Attached files

| file | filename |

|---|---|

| EX-23.1 - Inspyr Therapeutics, Inc. | v162316_ex23-1.htm |

| EX-5.01 - Inspyr Therapeutics, Inc. | v162316_ex5-01.htm |

As

filed with the Securities and Exchange Commission on October 15,

2009

Registration

No. [________]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

GENSPERA,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

2834

|

20-0438951

|

||

|

(State or jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer Identification No.)

|

2511

N Loop 1604 W, Suite 204

San

Antonio, TX 78258

(210)

479-8112

FAX

(210) 479-8113

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive offices)

Agent

for Service:

National

Corporate Research

800

Brazos St., Suite 400

Austin,

TX 78701

800-345-4647

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

Copy

to:

Raul

Silvestre

Silvestre

Law Group, P.C.

31200

Via Colinas, Suite 200

Westlake

Village, CA 91362

(818)

597-7552

Fax

(818) 597-7551

Approximate date of commencement of

proposed sale to the public: From time to time after this registration

statement becomes effective.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the

following box.

x

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act, please check the following box and list the

Securities Act registration statement number of the earlier effective

registration statement for the same offering. ¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

¨

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering.

¨

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting company. See

the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨

|

|

Accelerated filer

|

¨

|

||

|

Non-accelerated filer

|

¨ (Do

not check if smaller reporting company)

|

|

Smaller reporting company

|

x

|

Pursuant

to Rule 429 under the Securities Act of 1933, the prospectus included in this

registration statement is a combined prospectus relating to:

(i)

the resale of 437,271 common shares by

the Seller Stockholders being registered herein;

(ii) the

resale of 6,012,400 common shares previously registered

on registration statement no. 333-153829, filed by the registrant on

Form S-1 and declared effective December 31, 2008; and

(iii) the

resale of 4,516,120 common shares previously registered

on registration statement no. 333-160949, filed by the registrant on

Form S-1 and declared effective August 14, 2009.

This

registration statement, which is a new registration statement, also constitutes

post-effective amendment no. 1 to the above referenced registration statements,

and such post-effective amendment shall hereafter become effective concurrently

with the effectiveness of this registration statement and in accordance with

Section 8(c) of the Securities Act of 1933.

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of

Securities to be Registered

|

Amount to be

Registered

|

Proposed Maximum

Offering Price

|

Proposed Maximum

Aggregate Offering

Price

|

Amount of

Registration Fee

|

||||||||

|

Common

Stock, par value $0.0001 per share

|

185,002

|

$

|

1.50

|

(1) |

$

|

277,503

|

$

|

15.48

|

||||

|

Common

Stock, par value $0.0001 per share(3)

|

92,269

|

$

|

3.00

|

(2) |

$

|

276,807

|

$

|

15.45

|

||||

|

Common

Stock, par value $0.0001 per share(4)

|

100,000

|

$

|

1.50

|

(2) |

$

|

150,000

|

$

|

8.37

|

||||

|

Common

Stock, par value $0.0001 per share(5)

|

60,000

|

$

|

0.50

|

(2) |

$

|

30,000

|

1.67

|

|||||

|

Subtotal

|

437,271

|

$

|

744,310

|

$ |

40.97

|

|||||||

|

Previously

registered on Registration Statement No. 333-153829:

|

||||||||||||

|

Common

Stock, par value $0.0001 per share

|

4,490,000

|

(7) |

N/A

|

(9)

|

||||||||

|

Common

Stock, par value $0.0001 per share(4)(10)

|

1,522,400

|

(7) |

N/A

|

(9)

|

||||||||

|

Subtotal

|

6,012,400

|

(7) |

N/A

|

(9)

|

||||||||

|

Previously

registered on Registration Statement No. 333-160949:

|

||||||||||||

|

Common

Stock, par value $0.0001 per share

|

2,558,686

|

(8) |

N/A

|

(9)

|

||||||||

|

Common

Stock, par value $0.0001 per share (4)

|

394,187

|

(8) |

N/A

|

(9)

|

||||||||

|

Common

Stock, par value $0.0001 per share (6)

|

50,000

|

(8) |

N/A

|

(9)

|

||||||||

|

Common

Stock, par value $0.0001 per share (3)

|

1,513,247

|

(8) |

N/A

|

(9)

|

||||||||

|

Sub

Total

|

4,516,120

|

N/A

|

(9)

|

|||||||||

|

Total

|

10,965,791

|

|

|

|

|

|||||||

|

(1)

|

Estimated

solely for the purpose of calculating the registration fee in accordance

with Rule 457 of the Securities Act based upon a per share amount of

$1.50, based on the price at which the securities were previously

sold. There is currently no trading market for the Registrant's

common stock. The price of $1.50 is a fixed price at which the selling

stockholders identified herein may sell their shares until a market

develops for the Registrant's common stock, if ever, at which time the

shares may be sold at prevailing market prices or privately negotiated

prices.

|

|

(2)

|

Fee

based on exercise price applicable to shares issuable upon exercise of

warrants in accordance with Rule

457(g).

|

|

(3)

|

Represents

shares of Common Stock issuable upon the exercise (at a price of

$3.00 per share) of outstanding

warrants.

|

|

(4)

|

Represents

shares of Common Stock issuable upon the exercise (at a price of

$1.50 per share) of outstanding

warrants.

|

|

(5)

|

Represents

shares of Common Stock issuable upon the exercise (at a price of

$0.50 per share) of outstanding

warrants.

|

|

(6)

|

Represents

shares of Common Stock issuable upon the exercise (at a price of

$2.00 per share) of outstanding

warrants.

|

|

(7)

|

These

securities were previously registered on registration statement no.

333-153829 filed

with the SEC on Form S-1 and declared effective on December 31,

2008. Pursuant to Rule 429 of SEC Regulation C, this

registration statement will act as a post-effective amendment with respect

to that prior registration

statement.

|

|

(8)

|

These

securities were previously registered on registration statement no.

333-160949 filed

with the SEC on Form S-1 and declared effective on August 14,

2009. Pursuant to Rule 429 of SEC Regulation C, this

registration statement will act as a post-effective amendment with respect

to that prior registration

statement.

|

2

|

(9)

|

No

fees due as the shares were previously registered in connection with the

filing of the registration statement described in notes (6) and (7) and

the fees were previously paid as part of that

registration.

|

| (10) | Initial exercise price was $2.00, subsequently repriced |

THE

REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS

MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A

FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT

SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE

SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL

BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION

8(a), MAY DETERMINE.

3

SUBJECT

TO COMPLETION, DATED OCTOBER 15, 2009

The

information in this preliminary prospectus is not complete and may be changed.

These securities may not be sold until the registration statement filed with the

Securities and Exchange Commission is effective. This preliminary prospectus is

not an offer to sell nor does it seek an offer to buy these securities in any

jurisdiction where the offer or sale is not permitted.

PROSPECTUS

10,965,791

Shares

Common

Stock

This

prospectus relates to the resale of 10,965,791 shares of our common stock, by

the selling stockholders identified in the selling stockholders tables beginning

on page 37 of this prospectus (“Selling Stockholders”). We will not receive any

proceeds from the sale of these shares by the selling stockholders.

