Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - Watson Wyatt Worldwide, Inc. | a09-31905_1ex32.htm |

| EX-21 - EX-21 - Watson Wyatt Worldwide, Inc. | a09-31905_1ex21.htm |

| EX-31.2 - EX-31.2 - Watson Wyatt Worldwide, Inc. | a09-31905_1ex31d2.htm |

| EX-31.1 - EX-31.1 - Watson Wyatt Worldwide, Inc. | a09-31905_1ex31d1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

Amendment No. 1

(Mark One)

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

For the fiscal year ended June 30, 2009 |

|

Or

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

For the transition period from to |

|

Commission File Number: 001-16159

WATSON WYATT WORLDWIDE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

52-2211537 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

901 N. Glebe Road, Arlington, VA 22203

(Address of principal executive offices) (Zip Code)

(703) 258-8000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Class A Common Stock, $0.01 par value |

|

New York Stock Exchange and NASDAQ |

Securities registered pursuant to Section 12(g) of the Act:

|

|

|

|

|

(Title of class) |

||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x |

|

Accelerated Filer o |

|

Non-accelerated Filer o |

|

Smaller reporting company o |

|

(Do not check if a smaller reporting company) |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the registrant’s voting and non-voting common stock held by non-affiliates of the registrant was approximately $2,032,629,030 based on the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, December 31, 2008.

As of October 15, 2009 there were outstanding 42,528,286 shares of common stock par value $0.01 per share.

EXPLANATORY NOTE

Watson Wyatt Worldwide, Inc. is filing this Amendment No. 1 on Form 10-K/A (“Amendment”) to amend its Annual Report on Form 10-K for the year ended June 30, 2009, filed with the Securities and Exchange Commission (“SEC”) on August 14, 2009 (“Original 10-K”). We are filing this Amendment to the Original 10-K to include the information required by Item 5 of Part II for the performance graph and Items 10 through 14 of Part III of Form 10-K. Except for the addition of the Part II and Part III information, no other changes have been made to the Original 10-K. This Amendment does not reflect events occurring after the filing of the Original 10-K or modify or update those disclosures affected by subsequent events.

1

WATSON WYATT WORLDWIDE, INC.

|

|

|

|

|

|

|

|

|

3 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

||

|

|

|

|

|

9 |

||

|

|

|

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

35 |

|

|

|

|

|

|

Certain Relationships and Related Transactions, and Director Independence |

37 |

|

|

|

|

|

|

38 |

2

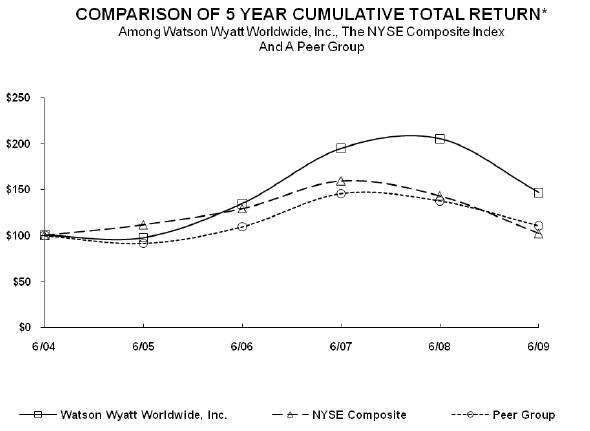

The graph below depicts total cumulative stockholder return on $100 invested on June 30, 2004 in (1) Watson Wyatt Worldwide, Inc. common stock; (2) the New York Stock Exchange Composite Index; and (3) an independently-compiled, industry peer group index composed of the common stock of all publicly-traded companies within the Company’s standard industrial classification code (SIC) offering management consulting services. The graph assumes reinvestment of dividends.

*$100 invested on 6/30/04 in stock or index, including reinvestment of dividends.

Fiscal year ending June 30.

|

|

|

6/04 |

|

6/05 |

|

6/06 |

|

6/07 |

|

6/08 |

|

6/09 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Watson Wyatt Worldwide, Inc. |

|

100.00 |

|

97.27 |

|

134.70 |

|

194.76 |

|

205.27 |

|

146.61 |

|

|

NYSE Composite |

|

100.00 |

|

111.76 |

|

129.30 |

|

159.65 |

|

143.30 |

|

102.20 |

|

|

Peer Group |

|

100.00 |

|

91.40 |

|

109.58 |

|

145.66 |

|

137.62 |

|

110.62 |

|

Companies included in the independently-compiled, industry peer group index include: Accenture Limited; Access Worldwide Communications Inc.; Bearingpoint Inc.; Brandpartners Group Inc.; Corporate Executive Board Company; Diamond Management & Technology Consultants; FTI Consulting Inc.; Hewitt Associates Inc.; Huron Consulting Group Inc.; LECG Corp.; The Management Network Group Inc.; Maximus Inc.; Navigant Consulting Inc.; The Hackett Group Inc. and Watson Wyatt Worldwide, Inc. Deletions from this group include Caneum Inc.; Harris Interactive Inc.; Inventiv Health Inc. and Thomas Group Inc., because they are no longer in the Company’s SIC.

3

Item 10. Directors, Executive Officers, and Corporate Governance.

DIRECTOR INFORMATION

Listed below are the names, ages and biographies of our current directors and executive officers at September 30, 2009. Our directors are elected annually and serve until the next annual meeting of stockholders and until their successors are elected and qualified. Our executive officers serve until the next annual meeting and until the election and qualification of their successors or until their earlier death, resignation or removal by our board of directors.

John J. Gabarro (age 70) has served as a Director since 1999 and was previously a Director of Watson Wyatt & Company from 1995 to 1998. Mr. Gabarro has been a professor at the Harvard Business School since 1972. Mr. Gabarro is the UPS Foundation Professor of Human Resource Management, Emeritus, in Organizational Behavior, having also served as Baker Foundation Professor. He has taught in Harvard’s MBA, Executive and Doctoral Programs. He has served as faculty chair of Harvard’s International Senior Management Program and twice as head of its Organizational Behavior faculty and most recently, as faculty chair of Harvard’s Advanced Management Program. Mr. Gabarro completed his MBA, doctorate and post doctoral work at Harvard before joining its faculty.

John J. Haley (age 59) has served as President and Chief Executive Officer of Watson Wyatt since January 1, 1999, Chairman of the Board of Watson Wyatt since 1999 and as a director of Watson Wyatt since 1992. Mr. Haley joined Watson Wyatt in 1977. Prior to becoming President and Chief Executive Officer of Watson Wyatt, he was the Global Director of the Benefits Group at Watson Wyatt. Mr. Haley is a Fellow of the Society of Actuaries and is a co-author of Fundamentals of Private Pensions (University of Pennsylvania Press). Mr. Haley also serves on the boards of MAXIMUS, Inc., a provider of health and human services program management, consulting services and system solutions, and Hudson Highland Group, Inc., an executive search, specialty staffing and related consulting services firm. He has an A.B. in Mathematics from Rutgers College and studied under a Fellowship at the Graduate School of Mathematics at Yale University.

R. Michael McCullough (age 70) has served as a Director since 1996. Mr. McCullough retired in 1996 as Chairman and CEO of the management consulting firm Booz, Allen & Hamilton. He joined Booz, Allen & Hamilton in 1965 as a consultant, was elected a partner in the firm in 1971, became Managing Partner of the firm’s Technology Center and was elected to the position of Chairman and CEO in 1984. Mr. McCullough is a member of the board of First Potomac Realty Trust, an industrial and office-industrial real estate investment trust. Mr. McCullough has a B.S. in Electrical Engineering from the University of Detroit.

