Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - AGA Medical Holdings, Inc. | a2194908zex-5_1.htm |

| EX-3.1 - EXHIBIT 3.1 - AGA Medical Holdings, Inc. | a2194736zex-3_1.htm |

| EX-1.1 - EXHIBIT 1.1 - AGA Medical Holdings, Inc. | a2194908zex-1_1.htm |

| EX-23.1 - EXHIBIT 23.1 - AGA Medical Holdings, Inc. | a2194413zex-23_1.htm |

| EX-23.2 - EXHIBIT 23.2 - AGA Medical Holdings, Inc. | a2194413zex-23_2.htm |

As filed with the Securities and Exchange Commission on October 13, 2009

Registration No. 333-151822

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT No. 11 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

AGA MEDICAL HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

3845 (Primary Standard Industrial Classification Number) |

41-1815457 (I.R.S. Employer Identification No.) |

||

5050 Nathan Lane North Plymouth, MN 55442 Telephone: (763) 513-9227 (Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices) |

||||

John R. Barr President and Chief Executive Officer AGA Medical Holdings, Inc. 5050 Nathan Lane North Plymouth, MN 55442 Telephone: (763) 513-9227 (Name, address, including zip code, and telephone number, including area code, of agent for service) |

||||

Copies to: |

||

| John B. Tehan, Esq. Kenneth B. Wallach, Esq. Simpson Thacher & Bartlett LLP 425 Lexington Avenue New York, NY 10017 Telephone: (212) 455-2000 Facsimile: (212) 455-2502 |

Alexander D. Lynch, Esq. Weil, Gotshal & Manges LLP 767 Fifth Avenue New York, NY 10153 Telephone: (212) 310-8000 Facsimile: (212) 310-8007 |

|

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities Registered |

Amount to Be Registered(1) |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee(3) |

||||

|---|---|---|---|---|---|---|---|---|

Common stock, $0.01 par value |

15,812,500 | $21.00 | $332,062,500 | $15,229.09 | ||||

|

||||||||

- (1)

- Including shares of common stock which may be purchased by the underwriters to cover overallotments, if any. See "Underwriting."

- (2)

- Estimated

solely for the purpose of calculating the registration fee in accordance with Rule 457(a) promulgated under the Securities Act of 1933.

- (3)

- Previously paid.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated October 13, 2009

PROSPECTUS

13,750,000 Shares

AGA Medical Holdings, Inc.

Common Stock

This is the initial public offering of our common stock. We are selling 8,500,000 shares of our common stock, and the selling stockholders named in this prospectus, which are controlled by a member of our board of directors, are selling 5,250,000 shares. We will not receive any proceeds from the sale of the shares of our common stock by the selling stockholders.

We currently expect the initial public offering price to be between $19.00 and $21.00 per share. We have applied to have the common stock included for quotation on the Nasdaq Global Market under the symbol "AGAM."

Investing in our common stock involves risks. See "Risk Factors" beginning on page 12.

| |

Per Share

|

Total

|

||

|---|---|---|---|---|

| Public offering price | $ | $ | ||

| Underwriting discount | $ | $ | ||

| Proceeds, before expenses, to AGA Medical | $ | $ | ||

| Proceeds, before expenses, to the selling stockholders | $ | $ |

The underwriters may also purchase up to an additional 2,062,500 shares from us, at the public offering price, less the underwriting discount, within 30 days of the date of this prospectus to cover overallotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2009.

| BofA Merrill Lynch | ||||||||

| Citi | ||||||||

| Deutsche Bank Securities | ||||||||

| Leerink Swann | ||||||||

| Wells Fargo Securities | ||||||||

Natixis Bleichroeder Inc.

The date of this prospectus is , 2009.

You should rely only on the information contained in this prospectus or in any free writing prospectus that we authorize to be delivered to you. We and the selling stockholders have not, and the underwriters have not, authorized anyone to provide you with additional or different information. If anyone provides you with additional, different or inconsistent information, you should not rely on it. We and the selling stockholders are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate as of the date on the front cover of this prospectus only, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, prospects, financial condition and results of operations may have changed since that date.

Through and including (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers' obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

i

The following summary highlights certain significant aspects of our business and this offering, but you should read this entire prospectus, including the financial statements and related notes, before making an investment decision. Unless the context otherwise requires, references in this prospectus to (1) "AGA" refer only to AGA Medical Holdings, Inc., the issuer of the common stock offered hereby, (2) "AGA Medical" refer to AGA Medical Corporation, a wholly owned subsidiary of AGA and (3) "we," "us," "our," and the "company" refer collectively to AGA and its consolidated subsidiaries. For ease of understanding of our disclosure, a glossary of technical terms used in this prospectus can be found in Appendix A hereto.

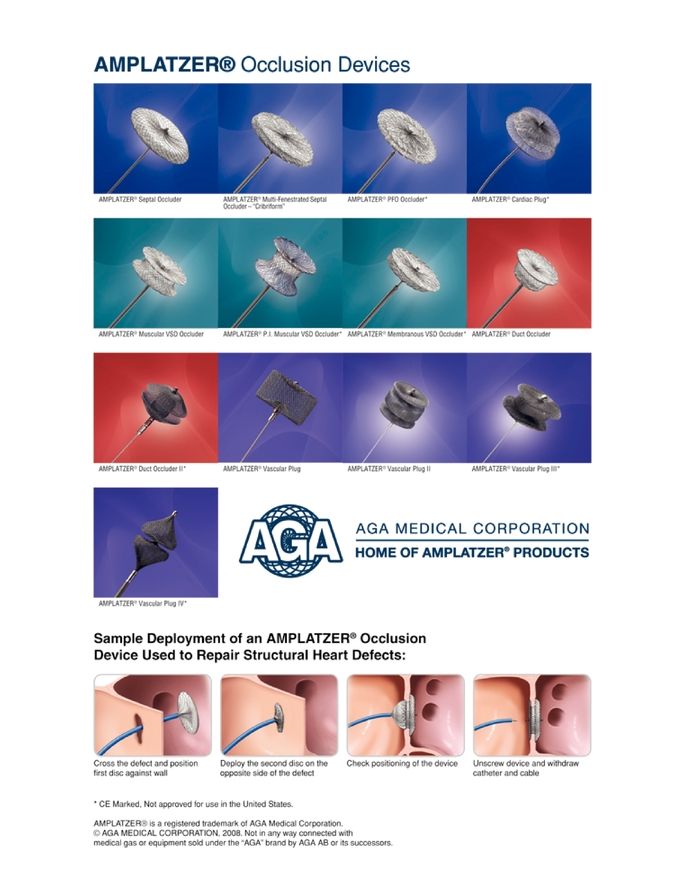

Our Business

We are a leading innovator and manufacturer of medical devices for the treatment of structural heart defects and vascular diseases. Our AMPLATZER occlusion devices offer minimally invasive, transcatheter treatments that have been clinically shown to be highly effective in defect closure. Our devices and delivery systems use relatively small catheters and can be retrieved and repositioned prior to release from the delivery cable, enabling optimal placement without the need to repeat the procedure or use multiple devices. We are the only manufacturer with occlusion devices approved to close seven different structural heart defects, and we believe we have the leading market positions in the United States and Europe for each of our devices. In 2003, we launched our first vascular products, which are designed to occlude abnormal blood vessels. For the year ended December 31, 2008 and the six months ended June 30, 2009, respectively, we generated net sales of $166.9 million and $94.4 million, earnings before interest, taxes, depreciation and amortization, or EBITDA, of $46.5 million and $17.8 million and net income (loss) of $9.1 million and $(4.2) million.