Our

common stock is not presently traded on any market or exchange. On

September 18, 2009, our common shares began quotation on the National

Association of Securities Dealers OTC Bulletin Board (“OTCBB”) under the trading

symbol of GNSZ. As of the date of this prospectus, the trading in our

common shares is limited and accordingly, no public market

exists. The Selling Stockholders may sell their shares at a price of

$1.50 per share or at prevailing market prices or privately negotiated

prices. Thereafter, the Selling Stockholders and any of their

pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of their shares of common stock on any stock exchange in which a market

develops or trading facility on which the shares are traded or in private

transactions.

Our

principal executive offices are located at 2511 N Loop 1604 W,

Suite 204, San Antonio, Texas, 78258, telephone number

210-479-8112.

Investing

in our common stock is highly speculative and involves a high degree of risk.

You should consider carefully the risks and uncertainties in the section

entitled “Risk Factors” of this prospectus.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS

APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR

ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

The date

of this Prospectus is 15.

4

TABLE

OF CONTENTS

|

|

Page

|

|

FORWARD

LOOKING STATEMENTS

|

6

|

|

RISK

FACTORS

|

6

|

|

USE

OF PROCEEDS

|

11

|

|

DIVIDEND

POLICY

|

12

|

|

DETERMINATION

OF OFFERING PRICE

|

12

|

|

OUR

BUSINESS

|

12

|

|

PROPERTIES

|

19

|

|

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

|

20

|

|

LEGAL

PROCEEDINGS

|

29

|

|

MANAGEMENT

|

29

|

|

EQUITY

COMPENSATION PLAN INFORMATION

|

33

|

|

CERTAIN

RELATIONSHIPS AND RELATED TRANSACTIONS

|

34

|

|

PRINCIPAL

STOCKHOLDERS

|

36

|

|

SELLING

STOCKHOLDERS

|

36

|

|

DESCRIPTION

OF SECURITIES

|

46

|

|

MARKET

FOR COMMON EQUITY & RELATED STOCKHOLDER MATTERS

|

47

|

|

SHARES

ELIGIBLE FOR FUTURE SALE

|

47

|

|

PLAN

OF DISTRIBUTION

|

49

|

|

INDEMNIFICATION

OF DIRECTORS AND OFFICERS

|

50

|

|

LEGAL

MATTERS

|

50

|

|

EXPERTS

|

50

|

|

INTERESTS

OF NAMED EXPERTS AND COUNSEL

|

50

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

51

|

|

FINANCIAL

STATEMENTS

|

F-1

|

You may

rely only on the information contained in this prospectus. We have not

authorized anyone to provide information or to make representations not

contained in this prospectus. This prospectus is neither an offer to sell nor a

solicitation of an offer to buy any securities other than those registered by

this prospectus, nor is it an offer to sell or a solicitation of an offer to buy

securities where an offer or solicitation would be unlawful. Neither the

delivery of this prospectus, nor any sale made under this prospectus, means that

the information contained in this prospectus is correct as of any time after the

date of this prospectus.

5

We

urge you to read this entire prospectus carefully, including the” Risk Factors”

section and the financial statements and related notes included in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2008, filed with

the Securities and Exchange Commission (“SEC”) on March 30, 2009 as well as all

subsequent Quarterly Reports on Form 10-Q. As used in this prospectus,

unless context otherwise requires, the words “we,” “us,”“our,” “the Company” and

“GenSpera” refer to GenSpera, Inc. Also, any reference to “common

shares” or “common stock” refers to our $.0001 par value common

stock.

FORWARD

LOOKING STATEMENTS

This

prospectus contains forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act

of 1934 (the "Exchange Act"), which are intended to convey our expectations or

predictions regarding the occurrence of possible future events or the existence

of trends and factors that may impact our future plans and operating results.

These forward-looking statements are derived, in part, from various assumptions

and analyses we have made in the context of our current business plan and

information currently available to us and in light of our experience and

perceptions of historical trends, current conditions and expected future

developments and other factors we believe are appropriate in the circumstances.

You can generally identify forward looking statements through words and phrases

such as “believe”, “expect”,

“seek”, “estimate”, “anticipate”, “intend”, “plan”, “budget”, “project”, “may

likely result”, “may be”, “may continue” and other similar

expressions.

When

reading any forward-looking statement you should remain mindful that actual

results or developments may vary substantially from those expected as expressed

in, or implied by, such statement for a number of reasons or factors, including

but not limited to:

|

|

·

|

our

research and development activities, the development of a viable product,

and the speed with which regulatory authorizations and product launches

may be achieved;

|

|

|

·

|

whether

or not a market for our product develops and, if a market develops, the

rate at which it develops;

|

|

|

·

|

our

ability to sell our products;

|

|

|

·

|

our

ability to attract and retain qualified personnel to implement our

business plan and growth

strategies;

|

|

|

·

|

our

ability to license or develop sales, marketing, and distribution

capabilities;

|

|

|

·

|

the

accuracy of our estimates and

projections;

|

|

|

·

|

our

ability to fund our short-term and long-term financing

needs;

|

|

|

·

|

changes

in our business plan and corporate growth strategies;

and

|

|

|

·

|

other

risks and uncertainties discussed in greater detail in the section

captioned “Risk Factors”

|

RISK

FACTORS

Investing

in our common stock involves a high degree of risk. You should carefully

consider the following risk factors and all other information contained in this

prospectus before purchasing our common stock. If any of the following events

were to occur, our business, financial condition or results of operations could

be materially and adversely affected. In these circumstances, the market price

of our common stock could decline, and you could lose your entire

investment.

Risks

Relating to Our Stage of Development

As a result of

our limited operating history, you cannot rely upon our historical performance

to make an investment decision.

Since

inception in 2003 and through June 30, 2009 we have raised approximately

$6,170,000 in capital. During this same period, we have recorded

accumulated losses totaling $7,590,844. As of June 30, 2009, we had working

capital of $1,750,163 and a deficiency in stockholders’ equity of $186,364. Our

net losses for the two most recent fiscal years ended December 31, 2007 and 2008

have been $691,199 and $3,326,261, respectively. Since inception, we have

generated no revenue.

Our

limited operating history means that there is a high degree of uncertainty in

our ability to: (i) develop and commercialize our technologies and proposed

products; (ii) obtain approval from the U.S. Food and Drug Administration

(“FDA”); (iii) achieve market acceptance of our proposed product, if developed;

(iv) respond to competition; or (v) operate the business, as management has not

previously undertaken such actions as a company. No assurances can be given as

to exactly when, if at all, we will be able to fully develop, commercialize,

market, sell and derive material revenues from our proposed products in

development.

6

We

will need to raise additional capital to continue operations.