Brendan R. O’Neill (age 60) has served as a Director since July 2006. Dr. O’Neill was Chief Executive Officer and Director of Imperial Chemical Industries PLC (“ICI”), a manufacturer of specialty products and paints, until April 2003. From 2003 until 2006, Mr. O’Neill was an independent director for a range of companies. Dr. O’Neill joined ICI in 1998 as its Chief Operating Officer and Director, and was promoted to Chief Executive Officer in 1999. Prior to Dr. O’Neill’s career at ICI, he held numerous positions at Guinness PLC, including Chief Executive of Guinness Brewing Worldwide Ltd, Managing Director International Region of United Distillers, and Director of Financial Control. Dr. O’Neill also held positions at HSBC Holdings PLC, BICC PLC, Aegis Group PLC, and the Ford Motor Company. He has an M.A. from the University of Cambridge and a Ph.D. in chemistry from the University of East Anglia, and is a Fellow of the Chartered Institute of Management Accountants (U.K.). Dr. O’Neill is also a Director of Tyco International Ltd., Informa Group PLC and Endurance Specialty Holdings Ltd.

Linda D. Rabbitt (age 60) has served as a Director since 2002 and is the founder and CEO of Rand Construction Corporation, a commercial construction company founded in 1989 that specializes in building renovation and tenant build-outs. Prior to founding Rand Construction Corporation, Ms. Rabbitt was the co-founder and co-owner of Hart Construction Company, Inc., a commercial tenant construction company. From 1981 to 1985, Ms. Rabbitt was with KPMG (formerly Peat Marwick), where she was Director of Marketing from 1982 to 1985. Ms. Rabbitt is a Director of Brookfield Properties, a commercial real estate company and is a Class C Director of the Federal Reserve Bank of Richmond. Ms. Rabbitt is also a Director of the Greater Washington Board of Trade and served as its Chair in 2002. Ms. Rabbitt has also served as a Director of the Economic Club of Washington, D.C., as a Director of Leadership Washington, and is a trustee of the Federal City Council and of George Washington University. Ms. Rabbitt has a B.A. from the University of Michigan, Ann Arbor, and an M.A. from George Washington University.

4

Gilbert T. Ray (age 65) has served as a Director since 2000. Mr. Ray was a partner of the law firm of O’Melveny & Myers LLP until his retirement in 2000. He practiced corporate law for almost three decades. He has extensive experience with corporate and tax exempt transactions, as well as international finance. Mr. Ray is a member of the boards of: Automobile Club of Southern California, a provider of emergency road and travel services and insurance; two variable annuity funds managed by SunAmerica Asset management; Advance Auto Parts Company, a retailer of automotive parts; Diamondrock Hospitality, a real estate investment trust; and Dinequity, Inc., a restaurant management and franchise company. Mr. Ray is also a trustee of The John Randolph Haynes and Dora Haynes Foundation.

John C. Wright (age 61) has served as a Director since 2002 and is a retired partner of the accounting firm Ernst & Young. He was with Ernst & Young for almost thirty years until his retirement in 2000. Mr. Wright has extensive expertise with complex financial accounting and reporting matters, including many years of experience working on matters before the Securities and Exchange Commission. During the last ten years of Mr. Wright’s career at Ernst & Young, he spent much of his time on international matters. After Ernst & Young, he served briefly as the Chief Financial Officer of Teligent, a telecommunications company, and was the Executive Vice President and Chief Financial Officer of QuadraMed Corporation, a provider of healthcare information technology solutions until 2005. Mr. Wright has a B.S. in Accounting from the University of North Carolina.

BIOGRAPHICAL INFORMATION FOR OTHER EXECUTIVE OFFICERS OF THE COMPANY

Walter W. Bardenwerper (age 58) has served as Vice President and General Counsel since joining Watson Wyatt in 1987 and has served as Secretary since 1992. Mr. Bardenwerper was a Director of Watson Wyatt & Company from 1992 to 1997. He is also a Director of Professional Consultants Insurance Company. Mr. Bardenwerper was previously an attorney with Cadwalader, Wickersham & Taft and Assistant General Counsel and Secretary of Satellite Business Systems. He has a B.A. with Honors in Economics and graduated Phi Beta Kappa from the University of Virginia, has a J.D. from the University of Virginia Law School and served as a Law Clerk to United States District Court Judge Albert W. Coffrin.

Robert J. Charles (age 44) has been a Vice President and the Regional Manager (Asia-Pacific) of Watson Wyatt since 2007. Mr. Charles was previously the Regional Practice Leader for the Benefits Practice in Asia-Pacific from 2003 to 2007 and also the Managing Consultant for Watson Wyatt’s Hong Kong Office from 2004 to 2007. Mr. Charles has also worked in India as Watson Wyatt’s Benefits Practice Leader for Watson Wyatt India, where he led the integration for a new acquisition. He started his career as a consulting actuary in Watson Wyatt’s Reigate office in 1987 and later became the Operations Manager for the London Benefits team. Mr. Charles was appointed a Partner of Watson Wyatt in Europe in 1999. He is a frequent speaker at conferences on pension reforms, is a Fellow of the Institute of Actuaries (UK) and holds a first class honours degree in mathematics from Oxford University.

David M.E. Dow (age 50) has served as Vice President and Global Practice Director of the Technology and Administration Solutions (TAS) Group since July 2005. Mr. Dow qualified as a Chartered Accountant with KPMG in 1983 and worked for a number of years in the insurance industry before joining The Wyatt Company in 1988 as a consultant. In the 21 years since, Mr. Dow has held various leadership positions in consulting, outsourcing and technology practices. He was Managing Director of Wyatt Financial Services Ltd from 1990 to 1995, Head of Practice of the Financial Services Group of Watson Wyatt Partners from 1995 to 1998, Head of Practice for Benefits Administration Solutions (Watson Wyatt’s UK outsourcing service) from 1998 and has been Vice President and Global Practice Director for TAS since 2005. Mr. Dow also held Partnership Board and Finance Committee roles within Watson Wyatt LLP and in his current role is a member of the firm’s Global Matrix Group and European Matrix Group.

Carl A. Hess (age 47) has served as Vice President and Global Practice Director, Investment Consulting since 2008. Prior to this, Mr. Hess served as Americas Practice Director, Investment Consulting from 2006 and as U.S. East Division’s Investment Practice Leader from 2004 to 2006. Mr. Hess joined Watson Wyatt in 1989 as a senior consulting actuary. Prior to joining Watson Wyatt, he worked for two other consulting firms and an insurance company. Mr. Hess has responsibility for a number of Watson Wyatt’s major investment clients, advising them on all investment issues. He also serves on the board of the Homer Laughlin China Company and its subsidiaries. Mr. Hess is a Fellow of the Society of Actuaries and a Chartered Enterprise Risk Analyst. He has a B.A. degree cum laude in Logic from Yale University.

5

Robert J. McKee (age 47) has served as Vice President and Global Director of Marketing since 2006. Mr. McKee joined Watson Wyatt in 1992 and was named Director of Marketing for Watson Wyatt & Company in 1998. Mr. McKee is responsible for: marketing strategy, planning and research, brand management, marketing communications and public relations, web-based marketing, and sales support. Prior to joining Watson Wyatt, Mr. McKee held marketing and public relations roles at Towers Perrin and at the Guardian Life Insurance Company of America. He has an A.B. degree from Columbia University.

Kevin L. Meehan (age 64) has served as Regional Manager (North America) since 2006, as a Vice President since 1994 and was a Director from 1999 to 2002, and again from 2007 to 2008. Mr. Meehan joined Watson Wyatt in 1983 and was instrumental in developing the company’s flexible benefits operations, our North America Technologies and Administration group and our Account Management function. Over the years Mr. Meehan has led teams that have won some of Watson Wyatt’s largest assignments and has managed some of Watson Wyatt’s largest accounts. Mr. Meehan has been a speaker on employee benefits tax and legal issues, and has testified before the IRS, the Department of Labor and Committees of Congress on these issues on behalf of our clients. Mr. Meehan has a B.A. from the College of the Holy Cross and a J.D. from St. John’s University Law School.

