Attached files

| file | filename |

|---|---|

| EX-1.01 - FORM OF SOLICITING ADVISOR AGR - Pebble U.S. Market Fund, LLC | pebble_s1-ex0101.htm |

| EX-8.01 - OPINION RE FEDERAL INCOME TAX - Pebble U.S. Market Fund, LLC | pebble_s1-ex0801.htm |

| EX-23.02 - CONSENT - Pebble U.S. Market Fund, LLC | pebble_s1-ex2302.htm |

| EX-5.01 - OPINION - Pebble U.S. Market Fund, LLC | pebble_s1-ex0501.htm |

| EX-3.02 - CERTIFICATE AND ARTICLES OF ORGANIZATION - Pebble U.S. Market Fund, LLC | pebble_s1-ex0302.htm |

| EX-10.01 - FORM OF CUSTOMER AGREEMENT - Pebble U.S. Market Fund, LLC | pebble_s1-ex1001.htm |

As

filed with the Securities and Exchange Commission on October 20,

2009

Registration

Number 333- _________

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Pebble

U. S. Market Fund, L.L.C.

(Exact

Name of Registrant as Specified in its Charter)

|

Louisiana

|

6799

|

27-0743658

|

|

(State

or Other Jurisdiction of

|

(Primary

Standard Industrial

|

(I.R.S.

Employer

|

|

Incorporation

or Organization)

|

Classification

Code Number)

|

Identification

No.)

|

3500

N. Causeway Blvd., Ste. 160

Metairie,

LA 70002

(504)

401-0179

(Address,

Including Zip Code, and Telephone Number, Including Area Code, of Principal

Executive Offices)

Philippe

J. Langlois

909

Poydras St., Ste 2300

New

Orleans, LA 70112

(504)

569-7144

(Name,

Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent

For Service)

Approximate

date of commencement of proposed sale to the public: December 1, 2009.

If any of

the securities being registered on this form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. ý

If this

form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. o

If this

form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement

for the same offering. o

If this

form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

number of the earlier effective registration statement for the same offering.

o

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See definition of “accelerated filer”, “large accelerated

filer”, “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of

the Exchange Act.

|

Large

accelerated filer o

|

Accelerated

filer o

|

Non-accelerated

filer o

|

Smaller

reporting company ý

|

|

(Do

not check if smaller reporting company)

|

CALCULATION

OF REGISTRATION FEE

|

Title

of

Each

Class

Of

Securities To Be

Registered

|

Amount

To

Be Registered

|

Proposed

Maximum

Offering

Price

Per

Unit

|

Proposed

Maximum

Aggregate

Offering

Price

|

Amount

Of

Registration

Fee

|

|

Units,

Series A

|

100,000

|

$1,000.00

|

$100,000,000.00

|

$5,580.00

|

The

registrant hereby amends this registration statement on such date or date(s) as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933, as amended, or until the registration statement shall

become effective on such date as the commission acting pursuant to said Section

8(a) may determine.

Part I –

Information Required in Prospectus

|

Item

1. Forepart of the Registration Statement and Outside Front Cover Page of

Prospectus.

|

Cover

Page, p.1

|

|

|

Item

2. Inside Front and Outside Back Cover Pages of

Prospectus.

|

Table

of Contents - Inside Cover Page, p.3; Prospectus Delivery Obligation –

Back Outside Cover

|

|

|

Item

3. Summary Information, Risk Factors and Ratio of Earnings to Fixed

Charges.

|

Summary,

p.7; Address and telephone number, Cover Page, p.2; Risk Factors,

p.13

|

|

|

Item

4. Use of Proceeds.

|

Use

of Proceeds, p.26;

|

|

|

Item

5. Determination of Offering Price.

|

Cover

Page, p.1

|

|

|

Item

6. Dilution.

|

Not

Applicable

|

|

|

Item

7. Selling Security Holders.

|

Not

Applicable

|

|

|

Item

8. Plan of Distribution.

|

Cover

Page, p.1; Summary, p.7

|

|

|

Item

9. Description of Securities to be Registered.

|

Cover

Page, p.1, Summary, p.7

|

|

|

Item

10. Interests of Named Experts and Counsel.

|

Certain

Legal Matters, p.34; Experts, p.35

|

|

|

Item

11. Information with Respect to the Registrant.

|

Cover

Page, p.1,2; Summary p.7; Pebble Asset Management, L.L.C., p.16; Reports,

p.11; Other Risks, p.15; Index to Financial Statements, p.36; Management

Discussion and Analysis of Financial Condition, p.18; Quantitative and

Qualitative Disclosures About Market Risk, p19; Fund Charges,

p.9;

|

|

|

Item

11A. Material Changes.

|

Not

Applicable

|

|

|

Item

12. Incorporation of Certain Information by Reference.

|

Not

Applicable

|

|

|

Item

12A. Disclosure of Commission Position on Indemnification for Securities

Act Liabilities.

|

Indemnification

and Standard of Liability,

p.24

|

Information

contained herein is subject to completion or amendment. A registration statement

relating to these securities has been filed with the Securities and Exchange

Commission. These securities may not be sold nor may offers to buy be accepted

prior to the time the registration statement becomes effective. This prospectus

shall not constitute an offer to sell or the solicitation of an offer to buy nor

shall there be any sale of these securities in any State in which such offer,

solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such State.

ii

Preliminary

Prospectus Dated October 8, 2009 – Subject to Completion

Part II –

Information Not Required in Prospectus

Item 13.

Other Expenses of Issuance and Distribution.

The

following expenses reflect the estimated amounts required to prepare and file

this registration statement.

|

Securities

and Exchange Commission Filing Fee

|

$ | 5,580 | ||

|

Blue

Sky (State) Filing Fees

|

$ | 10,000 | ||

|

Federal

Taxes

|

$ | 0 | ||

|

State

Taxes

|

$ | 0 | ||

|

Transfer

Agent Fees

|

$ | 0 | ||

|

Printing

Expenses

|

$ | 5,000 | ||

|

Fees

of Counsel

|

$ | 15,000 | ||

|

Fees

of Certified Public Accountant

|

$ | 10,000 | ||

|

Total

|

$ | 45,580 |

Item 14.

Indemnification of Directors and Officers.

Indemnification

and Standard of Liability, p.24

Item 15.

Recent Sales of Unregistered Securities.

There

have been no sales of unregistered securities

Item 16.

Exhibits and Financial Statement Schedules.

The

following documents (unless otherwise indicated) are filed herewith and made a

part of this Registration Statement.

(a)

Exhibits

Number Description of

Document

|

|

1.01

|

Form

of Soliciting Advisor Agreement between the Fund, Pebble Asset Management,

L.L.C., and Pebble Management Group,

L.L.C.

|

|

|

1.02

|

Form

of Additional Soliciting Advisor Agreement (attached as Exhibit A to Form

of Soliciting Advisor Agreement)

|

|

|

3.01

|

Pebble

U. S. Market Fund, L.L.C. Subscription Agreement (included as Exhibit A to

the Prospectus and Disclosure

Document)

|

|

|

3.02

|

Certificate

and Articles of Organization

|

|

|

5.01

|

Opinion

of Milling, Benson, and Woodward, LLP relating to the legality of the

Units.

|

|

|

8.01

|

Opinion

of Milling, Benson, and Woodward, LLP relating to the federal income tax

consequences of the Units.

|

|

|

10.01

|

Form

of Customer Agreement between the Fund and Clearing

Brokers.

|

|

|

10.02

|

Subscription

Documents (included as Exhibit C to the Prospectus and Disclosure

Document)

|

|

|

23.01

|

Consents

of Milling, Benson, Woodward, LLP (included as Exhibit

5.01)

|

|

|

23.02

|

Consents

of McGladrey & Pullen, LLP

|

|

|

(b)

Financial Statement Schedules

|

|

|

No

Financial Schedules are required to be filed

herewith.

|

iii

Item 17.