We

currently generate no cash. We have relied entirely on external financing to

fund operations. Such financing has historically come from the sale of common

stock to third parties, loans from our Chief Executive Officer and the exercise

of warrants/options. We have expended and will continue to expend substantial

amounts of cash in the development, pre-clinical and clinical testing of our

proposed products. We will require additional cash to conduct drug development,

establish and conduct pre-clinical and clinical trials, support commercial-scale

manufacturing arrangements and provide for the marketing and distribution of our

products if developed. We anticipate that we will require an additional $7

million to take our lead drug through Phase II clinical evaluation, which is

currently anticipated to occur in the fourth quarter of 2011.

From June

through September of 2009, we raised an aggregate of approximately $3,278,000

from the private placement of our securities. We anticipate that our

cash as of September 30, 2009, and will be sufficient to satisfy contemplated

cash requirements through October of 2010, assuming we do not engage in an

extraordinary transaction or otherwise face unexpected events or contingencies,

any of which could affect cash requirements. As of September 30, 2009, we had

cash on hand of approximately $2,614,000 Presently, the Company has

an average monthly cash burn rate of approximately $195,000. We

expect this average monthly cash burn rate to remain constant over the next

thirteen months, assuming we do not engage in an extraordinary transaction or

otherwise face unexpected events or contingencies. Accordingly, we

will need to raise additional capital to fund anticipated operating expenses

after October of 2010. In the event we are not able to secure financing, we may

have to delay, reduce the scope of or eliminate one or more of our research,

development or commercialization programs or product launches or marketing

efforts. Any such change may materially harm our business, financial

condition and operations.

Our long

term capital requirements are expected to depend on many factors,

including:

|

·

|

our

development programs;

|

|

·

|

the

progress and costs of pre-clinical studies and clinical

trials;

|

|

·

|

the

time and costs involved in obtaining regulatory

clearance;

|

|

·

|

the

costs involved in preparing, filing, prosecuting, maintaining and

enforcing patent claims;

|

|

·

|

the

costs of developing sales, marketing and distribution channels and our

ability to sell our products;

|

|

·

|

competing

technological and market

developments;

|

|

·

|

market

acceptance of our proposed products, if

developed;

|

|

·

|

the

costs for recruiting and retaining employees, consultants and

professionals; and

|

|

·

|

the

costs for educating and training physicians about our

products.

|

We cannot

assure you that financing whether from external sources or related parties, will

be available if needed or on favorable terms. If additional financing is not

available when required or is not available on acceptable terms, we may be

unable to fund operations and planned growth, develop or enhance our

technologies, take advantage of business opportunities or respond to competitive

market pressures.

Raising

needed capital may be difficult as a result of our limited operating

history.

When

making investment decisions, investors typically look at a company’s historical

performance in evaluating the risks and operations of the business and the

business’s future prospects. Our limited operating history makes such evaluation

and an estimation of our future performance substantially more difficult. As a

result, investors may be unwilling to invest in us or such investment may be on

terms or conditions which are not acceptable. If we are unable to secure such

additional finance, we may need to cease operations.

Our

independent auditors have issued a qualified report for the year ended December

31, 2008 with respect to our ability to continue as a going

concern.

For the

year ended December 31, 2008, our independent auditor issued a report relating

to our audited financial statements which contains a qualification with respect

to our ability to continue as a going concern because, among other things, our

ability to continue as a going concern is dependent upon our ability to develop

a product and generate profits from operations in the future or to obtain the

necessary financing to meet our obligations and repay our liabilities when they

come due. However, during 2009 we have raised approximately $4,028,000 through

our private placements and we expect that our cash on hand at September 30, 2009

will be sufficient to fund operations through October of 2010.

7

We

may not be able to commercially develop our technologies.

We have

concentrated our research and development on our drug

technologies. Our ability to generate revenue and operate profitably

will depend on our being able to develop these technologies for human

applications. Our technologies are primarily directed toward the development of

cancer therapeutic agents. We cannot guarantee that the results obtained in

pre-clinical and clinical evaluation of our therapeutic agents will be

sufficient to warrant approval by the U.S. Food and Drug Administration (“FDA”).

Even if our therapeutic agents are approved for use by the FDA, there is no

guarantee that they will exhibit an enhanced efficacy relative to competing

therapeutic modalities such that they will be adopted by the medical community.

Without significant adoption by the medical community, our agents will have

limited commercial potential which will likely result in the loss of your entire

investment.

Inability

to complete pre-clinical and clinical testing and trials will impair our

viability.

On

September 4, 2009, we received approval from the FDA for our first

Investigational New Drug application (“IND”) in order to commence clinical

trials. Although we have received approval from the FDA to commence

trials, the outcome of the trials is uncertain and, if we are unable to

satisfactorily complete such trials, or if such trials yield unsatisfactory

results, we will be unable to commercialize our proposed products. No assurances

can be given that the clinical trials will be successful. The failure of such

trials could delay or prevent regulatory approval and could harm our ability to

generate revenues, operate profitably or remain a viable business.

Future

financing will result in dilution to existing stockholders.

We will

require additional financing in the future. We are authorized to issue 80

million shares of common stock and 10 million shares of preferred stock. Such

securities may be issued without the approval or consent of our

stockholders. The issuance of our equity securities in connection with a

future financing will result in a decrease of our current stockholders’

percentage ownership.

Risks

Relating to Intellectual Property and Government Regulation

We

may not be able to withstand challenges to our intellectual property

rights.

We rely

on our intellectual property, including our issued and applied for patents, as

the foundation of our business. Our intellectual property rights may come under

challenge. No assurances can be given that, even if issued, our

patents will survive claims alleging invalidity or infringement on other

patents. The viability of our business will suffer if such patent protection

becomes limited or is eliminated.

We

may not be able to adequately protect our intellectual property.

Considerable

research with regard to our technologies has been performed in countries outside

of the United States. The laws protecting intellectual property in some of those

countries may not provide protection for our trade secrets and intellectual

property. If our trade secrets or intellectual property are

misappropriated in those countries, we may be without adequate remedies to

address the issue. At present, we are not aware of any infringement of our

intellectual property. In addition to our patents, we rely on confidentiality

and assignment of invention agreements to protect our intellectual property.

These agreements provide for contractual remedies in the event of

misappropriation. We do not know to what extent, if any, these

agreements and any remedies for their breach will be enforced by a court. In the

event our intellectual property is misappropriated or infringed upon and an

adequate remedy is not available, our future prospects will greatly

diminish.

Our

proposed products may not receive FDA approval.

The FDA

and comparable government agencies in foreign countries impose substantial

regulations on the manufacture and marketing of pharmaceutical products through

lengthy and detailed laboratory, pre-clinical and clinical testing procedures,

sampling activities and other costly and time-consuming procedures. Satisfaction

of these regulations typically takes several years or more and varies

substantially based upon the type, complexity and novelty of the proposed

product. On September 4, 2009, we received approval from the FDA for

our first IND in order to commence clinical trials. We cannot

assure you that we will successfully complete any clinical trials in connection

with any such IND application. Further, we cannot yet accurately

predict when we might first submit any product license application for FDA

approval or whether any such product license application would be granted on a

timely basis, if at all. Any delay in obtaining, or failure to

obtain, such approvals could have a materially adverse effect on the

commercialization of our products and the viability of the company.

