Attached files

Table of Contents

As filed with the Securities and Exchange Commission on October 13, 2009

Registration No. 333-160634

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ADDUS HOMECARE CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 8082 | 20-5340172 | ||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

2401 South Plum Grove Road

Palatine, Illinois 60067

(847) 303-5300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark S. Heaney

President and Chief Executive Officer

Addus HomeCare Corporation

2401 South Plum Grove Road

Palatine, Illinois 60067

(847) 303-5300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

It is respectfully requested that the Securities and Exchange Commission send copies of all notices, orders and communications to:

| Dominick P. DeChiara, Esq. | Colin J. Diamond, Esq. | |

| Lloyd H. Spencer, Esq. | White & Case LLP | |

| Nixon Peabody LLP | 1155 Avenue of the Americas | |

| 437 Madison Avenue | New York, New York 10036 | |

| New York, New York 10022 | (212) 819-8200 | |

| (212) 940-3000 |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| ¨ |

Large Accelerated Filer |

¨ | Accelerated Filer | |||

| x |

Non-accelerated Filer |

¨ | Smaller Reporting Company | |||

| (Do not check if a smaller reporting company) |

||||||

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||

| Common Stock, par value $0.001 per share |

$74,750,000 | $4,171 | ||

| (1) | Includes shares that the underwriters have the option to purchase to cover over-allotments. |

| (2) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (3) | An aggregate filing fee of $3,850 was previously paid in connection with the filing of this Registration Statement on July 17, 2009. The aggregate filing fee of $4,171 is being offset by the $3,850 payment previously made in connection with the prior filing of this Registration Statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED OCTOBER 13, 2009

Preliminary Prospectus

5,000,000 Shares

Addus HomeCare Corporation

Common Stock

We are offering 5,000,000 shares of our common stock. This is our initial public offering, and no public market currently exists for our common stock. We expect the initial public offering price to be between $11.00 and $13.00 per share. Our common stock has been approved for listing on The Nasdaq Global Market under the symbol “ADUS.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 13.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| PER SHARE | TOTAL | |||

| Public Offering Price |

$ | $ | ||

| Underwriting Discounts and Commissions |

$ | $ | ||

| Proceeds to Us (Before Expenses) |

$ | $ |

Delivery of the shares of common stock will be made on or about , 2009. We have granted the underwriters an option for a period of 30 days to purchase, on the same terms and conditions set forth above, up to an additional 750,000 shares of our common stock to cover over-allotments, if any.

| Robert W. Baird & Co. | Oppenheimer & Co. | |

| Stephens Inc. | ||

Prospectus dated , 2009

Table of Contents

Table of Contents

| Page | ||

| 1 | ||

| 13 | ||

| 26 | ||

| 27 | ||

| 29 | ||

| 30 | ||

| 31 | ||

| 33 | ||

| 38 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

47 | |

| 79 | ||

| 94 | ||

| 99 | ||

| 120 | ||

| 126 | ||

| 128 | ||

| 133 | ||

| 135 | ||

| 139 | ||

| 144 | ||

| 144 | ||

| 144 | ||

| F-1 |

You should rely only on the information contained in this prospectus, any amendment or supplement hereto or any free writing prospectus prepared by us or on our behalf. We have not authorized anyone to provide you with information that is different. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus or any free writing prospectus is accurate only as of its date, regardless of the time of delivery of this prospectus or any free writing prospectus or of any sale of the common stock.

This prospectus contains estimates and other statistical data made by independent parties relating to market size, expenditure, growth and other data about our industry. We have not independently verified the statistical and other industry data generated by independent parties and contained in this prospectus and, accordingly, we cannot guarantee their accuracy or completeness. References to websites where reports containing such estimates and statistical data can be found are inactive textual references only and are not a hyperlink. The information contained on, or accessible through, any such website, other than estimates and statistical data explicitly set forth in this prospectus, are not incorporated by reference into this prospectus.

Until , 2009 (25 days after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to its unsold allotments or subscriptions.

Table of Contents

This summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you need to consider in making your investment decision. You should read carefully this entire prospectus, including the matters set forth in the section entitled “Risk Factors,” our consolidated financial statements and the related notes and management’s discussion and analysis thereof included elsewhere in this prospectus, before deciding whether to invest in our common stock. In this prospectus, unless otherwise expressly stated or the context otherwise requires, “Addus,” “our company,” “we,” “us” and “our” refer to Addus HomeCare Corporation, a Delaware corporation, and its subsidiaries, “Holdings” refers exclusively to Addus HomeCare Corporation and “Addus HealthCare” refers to Addus HealthCare, Inc., our operating subsidiary.

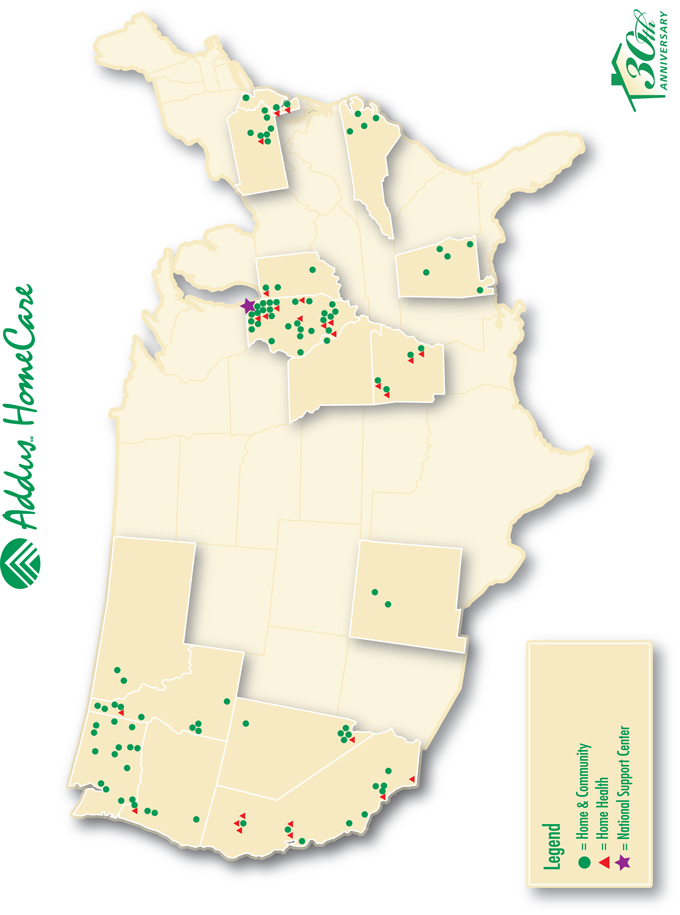

Our Company

We are a comprehensive provider of a broad range of social and medical services in the home. Our services include personal care and assistance with activities of daily living, skilled nursing and rehabilitative therapies, and adult day care. Our consumers are individuals with special needs who are at risk of hospitalization or institutionalization, such as the elderly, chronically ill and disabled. Our payor clients include federal, state and local governmental agencies, the Veterans Health Administration, commercial insurers and private individuals. We provide our services through over 120 locations across 16 states to over 23,000 consumers.

We operate our business through two divisions, home & community services and home health services. Our home & community services are social, or non-medical, in nature and include assistance with bathing, grooming, dressing, personal hygiene and medication reminders, and other activities of daily living. We provide home & community services on a long-term, continuous basis, with an average duration of 20 months per consumer. Our home health services are medical in nature and include physical, occupational and speech therapy, as well as skilled nursing. We generally provide home health services on a short-term, intermittent or episodic basis to individuals recovering from an acute medical condition, with an average length of care of 85 days.

