Attached files

Table of Contents

As filed with the Securities and Exchange Commission on October 16, 2009

Registration No. 333-160152

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO.2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WESTWOOD ONE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7900 | 95-3980449 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

40 West 57th Street, 5th Floor

New York, New York 10019

(212) 641-2000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David Hillman, Esq.

Chief Administrative Officer; EVP, Business Affairs;

General Counsel and Secretary

Westwood One, Inc.

40 West 57th Street, 5th Floor

New York, New York 10019

(212) 641-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Monica J. Shilling Michael A. Woronoff Proskauer Rose LLP 2049 Century Park East, Suite 3200 Los Angeles, California 90067 (310) 557-2900 |

Ann Lawrence Robert A. Claassen Paul, Hastings, Janofsky & Walker LLP 515 South Flower Street, 25th Floor Los Angeles, California 90071 (213) 683-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer x | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed (1)(2) |

Amount of Registration Fee | ||

| Common Stock, par value $0.01 per share |

$50,000,000 | $2,790(3) | ||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act. |

| (2) | Includes offering price for the shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (3) | Previously paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 16, 2009

PRELIMINARY PROSPECTUS

Shares

Common Stock

$ per share

Westwood One, Inc. is selling shares of our common stock and the selling stockholders named in this prospectus are selling shares of our common stock. We and the selling stockholders named in this prospectus have granted the underwriters a 30-day option to purchase up to an additional shares of our common stock to cover over-allotments, if any. We will not receive any of the proceeds from the sale of shares by the selling stockholders.

Our common stock is currently traded on the OTC Bulletin Board under the symbol “WWOZ.OB.” The last reported sale price on , 2009 was $ per share. We intend to apply to list our common stock on the NASDAQ Global Market under the symbol “WWON.”

INVESTING IN OUR COMMON STOCK INVOLVES RISKS. SEE “RISK FACTORS” BEGINNING ON PAGE 16.

| Per Share | Total | |||

| Public offering price | $ | $ | ||

| Underwriting discounts | $ | $ | ||

| Proceeds, before expenses, to us | $ | $ | ||

| Proceeds, before expenses, to selling stockholders | $ | $ |

Delivery of the shares of common stock will be made on or about , 2009.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| UBS Investment Bank | Thomas Weisel Partners LLC | |

| Roth Capital Partners | Moelis & Company | |

The date of this prospectus is , 2009.

Table of Contents

Table of Contents

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (“SEC”). You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell shares of common stock and seeking offers to buy shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the common stock.

| Page | ||

| 1 | ||

| 16 | ||

| 26 | ||

| 27 | ||

| 28 | ||

| 29 | ||

| 31 | ||

| 35 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

45 | |

| 72 | ||

| 88 |

| Page | ||

| 94 | ||

| 99 | ||

| 100 | ||

| 102 | ||

| 107 | ||

| 109 | ||

| 111 | ||

| 116 | ||

| 116 | ||

| Where You Can Find More Information and Incorporation by Reference |

117 | |

| Index To Consolidated Financial Statements and Financial Statement Schedule |

F-1 |

Unless otherwise stated in this prospectus, references to “the Company,” “we,” “our,” “ours,” “registrant” and “us” refer to Westwood One, Inc. and its consolidated subsidiaries, except where it is clear that such terms mean only Westwood One, Inc.

i

Table of Contents

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information you should consider before buying shares of our common stock. Before deciding to invest in shares of our common stock, you should read the entire prospectus carefully, including our consolidated financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” in each case included elsewhere in this prospectus.

OUR COMPANY

We produce and provide traffic, news, weather, sports, talk, music, special events and other programming. Our content is distributed to radio and television stations and digital platforms and reaches over 190 million people. We are one of the largest domestic outsourced providers of traffic reporting services and one of the nation’s largest radio networks, delivering content to over 5,000 radio and 170 television stations in the US. We exchange our content with radio and television stations for commercial airtime, which we then sell to local, regional and national advertisers. By aggregating and packaging commercial airtime across radio and television stations nationwide, we are able to offer our advertising customers a cost-effective way to reach a broad audience and target their audience on a demographic and geographic basis as demonstrated by the chart comparing CPMs among different media types that appears in the section entitled “Business—Industry Overview.”

We are organized into two business segments: Metro and Network.

Our Metro business produces and distributes traffic and other local information reports (such as news, sports and weather) to approximately 2,300 radio and television stations, which include stations in over 80 of the top 100 Metro Service Area (“MSA”) markets in the US. Our Metro business generates revenue from the sale of commercial advertising inventory to advertisers (typically 10 and 15 second spots in radio embedded within our information reports and 30 second spots in television). We provide broadcasters a cost-effective alternative to gathering and delivering their own traffic and local information reports and offer advertisers a more efficient, broad reaching alternative to purchasing advertising directly from individual radio and television stations.

Our Network business nationally syndicates proprietary and licensed content to radio stations, enabling them to meet their programming needs on a cost-effective basis. The programming includes national news and sports content, such as CBS Radio News, CNN Radio News and NBC Radio News and major sporting events, including the National Football League (including the Super Bowl), NCAA football and basketball games (including the Men’s Basketball Tournament, ie, “March Madness”) and the 2010 Winter Olympic Games. Our Network business features popular shows that we produce with personalities including Dennis Miller, Charles Osgood, Fred Thompson and Billy Bush. We also feature special events such as live concert broadcasts, countdown shows (including MTV and Country Music Television branded programs), music and interview programs. Our Network business generates revenue from the sale of 30 and 60 second commercial airtime, often embedded in our programming, that we bundle and sell to national advertisers who want to reach a large audience across numerous radio stations.

We believe that our market position in both the Metro and Network businesses and our recent turnaround strategies and revenue enhancement initiatives afford us with a number of revenue growth opportunities. We are developing additional potential revenue streams by leveraging our existing resources and accessing new distribution channels for our extensive content. In addition, we believe there

1

Table of Contents

is an opportunity to pursue acquisitions, partnerships and joint ventures to consolidate our existing business with competitors and expand into new markets. We routinely evaluate and analyze such opportunities, but we have no current binding plans or arrangements with respect to any such opportunities. We have an option, exercisable through December 1, 2009, to acquire TrafficLand, a provider of traffic video collected from local and state Departments of Transportation. Entering into any transactions with respect to such opportunities would be subject to completion of due diligence, finalization of key business and financial terms (including price) and negotiation of final definitive documentation as well as a number of other factors and conditions including, without limitation, the approval of our board of directors and any required third party consents (including any required lenders’ consent). We cannot predict how quickly the terms of any such transaction could be finalized, if at all. Accordingly, there can be no assurance that definitive documentation for any such transaction would be executed or even if executed, that any such transaction will be consummated. In connection with evaluating potential strategic acquisition and investment transactions, we have, and may in the future, incur significant expenses for the evaluation and due diligence investigation of these potential transactions.