Risks

Relating to Competition

Our

competitors have significantly greater experience and financial

resources.

We

compete against numerous companies, many of which have substantially greater

financial and other resources than us. Several such enterprises have research

programs and/or efforts to treat the same diseases we target. Companies such as

Merck, Ipsen and Diatos, as well as others, have substantially greater resources

and experience than we do and are situated to compete with us

effectively. As a result, our competitors may bring competing

products to market that would result in a decrease in demand for our product, if

developed, which could have a materially adverse effect on the viability of the

company.

8

Risks

Relating to Reliance on Third Parties

We

intend to rely exclusively upon the third-party FDA-approved manufacturers and

suppliers for our products.

We

currently have no internal manufacturing capability, and will rely exclusively

on FDA-approved licensees, strategic partners or third party contract

manufacturers or suppliers. Should we be forced to manufacture our products, we

cannot give you any assurance that we will be able to develop internal

manufacturing capabilities or procure third party suppliers. In the event we

seek third party suppliers, they may require us to purchase a minimum amount of

materials or could require other unfavorable terms. Any such event would

materially impact our prospects and could delay the development and sale of our

products. Moreover, we cannot give you any assurance that any contract

manufacturers or suppliers that we select will be able to supply our products in

a timely or cost effective manner or in accordance with applicable regulatory

requirements or our specifications.

General

Risks Relating to Our Business

We

depend on Craig A. Dionne, PhD, our Chief Executive Officer, and Russell

Richerson PhD, our Chief Operating Officer, for our continued

operations.

The loss

of Craig A. Dionne, PhD, our Chief Executive Officer, or Russell Richerson, PhD,

our Chief Operating Officer, would be detrimental to us. We currently maintain a

one million dollar “key person” life insurance policy on the life of Dr. Dionne

but do not maintain a policy on Dr. Richerson. Our prospects and operations will

be significantly hindered upon the death or incapacity of either of these key

individuals.

We

will require additional personnel to execute our business plan.

Our

anticipated growth and expansion into areas and activities requiring additional

expertise, such as clinical testing, regulatory compliance, manufacturing and

marketing, will require the addition of new management personnel and the

development of additional expertise by existing management. There is intense

competition for qualified personnel in such areas. There can be no

assurance that we will be able to continue to attract and retain the qualified

personnel necessary for the development of our business.

Our

business is dependent upon securing sufficient quantities of a natural product

that currently grows in very specific locations outside of the United

States.

The

therapeutic component of our products, including our lead compound G-202, is

referred to as 12ADT. 12ADT functions by dramatically raising the levels of

calcium inside cells, which leads to cell death. 12ADT is derived from a

material called thapsigargin. Thapsigargin is derived from the seeds of a plant

referred to as Thapsia

garganica which grows along the coastal regions of the

Mediterranean. We currently secure the seeds from Thapsibiza, SL, a third party

supplier. There can be no assurances that the countries from which we can

secure Thapsia

garganica will continue to allow Thapsibiza, SL to collect such

seeds and/or to do so and export the seeds derived from Thapsia garganica

to the United States. In the event we are no longer able to import

these seeds, we will not be able to produce our proposed drug and our business

will be adversely affected.

The

current manufacturing process of G-202 requires acetonitrile.

The

current manufacturing process for G-202 requires the common solvent

acetonitrile. Beginning in late 2008, there has been a worldwide shortage of

acetonitrile for a variety of reasons, and this shortage is predicted to last at

least until the end of 2009 and possibly into future years. We have also

observed that the available supply of acetonitrile is of variable quality, some

of which is not suitable for our purposes. If we are unable to

successfully change our manufacturing methods to avoid the reliance upon

acetonitrile, we may incur prolonged production timelines and increased

production costs. In an extreme case this situation could adversely affect our

ability to manufacture G-202 altogether, thus significantly impacting our future

operations.

In

order to secure market share and generate revenues, our proposed products must

be accepted by the health care community.

Our

proposed products, if approved for marketing, may not achieve market acceptance

since hospitals, physicians, patients or the medical community in general may

decide not to accept and utilize them. We are attempting to develop products

that will likely be first approved for marketing in late stage cancer where

there is no truly effective standard of care. If approved for use in late stage,

the drugs will then be evaluated in earlier stage where they would represent

substantial departures from established treatment methods and will compete with

a number of more conventional drugs and therapies manufactured and marketed by

major pharmaceutical companies. It is too early in the development cycle of the

drugs for us to accurately predict our major

competitors. Nonetheless, the degree of market acceptance of any of

our developed products will depend on a number of factors,

including:

|

|

·

|

our demonstration to the medical

community of the clinical efficacy and safety of our proposed

products;

|

|

|

·

|

our ability to create products

that are superior to alternatives currently on the

market;

|

9

|

|

·

|

our ability to establish in the

medical community the potential advantage of our treatments over

alternative treatment methods;

and

|

|

|

·

|

the reimbursement policies of

government and third-party

payors.

|

If the

health care community does not accept our products for any of the foregoing

reasons, or for any other reason, our business will be materially

harmed.

We

may be required to secure land for cultivation and harvesting of Thapsia

garganica.

We

believe that we can satisfy our needs for clinical development of G-202 through

completion of Phase III clinical studies from Thapsia garganica that grows

naturally in the wild. In the event G-202 is approved for commercial

marketing, our current supply of Thapsia garganica may not be

sufficient for the anticipated demand. We estimate that in order to

secure sufficient quantities of Thapsia garganica for the

commercialization of a product comprising G-202, we will need to secure

approximately 100 acres of land to cultivate and grow Thapsia

garganica. We anticipate the cost to lease such land

would be $40,000 per year but have not yet fully assessed what other costs would

be associated with a full-scale farming operation. There can be no assurances

that we can secure such acreage, or that even if we are able to do so, that we

could adequately grow sufficient quantities of Thapsia garganica to satisfy

any commercial objectives that involve G-202. Our inability to secure adequate

seeds will result in us not being able to develop and manufacture our proposed

drug and will adversely impact our business.

Thapsia

garganica and Thapsigargin can cause severe skin irritation.

It has

been known for centuries that the plant Thapsia garganica can cause

severe skin irritation when contact is made between the plant and the

skin. In 1978, thapsigargin was determined to be the skin-irritating

component of the plant Thapsia

garganica. The therapeutic component of our products, including our lead

product G-202, is derived from thapsigargin. We obtain thapsigargin from the

above-ground seeds of Thapsia

garganica. These seeds are harvested by hand and those conducting the

harvesting must wear protective clothing and gloves to avoid skin contact.

Although we obtain the seeds from a third-party contractor located in Spain, and

although the contractor has contractually waived any and all liability

associated with collecting the seeds, it is possible that the contractor or

those employed by the contractor may suffer medical issues related to the

harvesting and subsequently seek compensation from us via, for example,

litigation. No assurances can be given, despite our contractual

relationship with the third party contractor, that we will not be the subject of

litigation related to the harvesting.

The

synthesis of 12ADT must be conducted in special facilities.