Undertakings.

|

|

(1)

|

To

file, during any period in which offers or sales are being made, a

post-effective amendment to this registration

statement;

|

|

(i)

|

To

include any prospectus required by section 10(a)(3) of the Securities Act

of 1933, as amended;

|

|

|

(ii)

|

To

reflect in the prospectus any facts or events arising after the effective

date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in

volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from

the low or high end of the estimated maximum offering range may be

reflected in the form of prospectus filed with the Commission pursuant to

Rule 424(b) if, in the aggregate, the changes in volume and price

represent no more than a 20% change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the

effective registration statement;

|

|

|

(iii)

|

To

include any material information with respect to the plan of distribution

not previously disclosed in the registration statement or any material

change to such information in the registration statement, provided

however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the

registration statement is on Form S-3, Form S-8 or Form F-3, and the

information required to be included in a post-effective amendment by those

paragraphs is contained in periodic reports filed with or furnished to the

Commission by the registrant pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 that are incorporated by reference in the

registration statement.

|

Provided,

however, that:

|

|

(A)

|

Paragraphs

(a)(1)(i) and (a)(1)(ii) of this section do not apply if the registration

statement is on Form S–8, and the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed

with or furnished to the Commission by the registrant pursuant to section

13 or section 15(d) of the Securities Exchange Act of 1934 that are

incorporated by reference in the registration statement;

and

|

|

|

(B)

|

Paragraphs

(a)(1)(i), (a)(1)(ii) and (a)(1)(iii) of this section do not apply if the

registration statement is on Form S–3 or Form F–3 and the information

required to be included in a post-effective amendment by those paragraphs

is contained in reports filed with or furnished to the Commission by the

registrant pursuant to section 13 or section 15(d) of the Securities

Exchange Act of 1934 that are incorporated by reference in the

registration statement, or is contained in a form of prospectus filed

pursuant to Rule 424(b) that is part of the registration

statement.

|

|

|

(2)

|

That,

for the purpose of determining any liability under the Securities Act of

1933, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the

offering of such securities at that time shall be deemed to be the bona fide offering

thereof.

|

|

|

(3)

|

To

remove from registration by means of a post-effective amendment any of the

securities being registered which remain unsold at the termination of the

offering.

|

|

(4)

|

That,

for the purpose of determining liability under the Securities Act of 1933

to any purchaser:

|

|

(i)

|

If

the registrant is relying on Rule

430B:

|

|

|

(A)

|

Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be

deemed to be part of the registration statement as of the date the filed

prospectus was deemed part of and included in the registration statement;

and

|

iv

|

|

(B)

|

Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or

(b)(7) as part of a registration statement in reliance on Rule 430B

relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x)

for the purpose of providing the information required by section 10(a) of

the Securities Act of 1933 shall be deemed to be part of and included in

the registration statement as of the earlier of the date such form of

prospectus is first used after effectiveness or the date of the first

contract of sale of securities in the offering described in the

prospectus. As provided in Rule 430B, for liability purposes of the issuer

and any person that is at that date an underwriter, such date shall be

deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which that prospectus

relates, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof. Provided, however, that no

statement made in a registration statement or prospectus that is part of

the registration statement or made in a document incorporated or deemed

incorporated by reference into the registration statement or prospectus

that is part of the registration statement will, as to a purchaser with a

time of contract of sale prior to such effective date, supersede or modify

any statement that was made in the registration statement or prospectus

that was part of the registration statement or made in any such document

immediately prior to such effective date;

or

|

|

|

(ii)

|

If

the registrant is subject to Rule 430C, each prospectus filed pursuant to

Rule 424(b) as part of a registration statement relating to an offering,

other than registration statements relying on Rule 430B or other than

prospectuses filed in reliance on Rule 430A, shall be deemed to be part of

and included in the registration statement as of the date it is first used

after effectiveness. Provided, however, that no statement made in a

registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by

reference into the registration statement or prospectus that is part of

the registration statement will, as to a purchaser with a time of contract

of sale prior to such first use, supersede or modify any statement that

was made in the registration statement or prospectus that was part of the

registration statement or made in any such document immediately prior to

such date of first use.

|

|

|

(5)

|

That,

for the purpose of determining liability of the registrant under the

Securities Act of 1933 to any purchaser in the initial distribution of the

securities:

|

The

undersigned registrant undertakes that in a primary offering of securities of

the undersigned registrant pursuant to this registration statement, regardless

of the underwriting method used to sell the securities to the purchaser, if the

securities are offered or sold to such purchaser by means of any of the

following communications, the undersigned registrant will be a seller to the

purchaser and will be considered to offer or sell such securities to such

purchaser:

|

|

(i)

|

Any

preliminary prospectus or prospectus of the undersigned registrant

relating to the offering required to be filed pursuant to Rule

424;

|

|

|

(ii)

|

Any

free writing prospectus relating to the offering prepared by or on behalf

of the undersigned registrant or used or referred to by the undersigned

registrant;

|

|

|

(iii)

|

The

portion of any other free writing prospectus relating to the offering

containing material information about the undersigned registrant or its

securities provided by or on behalf of the undersigned registrant;

and

|

|

|

(iv)

|

Any

other communication that is an offer in the offering made by the

undersigned registrant to the

purchaser.

|

|

|

(b)

|

Insofar

as indemnification for liabilities under the Securities Act of 1933 may be

permitted to officers, directors or controlling persons of the registrant

pursuant to the provisions described in Item 14 above, or otherwise, the

registrant has been advised that in the opinion of the Securities and

Exchange Commission such indemnification is against public policy as

expressed in the Securities Act of 1933 and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities

(other than the payment by the registrant of expenses incurred or paid by

an officer, director, or controlling person of the registrant in the

successful defense of any such action, suit or proceeding) is asserted by

such officer, director or controlling person in connection with the

securities being registered, the registrant will, unless in the opinion of

its counsel the matter has been settled by controlling precedent, submit

to a court of appropriate jurisdiction the question whether such

indemnification by it is against public policy as expressed in the Act and

will be governed by the final adjudication of such

issue.

|

v

Signatures

Pursuant

to the requirements of the Securities Act of 1933, the Managing Partner of the

Registrant has duly caused this Registration Statement on Form S-1 to be signed

on its behalf by the undersigned, thereunto duly authorized, in the city of

Metairie, state of Louisiana, on the 20th day of October, 2009.

Pebble U. S. Market Fund,

L.L.C.

By: Pebble

Asset Management, L.L.C.

