Attached files

| file | filename |

|---|---|

| EX-32 - Yongye International, Inc. | v162701_ex32.htm |

| EX-31.2 - Yongye International, Inc. | v162701_ex31-2.htm |

| EX-31.1 - Yongye International, Inc. | v162701_ex31-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-K/A

(Amendment

No. 1)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE

|

SECURITIES

EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2008

OR

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE

|

SECURITIES

EXCHANGE ACT OF 1934

For

the transition period from _____ to __________

COMMISSION

FILE NO. 333-143314

YONGYE

INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

|

NEVADA

|

20-8051010

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(I.R.S.

Employer Identification No.)

|

6th Floor, Suite 608, Xue Yuan

International Tower,

No.

1 Zhichun Road, Haidian District, Beijing, PRC

(Address

of principal executive offices)

+86

10 8232 8866

(Issuer’s

telephone number, including area code)

Securities

Registered Pursuant to Section 12(b) of the Act: Common Stock, par value $.001

per share

Securities

Registered Pursuant to Section 12(g) of the Act: None.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in

Rule 405 of the Securities Act.

Yes ¨ No

x

Check

whether the issuer is not required to file reports pursuant to Section 13 or

15(d) of the Exchange Act.

Yes ¨ No

x

Check

whether the issuer (1) filed all reports required to be filed by Section 13 or

15(d) of the Exchange Act during the past 12 months (or for such shorter period

that the registrant was required to file such reports); and (2) has been subject

to such filing requirements for the past 90 days.

Yes x

No ¨

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained, to the best

of registrant’s knowledge, in definitive proxy or information statements

incorporated by reference in Part III of this Form 10-K or any amendment to this

Form 10K. ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of “accelerated

filer” and “large accelerated filer” in Rule 12b-2 of the Exchange

Act.

Large

Accelerated Filer ¨ Accelerated

Filer ¨ Non-Accelerated

Filer ¨

Smaller Reporting Company x

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes ¨ No

x

The

aggregate market value of the 20,000,374 voting and non-voting common equity

stock held by non-affiliates of the Registrant was approximately $70,001,309 the

last business day of the Registrant’s most recently completed second fiscal

quarter, based on the last sale price of the registrant’s common stock on the

most recent date on which a trade in such stock took place prior

thereto.

There

were a total of 32,790,327 shares of the registrant’s Common Stock, par value

$0.001 per share, outstanding as of September 9, 2009.

DOCUMENTS

INCORPORATED BY REFERENCE

None.

EXPLANATORY

NOTE

We are

filing this Annual Report on Form 10-K/A (the “Amendment”) to amend Part I, Item

1, Financial Statements and Item 2, Management’s Discussion and Analysis of

Financial Condition and Results of Operations, in the original Annual Report on

Form 10-K, filed with the Securities and Exchange Commission (“SEC”). This

Amendment has been filed to correct an error in the manner in which we

calculated the number of shares outstanding in determining earnings per share,

and another error in which we should have reclassified warrants issued as a

derivative liability, and the financial statements contained herein are being

restated accordingly. In addition, certain revisions are being made to the

disclosures included in our Annual Report on Form 10-K for the year ended

December 31, 2008 initially filed with the Securities and Exchange Commission

(the “Commission”) on March 24, 2009 in response to the Commission’s comment

letter dated September 1, 2009.

TABLE

OF CONTENTS

|

PART

II

|

|||

|

ITEM

1

|

Business

|

1

|

|

|

ITEM

1A

|

Risk

Factors

|

8

|

|

|

ITEM

7

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations

|

14

|

|

|

ITEM

8

|

Financial

Statements and Supplementary Data

|

24

|

|

|

ITEM

10

|

Directors,

Executive Officers and Corporate Governance

|

24

|

|

|

ITEM

11

|

Executive

Compensation

|

26

|

|

|

ITEM

12

|

Security

Ownership of Certain Beneficial Owners and Management and Related

Stockholder Matters

|

27

|

|

|

ITEM

13

|

Certain

Relationships and Related Transactions, and Director

Independence

|

29

|

|

|

Index

to Consolidated Financial Statements

|

31

|

||

|

Consolidated

Financial Statements

|

|||

i

ITEM

1 Business

Business

Overview

We are

engaged in the research, development and sales of fulvic acid based liquid and

powder nutrient compounds for plant and animal feed used in the agriculture

industry. Fulvic acid is produced by the decomposition of plant material

over a period of time and acts as a transport agent, which helps cells absorb

essential minerals and elements for growth. Based on our internal data and

research, we believe our proprietary technology for fulvic acid extraction

creates some of the purest and most effective fulvic acid base on the market in

China today. We have found that our fulvic acid has a very light weight

molecular composition, which we believe improves the overall permeability of

cell walls and allows more complete transport of nutrients across plant

membranes, effectively strengthening the overall health of plants.

Additionally, the Inner Mongolia Autonomous Region Scientific and Technology

Bureau (SEAL), on December 6, 2008, thoroughly reviewed the scientific and

economic data provided by the company and reached the opinion that information

provided by the project is complete; the data is detailed and reliable,

consistent with the identification requirements supports China’s agricultural

production development, the product has a wide range of efficacy, thereof

promoting plant growth, enhancing plant resistance, increasing production,

improving quality, increasing the utilization of fertilizer and etc. Large scale

experimentation has proven that the product can increase overall crop yield by

10-20%, and for vegetables, 15-30%, with the significant improvement of the

agricultural products quality, and outstanding economic and social benefits, the

project has obvious innovations in humic acid extraction process and of the

product preparation in selection and application in oxidants, composite

precipitators, complexing agent, distributed agent and additives.

Industry

and Market Overview

We

believe that in order to understand our business, it is important to understand

China’s economy. China has grown from a largely semi-subsistence economy to an

urban economy in recent years. The population shift to the first and

second tier cities (large populations with well developed infrastructure) such

as Beijing, Shanghai, Xian & Chengdu is already well documented and now

smaller cities such as Hohhot, Kunming and Linyi, with over 1 million people

each, are developing larger populations as well. The middle class is growing and

consumers are demanding better quality agricultural products and research

suggests that as income increases, as with other countries globally, consumers

begin to increase consumption of meat, fruit, vegetables, poultry and dairy

products (Economic Research Service/USDA, 2000). The agricultural industry

in China is expected to grow to keep up with this domestic demand, but added to

this is also a global demand for China’s agriculture products. This

increased demand is creating much volatility in the supply chain due to currency

fluctuations, logistics issues, pricing changes and market risk and we believe

farmers are at the crux of both a source of and solution to crop and animal

production issues China faces today. This is where we believe our products

can help to fulfill market need.

Currently,

crop production in China is limited to only 1.827 billion mu (121.8 million

hectares or approximately 301 million acres) of arable farm land, which is only

about 14% of all of China’s land (China, National Bureau of Statistics, 2008).

One principle to ensure food security is the “bottom line”: 1.8 billion mu (120

million hectares) of farmland which is (0.09 hectares) per capita, about a third

of the global average. In 1996, China had 1.951 billion mu (130.07 million

hectares), or 1.59 mu (0.11 hectares) per person — a loss of 6.4 percent of the

arable land in 11 years mainly to urbanization. China approves about 4 million

mu (266,667 hectares or 658,667 acres) for construction each year which impacts

about 2.82 million mu (188,000 hectares) of farmland. Currently about 70% of new

construction in second and third tier cities encroaches on farmland. China’s

urban population was about 43.9 percent in 2006 and continues to grow with

projections of 70 percent by 2050. China reported 7,438 square km of urban area

in 1981 and 32,521 square km in 2005, a 340-percent increase in 25

years.