There are

a limited number of manufacturing facilities qualified to handle and manufacture

using toxic agents for therapeutic compounds. This limits the potential number

of possible manufacturing sites for our therapeutic compounds derived from Thapsia

garganica. No assurances can be provided that these

facilities will be available for the manufacture of our therapeutic compounds

under our time schedules or within the parameters of our manufacturing budget.

In the event facilities are not available for manufacturing our therapeutic

compounds, our business and future prospects will be adversely

affected.

Our

lead therapeutic compound, G-202, has not been subjected to large scale

manufacturing procedures.

To date,

G-202 has only been manufactured at a scale adequate to supply early stage

clinical trials. There can be no assurances that the current procedure for

manufacturing G-202 will work at a larger scale adequate for commercial

needs. In the event G-202 cannot be manufactured in sufficient

quantities, our future prospects could be significantly impacted.

We

do not have product liability insurance.

The

testing, manufacturing, marketing and sale of human therapeutic products entail

an inherent risk of product liability claims. We cannot assure you

that substantial product liability claims will not be asserted against

us. In the event we are forced to expend significant funds on

defending product liability actions beyond our current coverage, and in the

event those funds come from operating capital, we will be required to reduce our

business activities, which could lead to significant losses.

We

cannot assure you that adequate insurance coverage will be available in the

future on acceptable terms.

Insurance

availability, coverage terms and pricing continue to vary with market

conditions. We will endeavor to obtain appropriate insurance coverage for

insurable risks that we identify. We may not be able to obtain

appropriate insurance coverage. The occurrence of any claim may have

an adverse material effect on our business.

10

Risks

Relating To Our Common Stock

There

is no public market for our securities.

On

September 18, 2009, our common shares began quotation on the

OTCBB. Notwithstanding, there has been little or no trading in our

common shares. Accordingly, there is no public market for our

securities. An investment in our common stock should be considered

totally illiquid. No assurances can be given that a public market for

our securities will ever materialize. Additionally, even if a public market for

our securities develops and our securities become traded, the trading volume may

be limited, making it difficult for an investor to sell shares.

We

face risks related to compliance with corporate governance laws and financial

reporting standards.

The

Sarbanes-Oxley Act of 2002, as well as related new rules and regulations

implemented by the SEC and the Public Company Accounting Oversight Board,

require changes in the corporate governance practices and financial reporting

standards for public companies. These new laws, rules and regulations, including

compliance with Section 404 of the Sarbanes-Oxley Act of 2002 relating to

internal control over financial reporting (“Section 404”), will materially

increase the Company's legal and financial compliance costs and make some

activities more time-consuming and more burdensome. As a result, management will

be required to devote more time to compliance which could result in a reduced

focus on the development thereby adversely affecting the Company’s development

activities. Also, the increased costs will require the Company to seek financing

sooner that it may otherwise have had to.

Starting

in 2007, Section 404 of the Sarbanes-Oxley Act of 2002 requires that

our management assess the company’s internal control over financial

reporting annually and include a report on such assessment in our annual report

filed with the SEC. Effective December 15, 2009 for a smaller reporting company,

our independent registered public accounting firm is required to audit both the

design and operating effectiveness of our internal controls and management's

assessment of the design and the operating effectiveness of such internal

controls.

Because

of our limited resources, management has concluded that our internal control

over financial reporting may not be effective in providing reasonable assurance

regarding the reliability of financial reporting and the preparation of

financial statements for external purposes in accordance with U.S. generally

accepted accounting principles.

To

mitigate the current limited resources and limited employees, we rely heavily on

direct management oversight of transactions, along with the use of legal and

accounting professionals. As we grow, we expect to increase our number of

employees, which will enable us to implement adequate segregation of duties

within the Committee of Sponsoring Organizations of the Treadway Commission

internal control framework.

We do not intend

to pay cash dividends.

We do not

anticipate paying cash dividends in the foreseeable future. Accordingly, any

gains on your investment will need to come through an increase in the price of

our common stock. The lack of a market for our common stock makes

such gains highly unlikely.

Our

board of directors has broad discretion to issue additional

securities.

We are

entitled under our certificate of incorporation to issue up to 80,000,000 common

and 10,000,000 “blank check” preferred shares. Blank check preferred shares

provide the board of directors broad authority to determine voting, dividend,

conversion, and other rights. As of September 30, 2009, we have issued and

outstanding 15,292,281 common shares and we have 7,884,502 common shares

reserved for issuance upon the exercise of current outstanding options, warrants

and convertible securities. Accordingly, we will be entitled to issue up to

56,823,217 additional common shares and 10,000,000 additional preferred shares.

Our board may generally issue those common and preferred shares, or options or

warrants to purchase those shares, without further approval by our

shareholders. Any preferred shares we may issue will have such

rights, preferences, privileges and restrictions as may be designated from

time-to-time by our board, including preferential dividend rights, voting

rights, conversion rights, redemption rights and liquidation provisions. It is

likely that we will be required to issue a large amount of additional securities

to raise capital to further our development and marketing plans. It is also

likely that we will be required to issue a large amount of additional securities

to directors, officers, employees and consultants as compensatory grants in

connection with their services, both in the form of stand-alone grants or under

our various stock plans. The issuance of additional securities may cause

substantial dilution to our shareholders.

Our

Officers and Scientific Advisors beneficially own approximately 47% of our

outstanding common shares.

Our

Officers and Scientific Advisors own approximately 47% of our issued and

outstanding common shares. As a consequence of their level of stock ownership,

the group will substantially retain the ability to elect or remove members of

our board of directors, and thereby control our management. This group of

shareholders has the ability to significantly control the outcome of corporate

actions requiring shareholder approval, including mergers and other changes of

corporate control, going private transactions, and other extraordinary

transactions any of which may be in opposition to the best interest of the other

shareholders and may negatively impact the value of your

investment.

USE

OF PROCEEDS

We will

not receive any of the proceeds from the sale of the shares by any of the

selling stockholders, but we will receive up to $3,431,687 upon the exercise of

warrants in the event they are exercised for cash. We will use the proceeds

received from the exercise of warrants, if any, for working

capital.

11

DIVIDEND

POLICY

We have

never paid or declared cash dividends on our common stock, and we do not intend

to pay or declare cash dividends on our common stock in the foreseeable

future.

DETERMINATION

OF OFFERING PRICE

The

Selling Stockholders will initially offer their shares at $1.50 per share until

such time as a public market develops, if ever. Once traded, the

shares will be offered at prevailing market prices, privately negotiated prices,

or in any other fashion as described in the section of this Prospectus entitled

“Plan of

Distribution.” The selling price has no relationship to any

established criteria of value, such as book value or earnings per

share. The price was chosen arbitrarily.

OUR

BUSINESS

Our

History

We are a

biotechnology company focused on the discovery and development of pro-drug

cancer therapeutics, an emerging medical science. A pro-drug is an inactive

precursor of a drug that is converted into its active form only at the site of

the tumor. We were incorporated as a Delaware corporation in

2003.

