Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OMNICOM GROUP INC. | e36808_8k.htm |

| EX-99.1 - EARNINGS RELEASE - OMNICOM GROUP INC. | e36808ex99_1.htm |

Investor Presentation

Third Quarter 2009 Results

October 21, 2009

Exhibit 99.2

Disclosure

1

October 21, 2009

The following materials have been prepared for use in the October 21, 2009 conference call on Omnicom’s results of operations for the

period ended September 30,

2009. The call will be archived on the Internet at http://www.omnicomgroup.com/financialwebcasts.

Forward-Looking Statements

Certain of the statements in this document constitute forward-looking

statements within the meaning of the Private Securities Litigation

Act of 1995. In addition,

from time to time, we or our representatives have made or may make forward-looking statements, orally or in

writing. These statements relate to future events or future financial performance and involve known and unknown risks and other factors

that

may cause our actual or our industry’s results, levels of activity, or achievement to be materially different from those expressed or

implied by any forward-looking statements. These risks and uncertainties include, but are not limited to, our future

financial condition and

results of operations, the continuing global economic recession and credit crisis, losses on media purchases on behalf of clients,

reductions in client spending and/or a slowdown in client payments, competitive factors, changes

in client communication requirements,

the hiring and retention of personnel, our ability to attract new clients and retain existing clients, changes in government regulations

impacting our advertising and marketing strategies, risks associated with

assumptions we make in connection with our critical accounting

estimates, legal proceedings, settlements, investigations and claims, and our international operations, which are subject to the risks of

currency fluctuations and exchange controls. Forward-looking

statements can generally be identified by terminology such as “may,” “will,”

“could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “potential” or “continue” or the negative of

those terms or other comparable terminology. These statements are present expectations. Actual events or results may differ materially.

We undertake

no obligation to update or revise any forward-looking statement, except as required by law.

Other Information

All dollar amounts are in millions except for Net Income per Common Share.

The following financial information contained in this

document has not been audited, although some of it has been derived from Omnicom’s historical financial statements, including its

audited financial statements. In addition, industry, operational

and other non-financial data contained in this document have been derived

from sources we believe to be reliable, but we have not independently verified such information, and we do not, nor does any other

person, assume responsibility for the accuracy

or completeness of that information. Certain amounts in prior periods have been

reclassified to conform to our current presentation.

The inclusion of information in this presentation does not mean that such information is material or that disclosure of such information is

required.

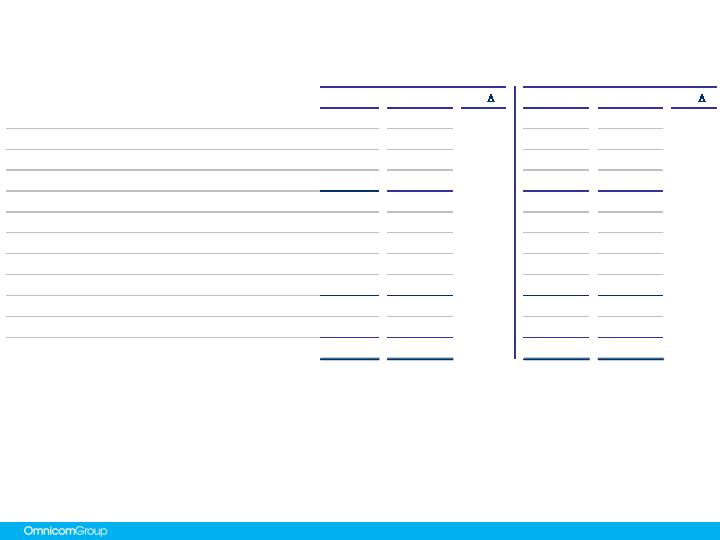

2009 vs. 2008 P&L Summary

October 21, 2009

2

(a)

Operating income includes depreciation and amortization expense of $60.2 million and $60.4 million for the three months

and $173.8 million and $176.2 million for the nine months ended September

30, 2009 and 2008, respectively.