Stephen E. Mele (age 59) has served as Vice President and Chief Human Resources Officer since 2007. Mr. Mele was most recently the Chief People and Technology Officer at Mercer HR Consulting, having previously worked at Prudential International as VP Human Resources. Earlier, he had been the Group Head for Human Resources Operations at Standard Chartered Bank and prior to that was HR Director at Clearstream and at Schlumberger. In particular he has lived and worked in North America, the UK and continental Europe. Mr. Mele received his B.S. in Business Administration from Fairleigh Dickinson University.

Roger F. Millay (age 52) has served as Vice President and Chief Financial Officer of Watson Wyatt since August 2008. Prior to this, Mr. Millay was with Discovery Communications LLC, a global cable TV programmer and digital media provider since 2006, where he served as Senior Executive Vice President and Chief Financial Officer. At Discovery he was responsible for the global financial functions, including accounting, treasury, budgeting, audit and tax. Prior to this, Mr. Millay was Senior Vice President and Chief Financial Officer with Airgas, Inc., an industrial gases and supplies distributor and producer from 1999 to 2006. Mr. Millay has over 25 years of experience in financial officer positions, including roles at Arthur Young & Company, Citigroup, and GE Capital. He holds a B.A. degree from the University of Virginia, an M.S. in Accounting from Georgetown University’s Graduate School of Business and is a Certified Public Accountant.

Peter E. Mills (age 51) has served as Vice President and Regional Manager (Latin America) since 2005, and has been with Watson Wyatt since 1988, most recently as Watson Wyatt’s Latin America Region Retirement Practice Leader. Before that, Mr. Mills was a Senior Consultant for Watson Wyatt in its Latin America and Caribbean region. He worked as a project manager and account manager, and consulted for clients throughout the region. Mr. Mills has over 20 years of professional experience. He graduated from the University of Connecticut in 1980 with a B.S. degree in Mathematics and is a Fellow of the Society of Actuaries, a member of the American Academy of Actuaries, a member of the Actuarial Association of Colombia, and an Enrolled Actuary.

Martin S. Pike (age 48) has served as Vice President and Global Practice Director of Insurance and Financial Services since June 2009, was most recently European Practice Director for the Insurance & Financial Services Practice, and is a member of the Global Practice Management Team. Mr. Pike advises insurers and banks on the full range of services including core actuarial activities and wide ranging strategic advice. Mr. Pike’s client experiences include senior relationship management activities with large clients, M&A transactions; advising a large UK company on the exercise of discretion in the with-profits funds; and restructuring of business operations. Mr. Pike graduated from Oxford University and joined Watson Wyatt in 1983, qualifying as a Fellow of the Institute of Actuaries in 1988.

Paul E. Platten (age 56) has been Vice President and Global Practice Director of the Human Capital Group since 2005 and served as the Managing Consultant for the Boston, Massachusetts office of Watson Wyatt Worldwide from 2003 to 2005. He joined Watson Wyatt in June 2000 as the National Practice Leader of Strategic Rewards, specializing in executive compensation and strategic human resource issues. Mr. Platten has spent more than 20 years working with organizations to develop pay and performance programs that effectively link with strategic goals and cultural values. Prior to joining Watson Wyatt, Mr. Platten was the partner in charge of the PricewaterhouseCoopers LLP Boston Global HR Solutions practice. For 15 years prior to joining PricewaterhouseCoopers, Mr. Platten was part of the Hay Group as Vice President and Managing Director of Eastern Operations. Mr. Platten is a frequent lecturer at the American Bar Association and World at Work. He is co-

6

author of the book People, Performance and Pay, which has been translated into three languages. Mr. Platten holds a B.S. degree in Psychology from Boston College and a Ph.D. degree in Industrial and Organizational Psychology from New York University.

Chandrasekhar (Babloo) Ramamurthy (age 53) has served as Vice President, Regional Manager (Europe) of Watson Wyatt since 2005 and served as a member of Watson Wyatt’s board of directors from 2005 to 2008. He joined The Wyatt Company in 1977. Following the establishment of the global Watson Wyatt Worldwide alliance in 1995, Mr. Ramamurthy became a partner of Watson Wyatt LLP. Mr. Ramamurthy has been based primarily in London, although between 1983 and 1986 he transferred to the international benefits and compensation consulting team based in the New York region, where he dealt primarily with the head offices of U.S. multinational companies. Since returning to Europe, Mr. Ramamurthy has been the account manager for a number of the firm’s major clients in the U.K., advising on a broad range of human capital and employee benefits issues both in the U.K. and overseas. Mr. Ramamurthy was the Head of the European Benefits Consulting Practice from 1999 to 2004, before being appointed Managing Partner of Watson Wyatt LLP in 2004, and has also served on Watson Wyatt LLP’s Partnership Board. Mr. Ramamurthy holds an honours degree in Mathematics from King’s College, London.

Gene H. Wickes (age 56) has served as the Global Director of the Benefits Practice of Watson Wyatt since 2005 and as a member of Watson Wyatt’s board of directors from 2002 to 2007. Mr. Wickes was Watson Wyatt’s Global Retirement Practice Director in 2004 and the U.S. West Division’s Retirement Practice Leader from 1997 to 2004. Mr. Wickes joined Watson Wyatt in 1996 as a senior consultant and consulting actuary. He assists clients with their retirement and executive benefit issues. Prior to joining Watson Wyatt, he spent 18 years with Towers Perrin, where he assisted organizations with welfare, retirement, and executive benefit issues. Mr. Wickes is a Fellow of the Society of Actuaries and has a B.S. in Mathematics and Economics, an M.S. in Mathematics and an M.S. in Economics, all from Brigham Young University.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

Watson Wyatt Worldwide, Inc. is committed to exercising the highest standard of ethical conduct and corporate governance which we believe best serve our stockholders, employees and clients. We have established and adopted Corporate Governance Guidelines for maintaining our ethical standards, as well as, adopting corporate governance practices that form a solid framework for effectively aligning our business objectives. Stockholders may obtain copies of our Codes of Business Conduct and Ethics, the Corporate Governance Guidelines and our Board committee charters on the Company’s website at http://www.watsonwyatt.com/ir or send a request addressed to Watson Wyatt Worldwide, Inc., Office of the Secretary, 901 N. Glebe Road, Arlington, Virginia 22203.

Code of Business Conduct and Ethics

The Company has a Code of Business Conduct and Ethics that applies to all of its employees, including the President and Chief Executive Officer, the Chief Financial Officer and the Controller. The Company also has a Code of Business Conduct and Ethics that applies to all of the Company’s Directors and any amendment or waiver of the Codes for executive officers and Directors will be disclosed on the Company’s website.

Communications with the Board or Presiding Director

It is the policy of the Company to facilitate communications of stockholders and other interested parties with the Board of Directors and the Company’s Presiding Director. Communications to Directors of the Company must be in writing and may be sent to any Director, in care of the Office of the Secretary, Watson Wyatt Worldwide, Inc., 901 N. Glebe Road, Arlington, Virginia 22203. Communications may be sent by email to all Directors as a group or to the Presiding Director using the email addresses posted by the Company on its web site at www.watsonwyatt.com under “Investor Relations.” Communications should identify the person submitting the communication, the interest of such person in the subject matter of the communication, and the address, telephone number and email address of the person submitting the communication. Each communication will be forwarded to the Director(s) to whom it is addressed. The Board has authorized the Company’s Secretary to adopt reasonable procedures for collecting and distributing communications to Directors. If such procedures are adopted, they will be made available on the Company’s website at www.watsonwyatt.com under “Investor Relations.”