OUR STRENGTHS

We believe our strengths include:

| Ø | Large Independent Provider of Content. We are one of the largest domestic outsourced providers of traffic reporting services and one of the nation’s largest radio networks, producing and distributing traffic, news, weather, sports, talk, music, special events and other programming. As an independent provider of content, without any stations under our ownership, we are able to transact with all station groups. We deliver content to over 5,000 radio and 170 television stations in the US. |

| Ø | Developer of Original Content. We create and develop content for radio and television stations. The programming includes several nationally known personalities including Dennis Miller, Charles Osgood, Fred Thompson and Billy Bush. We also provide stations with targeted programming, including national news, major sporting events and local news and traffic programming that they can generally not afford to develop on their own. |

| Ø | Multichannel Distributor of Content. As a producer of original content, we have the ability to utilize multiple media channels by leveraging our existing production capabilities and vast library of content to generate additional revenue without incurring significant costs. For example, much of the same content we distribute to our radio station customers is available to consumers online via podcasting or live streaming, which enables us to generate additional revenue from the sale of advertising embedded in such streams or podcasts. |

| Ø | Significant Operating Leverage. Our business model has a relatively fixed cost base leading to significant operating leverage. We have made progress and are working to further reduce our fixed costs which we believe will enhance our profitability if revenue increases in the future due to an economic recovery or organic growth factors. |

| Ø | Experienced Management Team. We have brought together a new, experienced management team with extensive strategic, operating and financial expertise. Our management team has an average of 16 years of industry experience. Our relationship with The Gores Group provides us with additional operational, financial and strategic support. We believe this management team has the ability to respond to economic and industry trends and cycles while maximizing revenue growth from the sale of commercial airtime. |

2

Table of Contents

OUR STRATEGY

Our goal is to grow the revenue and profitability of our business. Key elements of our strategy to achieve this goal include:

| Ø | Complete operational turnaround. We have recently begun and believe we will continue to increase our operational efficiency with the assistance of The Gores Group. We announced on March 16, 2009, certain re-engineering and cost-cutting initiatives, as described below in “Turnaround Strategies and Revenue Enhancement Initiatives”, that are collectively anticipated to result in total annual savings of approximately $55 to $63 million. In the third quarter of 2008, we announced a plan to restructure the traffic operations of the Metro Traffic business (commonly referred to by us as the Metro re-engineering) and to implement other cost reductions. The reengineering entailed reducing the number of our Metro Traffic operational hubs from 60 to 13 regional centers and produced meaningful reductions in labor expense, aviation expense, station compensation, program commissions and rent. We have also implemented additional cost reduction initiatives in the first half of 2009, including reductions in Network programming costs, labor expense, station compensation and other operating costs, to help improve our operating and financial performance and help establish a foundation for potential long-term growth. We have recognized $25.0 million of savings from both the Metro re-engineering and additional cost reduction initiatives undertaken by us through the end of the second fiscal quarter of 2009. We anticipate that the total annual savings in 2009 (from the start of the Metro re-engineering and other cost reductions in the third quarter of 2008) will be in the $53.0 million to $61.0 million range and additional savings in 2010 will be approximately $2.0 million, as additional phases of the Metro re-engineering and cost-reduction programs are implemented. These anticipated savings are comprised of labor savings, lower programming costs and reductions in aviation expense, station compensation and savings from consolidation of office leases. Many of the initiatives were instituted as of June 30, 2009. Not included in the foregoing are amounts related to the compensation reduction and furlough actions (aggregating 10 days of pay per each participating full-time employee) that we announced on September 29, 2009, which actions shall result in additional cost savings in 2009. |

These savings will be offset to a limited degree by investments in our sales force, technology and digital capabilities and certain strategic partnerships such as TrafficLand, a provider of traffic video collected from local and state Departments of Transportation.

| Ø | Expand our Sales Force. We have recently begun and plan to continue to build-out and leverage our extensive local and national sales force to generate increased revenue from the sale of commercial airtime. In our Network business, we are adding category management specialists in high-potential segments of the advertising market. In our Metro business, we have added new sales people at various locations across the country to deepen our local market coverage. We are also adding select sales people in our Metro business to expand the distribution of our local content. Additionally, in our Network business we recently began to offer copy-splitting advertising services which enable our advertising clients to reach more than one desired geographic area at the same time. |

| Ø | Pursue strategic opportunities. We evaluate acquisitions, partnerships and joint ventures on an ongoing basis and intend to pursue acquisitions of and partnerships or joint ventures with businesses in our industry and related industries that can assist us in achieving our growth strategy. We focus on opportunities with content and services businesses serving the radio, television and digital markets. We approach strategic opportunities in a disciplined manner and, with the assistance of The Gores Group, intend to focus on opportunities that strengthen our competitive position. |

| Ø | Produce cost-effective, original programming. We will continue to leverage our national scale to provide radio and television stations with programming and services that they may not be able to cost-effectively produce on their own, most notably on the Network side, where rights fees for sporting |

3

Table of Contents

| events and fees for prominent talent personalities are significant and have generally continued to increase over time (except in certain cases in 2009 where we have been able to negotiate lower fees, in part because of a weaker economy). As a syndicator of programming to over 5,000 radio stations and 170 television stations nationwide, we are able to pay such programming costs for a broad array of content, while one station, in most cases, could not. We distribute our programming on a barter basis in exchange for commercial airtime in lieu of cash, which allows stations to preserve capital. |

| Ø | Expand our distribution channels. We plan to continue expanding our product offerings across radio, television, online and other platforms through initiatives such as on-camera graphics and mobile video. Our Metro business is also expanding into the digital and wireless categories as a provider of traffic information on mobile and personal navigation devices. As part of this strategy, our Metro business recently entered into a License and Services Agreement with TrafficLand. The agreement provides our Metro business with the exclusive right to enter into affiliation agreements with third party broadcasters wanting access to TrafficLand’s live video traffic feeds, which (i) provides us with simultaneous access to 4,700 traffic cameras and (ii) enables us to enhance our product offerings to stations that carry our programming and data feeds. We have an option, exercisable through December 1, 2009, to acquire TrafficLand. We have also partnered with AirSage, a provider of digital traffic data, to enhance our real-time road condition and data reports and with TrafficCast, a traffic science company, to collaborate on licensing of integrated data for others. We believe these initiatives will allow us to significantly expand our digital content offerings. |

OUR INDUSTRY

Radio broadcasting and advertising

According to the Federal Communications Commission (“FCC”), there were 11,213 commercial radio stations serving listeners in the United States as of December 31, 2008. The Radio Advertising Bureau (“RAB”) reported on its website, based on information provided by Miller, Kaplan, Arase & Co., that the market for US radio advertising in 2008 was $19.5 billion. We compete in the local ($13.6 billion), national ($2.9 billion) and network ($1.2 billion) radio advertising segments which comprise the majority of the total industry.

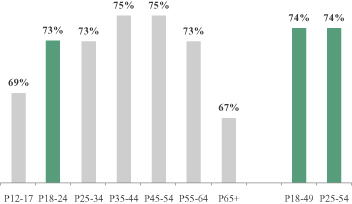

AM/FM radio is one of the most popular forms of media in terms of audience consumption. According to Arbitron’s Spring 2007 study, the average time spent listening to the radio by persons 12 years and older (“12+”) in the US is 19 hours per week. Similarly, network radio listenership remains strong among key demographics. According to Arbitron’s 2008 “Network Radio Today” report, network radio reaches nearly 75% of the 12+ US population each week and performs well within the key 18-24, 18-49 and 25-54 year old demographics, reaching 73%, 74% and 74%, respectively. Furthermore, the report also shows that more than 60% of adult consumers over the age of 18 listen to network radio out of the home, or approximately 143 million adults each week.

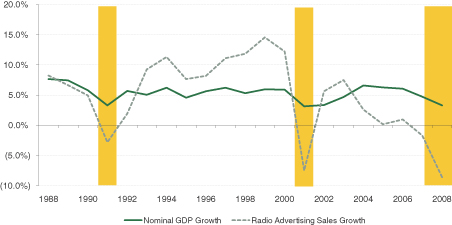

Radio offers a cost efficient way of reaching diverse audience groups in large numbers. Radio advertising can be purchased by advertisers on a local, regional or national basis. Local and regional purchases allow an advertiser to choose a geographic market for the broadcast of commercial messages. Advertising purchased from a national radio network allows an advertiser to target its commercial messages to a specific demographic within a large national audience. Radio advertising has historically been cyclical as spending on advertising can grow or decline depending on the state of the economy.