In early

2004, the intellectual property underlying our technologies was assigned from

Johns Hopkins University to the co-inventors, Dr. John Isaacs, Dr. Soren

Christensen, Dr. Hans Lilja and Dr. Samuel Denmeade. The Co-inventors

granted us an option to license the intellectual property in return for our

continued prosecution of the patent portfolio containing the intellectual

property. This option was exercised in early 2008 by reimbursement of past

patent prosecution costs previously incurred by Johns Hopkins University.

Subsequently, the co-inventors assigned us the intellectual property in April of

2008. Our activities during the period of 2004-2007 were limited to the

continued prosecution of the relevant patents.

Dr. John

Isaacs and Dr. Sam Denmeade serve on our Scientific Advisory Board as Chief

Scientific Advisor and Chief Medical Advisor, respectively. Dr Soren

Christensen and Dr. Hans Lilja also serve on the Company’s Scientific Advisory

Board. We currently have no oral or written agreements with

Johns Hopkins University with regard to any other intellectual

property or research activities.

The

Potential of Our Pro-Drug Therapies

Cancer

chemotherapy involves treating patients with cytotoxic drugs (compounds or

agents that are toxic to cells). Chemotherapy is often combined with surgery or

radiation in the treatment of early stage disease and it is the preferred, or

only, treatment option for many forms of cancer in later stages of the disease.

However, major drawbacks of chemotherapy include:

|

Side

effects

|

|

Non-cancer

cells in the body are also affected, often leading to serious side

effects.

|

|

Incomplete

tumor kill

|

|

Many

of the leading chemotherapeutic agents act during the process

of cell division - they might be effective with tumors comprised of

rapidly-dividing cells, but are much less effective for tumors that

contain cells that are slowly

dividing.

|

|

Resistance

|

|

Cancers

will often develop resistance to current drugs after repeated exposure,

limiting the number of times that a treatment can be effectively

applied.

|

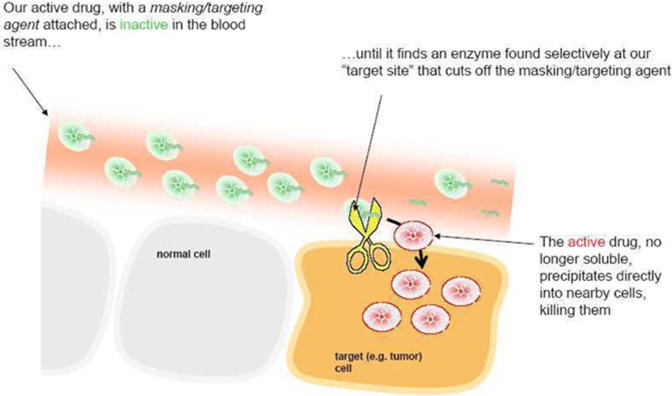

Pro-drug

chemotherapy is a relatively new approach to cancer treatment that is being

investigated as a means to get higher concentrations of cytotoxic agents at the

tumor location while avoiding the toxicity of these high doses in the rest of

the body. An inactive form of a cytotoxin (referred to as the “pro-drug”) is

administered to the patient. The pro-drug is converted into the active cytotoxin

only at the tumor site.

We

believe that, if successfully developed, pro-drug therapies have the potential

to provide an effective therapeutic approach to a broad range of solid tumors.

We have proprietary technologies that we believe appears, in animal models, to

meet the requirements for an effective pro-drug. In addition, we believe that

our cytotoxin addresses two other issues prevalent with current cancer drugs -

it kills slowly- and non-dividing cancer cells as well as rapidly dividing

cancer cells, and does not appear to trigger the development of resistance to

its effects.

Our

Technology

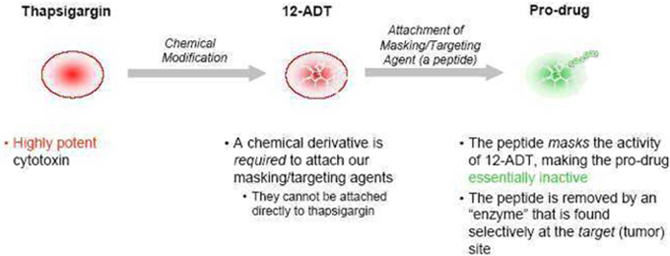

Our

technology supports the creation of pro-drugs by attaching “masking/targeting

agents” (agents that simultaneously mask the toxicity of the cytotoxin and help

target the cytotoxin to the tumor) to the cytotoxin “12ADT”, and does so in a

way that allows conversion of the pro-drug to its active form selectively at the

site of tumors. We own patents that contain claims that cover 12ADT as a

composition of matter.

12

Cytotoxin

12ADT is

a chemically modified form of thapsigargin, a cytotoxin that kills fast-, slow-

and non-dividing cells. Our two issued core patents, both entitled “ Tissue Specific Prodrug, ”

contain claims which cover the composition of 12ADT.

Masking/Targeting

Agent

We use

peptides as our masking/targeting agents. Peptides are short strings of

amino-acids, the building blocks of many components found in cells. When

attached to 12ADT, they can make the cytotoxin inactive - once removed, the

cytotoxin is active again. Our technology takes advantage of the fact that the

masking peptides can be removed by chemical reactors in the body called enzymes,

and that the recognition of particular peptides by particular enzymes can be

very specific. The peptides also make 12ADT soluble in blood. When it is

removed, 12ADT returns to its natural insoluble state and precipitates directly

into nearby cells.

How

we make our pro-drugs

How

our pro-drugs work

13

Our

Approach

Our

approach is to identify specific enzymes that are found at high levels in tumors

relative to other tissues in the body. Upon identifying these enzymes, we create

peptides that are recognized predominantly by those enzymes in the tumor and not

by enzymes in normal tissues. This double layer of recognition adds to the

tumor-targeting found in our pro-drugs. Because the exact nature of our

masking/targeting peptides is so refined and specific, they form the basis for

another set of our patents and patent applications on the combination of the

peptides and 12ADT.

Our

Pro-Drug Development Candidates

We

currently have four pro-drug candidates identified based on this technology, as

summarized in the table below (at this time we are only developing

G-202):

|

Pro-Drug Candidate

|

Activating enzyme

|

Target location of activation

enzyme

|

Status

|

||||

|

G-202

|

Prostate

Specific Membrane Antigen (PSMA)

|

The

blood vessels of all solid tumors

|

·

|

Investigational

New Drug Application planned is filed with the US Food and Drug

Administration. Currently on Clinical Hold pending our response to

questions.

|

|||

|

G-114

|

Prostate

Specific Antigen (PSA)

|

Prostate

cancers

|

·

|

Validated

efficacy in pre-clinical animal models (Johns Hopkins

University)

|

|||

|

G-115

|

Prostate

Specific Antigen (PSA)

|

Prostate

cancers

|

·

|

Validated

efficacy in pre-clinical animal models (Johns Hopkins

University)

|

|||

|

Ac-GKAFRR-L12ADT

|

Human

glandular kallikrein 2 (hK2)

|

Prostate

cancers

|

·

|

Validated

efficacy in pre-clinical animal models (Johns Hopkins

University)

|

|||

Strategy

Business

Strategy

We plan

to develop a series of therapies based on our pro-drug technology platform and

bring them through Phase I/II clinical trials.