7

Presiding Director

The Company’s Board of Directors has designated R. Michael McCullough as the Presiding Director of all executive sessions of the independent Directors of the Board.

Nominees for Director

The Nominating and Governance Committee makes recommendations to the Board concerning individuals who are qualified to stand for election as Directors. The Nominating and Governance Committee seeks individuals with a broad and diverse range of skills who have demonstrated the highest levels of personal and business integrity and sound business judgment, particularly in professional services industries. The Nominating and Governance Committee will consider suggestions of possible nominees for Director from the Board of Directors and management, and may in the future retain a search firm to assist it in identifying possible nominees for Director.

The Nominating and Governance Committee also will consider recommendations of possible nominees for Director submitted by stockholders. Recommendations may be submitted to any member of the Nominating and Governance Committee in care of the Office of the Secretary, Watson Wyatt Worldwide, Inc., 901 N. Glebe Road, Arlington, Virginia 22203. Candidates recommended by stockholders will be evaluated in the same manner as other candidates considered by the Nominating and Governance Committee.

Standing Committees of the Board

The Company has three standing committees: Audit, Compensation and Nominating and Governance. These committees operate pursuant to written charters adopted by the Board of Directors. The Company also has a Risk Management Committee consisting of six members, three of which are independent directors.

Audit Committee

The Audit Committee’s principal responsibilities, as set forth in its charter, are to assist the Board in overseeing the Company’s financial reporting process that is established and implemented by management. The Audit Committee oversees the work of the independent registered public accounting firm and also reviews information provided by the Company’s Director of Internal Audit, independent registered public accounting firm, and management concerning internal accounting procedures and controls.

The Audit Committee is currently composed of four independent Directors, John J. Gabarro, R. Michael McCullough, Gilbert T. Ray and John C. Wright (Chair), all of whom meet the current independence requirements of NYSE and NASDAQ’s listing standards. The Board of Directors has determined that Mr. Wright is both independent and an audit committee financial expert, as defined by SEC guidelines and NYSE and NASDAQ listing standards. The Audit Committee held eight meetings during fiscal year 2009.

Compensation Committee

The Compensation Committee oversees executive compensation policies, including the compensation of the Chief Executive Officer (“CEO”), and oversees administration of the 2001 Employee Stock Purchase Plan, the 2001 Deferred Stock Unit Plan for Selected Employees, the Watson Wyatt Performance Share Bonus Incentive Program and the 2000 Long-Term Incentive Plan. The Board has delegated to the Compensation Committee matters associated with succession planning for the CEO. The Compensation Committee currently is composed of John J. Gabarro, Brendan R. O’Neill, Linda D. Rabbitt and Gilbert T. Ray (Chair), all independent Directors, and all of whom meet the independence requirements of the NYSE and NASDAQ’s listing standards. The Compensation Committee held six meetings during fiscal year 2009.

Nominating and Governance Committee

The Nominating and Governance Committee provides assistance to the Board of Directors of the Company in fulfilling its responsibilities: by identifying individuals qualified to become Directors and approving the nomination of candidates for all Directorships to be filled by the Board of Directors or by the stockholders of the Company; identifying Directors qualified to serve on the committees established by the Board of Directors and recommending to the Board of Directors members for each committee to be filled by the Board of Directors; maintaining and reviewing the Corporate Governance Guidelines; and otherwise taking a leadership role in shaping the corporate governance of the Company.

8

The Nominating and Governance Committee currently is composed of R. Michael McCullough (Chair), Brendan O’Neill, Linda D. Rabbitt and John C. Wright, all independent Directors, and all of whom meet the independence requirements of the NYSE and NASDAQ’s listing standards. The Nominating and Governance Committee held five meetings during fiscal year 2009.

Board Meetings

The Board of Directors conducted eleven meetings during fiscal year 2009. All Directors attended 75 percent or more of the meetings of the Board and the committees on which they served.

Meetings of Non-Employee Directors

The non-employee Directors met without any management Directors or employees present two times last year to discuss board policies, processes and practices. The Presiding Director, who is also the Chair of the Nominating and Governance Committee, chaired these meetings.

Annual Meeting Attendance

All Directors attended the 2008 Annual Meeting of Stockholders. All Directors are expected to attend the annual meeting of the Company’s shareholders.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Summary

Our Compensation Discussion and Analysis will provide you with an overview and analysis of (i) our compensation programs and policies for certain of our executive officers identified below; (ii) the material compensation decisions made by the Compensation Committee (the “Committee”) of the Board of Directors under those programs and policies as reflected in the executive compensation tables that appear following this Compensation Discussion and Analysis; and (iii) the material factors that the Committee considered in making those decisions.

The Company’s executive compensation philosophy and the elements of our executive compensation program with regard to fiscal year 2009 are summarized below:

· The main objectives of the Company’s executive compensation program are attracting, motivating and retaining the best executives and aligning their interests with our strategy of maximizing stockholder value.

· Total direct compensation under the Company’s executive compensation program consists of base salary, supplemental performance-based awards in the form of fiscal year-end bonuses, and long-term incentive opportunities.

· The Committee is responsible for evaluating and setting the compensation levels of our executive officers. In setting compensation levels for executives other than the CEO, the Committee solicits the input and recommendations of our CEO, John J. Haley.

· Total target and actual direct compensation levels for the Company’s named executive officers compare lower than those of its peer group, primarily because of lower long-term incentive targets but also because of lower annual incentive targets. Because the Company’s executive compensation program has higher fixed elements such as base salaries and pension value, it has lower incentive elements. As a result, this has led the Committee to target total direct compensation lower than other companies of our size with similar performance.

· During fiscal year 2009, the Company operated in the midst of the worst recession since the Great Depression, which resulted in a worldwide economic slowdown, a freeze in available credit markets, and a crisis in confidence on a global scale. In spite of these challenges, the Company achieved the second best operating results in the Company’s history. Revenues were $1.68 billion, up 3 percent on a constant

9

currency basis, and net income for the year was $146.5 million, or $3.42 per diluted share. Constant currency adjusted earnings per share, excluding severance, increased 11 percent from $3.50 in fiscal year 2008 to $3.89 in fiscal year 2009. The Company managed strong profit margins of more than 12 percent and had zero debt as of June 30, 2009.

· Revenue growth and earnings per share are the primary quantitative metrics used by the Committee to determine long-term incentive compensation earned during the applicable three-year performance periods designated by the Committee for measuring long-term performance. For performance shares that vested at the end of fiscal year 2009, the compensation decisions reported herein reflect the Company’s performance above target with respect to both metrics for the three-year performance period ending June 30, 2009.

· Based on the Company’s sustained performance year over year relative to its peer group and the respective individual accomplishments of our named executives during fiscal year 2009, the Committee deemed it appropriate for fiscal year-end bonuses for our named executives for fiscal year 2009 to be demonstrably higher than target. In addition, certain named executives received a one-time transaction bonus in recognition of significant and extraordinary efforts made by those executives in negotiating and executing the pending merger agreement with Towers Perrin.

· The Committee will continue to consider all relevant competitive factors in determining compensation for our named executive officers.

Named Executives

Under the heading “Executive Compensation,” we present a series of tables containing specific information about the compensation earned or paid in fiscal year 2009 to the following individuals, whom we refer to as our named executives:

· John J. Haley, President, Chief Executive Officer, Chairman of the Board and Director

· Roger F. Millay, Vice President and Chief Financial Officer

· Carl D. Mautz, former Vice President and Chief Financial Officer

· Gene H. Wickes, Vice President and Global Director of the Benefits Practice

· Kevin L. Meehan, Vice President and Regional Manager (North America)

· Walter W. Bardenwerper, Vice President, Secretary and General Counsel

Mr. Mautz retired from the Company effective August 29, 2008. He was replaced by Mr. Millay, who started with the Company on August 18, 2008.