Our AMPLATZER occlusion devices utilize our expertise in braiding nitinol, a metal alloy with superelastic and shape-memory characteristics, and designing transcatheter delivery systems. While our structural heart defect occlusion devices have historically been used primarily by pediatric cardiologists, we believe that there is a significant opportunity to expand the use of our devices by cardiologists focused on the adult population. We have also leveraged our core competencies to develop products for the treatment of certain vascular diseases, which we sell primarily to interventional radiologists and vascular surgeons. In addition, we are focused on further expanding our product portfolio by developing new products, product enhancements and new applications for our existing products to address:

- •

- Patent Foramen Ovale. There is a growing body of evidence that links the presence of a patent foramen ovale, or PFO, the most common structural heart defect, to certain types of strokes and migraines. By closing the PFO with an occlusion device, we may be able to reduce the incidence of certain types of strokes and migraines. We currently sell our AMPLATZER PFO Occluder outside the United States, representing approximately 12.0% and 15.1% of our net sales for the year ended December 31, 2008 and for the six months ended June 30, 2009, respectively. Our largest clinical trial, the RESPECT study, is being conducted at approximately 60 U.S. sites to assess the impact of our AMPLATZER PFO Occluder in reducing the occurrence of certain types of stroke. Based on statistical models, we believe 500 patients should be sufficient to support a successful outcome in the RESPECT study, and on June 30, 2009, we had enrolled 576 patients. According to decision rules, a successful outcome in the clinical trial is achieved once a claim of superiority of PFO closure versus drug therapy is supported. A successful outcome can be achieved at any time during the study. We intend to continue to enroll up to 900 patients unless a successful outcome is achieved earlier. If we can establish a successful outcome, the next step would be to prepare the submission of our pre-market approval, or PMA, to the U.S. Food and Drug Administration, or FDA, which we would expect to do within

1

- •

- Left Atrial Appendage. We are developing a device to occlude

the left atrial appendage, or LAA, which targets reducing the incidence of stroke in patients with atrial fibrillation, one of the most common cardiac abnormalities in older people. We received CE

Mark clearance in Europe in December 2008 and have initiated marketing of the device in Europe. We also applied to the FDA to begin a clinical trial to support U.S. approval of our AMPLATZER Cardiac

Plug, with an initial indication for LAA occlusion, in August 2008. We estimate that clinical trials in the United States could take

approximately two to three years, after which we would file a PMA application with the FDA. We estimate that the market opportunity for LAA closure with a transcatheter approach worldwide is greater

than $1 billion annually.

- •

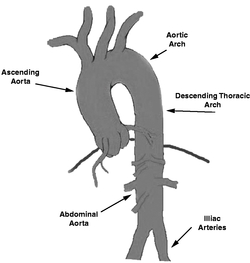

- Vascular Grafts. We are developing vascular grafts made from multiple layers of braided nitinol for the transcatheter treatment of aneurysms in a variety of blood vessel sizes. Aneurysms are localized bulges of a blood vessel caused by disease or weakening of the vessel wall. Our initial focus has been on aneurysms that occur in smaller peripheral arteries, such as the iliac arteries, arteries that branch off from the aorta and lead to the legs. We have already designed a tubular graft with the appropriate diameter to be deployed in these arteries. We intend to refile for CE Mark clearance in Europe and to apply to the FDA for an Investigational Device Exemption, or IDE, in the United States in the first half of 2010. We had previously intended to apply for these clearances in the first half of 2009 and, in the case of Europe, filed for a CE Mark in June 2009. We, however, intend to refile in Europe and are delaying our expected filing of the IDE in the United States because we encountered some issues with the delivery system in connection with the final engineering validation of our graft. We estimate that CE Mark review could take 90 to 180 days from the time of submission, and after CE Mark is granted, we would be able to begin marketing the product in Europe. We also estimate that clinical trials in the United States could take approximately two to three years, after which we would file a PMA application with the FDA. We estimate that the market opportunity for the transcatheter treatment of aneurysms in the United States and Europe is greater than $1 billion annually.

three to six months after achieving a successful outcome. Following receipt of a PMA application, the FDA determines whether it is sufficiently complete and, therefore, may be accepted for review. On a statutory basis, the FDA is required to complete a preliminary review of a PMA application within six months. The FDA review process of a PMA application, however, may take up to several years. Once the FDA has approved the PMA application, we would be able to begin marketing the product in the United States. We estimate that the market opportunity for PFO closure in the prevention of certain types of stroke in the United States and Europe is greater than $1 billion annually.

We sell our devices in 112 countries through a combination of direct sales and the use of distributors. In the United States, we market our AMPLATZER family of devices through a direct sales force of 42 representatives who call on interventional cardiologists, vascular surgeons and interventional radiologists. International markets represented 59.2% of our net sales in 2008 and 61.1% of our net sales in the six months ended June 30, 2009, and we anticipate continued growth internationally as we expand our presence in underserved countries, such as China, expand our direct sales presence into additional European countries and selectively convert our distribution to direct sales in certain other countries.

Industry Overview

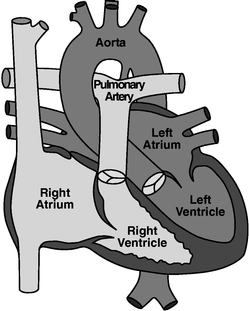

Structural Heart Defects

A structural heart defect is an abnormality in the structure of the heart and associated vessels, such as the aorta and pulmonary artery. Many structural heart defects result from problems in normal fetal heart development and are referred to as congenital heart defects. Structural heart defects can be

2

clinically significant and require immediate treatment early in life or can become clinically significant later in life when the child reaches adulthood. Two common categories of structural heart defects are (1) septal defects, which consist of a hole in the wall between the atria or ventricles that causes an errant flow of blood in the heart, and (2) failed closure of embryonic passageways, which reroute blood around the lungs in the prenatal heart. Another type of structural heart defect relates to the LAA, a small pouch on the left side of the heart, which is the remnant of the original embryonic left atrium that forms during early development. Atrial fibrillation, a condition that results in irregular electrical activity in the upper chambers of the heart, can cause blood to pool and stagnate in the LAA, increasing the chances of forming clots, which may travel to the brain and lead to stroke. Transcatheter devices can be used to close structural heart defects in lieu of other alternatives such as surgical closure.

Vascular Diseases

There are numerous vascular diseases characterized by defects in the blood vessel wall or abnormal or inappropriate blood flow. For example, aneurysms develop when the integrity and strength of the vessel wall is reduced, causing the vessel wall to progressively expand or balloon out. Peripheral embolization, a widely accepted treatment option for a large range of vascular conditions outside the heart, reduces or eliminates blood flow to an area of the body by blocking, or occluding, a blood vessel. Vascular occlusion can also be used to reroute blood away from inappropriately formed blood vessels to different blood vessels.

The AGA Solution

We develop products for the treatment of structural heart defects and vascular diseases. The performance or efficacy of our products has been documented in over 1,500 clinical publications. We have developed an expertise in the braiding of nitinol and in designing transcatheter delivery systems that enable simple and precise implantation of our AMPLATZER occlusion devices, while also providing the capability for physicians to retrieve and reposition the device during the procedure if they are not satisfied with its placement. Our AMPLATZER family of devices uses nitinol because its properties allow our devices to be compressed inside a delivery sheath and then return to their original shape once deployed at the implant site.