Television broadcasting and advertising

According to the Television Bureau of Advertising’s April 2009 report, total broadcast television advertising revenue in 2008 was $46.4 billion. Network television is the largest segment within broadcast

4

Table of Contents

television representing revenue of $25.4 billion in 2008. We compete in the local ($16.5 billion) and syndication ($4.4 billion) television advertising segments.

During the 2008-09 broadcast season, television was viewed in 114.5 million, or 98.9%, of all US households according to The Nielsen Company’s August 2008 report. Television remains the most popular form of media in terms of audience consumption with the average household (ie, all persons living in the house collectively) watching 8 hours and 18 minutes of television each day during the 2007-08 television season according to The Nielsen Company’s November 2008 report.

Television’s broad reach and visual impact makes it a powerful and attractive medium for advertisers. Television spots are generally 30 to 60 seconds in length and are purchased by advertisers on a local, regional or national basis. Similar to the radio broadcasting industry, local and regional purchases allow an advertiser to choose a geographic market for the broadcast of commercial messages. Advertising purchased from a national television network allows an advertiser to target its commercial messages to a specific demographic within a large national audience.

TURNAROUND STRATEGIES AND REVENUE ENHANCEMENT INITIATIVES

Since September 2008, we have implemented a significant number of key turnaround strategies and revenue enhancement initiatives, including:

| Ø | Re-Engineering of Traffic Operations |

| - | Regionalize 60 operating centers to 13 hubs |

| - | Reduce reliance on aircraft and implement new video and speed and flow technology |

| Ø | Cost Reduction Programs |

| - | Reduce salary/headcount |

| - | Reduce programming costs and eliminate unprofitable programming |

| - | Negotiate reductions in compensation paid to radio stations that provide us with commercial airtime to more effectively match compensation to revenue and profitability |

| Ø | Revenue Initiatives |

| - | Increase our sales force to expand our market presence across regions and products |

| - | Grow revenue and profitability from advertising through optimization of sales mix, inventory utilization and pricing |

| - | Deliver expanded product offerings such as copy-splitting, 15 second spots and pre-recorded advertisements |

| - | Add new programming such as The Fred Thompson Show and programming pursuant to recent deals with The Weather Channel and Sports USA |

| Ø | Management Reorganization |

| - | Engage new, experienced management team to provide greater leadership |

| - | Reorganize corporate structure to increase accountability |

RESTRUCTURING

At December 31, 2008, our principal sources of liquidity were our cash and cash equivalents of $6.4 million and borrowings under our Credit Agreement dated as of March 3, 2004 (the “Old Credit

5

Table of Contents

Agreement”). As previously disclosed in our Annual Report on Form 10-K for the year ended December 31, 2008 (the “2008 10-K”) and as discussed elsewhere in this prospectus, on February 27, 2009, our outstanding indebtedness under our Old Credit Agreement, which totaled approximately $41.0 million, matured and became due and payable in its entirety. Additionally, we had not made our most recent interest payment due to holders of our then outstanding senior notes (the “Old Notes”) on November 30, 2008. The non-payment of such amounts constituted an event of default under the Old Credit Agreement and the Old Notes, respectively. Based upon facts and circumstances that existed as of December 31, 2008, we previously disclosed in our 2008 10-K that there was a substantial doubt about our ability to continue as a going concern. We previously disclosed that, as of March 30, 2009, we were unable to meet our outstanding debt obligations, which raised substantial doubt about our ability to continue as a going concern and our sources of liquidity were anticipated to be inadequate to fund immediate and ongoing operating requirements.

In order to address these concerns, on April 23, 2009, we completed a refinancing of substantially all of our outstanding long-term indebtedness (approximately $241.0 million in principal amount) and a recapitalization of our equity (the “Restructuring”). As part of the Restructuring, our then existing debtholders released all of their existing obligations in exchange for (1) $117.5 million of 15% Senior Notes maturing July 15, 2012 (the “Senior Notes”), (2) 34,962 shares of Series B Preferred Stock (as defined below), and (3) a one-time cash payment of $25.0 million. We also entered into a new senior credit facility (the “Senior Credit Facility”) pursuant to which we have a $15.0 million revolving line of credit and a $20.0 million unsecured non-amortizing term loan which currently bear interest at 7.0% per annum based on the currently applicable LIBOR rate plus a 4.5% margin. As of the date of this prospectus, we have borrowed the entire amount under the term loan and we have borrowed $5.0 million under the revolving line of credit. The Senior Notes bear interest at 15.0% per annum, payable 10.0% in cash and 5.0% pay-in-kind (PIK interest). The PIK interest will be added to principal quarterly, but will not be payable until the Senior Notes become due. As a result of the Restructuring, the annual interest payments on our debt increased from approximately $12.0 million to $19.0 million (which amount includes interest payable on the $20.0 million term loan entered into on April 23, 2009), $6.0 million of which will be PIK interest and not payable in cash until the Senior Notes become due. To date, we have also made one deferral of $4.0 million in payments due to CBS Radio under the CBS Master Agreement (see “Business—CBS”).

In addition, Gores Radio Holdings, LLC (1) agreed to purchase, at a discount, approximately $22.6 million principal amount of our then existing debt held by debt holders who did not wish to participate in the Senior Notes, (2) agreed to guarantee the Senior Credit Facility and payments due to the NFL in an amount of up to $10.0 million for the license and broadcast rights to certain NFL games and NFL-related programming and (3) invested $25.0 million in the Company for 25,000 shares of 8.0% Series B Convertible Preferred Stock (the “Series B Preferred Stock”). In connection with Gores providing the guarantees and purchasing the debt from non-participating holders, the 75,000 shares of 7.5% Series A Convertible Preferred Stock (the “Series A Preferred Stock” and collectively with the Series B Preferred Stock, the “Preferred Stock”) held by Gores immediately prior to the Restructuring, which then had a liquidation preference of approximately $79.0 million, were exchanged for 75,000 shares of 7.5% Series A-1 Convertible Preferred Stock (the “Series A-1 Preferred Stock”) with a per share conversion price which provided Gores with an approximately 54.6% interest in the Company after the Restructuring.

Taking into account Gores’ Series B Preferred Stock, Series A-1 Preferred Stock and common stock, upon the consummation of the Restructuring, Gores’ ownership in the Company increased from approximately 36.8% to 75.1%. Accordingly, the Restructuring, when considering the ownership held by Gores as well as the ownership held by our then existing debt holders, constituted a change of control transaction that requires the Company to follow the purchase method of accounting, as described by

6

Table of Contents

Statement of Financial Accounting Standards (SFAS) 141R, “Business Combinations” (“SFAS 141R”). We have considered the ownership held by Gores and our then existing debt holders as a collaborative group in accordance with Emerging Issues Task Force D-97, “Push Down Accounting”. As a result, we will follow the acquisition method of accounting, as described by Statement of Financial Accounting Standards (SFAS) 141R, “Business Combinations” and will apply the SEC rules and guidance regarding “push down” accounting treatment effective April 23, 2009.

RECENT EVENTS

On October 14, 2009, we entered into separate agreements with the holders of our Senior Notes and Wells Fargo Foothill to amend the terms of our Securities Purchase Agreement (governing the Senior Notes) and Senior Credit Facility, respectively, to waive compliance with our debt leverage covenants which were to be measured on December 31, 2009 on a trailing four-quarter basis. As part of the Securities Purchase Agreement amendment, we have agreed to pay down our Senior Notes by using the gross proceeds of the offering and additional cash on hand, if necessary by: (i) $15.0 million if the gross proceeds of the offering are less than $40.0 million and (ii) $20.0 million (or more at our sole discretion) if the gross proceeds of the offering are equal to or greater than $40.0 million. If neither an offering of capital stock nor the proposed sale-leaseback of our Culver City properties occurs on or prior to March 31, 2010, we have agreed to pay down $3.5 million of our Senior Notes. Any such prepayments would be deemed optional prepayments under the Securities Purchase Agreement and made within 5 business days of the date the offering is consummated (in the case of clauses (i) or (ii) above) or April 7, 2010 in the event no offering or sale-leaseback was consummated.