The discussion below is intended to help you understand the detailed information provided in those tables and to put that information into context within our overall compensation program.

Objectives of Our Executive Compensation Program

The objectives of our executive compensation program are to:

1. Attract, motivate and retain the most highly qualified and capable executives by providing competitive compensation based on individual and Company performance and reflecting our mix of compensation elements.

We seek to compensate all of our executives fairly on a global basis and on a basis that reflects the Company’s performance relative to its key competitors. Toward this end, we provide competitive base compensation, supplemented with variable compensation based on individual achievement of annual results and, for select senior executives, long-term results. As discussed below, we tie both annual and long-term compensation to quantitative and qualitative performance assessments that impact our success in the marketplace.

10

2. Align executive compensation with the Company’s overall business strategies and values.

We apply our compensation objectives to all of our executives. In implementing our compensation objectives, we take into consideration the Company’s business strategy and prevailing market conditions. Specifically, our executive compensation program is designed to reinforce business goals identified through our PerformanceExcellence process and our Horizon initiatives.

Our PerformanceExcellence process is an annual three-phase performance management cycle composed of planning, a mid-year review and a year-end review. It is designed to (a) align our employees’ (whom we refer to as our associates) performance goals to our business priorities; (b) develop their ability to achieve their goals; and (c) recognize and reward their business results based on fair and accurate measurement.

Horizon is the Company’s strategic plan for attaining its vision of market leadership in the human capital consulting profession. Factors included in the strategic plan take into account our market share gains, the prioritization and allocation of our financial investments and resources based on contribution to market leadership, effectiveness in enhancing our organizational structure, and the achievement of strategic acquisitions.

3. Focus management on maximizing stockholder value.

We also believe that the best way to directly align the interests of our named executives with the interests of our stockholders is to ensure that our named executives acquire and retain an appropriate level of stock ownership throughout their careers with us. In fiscal year 2009, our compensation program pursued this specific objective in three ways: (i) through our Performance Share Bonus Incentive Program (discussed below); (ii) by paying 25 percent of annual fiscal year-end bonuses to our named executives and other senior executives in the form of Company stock; and (iii) through our stock ownership guidelines for our named executives, as described in more detail below.

4. Foster an ownership approach among our executives and reward their focus on long-term objectives.

For our named executives, a portion of their fiscal year 2009 total direct compensation was delivered through our Performance Share Bonus Incentive Program, which is a long-term performance-based arrangement that pays out in Company stock based on the achievement of performance goals over a three-year period. The Performance Share Bonus Incentive Program combines the elements of basing compensation on corporate performance, focusing on stockholder value, and rewarding long-term results.

When implementing our compensation program, the level of our named executives’ compensation is determined primarily based upon (a) an internal pay equity analysis that takes into account the named executive’s level of responsibility and function within the Company; (b) the extent to which the named executive has helped drive the achievement of financial and strategic goals that impact stockholder value; (c) the overall performance and profitability of the Company; and (d) our assessment of the competitive marketplace, including a comparison against what we deem to be our peer group of companies. We do not maintain employment agreements with any of the named executives.

How We Determine and Assess Executive Compensation

The Compensation Committee is responsible for evaluating the compensation levels for each of the named executives of the Company and for administering the Company’s cash- and equity-based incentive plans. The Committee engages an independent compensation consultant, Frederic W. Cook & Co., Inc. (“Frederic Cook”) and, in setting compensation levels for executives other than the CEO, solicits the input and recommendations of our CEO, John Haley. Frederic Cook periodically reviews the Company’s total compensation philosophy, target peer group and target competitive positioning for reasonableness and appropriateness; conducts competitive analyses of executive compensation for the chosen peer group and reports on its findings to the Committee; and reviews the Company’s total executive compensation program on behalf of the Committee, in consultation with management, and advises the Committee of changes that could be made to better reflect evolving best practices and improve effectiveness. For fiscal year 2009, the Compensation Committee instituted a formal process for conducting an annual assessment of its independent compensation consultant.

11

In making its determinations, the Committee relies on publicly available information, commissioned survey data, and its knowledge of the market for key executives. The Compensation Committee takes this peer data information into account and generally seeks to provide competitive pay by targeting total actual compensation opportunities for our named executives between the 50th and 75th percentiles relative to a peer group. However, the Compensation Committee does not target a particular peer group percentile for particular elements of compensation. The peer group was selected by the Compensation Committee based on the recommendations of Frederic Cook and input from management on the comparability of the business operations of potential peer group companies, and is re-evaluated annually.

The peer group companies include those few public companies with human resources consulting lines of business. Because many of the Company’s direct competitors are privately owned (e.g., Towers Perrin and the Hay Group) or are subsidiaries of larger public companies (e.g., Mercer Human Resource Consulting and Buck Consultants), the number of direct competitors for which public information is available for peer group comparison is limited. Therefore, additional peer group companies in the consulting, staffing and professional services businesses are selected using the following criteria: (a) reasonably comparable size (based on revenue and market capitalization); (b) positive earnings before interest, taxes, depreciation and amortization (EBITDA); (c) high human capital/low financial capital business model; (d) creative/innovative business product; (e) highly skilled employee base; (f) deemed a “comparable” by securities firms providing research coverage; and (g) global reach.

For conducting a competitive assessment of the compensation levels of each of its named executives in fiscal year 2009, the Compensation Committee approved a peer group of ten companies, with two changes from the peer group used in the prior fiscal year. Hudson Highland, which was a “primary” company in the prior fiscal year, was dropped because it is now primarily a staffing firm. Resources Connection was moved up to the “primary” sub-set. Frederic Cook presented the Committee with competitive compensation comparisons for the Company’s fiscal year 2008 actual total compensation and fiscal year 2009 target compensation against competitive 2008 actual and target compensation for the peer group companies. Comparisons were made separately by Frederic Cook against the five “primary” companies considered to be most similar to the Company, as well as against the combined peer group. The 10 companies comprising the combined peer group for fiscal year 2009 are as follows:

|

Primary Peers |

|

Secondary Peers |

|||

|

· |

FTI Consulting |

|

· |

|

Aon |

|

· |

Hewitt Associates |

|

· |

|

CIBER |

|

· |

Navigant Consulting |

|

· |

|

Convergys |

|

· |

Perot Systems |

|

· |

|

Gartner |

|

· |

Resources Connection |

|

· |

|

Huron Consulting |

|

|

|

Position Relative to Watson Wyatt (Based on Fiscal Year 2008 Data) |

|

|||||

|

|

|

Annual Revenue |

|

Market Capitalization |

|

Number of |

|

|

|

Median Size: Primary |

|

2,036 |

|

1,652 |

|

11,683 |

|

|

|

Median Size: Combined |

|

1,293 |

|

1,423 |

|

8,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

· |

Watson Wyatt |

|

1,760 |

|

2,038 |

|

7,230 |

|

Watson Wyatt is above median in size (average percentile rank of 60% when measured in terms of revenue, earnings before interest, taxes, depreciation and amortization, total assets, market capitalization and number of employees) compared to the combined peer group. The combined peer group was used for this purpose because it was determined that there are too few companies in the primary peer group to calculate meaningful percentile ranks. An analysis performed for the Company by Frederic Cook compared the compensation percentile ranks for our named executives versus the combined peer group based on 2008 data. The analysis revealed that the Company’s base salaries for named executives continued to compare above median, which the Committee believes is appropriate given the Company’s percentile rank based on average size. The competitiveness of target bonuses for our named executives varied by position and they are generally less competitive than our base salaries, but are sufficient to result in actual total cash compensation that is above median when our performance is above median.

