Attached files

| file | filename |

|---|---|

| EX-23.1 - Cedar Creek Mines Ltd. | v162589_ex23-1.htm |

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1/A-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

CEDAR CREEK MINES

LTD.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

1000

|

None

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

(Primary

Standard Industrial Classification Code Number)

|

(I.R.S.

Employer

Identification

Number)

|

4170

Still Creek Drive, Suite 200

Burnaby,

B.C., Canada V5C 6C6

Tel

(604) 320-7877

(Address,

including zip code, and telephone number, including area code, of registrant’s

principal executive offices)

Corporation

Service Company

2711

Centerville Road, Suite 400

Wilmington,

Delaware 19808

Tel

(302) 636-5400

(Name,

address, including zip code, and telephone number, including area code, of agent

for service)

with

a copy to:

Jensen

Lunny MacInnes Law Corporation

555

West Hastings Street, Suite 2550

Vancouver,

B.C., Canada V6B 4N5

Tel

(604) 684-2550

Attn: Michael

Shannon

Approximate

Date of Commencement of Proposed Sale to the Public: As soon as practicable after this

Prospectus is declared effective.

If any of

the securities being registered on this Form are to be offered on a delayed or

continuous basis pursuant to Rule 415 under the Securities Act of 1933, please

check the following box. R

If this

Form is filed to register additional securities for an offering pursuant to Rule

462(b) under the Securities Act of 1933 (the “Securities Act”), please check the

following box and list the Securities Act Prospectus number of the earlier

effective registration statement for the same offering. £

If this

Form is a post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. £

If this

Form is a post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same

offering. £

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company.

Large

accelerated filer o Accelerated

filer o

Non-accelerated filer o Smaller reporting

company þ

Calculation

of Registration Fee

|

Title of Each Class of Securities to be

Registered

|

Amount to

be

Registered(1)

|

Proposed

Maximum

Offering

Price per

Share(2)

|

Proposed

Maximum

Aggregate

Offering

Price(2)

|

Amount of

Registration

Fee

|

||||||||||||

|

Shares

of Common Stock, par value $0.00001

|

969,000 | $ | 0.25 | $ | 242,250 | $ | 9.52 | |||||||||

|

Total:

|

969,000 | $ | 0.25 | $ | 242,250 | $ | 9.52 | |||||||||

Notes:

|

(1)

|

The

shares of our Common Stock being registered hereunder are being registered

for resale by the selling stockholders named in the

prospectus.

|

|

(2)

|

Estimated

solely for the purposes of calculating the registration fee in accordance

with Rule 457(a) under the Securities Act. The price per share and the

aggregate offering price for the shares are calculated on the basis of our

most recent private placements of common stock at $0.25 per share in June,

2009.

|

The

registrant hereby amends this registration statement on such date or dates as

may be necessary to delay its effective date until the registrant shall file a

further amendment which specifically states that this registration statement

shall thereafter become effective in accordance with section 8(a) of the

Securities Act or until the registration statement shall become effective on

such date as the Securities and Exchange Commission, acting pursuant to said

section 8(a), may determine.

The

information in this prospectus is not complete and may be amended. The selling

stockholders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus

is not an offer to sell these securities and it is not soliciting an offer to

buy these securities in any state where the offer or sale is not

permitted.

PROSPECTUS

Cedar

Creek Mines Ltd.

969,000

Common Shares

Dated:

October 13, 2009

Before

this offering there has been no public market for our common stock.

We are

registering 969,000 shares of common stock held by 47 selling security holders,

including 12,000 shares held by Matthew Brusciano, our Secretary. The selling

security holders will sell at an initial price of $0.25 per share until our

common stock is quoted on the Over-the-Counter Bulletin Board (the “OTC Bulletin

Board”) and thereafter at prevailing market prices or privately negotiated

prices. We will file a post-effective amendment to this Prospectus to reflect

the change to a market price if our shares of common stock begin trading on a

market or exchange. No cash will be received by us from the sale of shares of

our common stock by the selling shareholders. We will incur all costs associated

with this Prospectus.

Our

common stock is presently not listed on any national securities exchange or the

NASDAQ Stock Market. We intend to seek a market maker to file an application

with the Financial Industry Regulatory Authority to have our common stock quoted

on the OTC Bulletin Board. We do not currently have a market maker who is

willing to list quotations for our common stock, and there can be no assurance

that an active trading market for our shares will develop, or, if developed,

that it will be sustained.

An

investment in our securities is speculative. Investors should be able to afford

the loss of their entire investment. See the section entitled "Risk Factors"

beginning on page 5 of this Prospectus.

Neither

the U.S. Securities and Exchange Commission nor any state securities commission

has approved or disapproved of these securities or passed upon the adequacy or

accuracy of this Prospectus. Any representation to the contrary is a criminal

offense.

This

Prospectus shall not constitute an offer to sell or the solicitation of an offer

to buy, nor shall the selling security holders sell any of these securities in

any state where such an offer to sell or solicitation would be unlawful before

registration or qualification under such state's securities laws.

No

underwriter or other person has been engaged to facilitate the sale of shares of

common stock in this offering. You should rely only on the information contained

in this prospectus and the information we have referred you to. We have not

authorized any person to provide you with any information about this offering,

Cedar Creek Mines Ltd. or the shares of our common stock offered hereby that is

different from the information included in this prospectus.

Cedar

Creek Mines Ltd.

TABLE

OF CONTENTS

|

Prospectus

Summary

|

2

|

|

Risk

Factors

|

5

|

|

Use

of Proceeds

|

13

|

|

Determination

of Offering Price

|

13

|

|

Dilution

|

14

|

|

Selling

Security Holders

|

14

|

|

Plan

of Distribution

|

18

|

|

Description

of Securities to be Registered

|

23

|

|

Interests

of Named Experts and Counsel

|

24

|

|

Description

of Business

|

25

|

|

Description

of Property

|

32

|

|

Legal

Proceedings

|

35

|

|

Market

For Common Equity and Related Stockholder Matters

|

35

|

|

Management’s

Discussion and Analysis of Financial Position and Results of

Operations

|

36

|

|

Directors,

Executive Officers, Promoters and Control Persons

|

42

|

|

Executive

Compensation

|

45

|

|

Security

Ownership of Certain Beneficial Owners and Management

|

46

|

|

Certain

Relationships and Related Transactions

|

47

|

|

Disclosure

of Commission Position on Indemnification of Securities Act

Liabilities

|

48

|

|

Financial

Statements

|

49

|

|

Index

|

F-1

|

1

Prospectus

Summary

This

Prospectus, any supplement to this Prospectus, and the documents incorporated by

reference include “forward-looking statements”. To the extent that the

information presented in this Prospectus discusses financial projections,

information or expectations about our business plans, results of operations,

products or markets, or otherwise makes statements about future events, such

statements are forward-looking. Such forward-looking statements can be

identified by the use of words such as “intends”, “anticipates”, “believes”,

“estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”.

Although we believe that the expectations reflected in these forward-looking

statements are based on reasonable assumptions, there are a number of risks and

uncertainties that could cause actual results to differ materially from such

forward-looking statements. These include, among others, the cautionary

statements in the “Risk Factors” section beginning on page 5 of this Prospectus,

and the “Management's Discussion and Analysis of Financial Position and Results

of Operations” section elsewhere in this Prospectus.