(b)

On January 1, 2009, we retrospectively adopted revisions to ASC Topic 810 Consolidation - Noncontrolling Interest in a

Subsidiary. In accordance with the presentation requirements

of ASC Topic 810, we modified the format of our

consolidated statement of income to conform to the disclosure requirements of the revised guidance.

(c)

See page 19 for supplemental earnings per share information.

2009

2008

%

2009

2008

%

Revenue

$ 2,837.6

$ 3,316.2

-14.4%

$ 8,454.9

$ 9,988.5

-15.4%

Operating Income (a)

294.8

373.4

-21.0%

975.3

1,241.0

-21.4%

% Margin

10.4%

11.3%

11.5%

12.4%

Net Interest Expense

28.9

20.7

72.1

50.4

Income Before Tax

265.9

352.7

-24.6%

903.2

1,190.6

-24.1%

% Margin

9.4%

10.6%

10.7%

11.9%

Taxes

90.5

118.2

308.9

400.6

% Tax Rate

34.0%

33.5%

34.2%

33.6%

Income from Equity Method Investments

7.3

6.8

20.5

26.0

Net Income (b)

182.7

241.3

614.8

816.0

Less: Net Income Attributed to Noncontrolling Interests (b)

(17.1)

(27.7)

(51.3)

(86.7)

Net Income - Omnicom Group

$ 165.6

$ 213.6

-22.5%

$ 563.5

$ 729.3

-22.7%

Net Income per Common Share - Omnicom Group - Diluted (c)

0.53

$

0.68

$

-22.1%

1.80

$

2.28

$

-21.1%

Third Quarter

Year to Date

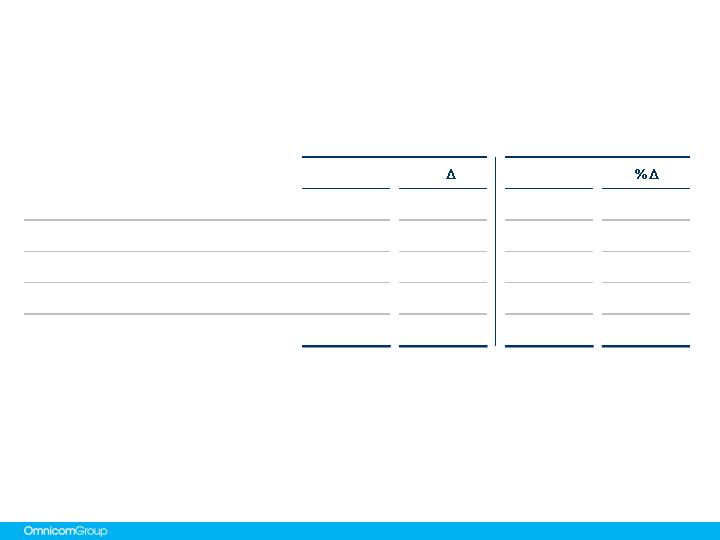

2009 Total Revenue Change

October 21, 2009

3

(a)

To calculate the FX impact, we first convert the current period’s local currency revenue using the average exchange rates

from the equivalent prior period to arrive at constant currency

revenue. The FX impact equals the difference between the

current period revenue in U.S. dollars and the current period revenue in constant currency.

(b)

Acquisition revenue is the aggregate of the applicable prior period revenue of the acquired businesses. Netted against this

number is the revenue of any business included in the

prior period reported revenue that was disposed of subsequent to

the prior period.

(c)

Organic revenue is calculated by subtracting both the acquisition revenue and the FX impact from total revenue growth.