Manager

By: /s/ Timothy Skarecky

Title: Manager,

Pebble Asset Management, L.L.C.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement

has been signed by the following persons on behalf of the Managing Partner of

the Registrant in the capacities and on the 20th day of October,

2009.

Pebble

Asset Management, L.L.C.

Managing

Partner of the Registrant

|

/s/ Timothy Skarecky

|

Manager

(Principal Executive Officer)

|

|

|

/s/ Richard Clement

|

President

(Principal Financial and Accounting

Officer)

|

vi

PRELIMINARY

PROSPECTUS AND DISCLOSURE DOCUMENT

DATED

OCTOBER 8, 2009 – SUBJECT TO COMPLETION

PEBBLE

U.S. MARKET FUND, L.L.C.

$100,000,000

SERIES A

UNITS

OF LIMITED LIABILITY COMPANY INTEREST

The

Offering

Pebble

U.S. Market Fund, L.L.C. (“Fund”), a Louisiana limited liability company, is

offering a series of limited liability company units (“Units”) of up to a

maximum value of $100,000,000. Throughout the initial offering period, the net

asset value of a Unit is $1,000.00. Units will be sold at net asset value

thereafter. Pebble Management Group, L.L.C. (PMG) and additional soliciting

advisors are offering the Fund’s Units at a price of month-end net asset value

per Unit. The offering will be conducted on a continuous basis until all Units

have been sold or the Fund is closed by the commodity pool operator, Pebble

Asset Management, L.L.C. (PAM), who reserves the right to close the fund prior

to all units being sold. No up-front underwriting discount or commissions apply.

The soliciting advisors are not required to sell any specific number of Units or

dollar amount of the Fund but will use their best efforts to sell Units of the

Fund. Subscription proceeds are held in a segregated account at Capital One

(Bank), NA until released to the Fund. There is no minimum number of Units that

must be sold for Units to be issued at the end of each month.

The

Risks

These are

speculative securities. This prospectus is in two parts: a disclosure document

and a statement of additional information. These parts are bound together, and

both contain important information. BEFORE YOU DECIDE WHETHER TO INVEST, READ

THIS ENTIRE PROSPECTUS CAREFULLY AND CONSIDER “RISK FACTORS” BEGINNING ON PAGE

13.

|

§

|

The

Fund is speculative and highly leveraged. The Fund will acquire positions

with face amounts substantially greater than their total equity. Leverage

magnifies the impact of both gains and

losses.

|

|

§

|

Performance

can be volatile and the net asset value per Unit may fluctuate

significantly in a single month.

|

|

§

|

You

could lose all or substantially all of your investment in the

Fund.

|

|

§

|

PAM

has total trading authority over the Fund. The use of a single advisor

could mean lack of diversification and, consequently, higher

risk.

|

|

§

|

There

is no secondary market for the Units, and none is expected to develop.

While the Units have redemption rights, there are restrictions. For

example, redemptions can occur only at the end of a month. See

“Distributions and Redemptions” on page 11 or page 26 for details on the

restrictions on the redemption

rights.

|

|

§

|

Transfers

of interest in the Units are subject to limitations, such as 30 days’

advance written notice of any intent to transfer. Also, PAM may deny a

request to transfer if it determines that the transfer may result in

adverse legal or tax consequences for the Fund. See “Pebble U.S. Market

Fund, L.L.C. Form of Operating Agreement” attached hereto as

Exhibit A

|

|

§

|

Substantial

expenses must be offset by trading profits and interest income for the

Fund to be profitable.

|

Investors

are required to make representations and warranties in connection with their

investment. Each investor is encouraged to discuss the investment with his/her

individual financial and tax adviser.

THESE

SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE

COMMISSION OR ANY STATE SECURITIES COMMISSION NOR HAS THE SECURITIES AND

EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY

OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

THE

COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF

PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR

ACCURACY OF THIS DISCLOSURE DOCUMENT.

THIS

PROSPECTUS IS IN TWO PARTS: A DISCLOSURE DOCUMENT AND A STATEMENT OF ADDITIONAL

INFORMATION. THESE PARTS ARE BOUND TOGETHER, AND BOTH CONTAIN IMPORTANT

INFORMATION. ADDITIONAL DISCLOSURE DOCUMENTS CAN BE DOWNLOADED AT NO CHARGE FROM

THE FUND WEBSITE, WWW.PEBBLEUS.COM.

1

COMMODITY

FUTURES TRADING COMMISSION

RISK

DISCLOSURE STATEMENT

YOU

SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO

PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT FUTURES

AND OPTIONS TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH

TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND

CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS

ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE

POOL.

FURTHER,

COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND

ADVISORYAND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT

TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR

EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE

DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGES 9 AND 10 AND 24

THROUGH 25 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN,

THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGE

10.

THIS

BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO

EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE

TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS

DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF

THIS INVESTMENT, AT PAGES 13 THROUGH 16.

THIS

PROSPECTUS DOES NOT INCLUDE ALL OF THE INFORMATION OR EXHIBITS IN THE

REGISTRATION STATEMENT. YOU CAN READ AND COPY THE ENTIRE REGISTRATION STATEMENT

AT THE PUBLIC REFERENCE FACILITIES MAINTAINED BY THE SECURITIES AND EXCHANGE

COMMISSION (“SEC”) IN WASHINGTON, D.C. THE FUND FILES QUARTERLY AND ANNUAL

REPORTS WITH THE SEC. YOU CAN READ AND COPY THESE REPORTS AT THE SEC PUBLIC

REFERENCE FACILITY IN WASHINGTON, D.C. PLEASE CALL THE SEC AT 1-800-SEC-0300 FOR

FURTHER INFORMATION. THE FUND’S FILINGS WILL BE POSTED AT THE SEC WEBSITE AT

HTTP://WWW.SEC.GOV.

The Fund

is a reporting company required to file quarterly 10-Q reports, annual 10-K

reports, 424(b)(3) reports, and other reports as needed describing material

changes in the Fund. The public may read and copy any materials filed with the

SEC at the SEC’s Public Reference Room located at 100 F Street, NE., Washington,

DC 20549. The public may obtain information on the operation of the Public

Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an

Internet site that contains reports, proxy and information statements, and other

information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Information about the Fund and all filings will be posted, free of charge, as

soon as reasonably practicable after filing on the website (www.pebbleus.com) for

public viewing, copying, and/or downloading.

The books

and records of Pebble U.S. Market Fund, L.L.C. and Pebble Asset Management,

L.L.C. will be kept electronically in compliance with Title 17: Commodity and

Securities Exchanges; Part 1 – General Regulations Under the Commodities

Exchange Act §1-31 and Part 275 – Rules and Regulations, Investment Advisers Act

of 1940 §275.204-2(g). Access to the books and records is available through any

principal of the firm. The main business address of Pebble U.S. Market Fund,

L.L.C. and Pebble Asset Management, L.L.C. is shown below.

PEBBLE

ASSET MANAGEMENT, L.L.C.