The comprehensive nature of our social and medical services enables us to maintain a long-term relationship with our consumers as their needs change over time and provides us with diversified sources of revenue. To meet our consumers’ changing needs, we have developed and are implementing an integrated service delivery model that allows our consumers to access social and medical services from one homecare provider and appeals to referral sources who are seeking a provider with a breadth of services, scale and systems to meet consumers’ needs effectively. Our integrated service delivery model enables our consumers to access services from both our home & community services and home health services divisions, thereby receiving the full spectrum of their social and medical homecare service needs from a single provider. Our integrated service model is designed to reduce service duplication, which lowers health care costs, enhances consumer outcomes and satisfaction, and lowers our operating costs, as well as drives our internal growth strategy. In our target markets, our care and service coordinators work with our caregivers, consumers and their providers to review our consumers’ current and anticipated service needs and, based on this continuous review, identify areas of service duplication or new service opportunities. This approach, combined with our integrated service delivery model, enabled us to derive approximately 25% of our Medicare home health cases in 2008 from our home & community consumer base.

We generated net service revenues of $236.3 million in 2008, up from $194.6 million in 2007, representing an increase of 21.5% driven by organic growth and acquisitions. Our home & community net service revenues in 2008 were $189.0 million, or 80.0%, of our total net service revenues. State and local government programs accounted for 96.9% of our home & community net service revenues, with the balance derived from commercial insurance programs and private individuals, who we refer to as private duty consumers. The Illinois Department on Aging, our largest payor client, accounted for 31.6% of our total net service revenues in 2008. Our home health net service revenues in 2008 were $47.3 million, or 20.0%, of our total net service revenues, 58.3% of which were reimbursed by Medicare, 23.4% by state and local government programs, 11.4% by commercial insurance programs and 6.9% from private duty consumers. Our operating income grew to $10.8 million in 2008 from $5.0 million in 2007. Our Adjusted EBITDA, which we define as net income plus depreciation and amortization, net

1

Table of Contents

interest expense, income tax expense and stock-based compensation expense, grew to $17.2 million in 2008 from $12.0 million in 2007. See “Summary Historical and Pro Forma Consolidated Financial and Other Data” for a definition of Adjusted EBITDA and reconciliation to net income.

Our Market and Opportunity

We provide services to the elderly and adult infirm who need long-term care and assistance with essential, routine tasks of life, as well as Medicare-eligible beneficiaries who are in need of recuperative care services following an acute medical condition. The Georgetown University Long-Term Care Financing Project estimated total expenditures in 2005 for services such as these, including services provided in the home or in a community-based setting, as well as in institutions such as skilled nursing facilities, at over $205 billion. See “Medicare and Long-Term Care,” published in 2007 by Ellen O’Brien, available at http://ltc.georgetown.edu/pdfs/medicare0207.pdf. It is estimated that 49.0% of these expenditures were paid for by Medicaid, 20.4% by Medicare, 18.1% by private duty, 7.2% by private insurance and 5.3% by other sources. Homecare services is the fastest growing segment within this overall market. According to Thomson Reuters (formerly Metstat), Medicaid expenditures for home & community services increased from $7.5 billion in 1995 to $37.9 billion in 2007, representing a compound annual growth rate, or CAGR, of 14.4%. See “Medicaid Long-Term Care Expenditures in FY 2007,” available at http://www.hcbs.org/moreInfo.php/doc/2374. According to the Medicare Payment Advisory Commission, or MedPAC, Medicare expenditures on home health care increased from $8.5 billion in 2001 to $13.7 billion in 2007, representing a CAGR of 8.3%. See “A Data Book: Healthcare Spending and the Medicare Program: June 2009,” available at http://www.medpac.gov/chapters/Jun09DataBookSec9.pdf.

We believe growth in homecare is being driven by the following trends:

| • | an aging population; |

| • | consumer preference to receive care in the home or in a community-based setting; and |

| • | the cost-effectiveness of the provision of care in the home. |

In addition to the projected growth of government-sponsored homecare services, the private duty market for our services is rapidly growing. We provide our private duty consumers with all of the services we provide to both our home & community and home health consumers. In addition, we have developed a comprehensive care management program, through which we provide additional services to our private duty consumers. Through our comprehensive care management program, we undertake a detailed assessment of our private duty consumers’ needs and resources and develop a complete plan of care, which may include consultative services, telephone reassurance and other services tailored to their specific needs.

Historically, there were limited barriers to entry in the homecare industry. As a result, the industry developed in a highly fragmented manner, with many small local providers. As such, few companies have a significant market share across multiple regions or states. More recently, the homecare industry has been subject to increased regulation. We believe limitations on the availability of new licenses, the rising cost and complexity of operations and pressure on reimbursement rates due to constrained government resources create substantial barriers for new providers and may encourage industry consolidation.

Competitive Strengths

We believe the following competitive strengths position us to grow our business and our market share:

| • | Large scale of operations. We believe we are one of the largest providers of comprehensive homecare services. We provide a broad range of social and medical services to over 23,000 consumers through over 120 locations across 16 states. Our size and the diversity of our services distinguish us from the vast majority of our competitors, which are generally small and local, and provide us with a broad platform from which we are able to expand into new markets, add new service lines and participate in new programs. |

| • | Comprehensive, integrated service offering. We offer a full spectrum of social and medical homecare services that allow our consumers to stay within our delivery system as their health care needs change over time. This approach |

2

Table of Contents

| serves to diversify our financial risk. Our approach is designed to reduce service duplication, which lowers overall health care costs, to enhance consumer outcomes, to increase referral sources and consumer satisfaction, to lower our operating costs and to drive our growth. |

| • | Long-term, mutually beneficial relationships with payors and referral sources. Our success has been built on establishing and maintaining long-term, mutually beneficial relationships with payors and referral sources. We are often invited to participate in advisory commissions that provide advice to our payor clients with respect to funding, procurement and service delivery matters. In addition, we are often selected to participate in the planning and implementation of pilot programs that test alternative methods and enhancements to service delivery. Our leadership in this area, as well as our targeted advocacy in support of other payor client initiatives, has developed and strengthened our relationships with our payor clients. Given the long duration of our average home & community services, we often report to a consumer’s physician on the status of his or her patient. This practice provides us with an opportunity to inform the physician about additional services that might benefit the patient and ensures that the physician is aware of the consumer’s current condition, leading to better and more cost-effective outcomes and strong referral relationships. |

| • | Strong relationships with employees. We continually strive to attract and retain qualified, talented employees by offering competitive compensation and benefit programs. We maintain strong working relationships with the labor unions that represent approximately 57% of our total workforce. Together with these unions, we work to improve wages and benefits and to support the introduction and passage of legislation and regulations favorable to the homecare industry. We believe our relationships with unions enhance our relationships with our employees. |

| • | Cost-effective, scalable operating model. We centralize accounting, payroll, billing, collections, human resources and information technology services in our National Support Center. We operate our business using a single information technology system, McKesson Horizon Homecare. The McKesson system provides us with real-time operating metrics, giving us the ability to monitor and adjust our services and operating performance on a continuous basis. This technology allows us to standardize and integrate the care delivered across our locations and within divisions, as well as to promote best clinical practices by blending social and medical models of care, thereby preventing hospitalizations and generally improving outcomes. We believe our centralized model and technology capabilities provide efficiencies, reducing the need for additional administrative staff and related expenses, and facilitate our efforts to be a low-cost provider. |

| • | Strong management team with extensive industry experience. We are led by an experienced management team, who have an average of over 12 years of experience in the home & community services industry and over 16 years of experience in the home health industry. Our senior management team has experience executing organic and acquisition-based growth strategies, having increased our net service revenues to $236.3 million in 2008 from $178.2 million in 2006. |