China has

the world’s largest population, which it sustains on a very low amount of arable

land on a per capita basis, approximately 0.09 hectare (according to a story

appearing in China Daily on October 3, 2008). This is approximately 50% of that

present in the United States (Source: US Census Bureau, www.census.gov). This

high population density in China requires that each hectare of land feed an

average of 10 people compared to the world average of 4.4 people, which means

farm land is being used at close to capacity levels just for domestic production

levels. Another problem is desertification, the transformation of arable or

habitable land to desert due to changes in climate. Desertification claimed

1,200 square miles of land in 2007, or 120,000 hectares. This is a major

improvement from losses in the 1990’s which reached 10,000 square miles per

annum. According to an estimate by Interfax China, if unabated, the shortage

could reach 6.67 million hectares by 2020.

This

combination of limited arable land and a large and growing population has

created a significant need to increase the output of crops per hectare in China

using agricultural inputs as the main technology. In China, the average grain

yield per acre grew 98 percent between 1980 and 2005, while total fertilizer use

increased 416 percent from 9.1M tons to 47M tons. Much of the excess, however,

is lost to the environment, degrading both air and water quality, with 70% of

the nutrients being lost due to poor crop management (China Agriculture

Statistical Year Book, 1980-2005). The last five years, beginning with 2005,

have seen year on year increases in crop production which hasn’t been seen since

economic reforms began in the late 1970s (USDA Foreign Agriculture Service). We

believe exports and domestic consumption will continue to pressure crop

production upwards, so, given the limited amount of arable land, further growth

in farming capacity is likely to come from continued reliance on agricultural

input technologies.

This is a

common occurrence in most developing nations and has prompted the Food and

Agriculture Organization of the United Nations to implement an on-going, high

priority initiative to increase farmer education proper plant nutrient

management. The key point is that the UN is encouraging farmers to increase

nutrients to the plant without increasing the amount of fertilizer used. In case

of farmer education, the FAO says that the majority of the world’s farmers are

females and they tend to continue cultivating in traditional ways. They need to

be educated about the modern methods and the governments should take initiatives

for this. Overall, we believe that this supports not only our plant nutrient

approach, but also our educational approach to selling our product, which is

helping farmers to increase yields via overall education and proper use of input

products.

Also,

with the growth of the economy has come growth in consumers’ demand for a wider

choice of food options. One key area of growth is the demand for dairy

products. The Chinese Government has now attached great importance to the

development of this industry and it is now growing after being dormant for many

years. However, average yield per cow is only about 2,000kg, indicating

relatively low productivity. One major reason for this low production is

mastitis, which is an inflammation of the teats which slows down milk

production. This is an industry wide problem where 35-40 cows out of 100 have

some form of mastitis, which is typically treated with antibiotics.

With this

backdrop, we began selling our plant and animal nutrient products to help

farmers increase their farming output. In crop production, we believe that our

product assists farmers in generating higher yields from their crops and our

first line of animal product for dairy cows assists with the reduction of

mastitis to increase milk production.

Our

Domestic Market

The

amount of land used for agriculture in China is declining because of urban

encroachment and increasing non-agricultural use of land, and a large number of

farmers have moved to cities for higher paying jobs. China is going through

rapid urbanization, creating pressure to use arable land for development and

industrial purposes. Arable land is also being lost because of pollution

(especially by heavy metals), uncontrolled erosion, overuse of chemical

fertilizers and desertification. At the end of 2007, China had a total of 122

million hectares of arable farmland, which is expected to decrease to about 97

million hectares by 2015 (China National Grain and Oil Information

Center).

1

As the

overall economy grows, consumer demand for better quality food products is also

growing. Over 60% of the nation’s population is comprised of low income, rural

farmers (Asian Development Bank). The government has made raising the level of

rural income, especially in Western China, a top economic and social goal.

The government expects annual rural income to grow between 5% and 10% through

2010. With increased income among a large portion of the population, demand for

better food products, including organic “Green Food,” is expected to grow. The

need to use land efficiently has led to a genuine need to improve productivity.

China’s increasingly affluent urban centers and rising concerns about food

quality and safety have led to greater demand for organic plant and animal

nutrients (Demand for Food Quantity and Quality in China, USDA/ERS, January

2007).

Barely

meeting domestic demand for agricultural products, food security has become a

national priority in China (as noted in China’s Food and Agriculture: Issues for

the 21st Century, ERS/USDA). China is self-sufficient in its ability to raise

most of its staple crops, which is a part of food security, but increasingly

dependent on imports of some agricultural products, such as soybeans, to meet

rising domestic demand. This was after China’s agricultural output increased 19%

in the period 1988 to 2004 from 394,080,000 tons to 469,469,000 tons (China’s

Hunger: The Consequences of a Rising Demand for Food and Energy).

We

estimate, by the end of 2008, the overall fertilizer market generated over $50

billion in sales in China and has grown about 30% a year from 2005 to 2009.

Demand for organic plant fertilizers and nutrients is expected to grow with

increasing concern over food quality and environmental issues. Over reliance on

chemical fertilizers has led to soil degradation and water pollution, raising

the importance of alternative means of increasing productivity. The government

plans to spend approximately $169 billion, 1.6% of GDP, between 2006 and 2010 on

environmental objectives (OECD, 2006). In 2007, China spent about $5.9 billion

on direct subsidies for grain production and the purchase of agricultural

materials, up 63% from 2006. The government is planning on additional farm

subsidies, land reform initiatives, and elimination of certain agricultural

taxes and is promoting the production of organically grown products by setting

new standards.

Domestic

competition for plant nutrients typically comes from companies in the

traditional fertilizer industry, though the plant nutrient market does not

directly compete with traditional fertilizer products. China’s fertilizer

industry is highly fragmented, with over 2,800 fertilizer products registered

with the government in 2007 (according to the PRC Ministry of Agriculture).

Yongye competes against 164 other fulvic acid fertilizer products (Chinese

Fertilizer Net), however, we believe that only four other similarly enhanced

fulvic acid based products are truly competitors. We have found that most of the

products provided by local fertilizer companies are low quality, liquid compound

fertilizers, many of which are not licensed for sale. We believe these products

do not provide plants with a full range of nutrients and international producers

have higher quality offerings, but are comparatively expensive. Yongye’s animal

nutrient product, which we believe helps to reduce the onset of mastitis,

competes against medicines with antibiotic properties, which are usually used to

treat livestock after the onset of infection. The Company’s nutrient product for

dairy cows underwent internal research and market testing, which substantiated

its beliefs that it improved milk production and helped dairy cows avoid a

number of diseases including mastitis. Thus, we believe that the use of our

animal nutrient product may promote health and decrease the need for expensive

medicines in dairy cows.

