Attached files

| file | filename |

|---|---|

| EX-5.1 - UNANIMOUS WRITTEN CONSENT DATED OCTOBER 8, 2009 - SOCIAL CUBE INC | exhibit5-1.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - SOCIAL CUBE INC | exhibit2-1.htm |

| EX-5.2 - WRITTEN CONSENTS DATED AS OF OCTOBER 8, 2009 - SOCIAL CUBE INC | exhibit5-2.htm |

| EX-99.1 - FINANCIAL STATEMENTS - SOCIAL CUBE INC | exhibit99-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 7, 2009

LEXON TECHNOLOGIES

INC.

(Exact name of registrant as specified in its

charter)

| Delaware | 0-24721 | 87-0502701 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

8 Corporate Park Suite 300 Irvine, CA

92606

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (949) 752-7700

________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

1

SECTION 1 - REGISTRANT’S BUSINESS AND OPERATIONS

ITEM 1.01 Entry into a Material Definitive Agreement.

See Item 2.01 for a description of the agreement and plan of merger, dated October 7, 2009, by and between Lexon Technologies, Inc. (“Lexon” or “our predecessor” or the “Company”) and Paragon Toner, Inc. (“Paragon").

SECTION 2 - FINANCIAL INFORMATION

ITEM 2.01. Completion of Acquisition or Disposition of Assets.

MERGER AGREEMENT

On October 7, 2009, Paragon, a California corporation, entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Lexon, a Delaware corporation, whereby our predecessor will issue 347,448,444 shares of common stock (the “Common Stock”) of the Company (the “Acquisition Shares”) to the shareholders of Paragon, representing approximately 67% of the issued and outstanding Common Stock after completion of the merger. The effective date of the Merger will be October 22, 2009 (“Effective Date”). We have decided to maintain the name of our predecessor company

The Company agrees to file a registration statement registering the Common Stock, subject to Securities and Exchange Commission (“SEC”) limitations.

In connection with the Merger and in addition to the foregoing, Mssrs. Joon Ho Chang and Kyu Hong Hwang resigned as the Directors of the Company. Mr. Hyung Soon Lee resigned as the Chief Executive Officer but will remain as a director of the Company. The following executive officers and directors of Paragon were appointed as executive officers and directors of the Company:

| Name | Title | |

| James Park | President, Chief Executive Officer and Chairman of the Board of Directors | |

| Young Won | Chief Operating Officer and Director | |

| Bong S. Park | Chief Financial Officer and Director |

SUMMARY

Paragon was founded in the state of California in 1993 and incorporated as an S Corp in 2004. Lexon was incorporated under the laws of the State of Delaware on April 20, 1989 under the name of California Cola Distributing Company, Inc. The name was later changed to Rexford, Inc. on October 1, 1992. Effective July 21, 1999, the name of the Company was changed from Rexford, Inc. to Lexon Technologies, Inc. We have opted to keep the name of Lexon Technologies Inc, and use a dba name of Paragon Toner going forward. For the purposes of this document, Paragon will signify the name of the main operation of the Company.

Paragon is in the business of manufacturing, marketing and selling recycled monochrome and color toner cartridges for laser printers and other related devices.

Paragon’s executive offices are located at 14830 Desman Road, La Mirada, CA 90638 and Paragon’s telephone number at such address is (714) 522-0260 and will be the business address of Lexon Technologies, Inc. after completion of the Merger.

FORWARD-LOOKING STATEMENTS

Statements in this current report on Form 8-K may be “forward-looking statements.” Forward-looking statements

2

include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this prospectus, including the risks described under “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this current report and in other documents which we file with the Securities and Exchange Commission. In addition, such statements could be affected by risks and uncertainties related to our ability to raise any financing which we may require for our operations, competition, government regulations and requirements, pricing and development difficulties, our ability to make acquisitions and successfully integrate those acquisitions with our business, as well as general industry and market conditions and growth rates, and general economic conditions. Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this current report.

RISK FACTORS

An investment in the Common Stock involves a high degree of risk. In determining whether to purchase the Common Stock, an investor should carefully consider all of the material risks described below, together with the other information contained in this report before making a decision to purchase the Company’s securities. An investor should only purchase the Company’s securities if he or she can afford to suffer the loss of his or her entire investment.

Risks Related to our Business

We may not maintain profitability.

Although we do not have a history of operating losses, we may incur additional substantial operating expenses for the foreseeable future in attempts to expand our business operations and/or marketing efforts, thereby potentially causing us to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. In such a situation, we may need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or maintain profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our Common Stock and investors may lose all or a substantial amount of their investment.

We will need significant additional capital, which we may be unable to obtain.

As of June 30, 2009, we had cash available of approximately $115,128, which we anticipate is likely to be sufficient only to allow the Company to fund its current operations. However, should our business encounter certain difficulties or our business plan not be realized for whatever reason, we will need additional capital in the future. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. If we are unable to raise substantial capital, investors may lose all or a substantial amount of their investment.

If our strategy is unsuccessful, we will not be profitable and our shareholders could lose their investment.

We believe there are few case precedents for companies pursuing our type of business strategy, and there is no guarantee that our strategy will be successful or profitable. If our strategy is unsuccessful, we will fail to meet our objectives and not realize the revenues or profits from the business we pursue, which would cause the value of the Company to decrease, thereby potentially causing in all likelihood, our shareholders to lose their investment.

We may not be able to effectively control and manage our proposed growth business plan, which would negatively impact our operations.

If our business and markets grow and develop, of which there are no assurances, it will be necessary for us to finance and manage expansion in an orderly fashion. We may face challenges in managing expanding service offerings and in

3

integrating any acquired businesses with our own. Such eventualities will increase demands on our existing management, workforce and facilities. Failure to satisfy increased demands could interrupt or adversely affect our operations and cause logistical and administrative inefficiencies.

We may be unable to successfully execute any of our identified business opportunities or other business opportunities that we determine to pursue.