Growth Strategy

We intend to grow as an integrated provider of homecare services. The following are the key elements of our growth strategy:

| • | Expand our comprehensive, integrated service model. Our comprehensive, integrated model provides significant opportunities to effectively market to a wide range of payor clients and referral sources, many of whom are responsible for consumers with both social and medical service needs. We have implemented this model in approximately 48% of our current locations and intend to extend this model to all of our markets, both organically and through strategic acquisitions. Over the past three years, we have acquired seven businesses that have enhanced our integrated service offerings in existing markets. |

| • | Drive growth in existing markets. We intend to drive growth in our existing markets by enhancing the breadth of our services, increasing the number of referral sources and leveraging and expanding our payor relationships in each market. We believe this will result in an increase in the number of consumers we serve and enable us to achieve greater market share at the local level. In addition, to take advantage of the growing demand for quality and reputable |

3

Table of Contents

| homecare services from private duty consumers, we are focusing on increasing and enhancing the private duty services we provide to veterans and other consumers in all of our locations. We have developed a comprehensive care management program through which we provide additional services to our private duty consumers. By providing private duty services through our existing home & community and home health employees, we expect to increase our net service revenues without a corresponding increase in our operating costs. |

| • | Expand into new markets. We intend to offer our services in new geographic markets by opening new locations, expanding services from current locations into geographically contiguous markets and through acquisitions. We target expansion locations where we believe we can establish a significant presence. We regularly assess potential acquisition candidates that will augment and extend our existing operations. Over the past three years, we have completed four acquisitions in new markets and established three new locations. |

Risks Associated With Our Business

Our ability to execute our strategy and capitalize on our advantages is subject to a number of risks more fully discussed in the “Risk Factors” section immediately following this summary. Before you invest in our shares, you should carefully consider all of the information in this prospectus, including matters set forth under the heading “Risk Factors,” such as:

| • | changes to Medicaid, Medicaid waiver or other state and local medical and social programs could adversely affect our net service revenues and profitability; |

| • | delays in reimbursement due to state budget deficits or otherwise have decreased, and may in the future further decrease, our liquidity; |

| • | the implementation or expansion of self-directed care programs in states in which we operate may limit our ability to increase our market share and could adversely affect our revenue; |

| • | failure to renew a significant agreement or group of related agreements may materially impact our revenue; |

| • | our industry is highly competitive, fragmented and market-specific, with limited barriers to entry; |

| • | our profitability could be negatively affected by a reduction in reimbursement from Medicare or other payors; |

| • | we are subject to extensive government regulation; and |

| • | our current principal stockholders will continue to have significant influence over us after this offering. |

Company Information

Addus HomeCare Corporation was incorporated in Delaware in 2006 under the name Addus Holding Corporation for the purpose of acquiring Addus HealthCare. The principal stockholders of Holdings are Eos Capital Partners III, L.P. and Eos Partners SBIC III, L.P., which we refer to as the Eos Funds. As of June 30, 2009, the Eos Funds beneficially owned approximately 78.9% of our outstanding common stock, assuming conversion of all outstanding shares of our series A convertible preferred stock, which we refer to as our series A preferred stock. Addus HealthCare was founded in 1979. Our principal executive offices are located at 2401 South Plum Grove Road, Palatine, Illinois 60067. Our telephone number is (847) 303-5300. We maintain a website at www.addus.com. Information contained on, or accessible through, our website is not a part of, and is not incorporated by reference into, this prospectus.

4

Table of Contents

The Offering

| Common stock offered by us |

5,000,000 shares |

| Common stock to be outstanding immediately after this offering |

10,096,251 shares |

| Use of proceeds |

We estimate that we will receive net proceeds from this offering of approximately $53.2 million, after deducting the underwriting discount and estimated offering expenses. We intend to use the net proceeds, together with $26.6 million of borrowings under a new credit facility that we intend to enter into at the completion of this offering: |

| • | to repay $60.1 million outstanding under our existing credit facility, together with related fees and expenses; |

| • | to make a $12.4 million payment to our Chairman of the Board, President and Chief Executive Officer, the Chairman of Addus HealthCare and certain of our other existing stockholders, pursuant to a contingent payment agreement entered into in connection with our acquisition of Addus HealthCare; |

| • | to pay $4.1 million of the $11.5 million of accrued and unpaid dividends on the shares of our series A preferred stock owned by the Eos Funds and Freeport Loan Fund LLC that will convert into common stock in connection with this offering; |

| • | to pay the Eos Funds or their designee(s) a $1.5 million one-time consent fee in connection with this offering; |

| • | to pay $1.2 million to the Chairman of Addus HealthCare under a separation and general release agreement pursuant to which he has agreed to resign his position as Chairman of Addus HealthCare effective at the completion of this offering; and |

| • | to pay fees and expenses of approximately $0.4 million in connection with our new credit facility. |

Pursuant to an agreement between Addus HealthCare and an affiliate of the Eos Funds, the management consulting agreement between Addus HealthCare and the affiliate of the Eos Funds will terminate prior to the completion of this offering.

| Dividend notes |

Immediately prior to the completion of this offering, in connection with the conversion of our series A preferred stock, we will issue to the Eos Funds 10% junior subordinated promissory notes in respect of the unpaid dividends accrued on their shares of our series A preferred stock, which we refer to as the dividend notes. Immediately following the completion of this offering, the aggregate outstanding principal amount of the dividend notes will be $7.4 million. See “Certain Relationships and Related Party Transactions—Dividend Notes.” |

See “Use of Proceeds” for additional information.

| Nasdaq Global Market symbol |

“ADUS” |

5

Table of Contents

| Risk Factors |

See “Risk Factors” for a discussion of factors that you should consider carefully before deciding whether to purchase shares of our common stock. |

The number of shares of common stock outstanding after this offering above and elsewhere in this prospectus excludes (1) 802,062 shares issuable upon the exercise of options outstanding at a weighted average exercise price of $9.35 per share under our 2006 Stock Incentive Plan, which we refer to as the 2006 Plan, and (2) 750,000 shares of our common stock, representing 6.8% of the total number of shares of our common stock outstanding on a fully diluted basis as of the completion of this offering, which we intend to reserve for future issuance following the completion of this offering under our 2009 Stock Incentive Plan, which we refer to as the 2009 Plan. We have not granted any options or other equity compensation subsequent to June 30, 2009 through the date of this prospectus. Immediately following the date of this prospectus, we intend to grant (1) options to purchase 104,500 shares in the aggregate with an exercise price equal to the initial public offering price to our President and Chief Executive Officer and two other officers, and (2) 2,500 restricted shares of our common stock to three directors.