$

%

Prior Period Revenue

$ 3,316.2

$ 9,988.5

Foreign Exchange (FX) Impact (a)

(97.8)

-2.9%

(584.8)

-5.9%

Acquisition Revenue (b)

(25.4)

-0.8%

(5.7)

-0.1%

Organic Revenue (c)

(355.4)

-10.7%

(943.1)

-9.4%

Current Period Revenue

$ 2,837.6

-14.4%

$ 8,454.9

-15.4%

Third Quarter

Year to Date

$

2009 Revenue by Discipline

October 21, 2009

4

(a)

“Change” is the year-over-year decrease from the prior period.

(b)

“Organic Change” reflects the year-over-year decrease in revenue from the prior period, excluding the foreign exchange

impact and acquisitions, net of dispositions, as defined on

page 3.

-12.9%

-19.6%

785.5

Specialty

-11.0%

-16.7%

798.0

PR

-10.8%

-16.1%

3,143.7

CRM

-7.1%

-13.5%

$ 3,727.7

Advertising

Change (b)

% Organic

% Change (a)

$ Mix

$ Mix

% Change (a)

% Organic

Change (b)

Advertising

$ 1,231.6

-11.6%

-8.4%

CRM

1,083.1

-16.2%

-13.6%

PR

266.2

-14.9%

-11.3%

Specialty

256.7

-19.3%

-8.5%

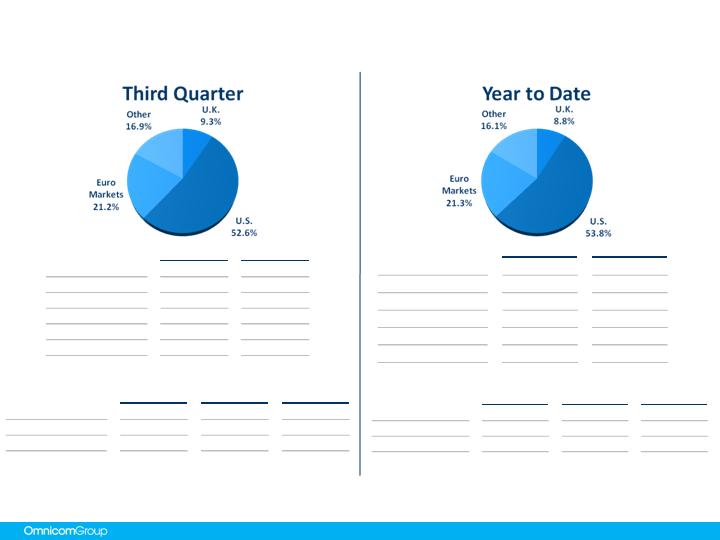

2009 Revenue By Geography

October 21, 2009

5

(a)

“Change” is the year-over-year increase or decrease from the prior period.

(b)

“Organic Change” reflects the year-over-year decrease in revenue from the prior period, excluding the foreign exchange

impact and acquisitions, net of dispositions, as defined on

page 3.

$ Mix

$ Change (a)

United States

4,548.0

$

(582.5)

$

Organic

(564.0)

Acquisition

(18.5)

International

3,906.9

$

(951.1)

$

Organic

(379.1)

Acquisition

12.8

FX

(584.8)

(a)

% Organic

$ Mix

% Change

Change (b)

United States

4,548.0

$

-11.4%

-11.0%

Euro Currency Markets

1,803.3

-18.8%

-9.9%

United Kingdom

745.8

-27.3%

-8.3%

Other

1,357.8

-15.8%

-4.7%

$ Mix

% Change

(a)

% Organic

Change (b)

United States

1,491.2

$

-13.2%

-11.5%

Euro Currency Markets

602.8

-16.2%

-12.7%

United Kingdom

262.9

-22.1%

-10.3%

Other

480.7

-11.2%

-5.8%

$ Mix

$ Change (a)

United States

1,491.2

$

(226.8)

$

Organic

(198.0)

Acquisition

(28.8)

International

1,346.4

$

(251.8)

$

Organic

(157.4)

Acquisition

3.4

FX

(97.8)