12

The value of long-term incentive compensation compared low, generally falling between the 25th percentile and the median, with the result that total direct compensation was at or below the median for most of our named executives. However, Watson Wyatt is one of only a few companies in our combined peer group with a defined benefit pension plan. Taking into account both the change in pension value and actual total direct compensation generally increases the competitiveness of the Company’s actual total compensation to above median and, in some cases, above the 75th percentile.

In light of its determination regarding actual total compensation, the Committee determined that total direct compensation for our named executives should continue to be positioned near, but below, the median. As a result, the Committee did not increase target annual and long-term incentive levels for fiscal year 2009. However, based on its post-year-end review of the Company’s sustained positive performance in fiscal year 2009, the Committee concluded that the annual year-end bonuses for our named executives generally should exceed target in order to reflect their strong performance during the fiscal year.

Elements of Our Executive Compensation Program

Our executive compensation program consists primarily of the following integrated components: base salary, supplemental performance-based awards in the form of fiscal year-end bonuses, and long-term incentive opportunities, which together make up a named executive’s total direct compensation for a given fiscal year. The only component not available to all associates is the long-term incentive opportunity.

The process for determining Mr. Haley’s salary and fiscal year-end bonus is discussed in more detail on page 18. In determining base salary increases and fiscal year-end bonus payments for the named executives other than Mr. Haley, the Committee asks for recommendations from Mr. Haley. In making his recommendations for the named executives, Mr. Haley reviews each named executive’s performance against their individual PerformanceExcellence goals. For our named executives, these goals consist primarily of objectives addressing the financial performance and effective management of their respective business practice, region or corporate function. While this process reflects a methodical approach to evaluating the job performance of our named executives, achievement of these goals is evaluated subjectively and scored in four weighted performance domains, as described below in the discussion relating to fiscal year-end bonuses. In making his recommendations, Mr. Haley also takes into consideration the named executive’s experience, the extent to which the named executive has contributed to the Company’s success during the fiscal year, the named executive’s expected level of responsibility in the coming year, base salary and bonus pool levels for the Company as a whole, peer group competitive data and relative pay levels of other Watson Wyatt associates. The following discussion will describe each of the components that comprise the total direct compensation of our named executives.

Base Salary

In order to provide a fixed level of compensation for the performance of an executive’s regular duties, the Company pays all of its named executives a fixed, annual base salary, which the Committee reviews and approves at the beginning of each fiscal year and which becomes effective on October 1 of each year. Base salary decisions are highly discretionary, and we do not target base salary as a particular percentage of total compensation. Mr. Haley makes salary recommendations to the Committee for the named executives other than himself.

Based upon the qualitative evaluation process discussed above, in conjunction with a review of competitive peer group survey data, Mr. Haley recommended salary increases for fiscal year 2009 for Messrs. Wickes and Meehan of 4.5% and for Mr. Bardenwerper of 4.2% that became effective October 1, 2008. In making these recommendations, the principal factors that Mr. Haley considered were the Company’s overall financial results for fiscal year 2008, the individual performance of each executive during the fiscal year and salary levels of similarly positioned executives in the Company’s primary peer group. Mr. Mautz did not receive a salary increase as he retired from the Company prior to October 1, 2008. Mr. Millay did not receive a salary increase effective October 1, 2008, as he had started with the Company just prior to that time. Mr. Haley discussed each recommendation with the Committee and, thereafter, the Committee approved the recommended salary increases.

13

A similar process was followed for determining the base salaries for the named executives other than Mr. Haley effective October 1, 2009. Because of general economic conditions and a desire to be prudent. Mr. Haley recommended that base salaries for all named executives remain unchanged effective October 1, 2009, and the Committee agreed with his recommendation. As discussed below, Mr. Haley’s base salary remained unchanged, as did the base salaries for the named executives other than Mr. Haley.

Fiscal Year-End Bonuses

The Company’s named executives participate in an annual fiscal year-end bonus program, which the Company provides in order to supplement base salary and reward achievement of individual, business unit/function and/or overall Company results for the most recently completed fiscal year. Pursuant to this program, each named executive is assigned a pre-determined bonus target as a percentage of base salary as shown in the table below:

|

Name |

|

Target Bonus Percentage |

|

|

John Haley |

|

100.0 |

% |

|

Roger Millay |

|

62.5 |

% |

|

Carl Mautz |

|

62.5 |

% |

|

Gene Wickes |

|

62.5 |

% |

|

Kevin Meehan |

|

62.5 |

% |

|

Walter Bardenwerper |

|

62.5 |

% |

Target bonus levels for our named executives are based on their respective band levels, which generally reflect their level of responsibilities and contributions to the business. Target bonus percentage increases as an associate’s band level increases. This reflects a belief that as associates move to higher levels of responsibility with greater ability to influence the Company’s results, a higher proportion of pay should be determined to be “at risk” and dependent on Company and individual performance. Mr. Haley’s target is higher than for the other named executives in order to reflect his greater level of responsibility and how critical his contributions are to the success of the Company.

The amount of fiscal year-end bonuses awarded as a percentage of target is discretionarily determined. Following the end of fiscal year 2009, Mr. Haley evaluated the performance of each of the other named executives by scoring their performance in four weighted performance domains, as follows: (i) Business practice, region or Corporate function (representing a qualitative assessment of financial and individual performance in leading their respective practice, region or Corporate function) — 50%; (ii) Watson Wyatt (representing a subjective judgment of their contribution to the Company as a whole during the fiscal year) — 25%; (iii) Other goals (representing individual goals that were developed through our PerformanceExcellence process) — 15%; and (iv) Global Matrix Group (GMG) participation (representing their contribution as a member of the Company’s GMG) — 10%. Mr. Haley assigned a rating to each of the other named executives for each performance category, which was then applied against the weighting for the particular category and totaled for each of the named executives to arrive at an overall performance rating for the fiscal year utilizing a six-point scale. A named executive’s actual bonus is based on this rating and the named executive’s applicable bonus funding percentage. The bonus funding percentage is the percentage of the Company-wide bonus pool that is subjectively allocated to each applicable practice, region or Corporate function as a result of their performance during the fiscal year.

In making his recommendations within the framework discussed above, Mr. Haley took into account each named executive’s responsibilities and accomplishments during the fiscal year. In addition to the sustained positive performance of the Company in fiscal year 2009 relative to its peers, the bonus recommendations provided to the Committee by Mr. Haley took into account the following qualitative assessment of each named executive’s performance during the fiscal year.

Mr. Millay successfully transitioned into his role as the new Chief Financial Officer of the Company and efficiently and effectively oversaw the Company’s adherence to the highest standards of financial reporting and controls. He led the development of improved processes and reporting capabilities within the global finance and accounting functions, while at the same time providing strong operational support and guidance to senior management and the Board of Directors.

14

Mr. Wickes, as the leader of the Company’s largest practice, managed to guide the Benefits Practice to a successful year in the midst of a global economic crisis and deteriorating market conditions. Pre-tax net operating income for the Benefits Practice reached an all-time high, and the annual organic, constant currency growth rate for the practice was strong, especially when considering the global economic environment.

Mr. Meehan, like Mr. Wickes, adapted well to rapidly changing and deteriorating market conditions and led our North America region to a strong performance in fiscal year 2009. The North America region effectively managed its costs, preserved its operating margins and was our most profitable region.

Mr. Bardenwerper provided critical leadership in helping the Company through the economic crisis. He also made significant strides in guiding the Company through the regulatory and litigation challenges facing it and provided valuable support to senior management and the Board of Directors.