Except as otherwise indicated, all information in this prospectus:

| • | assumes an initial public offering price of $12.00 per share, the midpoint of the range on the cover of this prospectus; |

| • | gives effect to a 10.8-for-1 split of our common stock, which occurred on October 1, 2009; |

| • | gives effect to an increase in authorized shares of common stock to 40,000,000, which occurred on October 1, 2009; |

| • | gives effect to the conversion of all outstanding shares of our series A preferred stock into an aggregate of 4,077,000 shares of our common stock at a ratio of 1:108 prior to the completion of this offering; |

| • | assumes that the aggregate gross proceeds from this offering will be no greater than $70 million and, accordingly, that $7.4 million aggregate principal amount of the dividend notes will be outstanding immediately following the completion of this offering; |

| • | does not give effect to the issuance of an aggregate of (i) 2,500 restricted shares of our common stock that we will issue to our independent directors immediately following the date of this prospectus or (ii) options to purchase 104,500 shares of our common stock that we will issue to certain officers immediately following the date of this prospectus; |

| • | gives effect to the effectiveness of our amended and restated certificate of incorporation and our amended and restated bylaws prior to the completion of this offering; and |

| • | assumes no exercise of the underwriters’ option to purchase up to 750,000 additional shares of our common stock. |

In addition, except as otherwise indicated, all share and per share data, except for par value, have been adjusted to reflect the 10.8-for-1 stock split for all periods presented.

6

Table of Contents

Summary Historical and Pro Forma Consolidated Financial and Other Data

Holdings was incorporated in Delaware on July 27, 2006 and acquired Addus HealthCare on September 19, 2006. Holdings is a holding company and has no material assets other than all of the capital stock of Addus HealthCare. The application of purchase accounting rules to the financial statements of Holdings resulted in different accounting bases from Addus HealthCare and, accordingly, different financial information for the periods beginning on or after September 19, 2006. We refer to Holdings and its subsidiaries, including Addus HealthCare, following the acquisition, as the successor for purposes of the presentation of the financial information below. We refer to Addus HealthCare prior to its acquisition by Holdings as the predecessor for purposes of the presentation of the financial information below.

We present in the tables below summary historical consolidated financial and other data of Holdings and its predecessor. The summary historical consolidated statements of income data for the periods January 1, 2006 through September 18, 2006 and September 19, 2006 through December 31, 2006 and the fiscal years ended December 31, 2007 and 2008 were derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated statements of income data for the six month periods ended June 30, 2008 and 2009 and balance sheet data as of June 30, 2009 were derived from our unaudited condensed consolidated financial statements included elsewhere in this prospectus, and in the opinion of management, include all normal recurring adjustments necessary to present fairly the data for such periods and as of such date. Operating results for the six months ended June 30, 2009 are not necessarily indicative of the results that may be expected for the year ending December 31, 2009 or for any future period.

We also present in the tables below unaudited pro forma consolidated statement of income data for the fiscal year ended December 31, 2008 and the six month period ended June 30, 2009 and unaudited pro forma consolidated balance sheet data as of June 30, 2009. The unaudited pro forma consolidated statements of income for the fiscal year ended December 31, 2008 and the six months ended June 30, 2009 give effect to the following transactions, in each case, as if each such transaction took place on January 1, 2008:

| • | this offering and the payment of related fees and expenses; |

| • | the incurrence of $18.8 million of indebtedness under a new credit facility that we intend to enter into at the completion of this offering, the simultaneous repayment of $53.8 million of indebtedness under our existing credit facility (the amount outstanding on January 1, 2008), and the payment of related fees and expenses; |

| • | the conversion of all outstanding shares of our series A preferred stock into an aggregate of 4,077,000 shares of common stock at a ratio of 1:108 prior to the completion of this offering, the payment of $4.1 million in respect of accrued and unpaid dividends on such shares and $0.9 million aggregate principal amount of the dividend notes to be outstanding immediately following the completion of this offering; and |

| • | the elimination of fees payable to an affiliate of the Eos Funds under the management consulting agreement between Addus HealthCare and that entity, which will terminate prior to the completion of this offering pursuant to an agreement between Addus HealthCare and the affiliate of the Eos Funds. |

The unaudited pro forma consolidated balance sheet data as of June 30, 2009 give effect to this offering and the payment of related fees and expenses and the following transactions, in each case as if each such transaction took place on June 30, 2009:

| • | the incurrence of $26.6 million of indebtedness under our new credit facility, the payment of $0.4 million of related fees and expenses and the simultaneous repayment of $60.1 million of indebtedness under our existing credit facility (the amount outstanding on June 30, 2009); |

| • | the conversion of all outstanding shares of our series A preferred stock into an aggregate 4,077,000 shares of common stock at a ratio of 1:108 prior to the completion of this offering, the payment of $4.1 million in respect of accrued and unpaid dividends on such shares and $7.4 million aggregate principal amount of the dividend notes to be outstanding immediately following the completion of this offering; |

7

Table of Contents

| • | the payment to the Eos Funds or their designee(s) of a $1.5 million one-time consent fee in connection with this offering, or the Sponsor Transaction; |

| • | the payment of $1.2 million to the Chairman of Addus HealthCare pursuant to his separation and general release agreement, or the Separation Transaction; and |

| • | the payment of $12.4 million to our Chairman of the Board, President and Chief Executive Officer, the Chairman of Addus HealthCare and certain of our other existing stockholders, pursuant to a contingent payment agreement entered into in connection with our acquisition of Addus HealthCare, or the Contingent Payment Transaction. |

None of the unaudited pro forma statements of income data reflect the Sponsor Transaction, the Separation Transaction or the Contingent Payment Transaction due to the non-recurring nature of these payments. The pro forma information is based upon available information and certain assumptions as discussed in the notes to the unaudited financial information presented under “Unaudited Pro Forma Financial Information.” The summary pro forma data are for informational purposes only and do not purport to represent what our results of operations or financial position actually would have been if each such transaction had occurred on the dates specified above, nor do these data purport to represent the results of operations for any future period.

You should read the information set forth below in conjunction with the information under “Capitalization,” “Selected Historical Consolidated Financial and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Unaudited Pro Forma Financial Information” and our consolidated financial statements, including the notes thereto, included elsewhere in this prospectus.

8

Table of Contents

| Actual | Pro Forma As Adjusted |

|||||||||||||||||||||||||||||||||||

| Predecessor | Successor | Year Ended December 31, 2008 |

Six Months Ended June 30, 2009 |

|||||||||||||||||||||||||||||||||

| January 1, 2006 to September 18, 2006 |

September 19, 2006 to December 31, 2006 |

Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||||||||||||||||||||||

| 2007 | 2008 | 2008 | 2009 | |||||||||||||||||||||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||||||||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||||||||||||||||||

| Consolidated statements of income data: |

||||||||||||||||||||||||||||||||||||

| Net service revenues (1) |

$ | 125,927 | $ | 52,256 | $ | 194,567 | $ | 236,306 | $ | 110,868 | $ | 126,805 | $ | 236,306 | $ | 126,805 | ||||||||||||||||||||

| Cost of service revenues |

91,568 | 36,767 | 139,268 | 167,254 | 78,737 | 89,440 | 167,254 | 89,440 | ||||||||||||||||||||||||||||

| Gross profit |

34,359 | 15,489 | 55,299 | 69,052 | 32,131 | 37,365 | 69,052 | 37,365 | ||||||||||||||||||||||||||||

| General and administrative expenses |

28,391 | 11,764 | 44,233 | 52,112 | 24,657 | 27,983 | 51,762 | 27,807 | ||||||||||||||||||||||||||||

| Depreciation and amortization (2) |

439 | 1,919 | 6,029 | 6,092 | 2,841 | 2,444 | 6,092 | 2,444 | ||||||||||||||||||||||||||||

| Total operating expenses |

28,830 | 13,683 | 50,262 | 58,204 | 27,498 | 30,427 | 57,854 | 30,251 | ||||||||||||||||||||||||||||

| Operating income |

5,529 | 1,806 | 5,037 | 10,848 | 4,633 | 6,938 | 11,198 | 7,114 | ||||||||||||||||||||||||||||

| Interest expense |

(750 | ) | (1,392 | ) | (4,952 | ) | (5,806 | ) | (2,633 | ) | (2,180 | ) | (3,150 | ) | (1,154 | ) | ||||||||||||||||||||

| Interest and other income |

100 | 65 | 144 | 51 | 49 | 12 | 51 | 12 | ||||||||||||||||||||||||||||

| Income from continuing operations before income taxes |

4,879 | 479 | 229 | 5,093 | 2,049 | 4,770 | 8,099 | 5,972 | ||||||||||||||||||||||||||||

| Income tax expense (2) |

434 | 82 | 32 | 1,070 | 430 | 1,474 | 2,221 | 1,934 | ||||||||||||||||||||||||||||

| Net income from continuing operations |

4,445 | 397 | 197 | 4,023 | 1,619 | 3,296 | 5,878 | 4,038 | ||||||||||||||||||||||||||||

| Income from discontinued operations, net of tax expense of $36 |

366 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||

| Net income |

4,811 | 397 | 197 | 4,023 | 1,619 | 3,296 | 5,878 | 4,038 | ||||||||||||||||||||||||||||

| Less: preferred stock dividends, undeclared subject to payment upon conversion |