The amendments also included consents by holders of the Senior Notes and Wells Fargo Foothill regarding the Culver City sale-leaseback described in the section entitled “Business—Properties” below and in the case of the amendment to the Senior Credit Facility, an increase in the letters of credit sub-limit from $1.5 to 2.0 million.

On August 3, 2009, we held a special meeting of our stockholders to consider and vote upon, among other proposals, amending our Restated Certificate of Incorporation to increase the number of authorized shares of our common stock from 300 million to 5 billion and to amend the Certificate of Incorporation to effect a 200 for 1 reverse stock split of our outstanding common stock (the “Charter Amendments”). On August 3, 2009, the stockholders approved the Charter Amendments, which resulted in the automatic conversion of all shares of preferred stock into common stock and the cancellation of warrants to purchase 10 million shares of common stock issued to Gores as part of their investment in our Series A Preferred Stock. There are no longer any issued and outstanding warrants to purchase our common stock or any shares of our capital stock that have any preference over the common stock with respect to voting, liquidation, dividends or otherwise. Under the Charter Amendments, each of the newly authorized shares of common stock has the same rights and privileges as previously authorized common stock. Adoption of the Charter Amendments did not affect the rights of the holders of our currently outstanding common stock nor did it change the par value of the common stock.

On July 9, 2009, Gores converted 3,500 shares of Series A-1 Convertible Preferred Stock into 103,512,913 shares of common stock (without taking into account the reverse stock split). Pursuant to the terms of our Certificate of Incorporation, the 291,722 outstanding shares of our Class B common stock were automatically converted into 291,722 shares of common stock (without taking into account the reverse stock split) because as a result of such conversion by Gores the voting power of the Class B common stock, as a group, fell below ten percent (10%) of the aggregate voting power of issued and outstanding shares of common stock and Class B common stock.

7

Table of Contents

In connection with the Restructuring and the issuance of the Preferred Stock, we determined that the Preferred Stock contained a beneficial conversion feature (“BCF”) of approximately $76.9 million that was partially contingent as described below. BCFs are generally recognized by allocating to shareholders’ equity that portion of the net proceeds from the sale of a convertible security equal to the intrinsic value of the BCF. Intrinsic value is calculated as the spread, as of the date we agreed to issue our Preferred Stock (the “commitment date”), between the conversion price of our Preferred Stock and the fair value of our common stock multiplied by the number of shares of common stock into which the Preferred Stock is convertible. In our case, because only a portion of the shares into which the Preferred Stock was convertible were authorized on the commitment date, a portion of the BCF was not immediately recognized because it was contingent on our stockholders approving an increase in the authorized shares. The portion of the BCF attributable to already authorized shares (approximately $10.9 million) was recognized at issuance on April 23, 2009 (issuance BCF) while the majority of the BCF (approximately $66 million) was contingent (contingent BCF) upon the authorization of 3,769,344,490 additional common shares. Because such shares were authorized on August 3, 2009, the contingent BCF was recognized on such date in the third quarter and, due to the immediate conversion of the Preferred Stock into common stock on such date, resulted in a deemed dividend of $65.9 million that will be included in our third quarter 2009 earnings per share.

ESTIMATED THIRD QUARTER PERFORMANCE

We estimate that for our third quarter ended September 30, 2009, our revenue will be approximately $ .

The foregoing amount is an estimate that is subject to adjustment in connection with our customary quarterly review processes. The inclusion of this estimate should not be regarded as an indication that we consider this estimate to be a reliable prediction of actual results. We cannot provide any assurance that the assumptions we made in preparing this estimate will prove accurate.

This estimate constitutes a forward-looking statement that is subject to significant risks and contingencies as described in more detail below in the section below entitled “Cautionary note regarding forward-looking statements” and could cause actual results to differ materially from the estimate expressed above.

The preliminary financial data for the third quarter included above has been prepared by, and is the responsibility of, our management. PricewaterhouseCoopers LLP has not audited, reviewed, compiled or performed any procedures with respect to the accompanying preliminary financial data and, accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto.

GOODWILL IMPAIRMENT

As a result of our Restructuring, we recorded new values for certain intangible assets and goodwill as of April 24, 2009, which values were calculated using the income approach and were based on our then most current forecast. The assumptions underlying our forecasted values were derived from the Company’s then best estimates including the industry’s general forecast of the advertising market which assumed an improvement in the economy and in advertising market conditions in the later half of 2009. In 2009, the television upfronts (where advertisers purchase commercial airtime for the upcoming television season several months before the season begins), which in prior years concluded in the second quarter, were extended through August to complete the upfront advertising sales. During this period, advertisers were slow to commit to buying commercial airtime for the third quarter of 2009. We believed that the conclusion of the television upfronts would help bring more clarity to both purchasers and

8

Table of Contents

sellers of advertising; however, once such upfronts concluded in August, it became increasingly evident from our quarterly bookings, backlog and pipeline data that the downturn in the economy was continuing and affecting advertising budgets and orders. These conditions, namely the weak third quarter and the likely continuation of the current economic conditions into the fourth quarter and the immediate future, caused us to reduce our forecasted results for the remainder of 2009 and 2010. We believe these new forecasted results constituted a triggering event and therefore we conducted a goodwill impairment analysis. The new forecast will more likely than not reduce the fair value of one or more of our reporting units below its carrying value. Accordingly, we performed a Step 1 analysis in accordance with ASC 350 by comparing our recalculated fair value based on our new forecast to our current carrying value. Our initial results indicate an impairment in our Metro Traffic segment. We are currently performing a more detailed Step 2 analysis to compare the implied fair value of goodwill for Metro Traffic with the carrying value of its goodwill. We currently estimate the goodwill impairment to be in the range of $40.0 million to $60.0 million. No assurance can be provided as to the ultimate charge which will be recorded in the third quarter of 2009.

THE GORES GROUP

The Gores Group owns approximately 75.1% of our common stock. Founded in 1987, Gores is a private equity firm focused on investing in businesses which can benefit from the firm’s operating and turnaround expertise. The firm’s current private equity fund has committed equity capital of $1.3 billion.

RISKS ASSOCIATED WITH OUR BUSINESS

Our business is subject to numerous risks and uncertainties, as more fully described under “Risk Factors” beginning on page 16, which you should carefully consider before deciding whether to invest in our common stock.