AMPLATZER Structural Heart Defect Occluders

We believe that our AMPLATZER structural heart defect occlusion devices offer the following advantages over our competitors' devices and open-heart surgery:

- •

- Easier to Implant, Retrieve and Reposition. We believe that

our AMPLATZER occlusion devices are easier to implant than our competitors' devices and are the only fully retrievable and repositionable occluders on

the market. The ability to retrieve and reposition the devices during the same procedure eliminates the need to remove the occlusion device and the catheter, which minimizes potential trauma to the

patient, potential complications with the procedure and disposal of damaged devices that could not be properly deployed.

- •

- Highly Effective Closure Rates. Our AMPLATZER occlusion devices have

consistently been shown to be highly effective in closing structural heart defects. Clinical publications have reported

closure rates of approximately 96% for our AMPLATZER ASD, or atrial septal defect, and PFO Occluders. Our occlusion devices have a long history of

durability as evidenced by some devices having been implanted in patients for over 13 years.

- •

- Minimally Invasive Procedures. All of our devices are inserted into the human body through a small catheter via the femoral artery in the patient's groin and then travel through the body's vasculature to the heart. This transcatheter approach minimizes blood loss, trauma and other

3

- •

- Cost Efficient. The minimally invasive nature of the procedures required to implant our AMPLATZER occlusion devices reduces costs by taking advantage of shorter hospital stays and reduced therapy and follow-up care requirements. In the United States, the average open-heart surgery procedure costs approximately $15,000 to $30,000, while the average total procedure cost to implant one of our AMPLATZER occlusion devices is generally less than $12,000, including device and hospital costs.

surgical complications associated with invasive open-heart surgery. Most patients have the procedure done on an outpatient or overnight basis and do not have to endure the lengthy two- to three-month recovery process required following open-heart surgery.

AMPLATZER Vascular Products

We are leveraging our expertise in nitinol braiding and our proficiency in the design of transcatheter delivery systems to develop products for the treatment of vascular diseases. We believe our existing vascular products and vascular products in our pipeline address a number of conditions characterized by large patient populations and existing therapies with significant shortcomings. Our initial vascular products seek to occlude abnormal blood vessels with our family of AMPLATZER Vascular Plugs and treat aneurysms in small arteries, such as the iliac arteries, and larger vessels, such as the thoracic and abdominal portions of the aorta, with our family of AMPLATZER Vascular Grafts.

Business Strategy

We seek to remain a leader in the innovation and manufacture of occlusion devices for the treatment of structural heart defects and to leverage our core competencies into leading positions in new markets. To accomplish this objective, we intend to:

- •

- grow our core business of structural heart defect occlusion and vascular devices;

- •

- capitalize on the PFO market opportunity;

- •

- expand and commercialize our research and development pipeline; and

- •

- continue to strengthen our global distribution.

Investment Risks

An investment in our common stock involves substantial risks and uncertainties. Some of the more significant risks include those associated with the following:

- •

- our ability to implement our business strategy;

- •

- regulatory approval and market acceptance of our new products, product enhancements or new applications for existing

products;

- •

- regulatory developments in key markets for our AMPLATZER occlusion

devices;

- •

- the success of our clinical trials; the success of existing and future research and development programs;

- •

- our ability to protect our intellectual property;

- •

- intellectual property claims exposure, related litigation expense, and any resultant damages, awarded royalties or other

remedies, in particular resulting from our Medtronic and Occlutech litigations;

- •

- demand for our products; product liability claims exposure;

4

- •

- failure to comply with laws and regulations, including the U.S. Foreign Corrupt Practices Act; changes in general economic

and business conditions; and

- •

- changes in currency exchange rates and interest rates.

You should carefully consider the matters described under "Risk Factors" before investing in our common stock. Any adverse effect on our business, financial condition, results of operations or cash flow could cause the trading price of our common stock to decline and could result in a partial or total loss of your investment.

Recent Developments

Effective January 1, 2009, we began direct distribution in Canada, Portugal, France, Belgium and the Netherlands as we purchased on such date the distribution rights, inventory and intangible assets from our distributors in these countries. The aggregate purchase price of these acquisitions totaled $10.8 million, consisting of cash payments of $6.1 million, the discounted value of $1.4 million in additional guaranteed payments and the discounted value of up to $3.3 million in additional contingent payments if certain revenue goals are achieved. On April 1, 2009, we paid our former French distributor $1.4 million in such additional guaranteed payments.

Effective January 1, 2009, we began direct distribution in Italy as a result of our purchase on January 8, 2009 of certain distribution rights, inventory, equipment, intangible assets and goodwill from our former Italian distributor. The aggregate purchase price was $41.0 million, consisting of cash payments of $26.6 million, the discounted value of $9.2 million in additional guaranteed payments and the discounted value of up to $5.2 million in additional contingent payments if certain revenue goals are achieved during the first three years following completion of the acquisition. On April 1, 2009, we paid our former Italian distributor $2.0 million in such additional contingent payments.

On January 5, 2009, in order to finance, in part, the acquisition of the assets of our former Italian distributor, AGA Medical issued to WCAS Capital Partners IV, L.P., one of our stockholders, for an aggregate purchase price of $15.0 million (1) $15.0 million in aggregate principal amount of 10% senior subordinated PIK notes due 2012, or the 2009 notes, and (2) 1,879 shares of Series B preferred stock. The 2009 notes are fully and unconditionally guaranteed by Amplatzer Medical Sales Corporation.

With respect to our patent litigation with Medtronic, on August 5, 2009, a jury returned a verdict that the subject AMPLATZER occluder and vascular plug products infringed two Medtronic patents and that the Medtronic patent claims at issue had not been proven by us to be invalid. The jury verdict awarded Medtronic damages of $57.8 million. This amount is equal to 11% of historical sales of the occluder and vascular plug products in question during the timeframe specified for each patent. Following the jury verdict, the court scheduled the non-jury phase of the trial for early December 2009, which will deal with other issues of invalidity and unenforceability. Upon conclusion of the non-jury phase of the trial, the court will consider post-trial motions and enter a judgment, which we expect will take place in early 2010. As part of its decision, the trial court could order a new trial on some or all of the issues in the case or amend or reaffirm the jury verdict based on one or more issues regarding infringement, validity, enforceability and damages. We also expect the trial court to decide whether any royalty payments relating to the patent that does not expire until 2018 are due for future periods and, if so, at what rate. Thereafter, the judgment will be subject to appeal by each party. See "Business—Legal Proceedings."

Notwithstanding the litigation proceedings, we are in the process of implementing changes to our business processes that will modify the final step in our manufacturing processes prior to inspection and the instructions for use of our products by physicians. These changes are intended to create an alternative process that we believe does not infringe Medtronic's patents. In addition, we intend to initiate a process to establish manufacturing operations in Europe for all of our devices that are sold in

5

international markets within 12 to 18 months. In addition to providing other benefits for our business, such as mitigating the risk inherent in relying on only one manufacturing facility, we believe the manufacture of our products outside of the United States would eliminate any claims for ongoing royalty payments on future sales with respect to such products sold outside of the United States.

Our executive offices are located at 5050 Nathan Lane North, Plymouth, MN 55442, and its telephone number is (763) 513-9227. We maintain a website at http://www.amplatzer.com. Information contained on our website or that can be accessed through our website does not constitute a part of this prospectus.