6

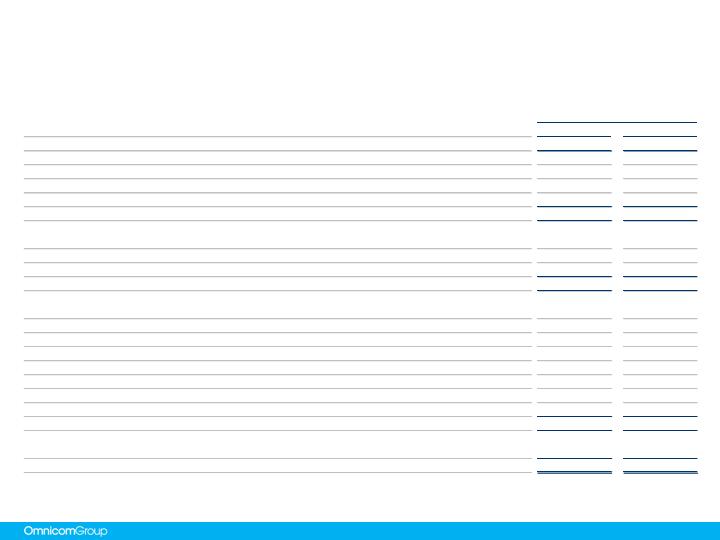

Cash Flow – GAAP Presentation (condensed)

October 21, 2009

2009

2008

Net Income

614.8

$

816.0

$

Share-Based Compensation Expense

56.7

44.3

Depreciation and Amortization

173.8

176.2

Other Non-Cash Items to Reconcile to Net Cash Provided by (Used in) Operating Activities, net

4.9

(12.9)

Other Changes in Operating Capital

(397.1)

(789.2)

Net Cash Provided by (Used in) Operating Activities

453.1

234.4

Capital Expenditures

(93.4)

(151.6)

Acquisitions

(124.9)

(389.4)

Other Investing Activities, net

28.5

20.7

Net Cash Used in Investing Activities

(189.8)

(520.3)

Dividends

(140.3)

(145.3)

Proceeds from Short-term Debt, net

157.9

115.3

Proceeds from Long-term Debt, net

497.8

55.3

Repayment of Convertible Debt

(1,316.7)

(1.6)

Stock Repurchases

(13.3)

(846.0)

Proceeds from Stock Plans

10.1

77.8

Excess Tax Benefit on Share-based Compensation

-

12.9

Other Financing Activities, net

(53.9)

(102.7)

Net Cash Used in Financing Activities

(858.4)

(834.3)

Effect of exchange rate changes on cash and cash equivalents

95.2

(142.4)

Net Decrease in Cash and Cash Equivalents

(499.9)

$

(1,262.6)

$

September 30,

9 Months ended

Current Credit Picture

October 21, 2009

7

(a)

“EBITDA” and “Gross Interest Expense” calculations shown are for the twelve months ending September 30. EBITDA is

defined as operating income before interest,

taxes, depreciation and amortization. Although EBITDA is a non-GAAP

measure, we believe EBITDA is more meaningful for purposes of this analysis because the financial covenants in our

credit facilities are based on EBITDA

(see reconciliation of Operating Income to EBITDA on page 21).

2009

2008

EBITDA (a)

$

1,657

$

2,007

Gross Interest Expense (a)

120.7

115.2

EBITDA / Gross Interest Expense

13.7

x

17.4

x

Total Debt / EBITDA

1.5

x

1.6

x

Debt

Bank Loans (Due Less Than 1 Year)

$

33

$

64

CP Issued Under $2.5B Revolver Due 6/23/11

144

113

Borrowings Under $2.5B Revolver Due 6/23/11

-

-

Convertible Notes Due 2/7/31

6

847

Convertible Notes Due 7/31/32

253

727

Convertible Notes Due 6/15/33

-

-

Convertible Notes Due 7/1/38

467

467

Senior Notes Due 4/15/16

997

996

Senior Notes Due 7/15/19

497

-

Other Debt

16

20

Total Debt

$

2,413

$

3,234

Cash and Short Term Investments

613

553

Net Debt

$

1,800

$

2,681

12 Months ended September 30,

8

Current Liquidity Picture

October 21, 2009

(a)

Credit facility expires June 23, 2011.