CORPORATE INFORMATION

We are a Delaware corporation. Our principal executive office is located at 40 West 57th Street, 5th Floor, New York, NY 10019. Our telephone number is (212) 641-2000 and our website address is www.westwoodone.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

9

Table of Contents

The offering

| Common stock offered by Westwood One |

shares |

| Common stock offered by the selling stockholders |

shares |

| Common stock to be outstanding after this offering |

shares, or shares if the underwriters exercise their over-allotment option in full |

| Over-allotment option |

shares |

| Use of proceeds |

Our net proceeds from this offering, after deducting underwriting discounts and estimated offering expenses will be approximately $ , assuming a public offering price of $ per share, which was the last reported sale price of our common stock on , 2009. As described in more detail elsewhere in this prospectus under the heading “Use of Proceeds”, we will use between $15.0 to $20.0 million of the proceeds to repay a portion of our outstanding indebtedness. We anticipate that we will use the remaining net proceeds of this offering for general corporate purposes and working capital, which may include: pursuit of possible acquisitions of complementary businesses or other assets such as TrafficLand (if we choose to exercise our purchase option, as described elsewhere in this prospectus) and funding our growth initiatives. |

We will not receive any proceeds from the sale of shares by the selling stockholders. See “Use of Proceeds.”

| Anticipated NASDAQ Global Market Symbol |

“WWON” |

The number of shares of our common stock to be outstanding upon completion of this offering is based on 20,312,229 shares of our common stock outstanding as of June 30, 2009 (after giving effect to the assumptions on the following page), and excludes:

| Ø | 31,705 shares of common stock issuable upon exercise of options outstanding as of June 30, 2009 at a weighted average exercise price of $7.16 per share,; |

| Ø | 27,709 shares of common stock reserved as of June 30, 2009 for future issuance under our 1999 Stock Incentive Plan, and an additional 12,291 shares of common stock reserved for issuance after June 30, 2009; and |

| Ø | 3,996 shares of common stock reserved as of June 30, 2009 for future issuance under our 2005 Equity Compensation Plan, and an additional 42,004 shares of common stock reserved for issuance after June 30, 2009. |

10

Table of Contents

Unless otherwise indicated, this prospectus (except in the historical consolidated financial statements included elsewhere in this prospectus):

| Ø | reflects and assumes the conversion of all shares of our Series A-1 Preferred Stock (3,500 shares of which were converted on July 9, 2009 and the remainder of which automatically converted on August 3, 2009) and Series B Preferred Stock (which automatically converted on August 3, 2009) into an aggregate of 19,798,483 shares of common stock; |

| Ø | reflects and assumes the automatic conversion of all outstanding shares of Class B stock into an aggregate of 1,459 shares of common stock that occurred on July 9, 2009; |

| Ø | reflects a 200 for 1 reverse stock split of our common stock that occurred on August 3, 2009; and |

| Ø | assumes no exercise by the underwriters of their option to purchase up to an additional shares from us and the selling stockholders to cover over-allotments. |

If the underwriters exercise their over-allotment option in full, shares of our common stock will be outstanding after this offering.

11

Table of Contents

Summary consolidated and other financial data

The following tables summarize our consolidated financial and other data. The consolidated statements of operations data for the fiscal years ended December 31, 2006, 2007 and 2008 and the consolidated balance sheet data as of December 31, 2007 and 2008 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The consolidated statement of operations data for the fiscal years ended December 31, 2004 and 2005 and the consolidated balance sheet data as of December 31, 2004, 2005 and 2006 have been derived from our audited financial statements not included in this prospectus. The consolidated statement of operations data for the periods comprising the six months ended June 30, 2008 and 2009, and the consolidated balance sheet data as of June 30, 2009, have been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated financial statements have been prepared on a basis consistent with our audited financial statements and include, in the opinion of management, all adjustments that management considers necessary for the fair statement of the financial information set forth in those financial statements. The following financial data should be read in conjunction with, and is qualified by reference to, our consolidated financial statements and related notes and schedule included elsewhere in this prospectus and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our historical results are not necessarily indicative of the results to be expected in any future period.

| Year ended December 31, |

Predecessor Company | Successor Company |

||||||||||||||||||||||||||||||

| For the six months ended June 30, 2008 |

For the period January 1, 2009 to April 23, 2009 |

For the period April 24, 2009 to June 30, 2009(4) |

||||||||||||||||||||||||||||||

| 2004(1) | 2005(1) | 2006 | 2007 | 2008 | ||||||||||||||||||||||||||||

| Consolidated statements of operations data: |

(in thousands, except per share data) | |||||||||||||||||||||||||||||||

| Revenue |

$ | 562,246 | $ | 557,830 | $ | 512,085 | $ | 451,384 | $ | 404,416 | $ | 206,998 | $ | 111,474 | $ | 58,044 | ||||||||||||||||

| Operating Costs |

379,097 | 378,998 | 395,196 | 350,440 | 360,492 | 179,640 | 111,580 | 52,116 | ||||||||||||||||||||||||

| Depreciation and Amortization |

18,429 | 20,826 | 20,756 | 19,840 | 11,052 | 6,397 | 2,585 | 5,845 | ||||||||||||||||||||||||

| Corporate General and Administrative Expenses |

13,596 | 14,028 | 14,618 | 13,171 | 13,442 | 4,665 | 4,248 | 2,407 | ||||||||||||||||||||||||

| Goodwill Impairment |

— | — | 515,916 | — | 430,126 | 206,053 | — | — | ||||||||||||||||||||||||

| Restructuring Charges |

— | — | — | — | 14,100 | — | 3,976 | 1,454 | ||||||||||||||||||||||||

| Special Charges |

— | — | 1,579 | 4,626 | 13,245 | (a) | 8,853 | 12,819 | 368 | |||||||||||||||||||||||

| Operating (Loss) Income |

151,124 | 143,978 | (435,980 | ) | 63,307 | (438,041 | ) | (198,610 | ) | (23,734 | ) | (4,146 | ) | |||||||||||||||||||

| Other Income |

(948 | ) | (1,440 | ) | (926 | ) | (412 | ) | (12,368 | ) |

|

(84 |

) |

|

(359 |

) |

|

(4 |

) | |||||||||||||

| Interest Expense |

11,911 | 18,315 | 25,590 | 23,626 | 16,651 | 9,751 | 3,222 | 4,692 | ||||||||||||||||||||||||

| Income taxes (benefit) |

53,206 | 49,217 | 8,809 | 15,724 | (14,760 | ) | (3,194 | ) | (7,635 | ) | (2,650 | ) | ||||||||||||||||||||

| Net (Loss) Income |

86,955 | 77,886 | (469,453 | ) | 24,368 | (427,563 | ) | $ | (205,082 | ) | $ | (18,961 | ) | $ | (6,184 | ) | ||||||||||||||||

| Net (Loss) Income attributable to Common Stockholders |

86,955 | 77,816 | (469,528 | ) | 24,363 | (430,644 | ) | $ | (205,270 | ) | $ | (22,037 | ) | $ | (9,595 | ) | ||||||||||||||||

| (Loss) Income Per Basic Share(2) |

||||||||||||||||||||||||||||||||

| Common stock |

$ | 179.80 | $ | 171.56 | $ | (1,091.76 | ) | $ | 56.59 | $ | (878.73 | ) | $ | (431.24 | ) | $ | (43.64 | ) | $ | (18.85 | ) | |||||||||||

| Class B stock |

$ | — | $ | 48.00 | $ | 51.20 | $ | 3.20 | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||

| (Loss) Income Per Diluted Share(2) |

||||||||||||||||||||||||||||||||

| Common stock |

$ | 175.65 | $ | 170.05 | $ | (1,091.76 | ) | $ | 56.38 | $ | (878.73 | ) | $ | (431.24 | ) | $ | (43.64 | ) | $ | (18.85 | ) | |||||||||||

| Class B stock |

$ | — | $ | 48.00 | $ | 51.20 | $ | 3.20 | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||

| Dividends Declared(2) |

||||||||||||||||||||||||||||||||

| Common stock |

$ | — | $ | 59.44 | $ | 64.10 | $ | 3.85 | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||

| Class B stock |

$ | — | $ | 48.00 | $ | 51.20 | $ | 3.20 | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||

|

(a) Does not include $3,272 of special charges classified as Operating Costs on the Statement of Operations.