The

Market for Plant Nutrients

China

Market

|

•

|

The

overall fertilizer market is estimated to be a $50B industry in China –

estimated to grow about 30% a year from 2005 to

2009

|

|

•

|

China

has about 1.81B Mu of arable land – we believe all cash and row crops

benefit from the use of Yongye’s “Shengmingsu”™

product

|

|

•

|

China

purchased 63% more agricultural materials in 2007 than 2006 - the market

is growing rapidly

|

Yongye’s Market: Ten

Provinces

|

•

|

Yongye

grew about 265% in 2008 as compared with its predecessor company in 2007

and expects to grow an additional 70-75% in

2009

|

|

•

|

Our

estimates show that nutrient products are applied to about 6% of all

arable land

|

|

Yongye International, Inc. and

Subsidiaries

|

The Predecessor

Inner Mongolia Yongye

|

|||||||||||||||||

|

YEAR ENDED DECEMBER 31, 2008

|

YEAR ENDED DECEMBER 31, 2007

|

|||||||||||||||||

|

Largest Customers

|

Amount of Sales

|

% Total

Sales

|

Largest Customers

|

Amount of Sales

|

% Total

Sales

|

|||||||||||||

|

Hebei

|

$ | 20,541,267 | 43 | % |

Xinjiang

|

$ | 3,853,891 | 29 | % | |||||||||

|

Xinjiang

|

$ | 6,886,624 | 14 | % |

Beijing

|

$ | 2,980,234 | 23 | % | |||||||||

|

Gansu

|

$ | 6,291,070 | 13 | % |

Hebei

|

$ | 1,976,680 | 15 | % | |||||||||

|

Inner

Mongolia

|

$ | 5,663,011 | 12 | % |

Dalian

|

$ | 1,216,097 | 9 | % | |||||||||

|

Shandong

|

$ | 4,727,842 | 10 | % |

Jiangsu

|

$ | 740,251 | 6 | % | |||||||||

|

Total

|

$ | 44,109,813 | 92 | % |

Total

|

$ | 10,767,153 | 82 | % | |||||||||

Competitive

Advantages

We

believe that we have the following four competitive advantages:

|

1.

|

Unique

formula for both plants and animals. Our patented plant product mixture

process and patent pending animal product mixture process are for the

invention of specific formulas used in these base products. We are the

first company to patent such formulas in our industry and we plan to

continue to improve and diversify them based on customer

need.

|

|

2.

|

Recognized

and certified product offerings. We believe we are well recognized in our

markets because we work with government authorities to establish the

strength of our product and company and we work with farmers in creating

loyalty via our sales and support process. We also make sure our products

are certified by all appropriate authorities starting with the Ministry of

Agriculture which allows domestic manufacturing and sales of the product.

We are also ISO 9001 certified.

|

2

|

3.

|

Provide

direct technical and support services to farmers who purchase products. We

work to create strong customer loyalty by supporting farmers from product

trials through initial purchase and finally into large quantity purchases.

We educate farmers in yield production techniques and show them how our

products are part of this process. We also show them how our product works

by setting up trials in specific areas and helping them use the product

throughout the season as well.

|

|

4.

|

Cost

effective extraction of fulvic acid on an industry scale. We believe our

extraction process is unique in our industry in that it allows us to

create a product which has been found to be more bioactive than other

fulvic acid mixtures on the market. We believe that we not only

create a better fulvic acid base for our products, but do it in a cost

effective manner. We believe this allows us to create a better

product at a competitive price.

|

We

believe that our strategic growth plan for 2009 capitalizes on the following

market conditions to build long term profitability:

|

•

|

In

October 2008, we began a restructuring process to acquire the

predecessor’s existing building and equipment for the 2000 tonnes per

annum (“TPA”) facility and 120 Mu of land which will house the entire

10,000 TPA facility. This effort will not be completed until approximately

October 4, 2009.

|

|

•

|

Completed

construction of a new 8,000 Tonnes Per Annum (TPA) processing facility in

October 2008, which increased the production to 10,000 tonnes per

annum.

|

|

•

|

Employing

strategic television and print advertising to support sales throughout

2008 and 2009. For example, we launched an infomercial campaign on local

channels to educate farmers and to help them alter usage

patterns.

|

|

•

|

Developing

customized and enhanced plant products targeting specific crops with the

intent to increase yields and market

position.

|

|

•

|

Increasing

our line of animal product offerings to capture a wider market – we hope

revenue from these products has the effect of reducing the seasonal sales

swings in slower quarters.

|

|

•

|

Building

our revenue base via increased sales coverage in current provinces and

increased market penetration through additional support staff

coverage.

|

Our

Corporate History and Background

We were

incorporated in the State of Nevada on December 12, 2006 under the corporate

name “Golden Tan, Inc.” At that time we were engaged in the business of

offering sunless tanning services and selling tanning lotions. In 2008, we

began to pursue an acquisition strategy, whereby we sought to acquire an

undervalued business with a history of operating revenues in markets that

provide room for growth.

The

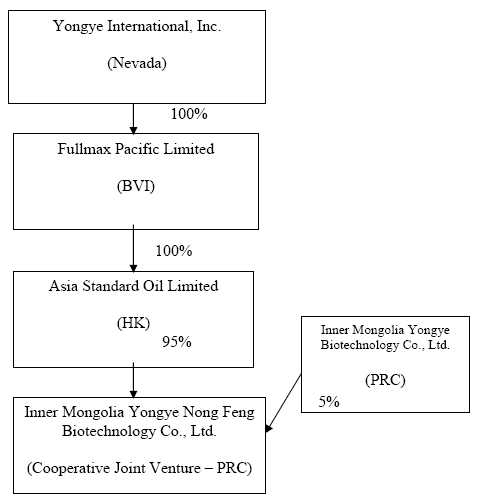

following chart reflects our current organizational structure as of the date

hereof:

Yongye

International Organizational Structure

On April

17, 2008, we entered into a Share Exchange Agreement (the “Exchange Agreement”)

with Fullmax Pacific Limited, a company organized under the laws of the British

Virgin Islands (“Fullmax”), the

shareholders of Fullmax (the “Shareholders”), who

together owned shares constituting 100% of the issued and outstanding ordinary

shares of Fullmax (the “Fullmax Shares”), and

our principal shareholder (the “Principal

Shareholder”). Pursuant to the terms of the Exchange Agreement, the

Shareholders transferred to us all of the Fullmax Shares in exchange for the

issuance of 11,444,755 (the “Shares”) shares of

our Common Stock (the “Share Exchange”). As

a result of the Share Exchange, Fullmax became our wholly owned subsidiary and

at that time, the Shareholders acquired approximately 84.7% of our issued and

outstanding Common Stock. As a result of the Share Exchange, we are now

engaged in the sales of fulvic acid based plant and animal nutrients in

China.