— | (1,070 | ) | (3,882 | ) | (4,270 | ) | (2,076 | ) | (2,284 | ) | — | — | |||||||||||||||||||||||

| Net income (loss) attributable to common shareholders |

$ | 4,811 | $ | (673 | ) | $ | (3,685 | ) | $ | (247 | ) | $ | (457 | ) | $ | 1,012 | $ | 5,878 | $ | 4,038 | ||||||||||||||||

| Basic income (loss) per common share: |

||||||||||||||||||||||||||||||||||||

| From continuing operations |

$ | 4,115.78 | $ | (0.66 | ) | $ | (3.62 | ) | $ | (0.24 | ) | $ | (0.45 | ) | $ | 0.99 | $ | 0.58 | $ | 0.40 | ||||||||||||||||

| From discontinued operations |

339.28 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||

| Basic income (loss) per common share |

$ | 4,455.06 | $ | (0.66 | ) | $ | (3.62 | ) | $ | (0.24 | ) | $ | (0.45 | ) | $ | 0.99 | $ | 0.58 | $ | 0.40 | ||||||||||||||||

| Diluted income (loss) per common share: |

||||||||||||||||||||||||||||||||||||

| From continuing operations |

$ | 4,115.78 | $ | (0.66 | ) | $ | (3.62 | ) | $ | (0.24 | ) | $ | (0.45 | ) | $ | 0.63 | $ | 0.58 | $ | 0.40 | ||||||||||||||||

| From discontinued operations |

339.28 | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||

| Diluted income (loss) per common share |

$ | 4,455.06 | $ | (0.66 | ) | $ | (3.62 | ) | $ | (0.24 | ) | $ | (0.45 | ) | $ | 0.63 | $ | 0.58 | $ | 0.40 | ||||||||||||||||

| Weighted average number of common shares and potential common shares outstanding: |

||||||||||||||||||||||||||||||||||||

| Basic |

1,080 | 1,019,250 | 1,019,250 | 1,019,250 | 1,019,250 | 1,019,250 | 10,096,251 | 10,096,251 | ||||||||||||||||||||||||||||

| Diluted |

1,080 | 1,019,250 | 1,019,250 | 1,019,250 | 1,019,250 | 5,203,203 | 10,200,221 | 10,205,926 | ||||||||||||||||||||||||||||

9

Table of Contents

| Predecessor | Successor | |||||||||||||||||||||||||||

| January 1, 2006 to September 18, 2006 |

September 19, 2006 to December 31, 2006 |

Year Ended December 31, |

Six Months Ended June 30, |

|||||||||||||||||||||||||

| 2007 | 2008 | 2008 | 2009 | |||||||||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||||||||

| Operational Data: |

||||||||||||||||||||||||||||

| General: |

||||||||||||||||||||||||||||

| Adjusted EBITDA (in thousands) (3) |

$ | 6,334 | $ | 3,939 | $ | 12,010 | $ | 17,212 | $ | 7,646 | $ | 9,522 | ||||||||||||||||

| States served at period end |

12 | 12 | 14 | 16 | 16 | 16 | ||||||||||||||||||||||

| Locations at period end |

93 | 92 | 104 | 122 | 120 | 121 | ||||||||||||||||||||||

| Employees at period end |

9,439 | 9,440 | 10,797 | 12,137 | 12,114 | 12,578 | ||||||||||||||||||||||

| Home & Community Data: |

||||||||||||||||||||||||||||

| Average weekly census |

16,044 | 16,275 | 17,117 | 19,432 | 18,808 | 20,147 | ||||||||||||||||||||||

| Billable hours (in thousands) |

6,798 | 2,864 | 10,421 | 12,139 | 5,832 | 6,355 | ||||||||||||||||||||||

| Billable hours per business day |

37,352 | 39,778 | 40,867 | 47,418 | 45,563 | 50,039 | ||||||||||||||||||||||

| Revenues per billable hour |

$ | 13.88 | $ | 13.88 | $ | 14.36 | $ | 15.57 | $ | 15.07 | $ | 16.13 | ||||||||||||||||

| Home Health Data: |

||||||||||||||||||||||||||||

| Average weekly census: |

||||||||||||||||||||||||||||

| Medicare |

1,187 | 1,114 | 1,130 | 1,270 | 1,221 | 1,433 | ||||||||||||||||||||||

| Non-Medicare |

1,389 | 1,442 | 1,435 | 1,413 | 1,383 | 1,536 | ||||||||||||||||||||||

| Medicare admissions (4) |

4,516 | 1,690 | 6,223 | 7,232 | 3,248 | 3,802 | ||||||||||||||||||||||

| Medicare revenues per episode completed |

$ | 2,534 | $ | 2,534 | $ | 2,563 | $ | 2,606 | $ | 2,608 | $ | 2,521 | ||||||||||||||||

| Percentage of Revenues by Payor: |

||||||||||||||||||||||||||||

| State, local or other governmental |

80 | % | 80 | % | 81 | % | 82 | % | 82 | % | 82 | % | ||||||||||||||||

| Medicare |

14 | 14 | 13 | 12 | 12 | 12 | ||||||||||||||||||||||

| Other |

6 | 6 | 6 | 6 | 6 | 6 | ||||||||||||||||||||||

| As of June 30, 2009 | ||||||

| Actual | Pro forma As Adjusted | |||||

| (unaudited) | ||||||

| (in thousands) | ||||||

| Consolidated Balance Sheet Data: |

||||||

| Cash |

$ | 850 | $ | 850 | ||

| Accounts receivable, net of allowances |

63,114 | 63,114 | ||||

| Goodwill and intangibles |

63,275 | 74,085 | ||||

| Total assets |

145,920 | 156,174 | ||||

| Total debt (5) |

64,414 | 38,230 | ||||

| Stockholders’ equity |

35,727 | 83,586 | ||||

| (1) | Acquisitions completed in 2007 accounted for $4.1 million of the growth in net service revenues for the year ended December 31, 2007 compared to the combined net service revenues for the periods from January 1, 2006 to September 18, 2006 and from September 19, 2006 to December 31, 2006. Acquisitions completed in 2008 and the results for the first twelve months of 2007 acquisitions included in 2008 accounted for $24.6 million of the growth in net service revenues for the year ended December 31, 2008 compared to the year ended December 31, 2007. Acquisitions completed in 2008 accounted for $5.1 million of the growth in net service revenues for the six months ended June 30, 2009 compared to the six months ended June 30, 2008. |

| (2) | The September 19, 2006 acquisition of Addus HealthCare by Holdings resulted in a stepped-up basis of the assets of the successor compared to the predecessor. In addition, the predecessor filed as an S corporation with earnings for federal and for selected state taxes passed through to each shareholder’s tax return, while the successor files as a C corporation with earnings for federal and state purposes taxed at the company level. |