6

Common stock offered by AGA |

8,500,000 shares | |

Selling shareholders |

Gougeon Shares, LLC and Franck L. Gougeon Revocable Trust Under Agreement Dated June 28, 2008, which are beneficially owned by Franck L. Gougeon, a member of our board of directors. |

|

Common stock offered by the selling stockholders |

5,250,000 shares |

|

Overallotment option |

The underwriters may also purchase up to an additional 2,062,500 shares from us, at the public offering price, less the underwriting discount, within 30 days of the date of this prospectus to cover overallotments, if any. |

|

Common stock to be outstanding after this offering |

48,055,683 shares (or 50,118,183 if the underwriters exercise in full their option to purchase additional shares to cover overallotments, if any) |

|

Use of proceeds |

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and estimated offering expenses, will be approximately $154.2 million, assuming the shares are offered at $20.00 per share, which is the mid-point of the estimated offering price range set forth on the cover page of this prospectus (or approximately $192.7 million if the underwriters exercise in full their option to purchase additional shares to cover overallotments, if any). We will not receive any of the proceeds from the sale of shares by the selling stockholders. A member of our board of directors controls the selling stockholders. See "Principal and Selling Stockholders." |

|

|

We intend to use $65.0 million of our net proceeds from this offering to prepay the principal amount of our 10% senior subordinated PIK notes due 2012 that were issued in 2005, or the 2005 notes, and the 2009 notes. In addition, we will use a portion of our net proceeds from this offering to pay accrued and unpaid interest on the 2005 notes and the 2009 notes. We intend to use approximately $47.9 million of our net proceeds from this offering to pay all accrued and unpaid dividends on our Class A common stock and Series A and Series B preferred stock, which will be converted into our common stock immediately prior to completion of this offering. We intend to use $25.0 million of our net proceeds from this offering to repay indebtedness outstanding under our revolving credit facility. We intend to use any remaining proceeds for working capital and general corporate purposes. See "Use of Proceeds." |

|

Dividend policy |

We do not intend to declare or pay dividends on our common stock in the foreseeable future. See "Dividend Policy." |

|

Proposed Nasdaq Global Market symbol |

"AGAM" |

7

Conflicts of Interest |

Affiliates of certain of the underwriters will receive a portion of the net proceeds from this offering and may be deemed to have a "conflict of interest" with us and the selling stockholders. For more information, see "Conflicts of Interest." |

Unless we indicate otherwise or the context requires, all information in this prospectus:

- •

- assumes (1) no exercise of the underwriters' overallotment option to purchase additional shares of our common stock

and (2) an initial public offering price of $20.00 per share, the midpoint of the initial public offering price range indicated on the cover of this prospectus;

- •

- gives effect to (1) the conversion of our Class A and Class B common stock and all of our

Series A and Series B preferred stock into our common stock immediately prior to completion of this offering; and (2) the 7.15 for 1.00 reverse stock split of our common stock

that will occur immediately prior to completion of this offering; and

- •

- does not reflect (1) 2,897,637 shares of our common stock issuable upon the exercise of outstanding stock options at a weighted average exercise price of $10.18 per share as of June 30, 2009, 1,306,834 of which were then exercisable; (2) approximately 46,152 shares of our common stock issuable upon the exercise of stock options that we expect to grant to certain of our directors in connection with this offering at an exercise price equal to the offering price, none of which will then be exercisable; and (3) approximately 2,510,755 shares of our common stock reserved for future grants under our 2008 Equity Incentive Plan and our Employee Stock Purchase Plan, which is being adopted in connection with this offering.

8

Summary Consolidated Financial Data

The following table sets forth our summary consolidated financial data for the periods indicated. We derived the summary consolidated financial data presented below as of December 31, 2007 and 2008 and for the years ended December 31, 2006, 2007 and 2008 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the consolidated summary financial data for the six months ended June 30, 2008 and 2009 from our unaudited consolidated interim financial statements included elsewhere in this prospectus. We have prepared the unaudited consolidated interim financial information set forth below on the same basis as our audited consolidated financial statements and have included all adjustments, consisting only of normal recurring adjustments, that we consider necessary for a fair presentation of our financial position and operating results for such periods. The interim results set forth below are not necessarily indicative of results for the year ended December 31, 2009 or for any other period.

The pro forma basic and diluted weighted average shares and pro forma basic and diluted net loss per common share data in the summary consolidated financial data table presented below are unaudited and give effect to the 7.15 for 1.00 reverse stock split of our common stock to occur immediately prior to the completion of this offering.

The as adjusted balance sheet data as of June 30, 2009 and as adjusted basic and diluted net income per share data for the year ended December 31, 2008 and the six months ended June 30, 2008 are unaudited and give effect to (1) the conversion of our Class A and Class B common stock and all of our Series A and Series B preferred stock into our common stock immediately prior to consummation of this offering, (2) the 7.15 for 1.00 reverse stock split of our common stock to occur immediately prior to the completion of this offering, (3) the application of $68.2 million of our net proceeds from this offering to prepay the principal and accrued and unpaid interest on the 2005 notes and the 2009 notes, (4) the application of $47.9 million of our net proceeds from this offering to pay accrued and unpaid dividends on our Class A common stock and Series A and Series B preferred stock and (5) the application of $25.0 million of our net proceeds from this offering to repay indebtedness outstanding under our revolving credit facility, as if each had occurred as of June 30, 2009 in the case of the as adjusted balance sheet date, and December 31, 2008, in the case of the as adjusted basic and diluted net income per share. The as adjusted consolidated summary financial data is not necessarily indicative of what our financial position or results of operations would have been if this offering had been completed as of the date indicated, nor is such data necessarily indicative of our financial position or results of operations for any future date or period.

Our historical results are not necessarily indicative of future operating results. The following summary and as adjusted financial data should be read in conjunction with, and are qualified in their entirety by reference to, "Selected Consolidated Financial Data," "Use of Proceeds," "Capitalization," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the related notes included elsewhere in this prospectus.

9

| |

Year Ended December 31, | Six Months Ended June 30, |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands, except per share data) |

2006 | 2007 | 2008 | 2008 | 2009 | ||||||||||||

| |

|

|

|

(unaudited) |

|||||||||||||

Statement of Operations Data: |

|||||||||||||||||

Net sales |

$ | 127,529 | $ | 147,255 | $ | 166,896 | $ | 80,845 | $ | 94,381 | |||||||

Cost of goods sold |

24,985 | 22,819 | 26,635 | 12,456 | 17,004 | ||||||||||||

Gross profit |

102,544 | 124,436 | 140,261 | 68,389 | 77,377 | ||||||||||||

Operating expenses: |

|||||||||||||||||

Selling, general and administrative |

37,515 | 50,190 | 65,669 | 31,757 | 46,456 | ||||||||||||

Research and development |

12,096 | 26,556 | 32,760 | 16,210 | 16,477 | ||||||||||||

Amortization of intangible assets |

12,682 | 15,233 | 15,540 | 7,690 | 9,894 | ||||||||||||

Change in purchase consideration |

— | — | — | — | (698 | ) | |||||||||||

FCPA settlement |

— | 2,000 | — | — | — | ||||||||||||

Loss (gain) on disposal of property and equipment |

709 | (3 | ) | 68 | 14 | (26 | ) | ||||||||||

Operating income (loss) |

39,542 | 30,460 | 26,224 | 12,718 | 5,274 | ||||||||||||

Interest income and investment and other income (loss), net |

2,885 | 669 | (250 | ) | (222 | ) | (1,016 | ) | |||||||||

Interest income—related party |

— | 6 | — | — | — | ||||||||||||

Interest expense |

(22,893 | ) | (21,213 | ) | (16,492 | ) | (8,595 | ) | (8,149 | ) | |||||||

Income (loss) before income taxes |

19,534 | 9,922 | 9,482 | 3,901 | (3,891 | ) | |||||||||||

Provision for income taxes |

(6,909 | ) | (3,844 | ) | (386 | ) | (1,548 | ) | (306 | ) | |||||||

Net income (loss) |

12,625 | 6,078 | 9,096 | 2,353 | (4,197 | ) | |||||||||||

Series A and Series B preferred stock and Class A common stock dividends |

(59,410 | ) | (15,372 | ) | (17,067 | ) | (8,815 | ) | (8,471 | ) | |||||||

Net loss applicable to common stockholders |

$ | (46,785 | ) | $ | (9,294 | ) | $ | (7,971 | ) | $ | (6,462 | ) | $ | (12,668 | ) | ||