Manufacturing

and Development Strategy

Under the

planning and direction of key personnel, we expect to outsource all of our Good

Laboratory Practices (“GLP”) preclinical development activities (e.g.,

toxicology) and Good Manufacturing Practices (“GMP”) manufacturing and clinical

development activities to contract research organizations (“CRO”) and contract

manufacturing organizations (“CMO”). Manufacturing will also be outsourced

to organizations with approved facilities and manufacturing

practices.

Commercialization

Strategy

We intend

to license our drug compounds to third parties after Phase I/II clinical trials.

It is expected that such third parties would then continue to develop, market,

sell, and distribute the resulting products.

Market

and Competitive Considerations

G-202

Our

primary focus is the opportunity offered by our lead pro-drug candidate, G-202.

We believe that we have validated G-202 as a drug candidate to treat various

forms of solid tumors; including breast, urinary bladder, kidney and prostate

cancer based on the ability of G-202 to cause tumor regression in animal models.

We filed our first IND for G-202 on June 23, 2009. On September 4,

2009, we received approval from the FDA for our first IND in order to commence

clinical trials. Although we have received approval from the FDA to

commence trials, the outcome of the trials is uncertain and, if we are unable to

satisfactorily complete such trials, or if such trials yield unsatisfactory

results, we will be unable to commercialize our proposed products. We

plan to begin the clinical evaluation of G-202 in late 2009. We hope to

eventually demonstrate that G-202 is more efficacious than current commercial

products that treat solid tumors by disrupting their blood

supply.

14

Potential

Markets for G-202

We

believe that if successfully developed, G-202 has the potential to treat a range

of solid tumors by disrupting their blood supply. It is too early in the

development process to determine target indications. The table below summarizes

a number of the potential United States patient populations which we believe may

be amenable to this therapy and represent potential target markets.

|

Estimated Number of

|

Probability of

Developing

(birth to death)

|

||||||||

|

Cancer

|

New Cases (2006)

|

Male

|

Female

|

||||||

|

Prostate

|

234,460 |

1

in 6

|

-

|

||||||

|

Breast

|

214,640 |

n/a

|

1

in 8

|

||||||

|

Urinary

Bladder

|

61,420 |

1

in 28

|

1

in 88

|

||||||

|

Kidney

Cancer

|

38,890 |

n/a

|

n/a

|

||||||

Source: CA Cancer J. Clin 2006;

56;106-130

The

clinical opportunity for G-202

We

believe that current anti-angiogenesis drugs (drugs that disrupt the blood

supply to tumors) validate the clinical approach and market potential of

G-202. Angiogenesis is the physiological process involving the growth

of new blood vessels from pre-existing vessels and is a normal process in growth

and development, as well as in wound healing. Angiogenesis is also a

fundamental step in the development of tumors from a clinically insignificant

size to a malignant state because no tumor can grow beyond a few millimeters in

size without the nutrition and oxygenation that comes from an associated blood

supply. Interrupting this process has been targeted as a point of intervention

for slowing or reversing tumor growth. A well known example of a successful

anti-angiogenic approach is the recently approved drug, Avastin TM , a monoclonal antibody that

inhibits the activity of Vascular Endothelial Growth Factor (“VEGF”), which is

important for the growth and survival of endothelial cells.

These

types of anti-angiogenic drugs have only a limited therapeutic effect with

increased median patient survival times of only a few months. Our approach is

designed to destroy both the existing and newly growing tumor vasculature,

rather than just block new blood vessel formation. We anticipate that this

approach will lead to a more immediate collapse of the tumors nutrient supply

and consequently an enhanced rate of tumor destruction.

G-202

destroys new and existing blood vessels in tumors

Competition

The

pharmaceutical, biopharmaceutical and biotechnology industries are very

competitive, fast moving and intense, and expected to be increasingly so in the

future. Although we are not aware of any competitor who is developing a

drug that is designed to destroy both the existing and newly growing tumor

vasculature in a manner similar to G-202, there are several marketed drugs and

drugs in development that attack tumor-associated blood vessels to some degree.

For example, Avastin TM

is a marketed product that acts predominantly as an anti-angiogenic

agent. Zybrestat TM

is another drug in development that is described as a

vascular-disrupting agent that inhibits blood flow to tumors. It is impossible

to accurately ascertain how well our drug will compete against these or other

products that may be in the marketplace until we have human patient data for

comparison.

15

Other

larger and well funded companies have developed and are developing drug

candidates that, if not similar in type to our drug candidates, are designed to

address the same patient or subject population. Therefore, our lead

product, other products in development, or any other products we may acquire or

in-license may not be the best, the safest, the first to market, or the most

economical to make or use. If a competitor’s product or product in

development is better than ours, for whatever reason, then our ability to

license our technology could be diminished and our sales could be lower than

that of competing products, if we are able to generate sales at

all.

Patents

and Proprietary Rights

Our

success will likely depend upon our ability to preserve our proprietary

technologies and operate without infringing on the proprietary rights of other

parties. However, we may rely on certain proprietary technologies and know-how

that are not patentable or that we determine to keep as trade secrets. We

protect our proprietary information, in part, by the use of confidentiality and

assignment of invention agreements with our officers, directors, employees,

consultants, significant scientific collaborators and sponsored researchers that

generally provide that all inventions conceived by the individual in the course

of rendering services to us shall be our exclusive property.

The

intellectual property underlying our technology is covered by certain patents

and patent applications previously owned by the Johns Hopkins University

("JHU"). In early 2004, the intellectual property underlying the Company’s

technologies was assigned from JHU to the co-inventors, Dr. John Isaacs, Dr.

Soren Christensen, Dr. Hans Lilja and Dr. Samuel Denmeade, who in turn granted

us an option to license the intellectual property in return for our continued

prosecution of the patent portfolio. This option was exercised in early 2008 by

payment to the co-inventors of past patent prosecution costs previously incurred

by Johns Hopkins University (approximately $122,000) and additional fees

(approximately $62,000) to cover the tax consequences of such payments to the

co-inventors. Subsequently, the co-inventors assigned us the intellectual

property in April of 2008 and we recorded these assignments in the United

States Patent & Trademark Office. By virtue of the April 2008 assignments,

we have no further financial obligations to the inventors or to JHU with regard

to the assigned intellectual property. JHU retains a paid-up, royalty-free,

non-exclusive license to use the intellectual property for non-profit

purposes. Each of the co-inventors remains affiliated with the Company as

a member of the Scientific Advisory Board.