In

November 2007, Asia Standard Oil Limited, a Hong Kong company that is the wholly

owned subsidiary of Fullmax (“Asia Standard”),

entered into a Sino-foreign cooperative joint venture agreement with Inner

Mongolia Yongye (“CJV

Agreement”), a PRC company that has been in the business of researching,

producing and selling its own proprietary plant and animal nutrient products

since 2003 (“Inner

Mongolia Yongye”). Asia Standard and Inner Mongolia Yongye formed

Yongye Nongfeng Biotechnology Co., Ltd., a new cooperative joint venture under

PRC law (the “CJV” or “Yongye Nongfeng

Biotechnology”) in January 2008. Yongye Nongfeng Biotechnology was

incorporated and approved by the Inner Mongolia Department of Commerce and the

Inner Mongolia Administration for Industry and Commerce on January 4,

2008. Under the CJV Agreement, being its capital contribution obligation,

Inner Mongolia Yongye shall assign (i) its intellectual property rights,

registered trademark and patents; (ii) assist the CJV to recruit the whole

management team; (iii) assist the CJV to handle various governmental approval

and filing matters; (iv) arrange the office and manufacturing sites for the CJV;

and (v) assist the CJV to take care of foreign employees. As a separate

matter, Inner Mongolia Yongye shall assign its customers and sales contracts to

the CJV. In addition, the CJV has an option to purchase the manufacturing plant

of Inner Mongolia Yongye in two years. The CJV has a ten-year term commencing

from January 2008, subject to extension and early termination. The CJV agreement

is essentially a joint venture agreement that governs the division of profits

between the parties and generally provides for how the CJV should be managed and

governed, subject to applicable PRC law. The CJV agreement may be amended

or supplemented by mutual agreement of the parties. The CJV agreement may

be terminated upon unanimous consent of the board of directors of the CJV,

subject to governmental approval. PRC law mandates the dissolution of a

contractual joint venture, subject to governmental approval, in certain cases:

(i) the term of cooperation expires; (ii) the cooperative enterprise is unable

to continue operation due to the occurrence of heavy losses or grievous injury

caused by force majeure; (iii) the cooperative enterprise is unable to continue

operation because one or several partners fail to implement the obligations

stipulated in the cooperative enterprise contract and the articles of

association; (iv) an occurrence of other causes for dissolution as set forth in

the cooperative enterprise contract and the articles of association; and (v) the

cooperative enterprise violates laws and administrative regulations, and is

ordered to be closed by law. Any rights of Inner Mongolia Yongye to

terminate the CJV agreement would be limited to (iii) in the preceding sentence,

subject to governmental approval; in the event of (ii) or (iv) in the preceding

sentence, the board of directors of the CJV must make such determination,

subject to governmental approval.

3

We

operate our businesses in China solely through Yongye Nongfeng Biotechnology,

which is 99.5% owned by Asia Standard and 0.5% owned by Inner Mongolia Yongye as

stipulated in the CJV contract. Such percentages reflect the equity ownership

assuming the total amount of registered capital has been fully paid, which is

$21,000,000, of which $20,900,000 shall be contributed by Asia Standard Oil

Limited, and $100,000 shall be contributed by Inner Mongolia Yongye.

Because ASO only paid $16,778,741 in the year ended 2008 and Inner Mongolia

Yongye fully paid the $100,000, based upon the amount of registered capital that

has been paid to date the percentages are 99.4% and 0.6%, respectively as of

December 31, 2008. As agreed by Inner Mongolia Yongye separately, the former

primary contract manufacturer of Shengmingsu products for Yongye Nongfeng

Biotechnology, it shall assign its management and administrative team,

manufacturing employees, customers, and sales contracts to Yongye Nongfeng

Biotechnology.

As part

of the September Financing, we began a restructuring process which required us

to purchase the land, buildings and equipment which comprised the 10,000 TPA

capacity completed in October 2008. We began this process by purchasing the

predecessor’s 2000TPA equipment in October 2008, but in order to complete the

process we needed to own the fertilizer license issued by the PRC Ministry of

Agriculture. The fertilizer license, previously issued to Inner Mongolia Yongye,

was issued in the name of Yongye Nongfeng Biotechnology (the “License”) on June

1, 2009, which now permits Yongye Nongfeng Biotechnology to manufacture its own

finished products. Now that the License has been received, we intend to

acquire the remaining land and assets related to the manufacture of finished

products from Inner Mongolia Yongye (the “CJV Restructuring”). The total

liability incurred for payments to the Predecessor company is limited to USD$6M

and thus far USD$.95M has been paid to the predecessor company.

Our

Principal Products and Services

The base

of our product is our own proprietary fulvic acid compound, which is extracted

from humic acid. Fulvic acid is a complex, acidic, biochemical polymer which can

either be produced naturally by the decomposition of plant material over a long

period of time or via a manufacturing process. Fulvic acid binds itself to

cellulose fibers and strengthens the cell walls of plants and animals and acts

as a transport agent helping cells absorb the essential minerals and elements

for growth. Fulvic acid usually carries 70 or more minerals and trace elements

as part of its molecular complexes. These are in ideal natural form to be

absorbed by plants and interact with living cells. Plants readily absorb high

amounts of fulvic acid, and more readily maintain the minerals and trace

elements brought in by fulvic acid. Fulvic Acid creates bioactivity in plant

cells and makes them healthier. Our proprietary process extracts fulvic acid

from humic acid and creates the base fulvic acid compound used in both our plant

(liquid form) and animal nutrient (powder form) products. We have determined

that this process will remain a trade secret due to its importance in the

creation of our final product. If we were to patent this process, we would

necessarily have to publicly disclose certain information as part of the patent

application, and thus lose our competitive advantage we believe we currently

have.

We

believe, and our research has shown, Fulvic Acid (FA) has the following key

attributes when used in the agricultural industry for both plants and

animals:

|

•

|

Dissolves

and then absorbs minerals into

itself;

|

|

•

|

Polymer

properties protect vitamins and minerals during uptake or

digestion;

|

|

•

|

Contains

many essential nutrients for health and

growth;

|

|

•

|

Works

especially well in adverse

conditions;

|

|

•

|

Increases

natural strength and ability of cells to fight off sickness and

disease;

|

|

•

|

Scavenges

free radicals and removes toxins such as heavy metals and

pollutants;

|

|

•

|

Increases

oxygen intake into the cells; and

|

|

•

|

Maximizes

enzyme development which results in better uptake or

digestion.

|

The

principal raw material used in creating fulvic acid is Humic Acid (HA). Humic

Acid is naturally occurring organic soil matter or “humic substance” which is

mined from Leonardite Coal. Humic Acid exhibits a high cation exchange capacity

(CEC) or in other words makes it easier for soil nutrient particles to move

within the soil, and thus to be taken in by plants. Humic Acid also increases

the nutrient intake ability of plants through “chelation”. Normally, trace

elements are positively charged while the pores or openings on the roots and

leaves of plants are negatively charged which restricts the transfer of minerals

because of the mismatched charges. However, with the addition of a chelate,

Humic Acid, the minerals are encapsulated in the chelate and the positive charge

changes into a net negative or neutral charge, which allows the element to pass

through the pore and into the plant. Also, we have believe that the regular use

of HA organic liquid compound fertilizer can enable fertilizer, insecticide,

herbicide and water use to be reduced. We believe this can be supportive to the

environment since it may prevent contamination of water sources caused by

runoff.