Net loss per common share—basic and diluted |

$ | (0.28 | ) | $ | (0.06 | ) | $ | (0.05 | ) | $ | (0.04 | ) | $ | (0.08 | ) | ||

Weighted average shares—basic and diluted |

167,000 | 161,236 | 153,600 | 153,600 | 153,600 | ||||||||||||

Pro forma net loss per common share—basic and diluted (unaudited)(1) |

$ | (2.00 | ) | $ | (0.41 | ) | $ | (0.37 | ) | $ | (0.30 | ) | $ | (0.59 | ) | ||

Pro forma weighted average shares—basic and diluted (unaudited)(1) |

23,356 |

22,550 |

21,482 |

21,482 |

21,482 |

||||||||||||

As adjusted net income per common share—basic and diluted (unaudited) |

0.27 | (0.02 | ) | ||||||||||||||

Weighted average shares used in computing as adjusted net income per common share—basic and diluted (unaudited) |

48,059 | 48,056 | |||||||||||||||

Other Data: |

|||||||||||||||||

Depreciation and amortization |

$ | 15,875 | $ | 19,953 | $ | 20,741 | $ | 10,433 | $ | 13,571 | |||||||

EBITDA(2) |

57,128 | 50,656 | 46,485 | 22,819 | 17,768 | ||||||||||||

| |

|

As of December 31, | As of June 30, 2009 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

|

2007 | 2008 | Actual | As Adjusted | |||||||||||

| |

|

|

|

(unaudited) |

||||||||||||

(in thousands) |

||||||||||||||||

Balance Sheet Data: |

||||||||||||||||

Cash and cash equivalents |

$ | 13,854 | $ | 22,808 | $ | 8,798 | $ | 25,096 | ||||||||

Working capital |

16,454 | 30,546 | 22,563 | 42,095 | ||||||||||||

Total assets |

256,015 | 272,328 | 326,282 | 339,280 | ||||||||||||

Long-term debt, less current portion |

242,600 | 253,442 | 291,420 | 206,036 | ||||||||||||

Redeemable convertible Series A and Series B preferred and Class A common stock |

158,701 | 174,571 | 184,922 | — | ||||||||||||

Total stockholders' deficit |

(217,769 | ) | (226,458 | ) | (237,058 | ) | 49,479 | |||||||||

(footnote on the following page)

10

- (1)

- Pro

forma presentation gives effect to the 7.15 for 1.00 reverse stock split of our common stock to occur immediately prior to the completion of this

offering.

- (2)

- EBITDA

represents net income (loss) before interest income, interest income—related party, interest expense, provision (benefit) for income tax,

and depreciation and amortization. We present EBITDA because we believe it is a useful indicator of our operating performance. Our management uses EBITDA principally as a measure of our operating

performance and believes that EBITDA is useful to investors because it is frequently used by securities analysts, investors and other interested parties in their evaluation of the operating

performance of companies in industries similar to ours. We also believe EBITDA is useful to our management and investors as a measure of comparative operating performance from period to period. Our

management also uses EBITDA for planning purposes, including the preparation of our annual operating budget and financial projections.

EBITDA, however, does not represent and should not be considered as an alternative to net income or cash flow from operations, as determined in accordance with GAAP, and our calculations thereof may not be comparable to similarly entitled measures reported by other companies. Although we use EBITDA as a measure to assess the operating performance of our business, EBITDA has significant limitations as an analytical tool because it excludes certain material costs. For example, it does not include interest expense, which has been a necessary element of our costs. Because we use capital assets, depreciation expense is a necessary element of our costs and ability to generate revenue. In addition, the omission of the substantial amortization expense associated with our intangible assets further limits the usefulness of this measure. EBITDA also does not include the payment of taxes, which is also a necessary element of our operations. Because EBITDA does not account for these expenses, its utility as a measure of our operating performance has material limitations. Because of these limitations management does not view EBITDA in isolation or as a primary performance measure and also uses other measures, such as net income, net sales, units sold and operating income, to measure operating performance.

The following is a reconciliation of EBITDA to net income for the periods presented:

| |

Year Ended December 31, | Six Months Ended June 30, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (in thousands) |

2006 | 2007 | 2008 | 2008 | 2009 | |||||||||||

Net income (loss) |

$ | 12,625 | $ | 6,078 | $ | 9,096 | $ | 2,353 | $ | (4,197 | ) | |||||

Interest income |

(1,174 | ) | (426 | ) | (230 | ) | (110 | ) | (61 | ) | ||||||

Interest income—related party |

— | (6 | ) | — | — | — | ||||||||||

Interest expense |

22,893 | 21,213 | 16,492 | 8,595 | 8,149 | |||||||||||

Provision for income taxes |

6,909 | 3,844 | 386 | 1,548 | 306 | |||||||||||

Depreciation and amortization |

15,875 | 19,953 | 20,741 | 10,433 | 13,571 | |||||||||||

EBITDA |

$ | 57,128 | $ | 50,656 | $ | 46,485 | $ | 22,819 | $ | 17,768 | ||||||

11

Investing in our common stock involves risks. You should carefully consider the following risks as well as the other information included in this prospectus, including our financial statements and related notes, before investing in our common stock.

Risks Related to Our Business

If we do not successfully implement our business strategy, our business and results of operations will be adversely affected.

We may not be able to successfully implement our business strategy. Any such failure may adversely affect our business and results of operations. For example, to implement our business strategy we need to, among other things, develop and introduce new products, find new applications for our existing products, obtain regulatory approval for such new products and applications and educate physicians about the clinical and cost benefits of our products and thereby increase the number of hospitals and physicians that use our products. In addition, we are seeking to increase our international sales and will need to increase our worldwide direct sales force and enter into distribution agreements with third parties in order to do so, all of which may also result in additional or different foreign regulatory requirements, with which we may not be able to comply. Moreover, even if we successfully implement our business strategy, our operating results may not improve. We may decide to alter or discontinue aspects of our business strategy and may adopt different strategies due to business or competitive factors.

The market opportunities that we expect to develop for our products may not be as large as we expect or may not develop at all.

The growth of our business is dependent, in large part, upon the development of market opportunities for our new products, product enhancements and new applications for our existing products. The market opportunities that we expect to exist for our devices may not develop as expected, or at all. For example, clinical studies have shown linkages between the existence of PFOs and certain types of strokes and migraines. If the connection between PFO closure and the prevention or reduction of the occurrence of stroke and migraines is not as strong as we anticipate, the market opportunity for our AMPLATZER PFO Occluders will not develop as expected, if at all. Moreover, even if the market opportunities develop as expected, new technologies and products introduced by our competitors may significantly limit our ability to capitalize on any such market opportunity. Our failure to capitalize on our expected market opportunities would adversely effect our growth.