Our

Business

Cedar

Creek Mines Ltd. (“Cedar Creek”, “we”, “us”) is an exploration stage company in

the business of mineral resource exploration. We were incorporated as a Delaware

company on April 3, 2008. We have one wholly owned subsidiary, Cedar Creek Mines

Inc. (“CCMI”), incorporated pursuant to the laws of Province of British

Columbia, Canada, on April 27, 2007, which we acquired on May 16, 2008. Our

executive office is located at 4170 Still Creek Drive, Suite 200, Burnaby, B.C.,

Canada, V5C 6C6. Our telephone number is (604) 320-7877. Our fiscal year end is

May 31.

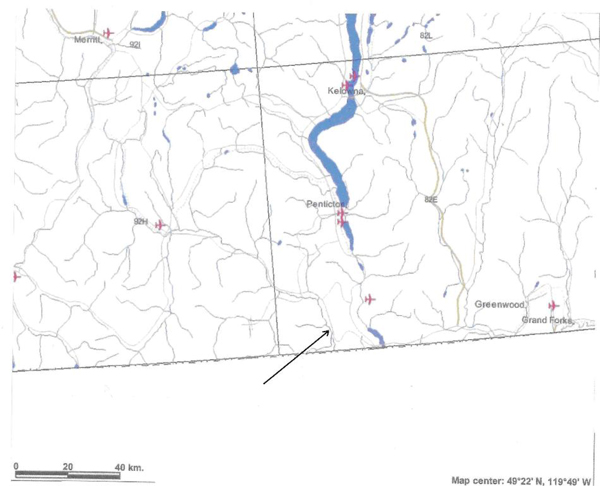

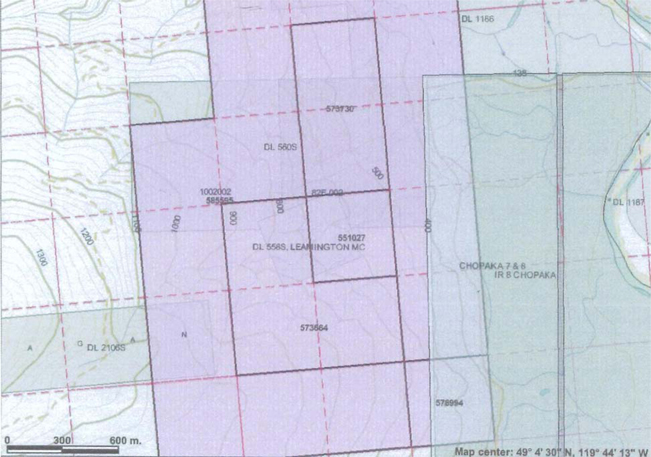

We intend

to build our business by acquiring, exploring and developing mineral resource

properties in the United States and Canada. We currently own, through our wholly

owned subsidiary CCMI, an undivided 100% interest in the following four mineral

claims located near the Similkameen Valley, 25 kilometers south of Keremeos,

British Columbia:

|

BC

Tenure Number

|

Tenure

Type

|

Claim

Name

|

Expiry

Date

|

Area

(hectares)

|

||||

|

551027

|

Mineral

|

Leamington

|

February

2, 2010

|

21.162

|

||||

|

573664

|

Mineral

|

Sisters

|

January

13, 2010

|

63.489

|

||||

|

573730

|

Mineral

|

SIS

|

January 14, 2010

|

42.318

|

||||

|

585595

|

|

Mineral

|

|

GUY

|

|

June

2, 2010

|

|

317.416

|

CCMI

acquired our interest in these four claims pursuant to a purchase agreement with

Mr. Ron Schneider dated June 25, 2008. In consideration for this interest, we

paid Mr. Schneider approximately $2,914. These claims require annual payments of

approximately $2,200 to keep them in good standing. Our specific exploration

plan for the four claims, along with information regarding their location,

accessibility, geology and history, is available elsewhere in this Prospectus

under the heading “Description of Property”.

Our

project is at the exploration stage and there is no guarantee that any of our

mineral claims contain a commercially viable ore body. We have not presently

determined if our property contains mineral reserves that are economically

recoverable, and we must complete an exploration program on the claims before we

can make such a determination. We will require additional financing to carry out

any exploration program, and there is no guarantee that we will be able to

secure the necessary funds to do so.

2

Over the

next 12 months we intend to hire a geologist, land specialist and engineer,

either on a part-time basis or as independent contractors, in order to meet the

technical requirements associated with exploring and developing an exploration

stage mineral property. We are searching for qualified and experienced personnel

but we have not yet identified any particular individuals to fill these roles.

There is no guarantee that we will be able to attract and retain qualified

personnel, and our failure to do so may cause us to go out of

business.

We have

only recently begun operations. We have not generated any revenues from our

business activities and we do not expect to generate revenues for the

foreseeable future. For the next 12 months (from the date of this prospectus),

we plan to spend approximately $347,200 to maintain our operations, carry out

the first phase of an exploration program on our mineral claims and acquire

interests in other exploration stage properties in Canada and the United States.

Since our inception, we have incurred operational losses, and we have been

issued a going concern opinion by our auditors. To finance our operations, we

have completed several rounds of financing and raised $139,650 through private

placements of our common stock.

We do not

currently have sufficient funds to fully carry out our business plan and there

is no assurance that we will be able to obtain the necessary funds to do so.

Accordingly, there is uncertainty about our ability to continue to operate. If

we cease our operations, you may lose your entire investment in our common

stock. There are also many factors, described in detail in the "Risk Factors”

section beginning on page 5 of this Prospectus, which may adversely affect our

ability to begin and sustain profitable operations.

The

Offering

The

969,000 shares of our common stock being registered by this Prospectus represent

approximately 2% of our issued and outstanding common stock. Both before and

after the offering Guy Brusciano, our President, Chief Executive Officer, Chief

Financial Officer, Principal Accounting Officer, Treasurer, and a director of

the Company, will control us. Guy Brusciano has sole or shared control over

50,086,000 shares, which is approximately 98% of our issued and outstanding

common stock.

|

Securities

Offered:

|

969,000

shares of common stock offered by the 47 selling security holders,

including 12,000 shares held by Matthew Brusciano, our

Secretary.

|

|

|

Initial

Offering Price:

|

The

$0.25 per share initial offering price of our common stock was determined

by our Board of Directors based on several factors, including our capital

structure and the most recent selling price of our common stock in a

private placement for 42,000 shares at $0.25 per share on July 3, 2009.

The selling security holders will sell at an initial price of $0.25 per

share until our common stock is quoted on the OTC Bulletin Board and

thereafter at prevailing market prices or privately negotiated

prices.

|

3

|

Minimum

Number of Securities to be Sold in this Offering:

|

None.

|

|

|

Securities

Issued and

to

be Issued:

|

As

of the date of this prospectus, we had 51,055,000 issued and outstanding

shares of our common stock and no outstanding options, warrants or other

convertible securities.