(b)

Represents uncommitted facilities in the U.S., U.K. and Canada. These amounts are excluded from our available liquidity

for purposes of this presentation.

Total Amount

of Facility

Outstanding

Available

Committed Facilities

Revolver Facility (a) & Outstanding Commercial Paper

2,500

$

144

$

2,356

$

Other Committed Credit Facilities

33

33

-

Total Committed Facilities

2,533

177

2,356

Uncommitted Facilities

(b)

351

-

-

(b)

Total Credit Facilities

2,884

$

177

$

2,356

$

Cash and Short Term Investments

613

Total Liquidity Available

2,969

$

As of September 30, 2009

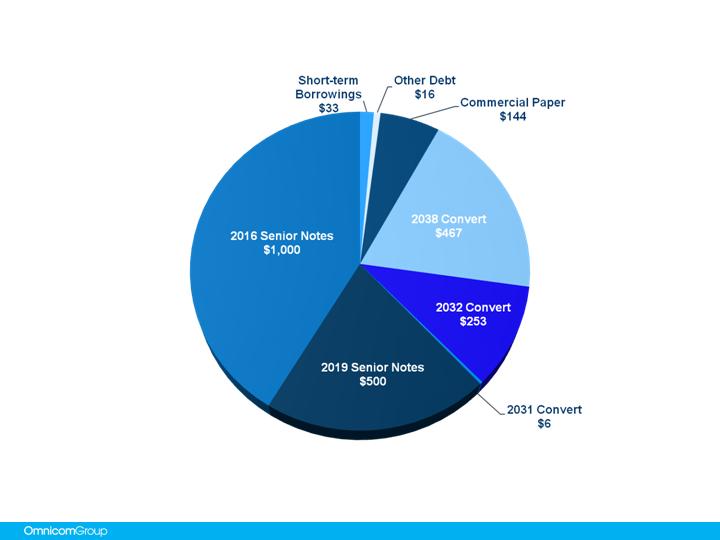

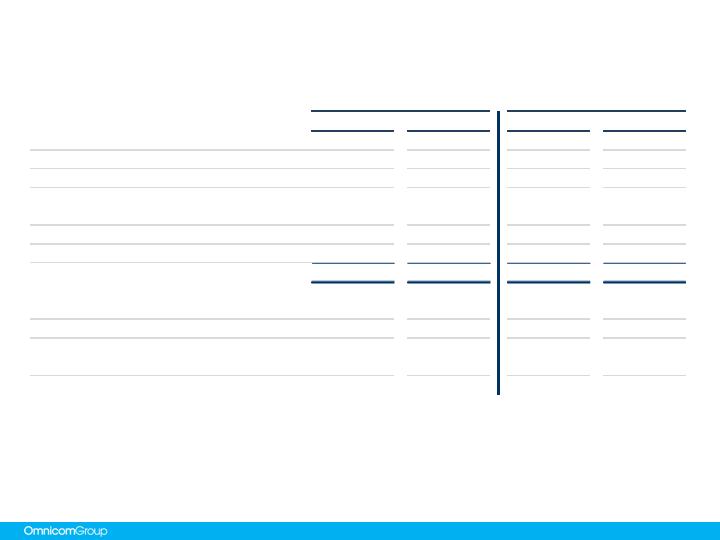

Omnicom Debt Structure

Supplemental Information

Omnicom Debt Structure

October 21, 2009

10

The above chart sets forth Omnicom’s debt outstanding at September 30, 2009. The amounts reflected above for the

2016 and 2019 Senior Notes represent the principal amount of

these notes at maturity on April 15, 2016 and July 15,

2019, respectively.