Our AMPLATZER Septal Occluders generate a large portion of our net sales. If sales of this family of products were to decline, our net sales and results of operations would be adversely affected.

Our lead family of products, the AMPLATZER Septal Occluders, represented approximately 55.4% of our net sales for the six months ended June 30, 2009, and we anticipate that this family of products will continue to account for a substantial portion of our net sales for the next few years. If sales of AMPLATZER Septal Occluders were to decline in any of our key markets because of decreased demand, adverse regulatory actions, patent infringement claims, failure to protect our intellectual property, manufacturing problems or delays, pricing pressures, competitive factors or any other reason, our net sales would decrease, which would negatively affect our business, financial condition and results of operations.

12

If we are unable to successfully develop and market new products or product enhancements or find new applications for our existing products, we will not remain competitive.

Our future success and our ability to increase net sales and earnings depend, in part, on our ability to develop and market new products, product enhancements and new applications for our existing products. However, we may not be able to, among other things:

- •

- successfully develop or market new products or enhance existing products;

- •

- find new applications for our existing products;

- •

- manufacture, market and distribute such products in a cost-effective manner; or

- •

- obtain required regulatory clearances and approvals.

Our failure to do any of the foregoing could have a material adverse effect on our business, financial condition and results of operations. In addition, if any of our new or enhanced products contain undetected errors or design defects or if new applications that we develop for existing products do not work as planned, our ability to market these products could be substantially impeded, resulting in lost net sales, potential damage to our reputation and delays in obtaining market acceptance of these products. We cannot assure you that we will continue to successfully develop and market new or enhanced products or new applications for our existing products.

We make our regulatory status forecasts, including determining expected dates of filings with, or submissions to, relevant authorities, based on the information currently available to us. The actual timing for any of these regulatory steps may vary, and we may revise any such forecasts as new information becomes available.

Moreover, most new or enhanced products or new applications for our existing products require that their safety and efficacy be proven by clinical trials before they receive regulatory approval. Our clinical trials may not prove the safety and efficacy of our products, and in such circumstances our products would not receive regulatory approval. In addition, these clinical trials typically last several years, and during that time competing products, procedures or therapies may be introduced that are less expensive and/or more effective than our products and thus render our products obsolete. If we do not continue to expand our product portfolio on a timely basis or if those products and applications do not receive regulatory and market acceptance or become obsolete, we will not grow our business as we currently expect.

If we fail to educate and train physicians as to the distinctive characteristics, benefits, safety, clinical efficacy and cost-effectiveness of our products, our sales will not grow.

Acceptance of our products depends, in large part, on our ability to (1) educate the medical community as to the distinctive characteristics, benefits, safety, clinical efficacy and cost-effectiveness of our products compared to alternative products, procedures and therapies and (2) train physicians in the proper use and implementation of our devices. Certain of the structural heart defects and vascular diseases that can be treated by our devices can also be treated by surgery, drugs or other medical devices, some of which have a longer history of use and are more widely used by the medical community. Physicians may be reluctant to change their medical treatment practices for a number of reasons, including:

- •

- lack of experience with new products;

- •

- lack of evidence supporting additional patient benefits;

- •

- perceived liability risks generally associated with the use of new products and procedures;

13

- •

- lack of availability of adequate reimbursement within healthcare payment systems; and

- •

- costs associated with the purchase of new products and equipment.

Convincing physicians to dedicate the time and energy necessary to properly train to use new devices is challenging, and we may not be successful in these efforts. If physicians are not properly trained, they may misuse or ineffectively use our products. Such misuse or ineffective use may result in unsatisfactory patient outcomes, patient injury, negative publicity or lawsuits against us. Accordingly, even if our devices are superior to alternative treatments, our success will depend on our ability to gain and maintain market acceptance for our devices. If we fail to do so, our sales will not grow and our business, financial condition and results of operations will be adversely affected.

The expansion of our product portfolio is dependent upon the success of our clinical trials and receipt of regulatory approvals. If these trials are not completed on schedule or are unsuccessful, or if we fail to obtain or experience significant delays in obtaining the necessary regulatory approvals for our product pipeline, we will not be able to market the related products.

A number of our products are in the early stages of development. In the United States, before we can market a new medical device, or a new application of, claim for, or significant modification to, an existing device, we must first receive either approval of a PMA application from the FDA or clearance under section 510(k) of the U.S. Federal Food, Drug, and Cosmetic Act, or 510(k) clearance, unless an exemption applies. Clinical trials are always required to support a PMA application approval and may be required to support a 510(k) clearance. Currently, we have four studies underway designed to evaluate the safety and efficacy of our AMPLATZER PFO Occluder to treat migraine or recurrent stroke, as applicable, in patients with PFOs, as well as a number of post-approval studies.

Our current or future clinical trials contemplated in support of our PMA or 510(k) applications may not commence or conclude in a timely fashion, or at all, or may not produce the desired results. For example, several of our products under development do not yet have agreed-upon protocols or approved Investigational Device Exemptions, or IDEs. Agreeing on clinical trial designs and protocols may be time consuming and requires interaction with and advance approval from regulatory authorities. We cannot assure you that we will be able to agree on appropriate trial designs and protocols with the FDA and thus commence clinical trials or, if commenced, that our PMA applications will be approved or our 510(k) clearances will be granted, in a timely fashion or at all. If our trials for any reason do not commence, do not produce the intended results or are delayed or halted due to the occurrence of adverse events, or if we do not otherwise obtain FDA or other regulatory agency approval with respect to our products in a timely fashion, our future growth may be significantly hampered. Our failure to comply with the regulations relating to the PMA approval and 510(k) clearance processes could also lead to the issuance of warning letters, injunctions, consent decrees, manufacturing suspensions, loss of regulatory approvals, product recalls, termination of distribution arrangements or product seizures. In the most egregious cases, criminal sanctions or closure of our manufacturing facilities could be imposed.

Moreover, sales of our products outside the United States are subject to foreign regulatory requirements that vary widely from country to country. Because a significant portion of our product sales are made in international markets, any failure to comply with directives and regulatory requirements imposed in foreign jurisdictions could also have a material adverse effect on our business, financial condition and results of operations.

Further, we continually evaluate the potential financial benefits and costs of our clinical trials and the products being evaluated in them. If we determine that the costs associated with attaining regulatory approval of a product exceed the potential financial benefits of that product or if the projected development timeline is inconsistent with our investment strategy, we may choose to stop a

14

clinical trial or the development of a particular product, enhancement or application, which could have a material adverse effect on the growth of our business and could result in a charge to our earnings.

We depend on clinical investigators and clinical sites to enroll patients in our clinical trials and on other third-party contract research organizations to manage our clinical trials and to perform related data collection and analysis, and as a result, we may face significant costs and delays that are outside of our control.

We rely on clinical investigators and clinical sites to enroll patients in our clinical trials and other third-party contract research organizations to manage our clinical trials and to perform related data collection and analysis. Our agreements with clinical investigators, clinical sites and other third parties for clinical testing place substantial responsibilities on these parties. If clinical investigators, clinical sites or other third parties do not carry out their contractual duties or fail to meet expected deadlines or if the quality or accuracy of the clinical data they obtain is compromised due to their failure to adhere to our clinical protocols or the FDA's good clinical practice regulations, our clinical trials may be extended, delayed or terminated, we may face significant costs and we may be unable to obtain regulatory approval or clearance for, or successfully commercialize, new products, enhancements or applications, in a timely manner, or at all.