All

of the common stock to be sold under this Prospectus will be sold by

existing stockholders. There is no established market for the common stock

being registered. We intend to apply to have our common stock quoted on

the OTC Bulletin Board. This process usually takes at least 60 days and

the application must be made on our behalf by a market maker. We have not

engaged any market maker as a sponsor to make an application on our

behalf. If we are unable to obtain a market maker for our securities, we

will be unable to develop a trading market for our common stock. If our

common stock becomes listed and a market for the stock develops, the

actual price of the stock will be determined by prevailing market prices

at the time of sale. Trading of securities on the OTC Bulletin Board is

often sporadic and investors may have difficulty buying and selling or

obtaining market quotations, which may have a depressive effect on the

market price for our common stock.

|

|

|

Proceeds:

|

We

will not receive any proceeds from the sale of our common stock by the

selling security

holders.

|

Financial

Summary Information

All of

the references to currency in this Prospectus are to U.S. Dollars, unless

otherwise noted. The

following table sets forth selected financial information, which should be read

in conjunction with the information set forth in the "Management’s Discussion

and Analysis of Financial Position and Results of Operations" section and the

accompanying consolidated Financial Statements and related notes included

elsewhere in this Prospectus.

Income

Statement Data

|

For the Year

ended May 31,

2009

(audited)

($)

|

Period from

inception on April

3, 2008 to

May 31, 2008

(audited)

($)

|

Period from

inception on April

3, 2008 to

May 31, 2009

(audited)

($)

|

||||||||||

|

Revenues

|

- | - | - | |||||||||

|

Expenses

|

147,187 | 78,912 | 226,099 | |||||||||

|

Net

Loss

|

(136,116 | ) | (78,912 | ) | (215,028 | ) | ||||||

|

Net

Loss per share

|

- | - | - | |||||||||

4

Balance

Sheet Data

|

May 31, 2009

(audited)

($)

|

May 31, 2008

(audited)

($)

|

|||||||

|

Working

Capital Surplus (Deficiency)

|

(756 | ) | 64,473 | |||||

|

Total

Current Assets

|

35,604 | 92,707 | ||||||

|

Total

Current Liabilities

|

36,360 | 28,234 | ||||||

Risk

Factors

Please

consider the following risk factors before deciding to invest in our common

stock.

This

offering and any investment in our common stock involves a high degree of risk.

You should carefully consider the risks described below and all of the

information contained in this Prospectus before deciding whether to purchase our

common stock. If any of the following risks actually occur, our business,

financial condition and results of operations could be harmed. The trading price

of our common stock could decline, and you may lose all or part of your

investment.

Business

Risks

1. We

lack an operating history and there is no assurance that our future operations

will result in revenues or profits. If we cannot generate sufficient revenues to

operate profitably, we may suspend or cease our operations.

We

were incorporated on April 3, 2008, our subsidiary was incorporated on April 27,

2007, and we have yet to generate any revenues. We also have very little

operating history upon which an evaluation of our future success or failure can

be made. As of May 31, 2009, we had incurred a net loss of

$215,028.

The

success of our future operations is dependent upon our ability to:

|

·

|

carry

out our planned exploration activities on our current mineral

claims;

|

|

·

|

acquire

additional interests in exploration stage properties;

and

|

|

·

|

compete

effectively with other mining

companies.

|

5

Based on

our current business plan, we expect to incur operating losses for the

foreseeable future. We cannot guarantee that we will ever be successful in

generating significant revenues, and our failure to achieve profitability may

cause us to suspend or cease our operations.

2. We

will need a significant amount of capital to carry out our proposed business

plan, and unless we are able to raise sufficient funds, we may be forced to

discontinue our operations.

In

order to carry out an exploration program on our current mineral claims and

acquire additional interests in exploration stage properties, we will require a

significant amount of capital. We estimate that we will need approximately

$347,200 to finance our planned operations for the next 12 months, including

$175,000 to undertake the first phase of our exploration

program.

We

will not receive the proceeds of this offering.

We

intend to raise our cash requirements for the next 12 months through the sale of

our equity securities in private placements, through shareholder loans, or

possibly through a registered public offering (either self-underwritten or

through a broker-dealer). If we are unsuccessful in raising enough money through

such capital-raising efforts, we may review other financing possibilities such

as bank loans. At this time we do not have a commitment from any broker-dealer

to provide us with financing. There is no assurance that any financing will be

available to us or if available, on terms that will be acceptable to us. We

intend to negotiate with our management and consultants to pay parts of their

salaries and fees with stock and stock options instead of cash.

Our

ability to obtain the necessary financing to carry out our business plan is

subject to a number of factors, including general market conditions and investor

acceptance of our business plan. These factors may make the timing, amount,

terms and conditions of such financing unattractive or unavailable to us. If we

are unable to raise sufficient funds, we will have to significantly reduce our

spending, delay or cancel our planned activities or substantially change our

current corporate structure. There is no guarantee that we will be able to

obtain any funding or that we will have sufficient resources to conduct our

business as projected, any of which could mean that we will be forced to

discontinue our operations.

3. Because

we are in the preliminary exploration stage on our mineral claims, we face a

high risk of business failure and this could result in a total loss of your

investment.

We are in

the preliminary stage of exploring our mineral claims, and thus have no way to

evaluate the likelihood of whether we will be able to operate our business

successfully. To date, we have been involved primarily in organizational

activities, acquiring interests in mineral properties, preparing a plan of

exploration and preliminary drilling. We have not earned any revenues and have

not achieved profitability.

New

mineral exploration companies often encounter difficulties, and the rate of

failure of such enterprises is high. The likelihood that we will succeed must be

considered in light of the problems, expenses, difficulties, complications and

delays encountered in connection with the exploration of the mineral properties

that we plan to undertake. These potential problems include, but are not limited

to, unanticipated problems relating to exploration and additional costs and

expenses that may exceed current estimates. We have no history upon which to

base any assumption as to the likelihood that our business will prove

successful, and we can provide no assurance to investors that we will generate

any operating revenues or ever achieve profitable operations. If we are

unsuccessful in addressing these risks, our business will likely fail and you

may lose your entire investment.

6

4. We

must comply with government regulations that may increase the anticipated time

and cost of our exploration program, which could prevent us from becoming

profitable.

We will

be subject to the mining laws and regulations in Canada as we carry out an

exploration program. Exploration and exploitation activities are subject to the

federal, provincial and local laws, regulations and policies of Canada,

including laws regulating the removal of minerals from the ground and the

discharge of materials into the environment. Exploration and exploitation

activities are also subject to federal, provincial and local laws and

regulations which seek to maintain health and safety standards by regulating the

design and use of drilling methods and equipment.

Various

permits from government bodies are required to conduct drilling operations, and

we cannot assure you that we will receive such permits. Environmental standards

imposed by federal, provincial or local authorities may change, and any such

changes may prevent us from conducting our planned activities or increase the

costs of doing so, which could have material adverse effects on our business.

Moreover, compliance with such laws could produce adverse effects by causing

substantial delays or requiring capital outlays in excess of those anticipated.

Additionally, we may be subject to liability for pollution or other

environmental damages which we may not be able to, or elect not to, insure

against due to prohibitive premium costs and other reasons.

While our

planned exploration program budgets for regulatory compliance, there is a risk

that our mineral exploration and mining activities may be adversely affected to

varying degrees by changing governmental regulations relating to the mining

industry. Any laws, regulations or policies of any government body or regulatory

agency may be changed, applied or interpreted in a manner which will alter and

negatively affect our ability to carry on our business.

5. Mineral

exploration is inherently dangerous, and there is a risk that we may incur

liability or damages that could force us to cease operations.