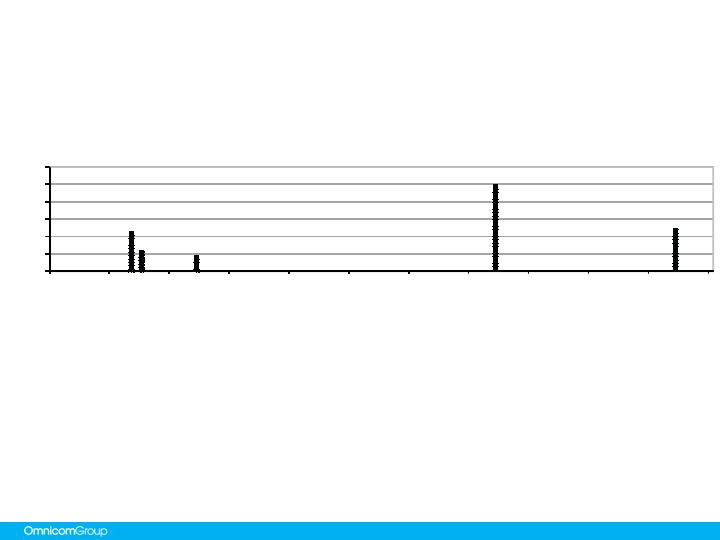

Omnicom Debt Structure

October 21, 2009

11

The Bank Facility and Commercial Paper Program together provide liquidity in the event any

convertible notes are put. We believe that we will then have flexibility to

refinance in different

debt capital markets.

Our 2031 Notes are putable annually, with the next put date in February 2010. Our 2032 Notes are putable annually, with the

next put date in July 2010. Our 2038 Notes are putable

in June 2010, 2013, 2018, 2023 and annually thereafter.

For purposes of this presentation we have included the following borrowings as of September 30, 2009 as outstanding through

June 2011, the date of expiration of our five-year credit facility:

short-term borrowings of $33 million, commercial paper

borrowings of $144 million and other debt of $16 million.