Other Key Financial Metric: |

|

|||||||||||||||||||||||||||||||

| Stock-based compensation |

14,844 | 11,686 | 12,269 | 9,606 | 5,443 | 2,455 | 2,110 | 853 | ||||||||||||||||||||||||

12

Table of Contents

| As of December 31, | As of June 30, | ||||||||||||||||||||||

| 2004(1) | 2005(1) | 2006 | 2007 | 2008 | 2008 | 2009(4) | |||||||||||||||||

| (in thousands) | |||||||||||||||||||||||

| Consolidated Balance Sheet Data(4): |

|||||||||||||||||||||||

| Current Assets |

$ | 174,346 | $ | 172,245 | $ | 149,222 | $ | 138,154 | $ | 119,468 | $ | 109,180 | $ | 107,454 | |||||||||

| Working Capital / (Deficit)(3) |

93,005 | 72,094 | 29,313 | 47,294 | (208,034 | ) | (15,181 | ) | 47,409 | ||||||||||||||

| Total Assets |

1,262,495 | 1,239,646 | 696,701 | 669,757 | 205,088 | 431,134 | 347,056 | ||||||||||||||||

| Long-Term Debt(3) |

359,439 | 427,514 | 366,860 | 345,244 | — | 199,495 | 128,078 | ||||||||||||||||

| Total Shareholders’ Equity (Deficit) |

800,709 | 704,029 | 202,931 | 227,631 | (203,145 | ) | 101,597 | 4,290 | |||||||||||||||

| Year ended December 31, | Predecessor Company | Successor Company | |||||||||||||||||||||||

| 2004(1) | 2005(1) | 2006 | 2007 | 2008 | Six months ended June 30, 2008 |

For the period January 1, 2009 to April 23, 2009 |

For the period April 24, 2009 to June 30, 2009 | ||||||||||||||||||

| (in thousands) | |||||||||||||||||||||||||

| Other Financial Data: |

|||||||||||||||||||||||||

| Adjusted EBITDA(5) |

$ | 184,397 | $ | 176,490 | $ | 114,540 | $ | 97,378 | $ | 39,198 | $ | 25,149 | $ | (2,243 | ) | $ | 4,374 | ||||||||

| (1) | Effective January 1, 2006, we adopted Financial Accounting Standards Board (“FASB”) Statement of Financial Accounting Standards No. 123 (Revised 2004), “Share Based Payment” (“SFAS 123R”) utilizing the modified retrospective transition alternative. Accordingly, results for years prior to 2006 have been restated to reflect stock—based compensation expense in accordance with SFAS 123R. |

| (2) | No cash dividend was paid on our common stock or Class B stock in 2004 or 2008. The payment of dividends is restricted by the terms of our outstanding indebtedness and we do not plan on paying dividends for the foreseeable future. On August 3, 2009, a 200:1 reverse stock split was declared and effective. All per share amounts have been adjusted for this split (see Note 1 to the Annual Consolidated Financial Statements). |

| (3) | On November 30, 2008, we failed to make the interest payment on our previously outstanding senior notes which constituted an event of default under the then existing senior notes. Accordingly, $249,053 of debt previously considered long-term was re-classified as short-term debt, which resulted in a working capital deficit of $208,034 on December 31, 2008. |

| (4) | As a result of the Restructuring, we have followed the acquisition method of accounting, as described by SFAS 141R. Accordingly, we have revalued our assets and liabilities using our best estimate of current fair value. Our consolidated financial statements prior to the closing of the Restructuring reflect the historical accounting basis in our assets and liabilities and are labeled predecessor company, while the periods subsequent to the Restructuring are labeled successor company and reflect the push down basis of accounting for the fair values which were allocated to our segments based on the business Enterprise Value of each. Deferred tax liabilities have been recorded as a part of acquisition accounting to reflect the future taxable income to be recognized relating to the cancellation of indebtedness income as well as the deferred tax liability related to the acquisition accounting. |

| In connection with the Restructuring and the issuance of the Preferred Stock, we have determined that the Preferred Stock contained a beneficial conversion feature (“BCF”) that was partially contingent. BCF is measured as the spread between the effective conversion price and the market price of common stock on the commitment date and then multiplying this spread by the number of conversion shares. We recognized the portion of the BCF that was not related to the contingent shares at issuance (issuance BCF) while the majority of the BCF was contingent (contingent BCF) upon the authorization of additional common shares that occurred on August 3, 2009. Because such shares were authorized on August 3, 2009, the contingent BCF was recognized on such date in the third quarter and, due to the immediate conversion of the Preferred Stock into common stock on such date, resulted in a deemed dividend of $65.9 million that will be included in our third quarter 2009 earnings per share. |

| (5) | Adjusted EBITDA is a non-GAAP financial measure (ie, it is not a measure of financial performance under generally accepted accounting principles) and should not be considered in isolation or as a substitute for consolidated statements of operations and cash flow data prepared in accordance with GAAP. We use Adjusted EBITDA to calculate our compliance with our leverage ratio covenants under our Senior Credit Facility and Senior Notes. We believe the presentation of Adjusted EBITDA is relevant and useful for investors because it allows investors to view performance in the same manner as our lenders (who also own approximately 23.0% of our equity as a result of the Restructuring, excluding Gores). |

(footnotes on following page)

13

Table of Contents

Our maximum senior leverage ratio (also referred to herein as our “debt leverage covenant”), defined as the principal amount of Senior Notes over our Consolidated EBITDA (defined below), is measured on a trailing, four-quarter basis. The covenant is the same under our Securities Purchase Agreement (“SPA”), governing the Senior Notes and our Senior Credit Facility with Wells Fargo Foothill (governing the term loan and revolver) except that they have different maximum levels. We have presented the more restrictive of the two levels below.

| Quarter ending |

Senior leverage ratio covenant |

Principal amount of senior notes (includes PIK)* |

Required adjusted EBITDA* | |||

| 12/31/09 |

6.25 to 1.0** | 106.9 | 17.1 | |||

| 3/31/10 |

6.00 to 1.0 | 108.3 | 18.1 | |||

| 6/30/10 |

5.5 to 1.0 | 109.6 | 19.9 | |||

| 9/30/10 |

5.00 to 1.0 | 111.0 | 22.2 | |||

| 12/31/10 |

4.50 to 1.0 | 112.4 | 25.0 | |||

| 3/31/11 |

4.25 to 1.0 | 113.8 | 26.8 | |||

| 6/30/11 |

4.00 to 1.0 | 115.2 | 28.8 | |||

| 9/30/11 |

3.75 to 1.0 | 116.7 | 31.1 | |||

| 12/31/11 |

3.50 to 1.0 | 118.1 | 33.7 | |||

| 3/31/12 |

3.50 to 1.0 | 119.6 | 34.2 | |||

| 6/30/12 |

3.50 to 1.0 | 121.1 | 34.6 |

| * | Numbers presented in the last two columns are dollars in millions and have been rounded to the nearest tenth. As described elsewhere in this prospectus under the heading “Use of Proceeds” we will use between $15.0 and $20.0 million of the proceeds of the offering to repay outstanding indebtedness. The above chart reflects a repayment of $15.0 million of the $117.5 principal amount of Senior Notes presently outstanding and includes the PIK interest that accrues on a quarterly basis. |

| ** | As described below in more detail, on October 14, 2009, we entered into agreements with the holders of our Senior Notes and Wells Fargo Foothill to waive compliance with our debt leverage covenants under our Senior Notes and Senior Credit Facility, respectively, which levels were scheduled to be measured on December 31, 2009. Accordingly, the first measurement period will occur on March 31, 2010. |

Consolidated EBITDA has the same definition in both agreements and means Consolidated Net Income (as defined in such agreements) for Westwood One and its subsidiaries adjusted for the following:

(a) minus any net gain or plus any loss arising from the sale or other disposition of capital assets;

(b) plus any provision for taxes based on income or profits;

(c) plus consolidated net interest expense;

(d) plus depreciation, amortization and other non-cash losses, charges or expenses (including impairment of intangibles and goodwill);

(e) minus any “extraordinary,” “unusual,” “special” or “non-recurring” earnings or gains or plus any “extraordinary,” “unusual,” “special” or “non-recurring” losses, charges or expenses;

(f) plus restructuring expenses or charges;

(g) plus non-cash compensation recorded from grants of stock appreciation or similar rights, stock options, restricted stock or other rights;

(h) plus any Permitted Glendon/Affiliate Payments (as described below);

(i) plus any Transaction Costs (as described below);

(j) minus any deferred credit (or amortization of a deferred credit) arising from the acquisition of any Person; and

(k) minus any other non-cash items increasing such Consolidated Net Income (including, without limitation, any write-up of assets);

in each case to the extent taken into account in the determination of such Consolidated Net Income, and determined without duplication and on a consolidated basis in accordance with GAAP. “Permitted Glendon/Affiliate Payments” means payments made at our discretion to Gores and its affiliates including Glendon Partners for consulting services provided to Westwood One and “Transaction Costs” refers to the fees, costs and expenses incurred by us in connection with the Restructuring.