The

search for valuable minerals involves numerous hazards. In the course of

carrying out an exploration program on our mineral claims, we may become subject

to liability for such hazards, including pollution, cave-ins, stuck drill steel,

physical risks to exploration personnel, adverse weather precluding drill site

access and other hazards against which we cannot insure or against which we may

elect not to insure. We do not currently have any insurance nor do we expect to

procure any insurance for the foreseeable future. If any hazards are to occur,

the costs of rectifying such hazards may exceed the value of our assets and

cause us to liquidate them, resulting in the loss of your entire investment in

our common stock.

6. We

may not locate any commercially viable mineral deposits on any of our current or

future properties, which could cause the value of your investment to

decline.

Our

exploration for commercially viable mineral deposits is highly speculative in

nature and involves the substantial risk that no viable mineral deposits will be

located on any of our present or future mineral properties. There is a

considerable risk that any exploration program we conduct on our properties may

not result in the discovery of any significant mineralization or commercial

viable mineral deposits. We may encounter numerous geological features that

limit our ability to locate mineralization or that interfere with our planned

exploration programs, each of which could result in our exploration efforts

proving unsuccessful. In such a case, we may incur the costs associated with an

exploration program without realizing any benefit. This would likely result in a

decrease in the value of our common stock.

7

7. We

may not be able to extract commercially viable mineral deposits from our current

or future properties, which could prevent us from achieving

profitability.

Although

we may succeed in discovering mineral deposits on our current or future

properties, we cannot be certain that these deposits will be capable of

supporting projected production levels or exist in sufficient quantities to be

commercially viable.

On a

long-term basis, our viability depends on our ability to find, acquire and

develop commercially viable mineral properties. The quantity of any future

deposits not only depends on our ability to develop existing properties, but

also on our ability to identify and acquire additional productive property

interests, find markets for the minerals we extract and effectively distribute

such minerals into those markets.

Our

exploration expenditures may not result in new discoveries of minerals in

commercially viable quantities. It is difficult to project the costs of

implementing an exploration program due to the inherent uncertainties of mining

in unknown formations, the costs associated with encountering various drilling

conditions such as over-pressured zones, tools lost in the hole, changes in

drilling plans and locations as a result of prior exploratory wells or

additional seismic data and interpretations thereof that may be required. Mining

hazards or environmental damage could greatly increase the cost of operations,

and various field conditions could adversely affect the production from

successful reserves. If exploration costs exceed our estimates, or if our

exploration activities do not produce results which meet our expectations, our

efforts may not be commercially successful, which could prevent us from becoming

profitable.

Our

mineral claims do not contain reserves or any proven commercially viable bodies

of ore. If our exploration programs are successful in establishing ore of

commercial tonnage and grade on any of our mineral claims, we will require

additional funds in order to advance the mineral claims into commercial

production. In such an event, we may be unable to obtain any such funds, or to

obtain such funds on terms that we consider economically feasible. If we do not

raise enough money for production, we will have to delay production or go out of

business. We may not be able to achieve any revenues, which will result in the

loss of your investment in our common stock.

8. Mineral

exploration is a highly competitive business, and we must compete with other

companies for financing and to acquire additional property interests. Our

inability to do either could cause us to cease our operations.

Mineral

exploration is a highly competitive business, and we have limited resources with

which to compete. Our competition includes large established mining companies

with substantial capabilities and with greater financial and technical resources

than we have. Numerous companies headquartered in the United States, Canada and

elsewhere in the world compete for financing and properties on a global basis,

and we may be unable to acquire either on terms we consider acceptable, or at

all. If we are unable to successfully attract the necessary investment capital

to fully explore and develop our mineral claims or acquire other desirable

properties, we may be forced to cease our operations.

8

9. Our

success depends in part on our ability to attract and retain key skilled

professionals, which we may or may not be able to do. Our failure to do so could

prevent us from achieving our goals or becoming profitable.

We plan

to hire a geologist, a land specialist and an engineer on a part-time basis or

as independent contractors to provide us with technical services regarding our

operations and proposed exploration program. However, competition for qualified

skilled professionals is intense, and we may be unable to attract and retain

such key personnel. This could prevent us from achieving our goals or becoming

profitable.

10. Since

our directors, executive officer and our business assets are not located in the

United States, you may be limited in your ability to enforce U.S. civil actions

against them. You may not be able to receive compensation for damages to the

value of your investment caused by wrongful actions by our directors and

executive officer.

Our

business assets are located in Canada, Guy Brusciano, our sole executive officer

and a director of the Company, is a resident of Canada and Anthony William

Howland-Rose, a director of our company is a resident of Australia.

Consequently, it may be difficult for U.S. investors to affect service of

process on them within the United States or to enforce a civil judgment of a

U.S. court in Canada or Australia if a Canadian or Australian court determines

that the U.S. court in which the judgment was obtained did not have jurisdiction

in the matter. There is also substantial doubt whether an original action

predicated solely upon civil liability may successfully be brought in Canada or

Australia against our directors and executive officer or any of our assets. As a

result, you may not be able to recover damages as compensation for a decline in

the value of your investment.

11. We

may denominate some of our sales, operating costs and assets in Canadian

dollars, which could affect the accuracy of our reported earnings or

losses.

Although

we intend to report our financial results in U.S. dollars, a portion of our

sales and operating costs, as well as some of our assets, may be denominated in

Canadian dollars. Consequently, any change in the value of the Canadian dollar

relative to the U.S. dollar during a given financial reporting period will

result in a foreign exchange gain or loss on the translation of the numbers from

one currency to the other. This could affect the accuracy of our reported

earnings or losses.

12. Our

operations are subject to various litigation risks that could increase our

expenses, impact our profitability and lower the value of your investment in

us.

Although

we are not currently involved in any litigation, the nature of our operations

exposes us to possible future litigation claims. There is a risk that any claim

could be adversely decided against us, which could harm our financial condition

and results of operations. Similarly, the costs associated with defending

against any claim could dramatically increase our expenses, as litigation is

often very expensive. Possible litigation matters may include, but are not

limited to, environmental damage and remediation, workers’ compensation,

insurance coverage, property rights and easements and the maintenance of mining

claims. Should we become involved in any litigation we will be forced to direct

our limited resources to defending against or prosecuting the claim(s), which

could impact our profitability and lower the value of your investment in

us.

9

13. Since

our sole executive officer does not have significant training or experience in

the mining industry, our ability to carry on business could be harmed by his

decisions and choices.

Guy

Brusciano, our sole executive officer, has limited experience in the field of

mineral resource exploration. With no direct training or experience in the

mining industry he may not be fully aware of many of the specific requirements

related to working within it, and his decisions and choices may fail to take

into account standard technical or managerial approaches which mineral resource

exploration companies commonly use. This could harm our ability to carry on

business.

14. We

may indemnify our directors and executive officer against liability to us and

our stockholders, and such indemnification could increase our operating

costs.

Our

Certificate of Incorporation and Bylaws allow us to indemnify our directors and

officers against claims associated with carrying out the duties of their

offices. Our Bylaws also allow us to reimburse them for the costs of certain

legal defenses. Insofar as indemnification for liabilities arising under the

Securities Act of 1933 (the “Securities Act”) may be permitted to our directors,

officers or control persons, we have been advised by the SEC that such

indemnification is against public policy and is therefore

unenforceable.

Since our

directors and executive officer are aware that they may be indemnified for

carrying out the duties of his offices, they may be less motivated to meet the

standards required by law to properly carry out such duties, which could

increase our operating costs. Further, if our directors or executive officer

file a claim against us for indemnification, the associated expenses could also

increase our operating costs.