2031

2032

2038

$1.0 Billion

Senior Notes

Revolver

and Other

Borrowings

$500 Million

Senior Notes

$0

$200

$400

$600

$800

$1,000

$1,200

Jan-09

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Jan-15

Jan-16

Jan-17

Jan-18

Jan-19

Jan-20

Senior Notes Due 2019

October 21, 2009

12

Principal Amount

$500 Million

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

July 1, 2009

Maturity

July 15, 2019

Security

Unsecured, pari passu with Bank Facility

Coupon

6.25%

Spread Over Comparable Treasury at Issue

2.75%

Ratings

Moody’s: Baa1

S&P: A-

Fitch: A-

Senior Notes Due 2016

October 21, 2009

13

Principal Amount

$1 Billion

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

March 29, 2006

Maturity

April 15, 2016

Security

Unsecured, pari passu with Bank Facility

Coupon

5.90%

Spread Over Comparable Treasury at Issue

1.30%

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

2032 Convertible Notes

October 21, 2009

14

Principal Amount

$253 Million

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

March 6, 2002

Maturity

July 31, 2032 with annual puts each July

Security

Unsecured, pari passu with Bank Facility

Coupon

0.00%

Conversion Price

$55

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

2038 Convertible Notes

October 21, 2009

15

Principal Amount

$467 Million

Co - Issuers

Omnicom Group, Omnicom Finance, Omnicom Capital

Date

June 10, 2003

Maturity

June 15, 2038 with puts in June of 2010, 2013, 2018, 2023

and annually thereafter until maturity

Security

Unsecured, pari passu with Bank Facility

Coupon

0.00%

Conversion Price

$51.50

Rating

Moody’s: Baa1

S&P: A-

Fitch: A-

Current Bank Credit Facility

October 21, 2009

16

Amount

$2.5 Billion

Type

Unsecured Revolving Credit

Maturity

5 Years – June 2011

Facility Fee

13BP per annum

Drawn Rate

Libor +17BP

Covenants

-Maximum Debt to EBITDA 3:1

-Minimum Interest Coverage 5:1

Current Omnicom Credit Ratings

October 21, 2009

17

Moody’s

S&P

Fitch

Long Term Ratings

Baa1

A-

A-

Short Term Ratings

P2

A2

F2

Outlook

Stable

Negative

Stable

Note: Reflects credit ratings as of October 20, 2009.

Supplemental Financial Information

19

2009 vs. 2008 Earnings Per Share (a)

(a)

On January 1, 2009, we adopted revisions to ASC Topic 260 Earnings per Share - Participating Securities and the Two-

Class Method, which provides that all outstanding unvested share-based payments

that contain rights to non-forfeitable

dividends participate in the undistributed earnings with the common shareholders and are therefore participating

securities. Companies with participating securities are required to apply the two-class

method in calculating basic and

diluted earnings per share. On adoption of the revised guidance, we retrospectively restated basic and diluted Net Income

per Common Share - Omnicom Group Inc. for each period presented.

October 21, 2009

2009

2008

2009

2008

Net Income per Common Share - Omnicom Group:

Basic

$ 0.53

$ 0.68

$ 1.81

$ 2.29

Diluted

0.53

0.68

1.80

2.28

Earnings Available for Common Shares:

Net Income - Omnicom Group

$ 165.6

$ 213.6

$ 563.5

$ 729.3

Earnings Allocated to Participating Securities

(1.8)

(3.1)

(6.6)

(9.0)

Earnings Available for Common Shares

$ 163.8

$ 210.5

$ 556.9

$ 720.3

Weighted Average Shares (millions):

Basic

308.6

309.1

308.0

315.0

Diluted

311.6

310.3

309.5

316.6

Dividend Declared per Share

$ 0.150

$ 0.150

$ 0.450

$ 0.450

Third Quarter

Year to Date

Acquisition Related Expenditures

October 21, 2009

20

(a)

Includes acquisitions of a majority interest in agencies resulting in their consolidation.

(b)

Includes acquisitions of additional equity interests in existing affiliate agencies resulting in their majority ownership and

consolidation.

(c)

Includes acquisitions of less than a majority interest in agencies in which Omnicom did not have a prior equity interest and

the acquisition

of additional interests in existing affiliated

agencies that did not result in majority ownership.

(d)

Includes the acquisition of additional equity interests in already consolidated subsidiary agencies.

(e)

Includes additional consideration paid for acquisitions completed in prior periods.

Nine Months YTD 2009

New Subsidiary Acquisitions (a)

5

$

Affiliates to Subsidiaries (b)

2

Affiliates (c)

-

Existing Subsidiaries (d)

12

Earn-outs (e)

106

Total Acquisition Expenditures

125

$

Reconciliation of Operating Income to EBITDA

October 21, 2009

21

The covenants contained in our credit facility are based on the EBITDA ratios as presented on pages 7 & 16 of this presentation. The

above reconciles our GAAP Operating Income to EBITDA

for the periods presented.

EBITDA is a non-GAAP financial measure within the meaning of applicable SEC rules and regulations. Our credit facility defines

EBITDA as earnings before deducting interest expense, income

taxes, depreciation and amortization. Our credit facility uses EBITDA

to measure our compliance with covenants, such as interest coverage and leverage. EBITDA is not, and should not, be used as a

substitute for Operating

Income as determined in accordance with GAAP and is only used to measure our compliance with our debt

covenants. Management does not use EBITDA for any other measurement purpose.

2009

2008

Operating Income

1,424

$

1,773

$

Depreciation

177

184

Amortization

56

50

EBITDA

1,657

$

2,007

$

12 Months ended September 30,