We currently have a limited corporate infrastructure. In order to pursue business opportunities, we will need to continue to build our infrastructure and operational capabilities to make it more efficient and capable of handling increased volume and sophisticated manufacturing processes. Our ability to do any of these successfully could be affected by any one or more of the following factors:

- our ability to raise substantial additional capital to fund the implementation of our business plan;

- our ability to execute our business strategy;

- the ability of our products to achieve market acceptance;

- our ability to manage the expansion of our operations and any acquisitions we may make, which could result in increased costs, high employee turnover or damage to customer relationships;

- our ability to attract and retain qualified personnel;

- our ability to manage our third party relationships effectively;

- our ability to accurately predict and respond to the rapid technological changes in our industry and the evolving demands of the markets we serve;

- challenges related to the manufacturing process of the Company, including breakdown or failure of equipment or processes; and

- major incidents and/or catastrophic events such as fires, explosions, earthquakes or storms.

Our failure to adequately address any one or more of the above factors could have a significant impact on our ability to implement our business plan and our ability to pursue other opportunities that arise, which could result in investors losing their entire investments.

Our business depends on the continued reliance of toner ink cartridges for printing, and if the market develops alternate, non-toner ink cartridge methods of printing which assumes dominance in the marketplace, our ability to attract and retain customers may be impaired and our business and operating results may be harmed.

We believe that toner ink cartridges will remain the industry standard for the short and immediate future. Industry reliance on toner ink cartridges is critical for our businesses. Therefore, new technological developments and changes in the imaging and printing industry will require us to make substantial investments with no assurance that these investments will be successful. If we fail or if we incur significant expenses (or significantly greater expenses than allocable) in this effort, our business, prospects, operating results and financial condition will be harmed.

Our operations may be negatively affected by currency exchange rate fluctuations.

Our assets, earnings and cash flows may be influenced by a wide variety of currencies due to the geographic diversity of the countries in which plan on operating in. Fluctuations in the exchange rates of those currencies, if we are able to commence operation in different countries, may have a significant impact on our financial results. Given the dominant role of the US currency in our affairs, the US dollar is the currency in which we present financial performance. It is also the natural currency for borrowing and holding surplus cash. We do not generally believe that active currency hedging provides long-term benefits to our shareholders. We may consider currency protection measures appropriate in specific commercial circumstances, subject to strict limits established by our Board. Therefore, in any particular year, currency fluctuations may have a significant and material adverse impact on our financial results.

Economic, political and other risks associated with international sales and operations could adversely affect our proposed business.

Since we intend to sell some of our products worldwide and currently purchase used ink cartridges from abroad, our proposed business is subject to risks associated with doing business internationally. In addition, our employees, contract manufacturers, suppliers and job functions may be located outside the U.S. Accordingly, our future results could be harmed by a variety of factors, including, but not limited to:

4

- interruption to transportation flows for delivery of parts to us and finished goods to our customers;

- changes in foreign currency exchange rates;

- changes in a specific country's or region's political, economic or other conditions;

- trade protection measures and import or export licensing requirements;

- negative consequences from changes in tax laws;

- difficulty in staffing and managing widespread operations;

- differing labor regulations;

- differing protection of intellectual property;

- unexpected changes in regulatory requirements; and

- geopolitical turmoil, including terrorism and war.

Our manufacturing processes and quality control capabilities are valuable for our survival, and the ability of others to replicate these capabilities could reduce the value of our products.

Our manufacturing processes and quality control capabilities are important assets for us. As a result of being one of the “first-to-market” we have gained a significant amount of know-how and expertise related to the design of these recycled toner. However, the manufacturing process is not proprietary and has not been registered for intellectual property protection. The barriers to entry are limited and increased competition would reduce our revenues and profit margins.

We may become liable for damages for violations of environmental laws and regulations.

We may be subject to various environmental laws and regulations enacted in the jurisdictions in which we operate which govern the manufacture, importation, handling and disposal of certain toner related materials used in our operations. There can be no assurance that our procedures will prevent environmental damage occurring from spills of materials handled by the Company or that such damage has not already occurred. On occasion, substantial liabilities to third parties may be incurred. We may have the benefit of insurance maintained by the Company or the operator; however, the Company may become liable for damages against which it cannot adequately insure or against which it may elect not to insure because of high costs or other reasons. We may be required to increase operating expenses or capital expenditures in order to comply with any new restrictions or regulations.

Our ability to compete and grow is dependent on access to adequate supplies of labor, equipment, parts and components.

Our ability to compete and grow will be dependent on our having access, at a reasonable cost and in a timely manner, to skilled labor, equipment, parts and components. Failure of suppliers to deliver such skilled labor, equipment, parts and components at a reasonable cost and in a timely manner would be detrimental to our ability to compete and grow. No assurances can be given we will be successful in maintaining our required supply of skilled labor, equipment and components. It is possible that the final costs of the major equipment contemplated by our capital expenditure program may be greater than the funds available to the Company, in which circumstances we may curtail, or extend the timeframes for completing, our capital expenditure plans. This could have a material adverse effect on our financial results.

The prices we will receive for our end products are uncertain.

The prices we receive for our end products will be dependent on demand for them and all estimates for the pricing of our end products are currently uncertain.

We rely on key personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our success depends in large part upon the abilities and continued service of our executive officers and other key employees. There can be no assurance that we will be able to retain the services of such officers and employees. Our failure to retain the services of our key personnel could have a material adverse effect on the Company. In order to support our projected growth, we will be required to effectively recruit, hire, train and retain additional qualified management personnel. Our inability to attract and retain the necessary personnel could have a material adverse effect on the Company.

5

Risks Related to the Common Stock

There is no trading market for the Common Stock.

The Common Stock is eligible for quotation on the Over-the-Counter Bulletin Board. However, to date there has been limited trading market for the Common Stock, and we cannot give an assurance that a trading market will develop. The lack of an active, or any, trading market will impair a stockholder’s ability to sell his shares at the time he wishes to sell them or at a price that he considers reasonable. An inactive market will also impair our ability to raise capital by selling shares of capital stock and will impair our ability to acquire other companies or assets by using common stock as consideration.

Stockholders may have difficulty trading and obtaining quotations for our common stock.