We also compete with other manufacturers of medical devices for investigators and clinical sites to conduct clinical trials. If we are unable to identify investigators and clinical sites on a timely and cost-effective basis, our ability to conduct trials of our products and, therefore, our ability to obtain required regulatory approval or clearance would be adversely affected.

We may be subject to compliance action, penalties or injunctions if we are determined to be promoting the use of our products for unapproved, or off-label, uses.

Our products are currently approved for the treatment of certain structural heart defects and vascular diseases. Pursuant to FDA regulations, we can only market our products in the United States for approved uses. Physicians may use our products for indications other than those cleared or approved by the FDA, even though we do not promote our products for such off-label uses. If the FDA, however, determines that our promotional materials or training constitutes promotion of an unapproved use, it could request that we modify our training or promotional materials or could subject us to regulatory enforcement actions, including the issuance of warning letters, injunctions, consent decrees, seizures, civil fines or criminal penalties. Other federal, state or foreign enforcement authorities might also take action if they consider our promotional or training materials to constitute promotion of an unapproved use, which could result in significant fines or penalties from other statutory authorities.

We operate in a very competitive environment.

The medical device industry is characterized by strong competition. We have several competitors, including Boston Scientific Corporation, NMT Medical, Inc., W. L. Gore & Associates, Inc., St. Jude Medical Inc., Cook, Inc., Occlutech GmbH, Cardia, Inc. and Atritech, Inc. Certain of our competitors have substantially greater capital resources, larger customer bases, broader product lines, larger sales forces, greater marketing and management resources, larger research and development staffs and larger facilities than ours and have more established reputations with our target customers, as well as global distribution channels that may be more effective than ours.

Our competitors may develop and offer technologies and products that are safer or more effective, have better features, are easier to use, less expensive or more readily accepted by the marketplace than ours. Their products could make our technology and products obsolete or noncompetitive. Our competitors may also be able to achieve more efficient manufacturing and distribution operations than we may be able to and may offer lower prices than we could offer profitably. We may decide to alter or

15

discontinue aspects of our business and may adopt different strategies due to business or competitive factors or factors currently unforeseen, such as the introduction by our competitors of new products or new medical technologies that would make our products obsolete or uncompetitive.

In addition, consolidation in the medical device industry could make the competitive environment more difficult. The industry has recently experienced some consolidation, and there is a risk that larger companies will enter our markets.

We depend on third-party distributors to market and sell our products internationally in a number of markets. Our business, financial condition and results of operations may be adversely affected by both our distributors' performance and our ability to maintain these relationships on terms that are favorable to us.

We depend, in part, on third-party distributors to sell our medical devices outside the United States, including in China. In 2008 and the six months ended June 30, 2009, our net sales through third-party distributors were 34.9% and 19.0%, respectively, of our total net sales. Our international distributors operate independently of us, and we have limited control over their operations, which exposes us to significant risks. Distributors may not commit the necessary resources to market and sell our products and may also market and sell competitive products. In addition, our distributors may not comply with the laws and regulatory requirements in their local jurisdictions, which may limit their ability to market or sell our products. If current or future distributors do not perform adequately, or if we are unable to locate competent distributors in particular countries and secure their services on favorable terms, or at all, we may be unable to increase or maintain our level of net sales in these markets or enter new markets, and we may not realize our expected international growth.

The terms and effects of our Deferred Prosecution Agreement with the U.S. Department of Justice relating to potential violations of the U.S. Foreign Corrupt Practices Act may negatively affect our business, financial condition and results of operations.

On June 2, 2008, we entered into a Deferred Prosecution Agreement, or the DPA, with the Department of Justice concerning alleged improper payments that were made by our former independent distributor in China to (1) physicians in Chinese public hospitals in connection with the sale of our products and (2) an official in the Chinese patent office in connection with the approval of our patent applications, in each case, in potential violation of the Foreign Corrupt Practices Act, or the FCPA. The FCPA makes it unlawful for, among other persons, a U.S. company, acting directly or through an agent, to offer or to make improper payments to any "foreign official" in order to obtain or retain business or to induce such "foreign official" to use his or her influence with a foreign government or instrumentality thereof for such purpose.

As part of the DPA, we consented to the Department of Justice filing a two-count criminal statement of information against us in the U.S. District Court, District of Minnesota, which was filed on June 3, 2008. The two counts include a conspiracy to violate the FCPA and a substantive violation of the anti-bribery provisions of the FCPA related to the above-described activities in China. Although we did not plead guilty to that information, we accepted responsibility for the acts of our employees and agents as set forth in the DPA, and we face prosecution under that information, and possibly other charges as well, if we fail to comply with the terms of the DPA. Those terms require us to, for approximately three years, (1) continue to cooperate fully with the Department of Justice on any investigation relating to violations of the FCPA and any and all other matters relating to improper payments, (2) continue to implement a compliance and ethics program designed to detect and prevent violations of the FCPA and other applicable anti-corruption laws, (3) review existing, and if necessary, adopt new controls, policies and procedures designed to ensure that we make and keep fair and accurate books, records and accounts and maintain a rigorous anti-corruption compliance code designed to detect and deter violations of the FCPA and other applicable anti-corruption laws, and (4) retain and pay for an independent monitor to assess and oversee our compliance and ethics

16

program with respect to the FCPA and other applicable anti-corruption laws. The DPA also required us to pay a monetary penalty of $2.0 million. In the fourth quarter of 2007, we had recorded a financial charge of $2.0 million for this expected settlement, which was paid in June 2008. The terms of the DPA will remain binding on any successor or merger partner as long as the agreement is in effect.

The effects that compliance with any of the terms of the DPA will have on us are unknown and they may have a material impact on our business, financial condition and results of operations. The activities of the government-approved independent monitor, as well as the continued implementation of a compliance and ethics program and the adoption of internal controls, policies and procedures to detect and prevent future violations of the FCPA and other applicable anti-corruption laws, may result in increased costs to us and change the way in which we operate, the outcome of which we are unable to predict. For example, implementing and monitoring such compliance procedures in the large number of foreign jurisdictions where we operate can be expensive and time-consuming. As a result of our remediation measures, we may also encounter difficulties conducting business in certain foreign countries and retaining and attracting additional business with certain customers, and we cannot predict the extent of these difficulties.

In addition, entering into the DPA in the United States may adversely affect our operations or result in legal claims against us, which may include claims of special, indirect, derivative or consequential damages.

Our failure to comply with the terms of the deferred prosecution agreement with the Department of Justice would have a negative impact on our ongoing operations.

As described above, we are subject to a three-year DPA with the Department of Justice. If we comply with the DPA, the Department of Justice has agreed not to prosecute us with respect to the above-described activities in China and, following the term of the DPA, to permanently dismiss the criminal statement of information that is currently pending against us. Accordingly, the DPA could be substantially nullified, and we could be subject to severe sanctions and resumed civil and criminal prosecution, as well as severe fines, penalties and other regulatory sanctions, in the event of any additional violation of the FCPA or any other applicable anti-corruption laws by us or any of our officers, other employees or agents in any jurisdiction or of our failure to otherwise meet any of the terms of the DPA as determined by the Department of Justice in its sole discretion. The claims alleged in the DPA with the Department of Justice only relate to our actions in China as outlined above, and do not relate to any future violations or the discovery of past violations not expressly covered by the DPA. Any breach of the terms of the DPA would also cause damage to our business and reputation, as well as impair investor confidence in our company and result in adverse consequences on our ability to obtain or continue financing for current or future projects.