15. The

enactment of the Sarbanes-Oxley Act may make it more difficult for us to retain

or attract officers and directors, which could increase our operating costs or

prevent us from becoming profitable.

The

Sarbanes-Oxley Act of 2002 was enacted in response to public concern regarding

corporate accountability in the wake of a number of accounting scandals. The

stated goals of the Sarbanes-Oxley Act are to increase corporate responsibility,

provide enhanced penalties for accounting and auditing improprieties at publicly

traded companies and protect investors by improving the accuracy and reliability

of corporate disclosure pursuant to applicable securities laws. The

Sarbanes-Oxley Act applies to all companies that file or are required to file

periodic reports with the SEC under the Securities Exchange Act of 1934 (the

“Exchange Act”).

Upon

becoming a public company, we will be required to comply with the Sarbanes-Oxley

Act. Since the enactment of the Sarbanes-Oxley Act has resulted in the

imposition of a series of rules and regulations by the SEC that increase the

responsibilities and liabilities of directors and executive officers, the

perceived increased personal risk associated with these changes may deter

qualified individuals from accepting such roles. Consequently, it may be more

difficult for us to attract and retain qualified persons to serve as our

directors or executive officers, and we may need to incur additional operating

costs. This could prevent us from becoming profitable.

10

Risks

Related to Our Securities

16. Because

there is no public trading market for our common stock, you may not be able to

resell your shares.

There is

currently no public trading market for our common stock. Therefore, there is no

central place, such as stock exchange or electronic trading system, to resell

your shares. If you do wish to resell your shares, you will have to locate a

buyer and negotiate your own sale. As a result, you may be unable to sell your

shares, or you may be forced to sell them at a loss.

We cannot

assure you that there will be a market in the future for our common stock. We

intend to apply to have our common stock quoted on the OTC Bulletin Board after

this Prospectus is declared effective by the SEC, but if for any reason our

common stock is not quoted on the OTC Bulletin Board or a public trading market

does not otherwise develop, purchasers of our securities may have difficulty

selling their shares. Even if our common stock is quoted on the OTC Bulletin

Board, the trading of securities on the OTC Bulletin Board is often sporadic and

investors may have difficulty buying and selling our shares or obtaining market

quotations for them, which may have a negative effect on the market price for

our common stock. You may not be able to sell your shares at their purchase

price or at any price at all. Accordingly, you may have difficulty reselling any

shares you purchase from the selling security holders.

17. The

continued sale of our equity securities will dilute the ownership percentage of

our existing stockholders and may decrease the market price for our common

stock.

Given our

lack of revenues and the doubtful prospect that we will earn significant

revenues in the next several years, we will likely have to issue additional

equity securities to obtain the $347,200 in financing we require for the next 12

months. Our efforts to fund our planned exploration and acquisition activities

will therefore result in dilution to our existing stockholders. In short, our

continued need to sell equity will result in reduced percentage ownership

interests for all of our investors, which may decrease the market price for our

common stock.

18. We

do not intend to pay dividends and there will thus be fewer ways in which you

are able to make a gain on your investment.

We have

never paid any cash or stock dividends and we do not intend to pay any dividends

for the foreseeable future. To the extent that we require additional funding

currently not provided for in our financing plan, our funding sources may

prohibit the payment of any dividends. Because we do not intend to declare

dividends, any gain on your investment will need to result from an appreciation

in the price of our common stock. There will therefore be fewer ways in which

you are able to make a gain on your investment.

19. Because

the SEC imposes additional sales practice requirements on brokers who deal in

shares of penny stocks, some brokers may be unwilling to trade our securities.

This means that you may have difficulty reselling your shares, which may cause

the value of your investment to decline.

Our

shares are classified as penny stocks and are covered by section 15(g) of the

Exchange Act, which imposes additional sales practice requirements on

broker-dealers who sell our securities in this offering or in the aftermarket.

For sales of our securities, broker-dealers must make a special suitability

determination and receive a written agreement from you prior to making a sale on

your behalf. Because of the imposition of the foregoing additional sales

practices, it is possible that broker-dealers will not want to make a market in

our shares. This could prevent you from reselling your shares and may cause the

value of your investment to decline.

11

20. Financial

Industry Regulatory Authority (“FINRA”) sales practice requirements may limit

your ability to buy and sell our common stock, which could depress the price of

our shares.

FINRA

rules require broker-dealers to have reasonable grounds for believing that an

investment is suitable for a customer before recommending that investment to the

customer. Prior to recommending speculative low-priced securities to their

non-institutional customers, broker-dealers must make reasonable efforts to

obtain information about the customer’s financial status, tax status and

investment objectives, among other things. Under interpretations of these rules,

FINRA believes that there is a high probability such speculative low-priced

securities will not be suitable for at least some customers. Thus, FINRA

requirements make it more difficult for broker-dealers to recommend that their

customers buy our common stock, which may limit your ability to buy and sell our

shares, have an adverse effect on the market for our shares, and thereby depress

our share price.

21. You

may face significant restrictions on the resale of your shares due to state

“blue sky” laws.

Each

state has its own securities laws, often called “blue sky” laws, which: (1)

limit sales of securities to a state’s residents unless the securities are

registered in that state or qualify for an exemption from registration; and (2)

govern the reporting requirements for broker-dealers doing business directly or

indirectly in the state. Before a security is sold in a state, there must be a

registration in place to cover the transaction, or it must be exempt from

registration. The applicable broker must also be registered in that

state.

We do not

know whether our securities will be registered or exempt from registration under

the laws of any state. A determination regarding registration will be made by

the broker-dealers, if any, who agree to serve as market makers for our common

stock. There may be significant state blue sky law restrictions on the ability

of investors to sell, and on purchasers to buy, our securities. You should

therefore consider the resale market for our common stock to be limited, as you

may be unable to resell your shares without the significant expense of state

registration or qualification.

22. Resale

restrictions for British Columbia residents and other Canadian residents may

limit your ability to sell your shares.

If you

are a resident of British Columbia, you must rely on an exemption from the

prospectus and registration requirements of B.C. securities laws to resell your

shares. Since our common stock is not quoted on the OTC Bulletin Board,

B.C. residents must comply with the B.C. Securities Commission's B.C. Instrument

72-502 - Trades In Securities

of U.S. Registered Issuers (“BCI 72-502”), which requires, among other

conditions, that B.C. residents hold their shares for four months and limit the

volume of shares they sell in any 12-month period (See "Canadian Securities Law"

under the Plan of Distribution). These restrictions limit the ability of

B.C. residents to resell shares of our common stock in the United States and

therefore, may materially affect the market value of your

investment.

12

If our

application to have our common stock quoted on the OTC Bulletin Board is

accepted, security holders who are residents of British Columbia will instead

need to comply with the restrictions and exemptions of the B.C. Securities

Commission's B.C. Instrument 51-509 - Issuers Quoted in the U.S.

Over-the-Counter Markets (“BCI 51-509”) to resell their

shares. We believe that BCI 51-509 will apply because our sole

executive officer and one of our directors is a resident of British

Columbia.

If you

are a resident of another Canadian province, you must rely on other available

prospectus and registration exemptions to resell your shares. If you cannot rely

on another such exemption, then you may have to hold your shares for an

indefinite period of time.