Our Common Stock does not trade, and the bid and asked prices for our Common Stock on the Over-the-Counter Bulletin Board may fluctuate widely in the future. As a result, investors may find it difficult to dispose of, or to obtain accurate quotations of the price of, our securities. This severely limits the liquidity of our Common Stock, and would likely reduce the market price of our Common Stock and hamper our ability to raise additional capital.

The market price of our Common Stock is likely to be highly volatile and subject to wide fluctuations.

Dramatic fluctuations in the price of our Common Stock may make it difficult to sell our Common Stock. The market price of our Common Stock is likely to be highly volatile and could be subject to wide fluctuations in response to a number of factors that are beyond our control, including:

- dilution caused by our issuance of additional shares of common stock and other forms of equity securities, in connection with future capital financings to fund our operations and growth, to attract and retain valuable personnel and in connection with future strategic partnerships with other companies;

- variations in our quarterly operating results;

- announcements that our revenue or income are below or that costs or losses are greater than expectations;

- the general economic slowdown;

- sales of large blocks of our common stock;

- announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; and

- fluctuations in stock market prices and volumes;

These and other factors are largely beyond our control, and the impact of these risks, singly or in the aggregate, may result in material adverse changes to the market price of our Common Stock and/or our results of operations and financial condition.

The ownership of our Common Stock is highly concentrated in our officers and directors.

Based on the 516, 660,999 of Common Stock outstanding as of the Effective Date, our executive officers and directors beneficially own approximately 63% of our outstanding Common Stock. As a result, they have the ability to exercise control over our business by, among other items, their voting power with respect to the election of directors and all other matters requiring action by stockholders. Such concentration of share ownership may have the effect of discouraging, delaying or preventing, among other items, a change in control of the Company. Our officers and directors acquired their securities in the Company at no or nominal cost.

The Common Stock will be subject to the “penny stock” rules of the SEC, which may make it more difficult for stockholders to sell the Common Stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

- that a broker or dealer approve a person's account for transactions in penny stocks; and

- the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

6

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

- obtain financial information and investment experience objectives of the person; and

- make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

- sets forth the basis on which the broker or dealer made the suitability determination; and

- that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The regulations applicable to penny stocks may severely affect the market liquidity for the Common Stock and could limit an investor’s ability to sell the Common Stock in the secondary market.

As an issuer of “penny stock,” the protection provided by the federal securities laws relating to forward looking statements does not apply to the Company.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, the Company will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by the Company contained a material misstatement of fact or was misleading in any material respect because of the Company’s failure to include any statements necessary to make the statements not misleading. Such an action could hurt our financial condition.

The Company has not paid dividends in the past and does not expect to pay dividends for the foreseeable future. Any return on investment may be limited to the value of the Common Stock.

No cash dividends have been paid on the Common Stock. We expect that any income received from operations will be devoted to our future operations and growth. The Company does not expect to pay cash dividends in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as the Company’s board of directors may consider relevant. If the Company does not pay dividends, the Common Stock may be less valuable because a return on an investor’s investment will only occur if the Company’s stock price appreciates.

DESCRIPTION OF BUSINESS

Overview

Paragon is one of the first movers in recyling toner cartridges for laser printers, fax and multifunction copiers. Paragon also specializes in difficult to find toner as well as color and special niche cartridges. Paragon has a 35,000 square foot factory, 86 employees and the capacity to manufacture 50,000 cartridges per month and recycle 350 different models of toner cartridges. Our main clients include multinational companies such as Micro Center, Royal Imaging, Staples, Inc., Katun Corporation and Royal Typewriter. Paragon also operates an online website for the sale of its toner products and is also a supplier numerous independent online websites.

Current Business Model

The process Paragon employs when recycling toner cartridges is as follows:

7

| a. |

Disassemble Empty (Used) Cartridges – We inspect and evaluate components to determine if the components can be recycled. | |

| b. |

Clean Components – We remove old components and clean components to be recycled. | |

| c. |

Inspect Components – We inspect all new and recycled components before assembly. | |

| d. |

Assemble Components – We assemble all of the components to create a refurbished cartridge and refill the cartridge with toner. | |

| e. |

Perform Quality Control Tests – We test all finished products using accurate testing equipment. | |

| f. |

Package – We package the product for shipping to the consumer. |

We are a vendor to:

| a. |

Big Box Clients (including Staples, Inc., Katun Corporation and Micro Center by Micro Electronics, Inc.) | |

| b. |

Distributors | |

| c. |

Online Retailers | |

| d. |

Small Businesses and Individuals through our online direct sales division. |

Paragon has benefited from the significant growth trends in the global recycled toner industry. Paragon has experienced a dramatic upward trend in its overall sales and net profits.

Post Merger Strategy

We plan to focus on the following activities after the merger:

| a. |

Attract High Caliber Management - Our management has demonstrated the ability to create value and maintain a profitable operation. As a private enterprise the company has been successful in achieving solid growth in sales and profits. As a public company, we intend to both improve the efficiency of our operations to optimize our organic growth and expand our operations by rapid growth through acquisition. Therefore, we will seek seasoned management having an in-depth knowledge of our industry and the requisite expertise to create a more efficient operation, by effectively introducing new products while expanding our client base. In addition, we will attract talented individuals with experience in mergers and acquisitions who can successfully identify ideal target companies, maximize terms during negotiation and successfully integrate these targets with our company’s operations. As a public company, we can create competitive incentive packages by allotting a certain percentage of the compensation in the form of equity and/or stock options. | |

| b. |

Invest in Infrastructure - We will identify aspects of our operations that can be upgraded or improved to increase sales and productivity. These improvements may include factory automation and identification of more cost effective suppliers. | |

| c. |

Increase Marketing – We have achieved growth in revenues and profitability with minimal expenditures towards marketing our products. Our current marketing efforts are comprised primarily of word of mouth and our staff’s persistent cold-calling sales efforts. After raising additional funds, we expect to expand our client base by hiring a more seasoned marketing staff and by investing in advertising with a specific focus on internet advertising. |