Manager

3500

N. Causeway Blvd., Suite 160

Metairie,

LA 70002

504-401-0179

2

TABLE

OF CONTENTS

|

SUMMARY

|

7

|

|

General

|

7

|

|

Minimum

Investment

|

7

|

|

How

to Subscribe for Units

|

7

|

|

Suitability

Guidelines

|

8

|

|

Risk

Factors to Consider Before Investing

|

8

|

|

Factors

to Consider Before Investing

|

9

|

|

Pebble

Asset Management

|

9

|

|

Fund

Charges

|

9

|

|

Pebble

Asset Management

|

9

|

|

Pebble

Management Group

|

9

|

|

Soliciting

Advisors

|

9

|

|

Brokerage

Fees

|

10

|

|

Breakeven

Analysis

|

10

|

|

Distributions

and Redemptions

|

11

|

|

Federal

Income Tax Aspects

|

11

|

|

Fees

Paid by the Fund

|

11

|

|

Reports

|

11

|

|

Organizational

Chart

|

12

|

|

RISK

FACTORS

|

13

|

|

Market

Risks

|

13

|

|

Possible

Total Loss of an Investment in the Fund

|

13

|

|

The

Fund is Highly Leveraged

|

13

|

|

Illiquidity

of Your Investment

|

13

|

|

Illiquidity

of the Markets

|

13

|

|

Non-Correlated,

Not Negatively Correlated, Performance Objective

|

13

|

|

Trading

Risks

|

13

|

|

Pebble

Asset Management, L.L.C. Analyzes Only Technical Market

Data

|

13

|

|

Speculative

Position Limits May Alter Trading Decisions for the Fund

|

14

|

|

Increase

in Assets Under Management May Affect Trading Decisions

|

14

|

|

Fund

Trading is Not Transparent

|

14

|

|

Tax

Risks

|

14

|

|

Investors

are Taxed Based on Their Share of Profits

|

14

|

|

Tax

Could Be Due From Investors Despite Overall Losses

|

14

|

|

Deductibility

of Management and Performance Fees

|

14

|

|

Other

Risks

|

15

|

|

Fees

and Commissions are Charged Regardless of Profitability and are Subject

to

Change

|

15 |

|

Failure

of Brokerage Firms; Disciplinary History of Clearing

Brokers

|

15

|

|

Investors

Must Not Rely on Past Performance of the Fund or Pebble

Asset

|

|

|

Management

in Deciding Whether to Purchase Units

|

15

|

|

Conflicts

of Interest

|

15

|

|

Lack

of Independent Experts Representing Investors

|

15

|

|

Reliance

on Pebble Asset Management

|

15

|

|

Possibility

of Fund Closure Prior to the Subscription of All Units

|

15

|

|

Possibility

of Termination of the Fund Before Fully Subscribed

|

15

|

|

The

Fund is Not a Regulated Investment Company

|

16

|

|

Proposed

Regulatory Change is Impossible to Predict

|

16

|

|

Restrictions

on Transferability

|

16

|

|

A

Single-Advisor Fund May Be More Volatile Than a Multi-Advisor

Fund

|

16

|

|

Money

Committed to Margin

|

16

|

|

PEBBLE

ASSET MANAGEMENT, L.L.C.

|

16

|

|

Description

|

16

|

|

The

Trading Advisor

|

17

|

|

Trading

Systems

|

17

|

|

Potential

Inability to Trade or Report Due to Systems Failure

|

18

|

|

Code

of Ethics

|

18

|

3

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

|

18

|

|

Introduction

|

18

|

|

Capital

Resources

|

18

|

|

Liquidity

|

18

|

|

Off-Balance

Sheet Risk

|

18

|

|

Off-Balance

Sheet Arrangements

|

19

|

|

Contractual

Obligations

|

19

|

|

Critical

Accounting Policies — Valuation of the Fund’s Positions

|

19

|

|

Disclosure

Controls and Procedures

|

19

|

|

Internal

Controls Over Financial Reporting

|

19

|

|

QUANTITATIVE

AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

19

|

|

Introduction

|

19

|

|

Past

Results Not Necessarily Indicative of Future Performance

|

19

|

|

Standard

of Materiality

|

20

|

|

Quantifying

the Fund’s Trading Value at Risk

|

20

|

|

Quantitative

Forward-Looking Statements

|

20

|

|

The

Fund’s Trading Value at Risk in Different Market Sectors

|

20

|

|

Material

Limitations on Value at Risk as an Assessment of Market

Risk

|

21

|

|

Non-Trading

Risk

|

21

|

|

Qualitative

Disclosures Regarding Primary Trading Risk Exposures

|

21

|

|

Stock

Indices

|

21

|

|

Agricultural

Market

|

21

|

|

Currencies

|

21

|

|

Metals

|

22

|

|

Interest

Rates

|

22

|

|

Energy

|

22

|

|

Qualitative

Disclosures Regarding Non-Trading Risk Exposure

|

22

|

|

General

|

22

|

|

Treasury

Bill Positions

|

22

|

|

Qualitative

Disclosures Regarding Means of Managing Risk Exposure

|

22

|

|

CONFLICTS

OF INTEREST

|

22

|

|

Pebble

Asset Management, L.L.C.

|

22

|

|

Introducing

Brokers

|

23

|

|

The

Clearing Brokers

|

23

|

|

The

Solicitation Advisors

|

23

|

|

Fiduciary

Duty and Remedies

|

23

|

|

Indemnification

and Standard of Liability

|

24

|

|

CHARGES

|

24

|

|

Management

Fee

|

25

|

|

Performance

Fee

|

25

|

|

Organization

and Offering Expenses

|

25

|

|

Operating

Expenses

|

25

|

|

Brokerage

Commissions and Fees

|

25

|

|

Solicitation

Advisors

|

25

|

|

Advisory

Fees

|

25

|

|

USE

OF PROCEEDS

|

26

|

|

THE

INTRODUCING AND CLEARING BROKERS

|

26

|

|

TradeStation

Securities, Inc

|

26

|

|

R J

O’Brien & Associates

|

26

|

|

DISTRIBUTIONS

AND REDEMPTIONS

|

26

|

|

Distributions

|

26

|

|

Redemptions

|

27

|

|

Net

Asset Value

|

27

|

|

PEBBLE

U S MARKET FUND, L.L.C. OPERATING AGREEMENT

|

27

|

|

Organization

and Limited Liabilities

|

27

|

|

Management

of Fund Affairs

|

27

|

|

Sharing

of Profits and Losses

|

27

|

|

Federal

Tax Allocations

|

28

|

|

Dispositions

|

28

|

4

|

Dissolution

and Termination of the Fund

|

28

|

|

Amendments

and Meetings

|

28

|

|

Indemnification

|

28

|

|

Reports

to Unit Holders

|

28

|

|

FEDERAL

INCOME TAX ASPECTS

|

29

|

|

Unit

Holder Tax Status

|

29

|

|

Taxation

of Unit Holders on Profits and Losses

|

29

|

|

Deduction

of Losses by Unit Holders

|

29

|

|

“Passive-Activity

Loss Rules” and Their Effect on the Treatment of Income and

Loss

|

29

|

|

Unit

Redemptions

|

29 |

|

Potential

Consequences of Redemptions and Transfers of Units

|

30

|

|

Gain

or Loss on Section 1256 Contracts

|

30

|

|

Tax

on Capital Gains and Losses

|

30

|

|

Interest

Income

|

30

|

|

Limited

Deduction for Certain Expenses

|

30

|

|

Syndication

Fees

|

30

|

|

Investment

Interest Deductibility Limitations

|

30

|

|

Unrelated

Business Taxable Income

|

30

|

|

Taxation

of Foreign Unit Holders

|

31

|

|

IRS

Audits of the Fund and its Unit Holders

|

31

|

|

State

and Other Taxes

|

31

|

|

INVESTMENTS

BY EMPLOYEE BENEFIT PLANS

|

31

|

|

General

|

31

|

|

“Plan

Assets”