All of the named executives other than Mr. Haley were rated by Mr. Haley as a “5 – Very Strong Performance,” corresponding to a suggested bonus range of 115% to 135% of target based on the named executives’ applicable bonus funding percentage. Based on these performance ratings, Mr. Haley recommended annual bonuses ranging from 118.7 percent to 138.9 percent of target for the other named executives, as set forth below.

|

Name |

|

Area |

|

Bonus as a |

|

|

Millay |

|

F&A |

|

118.7 |

% |

|

Mautz |

|

F&A |

|

N/A |

|

|

Wickes |

|

Benefits Practice |

|

138.9 |

% |

|

Meehan |

|

North America |

|

133.6 |

% |

|

Bardenwerper |

|

General Counsel |

|

131.5 |

% |

Because Mr. Mautz retired from the Company effective August 29, 2008, he did not receive a fiscal year-end bonus for fiscal year 2009.

Mr. Haley discussed each recommendation with the Committee. The Committee has the discretion to increase or decrease each of these amounts (though not above the maximum incentive award established by the Committee, described under “Tax and Accounting Treatments of Elements of Compensation” below), but determined to approve all of the recommended payouts without adjustment.

In order to facilitate stock ownership by associates at our most senior levels, we have an equity incentive feature of our bonus program under which 25 percent of the total bonus awarded is delivered in the form of Company stock under the Company’s 2001 Deferred Stock Unit Plan for Selected Employees, which could vest based on the discretion of the Committee over two years. The number of shares granted is based on the closing share price on the grant date, which is the bonus payment date. Consistent with past practice, the Committee exercised its discretion to grant fully vested shares for fiscal year 2009.

Transaction Bonuses

Mr. Haley also made recommendations to the Committee for special one-time cash bonuses to a select number of executives, including some of the named executives, in recognition of the significant and extraordinary efforts made by those executives in negotiating and executing the pending merger agreement with Towers Perrin. The Committee noted that the exceptional fiscal year 2009 results discussed above for the Company were achieved within the same time period as the Company’s Chief Executive Officer, the Chief Financial Officer, the General Counsel and the Global Director of the Benefits Practice were successfully negotiating the largest merger in the history not only of the Company itself, but of the human capital/actuarial industry as a whole.

Mr. Wickes, Mr. Bardenwerper and Mr. Millay took an active role throughout the lifecycle of the deal and devoted a significant amount of time and effort in helping to negotiate the terms of the merger agreement. Mr. Millay and Mr. Bardenwerper also both played key roles in leading the due diligence function and providing assistance in finalizing

15

the contractual terms of the merger. Accordingly, following discussions of the time and effort exerted by each named executive, the Committee approved the recommendations of Mr. Haley for special one-time cash bonuses in the amount of $150,000 for Mr. Millay, $200,000 for Mr. Wickes and $200,000 for Mr. Bardenwerper.

Long-Term Incentive Compensation: Performance Share Bonus Incentive Program

In fiscal year 2009, our named executives received long-term incentive compensation under our Performance Share Bonus Incentive Program (the “SBI Program”). The SBI Program advances our executive compensation objectives by rewarding the achievement of strategic performance objectives with equity awards. As a result, the Committee weighted our SBI Program so that it provides a significant portion of our named executives’ total direct compensation opportunity.

The target number of deferred stock units that may be earned by the named executives under the SBI Program represents a multiple of the cash portion (75 percent) of the named executive’s target bonus for the year of grant, with the multiples ranging from 2.0 for Mr. Haley to 1.25, 1.0 or 0.75 for the other named executives. Mr. Haley’s multiple is higher because his leadership is considered by the Committee to be critical to the Company. Mr. Millay’s multiplier, while not as high as Mr. Haley’s, is higher than for the other named executives in order to reflect the importance of his role as Chief Financial Officer. Mr. Bardenwerper’s multiplier is lower than the remaining named executives to reflect the fact that he is not a member of the Global Matrix Group. The following table shows how the number of deferred stock units granted in fiscal year 2009 under the SBI Program was determined for each of the named executives, for the performance period beginning July 1, 2008 and ending June 30, 2011.

|

LAST NAME |

|

BASE |

|

FISCAL |

|

PORTION |

|

CASH |

|

MULTIPLIER |

|

FULL

CASH |

|

STOCK |

|

NUMBER |

|

||||

|

HALEY |

|

$ |

915,000 |

|

100.0 |

% |

75.0 |

% |

$ |

686,250 |

|

2.00 |

|

$ |

1,372,500 |

|

$ |

52.89 |

|

25,951 |

|

|

MILLAY |

|

$ |

550,000 |

|

62.5 |

% |

75.0 |

% |

$ |

257,813 |

|

1.25 |

|

$ |

322,266 |

|

$ |

52.89 |

|

6,094 |

|

|

WICKES |

|

$ |

575,000 |

|

62.5 |

% |

75.0 |

% |

$ |

269,531 |

|

1.00 |

|

$ |

269,531 |

|

$ |

52.89 |

|

5,097 |

|

|

MEEHAN |

|

$ |

575,000 |

|

62.5 |

% |

75.0 |

% |

$ |

269,531 |

|

1.00 |

|

$ |

269,531 |

|

$ |

52.89 |

|

5,097 |

|

|

BARDENWERPER |

|

$ |

500,000 |

|

62.5 |

% |

75.0 |

% |

$ |

234,375 |

|

0.75 |

|

$ |

175,781 |

|

$ |

52.89 |

|

3,324 |

|

See note 1 to the table on Grants of Plan-Based Awards in Fiscal 2009 on page 24 for more information on the formula to be used to determine the amount payable based on results for the fiscal 2009 through 2011 performance period.

The number of deferred stock units earned is based upon the extent to which the Company meets certain performance goals set at the beginning of the three-year performance period. For the fiscal 2007 through 2009 performance period, the fiscal 2008 through 2010 performance period, and the fiscal 2009 through 2011 performance period, the Committee set financial metrics for the SBI Program because it concluded that such metrics accurately reflected the strategic performance goals for the Company and are aligned with the interests of the Company’s stockholders. The financial metrics for each of the three-year SBI Program performance periods are earnings per share growth and organic revenue growth. For significant foreign operations, revenue for use in the revenue growth calculations reflects a constant currency exchange between the local currency and the U.S. dollar.

Based on the extent to which financial metrics are achieved over a three-fiscal-year period, participants vest in between zero and 170 percent of the target number of deferred stock units, with a threshold vesting level set at 30 percent of target. Dividend equivalents are credited only on stock units that ultimately vest.

16

See note 2 to the Stock Vested During Fiscal Year 2009 table on page 27 for information on the formula used to determine the amount payable and the results for the fiscal 2007 through 2009 performance period.

The fiscal year 2008 and fiscal year 2009 SBI Program documents indicate that the Committee shall accelerate the determination of vesting of awards and provide for their immediate settlement in stock or cash in connection with a change in control, subject to the Committee’s authority to assure fair and equitable treatment of participants in the SBI Program.

Accordingly, on September 4, 2009, the Committee determined that, upon and subject to consummation of the proposed merger between Watson Wyatt Worldwide, Inc. and Towers, Perrin, Forster & Crosby to form a new, publicly listed company called Towers Watson & Co. (the “Merger”), the fiscal 2008 SBI Program awards shall not vest, with the effect that nothing will be earned or paid under those awards and the awards will be forfeited, but the fiscal 2009 SBI Program will vest at 100% of target. In reaching these determinations, the Committee assessed performance to date and projections of performance. As a result of these evaluations, the Committee concluded that it is not likely that the Company will achieve the fiscal year 2008 to 2010 minimum performance metrics. With respect to the fiscal 2009 to 2011 performance period, the Committee determined that it is appropriate to settle the awards at target in order to treat participants fairly, retain key talent, and take account of the fact that the level at which performance metrics may be met at the time of the Merger will be uncertain, as the performance period would be only halfway completed as of December 31, 2009, the projected date of the Merger.