10

Table of Contents

| (3) | We define Adjusted EBITDA as net income plus depreciation and amortization, net interest expense, income tax expense and stock-based compensation expense. Adjusted EBITDA is a performance measure used by management that is not calculated in accordance with generally accepted accounting principles in the United States (GAAP). It should not be considered in isolation or as a substitute for net income, operating income or any other measure of financial performance calculated in accordance with GAAP. |

Management believes that Adjusted EBITDA is useful to investors, management and others in evaluating our operating performance for the following reasons:

| • | By reporting Adjusted EBITDA, we believe that we provide investors with insight and consistency in our financial reporting and present a basis for comparison of our business operations between current, past and future periods. Adjusted EBITDA allows management, investors and others to evaluate and compare our core operating results, including return on capital and operating efficiencies, from period to period, by removing the impact of our capital structure (interest expense), asset base (amortization and depreciation), tax consequences and non-cash stock-based compensation expense from our results of operations, and also facilitates comparisons with the core results of our public company peers. |

| • | Our change from S-corporation status to C-corporation status for Federal income tax purposes on September 19, 2006 resulted in fluctuations in our tax expense or benefit unrelated to our results of operations. |

| • | We believe that Adjusted EBITDA is a measure widely used by securities analysts, investors and others to evaluate the financial performance of other public companies, and therefore may be useful as a means of comparison with those companies, when viewed in conjunction with traditional GAAP financial measures. |

| • | We adopted SFAS No. 123(R), “Share-Based Payment,” on September 19, 2006, the effective date of the 2006 Plan, and recorded stock-based compensation expense of approximately $214,000 for the period from September 19, 2006 through December 31, 2006, $944,000 for the year ended December 31, 2007 and $272,000 for the year ended December 31, 2008. This fluctuation in expense primarily resulted from one option grant in 2006 with a one-year vesting period, with other option grants being subject to five-year vesting periods. By comparing our Adjusted EBITDA in different periods, our investors can evaluate our operating results without the additional variations caused by stock-based compensation expense, which is not comparable from year to year due to differing vesting periods and is a non-cash expense that is not a key measure of our operations. |

In addition, management has chosen to use Adjusted EBITDA as a performance measure because the amount of non-cash expenses, such as depreciation, amortization and stock-based compensation expense, may not directly correlate to the underlying performance of our business operations, and because such expenses can vary significantly from period to period as a result of new acquisitions, full amortization of previously acquired tangible and intangible assets or the timing of new stock-based awards, as the case may be. This facilitates internal comparisons to historical operating results, as well as external comparisons to the operating results of our competitors and other companies in the homecare industry. Because management believes Adjusted EBITDA is useful as a performance measure, management uses Adjusted EBITDA:

| • | as one of our primary financial measures in the day-to-day oversight of our business to allocate financial and human resources across our organization, to assess appropriate levels of marketing and other initiatives and to generally enhance the financial performance of our business; |

| • | in the preparation of our annual operating budget, as well as for other planning purposes on a quarterly and annual basis, including allocations in order to implement our growth strategy, to determine appropriate levels of investments in acquisitions and to endeavor to achieve strong core operating results; |

| • | to evaluate the effectiveness of business strategies, such as the allocation of resources between our divisions, the mix of organic growth and acquisitive growth and adjustments to our payor mix; |

| • | as a means of evaluating the effectiveness of management in directing our core operating performance, which we consider to be performance that can be affected by our management in any particular period through their |

11

Table of Contents

| allocation and use of resources that affect our underlying revenue and profit-generating operations during that period; |

| • | for the valuation of prospective acquisitions, and to evaluate the effectiveness of integration of past acquisitions into our company; and |

| • | in communications with our board of directors concerning our financial performance. |

Although Adjusted EBITDA is frequently used by investors and securities analysts in their evaluations of companies, Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results of operations as reported under GAAP. Some of these limitations include:

| • | Adjusted EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or other contractual commitments; |

| • | Adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| • | Adjusted EBITDA does not reflect interest expense or interest income; |

| • | Adjusted EBITDA does not reflect cash requirements for income taxes; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated or amortized will often have to be replaced in the future, and Adjusted EBITDA does not reflect any cash requirements for these replacements; and |

| • | other companies in our industry may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative measure. |

Management compensates for these limitations by using GAAP financial measures in addition to Adjusted EBITDA in managing the day-to-day and long-term operations of our business. We believe that consideration of Adjusted EBITDA, together with a careful review of our GAAP financial measures, is the most informed method of analyzing our company.

The following table sets forth a reconciliation of net income, the most directly comparable GAAP measure, to Adjusted EBITDA:

| Predecessor | Successor | |||||||||||||||||||||

| January 1, 2006 to September 18, 2006 |

September 19, 2006 to December 31, 2006 |

Year Ended December 31, |

Six Months Ended June 30, | |||||||||||||||||||

| 2007 | 2008 | 2008 | 2009 | |||||||||||||||||||

| (unaudited) | ||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||

| Reconciliation of Adjusted EBITDA to Net income: |

||||||||||||||||||||||

| Net income |

$ | 4,811 | $ | 397 | $ | 197 | $ | 4,023 | $ | 1,619 | $ | 3,296 | ||||||||||

| Net interest expense |

650 | 1,327 | 4,808 | 5,755 | 2,584 | 2,168 | ||||||||||||||||

| Income tax expense |

434 | 82 | 32 | 1,070 | 430 | 1,474 | ||||||||||||||||

| Depreciation and amortization |

439 | 1,919 | 6,029 | 6,092 | 2,841 | 2,444 | ||||||||||||||||

| Stock-based compensation expense |

— | 214 | 944 | 272 | 172 | 140 | ||||||||||||||||

| Adjusted EBITDA |

$ | 6,334 | $ | 3,939 | $ | 12,010 | $ | 17,212 | $ | 7,646 | $ | 9,522 | ||||||||||

| (4) | Medicare admissions represents the aggregate number of new cases approved for Medicare services during a specified period. |

| (5) | Total debt includes the current portion of long-term debt classified in current liabilities of $10,139 at June 30, 2009. |

12

Table of Contents

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below before deciding to invest in shares of our common stock. Our business, prospects, financial condition or operating results could be materially adversely affected by any of these risks. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. In assessing the risks described below, you should also refer to the other information contained in this prospectus, including our consolidated financial statements and the related notes, before deciding to purchase any shares of our common stock.

Risks Related to Our Business

Changes to Medicaid, Medicaid waiver or other state and local medical and social programs could adversely affect our net service revenues and profitability.