|

32

|

|

Ineligible

Purchasers

|

32

|

|

PLAN

OF DISTRIBUTION

|

33

|

|

Subscription

Procedure

|

33

|

|

Representations

and Warranties of Investors in the Subscription Documents

|

33

|

|

Minimum

Investment

|

34

|

|

Investor

Suitability

|

34

|

|

The

Solicitation Advisors

|

34

|

|

CERTAIN

LEGAL MATTERS

|

34

|

|

EXPERTS

|

35

|

|

INDEX

TO FINANCIAL STATEMENTS

|

36

|

|

PART

TWO —STATEMENT OF ADDITIONAL INFORMATION COVER PAGE

|

41

|

|

PART

TWO —STATEMENT OF ADDITIONAL INFORMATION TABLE OF CONTENTS

|

42

|

|

STRATEGY

|

43

|

|

Market

Diversification

|

43

|

|

Technical

Trading Systems

|

43

|

|

Trend

Following

|

43

|

|

Money

Management

|

43

|

|

Additional

Information

|

43

|

|

Trading

Manager’s Performance

|

43

|

|

Table

1 – Actual performance with no fees, except brokerage fees, including

interest

|

44

|

|

Table

2 – Actual performance including maximum fees as would have been charged

according

to the prospectus

|

44 |

|

Notes

to Trading Manager’s Performance

|

45

|

|

WHY

A MANAGED FUTURES FUND?

|

46

|

|

WHY

PEBBLE US MARKET FUND?

|

46

|

|

WHY

NOW?

|

46

|

|

HISTORICAL

LOW-CORRELATED PERFORMANCE

|

46

|

|

THE

FUTURES MARKETS

|

46

|

|

REGULATION

|

47

|

|

Margin

|

47

|

|

POTENTIAL

ADVANTAGES OF FUTURES FUND INVESTMENTS

|

47

|

|

Profit

Potential

|

47

|

|

Interest

Credit

|

47

|

|

Ability

to Profit or Lose in a Rising or Falling Market

Environment

|

47

|

|

Professional

Trading

|

47

|

5

|

Convenience

|

48

|

|

Liquidity

|

48

|

|

Limited

Liability

|

48

|

|

POTENTIAL

DISADVANTAGES OF FUTURES FUND INVESTMENTS

|

48

|

|

Lack

of Diversification

|

48

|

|

Selection

of Brokers and Clearing Firms

|

48

|

|

Potentially

Higher Fees

|

48

|

|

Lack

of Transparency

|

48

|

|

Performance

History

|

49

|

|

EXHIBITS

|

|

|

Exhibit

A: Pebble U S Market Fund, L.L.C. Form of Operating

Agreement

|

A

|

|

Exhibit

B: Pebble U S Market Fund, L.L.C. Subscription

Representations

|

B

|

|

Exhibit

C: Pebble U S Market Fund, L.L.C. Subscription Documents

|

C

|

|

Exhibit

D: Pebble U S Market Fund, L.L.C. Request for Transfer

Form

|

D

|

|

Exhibit

E: Pebble U S Market Fund, L.L.C. Request for Redemption

|

E

|

|

Exhibit

F: Pebble U S Market Fund, L.L.C. Delivery Instructions

|

F

|

An

electronic version of this Prospectus is available on a dedicated web site

(http://www.pebbleus.com) being maintained by Pebble Asset Management,

L.L.C.

6

SUMMARY

General

Pebble

U.S. Market Fund, L.L.C. (the “Fund”), a Louisiana limited liability company, is

offering units of ownership in the Fund (“Units”) through an agreement with

Pebble Management Group, L.L.C. (PMG), an affiliate of Pebble Asset Management,

L.L.C. (PAM), the Commodity Pool Operator. The Units trade speculatively in the

U.S. futures, currency, and commodity markets. Specifically, the Fund trades in

a portfolio of futures, currency, and commodity contracts on U.S. exchanges

only. The traded markets include, but are not limited to, Stock Indices, Bonds,

Interest Rates, Currencies, Grains, Energy, Metals, and Agriculture markets. The

trades are placed using proprietary, computerized trading systems. The Fund

trading systems are licensed to PAM. The systems are monitored by PAM, the fund

manager. PAM has the option to manually or automatically initiate purchase and

sell orders based on trading signals. The Fund’s strategy is based on the

consistent implementation of the PAM philosophy of market diversification, money

management, and trend-following based on technical analysis of each market. PAM

is continually formulating and testing new strategies and approaches within the

framework of our philosophy striving to achieve the overall investment objective

of the Fund. PAM reserves the right to trade other pools and/or funds. The

trading methodology and leverage is identical to the systems used since August

2006 by Tim Skarecky, a member and manager of PAM, for his personal account.

Performance information for Mr. Skarecky’s personal account is shown beginning

on page 43.

The Fund

trades in a portfolio of futures, currency, and commodity contracts on U.S.

exchanges only. The traded markets include, but are not limited to, Stock

Indices, Bonds, Interest Rates, Currencies, Grains, Energy, Metals, and

Agriculture markets. The Fund analyzes and trades in markets with low

correlation to each other. The level of liquidity in each market is reviewed for

ease of order execution in opening and closing positions. Although there is an

overriding philosophy of diversification among markets traded, a majority of the

Fund’s market exposure may be concentrated in only one or two market sectors

from time to time. The methodology primarily uses trend following technical

trading strategies. The duration of these trends vary widely and can last from

days to months. The technical trading strategies are designed to identify

recurring market patterns that offer higher than average reward potential to the

risks assumed based on historical data. In addition, each trading strategy

includes a defined stop-loss level to help protect the assets from an unexpected

and catastrophic loss of capital. Although there is no guarantee that a

stop-loss would be effective in preserving assets in all circumstances, it is

generally considered an effective money management tool and a prudent management

technique in the unpredictable and volatile futures, currency, and commodity

markets.

Minimum

Investment

Minimum

initial investment in the Fund is $5,000 for initial membership Units.

Persons/entities that are existing owners of Units in the Fund may make

additional investments of at least $1,000.