23. Because

one of our directors and executive officer will control more than 50% of our

issued and outstanding common stock after this offering, he will retain control

of us and be able to elect our directors. You therefore may not be able to

remove him as a director, which could prevent us from becoming

profitable.

Guy

Brusciano, a director of the Company and our sole executive officer, has control

over 50,086,000 of our shares, which is approximately 98% of our issued and

outstanding common stock. Because Guy Brusciano will continue to control more

than 50% of our issued and outstanding common stock, he will be able to elect

all of our directors and control our operations. He may have an interest in

pursuing acquisitions, divestitures and other transactions that involve risks.

For example, he could cause us to sell revenue-generating assets or to make

acquisitions or enter into strategic transactions that increase our

indebtedness. He may also acquire and hold interests in businesses that compete

directly or indirectly with us. If Guy Brusciano fails to act in our best

interests or fails to manage us adequately, you may have difficulty removing him

as a director, which could prevent us from becoming profitable.

Use of

Proceeds

We will

not receive any proceeds from the resale of our common stock offered under this

Prospectus by the selling security holders.

Determination of Offering

Price

The

selling security holders will sell their shares at an initial offering price of

$0.25 per share until our common stock is quoted on the OTC Bulletin Board, and

thereafter at prevailing market prices or privately negotiated prices. We will

file a post-effective amendment to this Prospectus to reflect the change to a

market price if our shares of common stock begin trading on a market or

exchange. The initial offering price was determined by our Board of Directors,

who considered several factors in arriving at the $0.25 per share figure,

including the following:

|

·

|

our

most recent private placements of 42,000 shares of our common stock at

$0.25 per share on July 3, 2009;

|

|

·

|

our

lack of operating history;

|

|

·

|

our

capital structure; and

|

|

·

|

the

background of our management.

|

13

As a

result, the $0.25 per share initial price of our common stock does not

necessarily bear any relationship to established valuation criteria and may not

be indicative of prices that may prevail at any time. The price is not based on

past earnings, nor is it indicative of the current market value of our assets.

No valuation or appraisal has been prepared for our business. There is no

guarantee that a public market for any of our securities will

develop.

If our

common stock becomes quoted on the OTC Bulletin Board and a market for the stock

develops, the actual price of the shares sold by the selling security holders

will be determined by prevailing market prices at the time of sale or by private

transactions negotiated by the selling security holders. The number of shares

that may actually be sold by a selling security holder will be determined by

each selling security holder. The selling security holders are neither obligated

to sell all or any portion of the shares offered under this Prospectus, nor are

they obligated to sell such shares immediately hereunder. Security holders may

sell their shares at a price different than the $0.25 per share offering price

depending on privately negotiated factors such as the security holder's own cash

requirements or objective criteria of value such as the market value of our

assets.

Dilution

All of

the 969,000 shares of our common stock to be sold by the selling security

holders are currently issued and outstanding. Accordingly, they will not cause

dilution to any of our existing shareholders.

Selling Security

Holders

The 47

selling security holders are offering for sale 969,000 shares of our issued and

outstanding common stock which they obtained as part of the following stock

issuances:

|

·

|

On

April 4, 2008, we issued an aggregate of 50,000,000 shares of our common

stock to West Point Capital Inc., a company controlled by Guy Brusciano,

our President, Chief Executive Officer, Chief Financial Officer, Principal

Accounting Officer, Treasurer and a director of the Company, at $0.00001

per share for cash proceeds of $500. These shares were issued without a

prospectus pursuant to section 4(2) of the Securities

Act.

|

|

·

|

On

April 16, 2008, we issued an aggregate of 6,000 shares of our common stock

to three non-U.S. investors at $0.25 per share in exchange for cash

proceeds of $1,500.

|

|

·

|

On

May 16, 2008, we issued an aggregate of 71,600 shares of our common stock

to ten non-U.S. investors at $0.25 per share in exchange for cash proceeds

of $17,900.

|

|

·

|

On

May 16, 2008, we issued an aggregate of 498,400 shares of our common stock

to ten non-U.S. investors in exchange for 498,400 shares of the common

stock of Cedar Creek Mines Inc., our wholly owned subsidiary, pursuant to

share exchange agreements. The 498,400 shares of Cedar Creek Mines Inc.

were originally purchased for CDN $0.25 per

share.

|

|

·

|

On

May 28, 2008, we issued an aggregate of 152,000 shares of our common stock

to six non-U.S. investors at $0.25 per share in exchange for cash proceeds

of $38,000. Included in this issuance were 40,000 shares issued to Guy

Brusciano, our President, Chief Executive Officer, Chief Financial

Officer, Principal Accounting Officer, Treasurer and a director of the

Company, at $0.25 per share in exchange for cash proceeds of

$10,000.

|

14

|

·

|

On

July 21, 2008, we issued an aggregate of 8,000 shares of our common stock

to five non-U.S. investors at $0.25 per share in exchange for cash

proceeds of $2,000.

|

|

·

|

On

July 31, 2008, we issued an aggregate of 66,000 shares of our common stock

to three non-U.S. investors at $0.25 per share in exchange for cash

proceeds of $16,500.

|

|

·

|

On

August 11, 2008, we issued 5,000 shares of our common stock to one

non-U.S. investor at $0.25 per share in exchange for cash proceeds of

$1,250.

|

|

·

|

On

August 15, 2008, we issued 40,000 shares of our common stock to one

non-U.S. investor at $0.25 per share in exchange for cash proceeds of

$10,000.

|

|

·

|

On

September 4, 2008, we issued 55,000 shares of our common stock to three

non-U.S. investors at $0.25 per share in exchange for cash proceeds of

$13,750. Included in this issuance were 20,000 shares issued to Guy

Brusciano, our President, Chief Executive Officer, Chief Financial

Officer, Principal Accounting Officer, Treasurer and a director of the

Company, for cash proceeds of

$5,000.

|

|

·

|

On

June 12, 2009, we issued 14,000 shares or our common stock to three

non-U.S. investors at $0.25 per share in exchange for cash proceeds of

$3,500.

|

|

·

|

On

June 22, 2009, we issued 93,000 shares of our common stock to ten non-U.S.

investors at $0.25 per share in exchange for cash proceeds of

$23,250.

|

|

·

|

On

June 25, 2009, we issued 4,000 shares of our common stock to one non-U.S.

investor at $0.25 per share in exchange for cash proceeds of

$1,000.

|

|

·

|

On

July 3, 2009, we issued 42,000 shares of our common stock to three

non-U.S. investors at $0.25 per share in exchange for cash proceeds of

$10,500. Included in this issuance were 20,000 shares issued to Guy

Brusciano, our President, Chief Executive Officer, Chief Financial

Officer, Principal Accounting Officer, Treasurer and director, for cash

proceeds of $5,000 and 6,000 shares of common stock issued to Karen

Brusciano, the spouse of Guy Brusciano, for proceeds of

$1,500.

|

Other

than as described above, these shares were issued without a prospectus pursuant

to Regulation S promulgated under the Securities Act.

Our

reliance upon Rule 903 of Regulation S was based on the fact that the sales of

the securities were completed in an "offshore transaction", as defined in Rule

902(h) of Regulation S. We did not engage in any directed selling efforts, as

defined in Regulation S, in the United States in connection with the sale of the

securities. Each offshore investor was not a U.S. person, as defined in

Regulation S, and was not acquiring the securities for the account or benefit of

a U.S. person.