8

| d. |

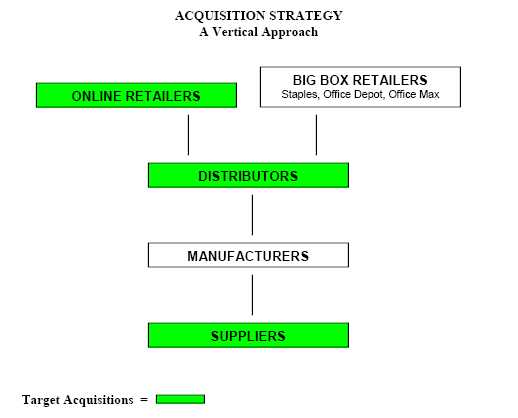

Growth by Acquisition - We will acquire other companies or assets within our industry or related industries, focusing on a vertical acquisition approach. |

We will focus our merger and acquisition activities on suppliers, distributors and online retailers. This vertical approach will increase sales and profitability. Integrating with these types of firms is relatively easier since each target in the vertical chain has a distinct role. By utilizing our stock, we can acquire companies with a combination of cash and stock to minimize excess use of our cash reserves.

| (i) |

Suppliers – (empty cartridge collectors and brokers) Maintaining a supply of empty cartridges is critical for our success. While we are proficient in both directly collecting and sourcing empty cartridges, an acquisition in this sector will ultimately increase our product quality control, sales and profitability. By controlling the source of our empty cartridges, we can insure the highest quality for our customers. In addition, by securing direct and preferential access to the empty cartridges, we can readily meet any order and reduce the raw material costs, thereby leading to higher net margins. | |

| (ii) |

Distributors – Many of our clients are large distributors who buy products from us and resell them to retailers and end users at higher prices. We will seek acquisition of a large distributor with a large client database, so we can utilize its sales channels and offer its clients high quality product at cheaper price while maintaining a high degree of profitability. While we favor already profitable distribution companies, we also view distressed distributors as viable acquisition targets. We can restructure these distributors and realize significant value from aggressively marketing to their client base. | |

| (iii) |

Online Retailers – Our online division at “www.yourcartridges.com” has significantly higher margins and real time cash flow. By acquiring online retailers, we can again provide the product at a cheaper cost and be more competitive in the internet market. Moreover, the cost of integration will be marginal as we already have a staff in place for both marketing and customer |

9

service. Based on our experience, online retailers can be purchased at low cost since they are often operated and owned by small independent business owners. By having access to their client database, we can create an aggressive marketing strategy to maximize their existing customer base. In the future, we intend to have more than half our revenues generated from online sources in order to optimize our margins and cash flow.

Quality Standards

Our laser toner cartridges not only meet OEM standards, but often exceed OEM standards. Our defect ratio is less than 1%, which is considered low in the toner industry. We also offer a 100% guarantee for all of our finished products.

Profitability

Since our establishment and most notably for the last 2 years we have seen an increase in both our profits and our revenues. This can be attributed to our experience in maintaining a streamline operation and our ability to reduce costs while maintaining high quality standards. The defective rate of our products is less than 1% and our repeat and long standing business with the major market players illustrate the high quality of our products.

Strong Online Presence

Our website YourCartridges.com is a leader in the online industry. The website alone has annual revenue of $650,000 without any significant marketing effort on our part. The net profit margin for the online segment of operation is close to 20% with greater cash flow. More importantly, we have obtained the expertise to expand this presence as well as identify strong Internet companies for possible acquisition.

Competition

We compete primarily with other small remanufacturers of toner cartridge products. However, due to the recent economic downturn and the failure of many individual companies to achieve profitability in this industry, many of our direct competitors have exited the market.

Insurance

We maintain medical and accident insurance for our employees to the extent required under federal laws and the laws of the State of California, and we also maintain fire and general commercial insurance with respect to our facilities. We do not have any business liability or disruption insurance coverage for our operations.

ISO 9001, 14001, Minority Status

We have minority owned business status in the state of California. We are in process of obtaining our ISO Certification for 9001and 14001.

The Recycled Toner Cartridge Market

The recycled toner business is a multi-billion dollar industry with continuing growth. According to Lyra Research, the recycled toner market size in 2008 was $6 Billion and is expected to grow to $8.2 Billion by the year 2012. As recycled toner is considerably less expensive than retail toner while maintaining equal quality, the market is expanding annually. Moreover, the market penetration of our products is still at its early stage. Walmart, Best Buy, Costco, Target, and most other major retailers do not yet carry recycled toner. In addition, the United Nations and U.S. federal, state and local governments have still not adopted a policy for the use of recycled toner.

10

Finally, recycled toner serves the protection of the environment as plastic cartridges are now being reused numerous times. More recently, the Obama administration is actively promoting clean technology and recycling of all products in the U.S. For example, under the new Stimulus Plan, tax breaks are being offered to recycling manufacturers. Staples Canada recently held an empty cartridge drive to collect 1 million empty cartridges for Earth Day April 22, 2009. Moreover, companies throughout the U.S. and internationally are emphasizing the use of the “green” products. Inevitably, companies and individuals will use products such as ours as it not only cheaper but helpful in preserving our economy.

For the consumer there is an effort to market “green” products, Walmart will introduce a “Sustainability Index” to mark each product based on their environmental impact.

Cartridges require tremendous energy to produce and recycling cartridges will save energy for the environment and reduce pollution. Secondly, an empty cartridge takes 400 – 1000 years to biodegrade. According to the UDC, there are 400 million empty cartridges being disposed of every year in the U.S. While saving costs and helping to protect the environment, the use of refurbished toner will continue to grow in the U.S.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Fiscal year 2008 compared to fiscal year 2007

The following table summarizes our results of operations for the periods indicated.