How

to Subscribe for Units

|

§

|

Investors

are required to make representations and warranties regarding their

suitability to purchase the Units in the Subscription Documents. See

Exhibit C – Subscription Documents. Read the Prospectus along with all

exhibits and the Subscription Documents carefully before you decide

whether to invest.

|

|

§

|

The

Fund is offering subscriptions continuously on a monthly basis. The

offering period can be closed to new investors, existing investors, or

both at the sole discretion of PAM.

|

|

§

|

Investors

must submit subscriptions at least five business days prior to the

applicable month-end closing date. Approved subscriptions will be accepted

once payments are received. Unit subscriptions will be cleared at the

applicable month-end net asset value. No Units will be issued until the

investor meets the initial investment level or existing Unit holders meet

the additional investment level.

|

|

§

|

The

Fund is offered through Registered Investment Advisors (RIA) pursuant to a

solicitation agreement between Pebble Management Group, L.L.C. (PMG) and

the RIA. The RIAs will use their best efforts to sell the Units offered,

without any firm commitment as to the number of units or assets placed in

the Fund. PMG is registered as a RIA and offers Units to potential

investors by distributing this Prospectus and making it available on a

dedicated internet website (http://www.pebbleus.com). The fees are charged

to the Unit owners in accordance with the fee structure in the prospectus

and disclosure document regardless of whether the investors subscribe

through a RIA or PMG. PAM intends to engage in marketing efforts through

media including but not limited to third party websites, newspapers,

magazines, other periodicals, television, radio, seminars, conferences,

workshops, and sporting and charity

events.

|

7

Suitability

Guidelines

The

primary objective of the Fund is to achieve capital appreciation over time. An

investment in Units of the Fund may fit within your portfolio allocation

strategy if you are interested in the Units’ potential to produce returns that

are generally uncorrelated to traditional securities investments. An investment

in this Fund is speculative and involves a high degree of risk. The Fund is

intended to be used as a diversification opportunity as part of a complete

investment portfolio. IT IS NOT A COMPLETE INVESTMENT PORTFOLIO BY ITSELF. An

investment in the Fund should be limited to 10% or less of an investor’s overall

portfolio. You must, at a minimum, have:

|

§

|

net

worth of at least $250,000, exclusive of home, furnishings and

automobiles; or

|

|

§

|

net

worth, similarly calculated, of at least $70,000 and an annual gross

income of at least $70,000.

|

Institutional

investors, including foundations, trusts, public funds, corporations,

partnerships, limited liability companies, and all other business structures,

must have a minimum net worth of $250,000 to invest in the Fund.

A number of jurisdictions in which the Units are offered or may be offered in the future impose higher minimum suitability standards on prospective investors. The suitability standards are regulatory minimums only. Just because you meet such standards does not mean that an investment in the Units is suitable for you. YOU MAY NOT INVEST MORE THAN 10% OF YOUR NET WORTH, EXCLUSIVE OF HOME, FURNISHINGS AND AUTOMOBILES, IN THE FUND. The only exception to the 10% maximum investment applies to the principals and immediate family members of the principals of PAM, the commodity pool operator. Principals and immediate family members may invest more than 10% of their net worth in the Fund without limitation. Immediate family is defined as spouse, siblings, parents, and children of the principal.

Risk

Factors to Consider Before Investing

|

§

|

Units

of the Fund are a highly volatile and speculative investment. There can be

no assurance that the Fund will achieve its objectives or avoid

substantial losses. You must be prepared to lose all or substantially all

of your investment.

|

|

§

|

For

every gain made in a futures transaction, the opposing side of that

transaction will have an equal and offsetting loss. The Fund will, from

time to time, likely experience drawdown. Drawdown is a general down

period in the Fund’s value over time shown as the difference between the

high value and low value for the given down

period.

|

|

§

|

The

Fund trades in futures contracts. The Fund is a party to financial

instruments with elements of off-balance sheet market risk, including

market volatility and possible illiquidity. There is also a credit risk

that counterparties will not be able to meet its obligations to the

Fund.

|

|

§

|

There

is no secondary market for Units of the Fund and it is not anticipated

that any such market will develop.

|

|

§

|

PAM

is both the Manager and trading advisor of the Fund and its fees and

services have not been negotiated at arm’s length. PAM has a disincentive

to replace itself as commodity pool operator, even if doing so may be in

the best interests of the Fund.

|

|

§

|

PAM,

the Fund’s clearing brokers and their respective principals and

affiliates, may trade in futures markets for their own accounts and may

take positions opposite or ahead of those taken for the Fund. Personal

accounts of principals of PAM with knowledge of the trading strategies

used in the Fund will be monitored. Principals of PAM with knowledge of

the trading strategies used and upcoming trades will not be allowed to

take a position in the same market ahead of the Fund

trades.

|

|

§

|

PAM’s

principals are not obligated to devote any minimum amount of time to the

Fund.

|

|

§

|

Owners

of Units take no part in the management of the Fund, and the past

performance of PAM, its principals, or the Fund is not necessarily

indicative of future results of the

Fund.

|

|

§

|

PAM

will be paid a monthly management fee of 1/12th of 1.50% of the

monthly net asset value (1.50% annually) for the Fund, regardless of

profitability. PAM will also be paid monthly performance fees equal to

12.5% of aggregate cumulative net appreciation of the Fund above its

previous highest value, excluding interest income, in net asset value, if

any.

|

|

§

|

The

Fund is a single-advisor fund which may be more volatile than

multi-advisor managed futures

products.

|

8

|

§

|

Units

may only be redeemed on a monthly basis on the last day of the month, upon

ten business days’ written notice. You may transfer or assign your Units

after 30 days’ advance written notice. The transfer will be completed only

with the consent of PAM, which may not be given if such transfer may

result in adverse legal or tax consequences for the

Fund.

|

|

§

|

PAM

does not presently intend to make distributions from the Fund. You will be

liable for taxes on your share of trading profits and other income of the

Fund. For U.S. federal income tax purposes, if the Fund has taxable income

for any year, that income will be taxable to you in accordance with your

allocable share of income from the Fund in which you invest even though

PAM does not presently intend to make distributions from the

Fund.

|

Factors

to Consider Before Investing

|

§

|

The

Fund is a highly leveraged investment fund managed by PAM, a professional

commodity pool operator, whose principals have extensive futures trading

experience, and it trades in a wide range of futures

markets.

|

|

§

|

PAM

utilizes proprietary trading systems for the

Fund.

|

|

§

|

The

Fund has the potential to help diversify traditional securities

portfolios. A diverse portfolio consisting of assets that perform in an

unrelated manner, or non-correlated assets, may increase overall return

and/or reduce the volatility of a portfolio. Non-correlation will not

provide any diversification advantages unless the non-correlated assets

are outperforming other portfolio assets, and there is no guarantee that

the Fund will outperform other sectors of an investor’s portfolio or not

produce losses. The Fund’s profitability also depends on the success of

PAM’s trading strategies.

|

|

§

|

Investors

in the Fund get the advantage of limited liability in highly leveraged

trading. Investors’ liability is limited to the amount of investment in

the Fund. Investors will not be required to make additional investments in

the Fund. See Exhibit A “Form of Pebble U. S. Market Fund, L.L.C.

Operating Agreement” Section 12(iii) for details on the limited liability

procedures in place to limit investors’

liability.

|

Pebble

Asset Management, L.L.C.

PAM, the

Manager and Commodity Pool Operator for the Fund, is responsible for the trading

of the Fund. PAM, as Manager, has an agreement with PMG, an affiliate of PAM, to

act as the administrator, introducing advisor, compliance officer and record

keeper for the Fund.

Fund

Charges

The Fund

charges and expenses must be offset by trading gains and interest income in

order to avoid depletion of Fund assets. This Fund is designed to be a fee-based

offering through State or SEC registered advisors only. There are no penalties

or charges applied upon the redemption of Units.