Under the amended terms of our indebtedness, our financial covenant will first be measured on March 31, 2010 based on our trailing four-quarter EBITDA. Our Adjusted EBITDA (which is the same as “Consolidated EBITDA” described above) for the

(footnotes on following page)

14

Table of Contents

three-month period ended June 30, 2009 was $9.1 million. In order to satisfy our 6.00 covenant under the terms of our Senior

Notes (which is more restrictive than the 6.90 covenant set forth in our Senior Credit Facility) on March 31, 2010, we would require Adjusted EBITDA (for the three quarters ended March 31, 2010) of $9.0 million or greater. This assumes the amount of Senior Notes outstanding on March 31, 2010 is reduced by $15.0 million from the proceeds of this offering and includes PIK interest accrued through March 31, 2010. This compares with Adjusted EBITDA of $16.2 million on June 30, 2009, on a trailing four-quarter basis, which amount does not include the full benefit of the cost reduction programs undertaken by us and described elsewhere in this prospectus in more detail.

Adjusted EBITDA, as we calculate it, may not be comparable to similarly titled measures employed by other companies. While Adjusted EBITDA does not necessarily represent funds available for discretionary use, and is not necessarily a measure of our ability to fund our cash needs, we use Adjusted EBITDA as a liquidity measure, which is different from our operating cash flow, the most directly comparable financial measure calculated and presented in accordance with GAAP. We have provided below the requisite reconciliation of operating cash flow to Adjusted EBITDA. Adjusted EBITDA, a non-GAAP measure, for the combined six months ended June 30, 2009 was $2.1 million as previously reported in our second quarter earnings press release.

| Predecessor Company | Successor Company |

|||||||||||||||||||||||||||||||||||

| Year ended December 31, | Six months ended June 30, |

For the period January 1, 2009 to April 23, 2009(4) |

For the period April 24, 2009 to June 30, 2009(4) |

|||||||||||||||||||||||||||||||||

| 2004 | 2005 | 2006 | 2007 | 2008 | 2008 | |||||||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||||

| Net Cash Provided by (Used in) Operating Activities |

$ | 117,456 | $ | 118,290 | $ | 104,251 | $ | 27,901 | $ | 2,038 | $ | (4,842 | ) | $ | (777 | ) | $ | (14,327 | ) | |||||||||||||||||

| Interest expense |

11,911 | 18,315 | 25,590 | 23,626 | 16,651 | 9,751 | 3,222 | 4,692 | ||||||||||||||||||||||||||||

| Income taxes (benefit) |

53,206 | 49,217 | 8,809 | 15,724 | (14,760 | ) | (3,194 | ) | (7,635 | ) | (2,650 | ) | ||||||||||||||||||||||||

| Restructuring |

— | — | — | — | 14,100 | — | 3,976 | 1,454 | ||||||||||||||||||||||||||||

| Special charges |

— | — | 1,579 | 4,626 | 16,517 | 8,853 | 12,819 | 368 | ||||||||||||||||||||||||||||

| Investment income |

(157 | ) | (436 | ) | (394 | ) | — | (207 | ) | (84 | ) | (359 | ) | (4 | ) | |||||||||||||||||||||

| Other non-operating income |

(791 | ) | (42 | ) | (532 | ) | (412 | ) | (998 | ) | — | (188 | ) | (76 | ) | |||||||||||||||||||||

| Deferred taxes |

5,276 | 7,451 | 20,546 | 6,480 | 13,907 | 7,196 | 6,874 | (2,162 | ) | |||||||||||||||||||||||||||

| Amortization of deferred financing costs |

(709 | ) | (333 | ) | (359 | ) | (481 | ) | (1,674 | ) | (792 | ) | (331 | ) | — | |||||||||||||||||||||

| Change in assets and liabilities |

(1,795 | ) | (15,972 | ) | (44,950 | ) | 19,914 | (6,376 | ) | 8,261 | (19,844 | ) | 17,079 | |||||||||||||||||||||||

| Adjusted EBITDA |

$ | 184,397 | $ | 176,490 | $ | 114,540 | $ | 97,378 | $ | 39,198 | $ | 25,149 | $ | (2,243 | ) | $ | 4,374 | |||||||||||||||||||

15

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as all of the other information contained or incorporated by reference in this prospectus, before deciding to invest in our common stock. The occurrence of any of the following risks could materially and adversely affect our business, financial condition, prospects, results of operations and cash flows. In such case, the trading price of our common stock could decline and you could lose all or part of your investment. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, financial condition, prospects, results of operations and cash flows.

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

Deterioration in general economic conditions and constrained consumer spending has caused, and could cause, additional decreases or delays in advertising spending, could harm our ability to generate advertising revenue and negatively affect our results of operations.

We derive the majority of our revenue from the sale of local, regional and national advertising. The current global economic slowdown has resulted in a decline in advertising and marketing services among our customers, resulting in a decline in advertising revenue across our businesses which to date has not abated. Additionally, advertisers, and the agencies that represent them, have put increased pressure on advertising rates, in some cases, requesting broad percentage discounts on ad buys, demanding increased levels of inventory and re-negotiating booked orders. The current state of the economy could also adversely affect our ability to collect accounts receivable from our advertisers, particularly those entities which have filed for bankruptcy. Reductions in advertising expenditures and declines in ad rates have adversely affected our revenue and the continuation of the global economic slowdown would likely continue to adversely impact our revenue, profit margins, cash flow and liquidity in future periods. In addition, once the current economic situation improves, we cannot predict whether or not advertisers’ demands and budgets for advertising will return to previous levels.

Our operating income has declined since 2002 and may continue to decline. We may not be able to reverse this trend or reduce costs sufficiently to offset declines in revenue if such trends continue.

Since 2002, our annual operating income has declined from operating income of approximately $180 million to an operating loss of $438 million, which included goodwill impairment charges of approximately $430 million, for the year ended 2008, with the most significant decline occurring between 2005 and 2008. Between 2002 and 2008, our operating income declined as a result of increased competition in our local and regional markets and an increase in the amount of 10 second inventory being sold by radio stations. The decline (between 2005 and 2008) also was due to reductions in national audience levels (which dropped significantly between 2005 and 2006), lower commercial clearance and audience levels of our affiliated stations and reductions in our local and regional sales force, which began in mid-2006. Recently, our operating income has also been affected by the weakness in the United States economy and advertising market. Given the current economic climate, it is possible our operating income will continue to decline.

16

Table of Contents

Risk factors

CBS Radio provides us with a significant portion of our commercial inventory and audience that we sell to advertisers. A material reduction in the audience delivered by CBS Radio stations or a material loss of commercial inventory from CBS Radio would have an adverse effect on our advertising sales and financial results.