| Year Ended December 31, | |||||||||

| 2008 | 2007 | % Change | |||||||

| Total net revenue | $ | 6,707,301 | $ | 5,738,176 | 16.9% | ||||

| Cost of revenue | |||||||||

| Beginning inventory | 655,117 | 423,466 | 54.7 | ||||||

| Purchases | 3,326,728 | 3,450,575 | (3.6 | ) | |||||

| Direct labor | 1,012,095 | 873,152 | 15.9 | ||||||

| Manufacturing overhead | 385,367 | 385,734 | N/M | ||||||

| Freight, supplies and other costs | 69,953 | 95,047 | (26.4 | ) | |||||

| 5,44,9260 | 5,227,974 | 4.2 | |||||||

| Less: Ending Inventory | (458,936 | ) | (655,117 | ) | 29.9 | ||||

| Total cost of goods sold | 4,990,324 | 4,572,857 | 9.1 | ||||||

| Gross profit | 1,716,977 | 1,165,319 | 47.3 | ||||||

| Gross profit margin(1) | 25.6% | 20.3% | |||||||

| Selling, general and administrative expenses | 1,574,051 | 1,052,709 | 49.5 | ||||||

| Operating income | 142,926 | 112,610 | 26.9 | ||||||

| Operating profit margin(2) | 2.1% | 2.0% | |||||||

| Other income (expenses): | |||||||||

| Interest income | (80,643 | ) | (89,338 | ) | 9.7 | ||||

| Gain on disposition of securities | 2,521 | N/M | |||||||

| Total net other expense | (80,643 | ) | (89,817 | ) | 10.2 | ||||

| Income before income tax expenses | 62,283 | 25,793 | 141.5 | ||||||

| Provision for income taxes(3) | 2,249 | 4,276 | (47.4 | ) | |||||

| Net income | 60,034 | 21,517 | 179.0 | ||||||

___________________________

N/M = not meaningful

Notes:

(1) Gross profit margin for each period is calculated by

dividing gross profit by total revenues for each period.

11

| (2) |

Operating profit margin for each period is calculated by dividing operating income by total revenues for each period. |

| (3) |

The Company elected to be subject to the S corporation provisions of the Internal Revenue Code for federal and state income tax purposes effective January 27, 2004. Accordingly, as an S corporation, the Company’s taxable income or losses and applicable tax credits are passed through to its shareholder and reported on shareholder’s individual income tax return. However, the State of California requires S corporations to pay a state franchise tax (currently 1.5% on its taxable income). |

Revenues

Our total revenues for FY2008 increased by 16.9% to $6,707,301 from $5,738,176 in FY2007, primarily due to:

-

a 12% increase in off-line sales of toner cartridges to resellers to 168,000 units in FY2008 from 150,000 units in FY2007; and

-

on-line Internet sales of 15,000 units of toner cartridges in FY2008 compared to none in FY2007.

Increases in revenues were partially offset by:

- a 4.2% decline in the average selling price to $36.70 per unit in FY2008 from $38.25 per unit in FY2007.

Cost of revenues

Our cost of revenues increased by 9.1% to $4,990,324 in FY2008 from $4,572,857 in FY2007, primarily due to:

- a 15.9% increase in direct labor costs to $1,012,095 in FY2008 from $873,152 in FY2007 which was largely attributed to the increase number of manufacturing employees from 40 to 50.

Such increases in cost of revenues were partially offset by:

- a 26.4% decrease in freight costs to $69,953 in FY2008 from $95,047 in FY2007, due to increased efficiencies in packaging and reduced volume rates through our packaging/mailing service.

Gross profit and margin

As a result of the foregoing, our gross profit increased by 47.3% to $1,716,977 in FY2008 from $1,165,319 in FY2007. Our gross profit margin increased to 25.6% in FY2008 from 20.3% in FY2007.

Selling, general and administrative expenses

Our selling, general and administrative expenses increased by 49.5% to $1,574,051in FY2008 from 1,052,709 in FY2007, primarily due to:

-

a 15.8% increase in salaries and wages to $789,164 in FY2008 from $681,423 in FY2007, largely attributed to an increase in employee headcount;

-

a substantial increase in advertising expenses to $6,584 in FY2008 from $123 in FY2007 due to new advertising initiatives to boost sales on the Internet;

-

a 69.3% increase in freight out expenses to $157,450 in FY2008 from $93,014 in FY2007 due to increased

12

unit sales; and

- a 326.7% increase in professional fees to $52,700 in FY2008 from $12,350 in FY2007 due to expenses incurred in connection with legal consulting and advisory services.

Such increases in selling, general and administrative expenses were partially offset by:

- a 23.1% decrease in commission paid to $47,021 in FY2008 from $61,139 in FY2007, for fees and expenses due largely to the discontinued use of one of our larger major toner marketing and distribution service providers.

Operating income and operating margin

As a result of the cumulative effects of the reasons stated above, we recorded an operating income of $142,926 in FY2008 compared to an operating income of $112,610 in FY2007, an increase of 26.9% year over year. Our operating profit margin increased slightly to 2.1% in FY2008 from 2.0% in FY2007.

Net other income (expense)

Our net other expenses decreased 9.7% to $80,643 in FY2008 from $86,817 in FY2007.

Income tax expenses

We recorded an income tax expense of $2,249 in FY2008, as compared to an income tax expense of $4,276 in FY2007.

Net income

Our net income increased by 179%, recording a net income of $60,034 in FY2008 compared to a net income of $21,517 in FY2007.

First half 2009 compared to first half 2008

The following table summarizes our results of operations for the periods indicated

| First half year ended June 30, | |||||||||

| 2009 | 2008 | % Change | |||||||

| Total net revenue | $ | 2,975,031 | $ | 4,028,081 | (26.1 | )% | |||

| Cost of revenue | |||||||||

| Beginning inventory | 458,936 | 655,117 | (29.9 | ) | |||||

| Purchases | 1,456,449 | 2,175,992 | (33.1 | ) | |||||

| Direct labor | 438,299 | 593,022 | (26.1 | ) | |||||

| Manufacturing overhead | 198,788 | 197,325 | (0.7 | ) | |||||

| Freight, supplies and other costs | 19,673 | 57,085 | ( 65.5 | ) | |||||

| 2,572,145 | 3,678,541 | (30.1 | ) | ||||||

| Less: Ending Inventory | (423,474 | ) | (661,738 | ) | 36.0 | ||||

| Total cost of goods sold | 2,148,671 | 3,016,803 | (28.8 | ) | |||||

| Gross profit | 826,360 | 1,011,279 | (18.3 | ) | |||||

| Gross profit margin(1) | 27.8% | 25.1% | |||||||

| Selling, general and administrative expenses | 578,131 | 1,008,994 | (42.7 | ) | |||||