Pebble

Asset Management, L.L.C. (PAM)

|

·

|

1.50%

annual management fee (1/12th of 1.50% payable

monthly) for the Fund.

|

|

·

|

12.50%

of new appreciation of the Fund’s net assets computed on a monthly basis

and excluding interest income and as adjusted for subscriptions and

redemptions.

|

|

·

|

Up

to 1% of net assets in the Fund per year for organization and offering

expenses such as accounting, auditing, legal, blue sky expenses, filing

fees and printing in connection with this offering, not to exceed the

amount of actual expenses

incurred.

|

Pebble

Management Group, L.L.C. (PMG)

1.25% of

net assets in the Fund per year (1/12th of

1.25% payable monthly) to Pebble Management Group, L.L.C. for operating expenses

such as wholesaling activities, subscriptions processing, operations, and

compliance for the Fund.

Soliciting

Advisors

The Fund

is offered through an asset-based fee program through state or SEC registered

investment advisors. The Units pay a 1.50% annual advisory fee in connection

with this offering. Investors have the right to negotiate the advisory fee

between the investor and soliciting registered investment advisory firm. The

negotiated fee may be higher or lower than 1.50%. However, the Fund is not a

party to the negotiation or advisory fee charged and has no responsibility to

either party as to billing or refunding fees different than the 1.50% advisory

fee assessed by the Fund. The advisory fee will be paid based on the month-end

net asset value per Unit (1/12th of

1.50% payable monthly). The advisory fee will be paid to PMG, an affiliate of

PAM, for distribution to the appropriate advisory firm or advisor according to

the Additional Soliciting Advisor Agreement. Registered Investment Advisors must

sign an Additional Soliciting Advisor Agreement with PMG prior to soliciting any

investments in the Fund.

9

Brokerage

Fees

Transaction

fees are estimated to be an average of $6.00 per round-turn transaction

including applicable National Futures Association (“NFA”) and exchange fees for

brokerage commissions. The actual transaction fees will vary by market. The Fund

maintains the investment account at R.J. O’Brien (RJO) through TradeStation

Securities, Inc. (TradeStation). TradeStation provides trade execution. RJO

provides custody of assets, trade clearance, trade notification, and monthly

statements for the Fund. Brokerage commissions and transaction fees charged on

round-turn transactions are paid directly to TradeStation as part of the trade

transaction. PAM and PMG do not receive any part of the commission or fee

charged as part of the execution and clearing of trades.

Breakeven

Analysis

The

following table show the fees and expenses that an investor would incur on an

initial investment of $5,000 in the Fund and the amount that such investment

must earn to break even after one year.

Fund

Units

|

Expenses

|

Percentage

Return Required Initial Twelve Months of

Investment

|

Dollar

Return Required ($5,000 Initial Investment) Initial Twelve Months of

Investment

|

||

|

Management

Fees

|

1.50%

|

$75.00

|

||

|

Manager

Performance Fees (1)

|

0.00%

|

$ 0.00

|

||

|

Advisory

Fees (2)

|

1.50%

|

$75.00

|

||

|

Offering

Expenses (3)

|

1.00%

|

$50.00

|

||

|

Operating

Expense (4)

|

1.25%

|

$62.50

|

||

|

Brokerage

Fees (5)

|

0.27%

|

$13.50

|

||

|

Less

Interest Income (6)

|

0.50%

|

$25.00

|

||

|

TWELVE-MONTH

BREAKEVEN

|

5.02%

|

$251.00

|

(1) No

performance fees will be charged until breakeven costs are met. However, because

PAM’s performance fee is payable monthly, it is possible for PAM to earn a

performance fee during a break-even or losing year if, after payment of a

performance fee, the Fund incurs losses resulting in a break-even or losing

year. It is impossible to predict what performance fee, if any, could be paid

during a break-even or losing year, thus none is shown.

(2) The

advisory fee is set at 1.50% per Unit (1/12th of

1.50% per month). The actual dollar return required may be higher or lower than

the estimated amount because fees are payable monthly and it is impossible to

predict the unit value at the end of each month. Investors have the right to

negotiate the advisory fee between the investor and soliciting registered

investment advisory firm. The negotiated fee may be higher or lower than 1.50%.

However, the Fund is not a party to the negotiation or advisory fee charged and

has no responsibility to either party as to billing or refunding fees different

than the 1.50% advisory fee assessed by the Fund.

(3) The

offering expenses are a maximum of 1% per year not to exceed the amount of

actual expenses incurred. This figure includes, but is not limited to,

organizational costs, accounting, auditing, legal, printing, and other expenses

directly related to offering of the product.

(4) The

Fund has contracted with PMG as the introducing RIA. PMG will conduct

wholesaling activities, subscriptions processing, recordkeeping, operations and

compliance oversight for the fund.

(5)

Assumes 450 round-turn transactions for the Fund per million dollars per year at

an average rate of $6 per transaction. The fund will be charged the actual

trading and clearing expenses incurred. All trades for the Fund will be executed

on U.S. exchanges.

(6)

Estimated on the basis of the recent results of the 26-week treasury auction

conducted by the Department of the Treasury. Results are rounded to the nearest

half percentage point. The twelve-month break-even points shown are dependent on

interest income of 0.50% per annum. If interest income earned is less, the Fund

will have to earn trading profits greater than the amounts shown to cover their

costs. Actual interest to be earned by the Fund will be at the prevailing rates

for the period being measured which may be less than or greater than 0.50% over

any twelve month period.

10

Distributions

and Redemptions

The Fund

is intended to be a medium-to-long-term, i.e. 5-year or more minimum, investment

time horizon. Units are transferable, but no market exists for their sale and

none is expected to develop. Monthly redemptions are permitted upon 10 business

days’ written notice to PAM, and will not be denied if submitted in good form

and in a timely manner. However, PAM may deny a request to transfer if it

determines that the transfer may result in adverse legal or tax consequences for

the Fund. PAM does not intend to make any distributions from the

Fund.

Federal

Income Tax Aspects

The Fund

will be organized as a limited liability company and will be classified as a

partnership for federal income tax purposes. As such, you will be taxed each

year on the income attributable to the Fund whether or not you redeem Units or

receive distributions from the Fund.

The Fund

invests in futures contracts. Any gain or loss on such investments will,

depending on the contracts traded, consist of a mixture of: 1) ordinary income

or loss; and/or 2) capital gain or loss. Forty percent (40%) of trading profits,

if any, on U.S. exchange-traded futures contracts are taxed as short-term

capital gains at ordinary income rates and the remaining sixty percent (60%) is

taxed as long-term capital gains at a lower maximum rate for non-corporate

investors. Interest income is taxed at ordinary income rates.

Capital

losses on the Units may be deducted against capital gains but may only be

deducted by non-corporate investors against ordinary income to the extent of

$3,000 per year. Therefore, you could pay tax on the Fund’s interest income even

though your overall investment in the Fund has been unprofitable. Please consult

your tax professional for any questions relating to the tax effects of investing

in the Fund.

In

addition to the federal income tax consequences described above, the Fund and

the Unit holders may be subject to various state, local, and other

taxes.