While we provide programming to all major radio station groups, we have affiliation agreements with most of CBS Radio’s owned and operated radio stations which, in the aggregate, provide us with a significant portion of the audience and commercial inventory that we sell to advertisers, much of which is in the more desirable top 10 radio markets. Although the compensation we pay to CBS Radio under our new 2008 arrangement is adjustable for audience levels and commercial clearance (ie, the percentage of commercial inventory broadcast by CBS Radio stations), any significant loss of audience or inventory delivered by CBS Radio stations, including, by way of example only, as a result of a decline in station audience, commercial clearance levels or station sales that resulted in lower audience levels, would have a material adverse impact on our advertising sales and revenue. Since implementing the new arrangement in early 2008 and continuing through the end of 2008, CBS Radio has delivered improved audience levels and broadcast more advertising inventory than it had under our previous arrangement. However, there can be no assurance that CBS Radio will be able to maintain these higher levels in particular, with the introduction of The Portable People Meter™, or PPM™, which to date has reported substantially lower audience ratings for certain of our radio station affiliates, including our CBS Radio station affiliates, in those markets in which PPM™ has been implemented as described below. Additionally, while our arrangement with CBS Radio is scheduled to terminate in 2017, there can be no assurance that such arrangement will not be breached by either party. If our agreement with CBS Radio were terminated as a result of such breach, our results of operations could be materially impacted.

We may not realize expected benefits from our cost cutting initiatives.

In order to improve the efficiency of our operations, we have implemented and continue to implement certain cost cutting initiatives, including headcount and salary reductions and more recently a furlough of participating full-time employees. We cannot assure you that we will realize the full level of expected cost savings or improve our operating performance as a result of our past, current and future cost cutting activities. We also cannot assure you that our cost cutting activities will not adversely affect our ability to retain key employees, the significant loss of whom could adversely affect our operating results. Further, as a result of our cost cutting activities, we may not have the appropriate level of resources and personnel to appropriately react to significant changes or fluctuations in the market and in the level of demand for our programming and services.

Our ability to grow our Metro business revenue may be adversely affected by the increased proliferation of free of charge traffic content to consumers.

Our Metro business produces and distributes traffic and other local information reports to approximately 2,300 radio and television affiliates and we derive the substantial majority of the revenue attributed to this business from the sale of commercial advertising inventory embedded within these reports. Recently, the US Department of Transportation and other regional and local departments of transportation have significantly increased their direct provision of real-time traffic and traveler information to the public free of charge. The ability to obtain this information free of charge may result in our radio and television affiliates electing not to utilize the traffic and local information reports produced by our Metro business, which in turn could adversely affect our revenue from the sale of advertising inventory embedded in such reports.

17

Table of Contents

Risk factors

If we are unable to achieve our financial forecast, we may require an amendment or additional waiver of our debt leverage covenant, which amendment or waiver, if not obtained, could have a material and adverse effect on our business continuity and financial condition.

Management believes that after giving effect to certain cost containment measures including furloughs and salary reductions for employees, we will generate sufficient Adjusted EBITDA in order to meet our debt leverage covenant over the next twelve months (namely, on March 31, 2010, June 30, 2010 and September 30, 2010 when the covenants are measured on a trailing four-quarter basis). However, as described elsewhere in this prospectus, we are operating in an uncertain economic environment with limited visibility on advertising orders for the duration of 2009 and the beginning of 2010. As described in the section entitled “Use of Proceeds”, we have agreed to pay down our Senior Notes in an amount of either $15.0 or 20.0 million, depending on the amount of gross proceeds of the offering. If we are unable to achieve our forecasted results, or sufficiently mitigate those results with certain cost reduction measures, and cannot obtain a waiver or amendment of our debt covenant requirements at March 31, 2010 or beyond, it could have a material and adverse effect on our business continuity, results of operations, cash flows and financial condition.

We may require additional financing to fund our working capital, debt service, capital expenditures or other capital requirements and the ongoing global credit market disruptions have reduced access to credit and created higher costs of obtaining financing.

Our primary source of liquidity is cash flow from operations, which has been adversely impacted by the decline in our advertising revenue. Based on our current and anticipated levels of operations, we believe that cash flow from operations as well as cash on hand (including amounts drawn or available under our Senior Credit Facility) will enable us to meet our working capital, capital expenditure, debt service and other capital requirements for at least the next 12 months. However, our ability to fund our working capital needs, debt service and other obligations, and to comply with the financial covenants under our financing agreements depends on our future operating performance and cash flow, which are subject to prevailing economic conditions and other factors, many of which are beyond our control. We recently negotiated agreements with the holders of our Senior Notes and Wells Fargo Foothill to waive compliance with our debt leverage covenants under our Senior Notes and Senior Credit Facility, respectively (which levels were to be measured on December 31, 2009), as a result of lower than anticipated revenue and the uncertain economic and advertising environments. If our future operating performance does not meet our expectations or our plans materially change in an adverse manner or prove to be materially inaccurate, we may need additional financing. There can be no assurance that such financing, if permitted under the terms of our financing agreements, will be available on terms acceptable to us or at all. Additionally, disruptions in the credit markets make it harder and more expensive to obtain financing. If available financing is limited or we are forced to fund our operations at a higher cost, these conditions may require us to curtail our business activities and increase our cost of financing, both of which could reduce our profitability or increase our losses. The inability to obtain additional financing in such circumstances could have a material adverse effect on our financial condition and on our ability to meet our obligations.

We have a significant amount of indebtedness, which could adversely affect our liquidity and future business operations if our operating income declines more than we currently anticipate.

As of September 30, 2009, we had approximately $120.4 million in aggregate principal amount of Senior Notes outstanding (of which $2.9 million is PIK interest), which bear interest at a rate of 15.0%, and a Senior Credit Facility consisting of: (x) a $20 million term loan and (y) a $15 million revolving line of credit which we intend to borrow against in the future. Loans under our Senior Credit Facility bear

18

Table of Contents

Risk factors

interest at LIBOR plus 4.5% (with a LIBOR floor of 2.5%) or a base rate plus 4.5% (with a base rate floor equal to the greater of 3.75% or the one-month LIBOR rate). As described in the section entitled “Prospectus Summary—Recent Events” above, we recently obtained waivers of compliance with our debt leverage covenants for the fourth quarter of 2009 measurement period. Our ability to service our debt in 2010 and beyond will depend on competitive pressures and our financial performance in an uncertain and unpredictable economic environment. Further, our Senior Notes and Senior Credit Facility restrict our ability to incur additional indebtedness. If our operating income declines more than we currently anticipate, resulting in an inability to incur additional indebtedness under the terms of our outstanding indebtedness, and we are unable to obtain a waiver to increase our indebtedness or successfully raise funds through an issuance of equity, we could have insufficient liquidity which would have a material adverse effect on our business, financial condition and results of operations. If we are unable to meet our debt service and repayment obligations under the Senior Notes or the Senior Credit Facility, we would be in default under the terms of the agreements governing our debt, which if uncured, would allow our creditors at that time to declare all outstanding indebtedness to be due and payable and materially impair our financial condition and liquidity.

Our Senior Credit Facility and Senior Notes contain various covenants which, if not complied with, could accelerate repayment under such indebtedness, thereby materially and adversely affecting our financial condition and results of operations.

Our Senior Credit Facility and Senior Notes require us to comply with certain financial and operational covenants. These covenants include, without limitation:

| Ø | a maximum senior leverage ratio (expressed as the principal amount of Senior Notes over our consolidated EBITDA (as defined in our Senior Credit Facility) measured on a trailing, four-quarter basis) which is 6.25 to 1.0 on December 31, 2009 but begins to decline on a quarterly basis thereafter, including to a 4.5 to 1.0 ratio on December 31, 2010 and a 3.5 to 1.0 ratio on December 31, 2011; and |

| Ø | restrictions on our ability to incur debt, incur liens, make investments, make capital expenditures, consummate acquisitions, pay dividends, sell assets and enter into mergers and similar transactions. |