| Operating income | 248,229 | 2,285 | 10,763.4 | ||||||

13

| Operating profit margin(2) | 8.3% | 0.1 % | |||||||

| Other income (expenses): | |||||||||

| Interest income | (23,545 | ) | (34,442 | ) | 31.6 | ||||

| Total net other expense | (23,545 | ) | (34,442 | ) | 31.6 | ||||

| Income before income tax expenses | 224,684 | (32,157 | ) | -- | |||||

| Provision for income taxes(3) | 3,883 | 3,218 | 20.7 | ||||||

| Net income | 220,801 | (35,375 | ) | -- |

| Notes: | |

| (1) |

Gross profit margin for each period is calculated by dividing gross profit by total revenues for each period. |

| (2) |

Operating profit margin for each period is calculated by dividing operating income by total revenues for each period. |

| (3) |

The Company elected to be subject to the S corporation provisions of the Internal Revenue Code for federal and state income tax purposes effective January 27, 2004. Accordingly, as an S corporation, the Company’s taxable income or losses and applicable tax credits are passed through to its shareholder and reported on shareholder’s individual income tax return. However, the State of California requires S corporation to pay a state franchise tax (currently 1.5% on its taxable income) |

Revenues

Our total revenues for 1H2009 decreased by 26.1% to $2,975,031 from $4,028,081 in 1H2008, primarily due to the loss of one of our largest clients, Rhinotek Computer Products, Inc., when they filed for bankruptcy.

Cost of revenues

Our cost of revenues decreased by 28.8% to $2,148,671 in 1H2009 from $3,016,803 in 1H2008, primarily due to a reduction in costs associated with the loss of one of our largest clients, Rhinotek Computer Products, Inc.

Gross profit and margin

As a result of the foregoing, our gross profit decreased by 18.3% to $826,360 in 1H2009 from $1,011,279 in 1H2008. Our gross profit margin increased to 27.8% in 1H2009 from 25.1% in 1H2008.

Selling, general and administrative expenses

Our selling, general and administrative expenses decreased by 42.7% to $578,131 in 1H2008 from $1,008,994 in 1H2009, primarily due to:

-

a 26% decrease in salaries and wages to $338,435 in 1H2009 from $457,059 in 1H2008, largely attributed to a decrease in employee headcount;

-

no bad debt expense in 1H2009 versus a bad debt expense of $247,793 in 1H2008; and

-

no commission expense in 1H2009 versus a commission expense of $47,021 in 1H2008.

Such increases in selling, general and administrative expenses were partially offset by:

- a 30.2% increase in freight expenses to $89,859 in 1H2009 from $69,009 in 1H2008 due to increased costs of packaging and shipping and increased volume of online orders.

Operating income and operating margin

As a result of the cumulative effects of the reasons stated above, we recorded an operating income of $248,229 in 1H2009 compared to an operating income of $2,285 in 1H2008, an increase of 10,763.4% year over year. Our operating profit margin increased sharply to 8.3% in 1H2009 from 0.1% in 1H2008.

14

Net other income (expense)

Our net other expenses decreased 31.6% to $23,545 in 1H2009 from $34,442 in 1H2008.

Income tax expenses

We recorded an income tax expense of $3,883 in 1H2009, as compared to an income tax expense of $3,218 in 1H2008.

Net income

We recorded a net income of $220,801 in 1H2009 compared to a net loss of $35,375 in 1H2008

Liquidity and Capital Resources

As of June 30, 2009, we had $115,128 in cash compared to $55,149 at June 30, 2008, an increase of $59,979. The increase in cash is a result of the company turning profitable on a net basis through increased efficiencies and trimming expenses.

While we are currently operationally profitable, we need to raise additional funds in order to fund expansion our operations. At the present time, we have no commitments for any additional financing.

Off-Balance Sheet Arrangements

None

Properties

Our principal executive offices will be located at 14830 Desman Road, La Mirada, CA 90638 and our telephone number at such address is (714) 522-0260. The offices consist of approximately 35,000 square feet, which are leased on a month-to month basis for approximately $21,000. We believe that our property is adequate for our current and immediately foreseeable operating needs.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information, as of the Effective Date with respect to the beneficial ownership of the outstanding Common Stock by (i) any holder of more than five (5%) percent; (ii) each of the Company’s executive officers and directors; and (iii) the Company’s directors and executive officers as a group. Except as otherwise indicated, each of the stockholders listed below has sole voting and investment power over the shares beneficially owned.

None of our common shares entitles the holder to any preferential voting rights. Beneficial ownership is determined in accordance with the rules of the Securities Exchange Commission, and includes the power to direct the voting or the disposition of the securities or to receive the economic benefit of the ownership of the securities.

15

| Number of | ||||||

| Shares | Percentage | |||||

| Beneficially | Beneficially | |||||

| Name | Owned | Owned | ||||

| James Park (CEO and Director) | 198,406,919 | 38.40% | ||||

| Young Won (COO and Director) | 99,030,531 | 19.17% | ||||

| Hyung Soon Lee (Director) | 28,828,333 | 5.58% | ||||

| Total of Management and Directors | 326,265,783 | 63.15% |

Directors and Executive Officers

The following table sets forth certain information relating to our directors and executive officers as of October 9, 2009. The business address of all of our directors and executive officers is our registered office at 14830 Desman Road, La Mirada, CA 90638.

| Name | Position |

| James Park | President, Chief Executive Officer and Chairman of the Board of Directors |

| Young Won | Chief Operating Officer and Director |

| Bong S. Park | Chief Financial Officer and Director |

James Park is the founder of Paragon and has worked at the company since 1993. Mr. Park was instrumental to Paragon’s growth from a small independent business. Mr. Park is a graduate of the University of California of Los Angeles.

Young Won has worked at Paragon for the last 14 years. Mr. Won is in charge of the production, operation, research and development of the company. He is has been integral in the success of Paragon. Previously, he worked for the Los Angeles Metropolitan Water District as a metallurgical engineer. Mr. Won received a B.S. in mechanical engineering from Korea University. He also graduated from the University of Southern California with an M.S. in materials science.