The 47

selling security holders will sell their shares at an initial offering price of

$0.25 per share until our common stock is quoted on the OTC Bulletin Board and

thereafter at prevailing market prices or privately negotiated prices. This

Prospectus includes registration of the following 969,000 shares of our common

stock:

15

|

·

|

12,000

shares owned by Matthew Brusciano, our Secretary;

and

|

|

·

|

957,000

shares owned by other security

holders.

|

We

determined that it is in the best interests of our stockholders to register the

foregoing 969,000 shares of common stock which comprise all of our common stock

not beneficially owned by our directors.

The

following table provides information as of the date of this prospectus,

regarding the beneficial ownership of our common stock held by each of the

selling security holders, including:

|

·

|

the

number of shares owned by each prior to this

offering;

|

|

·

|

the

number of shares being offered by

each;

|

|

·

|

the

number of shares that will be owned by each upon completion of the

offering, assuming that all the shares being offered are

sold;

|

|

·

|

the

percentage of shares owned by each;

and

|

|

·

|

the

identity of the beneficial holder of any entity that owns the shares being

offered.

|

|

Name

of Selling Security

Holder

|

Shares

Owned

Prior

to

the

Offering(1)

(#)

|

Percent

(%)

|

Maximum

Numbers

of

Shares

Being

Offered

(#)

|

Beneficial

Ownership

After

the

Offering

(#)

|

Percentage

Owned

upon

Completion

of

the

Offering

(%)

|

|||||||||||||||

|

Giuseppe

Anania(2)

|

2,000 |

(3)

|

2,000 | 0 | 0 | |||||||||||||||

|

Maria

Anania(2)

|

4,000 |

(3)

|

4,000 | 0 | 0 | |||||||||||||||

|

Allen

and Maryanne Armistead

|

10,000 |

(3)

|

10,000 | 0 | 0 | |||||||||||||||

|

Jason

Armistead

|

3,000 |

(3)

|

3,000 | 0 | 0 | |||||||||||||||

|

Stephen

Armistead

|

20,000 |

(3)

|

20,000 | 0 | 0 | |||||||||||||||

|

Jatinderpal

S. Bains

|

40,000 |

(3)

|

40,000 | 0 | 0 | |||||||||||||||

|

Carlos

Batista(4)

|

2,000 |

(3)

|

2,000 | 0 | 0 | |||||||||||||||

|

Viriato

Batista(4)

|

2,000 |

(3)

|

2,000 | 0 | 0 | |||||||||||||||

|

Jamie

Bezanson

|

40,000 |

(3)

|

40,000 | 0 | 0 | |||||||||||||||

|

Hemant

Bhardwaj

|

4,000 |

(3)

|

4,000 | 0 | 0 | |||||||||||||||

|

Gurdavanpreet

S. Boparai

|

8,000 |

(3)

|

8,000 | 0 | 0 | |||||||||||||||

|

Parminder

Singh Boparai

|

40,000 |

(3)

|

40,000 | 0 | 0 | |||||||||||||||

16

|

Name

of Selling Security

Holder

|

Shares

Owned

Prior

to

the

Offering(1)

(#)

|

Percent

(%)

|

Maximum

Numbers

of

Shares

Being

Offered

(#)

|

Beneficial

Ownership

After

the

Offering

(#)

|

Percentage

Owned

upon

Completion

of

the

Offering

(%)

|

|||||||||||||||

|

Joanna

Bowman

|

2,000 |

(3)

|

2,000 | 0 | 0 | |||||||||||||||

|

Mike

Brkic

|

20,000 |

(3)

|

20,000 | 0 | 0 | |||||||||||||||

|

Matthew

Brusciano

|

12,000 |

(3)

|

12,000 | 0 | 0 | |||||||||||||||

|

Darrell

Burnson

|

40,000 |

(3)

|

40,000 | 0 | 0 | |||||||||||||||

|

William

Chisholm

|

6,000 |

(3)

|

6,000 | 0 | 0 | |||||||||||||||

|

Domenic

Demarco

|

2,000 |

(3)

|

2,000 | 0 | 0 | |||||||||||||||

|

Nicole

Delorme

|

1,000 |

(3)

|

1,000 | 0 | 0 | |||||||||||||||

|

Robert

R. Eng

|

12,000 |

(3)

|

12,000 | 0 | 0 | |||||||||||||||

|

Pino

Fatiguso

|

100,000 |

(3)

|

100,000 | 0 | 0 | |||||||||||||||

|

Giuseppe

Gallo

|

4,000 |

(3)

|

4,000 | 0 | 0 | |||||||||||||||

|

Blake

D. Goddard

|

20,000 |

(3)

|

20,000 | 0 | 0 | |||||||||||||||

|

Paul

Gomes

|

1,200 |

(3)

|

1,200 | 0 | 0 | |||||||||||||||

|

Mike

Gregg

|

40,000 |

(3)

|

40,000 | 0 | 0 | |||||||||||||||

|

Harvir

Grewal

|

40,000 |

(3)

|

40,000 | 0 | 0 | |||||||||||||||

|

Bhag

S. Grewal

|

20,000 |

(3)

|

20,000 | 0 | 0 | |||||||||||||||

|

David

Haynes

|

1,200 |

(3)

|

1,200 | 0 | 0 | |||||||||||||||

|

Richard

Haynes

|

1,200 |

(3)

|

1,200 | 0 | 0 | |||||||||||||||

|

Kevin

Johnson

|

40,000 |

(3)

|

40,000 | 0 | 0 | |||||||||||||||

|

Leland

Jones

|

60,000 |

(3)

|

60,000 | 0 | 0 | |||||||||||||||

|

Ekbal

Kaura

|

20,000 |

(3)

|

20,000 | 0 | 0 | |||||||||||||||

|

Ludmilla

Kelderman

|

80,000 |

(3)

|

80,000 | 0 | 0 | |||||||||||||||

|

Carlo

Leal

|

10,000 |

(3)

|

10,000 | 0 | 0 | |||||||||||||||

|

Danielle

Ness

|

1,000 |

(3)

|

1,000 | 0 | 0 | |||||||||||||||

|

Bruce

Nolte

|

1,000 |

(3)

|

1,000 | 0 | 0 | |||||||||||||||

|

Bob

D. Perra

|

98,400 |

(3)

|

98,400 | 0 | 0 | |||||||||||||||

|

Carmine

Risi

|

16,000 |

(3)

|

16,000 | 0 | 0 | |||||||||||||||

|

Rajpal

S. Sander

|

20,000 |

(3)

|

20,000 | 0 | 0 | |||||||||||||||

|

Vijay

Sharma

|

5,000 |

(3)

|

5,000 | 0 | 0 | |||||||||||||||

|

Rocco

Sorace

|

40,000 |

(3)

|

40,000 | 0 | 0 | |||||||||||||||

|

Mario

Sorrentino

|

1,000 |

(3)

|

1,000 | 0 | 0 | |||||||||||||||

17

|

Name

of Selling Security

Holder

|

Shares

Owned

Prior

to

the

Offering(1)

