan private mortgage-backed securities and currently includes securities with unrecognized losses. We may continue to observe declines in the fair market value of these securities. We evaluate the securities portfolio for any other-than-temporary impairment each reporting period, as required by generally