Product Functions and

Results: Plant Line

Our plant

products are sold by the 100 ml bottle and in cases of 100 bottles each. The

average farmer in China has a cultivated land area of 2-4 Mu and this requires

about 6-12 bottles of product which is sprayed on every 15 days over a 45 day

growing period. We believe that if the farmer uses our product correctly, he can

decrease the use of fertilizers to normal levels and decrease overall usage of

pesticides and herbicides which may reduce their overall input costs. Internal

studies show that, depending upon the crop, the farmer will see increases in

yields and value in the market place which should increase overall income. Each

crop varies in response to the product, but we believe farmers may be expected

to experience increases on par with the following results under the proper

fertilizer and water conditions:

|

Crop

|

Yield

|

|

|

Capsicum

(green pepper)

|

increases

yield by up to 22.7%

|

|

|

Carrot:

|

increases

yield by up to 26.5%

|

|

|

Celery:

|

increases

yield by up to 26.3%

|

|

|

Cucumbers:

|

increases

yield to 21.7%, and the leaves are greener, the plants are higher by

3.0cm, and earlier to market by 11 days

|

|

|

Grapes:

|

increases

weight of individual grape 0.4g, 18.2%, increases sugar content

37.5%

|

|

|

Potatoes:

|

increases

yield up to 17.3%, and the leaves are thicker and they bloom 7 to 10 days

earlier

|

|

|

Watermelon:

|

increases

yield by up to 16.9%, increases sugar content 0.8%-1.8%

|

|

|

Wheat:

|

increases

yield up to 10.7%

|

Product Functions and

Results: Animal Line

Currently,

our animal product line is specifically targeted at dairy cows, although we plan

to develop products customized for other animals in the future. We believe

that our animal products will help increase the capacity of the dairy supply

chain by increasing the health of the dairy cows and reducing their problems

with mastitis. We use our base of fulvic acid and add the Chinese herbs Matrine

& Oxymatrine. Matrine and Oxymatrine are non-steroidal analgesics which are

anti-inflammatory in nature and are administered in treatment of mild to severe

pain or treatment of inflammatory states. They also have a variety of biological

activities.

4

In

general, our internal studies show that the financial impact for farmers from

using our product has been an annual net profit increase per cow due to an

increase in production, and if used for treatment of mastitis, a decrease in the

costs associated with the purchase of additional products to reduce bacterial

inflammation, which could also be expected to increase annual net profit.

We sell our product in 300g packets that are bundled into ten (10) 20g bags. A

typical regime of use would be one cow taking 1.5g daily over a 100 day period

of time.

New

Products for 2009

In 2008,

we did not roll out any customized products within our two product lines because

the market demand for our universal product for plants and for animals was

sufficient to gain market share and drive revenue. However, for 2009, we will

continue to look at opportunities to develop market driven additions to our

product lines as demand exists.

Plant

Products

Currently,

we use a universal product which can be applied to all types of crops, but will

increase our product offerings to the following:

Corn, La

Jiao Pepper, Wheat, Rice, Cucumber, Tomato, Cotton, Potato, Sunflower, Grapes,

Tropical Fruits and Flowers.

When we

introduce these products into the market place, we plan to charge a small

percentage more than we do for the universal product, which should increase our

revenue by a small amount. This will not replace our universally applied product

as we will leave it in the market as well. We also expect to increase the price

as market forces demand.

Animal

Product

After

successful sales in our test market, we will continue to offer our Dairy Cow

products, but expect to increase sales of the product due to targeted marketing

in selected provinces. We are also working on the introduction of products for

pigs, chickens and sheep.

Our

Contract Manufacturing Outsourced Process

We

believe that our competitive advantage begins with our core intellectual

property (“IP”)

and cost effective production capability, which is attributed to our IP and

manufacturing process we are acquiring from our contract manufacturer, Inner

Mongolia Yongye. The former chief scientist of Inner Mongolia Yongye

worked specifically on the Shengmingsu line of products for the first five years

of development and has over 40 years of experience in the industry. This has led

to two invention patents applied for by Inner Mongolia Yongye (the “Predecessor

Company”), which are used in the manufacturing process. Currently, one of

the two patent applications has been granted (plant patent) and is in the name

of the CJV while the other one is still pending (animal patent). The pending

patent’s transfer to the CJV has been approved and when issued, it will be

issued in the name of Yongye Nongfeng Biotechnology Co., Ltd. These

invention patents cover the formulation and stabilization of our unique plant

and animal nutrient products. Our products are approved and certified by

the PRC Ministry of Agriculture.

The

production process and IP we are acquiring from Inner Mongolia Yongye is

scientifically designed to ensure that the end product takes advantage of the

Intellectual Property and our vertical integration of our main raw materials

provider to ensure constantly high quality product. Inner Mongolia Yongye is ISO

9001:2000 (quality control certified (July 2007)), a Hohhot Industry and

Commerce Bureau AAA trusted company (awarded July 2007) and a Greenfood

certified (August 2008) production facility. The production facility is housed

in a 2,000 sq. meter building which is adjacent to a 4,000 sq meter building

used for heating and water filtration. The actual production process for Fulvic

Acid is the key intellectual property component. This process, generally

described, is as follows:

|

•

|

Humic

Acid is mixed with water and sodium hydroxide to form a

solution.

|

|

•

|

The

Humic Acid is precipitated as a solid while maintaining the solubilized

Fulvic Acid in solution.

|

|

•

|

The

solid Humic Acid and the solubilized Fulvic acid are

separated.

|

|

•

|

The

Fulvic Acid Compound is then mixed with special nutrients for its plant

and animal product lines.

|

|

•

|

The

animal product is turned into a

powder.

|

|

•

|

Other

customization is completed as required by

customers.

|

Our

products are packaged in bottles, bags and boxes. Each type of packaging

material, along with packaging labels, is purchased from three to four

manufacturers. These materials are readily available in the market. The products

are then assembled and packaged in Inner Mongolia and shipped to distributors

and retailers.

Manufacturing Outsourcing

Contract (10,000 Tonnes Per Annum Capacity)

From

January 2008 until March 2009, Yongye Nongfeng Biotechnology had an outsourcing

contract with Inner Mongolia Yongye for the production of our finished nutrient

product. From January 2008 until September 2008, the manufacturer was running at

2,000TPA capacity, but after constructing a new 8,000TPA facility, capacity was

increased to 10,000TPA. All employees have been transferred to Yongye

Nongfeng. The contract between the two companies had the following

stipulations:

|

•

|

Yongye

Nongfeng Biotechnology has negotiated a flat fee arrangement with Inner

Mongolia Yongye of RMB 350 per unit for our plant product and RMB 120 per

unit for our animal product. The term for this agreement is five (5) years

with quarterly options to renew based on general prevailing conditions at

the time.

|

|

•

|

Yongye

Nongfeng Biotechnology will work towards purchasing the existing site

and/or expanding to new production lines in the future. We will also work

towards building other equipment manufacturer (“OEM”) relationships with

other manufacturers in a way which will give us avenues for additional

capacity while also protecting our

IP.

|

|

•

|

Yongye

Nongfeng Biotechnology will have the option to purchase all the equipment,

facilities and land use right of Inner Mongolia Yongye during the first

two (2) years of the agreement, at the minimum purchase price permitted by

the Chinese government or a book

price.

|

|

•

|

The

amount of rent to be paid during the term of the agreement depends on the

amount of space used by Yongye Nongfeng Biotechnology, with the fee

equaling RMB 2 per square meter per

day.

|

|

•

|

We

were granted favorable tax benefits by the local tax authority because we

are designated a high technology company and are located in an economic

development zone in Hohhot city. This applies to the tax rate we incur for

revenue, profit and VAT and is granted on a year-by-year

basis.

|

Our

Marketing and Sales Support

Our sales

staff is trained to work with the distributor network, retail stores and farmers

to ensure that our customers receive the right product and after-sales

support. They share their knowledge by walking through farming

communities, organizing training courses, inviting local agricultural experts

and university professors to speak on proper agricultural techniques as well as

the use of our product. The Predecessor Company ended 2007 with marketing and

sales staff of 91, which included temporary staff, and at December 31, 2008 had

65 full-time staff. We expect that we will grow in 2009 to meet demand and

support the sales of the product to our distributors. Our management in Beijing

works with this staff to coordinate all marketing and sales

activities.