(#)

|

Percent

(%)

|

Maximum

Numbers

of

Shares

Being

Offered

(#)

|

Beneficial

Ownership

After

the

Offering

(#)

|

Percentage

Owned

upon

Completion

of

the

Offering

(%)

|

|||||||||||||||

|

Randy

G. Sunder

|

4,000 |

(3)

|

4,000 | 0 | 0 | |||||||||||||||

|

Semyon

Tsemakhovich

|

15,000 |

(3)

|

15,000 | 0 | 0 | |||||||||||||||

|

Ravinder

Bir Singh Tung

|

40,000 |

(3)

|

40,000 | 0 | 0 | |||||||||||||||

|

Robin

P. Weins

|

20,000 |

(3)

|

20,000 | 0 | 0 | |||||||||||||||

|

Total

|

969,000 | 969,000 | 0 | 0 | ||||||||||||||||

Notes:

|

(1)

|

The

number and percentage of shares beneficially owned is determined in

accordance with the Rules of the SEC and to the best of our knowledge, the

information is not necessarily indicative of beneficial ownership for any

other purpose. Under such rules, beneficial ownership includes any shares

as to which the selling security holder has sole or shared voting or

investment power and also any shares which the selling security holder has

the right to acquire within 60 days of the date of this

Prospectus.

|

|

(2)

|

To

the best of our knowledge, Giuseppe Anania and Maria Anania are husband

and wife.

|

|

(3)

|

Less

than 1%.

|

|

(4)

|

To

the best of our knowledge, Viriato Batista and Carlos Batista are father

and son.

|

The

percentages in the above table are based on the 51,055,000 shares of our common

stock outstanding as of the date of this prospectus and assume that none of the

selling security holders will sell shares not being offered in this Prospectus

or will purchase additional shares, and that all the shares being registered

will be sold.

Except as

otherwise noted in the above list, the named party beneficially owns and has

sole voting and investment control over the shares or the rights to the shares.

Furthermore, other than as described above, none of the selling security holders

or their beneficial owners has had a material relationship with us other than as

a shareholder at any time within the past three years, or has ever been one of

our officers or directors or an officer or director of our predecessors or

affiliates.

None of

the selling security holders are broker-dealers or affiliates of a

broker-dealer.

Plan of

Distribution

We are

registering 969,000 shares of our common stock on behalf of the selling security

holders. The 969,000 shares of our common stock can be sold by the selling

security holders at an initial offering price of $0.25 per share until our

common stock is quoted on the OTC Bulletin Board and thereafter at prevailing

market prices or privately negotiated prices.

No public

market currently exists for our common stock. We intend to apply to have our

common stock quoted on the OTC Bulletin Board, but in order for this to occur a

market maker must file an application on our behalf to make a market for our

common stock. This process takes at least 60 days and can take longer than a

year. We have not engaged any market maker as a sponsor to make an application

on our behalf. If we are unable to obtain a market maker for our securities, we

may be unable to develop a trading market for our common stock.

18

Trading

in securities quoted on the OTC Bulletin Board is often thin and is

characterized by wide fluctuations in trading prices due to many factors that

may have little to do with a company's operations or business prospects. The OTC

Bulletin Board should not be confused with the NASDAQ market, as OTC Bulletin

Board companies are subject to fewer restrictions and regulations than NASDAQ

market companies. Moreover, the OTC Bulletin Board is not a stock exchange, and

the trading of securities on the OTC Bulletin Board is often more sporadic than

the trading of securities listed on a quotation system like the NASDAQ Capital

Market or a stock exchange. In the absence of an active trading market investors

may have difficulty buying and selling or obtaining market quotations for our

common stock and its market visibility may be limited, which may have a negative

effect on the market price of our common stock.

There is

no assurance that our common stock will be quoted on the OTC Bulletin Board. We

do not currently meet the existing requirements to have our stock quoted on the

OTC Bulletin Board, and we cannot assure you that we will ever meet these

requirements.

The

selling security holders may sell some or all of their shares of our common

stock in one or more transactions, including block transactions:

· on

such public markets as the securities may be trading;

· in

privately negotiated transactions; or

· in

any combination of these methods of distribution.

The

selling security holders may offer our common stock to the public:

· at

an initial price of $0.25 per share until a market develops;

· at

the market price prevailing at the time of sale;

· at

a price related to such prevailing market price; or

· at

such other price as the selling security holders determine.

We are

bearing all costs relating to the registration of our common stock. The selling

security holders, however, will pay any commissions or other fees payable to

brokers or dealers in connection with any sale of the shares of our common

stock.

The

selling security holders must comply with the requirements of the Securities Act

and the Exchange Act in the offer and sale of our common stock. In particular,

during such times as the selling security holders may be deemed to be engaged in

a distribution of any securities, and therefore be considered to be an

underwriter, they must comply with applicable laws and may, among other

things:

|

·

|

furnish

each broker or dealer through which our common stock may be offered such

copies of this Prospectus, as amended from time to time, as may be

required by such broker or dealer;

|

|

·

|

not

engage in any stabilization activities in connection with our securities;

and

|

19

|

·

|

not

bid for or purchase any of our securities or attempt to induce any person

to purchase any of our securities other than as permitted under the

Exchange Act.

|

The

selling security holders and any underwriters, dealers or agents that

participate in the distribution of our common stock may be deemed to be

underwriters, and any commissions or concessions received by any such

underwriters, dealers or agents may be deemed to be underwriting discounts and

commissions under the Securities Act. Our common stock may be sold from time to

time by the selling security holders in one or more transactions at a fixed

offering price, which may be changed, at varying prices determined at the time

of sale or at negotiated prices. We may indemnify any underwriter against

specific civil liabilities, including liabilities under the Securities

Act.

The

selling security holders and any broker-dealers acting in connection with the

sale of the common stock offered under this Prospectus may be deemed to be

underwriters within the meaning of section 2(11) of the Securities Act, and any

commissions received by them and any profit realized by them on the resale of

shares as principals may be deemed underwriting compensation under the

Securities Act. Neither we nor the selling security holders can presently

estimate the amount of such compensation. We know of no existing arrangements

between the selling security holders and any other security holder, broker,

dealer, underwriter, or agent relating to the sale or distribution of our common

stock.

Because

the selling security holders may be deemed to be underwriters within the meaning

of section 2(11) of the Securities Act, they will be subject to the prospectus

delivery requirements of the Securities Act. Each selling security holder has

advised us that they have not yet entered into any agreements, understandings,

or arrangements with any underwriters or broker-dealers regarding the sale of

our common stock. We may indemnify any underwriter against specific civil

liabilities, including liabilities under the Securities Act.

Regulation

M

During

such time as they may be engaged in a distribution of any of the securities

being registered by this Prospectus, the selling security holders are required

to comply with Regulation M promulgated under the Exchange Act. In general,

Regulation M precludes any selling security holder, any affiliated purchaser and

any broker-dealer or other person who participates in a distribution from

bidding for or purchasing, or attempting to induce any person to bid for or

purchase, any security that is the subject of the distribution until the entire

distribution is complete.

Regulation

M defines a “distribution” as an offering of

securities that is distinguished from ordinary trading activities by the

magnitude of the offering and the presence of special selling efforts and

selling methods. Regulation M also defines a “distribution participant” as an underwriter,

prospective underwriter, broker, dealer, or other person who has agreed to

participate or who is participating in a distribution.

Regulation

M prohibits, with certain exceptions, participants in a distribution from

bidding for or purchasing, for an account in which the participant has a

beneficial interest, any of the securities that are the subject of the

distribution. Regulation M also governs bids and purchases made in order to

stabilize the price of a security in connection with a distribution of the

security. We have informed the selling security holders that the