In addition, although we are not currently restricted by the U.S. Department of Health and Human Services, Office of the Inspector General, from participating in federal healthcare programs, any criminal conviction of our company under the FCPA in the future would result in our mandatory exclusion from such programs, and it may lead to debarment from U.S. and foreign government contracts. Any such exclusion or debarment would have a material adverse effect on our business, financial condition and results of operations.

Our ability to comply with the terms of the DPA is dependent, among other things, on the success of our ongoing compliance and ethics program, including our ability to continue to manage our distributors and agents and supervise, train and retain competent employees, as well as the efforts of our employees to adhere to our compliance and ethics program and the FCPA and other applicable anti-corruption laws. It is possible that, despite our best efforts, additional FCPA issues, or issues under anti-corruption laws of other jurisdictions, could arise in the future. Any failure by us to adopt appropriate compliance and ethics procedures, to ensure that our officers, other employees and agents

17

comply with the FCPA and other applicable anti-corruption laws and regulations in all jurisdictions in which we operate or to otherwise comply with any term of the DPA would have a material adverse effect on our business, financial condition and results of operations.

In certain international markets, we have converted, or are in the process of converting, to a direct sales force model from a distributor-based sales model. Our business, financial condition and operating results may be adversely affected by the transition to a new sales model.

In August 2006, we negotiated an early termination with one of our international distributors, and we have since then undertaken to distribute our products in such distributor's country through our direct sales force. We also gave notice of termination to a second distributor and began operations in April 2008 through our direct sales force in such distributor's country. We gave notice of termination to a third distributor and began operations in July 2008 through our direct sales force in such distributor's country. In addition, we gave notice of termination to six other distributors and began operations in January 2009 through our direct sales force in these distributors' countries. We may also assess the viability of distributing our products directly in other international markets. We have limited experience with direct sales of our products in international markets and, therefore, may not obtain the financial benefits that we expect. In addition, we may experience delays in implementing our direct sales force model due to the difficulty of hiring a sales force, establishing relationships with physicians, complying with local regulatory requirements, and other factors, which could have an adverse effect on our business, financial condition and results of operations.

Fluctuations in foreign exchange rates may adversely affect our consolidated results of operations.

Our foreign operations expose us to currency fluctuations and exchange rate risks. Approximately 24.3% and 42.0% of our net sales for 2008 and for the six months ended June 30, 2009, respectively, were in foreign currencies. Accordingly, our consolidated results of operations have been, and will continue to be, subject to fluctuations in foreign exchange rates. Although we have benefited from foreign currency exchange rate fluctuations in the past, we may not benefit from the effect of foreign currency exchange rate fluctuations in the future, which may adversely affect our consolidated results of operations. During a period in which the U.S. dollar appreciates against a given foreign currency, our consolidated net sales will be lower than they might otherwise have been because net sales earned in such foreign currency will translate into fewer U.S. dollars. At present, based on a foreign exchange rate exposure management policy adopted in December 2008, we have started to engage in hedging transactions to protect against uncertainty in future exchange rates between particular foreign currencies and the U.S. dollar. As we grow our international direct sales, we expect our foreign currency-denominated net sales will increase, which would increase our risks related to fluctuations in foreign exchange rates. We cannot assure you that our monitoring of our net foreign currency exchange rate exposure, our foreign currency exchange rate exposure management policy or any foreign currency hedging activity that we implement will be effective or otherwise adequately protect us against fluctuations in foreign currency exchange rates.

Our ability to operate our company effectively could be impaired if we lose members of our senior management team or scientific personnel.

We depend on the continued service of key managerial, scientific and technical personnel, as well as our ability to continue to attract and retain highly qualified personnel. We compete for such personnel with other companies, academic institutions, government entities and other organizations. Any loss or interruption of the services of our key personnel could significantly reduce our ability to effectively manage our operations and meet our strategic objectives, because we may be unable to find an appropriate replacement, if necessary. For example, Dr. Amplatz plays a key role in the early stages of our research and development programs, which are crucial to expanding our product portfolio. We have a five-year research and development contract with Dr. Amplatz that expires in December 2010,

18

and we may not be able to renew it. The loss of Dr. Amplatz's services may negatively affect our ability to expand our product portfolio beyond our current pipeline. In addition, after termination of our contract with Dr. Amplatz, he is not allowed to compete with our company for 18 months in the United States. Any competition from Dr. Amplatz after that period or outside the United States may negatively affect our business.

Healthcare legislative or administrative changes resulting in restrictive third-party payor reimbursement practices or preferences for alternate treatment may decrease the demand for, or put downward pressure on the price of, our products.

Our products are purchased principally by hospitals, which typically receive reimbursement from various third-party payors, such as governmental programs (e.g., Medicare and Medicaid), private insurance plans and managed care plans, for the healthcare services provided to their patients. The ability of our customers to obtain appropriate reimbursement for their products and services from government and third-party payors is critical to our success. The availability of reimbursement affects which products customers purchase and the prices they are willing to pay. Reimbursement varies from country to country and can significantly impact the acceptance of new products. After we develop a promising new product, we may experience limited demand for the product unless reimbursement approval is obtained from private and governmental third-party payors.

Major third-party payors for hospital services in the United States and abroad continue to work to contain healthcare costs. The introduction of cost-containment incentives, combined with closer scrutiny of healthcare expenditures by both private health insurers and employers, has resulted in increased discounts and contractual adjustments to hospital charges for services performed. Initiatives to limit the growth of healthcare costs, including price regulation, are also underway in several countries in which we do business. Implementation of new legislative and administrative changes in the United States and in overseas markets, such as Germany and Japan, may limit the price of, or the level at which reimbursement is provided for, our products and, as a result, may adversely affect both our pricing flexibility and demand for our products. Hospitals or physicians may respond to such cost-containment pressures by substituting lower-cost products or other treatments for our products.

Further legislative or administrative changes to the U.S. or international reimbursement systems that significantly reduce reimbursement for procedures using our medical devices or deny coverage for such procedures, or adverse decisions relating to our products by administrators of such systems in coverage or reimbursement issues, would have an adverse impact on the number of products purchased by our customers and the prices our customers are willing to pay for them. This, in turn, would adversely affect our business, financial condition and results of operations.

Our business may be adversely affected if consolidation in the healthcare industry leads to demand for price concessions or if we are excluded from being a supplier by a group purchasing organization or similar entity.

Because healthcare costs have risen significantly over the past decade, numerous initiatives and reforms have been launched by legislators, regulators and third-party payors to curb these costs. As a result, there has been a consolidation trend in the healthcare industry to create larger companies, including hospitals, with greater market power. As the healthcare industry consolidates, competition to provide products and services to industry participants has become and will continue to become more intense. This has resulted and will likely continue to result in greater pricing pressures and the exclusion of certain suppliers from important markets as group purchasing organizations, independent delivery networks and large single accounts continue to use their market power to consolidate purchasing decisions. If a group purchasing organization excludes us from being one of their suppliers, our net sales will be adversely impacted. We expect that market demand, government regulation, third-party reimbursement policies and societal pressures will continue to change the worldwide healthcare industry, which may exert further downward pressure on the prices of our products.

19

We conduct substantially all of our operations at our corporate headquarters, and any fire, explosion, violent weather conditions or other unanticipated events affecting our corporate headquarters could adversely affect our business, financial condition and results of operations.