Bong S. Park was the Chief Financial Officer of the Company since 1997. He was previously the CEO of Tokyo Printing Ink, Corp. USA from 1985-1997. His experience as a seasoned executive and his extensive knowledge in the ink and toner industry has been instrumental for the growth of the Company. Mr. Park received a B.A. degree in business administration from Korea University.

Executive Compensation

Mr. James Park’s compensation as CEO of Paragon in 2007 and 2008 was an annual salary of $84,000.

Employment Agreements

As the incoming CEO of the Company, Mr. Park has entered into a new employment contract with the Company. Under the terms of the contract, he will receive a salary of $168,000 for a one-year term. No bonus or stock options are included in the contract. Any change in compensation will be determined by the Board of Directors after conclusion of the initial one-year term.

Director Compensation

No director of Paragon has received any compensation for services as director for the period since inception of the Company in 2004.

16

Certain Relationships and Related Transactions, and Director Independence

Our directors are not independent as that term is defined under the Nasdaq Marketplace Rules.

Joon Ho Chang , a former director of the Company, received 8,000,000 shares of Common Stock as a fee for professional services rendered in the merger transaction.

Legal Proceedings

To the best knowledge of management, there are three pending legal proceedings against us.

On July 14, 2008, Advanced Digital Technology Co. Ltd., a Korean corporation (“ADT”), filed a claim against Lexon and certain named individuals who are former and current officers of the Company. The claim alleges breach of an agreement to settle an earlier dispute, involving ADT's investment of $150,000 in Lexon on or about January 16, 2007 and ADT's subsequent unilateral decision to rescind and demand a refund of this investment. The total amount of damages claimed under the pending lawsuit is the investment amount of $150,000 plus filing costs, interest and attorney fees for an aggregate amount of $178,522.05. On or about May 2, 2009, Lexon became aware of a default judgment entered in the amount above. Such judgment was entered on December 22, 2009. On or about May 8, 2009, Lexon hasretained the law firm of Smith, Chapman & Campbell for the purpose of setting aside the default judgment as the Company was never in receipt of the notice of default entry. On or about July 21, 2009, the court set aside the default as the court agreed that service was never properly served. To date, Lexon has not received the complaint for this case.

On September 5, 2008, Vivien and David Bollenberg, a current shareholder (the “Bollenbergs”), filed a claim against Lexon and other third parties, including Byung Hwee Hwang (also referred to as "Ben Hwang") and other financial agents and institutions involved in the alleged fraudulent transaction. The lawsuit is currently pending in the Orange County Superior Court in Santa Ana, California. The filed complaint alleges that Ben Hwang together with his representatives, including his accountant, escrow agent and real estate agent/broker, made certain representations to and solicited the Bollenbergs to make an investment in several companies and ventures including Lexon with the intent to misappropriate the solicited funds for personal use. The Bollenbergs allege that they invested a total of $1,500,000 among and between the various companies and ventures recommended by Ben Hwang, of which investment amount approximately $550,000 was invested in Lexon ($150,000 for 600,000 shares at $0.25 per share and $400,000 initially invested in Lexon Korea and later converted into 1,150,000 shares in Lexon for a total of 1,750,000 shares in Lexon). The final disposition of this case has not yet been resolved. To date, Lexon has not been served the complaint for this action.

On or about August 5, 2009, Development Specialists, Inc. as Assignee for the Benefit of Creditors of Rhinotek Computer Products, Inc. (“Rhinotek”) filed a claim against Paragon for recovery of a preferential transfer in the amount of $143,289.39. As per the preferential transfer claim, the Assignee alleges that Paragons was inequitably paid the aforementioned amount during the 90 days prior to the insolvency of Rhinotek. We have retained Assay & Mauss to serve as legal counsel to assert the defense that such payments were in the course of ordinary business. We have received an extension to file an answer to the complaint until November 10, 2009. Moreover, Paragon has also lodged a proof of claim against Rhinotek in the amount $247,793.24 which is the outstanding amount owed to us at the time of their insolvency.

Market Price of and Dividends on Common Equity and Related Stockholder Matters

The Common Stock is eligible for quotation on the Over-the-Counter

Bulletin Board under the symbol "LEXO.OB”.

As of the date of the filing of this report, there has been limited trading

in the Common Stock.

As of the Effective Date, 2009, there will be approximately 350 holders of record

of the Common Stock.

As of the Effective Date, we will have 1,483,339,001 shares of Common Stock

reserved for issuance

Dividends

Lexon has never declared or paid any cash dividends on its Common Stock. The Company currently intends to retain

17

future earnings, if any, to finance the expansion of its business. As a result, the Company does not anticipate paying any cash dividends in the foreseeable future.

Securities Authorized for Issuance Under Equity Compensation Plans

The Company has not adopted any equity compensation plan as of October 8, 2009.

Recent Issuance of Securities

On October 7, 2009, shares were issued prior to the Merger Agreement, Shareholder’s Meeting and as follows:

| Name of Shareholder | Number of Shares |

| 1a. Joon Ho Chang | 10,030,000 |

| 1b. Joon Ho Chang | 3,570,000 |

| 2a. Hyung Soon Lee | 4,720,000 |

| 2b. Hyung Soon Lee | 9,108,333 |

| 2c. Hyung Soon Lee | 15,000,000 |

| 3. Kyu Hong Hwang | 5,000,000 |

| 4. Kyong Ho Lim | 5,000,000 |

| 5. Yong Ok Lee | 250,000 |

| TOTAL | 52,678,333 |

1a. Shares were issued as a settlement of short term borrowings made from December 8 2004 – December 31, 2006 which was paid in Korean Won in the amount of KRW 40,000,000 (approximately $33,333).

1b. Shares were issued as a settlement of short term borrowings made from November 27, 2007 – June 27, 2009 in the amount of $21,420.

2a. Shares were issued as a settlement of short term borrowings made on December 8, 2004 – December 31, 2006 which was paid in Korean Won in the amount of KRW 45,000,000 (approximately $37,500).

2b. Shares were issued as a settlement of short term borrowing made from February 15, 2008 – May 19, 2009 in the amount of $54,650.