Fees

Paid by the Fund

|

Pebble

Asset Management, L.L.C.(PAM)

|

|

|

Management

Fee

|

1.50%

|

|

Performance

Fee.

|

12.50%

|

|

Offering

Expenses

|

1.00%*

|

|

Pebble

Management Group, L.L.C.(PMG)

|

|

|

Operating

Expenses

|

1.25%

|

|

Advisory

Fee

|

1.50%**

|

* Not to

exceed the amount of actual expenses incurred.

** The

advisory fee will be paid by PMG to the soliciting registered investment advisor

or the investment advisor representative if licensed through PMG.

Above

amounts are annualized and paid monthly in arrears at 1/12th the

rates shown except the Performance Fee. The Performance Fee will be charged at

12.50% when applicable.

The Fund

will be charged a brokerage commission for execution and brokerage services

estimated to be $6.00 per round turn transaction per contract plus applicable

NFA and exchange fees. A round turn transaction is the opening and closing

transaction for a futures contract. This figure is an estimate based on

differing cost of execution and clearing in various traded markets. The Fund

will pay actual charges by the brokerage processing and clearing the trades. PAM

and PMG do not receive any brokerage commission related expenses incurred by the

Fund.

Reports

PAM will

distribute a monthly report of the Fund to investors within 30 calendar days

after the end of each month. PAM will also distribute an annual report of the

Fund within 90 calendar days after the end of the Fund’s fiscal year and will

provide investors with federal income tax information for the Fund before April

15 of each year. The financial information distributed to Unit holders of the

Fund will be completed by an independent certified public accountant. The Fund

financial information and systems will be audited and an opinion expressed by an

independent auditor or certified public accountant on an annual basis. Fund

results and financial reports will be posted on the Fund website (www.pebbleus.com)

within 30 calendar days after the end of each month and the annual report will

be posted within 90 calendar days after the end of the fiscal year. Commodity

Futures Trading Commission (“CFTC”) rules require that this Prospectus be

accompanied by summary financial information, which may be a recent monthly

report of the Fund, current within 60 calendar days.

11

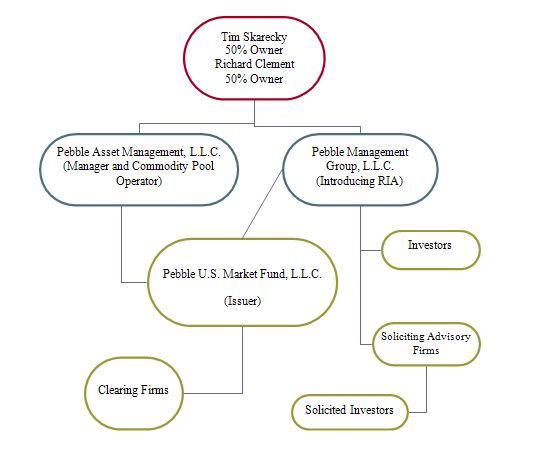

Organizational

Chart

The

organizational chart below illustrates the relationships among the various

service providers of the Fund. PAM is both the Manager and Commodity Pool

Operator for the Fund. The soliciting advisors (other than PMG) and clearing

brokers are not affiliated with PAM or the Fund.

Descriptions

of the dealing between PAM and its affiliates and the Fund are set forth under

“General” on page 7 and “Pebble Management Group, L.L.C.” on page

9.

12

RISK

FACTORS

Market

Risks

Possible

Total Loss of an Investment in the Fund

Futures

contracts have a high degree of price variability and are subject to occasional

rapid and substantial changes. Consequently, you could lose all or substantially

all of your investment in the Fund.

The

Fund is Highly Leveraged

The

amount of margin funds necessary to be deposited with a clearing broker in order

to enter into a futures contract position is typically about 1% to 10% of the

total value of the contract. The Fund will be able to hold positions with face

values equal to several times the Fund’s net assets. The target ratio of margin

to equity for the Fund is approximately 25%, but can range from 0% to 50% due to

factors such as market volatility and changes in margin requirements. As a

result of this leveraging, even a small adverse movement in the price of a

contract can cause major losses. PAM will monitor the leverage of the Fund

regularly but is not limited by the amount of leverage it may

employ.

Illiquidity

of Your Investment

There is

no secondary market for the Units. While the Units have redemption rights, there

are restrictions. For example, redemptions can occur only at the end of a month.

If a large number of redemption requests were to be received at one time, the

Fund might have to liquidate positions to satisfy the requests. Such a forced

liquidation could adversely affect the Fund and consequently your investment.

Transfers of the Units are subject to limitations, such as 30 days’ advance

written notice of any intent to transfer. Also, PAM may deny a request to

transfer if it determines that the transfer may result in adverse legal or tax

consequences for the Fund. Notwithstanding the foregoing, PAM will not deny a

redemption request in good form submitted in a timely manner. Because Units

cannot be readily liquidated, it will not be possible for you to limit losses or

realize accrued profits, if any, except at a month-end in accordance with the

Fund’s redemption provisions. See Exhibit A, “Form of Pebble U.S. Market Fund,

L.L.C. Operating Agreement.”

Illiquidity

of the Markets

In

illiquid markets, the Fund could be unable to close out positions to limit

losses or to take positions in order to execute the trading system. There are

too many different factors that can contribute to market illiquidity to predict

when or where illiquid markets may occur. Unexpected market illiquidity has

caused major losses for some traders in recent years in such market sectors as

emerging market currencies. There can be no assurance that the same will not

happen in the markets traded by the Fund. In addition, the large size of the

positions the Fund may take increases the risk of illiquidity by both making its

positions more difficult to liquidate and increasing the losses incurred while

trying to do so. United States commodity exchanges impose limits on the amount

the price of some, but not all, futures contracts may change on a single day.

Once a futures contract has reached its daily limit, it may be impossible for

the Fund to liquidate a position in that contract, if the market has moved

adversely to the Fund, until the limit is either raised by the exchange or the

contract begins to trade away from the limit price.

Non-Correlated,

Not Negatively Correlated, Performance Objective

Historically,

managed futures have been generally non-correlated to the performance of other

asset classes such as stocks and bonds. Non-correlation means that there is no

statistically valid relationship between the past performances of futures

contracts on the one hand and stocks or bonds on the other hand. Non-correlation

should not be confused with negative correlation, where the performance of two

asset classes would be exactly opposite. Because of this non-correlation, the

Fund cannot be expected to be automatically profitable during unfavorable

periods for the stock market, or vice versa. The futures markets are

fundamentally different from the securities markets in that for every gain made

in a futures transaction, the opposing side of that transaction will have an

equal and off-setting loss. If the fund does not perform in a manner

non-correlated with the general financial markets or does not perform

successfully, you will obtain no diversification benefits by investing in the

Units of the Fund and the Fund may have no gains to offset your losses from

other investments.

Trading

Risks

PAM

Analyzes Only Technical Market Data

The

proprietary trading systems used by PAM for the Fund are technical,

trend-following methods involving instruments that are not historically

correlated with each other. The profitability of trading under these systems

depends on, among other things, the occurrence of significant price trends.

Price trends are sustained movements, up or down, in futures prices. Such trends

may not develop; there have been periods in the past without price trends in

certain markets. The likelihood of the Fund being profitable could be materially

diminished during periods when events external to the markets themselves have an