In the

past we have grown via market trials and word of mouth, but in 2008 we

introduced many larger market media programs. We work with our independent

distributors to coordinate television advertisements on local channels and

arrange other mass media events. We will continue to use conferences and

seminars, newspaper ads and pamphlets to get customer recognition and product

branding. Our staff emphasizes the technological components of our products to

help end users understand the differences in products available and how to use

them. Word-of-mouth advertising and sample trials of new products in new areas

are essential.

One new

strategy will include an infomercial campaign to promote and educate farmers on

benefits of Yongye’s nutrient products and provide in-store training for farmers

on the use of the products. In 2009, we began running this on CCTV, which is the

agricultural channel in China. In this way, we hope to increase the

predictability of operational and sales performance for both the franchisee and

the farmer.

5

Our

Distribution & Sales Network

Our

Distributor Network channel is comprised by provincial or regional agents who

purchase our products and sell them through a chain of local agents whose

terminal sales point is a retail store or large farm. As of March 31, 2009 there

were approximately 3,500 retail stores selling Shengmingsu products. This group

of stores is comprised of pre-existing, independently owned agricultural product

stores, which sell our product to local farmers. As of March 31, 2009, there

were 2,000 such stores in the Yongye Branded Store network and 1,500 stores

which are in a trials basis to become a branded store.

This

network of retail stores create a “community-direct” model through which our

distributors sell our product. In these stores, Yongye products are featured and

prominently displayed. We believe these stores have a local feel and have long

time recognition in the community as the “trusted” local agricultural product

expert. Before a distributor decides to bring a store into his segment of the

Branded Store network, he may require it to go through a trials process whereby

the owner works with him to reach specific performance goals. After branding,

each store has the opportunity to sell a nationally distributed product which

attracts attention to the store.

While we

generally encourage distributors to model each branded store after our own

national model, he ultimately has the control over the final implementation of

the branding along with the store owner. Store owners receive a proven product,

training and promotional assistance. Some stores are supplied with a computer

that has educational and promotional programs used to help farmers understand

the benefits of using Yongye products. The goal being to encourage farmers

to make Yongye products a greater part of their annual planning process while

building brand awareness.

Raw

Materials and Our Principal Suppliers

The humic

acid we use comes from lignite coal which is mined in Inner Mongolia and it can

be purchased at normal market rates on a per ton basis. Humic Acid is mined from

lignite or Leonardite coal. Leonardite is defined as highly oxidized low grade

lignite that contains a relatively high concentration of the smaller molecular

units (fulvic acids (FA)). China has approximately 12% of the world’s lignite

reserves according to the survey of energy resources published by the World

Energy Council.

We

believe we are able to produce a high quality fulvic acid base product by

controlling the input of humic acid from direct, contracted suppliers.

Currently, they have four principal suppliers which are all in Hohhot City: Heng

Ya Trading Company, Bo Yi Ze Trading Company, Feng Li Trading Company and

Sinochem. Their main supplier has dedicated one production line to us and has

based their production design on our specific technical requirements. This line

produces much of the humic acid we need, but only constitutes about 40% of their

capacity. The other suppliers take up slack in supply when needed.

In

addition to humic acid, we also utilize up to 18 different components in our

production process, all of which can be readily obtained from numerous sources

in local markets and require no special purchase requirements.

Competition

The

Chinese fertilizer industry is highly fragmented. By 2007, there were over 2,000

fertilizer products in the government’s registry. We compete more specifically

with producers of fulvic acid products and there are 164 of these in the

registry (Source: Chinese Fertilizer Net). Of these 164, we believe that only

four other products are similar to ours in the type of raw materials

added. The top three producers of these products based on revenue

generated in 2007 were:

|

1.

|

Dry

Dragon – USD $16M. Based in Xinjiang and in business for 15

years.

|

|

2.

|

Penshibao

– USD $13.5M. Based in Guangxi. Founded in

1985.

|

|

3.

|

Inner

Mongolia Yongye – USD $13.1M.

|

Competitive

Advantages

We

believe that we have the following four competitive advantages:

|

1.

|

Unique

formula for both plants and animals. Our pending patents, as listed below,

are for the invention of the specific formulas for our base plant and

animal products. We will continue to improve and diversify them based on

customer need.

|

|

2.

|

Recognized

and certified product offerings. We believe we are well recognized in our

markets because we work with government authorities to establish the

strength of our product and company and we work with farmers in creating

loyalty via our sales and support process. This leads to high recognition.

We also make sure our products are certified in all the appropriate

ways.

|

|

3.

|

Provide

direct technical and support services to farmers who purchase products. We

work to create strong customer loyalty by supporting farmers from product

trials through initial purchase and finally into large quantity purchases.

We will educate farmers in yield production techniques and how our

products are part of this process. We will then show them how our product

works and even set up trials in specific areas. We will then help them use

the product throughout the season as

well.

|

|

4.

|

Cost

effective extraction of fulvic acid on an industry scale. We believe

our extraction process is unique in our industry in that it allows us to

create a product which has been found to be more bioactive than other

fulvic acid mixtures on the market. We believe that we not only

create a better fulvic acid base for our products, but do it in a cost

effective manner. We believe this allows us to create a better

product at a competitive price.

|

Employees

The past

few years have seen tremendous growth in the company and our employee base has

also scaled with the business model. In focusing on our distribution base rather

than on direct sales to farmers, we have decreased the number of temporary

employees which are reflected in the 2007 numbers, and have hired full time

sales professionals who work directly with distributors and branded stores. Here

are our 2006, 2007 and 2008 numbers broken out between Yongye Nongfeng

Biotechnology Co., Ltd. (YNFB), and its contracted manufacturing company Inner

Mongolia Yongye (YBL):

|

Category

|

2006

YBL

|

2007

YBL

|

2008

YNFB

|

||||||

|

Admin

|

20

|

31

|

88

|

||||||

|

Manufacturing

|

24

|

60

|

0

|

||||||

|

Research

& Development

|

11

|

15

|

0

|

||||||

|

Sales

& Support

|

17

|

91

|

65

|

||||||

|

Total

|

72

|

197

|

153

|

As of

December 31, 2008, all employees, including manufacturing staff, have signed

contracts with Yongye Nongfeng Biotechnology Company, Ltd. and work exclusively

for us. The manufacturing and R&D staff will be transferred over in 2009 as

part of the restructuring process. None of our employees are under collective

bargaining agreements. We believe that we maintain a satisfactory working

relationship with our employees and we have not experienced any significant

labor disputes or any difficulty in recruiting staff for our

operations.

Research

and Development

The

product development life cycle is an important part of the way we do business.

We bring new products to market in the following way: market research, funding

approval, R&D on product, trials, approvals, model for marketing and market

entry. The typical process may take up to three years depending upon the

governmental approval process.