2c. Shares were issued as a settlement for unpaid salary dating from April 2007 to September 2009 in the amount of $90,000

3. Shares were issued as a settlement of short term borrowings made from December 8, 2004 – December 31, 2009 which was paid in Korean Won in the amount of the amount of KRW 45,000,000 (approximately $37,500).

4. Shares were issued as a settlement of short term borrowings made from December 8, 2004 – December 31, 2009 which was paid in Korean Won in the amount of KRW 96,700,000 (approximately $80,583).

5. Shares were issued as a settlement of short term borrowings made from December 8, 2004 – December 31, 2009 which was paid in Korean Won in the amount of KRW 5,000,000 (approximately $4,166).

18

On October 8, 2009, after the ratification of the Shareholder Resolution, and Merger, shares were issued as follows:

| Name of Shareholder | Number of Shares |

| 1. Yang H. Park | 7,500,000 |

| 2. Sunmin Won | 2,500,000 |

| 3. Paragon Toner, Inc | 3,000,000 |

| 4a. Dimitri Felix & Associates LLC | 16,666,666 |

| 4b. Dimitri Felix & Associates LLC | 8,000,000 |

| 5. Joon Ho Chang | 8,000,000 |

| 6. Yang K. Park | 2,500,000 |

| TOTAL | 48,166,666 |

| 1. Shares were issued as a settlement of short term loans made from May 14, 2009 – August 24, 2009 for the amount of $45,000. |

| 2. Shares were issued as a settlement of short term loans made from May 14, 2009 – June 24, 2009 for the amount of $15,000. |

| 3. Shares were issued as a settlement of short term loans made from April 24, 2009 - September 16, 2009 for the amount of $18,000. |

| 4a. Shares were issued as per a Subscription Agreement dated October 8, 2009. |

| 4b. Shares were issued in lieu of a cash success fee of $50,000. |

| 5. Shares were issued in lieu of cash success fee of $50,000. |

| 6. Shares were issued as a settlement of short term loans made from May 14, 2009 – September 15, 2009 for the amount of $15,000. |

Description of Securities

The Company’s authorized capital stock consists of 2,000,000,000 shares of Common Stock at a par value of $0.001 per share. As of the Effective Date, there were will be 516,660,099 shares of the Company’s Common Stock issued and outstanding held by approximately 350 stockholders of record.

Holders of the Company’s Common Stock are entitled to one (1) vote for each share on all matters submitted to a stockholder vote. Holders of Common Stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of Common Stock voting for the election of directors can elect all of the directors. Holders of the Company’s Common Stock representing a majority of the voting power of the Company’s capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of stockholders. A vote by the holders of a majority of the Company’s outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to the Company’s articles of incorporation.

Holders of the Company’s Common Stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of a liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. The Company’s Common Stock has no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to the Company’s Common Stock.

19

Indemnification of Directors and Officers

The Company’s bylaws contain certain provisions permitted under Delaware General Corporation Law relating to the liability of directors. The provisions eliminate a director’s liability for monetary damages for a breach of fiduciary duty, except in certain circumstances where such liability may not be eliminated under applicable law. Further, the Company’s certificate of incorporation contains provisions to indemnify the Company’s directors and officers to the fullest extent permitted by the Delaware General Corporation Law. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, or otherwise, the Company has been advised that in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

Financial Statements and Supplementary Data

With regard to Lexon’s financial statements, reference is made to the filings with the SEC made by Lexon on Form 10-K on May 4, 2009 and Form 10-Q on August 19, 2009. The financial statements of Paragon begin on Page F-1 to this Form 8-K.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 2.05 Costs Associated with Exit or Disposal Activities

None.

Item 2.06 Material Impairments

None.

SECTION 3 - SECURITIES AND TRADING MARKETS

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

None.

Item 3.02 Unregistered Sales of Equity Securities.

See Item 1.01.

In connection with the foregoing, the Company relied upon the exemption from securities registration afforded by Rule 506 of Regulation D as promulgated by the SEC under the Securities Act and/or Section 4(2) of the Securities Act. No advertising or general solicitation was employed in offering the securities. The issuances were made to a limited number of persons, all of whom were “accredited investors,” and transfer of the securities was restricted in accordance with the requirements of the Securities Act.

SECTION 5 - CORPORATE GOVERNANCE AND MANAGEMENT

Item 5.01 Changes in Control of Registrant.

The Merger will result in a change of control of Lexon on the Effective Date. See Item 2.01 “Completion of Acquisition or Disposition of Assets” above.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

20

See Item 1.01.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Immediately prior to the Merger Agreement, we filed an amendment to Lexon certificate of incorporation, effective to increase the number of authorized shares of its Common Stock from 100,000,000 to 2,000,000,000. In connection with the Merger, effective October 22, 2009, we filed a certificate of merger to effect the merger of Paragon, with and into Lexon.

We will account the Merger as a “reverse merger” because there was a change of control at the Merger Closing. Accordingly, for accounting purposes, Paragon will be treated as the continuing reporting entity and accounting acquirer that acquired Lexon, which accounting treatment will result in the us adopting the December 31 fiscal year-end of Lexon. Subsequent to the Merger Closing, the historical statements of operations will be those of Paragon’s and the balance sheet will consist of the net assets of Paragon's. All capital stock shares and amounts and per share data will be retroactively restated. As a result of the accounting treatment of the Merger, subject to our filing of an amendment to this Current Report or the filing of any further Current Reports on Form 8-K, we expect that the next periodic report that we will file pursuant to our obligations under Section 13 or 15(d) of the Securities Exchange Act of 1934 will be an Annual Report on Form 10-KSB for the annual year-ending December 31, 2009.

Item 5.06 Change in Shell Company Status.

As a result of the Merger, the Company is no longer a shell company (See Item 1.01) .

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements of Paragon. See Page F-1.

(b) Pro

forma financial information. See Exhibit 99.1.

(c) Shell Company

Transactions. See (a) and (b) of this Item 9.01.

(d) Exhibits

* filed herewith

21

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| LEXON TECHNOLOGIES INC. | ||

| Date: October 9, 2009 | By: | /s/ Hyung Soon Lee |

| Hyung Soon Lee | ||

| CEO | ||

22