As a result, the following number of shares of Towers Watson & Co.’s Class A common stock, plus dividend equivalents that will have accrued, will be paid to the Company’s named executives for their vested fiscal 2009 SBI Program awards upon consummation of the Merger: Mr. Haley - 25,951; Mr. Millay - 6,094; Mr. Wickes - 5,097; Mr. Meehan - 5,097; and Mr. Bardenwerper - 3,324.

Also, in light of the pending Merger, the Committee determined to grant nonqualified stock options as incentive compensation in lieu of establishing awards under the SBI Program for fiscal 2010. The options were granted on September 9, 2009 under the Company’s 2000 Long-Term Incentive Plan. The options were granted to high-performing senior executives of the Company, including the named executives, who otherwise would have been selected by the Committee to receive SBI Program awards as a result of the executives having direct impact on or responsibility for driving strategy throughout the Company. In light of the anticipated timing of the Merger, the Committee granted options with a Black-Scholes value equal to approximately one-half of the target value of grants under the SBI Program. The options have a seven year term and will vest ratably over each of the three years following the date of grant, provided that upon a change in control of the Company, including the Merger, the options become fully exercisable. The options have an exercise price equal to the grant date market price of the Company’s common stock ($42.47), so that participants will be able to realize value under their options only to the extent that the options become vested and the value of the Company’s stock price, or the share-equivalent value of Towers Watson common stock following the Merger, appreciates. The options otherwise will expire to the extent that they are unvested upon a participant’s termination of employment for reasons other than death, disability, retirement or termination without cause. The number of options granted to each of the named executives was as follows: Mr. Haley – 55,530; Mr. Millay - 13,042; Mr. Wickes – 10,908; Mr. Meehan – 10,908; and Mr. Bardenwerper - 7,114.

Equity Award Policies

As discussed above, in fiscal year 2009 we paid a portion of annual fiscal year-end bonuses in the form of stock and also awarded stock under the SBI program for the fiscal 2007 through 2009 performance period. The calculations of the amount of equity to be awarded are performed as of the last business day preceding the bonus payment date, in the case of annual fiscal year-end bonuses, and as of the last day of the preceding fiscal year, in the case of the SBI Program. The timing of these calculations is fixed in advance so as to eliminate the opportunity for taking advantage of material nonpublic information.

17

Base Salary and Bonus for the Chief Executive Officer

Mr. Haley’s base salary from October 1, 2008 to September 30, 2009 was $915,000, an increase of $40,000, or 4.6 percent over his previous year’s base salary of $875,000. Effective October 1, 2009, Mr. Haley’s annual base salary remained unchanged at $915,000. In determining to leave Mr. Haley’s base salary unchanged, the principal factors that the Compensation Committee considered were salary levels of CEOs in the Company’s peer group, general economic conditions and the desire to be consistent with the treatment of the other named executives.

The Committee recommended, and the Board of Directors approved, a bonus ($1,281,000) equal to 140 percent of Mr. Haley’s target bonus. Below are Mr. Haley’s fiscal year 2009 performance goals, which were the principal factors taken into account in determining Mr. Haley’s bonus.

1. Meet the fiscal year 2009 financial plan for revenue of $1.875 billion, Net Operating Income of $478 million, and Earnings Per Share of $3.84. For significant foreign operations, the calculation of fiscal year 2009 revenue, Net Operating Income and Earnings Per Share reflects a constant currency exchange between the local currency and the U.S. dollar from fiscal year 2008 to fiscal year 2009.

2. Make sure that the Insurance & Financial Services Practice meets fiscal year 2009 financial plan for revenue of $125 million ($119 million in fiscal year 2008) and Net Operating Income of $10 million, or 8% ($2 million, or 2% in fiscal year 2008). For significant foreign operations, the calculation of fiscal year 2009 revenue, Net Operating Income and Earnings Per Share reflects a constant currency exchange between the local currency and the U.S. dollar from fiscal year 2008 to fiscal year 2009.

3. Champion and monitor the Diversity Program.

4. Continue to develop succession planning for the CEO and top business leaders and instill a succession process and culture in the organization.

5. Work with the new CFO to drive continued enhancement in financial reporting processes.

6. Use Horizon strategy to drive Company actions and plans. Continue to ensure that strategy is consistent with current and future needs.

The Committee determined that Mr. Haley did not meet the financial plan for fiscal year 2009, but that he did meet or exceed his other goals for fiscal year 2009, and that financial performance was strong in light of the difficult economic environment. In making its bonus decision, the Committee also considered the results of an internal CEO 360 evaluation of Mr. Haley by his direct reports and the Board of Directors in which Mr. Haley scored very favorably in almost all categories.

Mr. Haley’s compensation level is significantly higher than that of the other named executives. The Committee believes this is appropriate given:

a. His years of experience in the human capital consulting industry;

b. His lengthy tenure and consistently superior performance as CEO of the Company;

c. His level of responsibility and the significance and critical nature of his contributions to the success of the Company; and

d. The growth and performance of the Company under his leadership.

Severance Benefits

The Company has not entered into employment agreements with its named executives. The Company also does not maintain a broad-based severance plan. As a result, the Company is not obligated to pay severance in the event of an involuntary termination of employment of one of its named executives. However, because the SBI Program represents a significant percentage of our named executives’ total direct compensation opportunity, the Committee retains the discretion to determine whether and how to adjust outstanding SBI Program awards in the event of a termination of employment. In connection with Mr. Mautz’s retirement from the Company effective August 29, 2008, the Committee, in the exercise of such discretion, determined that Mr. Mautz should vest in his fiscal year 2007 and fiscal year 2008 SBI Program awards at the same time and to the same extent as other SBI Program participants, dependent upon the achievement of relevant Company metrics for each of the applicable three-year performance periods. The plan under which the SBI Program is conducted also states that upon a change in control,

18

the Committee shall accelerate the vesting of awards, subject to the Committee’s authority to assure fair and equitable treatment of participants.

The Company also maintains severance pay guidelines for associates, which would include the named executives. The guidelines are completely discretionary in the event of a termination of employment, and for any termination, the amount paid by the Company may vary. The guidelines provide for severance pay in an amount equal to two weeks pay for each full year of the named executive’s service, up to a maximum of 24 weeks’ pay, or an amount equal to one week’s pay for each full year of service, whichever is greater, payable in a lump sum upon termination. Any severance benefits payable to a named executive in such circumstances would be entirely discretionary and would be determined by the Company on an individual basis with the approval of the Committee.

Retirement and Savings Plan Benefits

Retirement Plans

The named executives participate in a defined benefit plan available to Watson Wyatt associates in the United States. The Company’s sponsorship of such a plan is consistent with our belief that defined benefit plans continue to represent a crucial and viable means for us to provide for the future retirement security of our employees and to encourage sustained service to the Company. The plan benefits are based upon years of service with the Company and the highest consecutive 60-month average of total pay, which includes base pay and bonus. More details regarding the defined benefit plan are included in the discussion following the Pension Benefits table on page 28.

Savings Plans

Our named executives are also eligible to participate in the 401(k) plan available to Watson Wyatt associates in the U.S. and in a non-qualified plan designed to permit employees impacted by Internal Revenue Code (IRC) limitations on annual contributions to 401(k) plans to continue to receive Company matching contributions as if salary deferrals had continued once they exceeded the IRC limitations.

Non-Qualified Retirement Plans

The Company also sponsors non-qualified defined benefit and defined contribution retirement plans for our highly compensated executives, including our named executives in the United States, which provide benefits in excess of IRC limits. The purpose of these plans is to provide our senior executives with the retirement benefits they would have received in the absence of the IRC limitations.

Employee Welfare Benefit Plans

Our named executives are eligible for medical, life insurance and other welfare benefits available to other Watson Wyatt associates, depending upon the region in which they are located. There are no special medical plans or other welfare plans for our named executives, except that the named executives are covered by an excess personal liability policy that the Company provides to only certain of its senior executives.