6

Intellectual

Property

Inner

Mongolia Yongye, the predecessor company, has carried on independent research

for many years in the area of biochemistry including humic acid and fulvic acid

research, development and industrialization. This research was transferred to

Yongye Nongfeng as part of the CJV agreement and is the intellectual property we

currently use. Inner Mongolia Yongye filed two invention patent applications

with the State of Intellectual Property Office of the PRC with the application

numbers 200610131953.7 and 200510118240.2. Currently, one of the two patent

applications has been granted (plant patent) and is in the name of the CJV while

the other one is still pending (animal patent). The pending patent’s transfer to

the CJV has been approved and when issued, it will be issued in the name of

Yongye Nongfeng Biotechnology Co., Ltd. We also filed two trademark registration

applications with the Trademark Bureau of the State Administration of Industry

and Commerce of the PRC.

Our

invention patents cover the mixture of both the base formulas for the plant and

animal nutrient products and we will work to ensure that this mixture process is

consistently carried out while also protecting our Intellectual Property.

The Inner Mongolia Science & Technology Department has tested and compared

our fulvic acid product with other fulvic acid products and found that it has a

lighter weight and higher bio-activity than the other products it tested. Our

extraction process for fulvic acid remains a trade secret and is protected by a

non-compete contract with Professor Gao Jing.

In

addition to trademark and patent protection law in China, we also rely on

contractual confidentiality and non-compete provisions to protect our

intellectual property rights and brand. We also take the further steps of

limiting the number of people involved in the production process and, when

taking in raw materials and preparing them for mixture, we refer to each

ingredient by a number rather than its name.

Governmental

Regulation

Our

products and services are subject to regulation by central and provincial

governmental agencies in the PRC. Business and company registrations, along with

the products, are certified on a regular basis and must be in compliance with

the laws and regulations of the PRC and provincial and local governments and

industry agencies, which are controlled and monitored through the issuance of

licenses. Our licenses include:

Operating

license

Our

operating license enables us to undertake research and development, sales and

services of humic acid liquid fertilizer, sales of pesticides, and export and

import of products, technology and equipment. The registration No. is

150000400000679, and it is valid until February 2010. Once the term has expired,

the license is renewable for a five-year term. The license is in the name

of the CJV.

Green Food

Certified

All of

our fertilizer products are certified by the PRC government as green products

for growing Grade AA “Green” foods which means they contain little or no

chemical materials and can be used to grow organic foods. This is given by the

China Green Food Research Center which has been researching organic food issues

since 1992 and is part of the PRC Ministry of Agriculture. Our certificate is

valid from August 2007 to August 2010 and requires an annual inspection, which

we passed in 2008.

Fertilizer

Registration

Fertilizer

registration is required for the production of liquid fertilizer and issued by

the Ministry of Agriculture of the PRC. Our registration number is Agriculture

Fertilizer No. 2630 (2008).

Environmental

Laws

We are in

compliance in all material respects with the numerous laws, regulations, rules,

specifications and permits, approvals and registrations relating to human health

and safety and the environment except where noncompliance would not have a

material adverse effect on our business, financial condition and results of

operations. We make capital expenditures from time to time to stay in

compliance with applicable laws and regulations, though the cost in not directly

passed on to our customers as we do not use cost-based pricing.

Executive

Office

Our

principal executive offices are located on the 6th Floor, Suite 608, at Xue Yuan

International Tower, No. 1 Zhichun Road, Haidian District, Beijing, PRC. Our

telephone number at that address is 86 -10-8232-8866 x8880. Our corporate

website is www.yongyebiotech.com. Information contained on or accessed through

our website is not intended to constitute and shall not be deemed to constitute

part of this registration statement on Form S - 1.

Legal

Proceedings

We are

not a party to any material legal proceedings nor are we aware of any

circumstance that may reasonably lead a third party to initiate legal

proceedings against us.

Property

Our

principal executive offices are located at 6th floor, Xue Yuan International

Tower, No. 1 Zhichun Road, Haidian District, Beijing PRC and the telephone

number is 86-10-8232-8866 x8880. The office space is approximately 1,000 square

meters in area. Inner Mongolia Yongye’s main production facility is in the

High Tech Economic Development Zone in Hohhot City in Inner

Mongolia.

There is

no private ownership of land in China. All land ownership is held by the

government of the PRC, its agencies and collectives. Land use rights can be

transferred upon approval by the land administrative authorities of the PRC

(State Land Administration Bureau) upon payment of the required land transfer

fee. Inner Mongolia Yongye owns the land use rights for the land on which its

manufacturing facility is situated, which have a term of 50 years from

2003.

7

ITEM

1A Risk Factors

An

investment in our Common Stock is speculative and involves a high degree of risk

and uncertainty. You should carefully consider the risks described below,

together with the other information contained in this prospectus, including the

consolidated financial statements and notes thereto, before deciding to invest

in our Common Stock. Additional risks not presently known to us or that we

presently consider immaterial may also adversely affect our Company. If any of

the following risks occur, our business, financial condition and results of

operations and the value of our Common Stock could be materially and adversely

affected.

Risks

Related to Our Business

The

CJV is still in the process of transitioning its business operations from our

predecessor company.

We

established the Cooperative Joint Venture, Yongye Nongfeng Biotechnology, on

January 4, 2008, with the intention and ultimate goal of carrying out the

business of marketing and distributing our fulvic acid plant and animal nutrient

products. We have transitioned all personnel, services, and control issues for

the distribution and sales operations from our predecessor company Inner

Mongolia Yongye (which currently, under contract, has a 0.5% ownership interest

in the Cooperative Joint Venture and is under the control of Mr. Zishen Wu), to

the Cooperative Joint Venture (Mr. Wu is also the CEO of the Cooperative Joint

Venture). All personnel, services, and control issues relating to the

manufacturing operations - from procurement of raw materials to final

production, have also been transferred to Yongye Nongfeng from the predecessor

company, which was our primary contract manufacturing company for acquiring

finished goods for all of 2008 and the first three quarters of 2009. This was

implemented as part of the restructuring plan agreed upon in the September 2008

financing. We began transitioning the manufacturing entity to the CJV starting

with the valuation of the Predecessor’s 2,000TPA equipment in October 2008,

continued with the issuance of the fertilizer license into the name of the CJV

on June 1, 2009 by the Ministry of Agriculture, and will be completed with the

transfer of the title for the land and remaining buildings, which we anticipate

will occur by October 11, 2009. The total liability incurred for payments to the

predecessor company is limited to USD$6M and thus far USD$.95M has been paid to

the predecessor company.

We have

complied with all of the stipulations in the supplemental agreement related to

the transition of the business. The IP related transfer for the plant product

has been officially completed with the patent being granted to the predecessor

company and then transferred into the name of the CJV. However, the patent for

the animal product has not been granted though the transfer agent has approved

the transfer of the patent into the name of the CJV once it has been

granted.

To the

extent that the current corporate structure is ineffective in facilitating our

business operations as contemplated, we may decide to unwind or modify the

current Cooperative Joint Venture in favor of a more efficient corporate

structure, which may include formation of a wholly owned foreign entity. This

may be accomplished without seeking approval from investors in the

financing.