For the years ended December 31, 2006, 2007 and 2008, we derived 80%, 81% and 82%, respectively, of our net service revenues from agreements that are directly or indirectly paid for by state and local governmental agencies, such as Medicaid funded programs and Medicaid waiver programs. Governmental agencies generally condition their agreements with us upon a sufficient budgetary appropriation. If a governmental agency does not receive an appropriation sufficient to cover its contractual obligations with us, it may terminate an agreement or defer or reduce the amount of the reimbursement we receive. Several of the states in which we operate are facing budgetary shortfalls due to the current economic downturn and the rising costs of health care, and as a result, have made or may consider making changes in their Medicaid, Medicaid waiver or other state and local medical and social programs. The Deficit Reduction Act of 2005 permits states to make benefit cuts to their Medicaid programs, which could affect the services for which states contract with us. Changes that states have made or may consider making to address their budget deficits include:

| • | limiting increases in, or decreasing, reimbursement rates; |

| • | redefining eligibility standards or coverage criteria for social and medical programs or the receipt of homecare services under those programs; |

| • | increasing the consumer’s share of costs or co-payment requirements; |

| • | decreasing the number of authorized hours for recipients; |

| • | slowing payments to providers; |

| • | increasing utilization of self-directed care alternatives or “all inclusive” programs; or |

| • | shifting beneficiaries to managed care programs. |

Certain of these measures have been implemented by, or are proposed in, states in which we operate. For example, Washington has implemented restrictions that limit agencies from employing family caregivers, California has considered a number of proposals, including potential changes in eligibility standards, Illinois has delayed payments to providers and Nevada recently approved a reduction in hourly rates. In 2008, we derived approximately 39% of our total net service revenues from services provided in Illinois, 13% of our total net service revenues from services provided in California, 9% of our total net service revenues from services provided in Washington and 8% of our total net service revenues from services provided in Nevada. Because a substantial portion of our business is concentrated in these states, any significant reduction in expenditures that pay for our services in these states and other states in which we do business may have a disproportionately negative impact on our future operating results. In June 2009, President Obama announced plans to offset the cost of health care reform by reducing Medicare and Medicaid spending by $200 billion to $300 billion over 10 years. If changes in Medicaid policy result in a reduction in available funds for the services we offer, our net service revenues could be negatively impacted.

Delays in reimbursement due to state budget deficits or otherwise have decreased, and may in the future further decrease, our liquidity.

There is generally a delay between the time that we provide services and the time that we receive reimbursement or payment for these services. Over 45 states are facing budget deficits. Of the 16 states in which we operate, 14 are operating

13

Table of Contents

with budget deficits for their current fiscal year, and 15 are projecting budget deficits for their upcoming 2010 fiscal year. These and other states may in the future delay reimbursement, which would adversely affect our liquidity. Due to budget issues, the State of Illinois is currently reimbursing us on a delayed basis, including with respect to our agreements with the Illinois Department on Aging, our largest payor, and as a result, our open receivable balance derived from these agreements increased by $3.0 million in 2008 and an additional $7.9 million in the first six months of 2009. Our reimbursements from the State of Illinois could be further delayed. In addition, from time to time, procedural issues require us to resubmit claims before payment is remitted, which contributes to our aged receivables. Additionally, unanticipated delays in receiving reimbursement from state programs due to changes in their policies or billing or audit procedures may adversely impact our liquidity and working capital. Because we fund our operations primarily through the collection of accounts receivable, any delays in reimbursement would result in the need to increase borrowings under our credit facility.

The implementation or expansion of self-directed care programs in states in which we operate may limit our ability to increase our market share and could adversely affect our revenue.

Self-directed care programs are funded by Medicaid and state and local agencies and allow the consumer to exercise discretion in selecting home & community service providers. Consumers may hire family members, friends or neighbors to provide services that might otherwise be provided by a home & community service provider, such as our company. Most states and the District of Columbia have implemented self-directed care programs, to varying degrees and for different types of consumers. States are under pressure from the federal government and certain advocacy groups to expand these programs. The Centers for Medicare & Medicaid Services, or CMS, has provided states with specific Medicaid waiver options for programs that offer person-centered planning, individual budgeting or self-directed services and support as part of the CMS Independence Plus initiative introduced in 2002 under an Executive Order of the President. Certain private foundations have also granted resources to states to develop and study programs that provide financial accounts to consumers for their long-term care needs, and counseling services to help prepare a plan of care that will help meet those needs. Expansion of these self-directed programs may erode our Medicaid consumer base and could adversely affect our net service revenues.

Failure to renew a significant agreement or group of related agreements may materially impact our revenue.

In 2008, we derived approximately 31.6% of our net service revenues under agreements with the Illinois Department on Aging, 7.5% of our net service revenues under an agreement with Nevada Medicaid and 6.6% of our net service revenues under an agreement with the Riverside County (California) Department of Public Social Services. Each of our agreements is generally in effect for a specific term. For example, the services we provide to the Illinois Department on Aging are provided under a number of agreements that expire at various times through 2013, while our agreement with the Riverside County Department of Public Social Services is reevaluated and subject to renewal annually. Even though our agreements are stated to be for a specific term, they are generally terminable by the counterparty upon 60 days’ notice. Our ability to renew or retain our agreements depends on our quality of service and reputation, as well as other factors over which we have little or no control, such as state appropriations and changes in provider eligibility requirements. Additionally, failure to satisfy any of the numerous technical renewal requirements in connection with our proposals for agreements could result in a proposal being rejected even if it contains favorable pricing terms. Failure to obtain, renew or retain agreements with major payors may negatively impact our results of operations and revenue. We can give no assurance these agreements will be renewed on commercially reasonable terms or at all.

Our industry is highly competitive, fragmented and market-specific, with limited barriers to entry.

We compete with home health providers, private caregivers, larger publicly held companies, privately held homecare companies, privately held single-site agencies, hospital-based agencies, not-for-profit organizations, community-based organizations and self-directed care programs. Our primary competition is from local service providers in the markets in which we operate. Some of our competitors have greater financial, technical, political and marketing resources, name recognition or a larger number of consumers and payors than we do. In addition, some of these organizations offer more services than we do in the markets in which we operate. Consumers or referral sources may perceive that local service providers and not-for-profit agencies deliver higher quality services or are more responsive. These competitive advantages may limit our ability to attract and retain referrals in local markets and to increase our overall market share.

14

Table of Contents

There are limited barriers to entry in providing home-based social and medical services, and the trend has been for states to eliminate many of the barriers that historically existed. For example, Illinois has recently changed the way in which it procures home & community service providers, now allowing all providers that are willing and capable to obtain state approval and provide services. This may increase competition in that state, and because we derived approximately 48% of our home & community net service revenues from services provided in Illinois in 2008, this increased competition could negatively impact our business.

Local competitors may develop strategic relationships with referral sources and payors. This could result in pricing pressures, loss of or failure to gain market share or loss of consumers or payors, any of which could harm our business. In addition, existing competitors may offer new or enhanced services that we do not provide, or be viewed by consumers as a more desirable local alternative. The introduction of new and enhanced service offerings, in combination with the development of strategic relationships by our competitors, could cause a decline in revenue, a loss of market acceptance of our services and a negative impact on our results of operations.

Our profitability could be negatively affected by a reduction in reimbursement from Medicare or other payors.

For the years ended December 31, 2006, 2007 and 2008, we received 14.2%, 12.7% and 11.7%, respectively, of our net service revenues from Medicare. We generally receive fixed payments from Medicare for our services based on a projection of the services required by our consumers, which is generally based on acuity. For our Medicare consumers, we typically receive a 60-day episodic-based payment. Although Medicare currently provides for an annual adjustment of payment rates based on the increase or decrease of the medical care expenditure category of the Consumer Price Index, these rate increases may be less than actual inflation or costs, and could be eliminated or reduced in any given year. The base episode rate for home health services is also subject to an annual market basket adjustment. This annual adjustment could also be eliminated or reduced in any given year. Medicare has in the past reclassified home health resource groups. As a result of reclassifications, we could receive lower reimbursement rates depending on the consumer’s case mix and services provided. Medicare reimbursement rates could also decline due to the imposition of co-payments or other mechanisms that shift responsibility for a portion of the amount payable to beneficiaries. Rates could also decline due to adjustments to the wage index. Our profitability for Medicare reimbursed services largely depends upon our ability to manage the cost of providing these services. If we receive lower reimbursement rates, or if our cost of providing services increases by more than the annual Medicare price adjustment, our profitability could be adversely impacted.