|

Number

|

Country

|

Filing

Date

|

Issue Date

|

Expiration

Date

|

Title

|

||||||

|

Patents

Issued

|

|||||||||||

|

6,504,014

|

US

|

6/7/00

|

1/7/2003

|

6/6/2020

|

Tissue

specific pro-drug (TG)

|

||||||

|

6,545,131

|

US

|

7/28/00

|

4/8/2003

|

7/27/2020

|

Tissue

specific pro-drug (TG)

|

||||||

|

6,265,540

|

US

|

5/19/98

|

7/24/2001

|

5/18/2018

|

Tissue

specific pro-drug (PSA)

|

||||||

|

6,410,514

|

US

|

6/7/00

|

6/25/2002

|

6/6/2020

|

Tissue

specific pro-drug (PSA)

|

||||||

|

7,053,042

|

US

|

7/28/00

|

5/30/2006

|

7/27/2020

|

Activation

of peptide pro-drugs by HK2

|

||||||

|

7,468,354

|

US

|

11/30/01

|

12/23/08

|

11/29/2021

|

Tissue

specific pro-drug

(G-202,

PSMA)

|

||||||

|

Patents

Pending

|

|||||||||||

|

US

2008/0247950

|

US

|

3/15/07

|

Pending

|

N/A

|

Activation

of peptide pro-drugs by HK2

|

||||||

|

US

2007/0160536

|

US

|

1/6/2006

|

Pending

|

N/A

|

Tumor

Activated Pro-drugs (PSA,G-115)

|

||||||

|

US

2009/0163426

|

US

|

11/25/08

|

Pending

|

N/A

|

Tumor

specific pro-drugs (PSMA)

|

16

When

appropriate, we will continue to seek patent protection for inventions in our

core technologies and in ancillary technologies that support our core

technologies or which we otherwise believe will provide us with a competitive

advantage. We will accomplish this by filing and maintaining patent applications

for discoveries we make, either alone or in collaboration with scientific

collaborators and strategic partners. Typically, we plan to file patent

applications in the United States. In addition, we plan to obtain licenses or

options to acquire licenses to patent filings from other individuals and

organizations that we anticipate could be useful in advancing our research,

development and commercialization initiatives and our strategic business

interest.

Manufacturing

& Development

12ADT is

manufactured by chemically modifying the cytotoxin thapsigargin, which is

isolated from the seeds of

Thapsia garganica, a plant found in the Mediterranean. Our pro-drug,

G-202, is then manufactured by attaching a specific peptide to

12ADT.

Outsource

Manufacturing

To

leverage our experience and available financial resources, we do not plan to

develop company-owned or company-operated manufacturing facilities. We plan to

outsource all drug manufacturing to contract manufacturers that operate in

compliance with GMP. We may also seek to refine the current manufacturing

process and final drug formulation to achieve improvements in storage

temperatures and the like.

Supply

of Raw Materials – Thapsibiza SL

To our

knowledge, there is only one commercial supplier of Thapsia garganica seeds. In

April 2007, we obtained the proper permits from the United States Department of

Agriculture (“USDA”) for the importation of Thapsia garganica

seeds. In January 2008, we entered into a sole source agreement with this

supplier, Thapsibiza, SL. The material terms of the agreement are as

follows:

|

Term

|

|

The

term of the agreement is for 5 years.

|

|

Exclusivity

|

Thapsibiza

shall exclusively provide Thapsia garganica

seeds to the Company. The Company has the ability to seek addition

suppliers to supplement the supply from Thapsibiza, SL.

|

|

|

Pricing

|

The

price shall be 300 Euro/kg. Thapsibiza may, from time to time, without

notice, increase the price to compensate for any increased governmental

taxes.

|

|

|

Minimum

Order

|

Upon

successfully securing $5,000,000 of equity financing, and for so long as

the Company continues to develop drugs derived from thapsigargin, the

minimum purchase shall be 50kg per harvest period year.

|

|

|

Indemnification

|

Once

the product is delivered to an acceptable carrier, the Company shall be

responsible for an injury or damage result from the handling of the

product. Prior to delivery, Thapsibiza shall be solely

responsible.

|

Government

Regulation

The FDA,

as well as drug regulators in state and local jurisdictions, imposes substantial

requirements upon the clinical development, manufacturing and marketing of

pharmaceutical products. The process we are required by the FDA to

complete before our drug compound may be marketed in the U.S. generally involves

the following:

|

·

|

Preclinical

laboratory and animal tests;

|

|

|

·

|

Submission

of an IND, which must become effective before human clinical trials may

begin;

|

|

|

·

|

Adequate

and well-controlled human clinical trials to establish the safety and

efficacy of the product candidate for its intended use;

|

|

|

·

|

Submission

to the FDA of an New Drug Application (“NDA”); and

|

|

|

·

|

FDA

review and approval of an

NDA.

|

The

testing and approval process requires substantial time, effort, and financial

resources, and we cannot be certain that any approval will be granted on an

expeditious basis, if at all. Preclinical tests include laboratory

evaluation of the drug candidate, its chemistry, formulation and stability, as

well as animal studies to assess the potential safety and efficacy of the drug

candidate. Certain preclinical tests must be conducted in compliance with

good laboratory practice regulations. Violations of these regulations can, in

some cases, lead to invalidation of the studies, requiring such studies to be

replicated. In some cases, long-term preclinical studies are conducted

while clinical studies are ongoing.

17

The

results of the preclinical tests, together with manufacturing information and

analytical data, are submitted to the FDA as part of an IND, which must become

effective before we may begin human clinical trials. The IND automatically

becomes effective 30 days after receipt by the FDA, unless the FDA, within the

30-day time period, raises concerns or questions about the conduct of the trials

as outlined in the IND and imposes a clinical hold. In such a case, the

IND sponsor and the FDA must resolve any outstanding concerns before clinical

trials can begin. Our submission of an IND may not result in FDA

authorization to commence clinical trials for any particular compound. All

clinical trials must be conducted under the supervision of a qualified

investigator in accordance with good clinical practice regulations. These

regulations include the requirement that all prospective patients provide

informed consent. Further, an independent Institutional Review Board (“IRB”) at

each medical center proposing to conduct the clinical trials must review and

approve any clinical study. The IRB also monitors the study and must be

kept informed of the study’s progress, particularly as to adverse events and

changes in the research. Progress reports detailing the results of the

clinical trials must be submitted at least annually to the FDA and more

frequently if adverse events occur.

Human

cancer drug clinical trials are typically conducted in three sequential phases

that may overlap:

|

·

|

Phase

I: The drug candidate is initially introduced into cancer patients and

tested for safety and tolerability at escalating

dosages,

|

|

·

|

Phase

II: The drug candidate is studied in a limited cancer patient population

to further identify possible adverse effects and safety risks, to evaluate

the efficacy of the drug candidate for specific targeted diseases and to

determine dosage tolerance and optimal

dosage.

|

|

·

|

Phase

III: When Phase II evaluations demonstrate that a dosage range of the drug

candidate may be effective and has an acceptable safety profile, Phase III

trials are undertaken to further evaluate dose response, clinical efficacy

and safety profile in an expanded patient population, often at

geographically dispersed clinical study

sites.

|

Our

business strategy is to bring our drug candidates through Phase I/II clinical

trials before licensing them to third parties who would then further develop the

drugs and seek marketing approval. Once the drug is approved, the third party

licensee will be expected to market, sell, and distribute the products in

exchange for some combination of up-front payments, royalty payments, and

milestone payments. Management cannot be certain that we, or our licensees, will

successfully initiate or complete Phase I, Phase II, or Phase III testing of our