Currently,

all of the distributorship agreements are in the name of Yongye Nongfeng,

however, there are no formal agreements between Yongye Nongfeng and the branded

stores. The limited operating history and the early stage of development of the

Cooperative Joint Venture make it difficult to evaluate its business and future

prospects. Although the “Predecessor” company, Inner Mongolia Yongye’s revenues

have risen quickly and has transferred the same agreements to the CJV, we cannot

assure you that the Cooperative Joint Venture will continue to maintain such

profitability or that it will not incur net losses in the future. We expect that

our operating expenses will increase as we expand. Any significant failure to

realize anticipated revenue growth could result in operating

losses.

Our

reliance upon our contract manufacturer for finished goods may hinder our

ability to be profitable.

We are

dependent upon our relationship with our contract manufacturer, Inner Mongolia

Yongye, which provides us with 100% of their production of goods up until the

time that all the manufacturing assets are transferred to the CJV. The CJV has

the opportunity to purchase from other suppliers, but Inner Mongolia Yongye is

required to sell us 100% of their production and they supplied us with

approximately 100% of our finished goods in 2008. Should they be unable to

procure sufficient amounts of their raw materials, they may be unable to meet

all of our demand. Or, if they have production restrictions and cannot perform

their obligations as agreed, we may be unable to specifically enforce our

agreements and will need to find other suppliers. If they are unable to obtain

adequate quantities of humid acid at economically viable prices, our business

could be unprofitable and investors may lose their entire investment in

us.

Failure

to manage our recent dramatic growth could strain our management, operational

and other resources, which could materially and adversely affect our business

and prospects.

We have

been expanding our operations dramatically and plan to continue to expand

rapidly. To meet the demand of our customers, we must continue to expand our

distribution network in terms of numbers and locations. The continued growth of

our business has resulted in, and will continue to result in, substantial demand

on our management, operational and other resources. In particular, the

management of our growth will require, among other things:

|

•

|

increased

sales and sales support activities;

|

|

•

|

improved

administrative and operational

systems;

|

|

•

|

stringent

cost controls and sufficient working

capital;

|

|

•

|

strengthening

of financial and management controls;

and

|

|

•

|

hiring

and training of new personnel.

|

As we

continue this effort, we may incur substantial costs and expend substantial

resources. We may not be able to manage our current or future operations

effectively and efficiently or compete effectively in new markets we enter. If

we are not able to manage our growth successfully, our business and prospects

would be materially and adversely affected.

We

rely on contractual arrangement with Inner Mongolia Yongye for our China

operations, which may not be as stable and effective in providing operational

control as direct ownership.

We rely

on the CJV Agreement with Inner Mongolia Yongye to operate our business. Under

the current CJV agreement, as a legal matter, if Inner Mongolia Yongye exercises

its contractual rights to terminate the CJV agreement, we would have no rights

to prevent such an event from occurring. In addition, if Inner Mongolia Yongye

fails to perform its obligations under the CJV agreement, we may have to incur

substantial costs and resources to enforce such arrangements, and rely on legal

remedies under PRC laws, including seeking specific performance or injunctive

relief, and claiming damages, which we cannot assure you would be effective.

Accordingly, it may be difficult for us to change our corporate structure or to

bring claims against Inner Mongolia Yongye if it does not perform its

obligations under its contracts with us.

The CJV

agreement is governed by PRC laws and provides for the resolution of disputes

through either arbitration or litigation in the PRC. Accordingly, this agreement

would be interpreted in accordance with PRC laws and any disputes would be

resolved in accordance with PRC legal procedures. The legal environment in the

PRC is not as developed as in other jurisdictions, such as the United States. As

a result, uncertainties in the PRC legal system could limit our ability to

enforce these contractual arrangements. In the event we are unable to enforce

these contractual arrangements, we may not be able to exert effective control

over our operating entities, and our ability to conduct our business may be

negatively affected.

Inner

Mongolia Yongye’s reliance upon third-party suppliers for raw materials may

hinder our ability to be profitable.

Inner

Mongolia Yongye, or the CJV once the restructuring process is complete, is

dependent upon its relationships with third parties for its supply of humic

acid. Inner Mongolia Yongye has three major suppliers of humic acid, which

provided approximately 100% of its raw material feedstock in 2007, and 100% in

2008. Should any of these suppliers terminate their supply relationships, Inner

Mongolia Yongye, or the CJV once the restructuring is complete, may be unable to

procure sufficient amounts of humic acid to meet the demand and our

profitability may be limited. In addition, these suppliers may not perform their

obligations as agreed, and it may not be possible to specifically enforce the

related agreements. If Inner Mongolia Yongye, or the CJV once the restructuring

is complete, is unable to obtain adequate quantities of humid acid at

economically viable prices, our business could become unprofitable and investors

may lose their entire investment in us.

8

Adverse

weather conditions could reduce demand for fertilizer products.

The

demand for our nutrient products fluctuates significantly with weather

conditions, which may delay the application of the fertilizer or render it

unnecessary at all. If any natural disasters, such as flood, drought, hail,

tornado or earthquake, occur, demands for our products will be

reduced.

Our

business will suffer if Inner Mongolia Yongye loses its land use

rights.

There is

no private ownership of land in China and all land ownership is held by the

government of the PRC, its agencies and collectives. Land use rights can be

obtained from the government for a period up to 70 years, and are typically

renewable. Land use rights can be transferred upon approval by the land

administrative authorities of the PRC (State Land Administration Bureau) upon

payment of the required land transfer fee. Inner Mongolia Yongye has received

the necessary land use right certificate for its primary operating facilities,

but we can give no assurance that these land use rights will be renewed on

favorable terms or renewed at all. If Inner Mongolia Yongye, or the CJV once the

restructuring is complete, loses its land right certificates we may lose access

to production facilities that may be difficult or impossible to replace. Should

we, or the CJV once the restructuring is complete, have to relocate, the

workforce may be unable or unwilling to work in the new location and operations

will be disrupted during the relocation. The relocation or loss of facilities

could cause us, or the CJV, to lose sales and/or increase costs of production,

which will negatively impact our financial results.

Our

business will be harmed if our major distributors reduce their orders or

discontinue doing business with us.

For the

year ended December 31, 2008, we sold our products primarily through 5 major

distributors in our top 4 provinces. These five major customers accounted for

92% (and one major customer accounted for 43%) of our net revenue for the year

ended December 31, 2008. These five major customers accounted for 82% (and the

same one major customer accounted for 29%) of the predecessor’s net revenue for

the year ended December 31, 2007. Although we believe that our

relationship with these distributors is good, we have no long-term supply

agreements with them and any or all of them could termination their relationship

with us in favor of competitors with increased productions capabilities or

offering lower prices or other favorable terms. If some or all of these

distributors reduce their orders or discontinue doing business with us, we could

have difficulties finding new distributors to distribute our products and our

revenues and net income could in turn decline considerably. Our reliance on

these major distributors could also affect our bargaining power in getting

favorable prices for our products. In addition, untimely payment and/or failure

to pay by these major distributors would negatively affect our cash

flow.

If

we cannot renew our fertilizer registration certificate, which expires in one

year, we will be unable to sell some of our products which will cause our sales

revenues to significantly decrease.

All

fertilizers produced in China must be registered with the PRC Ministry of

Agriculture. No fertilizer can be manufactured without such registration. Inner

Mongolia Yongye has obtained a Fertilizer Registration Certificate from the PRC

Ministry of Agriculture. Such certificate was issued in February 2008 and was

reissued in June 2009 in the name of the CJV. The certificate has a 5-year