In late February 2009, President Obama released the outline of his proposed fiscal 2010 budget for the United States. The budget outline included a provision to create a reserve fund to pay for a portion of the cost of reforming the country’s health care system. The budget outline indicated that a portion of the reserve would be funded through restructuring Medicare home health care payments. This provision, if enacted, could have a negative impact on Medicare reimbursement beginning in 2010. Medicare rate reductions would adversely impact our results of operations.

One specific proposal by MedPAC, which is subject to change and congressional approval, would eliminate the home health market basket update for 2010, accelerate the case-mix adjustment of 2.71% for 2011 to 2010, and starting in 2011, rebase costs to an earlier year. If adopted as proposed, these potential reimbursement rate reductions would impact a portion of our business that represented approximately 12% of our net service revenues in 2008. The President’s proposed budget for 2011 appears to align with the MedPAC proposal. In addition, in May 2009 the Senate Committee on Finance released policy options for financing comprehensive health care reform, one of which included reducing Medicare payment rates for home health services to be more reflective of the actual costs of providing care. In June 2009, President Obama announced plans to offset the cost of health care reform by reducing Medicare and Medicaid spending by $200 to $300 billion over 10 years. On July 30, 2009, CMS published proposed regulations providing for a 2.2% full home health market basket increase for calendar year 2010. A market basket is a fixed-weight index that measures the cost of a specified mix of goods and services as compared to a base period. The home health market basket, which is used to adjust annually the Medicare base episodic rate for home health services, measures inflation or deflation in the prices of a mix of home health goods and services. A 2.2% full home health market basket increase indicates an increase in the cost of home health goods and services and will produce a corresponding increase to the payment and cost limits for home health services in the CMS payment system. A home health market basket reduction would occur in the event of deflation. In addition, the amount of reimbursement based on the home health market basket may be reduced with respect to an agency seeking reimbursement if

15

Table of Contents

certain requirements are not met. Reduction in the payments and cost limits for the identified basket of goods based on deflation or failure to meet certain requirements is referred to in the industry as a market basket reduction. Under the proposed regulations, the home health market basket increase can be reduced by 2 percentage points to 0.2% due to a failure on the part of an agency to submit certain required quality data when seeking reimbursement. The required quality data consists of a set of data elements that are used to assess outcomes for adult homecare patients, which include, among other things, improvements in ambulation, bathing and surgical wound status.

CMS has indicated that it continues to expect certain reimbursement formula reductions to become effective in 2010, which would result in a 2.75% reduction of the 60-day episode rate. An overall market basket reduction would result in a decrease in the amount of reimbursements we receive. Any reduction in Medicare and Medicaid reimbursements would adversely affect our profitability.

Private payors, including commercial insurance companies, could also reduce reimbursement. Any reduction in reimbursement from private payors would adversely affect our profitability.

We are subject to extensive government regulation. Changes to the laws and regulations governing our business could negatively impact our profitability and any failure to comply with these regulations could adversely affect our business.

The federal government and the states in which we operate regulate our industry extensively. The laws and regulations governing our operations, along with the terms of participation in various government programs, impose certain requirements on the way in which we do business, the services we offer, and our interactions with consumers and the public. These requirements relate to:

| • | licensure and certification; |

| • | adequacy and quality of health care services; |

| • | qualifications and training of health care and support personnel; |

| • | confidentiality, maintenance and security issues associated with medical records and claims processing; |

| • | relationships with physicians and other referral sources; |

| • | operating policies and procedures; |

| • | addition of facilities and services; and |

| • | billing for services. |

These laws and regulations, and their interpretations, are subject to frequent change. These changes could reduce our profitability by increasing our liability, increasing our administrative and other costs, increasing or decreasing mandated services, forcing us to restructure our relationships with referral sources and providers or requiring us to implement additional or different programs and systems. Failure to comply could lead to the termination of rights to participate in federal and state-sponsored programs and the suspension or revocation of licenses and other civil and criminal penalties.

Congress is currently considering many policy changes and proposals as part of comprehensive health reform legislation. A major component of such proposals is a reduction of Medicare and Medicaid reimbursement. We may be unable to mitigate any reimbursement changes that are ultimately enacted, any of which could have a material adverse effect on our liquidity, results of operations and financial condition.

We are subject to federal and state laws that govern our employment practices. Failure to comply with these laws, or changes to these laws that increase our employment-related expenses, could adversely impact our operations.

We are required to comply with all applicable federal and state laws and regulations relating to employment, including occupational safety and health requirements, wage and hour requirements, employment insurance and equal employment opportunity laws. These laws can vary significantly among states and can be highly technical. Costs and expenses related to these requirements are a significant operating expense and may increase as a result of, among other things, changes in federal or state laws or regulations requiring employers to provide specified benefits to employees, increases in the minimum

16

Table of Contents

wage and local living wage ordinances, increases in the level of existing benefits or the lengthening of periods for which unemployment benefits are available. We may not be able to offset any increased costs and expenses. Furthermore, any failure to comply with these laws, including even a seemingly minor infraction, can result in significant penalties which could harm our reputation and have a material adverse effect on our business.

In addition, certain individuals and entities, known as excluded persons, are prohibited from receiving payment for their services rendered to Medicaid or Medicare beneficiaries. If we inadvertently hire or contract with an excluded person, or if any of our current employees or contractors becomes an excluded person in the future without our knowledge, we may be subject to substantial civil penalties, including up to $10,000 for each item or service furnished by the excluded individual to a Medicare or Medicaid beneficiary, an assessment of up to three times the amount claimed and exclusion from the program.

We are subject to reviews, compliance audits and investigations that could result in adverse findings that negatively affect our net service revenues and profitability.

As a result of our participation in Medicaid, Medicaid waiver and Medicare programs and other state and local governmental programs, and pursuant to certain of our contractual relationships, we are subject to various reviews, audits and investigations by governmental authorities and other third parties to verify our compliance with these programs and agreements as well as applicable laws, regulations and conditions of participation. If we fail to meet any of the conditions of participation or coverage, we may receive a notice of deficiency from the applicable surveyor or authority. Failure to institute a plan of action to correct the deficiency within the period provided by the surveyor or authority could result in civil or criminal penalties, the imposition of fines or other sanctions, damage to our reputation, cancellation of our agreements, suspension or revocation of our licenses or disqualification from federal and state reimbursement programs. These actions may adversely affect our ability to provide certain services, to receive payments from other payors and to continue to operate. Additionally, actions taken against one of our locations may subject our other locations to adverse consequences. We may also fail to discover all instances of noncompliance by our acquisition targets, which could subject us to adverse remedies once those acquisitions are complete. Any termination of one or more of our locations from the Medicare program or another state or local program for failure to satisfy such program’s conditions of participation could adversely affect our net service revenues and profitability.

Payments we receive in respect of Medicaid and Medicare can be retroactively adjusted after a new examination during the claims settlement process or as a result of pre- or post-payment audits. Federal, state and local government payors may disallow our requests for reimbursement based on determinations that certain costs are not reimbursable because proper documentation was not provided or because certain services were not covered or deemed necessary. In addition, other third-party payors may reserve rights to conduct audits and make reimbursement adjustments in connection with or exclusive of audit activities. Significant adjustments as a result of these audits could adversely affect our revenues and profitability.